Best Free Telegram Trading Channels In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best free Telegram channels for traders:

Kharitonov FX Trading - fast-growing channel in Telegram (80K+ subscribers).

FXPremiere.com – a leading Telegram channel for Forex signals, boasting a community of over 168k members.

Ultreos Forex – known for delivering comprehensive Forex signals paired with trade analysis.

Trading moves fast, and it can feel like you’re always scrambling to keep up. But imagine having a way to get crucial market updates and expert strategies without spending a cent. Telegram has become a go-to tool for traders who want to stay in the know, offering channels that deliver real-time tips, honest analysis, and a community that actually shares useful advice. Whether you’re into crypto, Forex, or stocks, these free channels could totally shift your trading game, giving you more than just news but real ideas that can make a difference.

Best free Telegram channels

Best free Telegram channels for traders

Telegram allows traders to stay connected, exchange ideas, and receive real-time updates without needing to visit multiple sites or apps. Here are some of the key benefits it provides to traders:

Real-time signals and alerts. Channels often provide timely notifications on trade setups, economic news, and market trends.

Community and networking. Many channels host discussions that allow members to connect with like-minded traders and learn from one another.

Education and learning. Many channels provide resources, from basic guides to advanced strategies, often broken down for easy understanding.

Forex trading channels

Forex trading channels on Telegram are dedicated to providing traders with real-time currency pair signals, market updates, and insights from experienced professionals. These channels help users stay on top of Forex trends, offering both free and premium options to suit different trading needs. Below are some of the top Forex channels currently available on Telegram.

Kharitonov FX Trading - fast-growing channel in Telegram (80K+ subscribers). Exclusive from Traders Union with Anton Kharitonov. Daily analytics, forecasts, and ideas for your Forex trades are added regularly.

FXPremiere.com – A leading Forex channel on Telegram, with over 168k followers, offering both complementary and premium signal options.

Ultreos Forex – Known for delivering comprehensive Forex signals paired with trade analysis, engaging a community of 38k users.

Forex GDP – This channel is renowned for its high-accuracy signals and frequent market updates, followed by a dedicated group of 105k.

ForexSignals.io – Popular for its free and VIP signals, technical chart analysis, and multilingual support, serving a large base of 304k.

TopTrading Signals – Known for offering scalping and swing trade signals, this channel keeps 109k traders informed with timely insights.

FXStreet – A respected source for Forex news, signals, and expert advice, followed by a community of 98k.

| Channel Name | Members | Key Features | Short Description |

|---|---|---|---|

| Kharitonov FX Trading | 80k+ | Free analytics, forecasts, and ideas | Fast-growing channel in Telegram. Daily analytics, forecasts, and ideas for your Forex trades |

| FXPremiere.com | 168k+ | Free and premium signals | A leading Forex channel providing both free and VIP signals, covering popular currency pairs with regular updates. |

| Ultreos Forex | 38k | Comprehensive signals, trade analysis | Known for delivering detailed Forex signals alongside trade analysis for more informed trading. |

| ForexGDP | 105k | High-accuracy signals, frequent updates | Renowned for its high-accuracy signals and market insights, catering to a focused group of traders. |

| ForexSignals.io | 304k | Free and VIP signals, multilingual support | Popular for its signals and technical chart analysis, available in multiple languages to serve a wide audience. |

| TopTrading Signals | 109k | Scalping and swing trade signals | Known for timely scalping and swing trade signals, helping traders stay up-to-date on market trends. |

| FXStreet | 98k | Forex news, expert advice | A well-regarded source for Forex news, signals, and expert recommendations for dedicated Forex traders. |

Stock trading channels

Stock trading channels are ideal for traders interested in NASDAQ, gold, and other key stock markets. Here are some of the most popular stock trading channels that provide great resources and insights.

Learn2Trade – Provides stock trading signals, market updates, and educational content for a growing audience of 38k.

Nasdaq/Gold Signals – Specializes in stock market alerts, focusing on NASDAQ, gold, and key indices, with a community of 178k.

| Channel Name | Members | Key Features | Short Description |

|---|---|---|---|

| Learn2Trade | 38k | Stock signals, educational content | Provides stock trading signals, market updates, and educational resources. |

| Nasdaq/Gold Signals | 178k | NASDAQ and gold signals, indices | Specializes in alerts for NASDAQ, gold, and key stock indices with timely updates. |

Cryptocurrency trading channels

Cryptocurrency trading channels on Telegram offer signals and market analysis tailored to the fast-paced and volatile world of crypto. These channels provide trade alerts, project insights, and educational resources, making them ideal for crypto traders of all levels. Below is a list of popular cryptocurrency trading channels to consider.

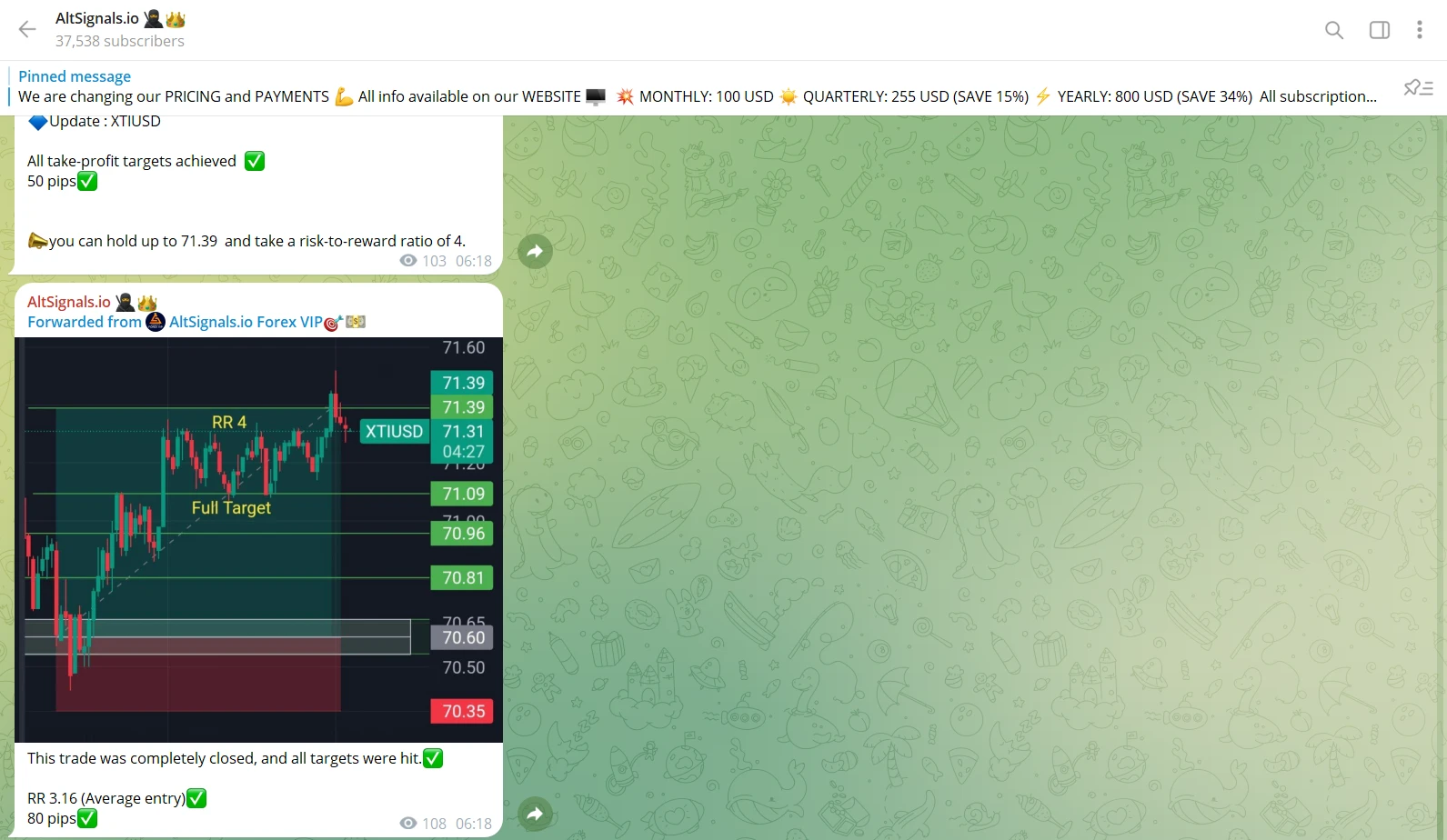

AltSignals – A well-regarded channel for crypto trade alerts and analysis, with a subscriber base of 37k.

MyCryptoParadise – Offers VIP content and educational material along with crypto signals, followed by 10k enthusiasts.

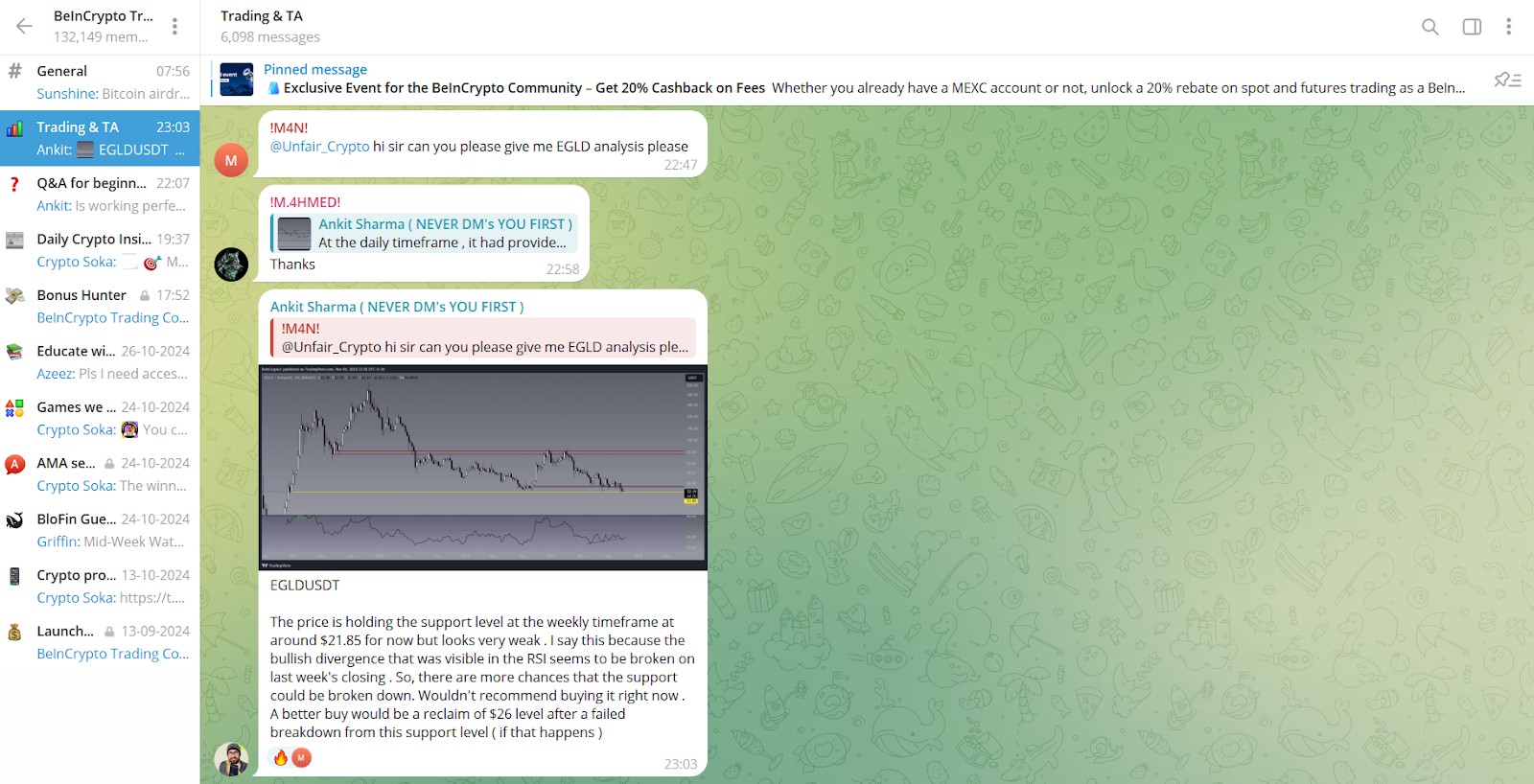

BeInCrypto Trading Community – Shares crypto trading signals, project insights, and educational resources, serving 132k members.

| Channel Name | Members | Key Features | Short Description |

|---|---|---|---|

| AltSignals | 37k | Crypto trade alerts, analysis | A well-regarded channel offering crypto signals and market analysis for traders seeking detailed insights. |

| MyCryptoParadise | 10k | VIP content, educational material | Provides crypto signals along with exclusive VIP content and educational resources for enthusiasts. |

| BeInCrypto Trading Community | 132k | Crypto signals, project insights | Shares crypto trading signals, in-depth project insights, and educational content to a large community. |

How to choose the right trading channel

When selecting a trading channel, here are some factors to consider:

Content quality. Check if the channel provides clear and well-explained signals or analysis.

Reputation. Research the channel’s reviews and ask other traders about their experiences.

Frequency of updates. Choose a channel that provides timely updates suitable for your trading style.

Type of signals or analysis. Ensure the channel aligns with your trading interests, whether it’s Forex, crypto, stocks, or general market analysis.

Risk management advice. Look for channels that offer not just signals but also advice on risk management and proper stop-loss levels.

Tips for using Telegram trading channels effectively

To maximize the benefits of Telegram trading channels, consider these strategies:

Use demo accounts. Before trading with real money, test signals from channels on a demo account to gauge accuracy.

| Min. deposit, $ | Demo | Min Spread EUR/USD, pips | MAX Spread GBP/USD, pips | Deposit fee, % | Withdrawal fee, % | Max. Regulation Level | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 100 | Yes | 0,5 | 1,0 | No | No | Tier-1 | Open an account Your capital is at risk. |

|

| No | Yes | 0,5 | 1,4 | No | No | Tier-1 | Open an account Your capital is at risk.

|

|

| No | Yes | 0,1 | 0,5 | No | No | Tier-1 | Open an account Your capital is at risk. |

|

| 100 | Yes | 0,7 | 1,4 | No | No | Tier-1 | Study review | |

| No | Yes | 0,2 | 1,5 | No | Yes | Tier-1 | Open an account Your capital is at risk. |

Set alerts and notifications. Stay updated by turning on notifications for critical updates.

Engage with the community. Participate in discussions or ask questions to learn from other members.

Avoid over-reliance on signals. While signals can be helpful, it’s best to combine them with your analysis.

Stay updated on market news. Supplement signals with current market news and analysis for a comprehensive view.

Pros and cons

- Pros

- Cons

Timely updates. Channels offer real-time signals and market insights, allowing quick reactions.

Community learning. Supportive communities enable traders to share strategies and learn together.

Educational resources. Many channels provide tutorials and analysis for knowledge building.

Market variety. Options across Forex, stocks, and crypto cater to different trading interests.

Affordable access. Free channels offer insights at little to no cost, ideal for beginners.

Signal reliability. Accuracy can vary, so not all channels are dependable.

Over-reliance risk. Relying on signals alone may hinder skill development.

Market volatility. Signals, especially in crypto, may be unstable.

Scam risk. Some channels may be fraudulent; it’s crucial to verify sources.

Risks and warnings

While free Telegram channels can be valuable, they also carry certain risks:

Inconsistent signals. Not all signals will be profitable, and some channels may have inconsistent accuracy.

High market volatility. Signals, especially in crypto channels, are subject to market volatility, which can lead to unexpected losses.

Lack of regulation. Telegram channels are often unregulated, and signal providers may not be qualified analysts.

Emotional trading. Relying on signals can lead to impulsive trading without a proper strategy.

Use demo account to test and refine your strategies without risking

Telegram trading channels can be incredibly useful, but it’s essential to approach them with a balanced mindset. The signals and insights you get from these channels should serve as guidance, not as a replacement for your own analysis and strategy. It’s tempting to lean on signals alone, especially when starting out, but success in trading requires a foundation of knowledge and the confidence to trust your own judgment.

One of the best ways to use Telegram channels effectively is by combining their insights with a demo account, where you can test and refine your strategies without risking real money. Take note of each signal’s accuracy over time; track which channels consistently deliver value and which ones might be hit or miss. Patience and discipline are your best allies — stick to channels that align with your trading style and goals, and don’t be afraid to walk away from those that don’t.

Conclusion

Using the right Telegram channels can completely change the way you approach trading, making it easier to learn and stay flexible as the markets move. Don’t just read and scroll — jump in, ask questions, and use what these communities offer to really boost your skills and make smarter choices. Picture these channels as trusted friends who’ve got your back, ready to guide you when things get unpredictable. Why not explore and take advantage of the support and insights they provide? The ideas you pick up could be just what you need to take your trading to the next level.

FAQs

Can I trust free trading signals on Telegram channels?

While some free signals are trustworthy, always verify by testing them in a demo account first to evaluate their accuracy before trading real money.

How do I know if a Telegram trading channel is reliable?

Look for channels with positive reviews from real traders, transparency about results, and consistent, quality content. Be cautious with channels making unrealistic profit promises.

Do I need to pay for premium channels, or are free ones enough?

Free channels can be a good starting point, but premium ones often offer more accurate signals and detailed analysis. Test both to see if a paid channel adds value for you.

Can I use signals from multiple Telegram channels at the same time?

Yes, you can, but it’s better to avoid conflicting signals. Choose channels that align with your trading strategy to keep your decisions consistent.

Related Articles

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.