Weekend Trading: Can You Trade Forex on Weekends?

Can You Trade on Weekends? In most cases, Forex brokers and stock brokers do not provide the opportunity to manage trades on weekends. The exception is cryptocurrencies. You can also trade on the Tel Aviv Stock Exchange, the Saudi Arabian market, on weekends.

For many traders, weekends signal a break from the markets after a long week. However, some see weekends as an untapped opportunity for additional trading hours. While most major exchanges remain closed during Saturdays and Sundays, reduced market activity doesn't necessarily mean an absence of profit potential. Traders focused on cryptocurrencies can take advantage of round-the-clock trading access. Some alternative stock markets also facilitate weekend action. With careful planning and risk management, those willing to trade outside standard market hours can benefit from added analysis time, strategy testing with real positions, or simply getting a jump start on the next week. Of course, low liquidity and irregular trading patterns during weekends bring unique challenges. This article evaluates the viability of weekend trading and provides guidance for navigating extended market access.

-

Should beginner traders attempt weekend trading?

Weekend trading carries extra risks, prices can fluctuate more sharply on low liquidity, so beginners should avoid it until gaining more experience.

-

What cryptocurrency trading strategies work on weekends?

Gap trading, Bollinger Bands, breakout trading with sufficient volatility.

-

Should stop losses be wider on weekends?

Yes, to protect from potential gaps due to low liquidity overnight or between sessions.

-

Does weekend trading require a different mindset?

Yes, patience and discipline are key due to lack of confirmations from regular market activity.

Should I Trade on the Weekends?

Most professional traders choose not to trade on weekends because most of the main markets are closed. They also avoid it because weekends experience the lowest liquidity, amongst other issues. But, there are a few benefits to trading on the weekends as well.

Pros

Here is why traders should consider weekend trading:

Traders Have Ample Time to Analyze Markets in Peace

During the weekdays, many retail traders are busy at work. They have minimal time to keep track of charts and follow market news. Also, not every retail trader can afford to pay someone to handle their trades for them. Therefore, weekends provide an opportunity for traders to dedicate more time to studying trends and thus trading more.

More Time for Cryptocurrency Traders

Unlike the forex and stock markets, the cryptocurrency market is open 24/7. Weekend trading for crypto traders is a great way to increase earnings.

Opportunity to Practice Trading Strategies

Weekend trading is a great time to test strategies. The open markets are slow and few people are active. You do not need to test strategies on live accounts, but it will be easier to observe trends and draw conclusions.

Get a Head Start for Weekday Trading

Many traders use the points discussed above to prepare themselves for weekday trading. Analyzing the markets in a calm environment, and fine-tuning strategies are all crucial in giving a head start for the upcoming week.

Cons

Here are some reasons why you may want to avoid weekend trading:

Less Liquid Markets

Weekend markets have fewer active managers and participants, making trades less liquid. The scarcity of economic and geopolitical news is another contributor, forcing minimal movement for market prices. This situation makes the market less volatile. A less volatile market provides minimal opportunities for profits.

Fewer Markets and Trading Assets

Most major markets are closed on weekends. Traders, therefore, have to make do with fewer, less popular markets that they may not usually trade on. This could be an inconvenience.

Weekends also avail fewer trading instruments and assets, regardless of the market. Trading is therefore not as flexible as it is during the weekdays.

Odd Trading Hours

If a trader would prefer to stick to the major markets, they would need to trade at odd hours. In the example given at the beginning of this post, traders eager to keep trading into the weekend would only have the first four hours of the day.

Top 3 Options to Trade on the Weekends

We have mentioned a lot about specific markets that remain open over the weekend, but which markets are they? Here are some markets to consider for weekend trading:

Cryptocurrency Market

The first market you should consider is the cryptocurrency market. It remains open 24/7 so you can consistently trade on this market without having to switch over the weekend. It is also the most rational option as this market is easy to access.

In addition, sometimes on weekends, there is normal liquidity. Unlike the forex and stock markets, the cryptocurrency market can be more stable over weekends. Continuous availability means that traders can maximize their profits as well.

Tel-Aviv Stock Exchange

The Tel-Aviv Stock Exchange is open every day of the year except for select holidays. This market also has numerous assets and securities available for traders.

Traders have the option of choosing from:

Convertible securities

Corporate and government bonds

Short-term certificates

There are several companies to consider in this market, but the most promising are:

Bank Leumi

Solar Edge Technologies

Tadawul Index – Saudi Arabia

Tawadul market is open on all days of the week except for select holidays that change from year to year. You can confirm and keep track of them here. You can trade on all major assets, and with all major instruments on this market.

The best companies to consider in this market are:

Saudi Aramco

Saudi Basic Industries

Saudi Telecom Companies

5 Tips For Trading on the Weekends

Now that you have decided to take the step and trade on the weekends, you need to know how best to go about it. Weekend trading is unique terrain. You will need strategies that are Here are some tips to get the best out of it:

Use the Gap Trading Strategy

This is the best weekend trading strategy. It is also quite simple. Traders attempt to profit from price movement between the market’s close on Friday and its reopening on Sunday.

Bollinger Bands

Bollinger bands indicate price channels that a specific market should not leave. During the week, high activity makes their predictions unstable. Over the weekend, Bollinger bands are more stable. Therefore, skilled traders can make more accurate predictions on trade outcomes.

Be Mindful of Timezones

Traders need to be careful about how they calculate time zones when dabbling in weekend trades. This caution is necessary because most markets that remain open are in the Middle East. Therefore, traders need to be careful to know when exactly the weekend begins for them to change strategies.

Analyze and Strategize

You can choose to avoid any live trading and instead hone your skills. This strategy may seem null, but it is equally important. Spending the weekend furthering your education on the stock market through courses and webinars will help you boost profits in the long term.

Get a Broker that Fully Supports Weekend Trading

Finally, all of these strategies are null and void if you do not have an appropriate platform. We will discuss two of the best platforms in the next section.

If your broker does not offer weekend trading, it would be great to switch platforms. However, if you are enjoying the services and are not willing to move, you can open an account dedicated to weekend trading.

Top 5 weekend trading brokers 2024

| Broker | Features |

|---|---|

RoboForex |

Best for weekend trading broker |

IC Markets |

Best crypto CFD trading |

EXNESS Group |

Best for weekend trading for select forex pairs, cryptocurrencies, and indices |

eToro |

Best for weekend crypto trading |

Interactive Brokers |

Best for Stock Trading on Weekends |

Regarding trading on weekends, not all apps are created equal. In other words, some offer weekend trading, while others do not. Here is a look at some top trading platforms and how they measure up.

| Broker | Features |

|---|---|

RoboForex |

Best for weekend trading broker |

IC Markets |

Best crypto CFD trading |

EXNESS Group |

Best for weekend trading for select forex pairs, cryptocurrencies, and indices |

eToro |

Best for weekend crypto trading |

Interactive Brokers |

Best for Stock Trading on Weekends |

RoboForex - The best broker for weekend stock trading

RoboForex is a versatile platform with over 4.56 million clients in nearly 169 countries. This award-winning platform offers weekend trading and assets such as indices, stocks, CFDs, commodities, metals, and ETFs.

Features:

RoboForex does not charge commission fees when using a Pro account. It offers simplified EA integration, copy trading platform, a lot of bonuses, over 12.000 trading instruments, and low prices. It is considered the best and very cost-effective, as one of the cheapest brokers available.

Incredibly education-friendly, RoboForex offers resources such as economic calendars, analytics centers, and various other educational tools. This platform is regulated by the Financial Services Commission (FSC) in Belize and has a Civil Liability insurance program for a limit of 5,000,000 EUR; it offers a wide array of products, account types, and learning resources. In addition, the platform provides excellent quality and highly unique trading conditions compared to other such platforms.

👍 Pros

•Platforms Offered: RoboForex offers the MetaTrader Suite (Plus Other Platforms)

•Zero Commissions: For users who sign up for pro accounts, RoboForex offers zero commissions on trades.

•Trading Conditions: Those who use Prime, ECN, and R StocksTrader Accounts gain access to amazing Trade Conditions with an award-winning record.

•Account Options: RoboForex also offers a wide range of accounts, including Islamic, Copy accounts, and more.

👎 Cons

•Pro Conditions: One of the negative aspects of RoboForex is that pro conditions are not as excellent as Prime/ECN

•Withdrawal Fees: Users may be charged fees for withdrawals.

IC Markets - The best broker for weekend trading with tight spreads

IC Markets is considered one of the best brokers for weekend trading due to their availability of trading during extended hours. They offer to trade on weekends for selected instruments such as cryptocurrencies, indices, and some forex pairs. In addition, IC Markets' trading platform is known for its fast execution speeds and tight spreads, essential for traders who want to take advantage of short-term opportunities.

Features

The prominent features of IC Markets are:

Accepts all Strategies

Exceptional Trading Conditions

Robust Range of Securities Supported

Always Accessible Customer Service

👍 Pros

•Exceptional Order Execution Speeds

•No Fees for Deposits or Withdrawals

•24/7 Customer Service Availability

•Intuitive Trading Platforms and Profound Tools

•Highly Tight Adjustable Spreads & Low Commissions

•Support Trading for All Styles & Strategies

👎 Cons

•Us Clients Not Accepted

•Greater Minimum Deposit

EXNESS - best weekend trading broker for beginners

Exness offers an array of beginner’s tools. The broker offers cent accounts for practicing in the real market, unlimited leverage, low entry threshold, classic platform MT4 and MT5 and proprietary browser terminal, and a copy trading service.

Features

In terms of the key features offered by Exness, some of them are as follows:

Mobile Trading: Exness offers full mobile trading experience, unlike other platforms that offer only a limited number of features on mobile apps.

Account Management: Exness makes account management simple. The platform provides a simplified method of managing all trading accounts, including trading and demo accounts.

Execute Transaction on the go: Exness makes a transaction on the go possible. Users can make deposits, withdrawals, and transfers from the comfort of their phones.

Live Chat: Exness offers Live Chat support that enables you to get the answers to pressing questions in real-time.

Educational Tools: Exness offers economic news features with articles, analysis, and more.

Multi-Lingual: Exness also offers an array of languages on its mobile app.

👍 Pros

•Tight spreads in forex pairs.

•Third-party tools.

•24/7 support.

•Several account types.

•Virtual Private Server (VPS).

•Social Trading.

•Minimal Fees.

👎 Cons

•Not available in Europe or the UK for retail clients.

•Limited regulatory oversight for some clients.

eToro

eToro is the best for 24/7 crypto trading because you can use the platform for several other kinds of assets during the weekdays as well. You can have one platform for all your trading needs. It also has relatively low trading fees.

Interactive Brokers - Best for Stock Trading on Weekends

If you are interested in stock trading over the weekend, Interactive Brokers is the best option. It offers exclusive access to the highly lucrative Tel-Aviv Stock Exchange and Tadawul Index market.

Main strategies designed for weekend trading

Here are the main strategies designed for weekend trading:

Gap Trading Strategy

Gap trading is a straightforward and systematic approach to buying and shorting stocks. It occurs when finding stocks with a price gap from the previous close. Users are then expected to watch the first hour of trading to classify the trading range. In other words, increasing above that range signals a buy, while dropping below signals a short.

👍 Pros

•Traders can leverage tools to help interpret data.

•Great for seasoned investors.

•It can be highly lucrative when done right.

👎 Cons

•Traders must be capable of interpreting their own data.

•False positives are common.

•Not good for beginners.

Bollinger Bands

On the other hand, Bollinger Bands are a trading tool that helps determine entry and exit points for a trade. They are typically used bands to decide overbought and oversold conditions.

👍 Pros

•Easy to interpret visually.

•May be used both as a volatility indicator, as well as a momentum oscillator.

•May be applied to underlying assets across any time frame.

•Can provide precise entry levels and stop loss and take-profit zones.

👎 Cons

•They work better in sideways markets than in trending markets.

•Not ideal for extreme price readings

•They may trigger their signals. Therefore, it’s crucial to use signals in agreement with other aspects of technical analysis.

US Stock Market Trading Hours

The US Stock market operates within certain days and hours for uniformity. It also closes on the following holidays:

Martin Luther King Jr. Day

President's Day

Good Friday

Memorial Day

Juneteenth

Independence Day

Labor Day

Thanksgiving Day

Christmas.

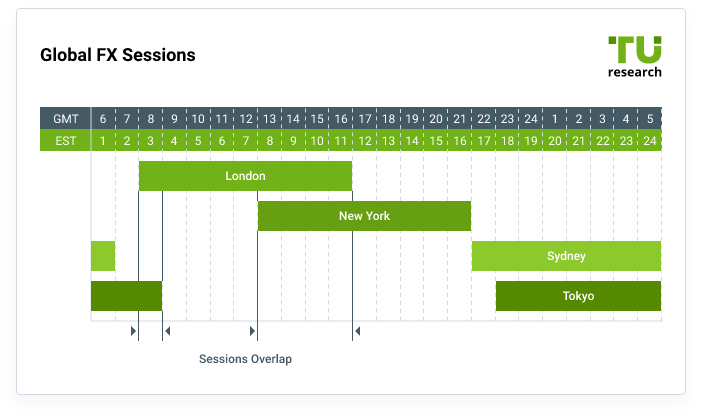

Forex Market Trading Hours

Here is a table of forex market trading hours:

Forex global trading sessions | Hours of overlap

Summary

Weekend trading is a possibility for any trader who is interested in the idea. There is no harm in going against the grain. This post provides all the information needed to make weekend trading a successful endeavor.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

5

Bollinger Bands

Bollinger Bands (BBands) are a technical analysis tool that consists of three lines: a middle moving average and two outer bands that are typically set at a standard deviation away from the moving average. These bands help traders visualize potential price volatility and identify overbought or oversold conditions in the market.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).