What Is The Psychology Of A Crypto Trader?

The psychology of cryptocurrency traders includes their mental and emotional condition, which plays a vital role in their trading decisions and overall success in the cryptocurrency market. Emotions such as fear, greed, and fear of missing out can influence decision-making. It's crucial for traders to understand and manage these psychological aspects to achieve trading results.

Cryptocurrency trading involves navigating an array of complex psychological and emotional challenges. Understanding and managing your emotions is essential for making rational decisions and achieving success in the crypto market.

This article explores the psychology of crypto trading, from recognizing and managing emotions to developing a trading plan and implementing risk management strategies.

Start Trading Now with ByBit To Get Crypto BonusKey takeaways

-

Crypto trading psychology refers to a trader’s mental and emotional state and its impact on trading decisions and outcomes

-

Emotions like fear, greed, and FOMO can influence decision-making and lead to poor trading results

-

Mastering crypto trading psychology involves recognizing and managing emotions and biases

Crypto trading psychology

Crypto trading psychology refers to a trader’s mental and emotional state and its impact on trading decisions and outcomes. Mastering emotions is essential for making informed decisions and controlling irrational ones.

Strategies for mastering crypto trading psychology include developing a trading plan, implementing risk management, practicing mindfulness and meditation, and learning from losses. Recognizing and managing emotions is crucial for rational decision-making and consistent trading results.

Analyzing the provided chart, the following can be seen:

-

FOMO (Fear of Missing Out): This is the anxiety that arises when traders believe they are missing out on a potential profit, often leading them to make impulsive buys. As seen in the chart, periods labeled "FOMO" are typically characterized by rapid price ascents, as traders rush to buy in hopes of catching the uptrend

-

PANIC: This represents the fear and uncertainty that can grip traders when the market takes a downturn. It can lead to rash decisions, such as selling off assets prematurely. In the chart, "PANIC" zones are marked by sharp declines in price, indicative of a widespread sell-off

Understanding these emotional triggers is crucial for any crypto trader, as they can greatly impact decision-making, potentially leading to financial losses. Recognizing and managing these psychological elements can be the difference between successful and unsuccessful trading.

How psychological biases can affect crypto traders

Crypto trading can be heavily impacted by psychological biases. Some common biases include:

-

Greed

-

Fear

-

FOMO

-

Anchoring bias

-

Confirmation bias

These biases can cloud a trader’s judgment and lead to irrational decision-making. Therefore, it is essential for traders to be aware of these biases and to develop strategies to manage and mitigate their effects.

Understanding how these biases can influence trading decisions is the first step in overcoming them. Greed, for example, can lead traders to take excessive risks in pursuit of high profits, while fear can cause traders to panic sell during market downturns.

How crypto traders can manage their psychology

To manage and mitigate these biases, traders can employ various strategies. One effective strategy is to have a well-defined trading plan in place. This plan should include specific entry and exit points, as well as risk management measures such as stop-loss orders.

By sticking to a predetermined plan, traders can minimize the influence of biases and make more rational decisions based on objective criteria. You can read our guide on trading psychology and how to overcome yourself.

Traders can also benefit from keeping a trading journal. This journal can help them track their emotions and biases, allowing them to identify patterns and areas for improvement. Regularly reviewing and analyzing past trades can help traders gain insight into their decision-making processes and make necessary adjustments.

Lastly, seeking external perspectives can provide valuable insights. Engaging in discussions with other traders, participating in trading communities, or seeking guidance from mentors can bring fresh perspectives and challenge one’s own biases.

Let’s further explore each of the common biases.

Greed

Greed is one of the most common psychological biases and can lead to irrational decisions and poor trading outcomes for crypto traders.

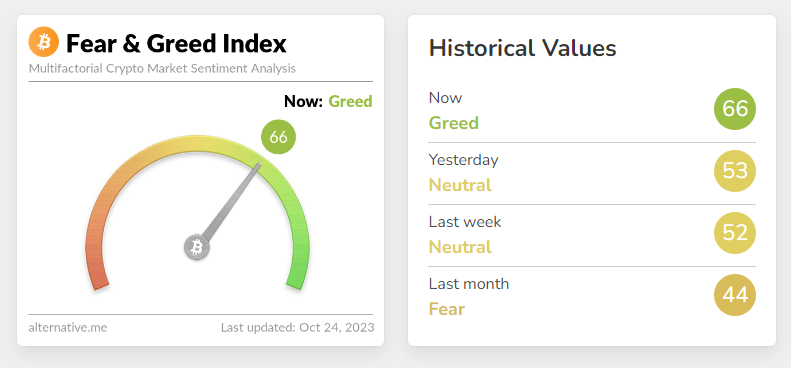

As you can see above, in terms of market sentiment, greed is the opposite of fear, as they can lead to excessive and irrational buying and selling respectively.

Greed leads to overtrading, taking excessive risks, and disregarding stop-loss orders. It can also cause traders to become overconfident and disregard market signals.

Fear (Panic)

Fear can lead to irrational decisions, like trading out of panic, selling too quickly, or even holding onto assets too long. It can also lead to other biases, such as confirmation bias and loss aversion.

Generally speaking, the higher the level of fear, the harder it is to stay collected and make rational decisions. Panic is considered the highest level of fear.

Developing a trading plan, setting clear goals, and practicing risk management can help traders make rational decisions and avoid being ruled by fear.

FOMO (Fear of missing out)

FOMO is a specific type of fear that’s commonly associated with crypto trading and refers to the fear of missing out on prices going up and therefore on potential profits. In that regard, FOMO is not dissimilar to greed, as it can cause crypto traders to impulsively buy without much analytical thought.

Oftentimes, FOMO can cause traders to bypass their normal risk assessment and enter into trades too quickly.

Anchoring bias

Anchoring bias can cause traders to rely too heavily on initial information. In the context of trading, this bias can manifest in various ways:

-

Price Levels: Traders might become fixated on a specific price level they initially bought an asset at or heard about. Even if new information suggests that this level is no longer relevant, they might still use it as a reference point for making future trading decisions

-

Historical Highs or Lows: A trader might anchor their expectations based on historical highs or lows, believing that a stock or asset will revert to these levels, even if market conditions have significantly changed

-

Forecasts and Predictions: If a trader hears a prediction or forecast, they might anchor their expectations to this figure, even if subsequent information or events make the forecast outdated or irrelevant

To combat this type of bias, traders should pay more attention to newer information, as well as not avoid entering a second trade if the first trade was closed at a stop loss.

Confirmation bias

Confirmation bias involves seeking and interpreting information in a way that confirms traders’ existing beliefs. For example, if a trader believes Bitcoin will continue to rise in price, they may look for news and analyses that support that thesis. This type of bias can prevent traders from considering alternative perspectives or data which may conflict with their existing beliefs.

Traders should strive to be objective and consider all relevant factors. It takes a certain level of mental effort to be open to hearing news and perspectives that are opposed to the trader’s own personal beliefs.

Overconfidence

An often overlooked psychological bias that can have a major impact on crypto traders is overconfidence. This bias occurs when a trader overestimates their knowledge and ability in the market, leading to excessive risk-taking and poor decision-making.

This can manifest in several ways, such as:

-

Lack of risk management:

-

Taking on more risk than necessary

-

Not setting stop-loss orders

-

Ignoring risk/reward ratios

-

-

Poor decision-making:

-

Making trades despite lack of market knowledge

-

Not following a trading plan

-

Failing to assess potential risks

-

Overcoming overconfidence requires discipline, self-control, and a long-term perspective. Other strategies include taking breaks, setting clear goals, and practicing mindfulness.

Best crypto exchanges

Tips for managing your emotions when crypto trading

Although emotions can be difficult to handle and prevent from affecting trader’s decision making, there are ways to mitigate their influence, and ideally even eliminate it altogether. Here are some tips that can help with emotion management:

-

Set clear goals and expectations

-

Do research to develop a trading plan

-

Use stop-loss orders and risk management techniques

-

Take breaks from trading and don’t look at charts all day every day

-

Start a trader's diary and analyze your trades and the emotions you felt while trading. Try to improve yourself, it is not easy but it is necessary in order to survive in the crypto market

Traders should also have a long-term perspective and accept losses as part of the process. Seeking professional help, such as a trading coach or mentor, or joining trading forums can also be beneficial.

Practicing mindfulness and relaxation techniques can help reduce overall stress and anxiety, which in turn will help make rational trading decisions.

Conclusion

Crypto trading is a complex endeavor that requires an understanding of both the markets and psychology. Successful crypto traders must learn to identify and manage their emotions. They also need to develop a trading plan and implement risk management strategies.

By recognizing the psychological pitfalls of trading and taking steps to manage them, traders can develop the discipline and patience necessary to succeed in the crypto markets.

The following table provides a summary of the most common negative impacts that psychological biases can have on traders, and how they can combat them.

| Negative Impact | Positive Impact | How to Achieve Positive Impact |

|---|---|---|

|

Overemotional decisions |

Confidence |

Self-control |

Overtrading |

Following trading plan |

Careful and rational market analysis |

Excessive risk |

Risk management |

Mindfulness |

Ignoring stop-losses |

Setting goals |

Learning from losses |

Overconfidence |

Patience |

Focus on staying humble |

For further reading, our article on how to trade crypto provides a comprehensive guide to trading cryptocurrencies for beginners.

FAQs

What is the psychology behind trading?

Trading psychology refers to the emotions and mental state that affect a trader's decision-making process, including fear, greed, confidence, and discipline, which play crucial roles in determining trading outcomes.

What makes you a good crypto trader?

A good crypto trader possesses a solid understanding of the market, maintains emotional discipline, employs effective risk management strategies, and continuously educates themselves about evolving trends and technologies.

What is the motivation for a crypto trader?

The motivation for a crypto trader often stems from the potential for high returns, the allure of the decentralized financial world, and the excitement of participating in a rapidly evolving market landscape.

How can I be psychologically strong in crypto trading?

Develop a clear trading strategy, avoid emotional decision-making, continuously educate yourself, and practice regular self-reflection to understand and manage emotional triggers.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Crypto trading

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

-

5

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).