USD/JPY forecast for today by Traders Union analysts

The USD/JPY is one of the most popular pairs among Forex traders. The USD/JPY forecast for today is prepared by the analytical department of Traders Union based on the technical analysis of the price: support and resistance levels and also Forex indicators.

USD/JPY continues to recover

08.07.2025

Once again rebounding from 144.30 support against the Japanese yen, the US dollar this time broke 145.20 resistance and tested 146.20 resistance. Trump has sent Japan a notice about tariff increases starting August 1, which may negatively affect yen dynamics, but the risks of a renewed dollar decline still remain.

USD/JPY remains under pressure

07.07.2025

The rise of the US dollar against the Japanese yen has also been used for selling, pushing the pair down to 144.20 support after testing 145.20 resistance. The nearest local resistance is around 144.60, below which the risks of breaking support and declining toward 144.00–143.70 prevail; a move through local resistance would lead to a rise toward 144.80–145.00.

USD/JPY bought on US data

04.07.2025

Buying of the US dollar against the Japanese yen on the US employment report led to the break of 144.20 resistance and the rise to 145.20. The dollar’s recovery may be used for selling and testing 144.20 support, where it may be bought again; a break of 145.20 resistance would lead to a rise toward 145.50–146.00.

USD/JPY under pressure again

03.07.2025

After finding support around 143.40, the US dollar resumed its recovery against the Japanese yen, breaking resistance 143.80 and testing resistance 144.20. Selling resumed on the rise, and bears are currently testing support 143.60. The dollar remains vulnerable, so a decline toward support 143.30–143.00 is possible; a break of 143.80 would allow bulls to test 144.00–144.20.

USD/JPY was bought on decline

02.07.2025

Selling of the US dollar against the Japanese yen led to the break of support 143.80 and a decline to support 142.70. After testing it, there was a rebound to resistance 143.80, where the dollar continues to be sold. Below this level, the risks favor a decline toward 143.00–142.70; a break of resistance would lead to a rise toward 144.00–144.30.

USD/JPY sold on rally

01.07.2025

The US dollar was sold against the Japanese yen on the rebound from 143.80 support toward 144.50 resistance, and bears are once again testing this support. The return to this level increases the risk of a break and a decline toward 143.50–143.20, where the dollar may be bought. A move through 144.20 would lead to a rise toward 144.50–144.70.

USD/JPY recovers, but downside risks remain

30.06.2025

Buying of the US dollar against the Japanese yen from 144.20 support pushed the pair back toward 144.90 resistance. Bulls failed to break through, keeping risks elevated for a drop toward 144.20–144.00. A move through resistance would lead to growth toward 145.20–145.50, where the dollar may face renewed selling. Yen weakness may continue to be used for buying opportunities.

USD/JPY under selling pressure

27.06.2025

Remaining under pressure against the Japanese yen, the US dollar broke 144.60 support and declined to 143.80 support. As is typical, bulls are now attempting to break 144.60, which has turned into resistance and may trigger selling. A break of resistance would lead to a rise toward 145.00–145.30.

USD/JPY sold on rally

26.06.2025

On a decline to 144.60–144.50 support, the US dollar was once again bought against the Japanese yen, but its rise was capped by 145.90 resistance, where it came under renewed pressure and retreated to 145.10 support. Below 145.90–146.00, downside risks toward 144.00–143.50 remain; a break above 146.00 would lead to a move toward 146.40–146.70.

USD/JPY remains under pressure

25.06.2025

Selling of the US dollar against the Japanese yen continued, leading to the break of 145.40 support and the decline toward 144.60 support. From current levels, a rebound toward 145.40 is possible; a loss of support would lead to a move toward 144.00. Yen declines may continue to be used for buying.

USD/JPY sold off on rally

24.06.2025

The US dollar was sold against the Japanese yen from 148.00 resistance, causing the pair to decline to 146.10 support. Here, bulls may become active and test 146.80–147.00 resistance; a loss of support would lead to a decline toward 145.40–145.10. There are currently no strong reasons for a large-scale yen sell-off.

USD/JPY extended its recovery

23.06.2025

Finding support around 145.20, the US dollar extended its recovery against the Japanese yen, testing 145.70 resistance and then strong resistance around 146.20/30. From there, bears may again attempt to regain control, but the chances of a break and a move toward 147.00 have increased. A loss of 145.70 support would lead to a decline toward 145.20–145.00.

USD/JPY broke 145.40 resistance

20.06.2025

Buying of the US dollar from 144.30 against the Japanese yen led to the break of 145.40 resistance and the rise toward 145.75 resistance. The nearest support now stands around 145.40, from which further growth toward 145.80–146.00 is possible; a loss of support would trigger a decline toward 145.00–144.80.

USD/JPY bought on dip

19.06.2025

Under selling pressure in the pair with the Japanese yen, the US dollar declined to 144.40 support, where it was bought again, and bulls retested 145.20 resistance. The Bank of Japan left the interest rate unchanged, which added pressure on the yen, though ongoing demand for safe-haven assets may support it. In the short term, the pair may trade in a range, with downside risks still present; a break above 145.20 resistance would allow bulls to retest 145.40 resistance.

USD/JPY returns to strong resistance

18.06.2025

The US dollar was bought from 144.40 support against the Japanese yen, and on another attempt, the bulls managed to break through 145.00/10 resistance and test 145.35 resistance. From current levels, bears may still attempt to regain control, but the chances of breaking resistance have increased, and if successful, bulls could test 146.00–146.30.

USD/JPY bought on dip

17.06.2025

The decline of the US dollar toward 143.70 support against the Japanese yen was used for buying, but the rally was capped by 144.85 resistance. From there, another pullback toward 143.80–143.40 support is possible; a break of resistance would lead to a move toward 145.20–145.50. The Bank of Japan’s interest rate decision may impact the pair’s dynamics.

USD/JPY also bought on dip

16.06.2025

Breaking 143.20 support, the US dollar tested 142.80 against the Japanese yen, where it was bought. At this stage, its recovery is capped by 144.40/50 resistance, but with demand emerging from 143.85, bulls may attempt to break this resistance; losing support would lead to a decline toward 143.40–143.00.

USD/JPY also resumes decline

13.06.2025

Selling in the US dollar has resumed against the Japanese yen as well. After breaking 144.00 support, the pair fell to 143.20 support, with recovery attempts now capped by 143.80/90 resistance. As long as the pair stays below this resistance, risks remain elevated for a break of support and a move toward 142.80–142.60. A push through resistance would open the way to 144.20–144.40.

USD/JPY sold on rally

12.06.2025

The US dollar was sold against the Japanese yen on a rally to 145.40 resistance, and bears tested 144.40 support. A rebound from there toward 146.00 is possible; a loss of support would lead to a decline toward 144.00. At this stage, there are no clear reasons for large-scale selling or buying of the yen, so the pair may continue trading in a broad range.

USD/JPY bought on dips

11.06.2025

The US dollar’s decline against the Japanese yen from 145.20 resistance to 144.45 support was used for buying, which pushed the pair to test 145.00 resistance. The rise may still be used for selling and a retest of 144.45 support at minimum; a move above resistance would increase the chances of breaking 145.20 and rising toward 145.70–146.00.

USD/JPY trades mixed

10.06.2025

Selling of the US dollar against the Japanese yen from 145.00 resistance led to a decline toward 144.00 support, where the dollar was bought again. This time, the bulls failed to break 144.70 resistance, keeping the risk of a break below local 144.40 support and a move to 144.00 at minimum elevated. A break of resistance would allow bulls to retest 145.00.

USD/JPY Continues Recovery

09.06.2025

On Friday, the US dollar continued its recovery against the Japanese yen, as a result of which the resistance in the 144.40 area was broken and the 145.10 level was tested. Its growth can still be used for sales, where the nearest target for bears may be the support at 144.40; a break of the current resistance will lead to growth towards 145.50-146.00.

USD/JPY under pressure after attempted rally

06.06.2025

After buying up the US dollar against the Japanese yen, dollar bulls broke 143.40 resistance and tested 143.80 resistance. The yen’s weakness is still being used as an opportunity to buy it, so the dollar remains under pressure and risks returning to 143.00–142.60 support. A break of resistance would lead to a rise toward 144.30–144.50.

USD/JPY selling off after rally

05.06.2025

US dollar bulls failed to break 144.30 resistance, which encouraged bears to push through 143.80/70 support and test 142.60 support. From current levels, renewed attempts to rise toward 143.20–143.60 are possible; a break below current support would increase the risk of breaking 142.40 and moving down toward at least 142.00.

USD/JPY recovering losses

04.06.2025

The US dollar was bought back from 142.60 support against the Japanese yen, allowing it to rise to 144.10 resistance. A break would lead to a move toward 144.40–144.60, though bears may become active again on the rise. Clearing the latter could allow bulls to test 145.00; losing 143.80 support would lead to a decline toward 143.30.

USD/JPY also continued to decline

03.06.2025

The US dollar remained under selling pressure yesterday against the Japanese yen, breaking 143.60 support and testing 142.60 support. The nearest resistance is around 143.00, and the bulls’ failure to break above it indicates risks of a decline toward 142.00; a break above resistance would lead to a rise toward 143.60.

USD/JPY risks further decline

02.06.2025

The US dollar is also under selling pressure against the Japanese yen, with the pair capped by 144.20–144.40 resistance, while bears are actively trying to break 143.50 support. The likelihood of a break and a move toward 143.00 appears high; a break through 144.10 resistance would lead to a rise toward 144.40–144.80. The yen, like the franc, may continue to be in demand as a safe-haven asset.

USD/JPY selling off after rally

30.05.2025

The US dollar was sold against the Japanese yen on the rise to 146.10 resistance. After breaking through a series of supports, the dollar plunged to 144.00 support, which bears initially failed to break. However, the nearest resistance lies around 144.20/40, suggesting risks of a break below support and a decline toward 143.60–143.30; a move through resistance would lead to a rise toward 144.80–145.00.

USD/JPY continues to recover

29.05.2025

After finding support around 144.00–143.90 in the pair with the Japanese yen, the US dollar extended its recovery, breaking 144.70 resistance and testing 145.10. The dollar’s recovery can still be used for selling, and bears may test 144.50–144.30 support; a break of resistance would lead to an advance toward 145.30–145.50.

USD/JPY recovers after decline

28.05.2025

The US dollar’s decline against the Japanese yen was halted by buying interest from 142.20, after which the dollar broke 143.00 resistance and tested 144.40 resistance. A break above it would pave the way for a recovery toward 144.80–145.00; loss of 143.80 support would lead to a drop toward 143.00. In the short term, wide-range trading is possible.

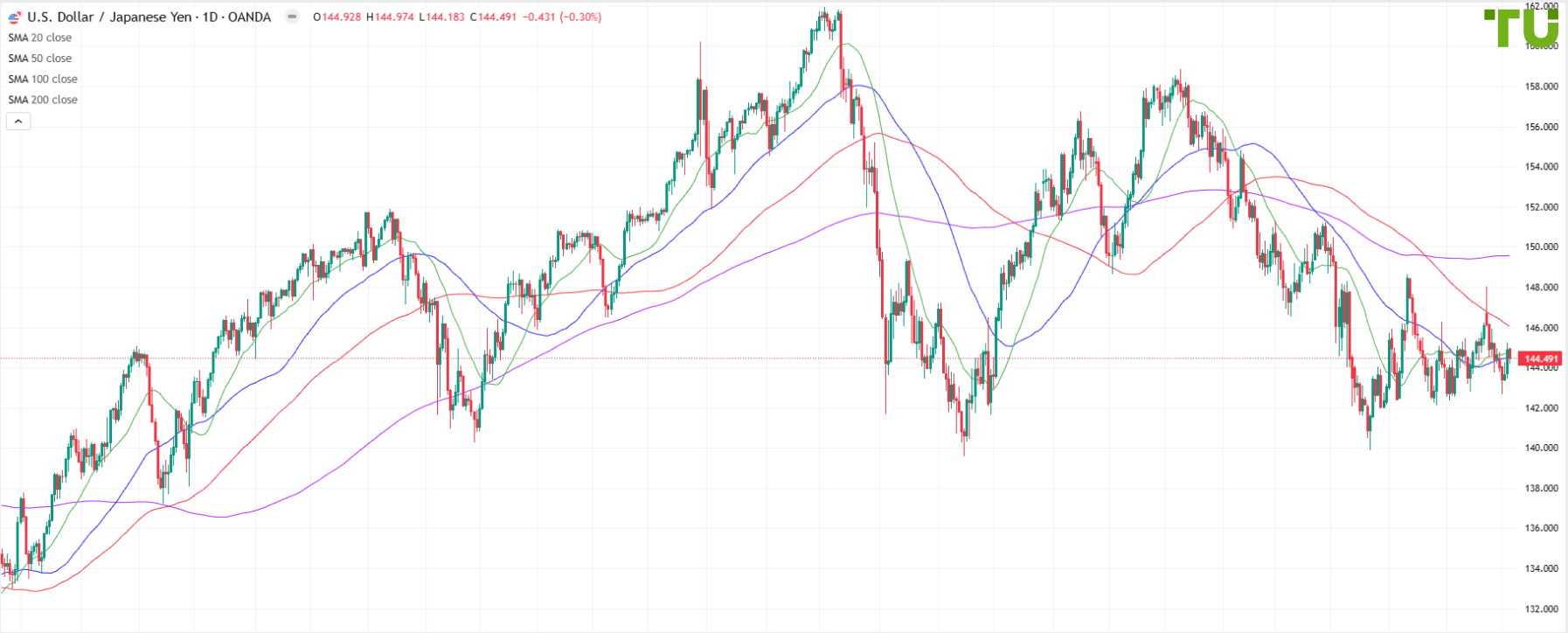

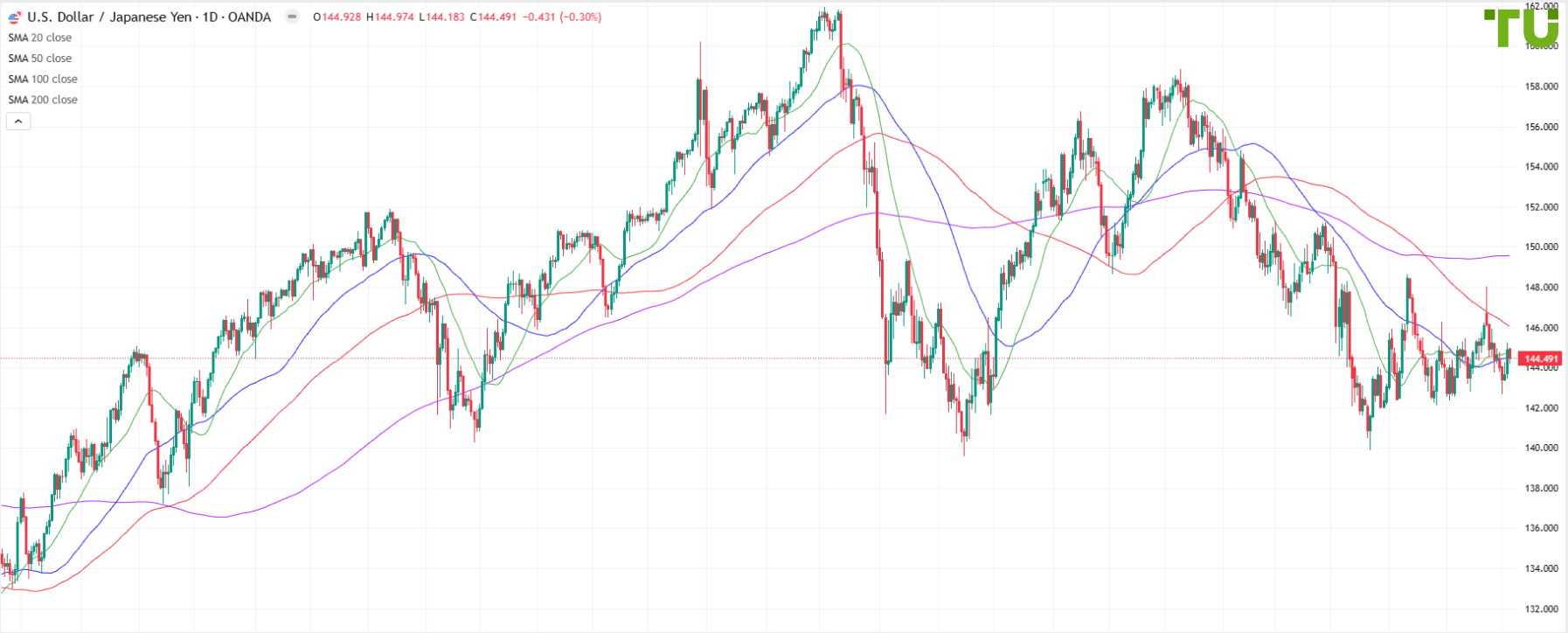

USD/JPY chart

{{filterName}}

{{typeName}}

Why is it important to know the USD/JPY price prediction?

The US Dollar / Japanese yen (USD/JPY) currency pair belongs to the group of the best currency pairs for trading, as it is highly liquid. This pair is particularly interesting for scalping and day trading.

The popularity and high liquidity of USD/JPY can be explained by economic factors, as the U.S. and Japan hold key positions in the global economy. Forex market is used to ensure foreign trade transactions. Forex traders can earn their profit on currency price fluctuations.

FAQ

1

What is the USD/JPY price prediction based on?

Traders Union analysts use various methods of technical analysis:

indicators, support and resistance levels, patterns, etc.

2

What is technical analysis in the Forex market?

Technical analysis is a method of predicting the price movement of a currency pair based on the patterns in the past. It is believed that traders act in the same way under the same circumstances, which is reflected in the price chart.

3

How accurate is the USD/JPY price prediction?

One needs to understand that nobody can give a 100% guarantee. However, Traders Union price predictions are rather accurate, as they take into consideration a combination of factors. Also, the analysts try to provide two versions of development of events: the basic and an additional one.

4

What impacts Japanese yen price against the US dollar

The price of the Japanese yen against the US dollar forms under the influence of economic and speculative factors. Here are some of them:

- Policies of the Central banks of the U.S. and Japan;

- Dynamics of export-import transactions of the two countries;

- Level of inflation;

- Overall situation in the global financial markets;

- Latest Forex trends.

- Policies of the Central banks of the U.S. and Japan;

- Dynamics of export-import transactions of the two countries;

- Level of inflation;

- Overall situation in the global financial markets;

- Latest Forex trends.