XRP/USD forecast for today by Traders Union analysts

The XRP/USD pair means that the price of Ripple is measured in the U.S. dollars. This altcoin was launched by Ripple Labs Inc. as a “digital asset for global payments”. High transaction processing speed and miser transaction fees are the key benefits of Ripple.

RippleNet operates on the basis of the existing banking infrastructure and XRP register, which allows for improvement and expansion of the traditional financial system capacity. This explains investor interest towards the XRP/USD pair. However, recognition of XRP as a security remains a question. The lawsuit of the SEC filed against Ripple in 2020 still hasn’t been resolved. This means that there is a certain risk for investors.

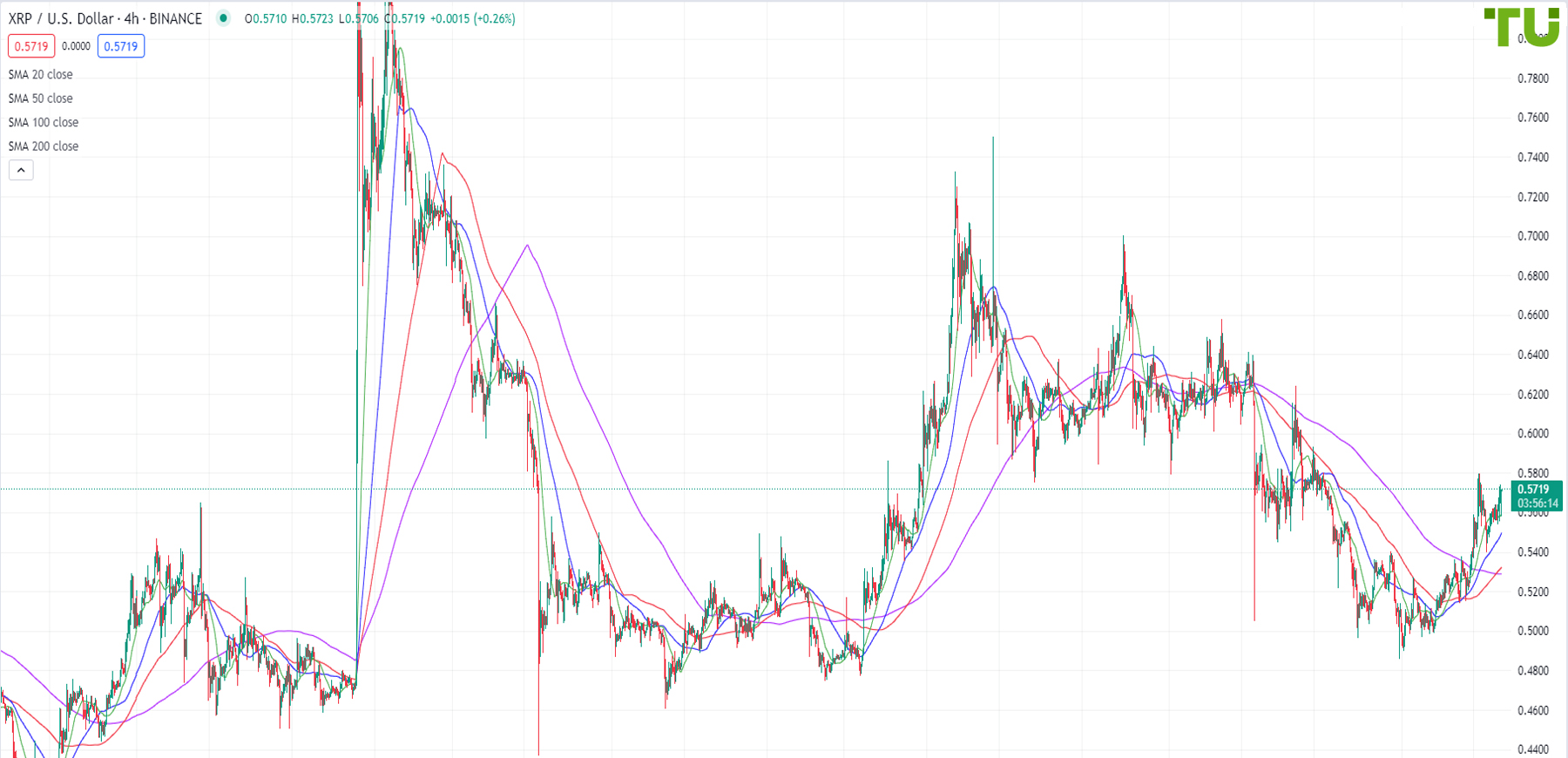

TU analysts make daily XRP/USD price predictions to give you an idea for the price movement today, in a week, in a month, etc. The experts use methods and instruments of technical analysis (support/resistance levels, indicators, etc.) to make the predictions. In addition, you can view the Ripple price live on an interactive chart on the website.

XRP/USD is recovering after a drop

24.04.2024

XRP/USD collapsed to 0.4300

16.04.2024

XRP/USD is trying to resume growth

09.04.2024

XRP/USD resumed its decline

02.04.2024

XRP/USD declines after rising

26.03.2024

XRP/USD continues to fall

19.03.2024

XRP/USD updated the current highs

12.03.2024

XRP/USD is trying to break through the resistance of 0.6692

05.03.2024

XRP/USD storms resistance at 0.5700

28.02.2024

XRP/USD rises in price after a decline

20.02.2024

XRP/USD is being bought back on the ottates

14.02.2024

XRP/USD under pressure after recovery

06.02.2024

XRP/USD under pressure after growth

30.01.2024

XRP/USD broke through the support and continued falling

23.01.2024

XRP/USD returned to the consolidation range

16.01.2024

XRP/USD in the consolidation phase after the fall

09.01.2024

XRP/USD was bought back in the fall

19.12.2023

XRP/USD sold on the growth

12.12.2023

XRP/USD remains in a narrow range

05.12.2023

XRP/USD returned to the area of 0.60000 level

28.11.2023

XRP/USD under pressure after growth

21.11.2023

XRP/USD declines after trying to break through the highs

15.11.2023

XRP/USD updated the current highs

07.11.2023

XRP/USD broke through resistance

31.10.2023

XRP/USD broke through several resistances and tested 0.58510

24.10.2023

XRP/USD returned to support after growth

18.10.2023

XRP/USD resumed its decline

10.10.2023

XRP/USD sold off again on the growth

03.10.2023

XRP/USD remains under pressure from bears.

26.09.2023

XRP/USD returned to resistance.

19.09.2023

Ripple USD chart (live)

Why is it important to know how the Ripple price changes against the U.S. dollar?

Ripple has a weak correlation with the price performance of Bitcoin, the first cryptocurrency. It is difficult to draw a parallel. This is primarily because the altcoin cannot be mined. The Ripple price is influenced by demand/supply at cryptocurrency exchanges, number of coins in circulation and emission, news related to the token, etc. Both bearish and bullish trends can form.

Trading XRP/USD allows traders to earn profit even with minor price fluctuations, although you need to continuously monitor the pair’s price chart to achieve that. Ripple price prediction for today by TU analysts will also come in handy.

FAQ

How is the XRP/USD forecast made?

Can the XRP/USD forecast be trusted?

What factors influence the Ripple price chart?

• emission and number of coins in circulation;

• financial market volatility;

• decisions of the SEC;

• unplanned events and economic and political news.