Forex Copy Trading | A Comprehensive Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Copy trading allows investors to replicate the trades of experienced traders in real-time. This helps beginners benefit from the expertise of seasoned traders without needing deep market knowledge. To use it, select a reliable copy trading platform, choose successful traders to follow, and allocate funds.

According to statistics, only 11-25% of beginners manage to stay in the Forex market and make money professionally. There are several reasons, but the main ones are psychological factors and not having enough time. However, even a beginner with limited time can still earn money and gain valuable experience with minimal risk by using Forex copy trading or auto trading.

Forex copy trading means you don’t make your own trades. Instead, you copy the trades of another trader who has a successful track record. By following the strategies of a successful trader, you can increase your chances of making consistent profits. Of course, it's important to choose a good trader to copy from. In return for sharing their strategy with you, the successful trader usually takes a small percentage of your earnings as a commission on each trade, creating a win-win situation.

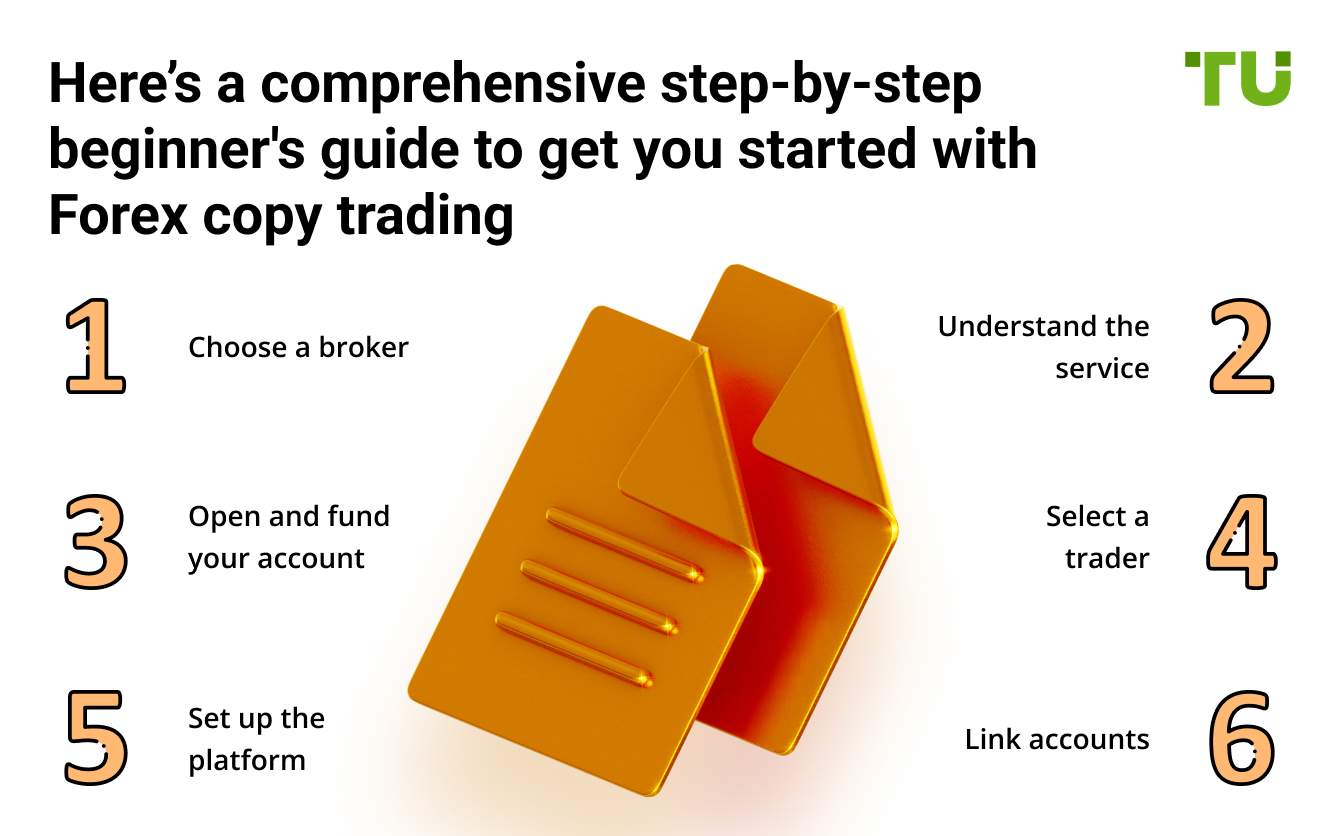

Beginner's guide to use Forex copy trading

Forex copy trading is an innovative way for beginners to engage in the Forex by mimicking the trades of experienced traders. This approach allows novices to benefit from the knowledge and strategies of seasoned traders without needing extensive market analysis or trading experience themselves.

Here’s a comprehensive step-by-step beginner's guide to get you started with Forex copy trading:

Choose a broker:

Pick a broker from the provided list that offers copy trading.

Understand the service:

Check the broker's website for details on their copy trading service.

Open and fund your account

Create your trading account and deposit funds.

Select a trader:

Choose a successful trader whose transactions you want to copy.

Set up the platform:

Download and run the trading platform (MT4, MT5, ZuluTrade, etc.).

Link accounts:

Add the trader's account to yours in the Accounts section.

Methods of copy trading

Direct copy trading:

Description: This involves automatically copying all trades executed by a selected trader. Once you select a trader to follow, every trade they make is replicated in your account in real-time.

How It Works: You allocate a portion of your funds to copy a trader. The platform then mirrors the trades made by the selected trader, proportionally to your allocated funds.

Mirror trading:

Description: Similar to direct copy trading, but focuses on mirroring the strategies rather than individual trades. You essentially follow a trader's strategy which the platform automatically applies to your account.

How It Works: You choose a strategy developed by an experienced trader or a group of traders. The system then executes trades based on the predefined rules of that strategy.

Social trading:

Description: This method combines elements of social media with trading. Traders can share their strategies, insights, and trade signals with their followers.

How It Works: You follow traders whose strategies and insights you trust. While you can automatically copy their trades, social trading platforms often allow for more interaction and manual copying based on shared information.

Signal copying:

Description: Traders or signal providers offer trade signals which you can manually or automatically copy. These signals include trade recommendations, often with entry and exit points.

How It Works: You subscribe to a signal service. When a signal is issued, you have the option to execute the trade manually or have it automatically copied to your account.

Fund copying:

Description: Similar to mutual funds, but for Forex trading. Here, you invest in a fund managed by a professional trader or a group of traders.

How It Works: You invest a portion of your capital into a managed fund. The fund manager executes trades on behalf of all investors, and profits or losses are shared proportionally based on your investment in the fund.

Semi-automatic copy trading:

Description: This method allows for a more hands-on approach where you can choose which trades to copy rather than copying all trades automatically.

How It Works: You receive notifications or alerts about trades made by a selected trader. You then decide manually whether to copy each trade based on your assessment.

How to start earning on copy trading

Auto trading is the easiest way to start investing in Forex because it doesn't require market analysis or predictions. To get started, you need to choose the right Forex broker and the best trader to copy.

1. Choosing a broker

Many Forex brokers offer auto trading services that let you copy transactions from other traders.

When selecting a broker, consider:

The number of traders available to copy.

A wide selection of trading instruments.

The commission for auto trading.

Rebate options (partial return of the spread).

Minimum deposit requirements (typically around $500).

2. Choosing a trader

The success rate of copied trades can be as high as 70%. When selecting a trader, consider these factors:

Profitability: Look at the trader's performance over longer periods to get a clear picture of their success.

Duration of trading: Check how long the trader has been active with the broker, not just their overall experience.

Number of followers: A higher number of people copying a trader can indicate reliability, but don't overlook promising new traders.

Risk level: Assess the trader's maximum risk, which includes their deposit usage and leverage. Higher risk can mean higher potential returns but also higher potential losses.

Commission: Each trader sets their commission rate for successful trades. You only pay this if the trade is profitable.

We have analyzed several brokers for you to help you get started on your copy trading. And here are their basic conditions.

| Pepperstone | OANDA | FOREX.com | IG Markets | Thinkorswim | |

|---|---|---|---|---|---|

|

Copy trading |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

No | No | 100 | 1 | 2000 |

|

Minimum order, $ |

0.01 lot | 0,01 lot | 0.01 | 0.01 | 0.1 |

|

Demo account |

Yes | Yes | Yes | Yes | No |

|

Leverage, 1: |

Up to $400:1 retail, 500:1 Pro | Up to 1:200 | Up to 1:400 | Up to 1:200 | Floating |

|

Trading platform |

MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | WebTrader, MetaTrader4, Mobile platforms, MetaTrader5 | FOREX.com, MT4, MT5 | MetaTrader4, API, ProRealTime, IG Trading Platform | Thinkorswim |

|

Open an account |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Study review | Study review |

Trading platforms and signals

Auto trading through brokers’ services is the most popular way to invest in Forex, but it's not the only method. Another popular option is using auto copy platforms, such as MQL5 and ZuluTrade, which provide trading signals. Here are two more ways to copy trades:

1. Copying through platforms

How it works: Traders work directly with platforms, not brokers. They can deliver signals (trades for copying).

Features: Each platform has trader ratings, paid and free copying options, and modes like fully automatic, semi-automatic, and manual copying.

Benefits: Platforms offer bonuses for attracting investors.

2. Copying through social networks of traders

How it works: Created by brokers, these networks combine auto copy platforms with social interaction.

Features:

1. Detailed trader information and direct chat options.

2. Ability to copy trades and decisions of other successful investors.

3. No commission for copied trades; payment is from the spread.

We recommend using trusted brokers for copying transactions because they offer more reliability and better opportunities to diversify risks.

Tips for choosing a trader to copy

Choosing a successful trader to copy is crucial for your income. Here’s how to make a smart choice:

Check trader ratings:

Look at the ratings of successful traders who offer their trades for copying. Start with the Top 5 or Top 10.

Compare profitability:

Review the traders' profitability over the past 1-3 months, not just the last few days.

Assess experience:

See how long each trader has been active on the platform and how many investors are copying their trades.

Evaluate key parameters:

Focus on profitability, duration of trading, and the number of followers. Choose a trader who performs well across all these parameters.

Consider risk levels:

If available, check the maximum risk associated with each trader. Starting with lower-risk traders might be wise.

Compare commissions:

Review the commission rates of top traders. Similar commissions are typical among the best traders. Some offer free copying, which can be beneficial.

Read reviews:

Check reviews from other traders for additional insights.

By following these steps, you can select a managing trader who balances profitability, experience, and risk, ensuring a better chance of success in your copy trading endeavors.

Pros and cons of copy trading

By understanding these pros and cons, you can make informed decisions about using automated copy trading to invest in Forex.

- Pros

- Cons

- No emotional decisions: Trades are made by professionals, not influenced by your emotions.

- Diversified risks: Spread across multiple successful traders and assets.

- No need for Forex knowledge: You don't need to analyze markets; just choose brokers and traders.

- Variety of choices: Many brokers, traders, and auto-copying options available.

- Potential for good income: Leverage and diversification can lead to significant profits.

- Limited learning: You don’t gain much trading experience or improve your prediction skills.

- Remaining risks: Even top traders can make mistakes.

Copy Forex trading for everyone

I believe copy trading offers a practical entry point for beginners and a convenient strategy for experienced traders. The ability to replicate the trades of successful professionals minimizes the learning curve and reduces the time commitment needed to analyze markets independently. However, it's essential to approach it with a strategic mindset—carefully selecting traders based on their performance, experience, and risk profile.

By diversifying investments across multiple traders and assets, you can manage risks more effectively. Despite its advantages, remember that no strategy is foolproof; even top traders can make mistakes. Therefore, continuously monitoring and adjusting your portfolio is crucial for sustained success. Copy trading provides a balanced blend of automation and personal oversight, making it a versatile tool in the Forex market.

Summary

Copy trading allows investors to replicate the trades of experienced Forex traders, providing a way to benefit from their expertise without extensive market analysis. By selecting traders based on performance, experience, and risk level, investors can diversify their portfolios and manage risks more effectively. While copy trading simplifies the investment process, it requires careful selection and ongoing monitoring to ensure consistent returns. This method combines automation with strategic oversight, making it a practical option for both beginners and seasoned traders.

FAQs

Why should I invest in the Forex market?

Investing in Forex is accessible to everyone, regardless of their background. While a degree in economics can be beneficial, it’s not necessary. People from all professions successfully trade in the Forex market.

How does copying transactions help me make money?

By copying transactions, you rely on the expertise of experienced traders with proven success. This increases your chances of profitability and reduces risks by diversifying your investments across multiple assets and top traders.

How can I protect myself when entering the Forex market?

Registering through Traders Union rather than directly with a broker offers added security. Traders Union partners with trusted, licensed brokers and provides additional legal support to its members.

What economic benefits do I get from the Traders Union?

Traders Union offers rebates, which return part of the spread (broker’s commission) to you. Additionally, they hold contests for their traders, providing opportunities for extra income.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Social trading is a form of online trading that allows individual traders to observe and replicate the trading strategies of more experienced and successful traders. It combines elements of social networking and financial trading, enabling traders to connect, share, and follow each other's trades on trading platforms.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.