BlockFi Australia Review - Is It legit? Is it Safe?

BlockFi Australia is a leading cryptocurrency exchange that also offers low-interest-rate loans and interest-bearing accounts. The exchange works with local clients and does not charge trade transactions fees.

Moreover, traders don’t have to worry about any minimum balance, making the platform ideal for beginners too. In this guide, you’ll learn if BlockFi Australia is a good crypto exchange and which features make the platform safe for crypto trading.

Is BlockFi Available in Australia?

BlockFi is completely operational and legal in Australia. Australian traders can use BlockFi to enjoy commission-free trades. In fact, BlockFi is available in all countries of the world, except the sanctioned ones.

Is BlockFi Australia Safe?

One of the top attractions of BlockFi Australia is that the platform takes many measures to ensure the safety of transactions for its users. Since BlockFi is originally based in the US, it follows the federal regulations of the country. But do note that BlockFi is not regulated by the SPIC or the FDIC.

However, BlockFi uses Gemini as its custodian, and the third-party crypto exchange is regulated by the New York State Department of Financial Services. Besides Gemini, BlockFi also keeps its reserves in Coinbase and BitGo.

But BlockFi’s association with third-party reserves isn’t the only thing that makes the exchange a credible option. Renowned investors, such as Morgan Creek Capital Management and Valar Ventures, back the platform.

Since BlockFi also has investment features, it takes certain measures to ensure security in that regard too. For one, the platform only buys equities regulated by the SEC and futures regulated by the CFTC. Simply put, all investments on BlockFi are government-regulated.

As for the users, BlockFi has some features you can use to keep your account safe. One of these features is allowlisting. It’s a self-service feature that lets you restrict or ban withdrawals to specific addresses. In this way, you can prevent the theft of your assets.

BlockFi Australia - General Information

Although primarily a cryptocurrency exchange, BlockFi also has interest-earning accounts for individual users and businesses. On top of that, there’s no minimum deposit, no trade fees, and an abundance of cryptocurrencies to trade.

-

💰 Account currency:

Cryptos, USD, Stablecoins

-

🚀 Minimum deposit:

No

-

⚖️ Leverage:

No

-

💱 Spread:

Market

-

🔧 Instruments:

Cryptos, USD

-

💹 Margin Call / Stop Out:

No

BlockFi Australia Pros and Cons

👍 Pros

•No minimum deposits

•No trade commission fees

• Interest-bearing accounts

• One free crypto withdrawal per calendar month

• Instant trades

👎 Cons

• Website is difficult to navigate

• No explainer videos/tutorials for beginners

BlockFi Australia - Fees

BlockFi charges different withdrawal fees for each cryptocurrency. As mentioned above, there is no commission or transaction fee. So, only the withdrawal fee applies.

| Cryptocurrency | Fees |

|---|---|

BTC |

0.00075 BTC |

LTC |

0.001 LTC |

GUSD, USDC, BUSD, PAX, DAI, USDT |

50 USD |

ETH |

0.015 ETH |

LINK |

2 LINK |

PAXG |

0.035 PAXG |

UNI |

2.5 UNI |

BAT |

60 BAT |

Apart from these regular fees, there are also loan fees on the platform. But you’re only required to pay them if you take a loan. The origination fee for all loans is 2%, and the interest rate ranges from 4.5% to 9.75%.

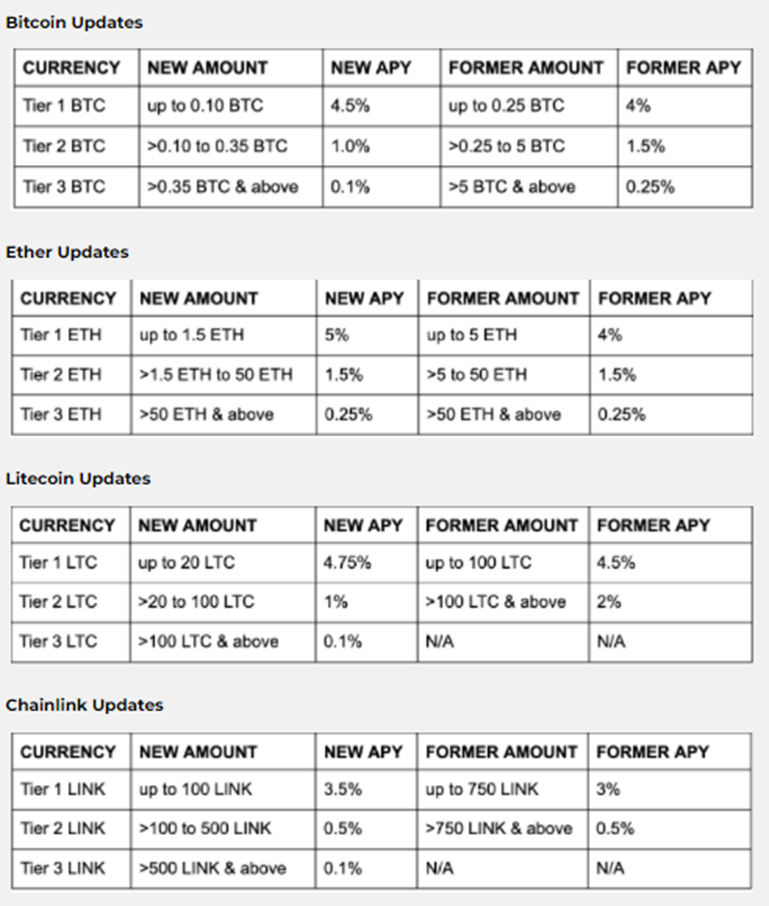

BlockFi Australia Interest Rates

With the BlockFi interest-bearing accounts, you can earn quite a bit of money on the platform. These accountholders earn interest on the cryptocurrency they’ve purchased or deposited on the exchange. The BlockFi Australia interest account is similar to an investment account.

When you sign up for an interest-bearing account, keep in mind that you can only withdraw one stablecoin and one crypto per month for free. Every subsequent withdrawal requires a fee. Apart from individuals, businesses can also set up interest-bearing accounts on BlockFi.

The only difference between individual and business accounts is that the latter is registered in the company’s name. You’ll have to provide some extra documents to get verified, and the verification process may also be lengthier. Previously, the interest rates for each cryptocurrency on the platform were as follows:

| Currency | APY |

|---|---|

BTC (Tier 1) |

4.5% |

BTC (Tier 2) |

1.0% |

BTC (Tier 3) |

0.1% |

ETH (Tier 1) |

5% |

ETH (Tier 2) |

1.5% |

ETH (Tier 3) |

0.25% |

SOL |

5.0% |

ADA |

5.5% |

DOT |

9.5% |

AVAX |

10.0% |

DOGE |

2.0% |

MATIC |

11.0% |

LTC (Tier 1) |

3.50% |

LTC (Tier 2) |

1% |

LTC (Tier 3) |

0.1% |

UNI (Tier 1) |

3.25% |

UNI (Tier 2) |

0.2% |

UNI (Tier 3) |

0.1% |

LINK (Tier 1) |

2.50% |

LINK (Tier 2) |

0.20% |

LINK (Tier 3) |

0.1% |

ALGO |

2.5% |

BCH |

4.5% |

FIL |

2.0% |

ATOM |

7.0% |

BAT (Tier 1) |

1.0% |

BAT (Tier 2) |

0.2% |

BAT (Tier 3) |

0.1% |

PAXG (Tier 1) |

3.25% |

PAXG (Tier 2) |

0.2% |

PAXG (Tier 3) |

0.1% |

USDT (Tier 1) |

8.00% |

USDT (Tier 2) |

7.00% |

USDT (Tier 3) |

5.50% |

USDC (Tier 1) |

8.00% |

USDC (Tier 2) |

7.00% |

USDC (Tier 3) |

5.50% |

BUSD (Tier 1) |

8.00% |

BUSD (Tier 2) |

7.00% |

BUSD (Tier 3) |

5.50% |

DAI (Tier 1) |

8.00% |

DAI (Tier 2) |

7.00% |

DAI (Tier 3) |

5.50% |

PAX (Tier 1) |

8.00% |

PAX (Tier 2) |

7.00% |

PAX (Tier 3) |

5.50% |

GUSD (Tier 1) |

8.00% |

GUSD (Tier 2) |

7.00% |

GUSD (Tier 3) |

5.50% |

Following September 1, 2021, BlockFi made adjustments to the interest earned on a few cryptocurrencies. These include Bitcoin, Ether, Litecoin, and Chainlink.

Photo: Interest Rates

BlockFi also has a credit card that lets you earn crypto on every purchase. With 1.5% crypto earnings on every purchase, BlockFi credit card Australia is an ideal option for people who want to earn crypto regularly.

The BlockFi Visa Australia credit card has no annual or foreign transaction fee. Besides, the BlockFi credit card Australia also offers an intro bonus, spend bonus, and trading bonus.

BlockFi Australia - Supported Coins

BlockFi Australia supports only eight cryptocurrencies and USD-based stablecoins. These include BTC, USDC, ETH, LTC, PAXG, GUSD, USDT, and PAX. However, the platform claims that it will add ‘’as many cryptocurrencies as possible’’ as it continues to grow.

Interest-bearing account holders can earn interest on the following cryptocurrencies. Do note that interests start accruing the day following your deposit and not on the same day as you deposit the crypto.

Bitcoin

Ethereum

LINK

PAX Gold

Litecoin

Paxos Standard

USDT

GUSD and BUSD

How to Withdraw From BlockFi Australia

BlockFi has no restrictions on when or how often you can withdraw your funds. At the moment, the platform gives you one free monthly withdrawal on the following cryptocurrencies:

BTC

LTC

Stablecoins (GUSD, USDC, BUSD)

DAI

PAX

USDT

All subsequent withdrawals in the same calendar month are subject to certain fees. Currently, you can request three types of withdrawals: Wire, ACH, and crypto. When withdrawing funds into your bank account through ACH, keep in mind that the funds may take a while to show in your account since your bank may take some time to process the ACH payment.

As for Wire transfers, BlockFi only supports transfers of $5,000 USD for Australian and other international clients. Plus, you can only initiate Wires in stablecoins.

Here’s how to withdraw your funds from BlockFi.

Go to your account dashboard.

Click the ‘’Interest Account’’ tab.

Choose the asset you want to withdraw.

Click the ‘’Withdraw’’ button.

Type the amount you want to withdraw. You’re done.

BlockFi has a security hold on all withdrawals. Due to this, the processing of a withdrawal takes one business day. If you place your request before 5 pm EST, BlockFi will process it the next business day. But if you place the withdrawal request after 5 pm EST, it will take two business days to process your request.

In some cases, the platform may ask for additional verification to proceed with the withdrawal. If you do not provide verification in a timely manner, your withdrawal will be delayed.

Summary. Is BlockFi Australia a Good Exchange?

To sum up, BlockFi Australia is a good cryptocurrency exchange for intermediate to expert traders who need a one-stop for their crypto needs. It offers fee-free trades and interesting-bearing accounts, allowing traders to earn crypto on their deposits. Plus, the BlockFi Visa Australia credit card is a great way to earn crypto on purchases.

Top 5 BlockFi Reviews

-

Comment

I am 100% confident in the reliability of BlockFI. I have been cooperating with it since it was founded in 2017. For all the time, there have never been any security problems, and hackers have not encroached on the platform, since there are no technical vulnerabilities here. I did not find any design flaws, the terminal is typical, but this does not affect its functionality in any way. I travel a lot, so I really appreciate the possibilities for mobile trading. I use the referral program for additional earnings, but I have not reached any investment decisions, although I heard from friends that the rates are profitable.

-

Comment

This cryptocurrency exchange is full of newbies and I understand why. This platform has made the conditions as comfortable as possible for those who are just starting their way in the financial markets. I liked the simplified registration and verification, the intuitive terminal, and the high-quality customer service. Support is available 24/7, and there are several channels to communicate with the support team. Technical support is sensible, and all issues are resolved promptly.

-

Comment

This crypto exchange has favorable trading conditions, but I came here not for trading or the exchange, but for investing. I learned from a friend that you can earn more money by staking with a freeze of a deposit than by bank deposits. Depending on the type of asset, they pay up to 8% per annum. You can withdraw your money at any time, but you need to understand that in this case, the total amount of payments will be reduced. Interest is paid monthly, and you don't have to wait long. Of the minuses, there are limits for withdrawing funds from the platform and commissions for withdrawing profit.

-

Comment

If you are counting on Blockfi, you are clearly in vain! This is a great way to drain money, nothing more. At one time, I hoped for this company, and went bankrupt ...

-

Comment

I recently started trading on the crypto market, but my experience is still minimal. For six months, I managed to test 3 exchanges, including BlockF. I stopped on this platform because there are no restrictions on trading strategies, and commissions for trading and exchanging digital currencies are zero. Even beginners will feel comfortable on this site - the registration and verification process takes a minimum of time, and there are no problems. Dealing with the terminal will not be a problem either, since it is simple and straightforward in terms of functionality. My verdict: this exchange is excellent, and you can trust it.

FAQs

Do I Need an Account to Be Approved for the BlockFi Credit Card?

Yes, you must have a BlockFi account in order to be approved for the credit card. You’ll only receive your rewards from the credit card if you have an account on the crypto exchange.

How Does BlockFi Calculate Interest Payments?

The platform starts calculating interest the day following your deposit into your Interest Account. The interest accrues on a daily basis, and BlockFi makes interest payments on the last business day of the calendar month.

Can I Lose Money on BlockFi?

Unlike traditional savings and investment accounts, BlockFi is not insured by the FDIC or the SPIC. In case BlockFi goes out of business or there’s a security compromise, you’re at risk of losing the funds in your investment and interest accounts.

How Do BlockFi Crypto-Backed Loans Work?

You have to keep your crypto assets, such as ETH, PAXG, LTC, or BTC, as collateral. Then, you can borrow stablecoins or USD against this collateral.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).