ByBit Copy Trading Review

How to copy trade on ByBit:

Copy trading provides an excellent strategy for traders who are new at this thing and could only commit a little bit of time to do this. The copy trade is when the positions of one trader are copied by the positions of another trader.

Copying the trades of an experienced trader could be lucrative. So we prefer a platform that offers such services as one that could help us gain more. ByBit is one such platform. Here, we will learn how you can become a copy trader on ByBit and master it.

How to copy trade on Bybit?

ByBit allows Copy Trading on both Spot and Derivatives markets, enabling Followers to replicate the trades of experienced Master Traders for potential profits.

To become a copy trading subscriber on ByBit, you have to follow the following steps:

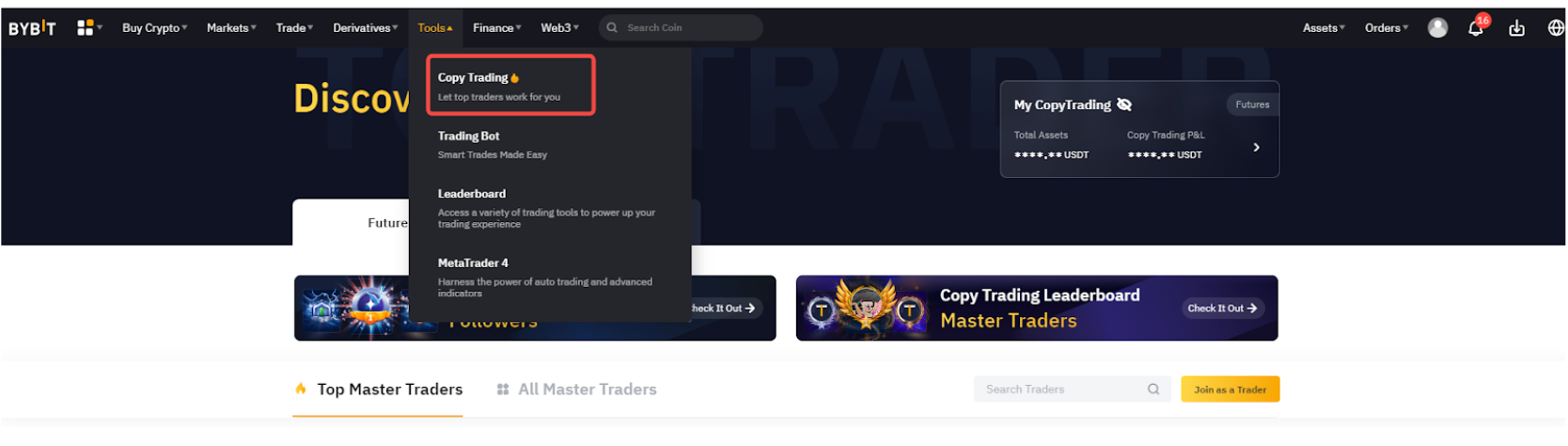

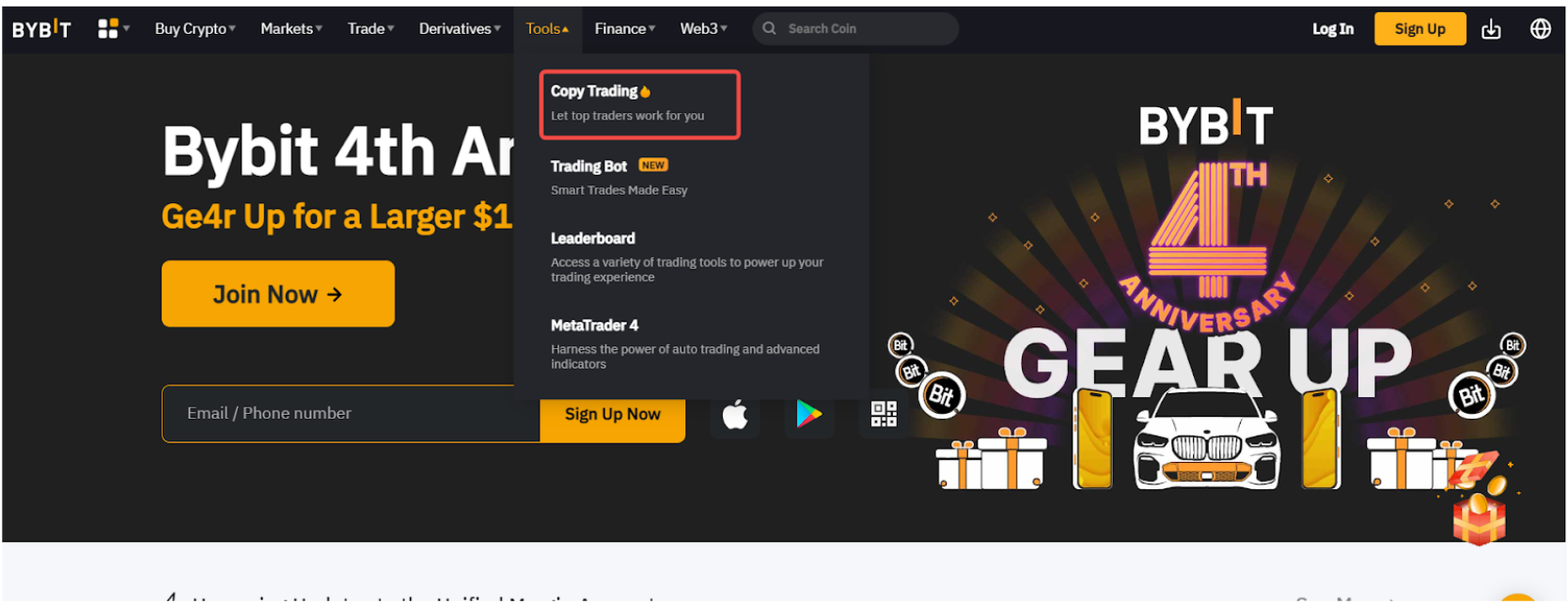

Accessing the copy trading page

Accessing the copy trading page

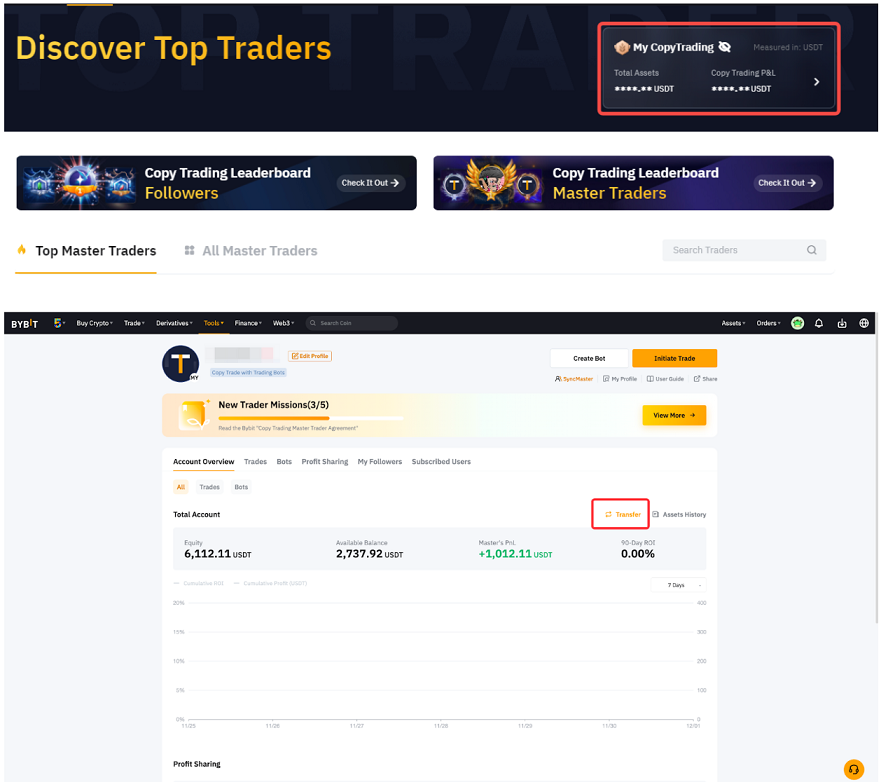

Log in to your ByBit account, go to Tools, and then Copy Trading in the main menu. This will take you to the Copy Trading page, where you can explore Master Traders and their profiles.

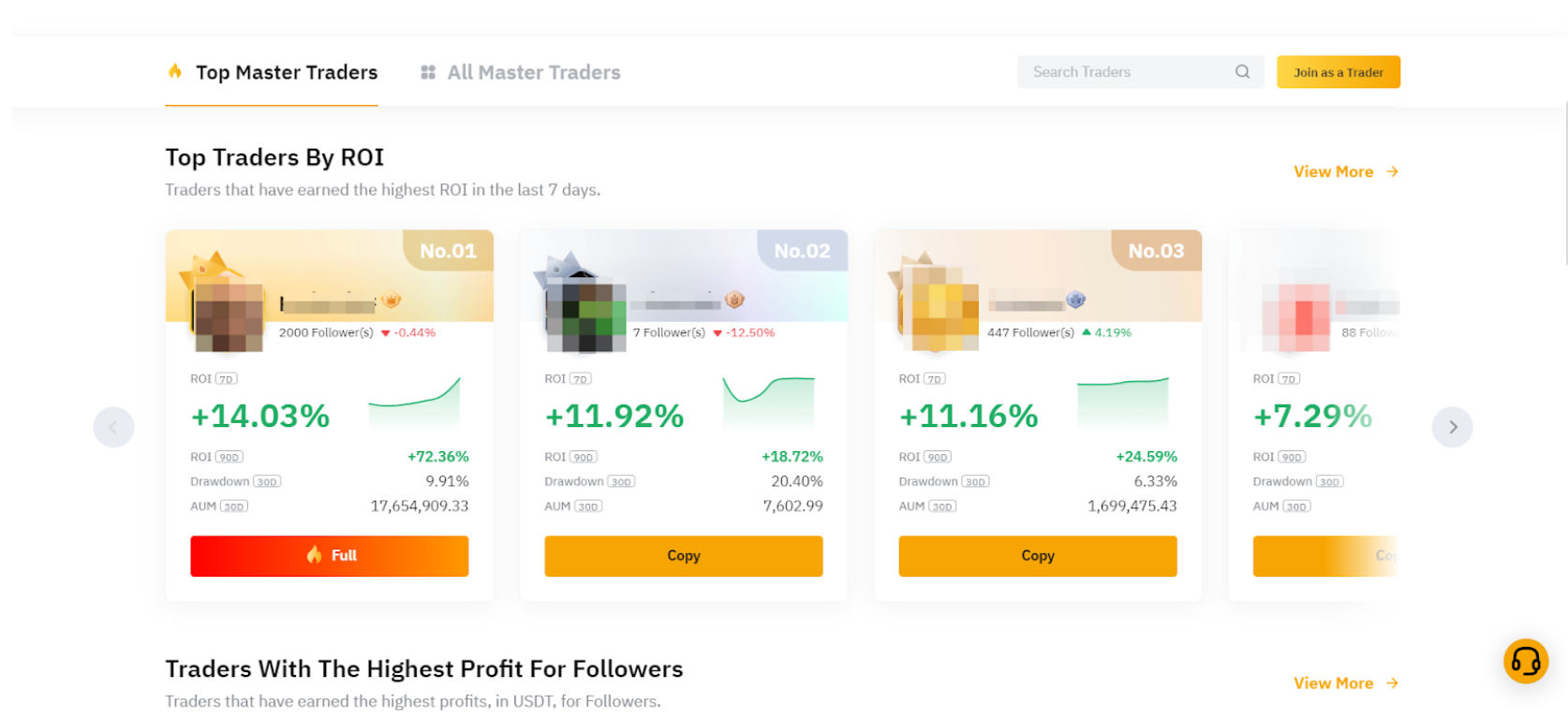

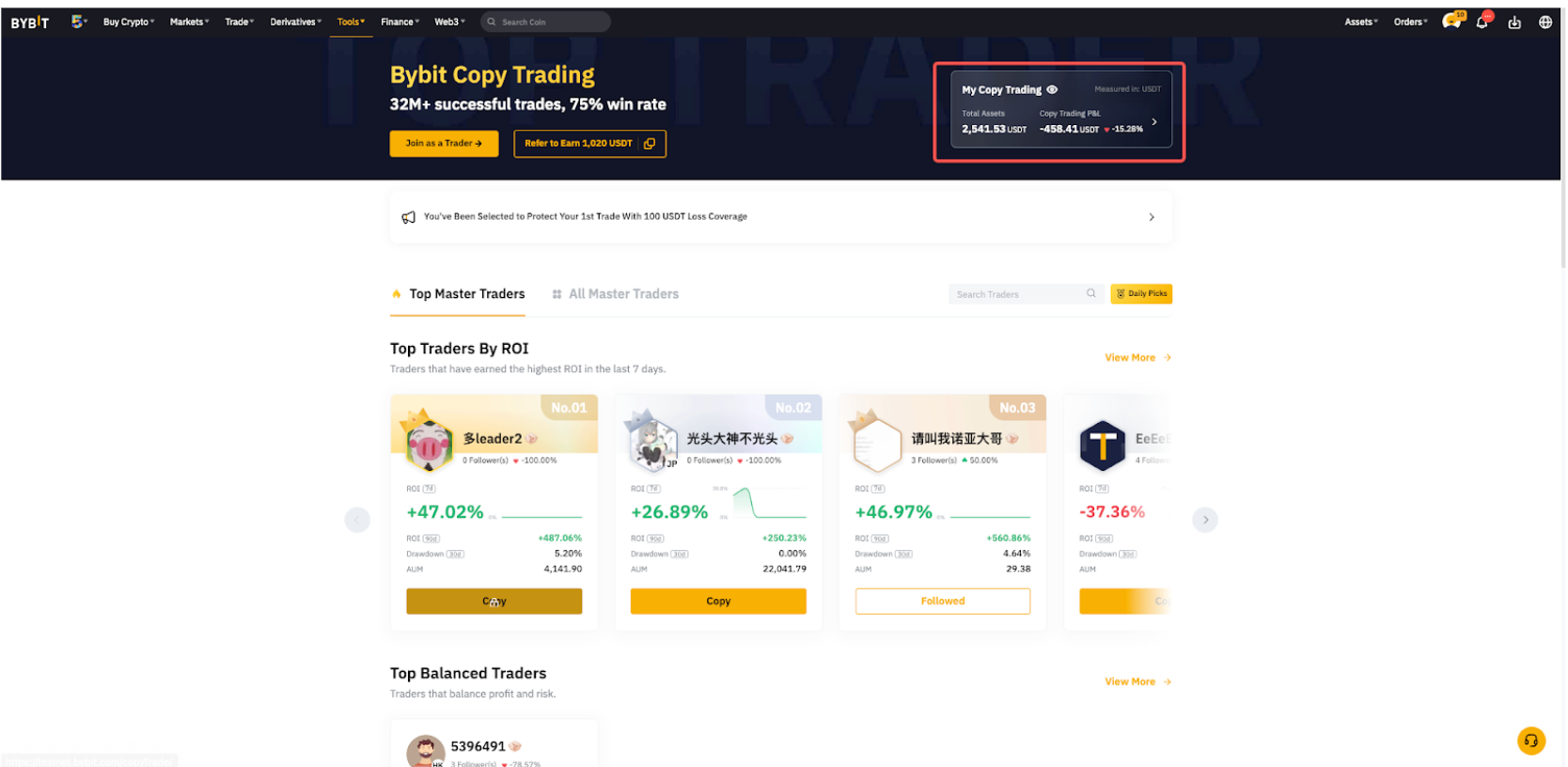

Selecting a master trader

Selecting a master trader

Browse through the available Master Traders and evaluate their performance. Click on a trader’s card to view details like their ROI, trading history, and profit-sharing ratio. Once you’ve chosen a Master Trader, click Copy to proceed.

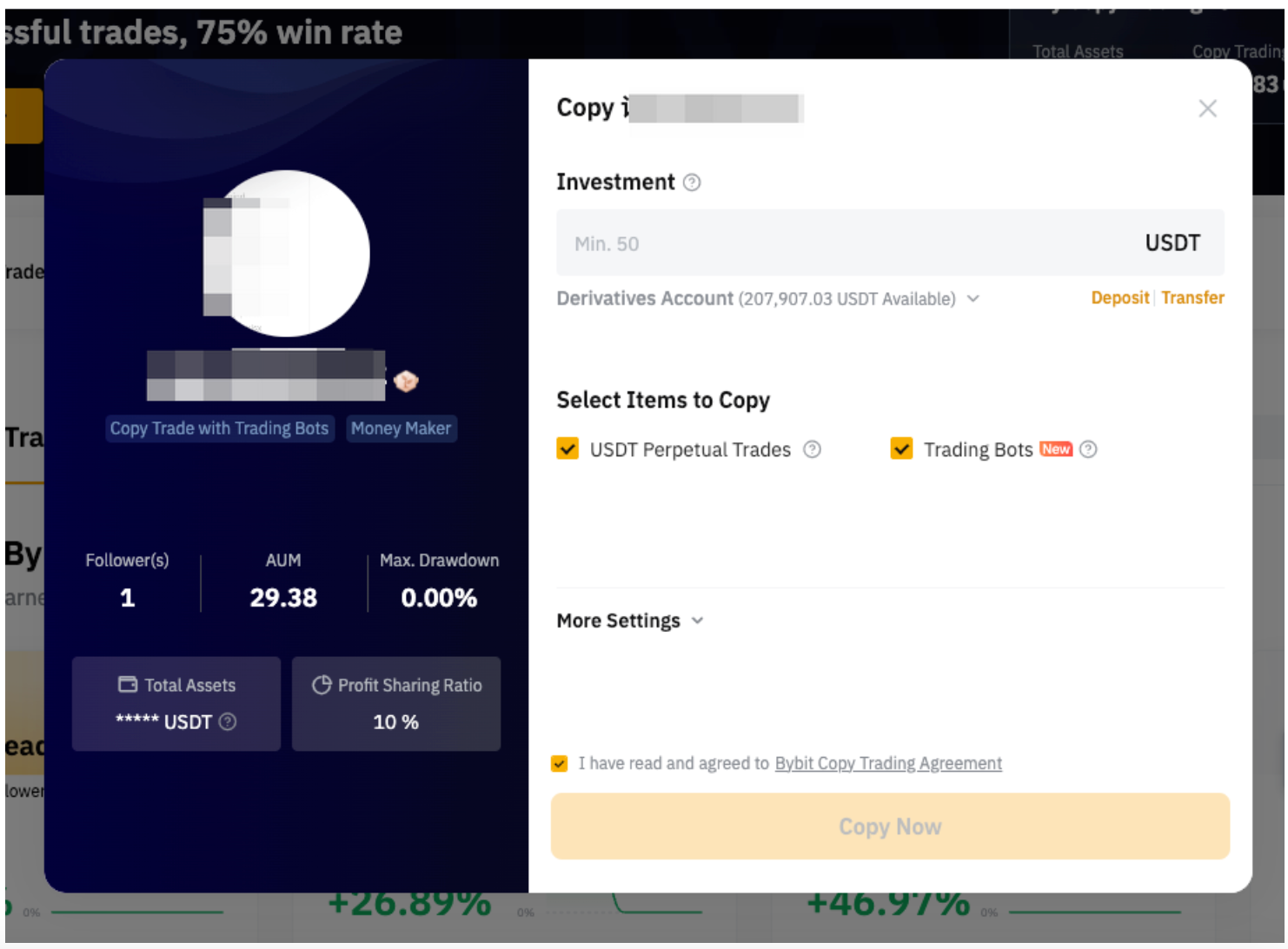

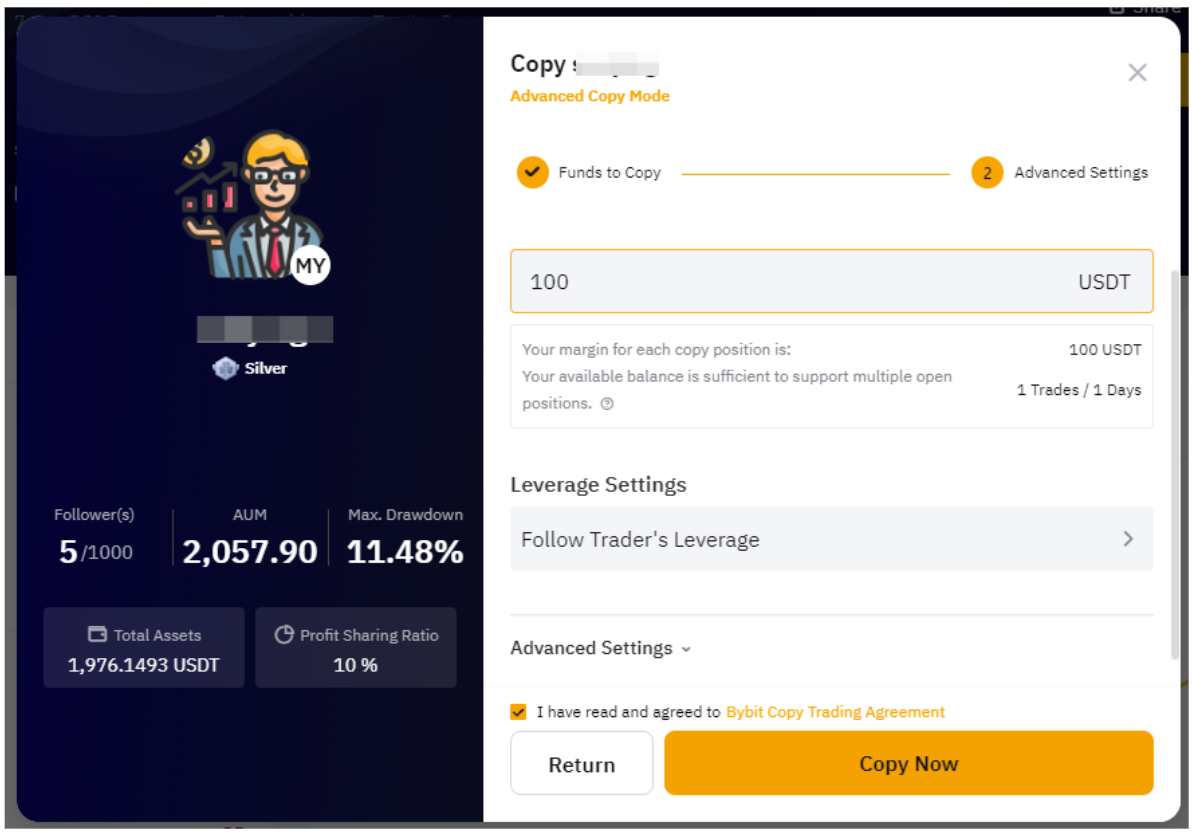

Setting up your copy trade

Setting up your copy trade

Decide how much you want to invest. The minimum investment is 50 USDT, but some Master Traders may set a higher requirement. Next, choose what to copy:

USDT Perpetual Trades: Trades for Perpetual contracts.

Trading Bots: Automated bot strategies created by the Master Trader.

If needed, customize additional settings such as leverage, stop-loss, or take-profit under the More Settings section. Be aware that if the Master Trader has enabled Forced Sync, some settings may not be adjustable.

Confirming and starting your copy trade

Confirming and starting your copy trade

Review your setup, including the investment amount and profit-sharing details. Once satisfied, check the agreement acknowledgment box and click Copy Now. Your trades will now automatically mirror the selected Master Trader.

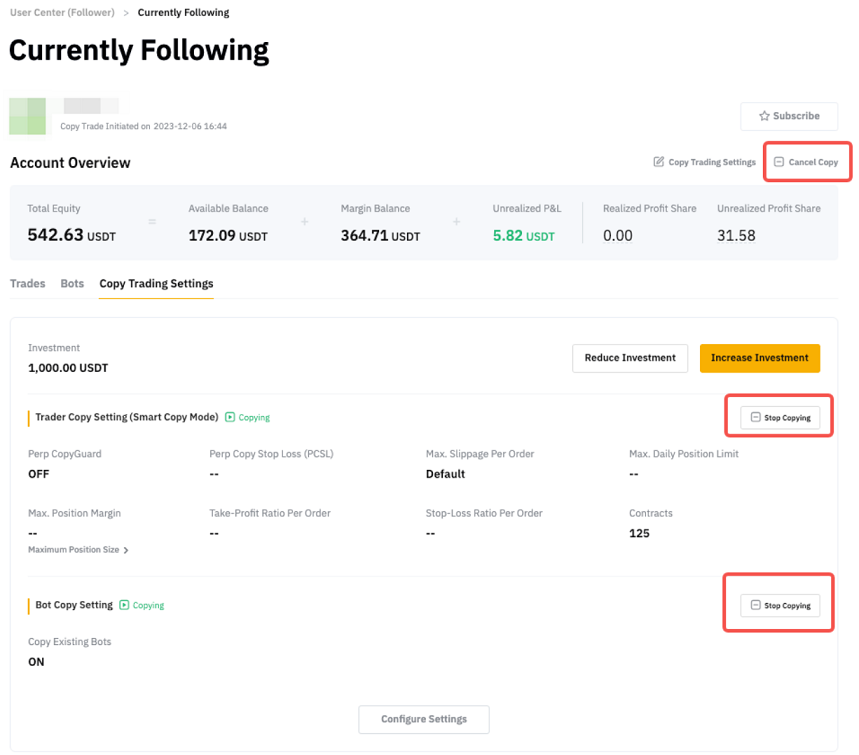

Monitoring and managing trades

Monitoring and managing trades

Track your trades through the My Copy Trading section. Here, you can monitor active USDT Perpetual trades or Trading Bots in the Trades and Bots tabs. You can also close positions manually or terminate bots when needed. Adjustments to your settings, such as leverage or stop-loss, can be made under the Details of your selected Master Trader.

Adjusting or canceling copy trades

Adjusting or canceling copy trades

To make changes or stop copying a Master Trader, go to the Copy Trading Settings page. Use the Stop Copying option for specific trades or select Cancel Copy to unfollow the Master Trader entirely. Keep in mind that re-following may not be possible if all slots are occupied.

How to become a master trader?

Becoming a Master Trader on ByBit is an excellent opportunity to share your trading expertise, earn profit-sharing from Followers, and build a reputation in the trading community. As a Master Trader, you can initiate Perpetual Trades or create Futures Grid Bots that Followers can replicate, allowing you to maximize your skills and earnings potential.

To become a Master Trader, you need to meet these criteria:

Close all open positions and unfollow other Master Traders.

Transfer any remaining assets out of your Copy Trading Account.

Maintain a minimum balance of 100 USDT in your Master Trader Subaccount.

Complete the New Trader Missions, which involve:

Trading three derivatives.

Earning 50 USDT from derivatives trading.

Reviewing ByBit's Copy Trading penalties.

Joining the official ByBit Telegram group for copy trading.

To get started as a Master Trader on ByBit, follow these steps:

Accessing the copy trading page

Accessing the copy trading page

Log in to your ByBit account and navigate to Tools → Copy Trading from the main menu. This will take you to the Copy Trading page, where you can manage your Master Trader account.

Transferring assets

Transferring assets

To start trading, transfer funds to your Master Trader Subaccount. Go to My Copy Trading (Master Trader) → Transfer, and deposit funds into your Derivatives Account or Unified Trading Account. Ensure a minimum of 100 USDT is available to activate your account.

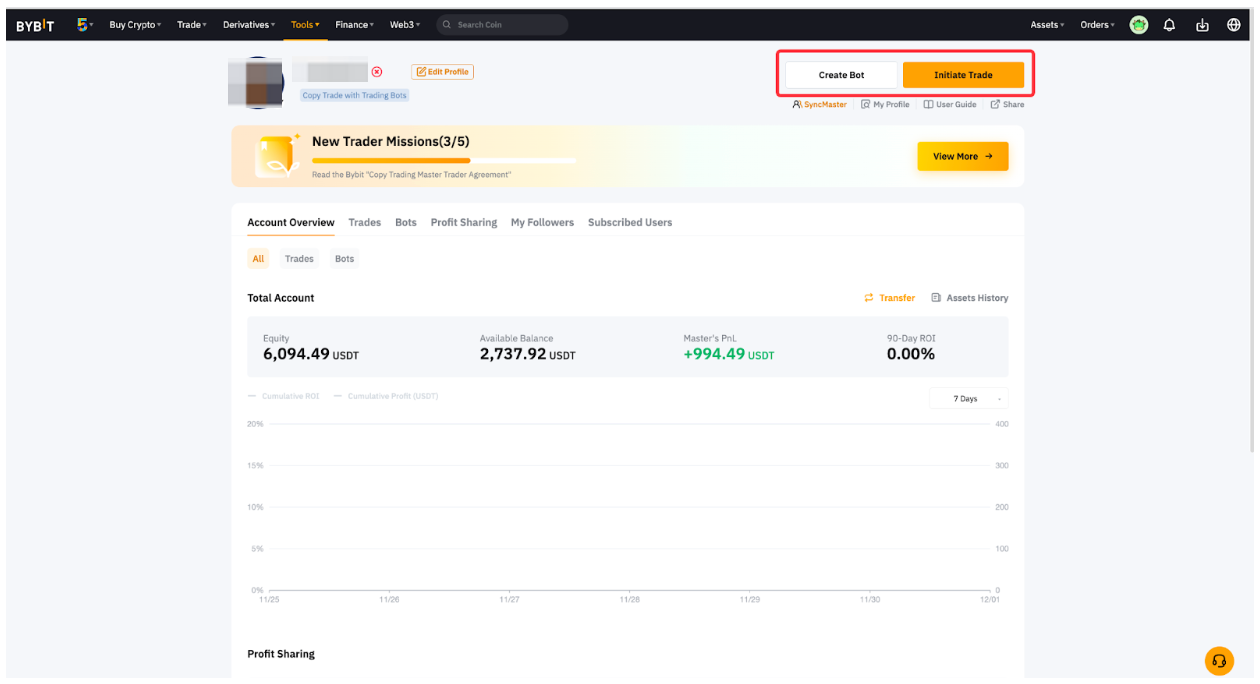

Initiating a trade or creating a bot

Initiating a trade or creating a bot

Click Create Bot to access the Futures Grid Bot creation page or Initiate Trade for USDT Perpetual Contracts. Customize bot parameters using ByBit’s Aurora AI for strategy suggestions, or manually configure your trade settings.

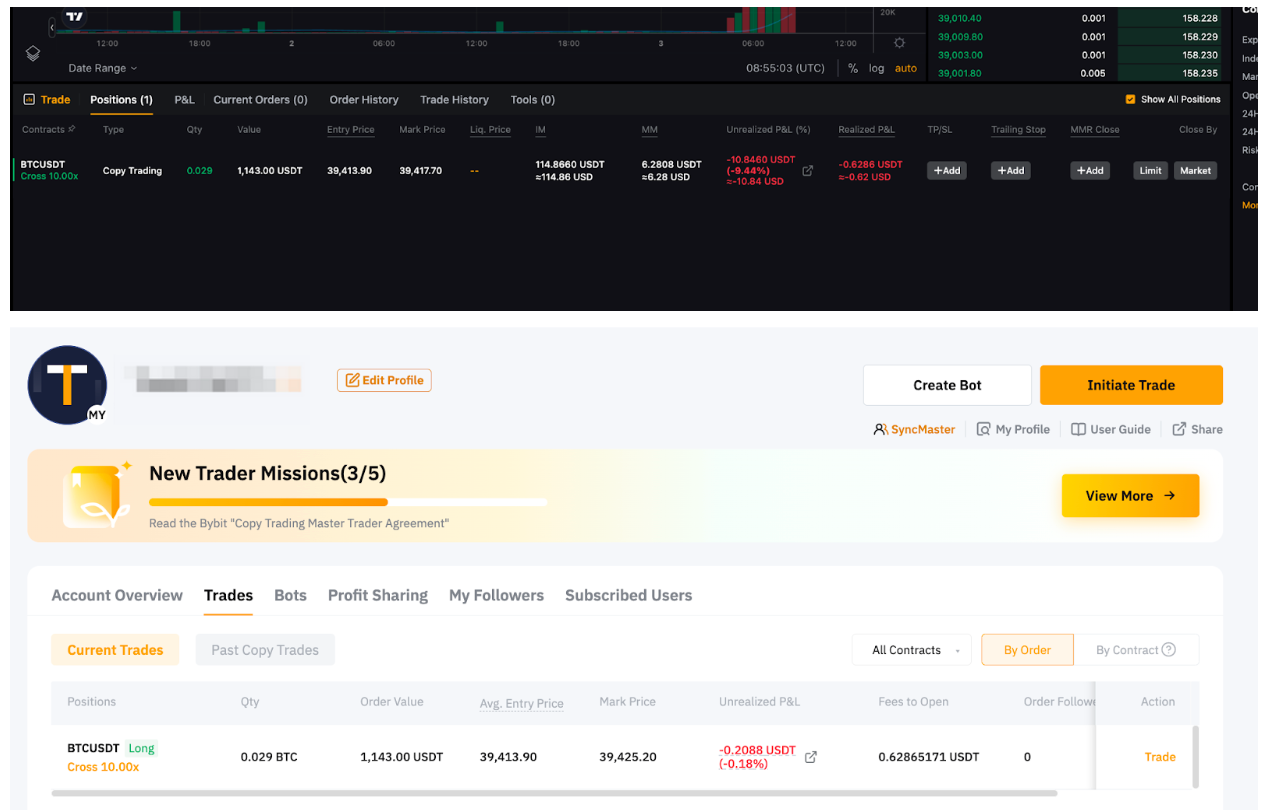

Managing trades and positions

Managing trades and positions

Track your orders and positions in User Center (Master Trader) → Trades. For Perpetual Trading, view details like entry price, order quantity, and unrealized P&L. For active bots, go to Bots → Running to check investment, total P&L, and other key metrics.

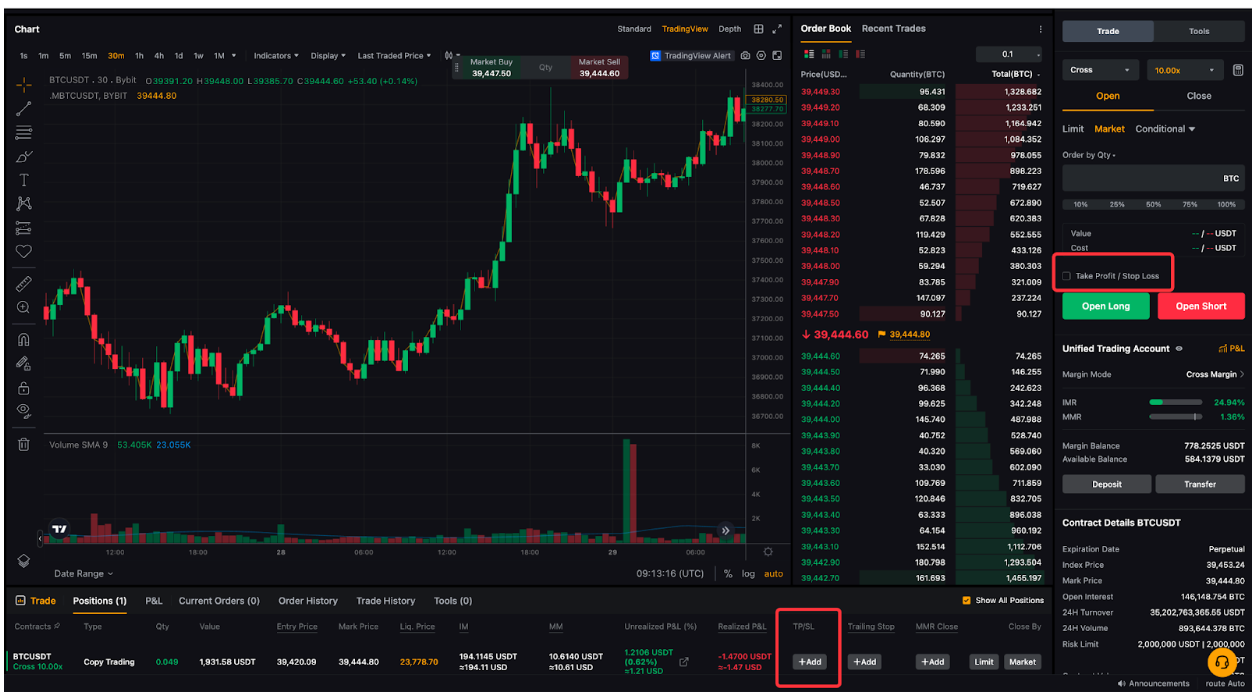

Setting take-profit and stop-loss

Setting take-profit and stop-loss

For Perpetual Trades, set TP/SL during order creation or for active positions under the Positions tab. For bots, configure TP/SL as USDT amounts or percentages during setup or on the bot details page.

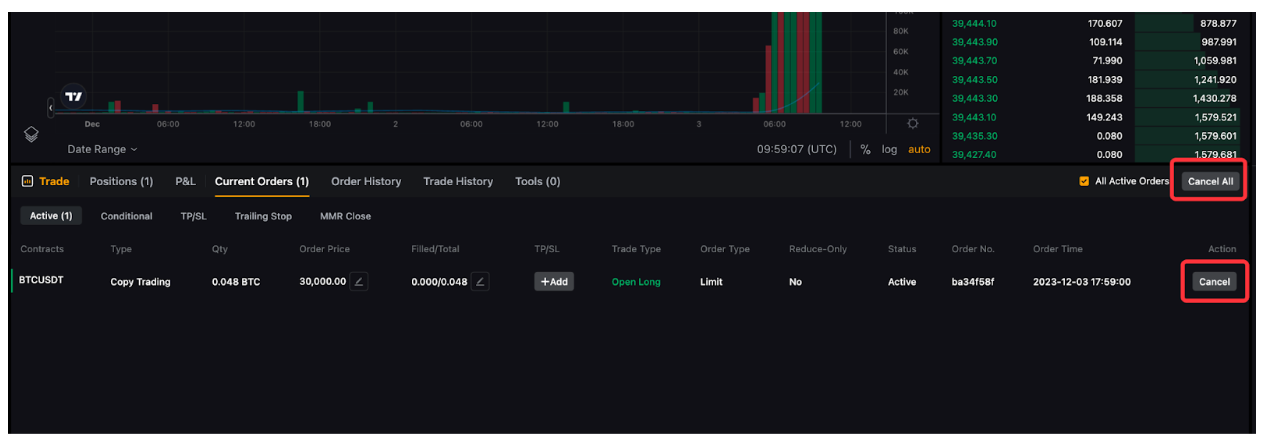

Canceling orders, closing positions, or terminating bots

Canceling orders, closing positions, or terminating bots

Cancel Perpetual Trades from the Current Orders tab or close positions via the Positions tab using limit or market orders. For bots, terminate them in Tools → Trading Bot → View My Copied Bots, where pending orders will be canceled and funds returned.

How to choose a master trader on Bybit?

To choose a Master Trader on ByBit, consider the following factors to ensure their strategy aligns with your trading goals:

Return on investment ( ROI). Assess a trader's profitability by evaluating their ROI. A smooth, upward profit trend indicates consistent success.

7-day profit/loss percentage. Examine this ratio to understand short-term profitability. For example, a $250 profit/loss ratio indicates that for every $250 made in the last week, $1 was lost.

Follower profits over time. Check how much profit the Master Trader has generated for their Followers. Keep in mind this number is cumulative, so traders with more Followers may have higher totals.

Trading background. Review the Master Trader's history and strategy. Look for effective use of stop-losses and ensure their approach aligns with your risk tolerance and objectives.

Spot copy trading on Bybit

Spot copy trading on ByBit is a great way to follow experienced traders without having to make every decision yourself. It’s simple, and right now, it works only with USDT. If you’re considering using this feature, here’s what you need to know:

Set your investment amount. Decide how much you’re comfortable investing. The system will automatically copy the amount your Master Trader uses for their trades. Don’t worry if you don’t have the exact amount they do — ByBit will still execute the trade with whatever balance you have left.

Understand Copy Stop-Loss ( CSL). CSL is your safety net. If your losses hit a certain point, the system will sell all your copied trades at the market price and unfollow the Master Trader. By default, CSL is set to 0%, so make sure to adjust this if you want that protection.

Keep in mind.

If the Master Trader closes their trade, your stop-loss setting won’t be affected.

If you’re using spot margin trading, you can only withdraw funds if your risk level stays under 80%.

Spot copy trades don’t qualify for any incentives on ByBit, so don’t expect bonuses.

Derivative copy trading on Bybit

ByBit provides a derivative copy trading facility. It only supports it in USDT for now. Consider the following things when creating a copy trade.

For each order, enter a fixed margin amount. For instance, if you establish a fixed margin of 100 USDT, that amount will be the margin for each copy order.

Stop Loss ( CSL): If your cumulative losses with a Master Trader reach a certain number, you are instructed to reduce the risk of your copy positions. As an illustration, let's say you decide to copy a Master Trader and set a CSL of 400 USDT. You will immediately stop following the Master Trader if the total losses on your copied positions with them reach 400 USDT. Your remaining positions will then be handled per your desired CSL settings.

Set your desired leverage after choosing Fixed Leverage or Custom Leverage. The default setting for the leverage is 15x.

Differences between derivatives copy trading and spot copy trading

For Master Trader

Derivatives copy trading vs spot copy trading

| Derivatives Copy Trading | Spot Copy Trading |

|---|---|

You can initiate an order once you are successfully registered as a Master trader. | To initiate an order you have to contact their customer service after registering as a Master Trader and provide your UID to be added as a Spot Master Trader. |

You have to source funds from the derivative account manually. | You have to source funds from the spot account manually. |

It supports derivative trading pairs. | It supports spot trading pairs. |

The maximum order amount limit is different for different pairs. | The maximum order amount limit is 1,000 USDT. |

The trading signal duration is 10 minutes. | The trading signal duration is 12 seconds. |

The maximum order quantity is 50. | There is no maximum order quantity. |

For Followers

Derivatives copy trading vs spot copy trading

| Derivatives Copy Trading | Spot Copy Trading |

|---|---|

You have to source funds from the derivative account manually. | You have to source funds from the spot account manually. |

To unfollow the master trader you have to manually cancel the copy or it automatically unfollows the master after 20 failed orders. | To unfollow the master trader you have to manually cancel the copy or it automatically unfollows when the stop loss is triggered. |

It supports TP/SL per order and Stop-Loss/Take-Profit ratio on Total Order Cost. | It supports the Stop-Loss ratio on Total Order Cost. |

Customize risk and track consistency in Bybit copy trading

ByBit copy trading isn’t just about picking top-ranked traders. Look closely at how often and how long they hold trades. Choose traders with a steady track record over several months, not just recent lucky wins. This approach helps you follow proven strategies that work long-term.

Also, adjust your risk settings smartly. If a trader risks 50% of their funds on a trade, decide if that’s right for you. Use proportional fund allocation and stop-loss features to manage your exposure while still following expert moves. This way, you stay in control while learning from the best.

Conclusion

ByBit copy trading isn’t just about copying trades — it’s a way for beginners to learn while earning. Follow traders with steady long-term results and tweak your approach as you gain experience. Adjust your risk settings, keep track of your trades, and stay curious about how the platform works. The more you engage, the better you’ll get at making smart trading decisions.

FAQs

Can you copy trade on Bybit?

ByBit currently offers Copy Trading on both Spot and Derivatives. The goal of ByBit's Copy Trading platform is to provide Followers and Master Traders with a lucrative trading environment.

Is copy trading in Bybit profitable?

Copy trading on ByBit can be profitable. The profitability of copy trading depends on the amount you have invested and the success of the trader whose trades you are copying.

What tokens can be used for derivatives copy trading with Bybit?

ByBit only supports USDT right now.

Are there any KYC requirements for copy trading in derivatives?

Yes, ByBit requires at least Individual KYC Level 1 or Business KYC verification to participate in derivatives copy trading. This ensures compliance with platform regulations and enhances user security.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).