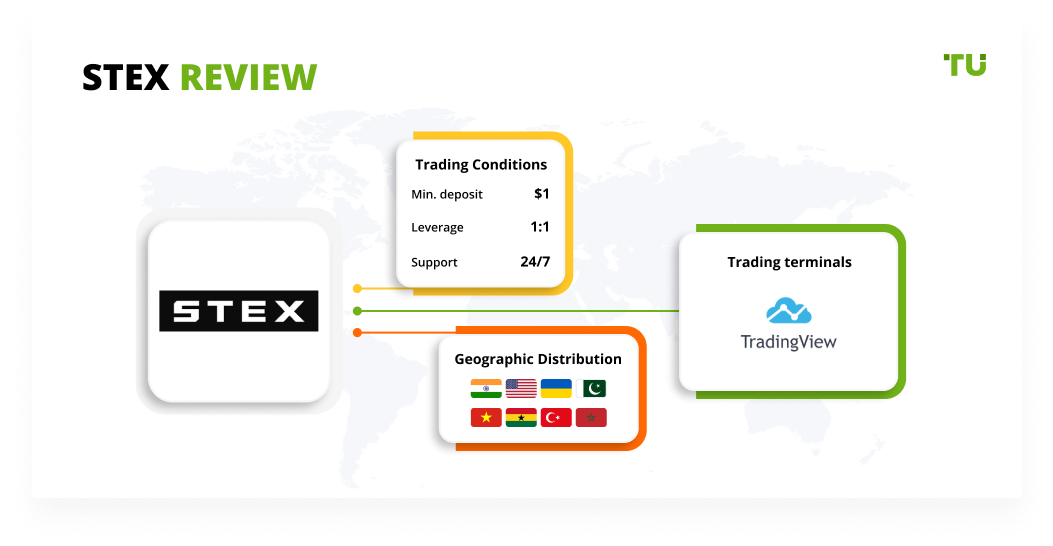

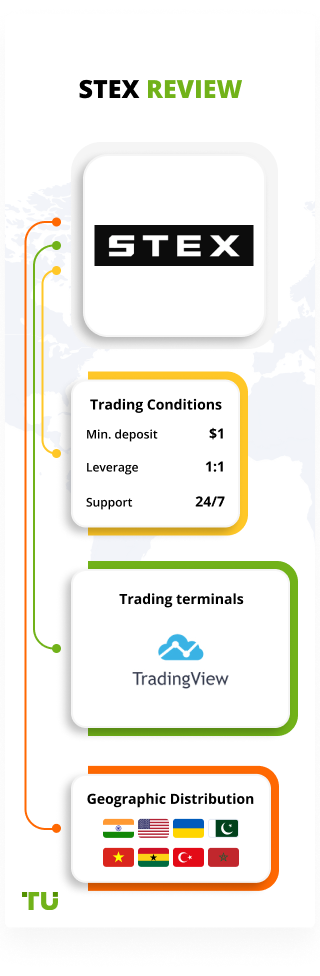

deposit:

- $1

Trading platform:

- TradingView

STEX Review 2024

deposit:

- $1

Trading platform:

- TradingView

- Most popular cryptocurrencies and tokens, no fiats, exchange service, standard referral program, profitable investment program with a reserve fund, and no minimum deposit

Summary of STEX Crypto Exchange

STEX is a high-risk cryptocurrency exchange with the TU Overall Score of 2.63 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by STEX clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. STEX ranks 92 among 173 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria.

The STEX crypto exchange offers all the necessary tools for comfortable cryptocurrency and token trading. There are no fiat pairs, leverage, or over-the-counter trading on the exchange. The terminal is TradingView, plus applications for iOS and Android. Commissions are objectively low, the same for experienced and beginner traders. The referral program is standard. The investment program allows you to participate in the Defi coin and JNTR auctions, which take place daily. The coin has a high payback and profit potential, the risks are minimal.

NOTE!

If you are planning to trade cryptocurrencies, and not just keep your savings in crypto wallets, we recommend that you choose one of the top brokers with reliable regulation and access to trading crypto CFDs. This type of trading will help you avoid holding your cryptocurrency in e-wallets of exchanges, which quite regularly get hacked. Also, availability of leverage will allow you to trade crypto CFDs for amounts much higher than your deposit.

Traders Union experts recommend considering Top 3 companies from our rating:

The STEX (Spot Trading Exchange) exchange is a platform where you can exchange and trade cryptocurrencies where all popular cryptocurrencies and tokens are available for exchange, as well as several dozens of fiat funds. Transactions can be carried out via direct payment by bank card. Pairs with Bitcoin (₿), Litecoin (Ł), Ethereum (Ξ), Tether (₮), LINK, DAI, and a variety of other cryptocurrencies and tokens are available for limit and stop-limit order trading. The exchange has low trading fees (up to 0.2%), which depend not on the volume of trades, but on the type of service that the client used for verification. There are no demo accounts or training materials, but there is no minimum deposit either. There is a profitable referral program. Also, the site offers a unique program of investment in the blockchain project called Jointer with daily payments.

| 💰 Account currency: | Cryptos and tokens |

|---|---|

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | No |

| 💱 Spread: | Market |

| 🔧 Instruments: | Cryptos and tokens |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with STEX:

- loads of cryptocurrencies and tokens to trade and exchange for fiat currencies;

- 2FA authentication, PGP key, and web authentication;

- customer funds are kept cold and segregated;

- availability of TradingView terminal and mobile trading application;

- IP whitelisting, log in via Google, Microsoft, or Linkedin;

- less than one-second order processing;

- off-the-charts stability;

- high-profile advanced charting features;

- referral payments: 25% of partner's trading fees;

- opportunity to reduce commissions to 0.1%;

- no withdrawal limits (only for L1 tier).

👎 Disadvantages of STEX:

- no demo account or solutions for beginners;

- no call center, the connection with the technical support is by email only;

- no information about the license of the company.

Evaluation of the most influential parameters of STEX

Geographic Distribution of STEX Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of STEX

The STEX exchange provides cryptocurrency trading via the TradingView browser and terminal. The terminal has some modifications in terms of functionality (e.g., adaptive arrangement of blocks and additional settings for chart display). The Company has developed its mobile applications for iOS and Android devices. The browser terminal and the application do not have any vulnerabilities or technical deficiencies and work stably. Transactions take less than 1 second to complete.

No fraud, tax evasion, or failure to meet its obligations to customers were detected during the inspection. Also, the exchange does not provide data on the actual license for financial activity. STEX is characterized by large trading volumes, and the most popular cryptocurrencies and tokens are available. There are crypto-to-crypto pairs only; fiats are available exclusively in the exchange service. There are various deposit and withdrawal options.

The platform is optimal for beginners and experienced traders, as well as for investors because it presents options for passive income. The conditional disadvantages of users include the absence of fiat currencies for exchange trading, lack of demo accounts, and no telephone communication with technical support. But it is noted that support promptly responds by email. Significant shortcomings in the site's work are not noted.

Dynamics of STEX’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Crypto Exchange

The STEX crypto exchange offers the Jointer investment program. It is a blockchain project in which the liquidity of the Defi and JNTR coins is provided by real estate. Technically, profit generation is implemented on the principle of staking. In other words, the platform develops through external investments, increasing its profitability and paying interest to investors. But the investment methodology is based on the principles of an auction, so it differs from staking in blockchain projects on other exchanges.

Every STEX user can buy a JNTR coin on the exchange and invest it in an auction. The exchange gives investors a discount on coin purchases, the discount is proportional to the total amount of coins invested. The basic yield of the program is 1% of all deposited funds, this percentage is distributed proportionally to the deposits. Bonus payments range from 15-50% per annum. The auction is launched daily. The investor can withdraw the invested funds at any time because they are not frozen.

To participate in the Jointer auction, investors must keep unlocked and unused JNTRs in their wallets with a 1:1 par value ratio. For more terms and information about the program, visit the DeFee Auctions section.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

STEX’s affiliate programs:

Every STEX customer can participate in the STEX referral program and receive payments for the invited users. After registration and verification in the trader’s personal account (in the "Referral program" section) your personal affiliate link will be available. It can be placed in forums, social networks, and other forums without any restrictions.

Each user who registers and verifies at STEX, previously passing the referral link, will bring the inviting trader 25% of his trading fees. The program is termless so the invited user will provide a passive income to the invited trader throughout the time that he trades on the site. The program is unlimited, hence you can invite any number of users and get paid for each of them.

Only one level of the program is provided, so the user does not receive payments for those who have been invited to the site by his partners. Referral payments are made daily, in the currency of the transaction carried out by the partner.

Trading Conditions for STEX Users

The STEX crypto exchange does not set a minimum deposit. To start trading, a client needs to register and confirm his identity using one of the offered methods. Additional mandatory actions are not required because the client determines his financial policy and makes the optimal deposit. Only exchange trading without leverage is available. Clients are not limited in the choice of strategy, so you can use API, but must trade with his own funds; there is no leverage trading here. Technical support is available 24 hours a day and answers promptly, but only by email. See the "Contact us" section. Below is the table showing the trading conditions of the exchange.

$1

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | TradingView (in browser) |

|---|---|

| 📊 Accounts: | Standard |

| 💰 Account currency: | Cryptos and tokens |

| 💵 Replenishment / Withdrawal: | Bank cards and accounts, electronic and cryptocurrency wallets |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | From 0 |

| 💱 Spread: | Market |

| 🔧 Instruments: | Cryptos and tokens |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Not indicated |

| ⭐ Trading features: | Most popular cryptocurrencies and tokens, no fiats, exchange service, standard referral program, profitable investment program with a reserve fund, and no minimum deposit |

| 🎁 Contests and bonuses: | Not indicated |

Broker comparison table of trading instruments

| STEX | Bybit | MEXC | Binance | StormGain | WhiteBIT | |

| Forex | No | No | No | Yes | No | No |

| Metalls | No | No | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes | Yes | Yes |

| CFD | No | No | No | No | No | No |

| Indexes | No | No | No | No | No | No |

| Stock | No | No | No | No | No | No |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

STEX Commissions & Fees

-

Level 1 (L1) - 0.2% for users verified through the site service (withdrawal limit — up to $500,000 per day);

-

Level 2 (L2) - 0.15% for users verified via STEX, Smart-ID, or Fractal;

-

Level 3 (L3) - 0.1% for users verified through Cryptonomica.

There is only one way to reduce commissions after verification which is by using rebates from the Traders Union. But even the L1 level commission of 0.2% for a taker/maker is below average in the market segment.

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | Up to 0.2% per order | Yes |

This crypto exchange does not set the maximum withdrawal limits (except the limit on L1). The minimal withdrawal amount can be 0.00000010 or 0.00000100 depending on the asset. Commission for withdrawal differs and is calculated based on the following factors: asset and withdrawal channel. All data will be specified when applying for withdrawal.

| Broker | Average commission | Level |

| STEX | $0.2 | Medium |

| Bybit | $20 | High |

| Bitfinex | $0.1 | Low |

Contacts

| Foundation date | 2017 |

| Registration address | Tallinn, Harjumaa, Estonia |

| Official site | https://www.stex.com/ |

| Contacts |

Email:

support@stex.com,

|

Read also about other cryptocurrency exchanges:

Find out how STEX stacks up against other brokers.

Articles that may help you

FAQs

Do reviews by traders influence the STEX rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about STEX you need to go to the broker's profile.

How to leave a review about STEX on the Traders Union website?

To leave a review about STEX, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about STEX on a non-Traders Union client?

Anyone can leave feedback about STEX on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!