Don’t risk it.

Always play safe and exit the trade promptly if conditions are unfavorable.

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

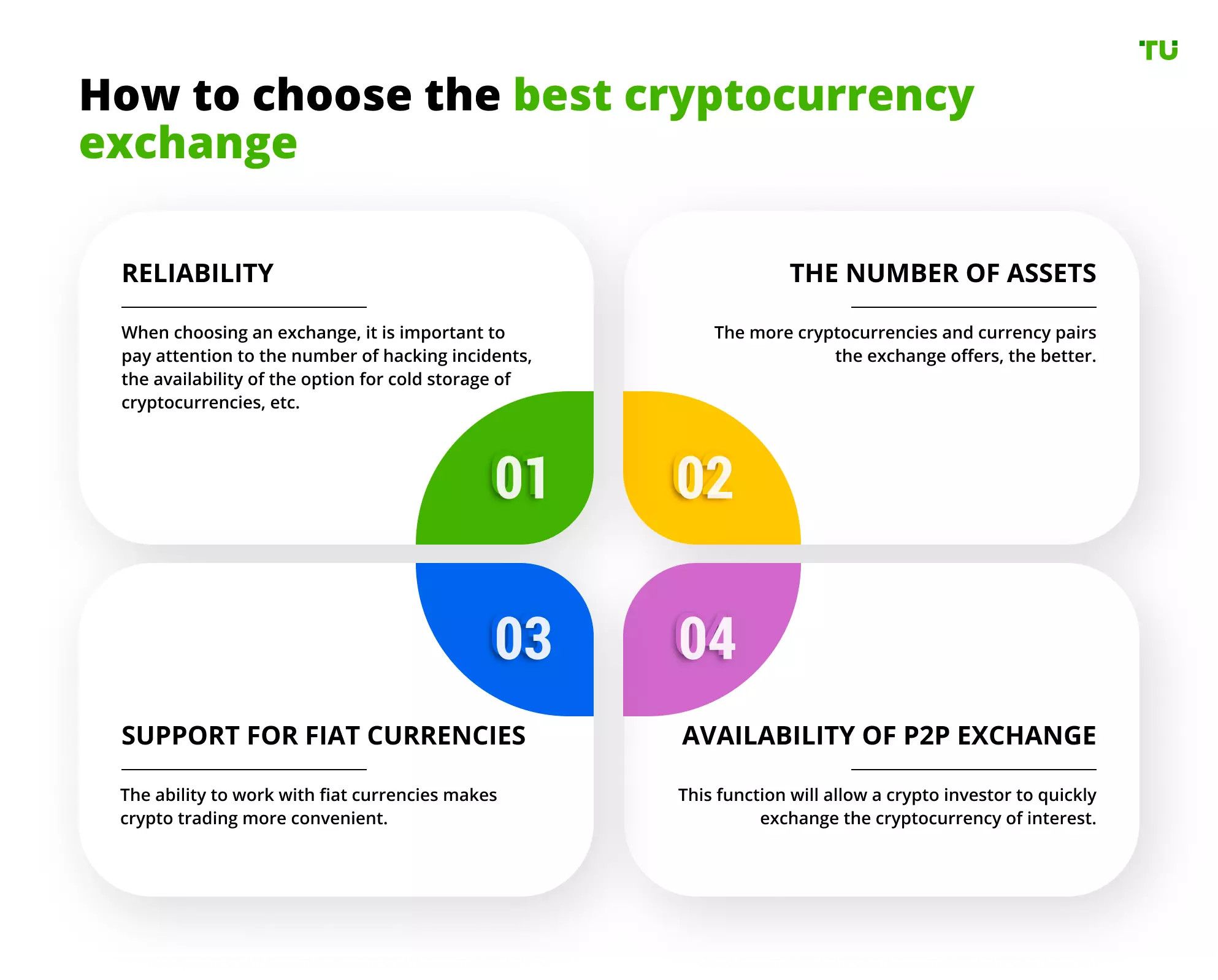

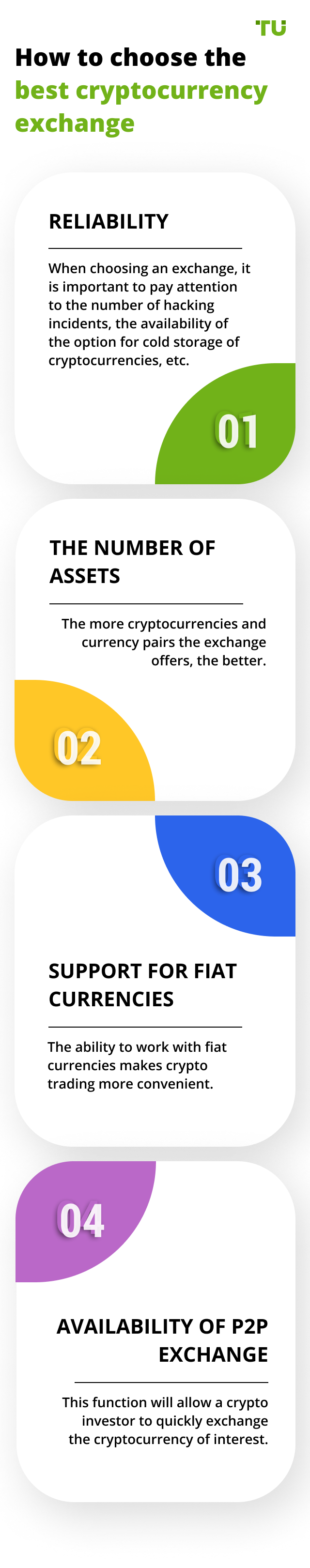

Selecting a trustworthy cryptocurrency exchange is a key step for anyone planning to trade or invest in digital assets. The platform you choose directly affects your trading conditions, access to liquidity, security of funds, and overall user experience.

To simplify this process, we have compiled a comprehensive rating of leading crypto exchanges. Each platform is evaluated based on transparent criteria: regulatory status, trading tools, supported assets, commission structure, and user reviews.

Our rating will help you navigate the crypto market more effectively — whether you're buying Bitcoin, exchanging altcoins, or converting crypto to fiat. Instead of spending days comparing platforms, rely on our expert analytics — and choose a crypto exchange that meets your goals and trading profile.

Best Crypto Exchanges for 2025 (United States)

Your location is United States

We’ve selected Top Crypto Exchanges providing services in your country. If you would like to learn about the best crypto exchanges in a different region, please use the “Find my crypto exchange” service.

The cryptocurrency exchange rating was created by Traders Union experts to provide everyone with objective and independent information about the best crypto exchanges. Traders Union specialists have access to the internal trading and client indicators of a record number of cryptocurrency exchanges, and can also analyze data from thousands upon thousands of traders. This is precisely why the Traders Union rating of cryptocurrency exchanges is the most objective rating available for 2025.

Do you prefer watching videos? Then watch the video summary of this article.

Below you will find all the information.

Just study the cryptocurrency exchange rating compiled by financial specialists and analysts of the Traders Union to choose the best exchange for cryptocurrency trading. Also, you must familiarize yourself with the main crypto-exchange trading terms in its profile. You can then open an account using the referral link of the Union.

Study the available services and trading tools for cryptocurrency trading on the company's website to form an impression of the crypto exchange’s quality of service. It is important to know if a cryptocurrency exchange is available in your country. On the Traders Union website, you will find the best exchanges that operate in different countries and regions - for example, Australia, USA, UK, Europe, etc.

Study the official website of the cryptocurrency exchange in detail to independently conduct a comprehensive analysis of its services and offers.

These are the sections that should be available on a reliable cryptocurrency exchange website:

A section on each cryptocurrency exchange, with a description of its history, its purpose, and mission in the cryptocurrency market, as well as the country and registration address, the name of the financial regulator, and the exchange’s license number and contact details of the crypto exchange.

This section describes the exchange’s trading conditions and trading instruments. Here you can find a list of available cryptocurrencies, price movement charts of a selected asset, current price quotes, as well as information about the fees of the cryptocurrency exchange. In the TU rating, you can find commission-free cryptocurrency exchanges.

An educational section with basic information about the cryptocurrency market, which will help a novice trader learn the basics of crypto trading. Also, there’s a help section with detailed guides for working with the cryptocurrency exchanges, such as instructions for opening a trading account, working with a trading platform, etc.

The section with analytics and the latest news of the cryptocurrency market on the cryptocurrency exchange website will enable you to estimate the market situation in real-time and, as a result, invest in a particular digital asset more effectively, thus, hopefully, making more profit.

The customer support portal ensures prompt communication with representatives of the cryptocurrency exchange when questions arise.

and a 24/7 support service are additional advantages of a crypto exchange.

You can register a personal account on the website of a cryptocurrency exchange. It stores the client's data, information about account verification, trading activity on accounts, the deposit/withdrawal transactions history, as well as extra tools available only to registered users.

Author, Financial Expert

at Traders Union

After the crash of FTX and several other smaller cryptocurrency platforms, investors are paying increasing attention to their reliability. And for a good reason. Of course, investors should focus on the transparency of the exchange data, regulations, and methods of information protection. Traders Union experts, when compiling the rating, dedicated considerable attention and time to evaluating the reliability and stability of exchanges.

The optimal choice of a cryptocurrency exchange also largely depends on the goals of a specific investor. Some exchanges specialize in spot trading, offering a vast selection of coins specifically for spot trading and investing. Others focus on the futures market, where key indicators include commission size, integration of the trading platform with bots, and high liquidity. The third type of exchanges has created comfortable conditions for earning passive income through staking. To make the optimal choice, thoroughly read detailed reviews on the Traders Union portal.

Don’t risk it.

Always play safe and exit the trade promptly if conditions are unfavorable.

Be patient.

Wait for optimal trading signals to start. Patience allows you to avoid unnecessary risks and rash moves.

Controlling the order book with the list of quotes is an extremely important skill since the further profit of the trader depends on the quotes.

Be aware.

Always be aware of information on the volume and capitalization of the market. This will allow you to predict future quotations and market behavior.

Being informed of current conditions in the primary market enables you to minimize the number of unsuccessful transactions. Veteran traders also recommend minimizing trading losses by committing no more than 50% of the amount of money in your trading account at any one time. Close a trade if market conditions become unfavorable.

Important

It is quite difficult to trade large amounts on crypto exchanges, since other traders, having found such orders, always try to be proactive and begin to sell their coins widespread, as they expect new activity in the market. So, divide your application into several small orders, which should not exceed 0.5 BTC.

Keep in mind that cryptocurrency exchanges get their main liquidity from limited groups of participants that can make a significant correction in the rate, and it is very important to be able to detect a change in trend and place appropriate orders promptly.

NFT (non-fungible tokens) allow you to sell objects of art, gaming objects and other singular digital objects. Top exchanges offer NFT marketplaces.

Decentralized Finance (DeFi) are the financial instruments of the 21st century; they enable users to provide services to each other without intermediaries such as traditional banks and insurance companies.

Tokenized assets – cryptocurrency exchanges are increasingly offering access to trade not only cryptocurrencies, but also tokenized Forex pairs, stocks, real estate, and other financial assets. This expands the area of use of the exchanges.

Crypto exchange fees are an essential aspect to consider when choosing a platform. Choosing the crypto exchange with the lowest fees helps give you a bigger profit when trading. Let's explore the different types of fees commonly associated with cryptocurrency exchanges:

Trading fees are charges imposed by exchanges for executing trades on their platforms. They are typically calculated as a percentage of the trade's value or as a fixed fee per trade. These fees can vary significantly among exchanges. It's important to consider the fee structure and compare it with other platforms to ensure you're getting the best value for your trades.

Some exchanges may charge fees for depositing funds into your trading account. These fees can vary depending on the payment method used, such as bank transfers, credit/debit cards, or cryptocurrency deposits. It's advisable to review the deposit fee structure of an exchange before initiating any transactions to understand the potential costs involved.

Similar to deposit fees, withdrawal fees are charges imposed by exchanges when you withdraw funds from your trading account. These fees can also vary depending on the withdrawal method chosen and the cryptocurrency being withdrawn. It's essential to consider withdrawal fees, especially if you plan to move your funds frequently or in large amounts.

Account fees are charges associated with maintaining an account on a crypto exchange. Some exchanges may require users to pay a subscription fee or a fee for accessing premium features or services. It's important to review the account fee structure of an exchange to understand any potential ongoing costs.

Opening a crypto exchange account is a straightforward process. Here is a step-by-step guide.

Go to the crypto exchange website using a web browser of your choice.

Click on the "Sign Up" or "Register" button on the homepage. You will be directed to the registration page.

Enter your email address and choose a strong password for your account. Make sure to follow any specified password requirements.

Check your email inbox for a verification email from your crypto exchange. Click on the verification link provided to confirm your email address.

To enhance the security of your account, set up Two-Factor Authentication (2FA). This typically involves linking your account to an authenticator app, such as Google Authenticator or Authy, to generate one-time verification codes.

Bybit may require you to complete a Know Your Customer (KYC) verification process. This process involves providing personal information and identity verification documents, such as a passport or driver's license. Follow the instructions provided by crypto exchange to complete the KYC verification.

Once your account is verified, you can proceed to fund your account. Select the desired cryptocurrency and follow the instructions to deposit funds into your account.

It's advisable to start with small amounts and gradually increase your trading activity as you gain experience and confidence in the market.

I was impressed by Balancer’s flexibility. I add assets to liquidity pools and receive a share of transaction fees. The platform supports up to eight assets in a single pool, which helps diversify the portfolio. Participants receive BAL tokens, which can be used to vote on changes to Balancer. The average trading fee is around 5 percent, which is slightly higher than some centralized exchanges, but the absence of intermediaries makes it worthwhile. The main drawback is the Ethereum gas fees, which can be substantial.

On the HTX (Huobi) exchange, you can trade with leverage up to 1:200, and you only need $1 to get started. The platform supports mobile apps for iOS and Android, as well as a browser-based version. Pros include the availability of a referral program and bonuses. However, there is no segregation of client funds or a compensation fund in case the exchange is liquidated. Also, only one standard account type is available for trading, and customer support is limited in terms of contact options.

What interested me about BTCC is that it is regulated in the United States and Canada, which makes it more trustworthy. I participated in a trader competition, but the conditions were quite strict, especially regarding margin. Copy trading looks promising, but the share taken by leaders is noticeable when profits are low. Withdrawal fees depend on the network, so it is important to plan ahead. The platform is not suitable for long-term investments, as there is no staking or Earn program. There are also fewer trading pairs than I would like.

Bitcointry has become my primary cryptocurrency trading platform because of its high-security standards and support for modern Web3 technologies. I like that I can trade not only Bitcoin and Ethereum but also participate in decentralized finance and NFT markets. Client support is always responsive, which is a huge plus. The user-friendly interface and variety of analytical tools help me better understand the market and make informed decisions. The only downside is the limited number of supported cryptocurrencies, but it’s sufficient for my needs.

My overall impression of bitcastle is positive. The platform offers futures trading with leverage up to 1:150, which opens up opportunities for potentially profitable trades. I particularly enjoy placing orders through its mobile app, as it makes trading more flexible and accessible. Deposits are available through cryptocurrencies and bank cards, including Visa and Mastercard, which simplifies the process for users accustomed to fiat currencies. However, one notable drawback is the limited choice of currencies for fiat deposits. Otherwise, trading is smooth, support is available 24/7, and the platform demonstrates good technical stability.

WhiteBIT won me over with its versatility — from spot trading to margin trading with up to 1:100 leverage. Support for USD, EUR, and UAH is a big plus for users from the CIS region. It's convenient that the minimum entry is just 0.0005 BTC. There’s a mobile app and a standard demo token for practice. The platform is suitable for beginners thanks to its simple interface and transparent fee policy. However, I’d like to see more investment options — the current selection is still limited.

What I appreciated about Cryptohopper is the crypto market simulator — it lets you test your strategy before going live, which is especially useful when working with new tokens. Among the pros are fast synchronization with accounts on external exchanges and the ability to trade Bitcoin, Ethereum, and Litecoin. The minimum trade size is 0.01, so you can place small orders. The platform is entirely in English, which might be a barrier for some users. Other than that, it offers a user-friendly interface and mobile access — no glitches, and trades execute reliably.

I have been using Balancer for trading and earning from liquidity since 2021. The platform runs on Ethereum, providing access to numerous ERC-20 tokens such as ETH and USDT. I like the ability to create pools with different assets and manage their parameters. Trading fees are set by pool owners and can vary. On the downside, Ethereum gas fees are high, making frequent transactions expensive. However, if you rarely withdraw funds and use pools with low fees, it can be manageable.

I've been using bitcastle for about a year. With its simple and intuitive interface, the platform is indeed user-friendly for cryptocurrency trading, especially for novice traders. Spot trading fees for popular coins like Bitcoin and Ethereum are 0%, saving on each order. However, I was a bit disappointed by the limited choice of coins available for staking, hindering portfolio diversification. Staking returns are good, but you have to be prepared for asset lock-up periods for up to 365 days, which isn't always convenient. The exchange actively supports its clients, and its representative offices in several countries increase the level of trust and convenience.

I’ve been using the Bitcointry platform for several months now, and I’m very satisfied. The interface is user-friendly and intuitive, which is especially important for me as a beginner trader. The platform offers a wide range of market analysis tools, helping me make more informed decisions. Client support is always available and ready to assist at any time of the day. I appreciate the ability to trade cryptocurrencies and access Web3 features like DeFi and NFTs. Overall, my experience with the platform has been positive.

To buy cryptocurrency, you need to choose a reputable crypto exchange, create an account, deposit funds into your account, select the desired cryptocurrency, and place a buy order at the current market price or a specific price of your choice. Once your order is filled, the purchased cryptocurrency will be credited to your exchange account, and you can choose to transfer it to a personal wallet for added security if desired.

The number of crypto exchanges is continually evolving as new platforms emerge and existing ones evolve or shut down. Currently, there are thousands of crypto exchanges available worldwide, catering to different markets and offering various features and services.

Bybit, one of the biggest crypto exchanges today, is known for its extensive selection of cryptocurrencies, making it one of the exchanges with the most coin options. It offers a wide range of cryptocurrencies, including major ones like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as numerous altcoins and new project listings.

The amount of money required to buy crypto depends on various factors, including the price of the cryptocurrency you wish to purchase, the exchange's minimum investment requirements, and your personal investment goals.

A crypto exchange is an online service where traders exchange similar digital (crypto) currencies at a favorable rate. Cryptocurrency trading is the process of digital assets buying and selling to reap a profit from the difference in their rates.

Pay attention to its position in the ranking when choosing a cryptocurrency exchange. The higher position they are in the rating table reflects their reliability and popularity among traders.