How to open a DEGIRO account

DEGIRO has rapidly grown to become one of Europe's top dealers. DEGIRO stands out from the competition because the portal provides the rare mix of a comprehensive and user-friendly platform with exceptionally inexpensive fees.

Moreover, a highly competitive commission structure is available to retail investors in 18 European countries thanks to DEGIRO's expansion.

This article will teach us how to open and close your DEGIRO account and all its essential details. You can visit DEGIRO to get more detailed information about them.

DEGIRO account requirements and documents

The first thing to note is that your DEGIRO registration is entirely digital. This implies that having your documentation ready can significantly expedite the procedure. When you have completed all aspects of your registration, the broker will authorize you within one business day.

The following is a list of the documents involved in the DEGIRO account:

The IBAN of the bank account

Passport or identity card

AHV number

Contact number to verify your account.

To confirm the account, you must use derived bank identification. As a result, you will need to deposit just €0.01 from a bank account under the name that appears on your account.

There are no additional fees or minimum deposit amounts; you can deposit as much or as little as you choose. It's essential to keep in mind that only deposits from within Europe are accepted when making a DEGIRO deposit.

DEGIRO account types

DEGIRO offers various account types with commission, margin, leverage, and minimum deposit requirements. Let's look into the DEGIRO accounts in detail and learn more about it.

Basic account

The most flexible and default account is the basic one. Users get access to product trading and warrant trading in addition to the functionality of the Custody account.

It allows access to all fundamental functionalities but disallows leveraging. It has no additional costs or restrictions comparable to some of the other accounts.

| Markets | Stocks, bonds, ETFs, investment funds (over 50 exchanges) |

| Commissions | Starting from 1€ on US stocks |

| Trade size | From 1 contract |

| Leverage | Not available |

| Special features | No fees on certain ETFs (Core-ETF selection) |

An active account

The Custody and Basic accounts and the Active account are comparable, but the Active account allows for leverage. However, no ratios are indicated. Additionally, it offers the choice of going short and the chance to buy with up to 50% of your available margin.

| Availability | In Europe |

| Account opening | Although there is no demo account, you can test the platform with a minimal investment of €0,01. |

| Trade size | From 1 contract |

| Leverage | Margin up to 33% of the value of the position |

| Special features | The core-ETF selection is available. |

A trader account

Like the other three above accounts, the Trader account has access to leverage. However, there is no mention of leverage on the website.

Using their margin of up to 100%, customers of the Trader account can purchase. Additionally, traders using this account type have free dividend and coupon processing.

| Commissions | Commissions for US equities start at €1, and there is an overnight cost if you hold a CFD position overnight. |

| Leverage | Margin of up to 80% of the position's value. |

| Trade size | From 1 contract |

| Special features | Certain ETFs do not charge fees (Core-ETF selection). |

| Account opening | A minimum deposit of €0.01 is required to open an account. There is no free trial version available. |

A day trader account

Derivatives and buys can be conducted on 100% of the available margin, with additional margin available during open market hours. The same trading fees apply to day traders using this account as they do to regular users.

The account above types can accommodate the requirements of most traders. Furthermore, each account has its unique set of advantages. Many can be customized to meet the needs of particular traders.

| Commissions | They begin at 1€ on US equities and include an overnight fee if you keep a CFD position overnight. |

| Special features | Core-ETF selection |

| Markets | Stocks, bonds, ETFs, investment funds, futures, options, leveraged products such as warrants (over 50 exchanges) |

| Leverage | The margin is 80% of the position's value or more, and margins will be lower when the markets open. |

| Account opening | There is no virtual account available to test the service first. You can, however, start an account for as little as €0.01. |

DEGIRO account opening guide

DEGIRO offers several account kinds, including custody, basic, trader, active, and day trader accounts, each with different features and services. Look at the steps for "How to open a DEGIRO account?"

On the webpage, click "Open an account."

How to open a DEGIRO account

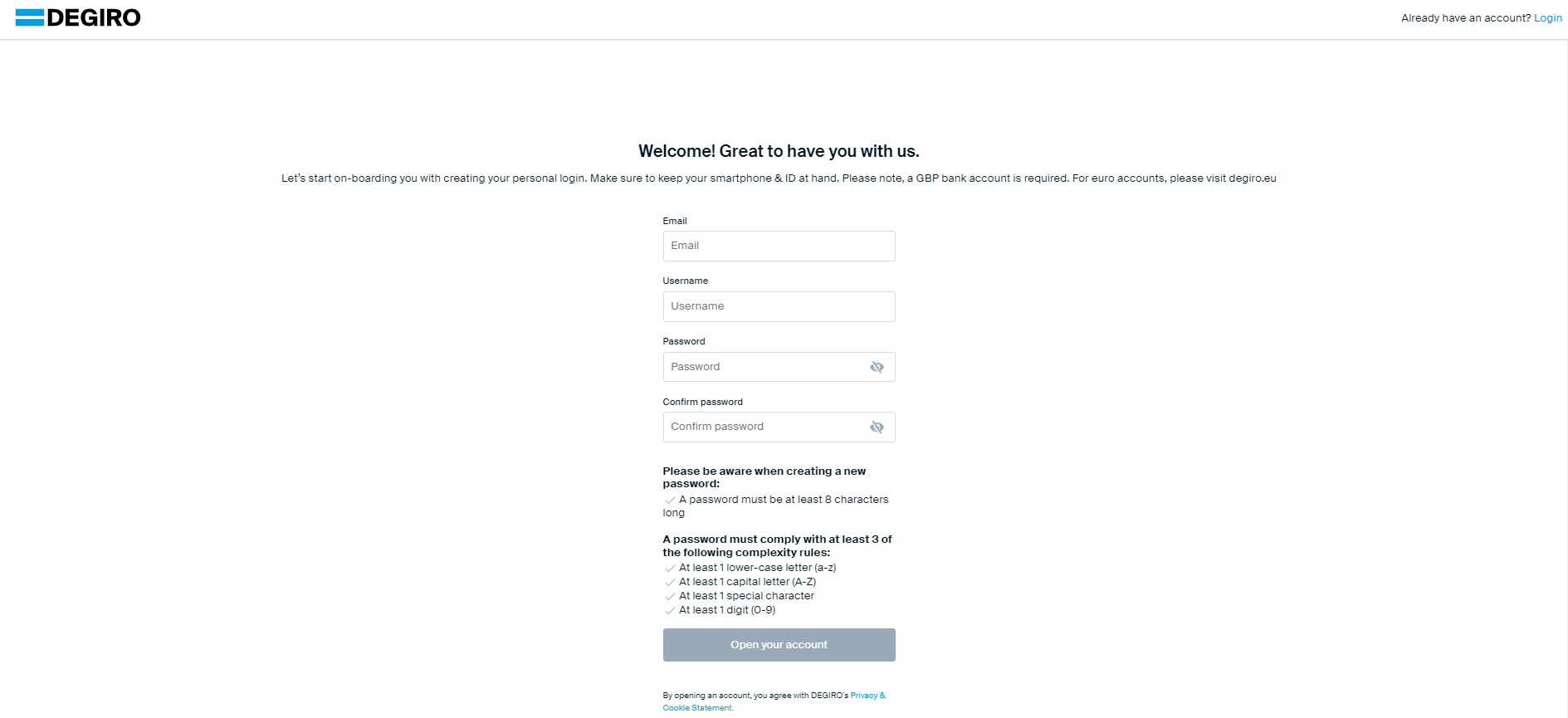

Fill up your email address and select a username and password.

How to open a DEGIRO account

After confirming the email account, provide personal details.

Verify the information is accurate before adding the bank account.

Upload your identity documentation, such as a passport or ID card.

The last step is to transfer a small amount, as little as €/£0.01, to start your DEGIRO account after reviewing your application.

How to close a DEGIRO account?

If you want to know how to close a DEGIRO account, then the process is straightforward.

Before closing your account, make sure it is empty;

You should have all positions closed;

All real-time subscriptions must be disabled;

All funds must be withdrawn.

Moreover, Closing your account may take up to 30 days since all outstanding fees must be charged first. You do not have to pay any fees when you close your account.

You can also contact DEGIRO if you have any questions regarding your account.

FAQ

How long does DEGIRO take to verify?

DEGIRO imposes most of its fees into two rates

When you have completed all aspects of your registration, you will be verified by the broker within 1 business day.

How many people are using DEGIRO?

Create a free account to join the 2 million investors already using this convenient platform.

Is DEGIRO governed?

Yes, The AFM, DNB, and FCA govern DEGIRO.

What is the DEGIRO minimum deposit?

$0 is the DEGIRO minimum deposit.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.