DEGIRO Account Types Compared

The most suitable investment platform for a trader's money is the one they trust the most. Therefore, finding a reputable brokerage platform that offers an array of account types in addition to distinguishing itself from the competition in terms of account features can be challenging. But not with DEGIRO.

Below is an in-depth comparison of the various types of accounts offered by this Dutch Online platform (DEGIRO), which is tailored to assist traders in finding out which type of account is most suitable according to their specific trading requirements.

DEGIRO basic account:

This versatile and the most default account from DEGIRO not only provides its traders to trade diverse financial instruments but also offers the functionality of a custody account, & allows users to trade products and warrants.

Regarding its

Connection cost (Exchange Connection Fee): €2.50 per scholarship annually.

Dividend Processing: Free

Coupon Processing: Free

Conversion fee: only applicable (If the base and withdrawal currencies are not the same.)

Fees (Charge): £1.75+0.014% (there is a maximum charge per trade of £5.00).

Note:

Traders cannot trade leverage and can't short stocks or buy on margin.

DEGIRO active account:

Akin to the basic account, this Active Account from DEGIRO is a full-featured account that allows its traders to access all the DEGIRO products (including leverage) and debit money up to a value of 33%.

Regarding its

Connection cost (Exchange Connection Fee): €2.50 per scholarship annually.

Conversion fee: only applicable (If the base and withdrawal currencies are not the same.)

Fees (Charge): £1.75+0.014% (there is a maximum charge per trade of £5.00.)

DEGIRO trader account:

Trading through this account from DEGIRO gives traders access to all financial instruments (including leverage).

Regarding its

Connection cost (Exchange Connection Fee): €2.50 per scholarship annually.

Dividend Processing: Free

Coupon Processing: Free

Conversion fee: only applicable (If the base and withdrawal currencies are not the same.)

Fees (Charge): £1.75+0.014% (there is a maximum charge per trade of £5.00.)

Note:

There are no indications as to what the leverage would be. And also, traders are allowed to debit their money upto 70% (of value).

DEGIRO daytime trader account:

Likewise, as with all the three accounts mentioned above, this account from DEGIRO gives traders access to all financial instruments (including leverage & derivatives).

Regarding its

Connection cost (Exchange Connection Fee): €2.50 per scholarship annually.

Dividend Processing: Free

Coupon Processing: Free

Conversion fee: only applicable (If the base and withdrawal currencies are not the same.)

Fees (Charge): £1.75+0.014% (there is a maximum charge per trade of £5.00.)

Note:

There are no indications as to what the ratio would be. And also, traders are allowed to fully utilize (100%) their available margin at any given time, with additional margins available if they wish to do so during the open market hours.

DEGIRO custodian account:

This entry-level account from DEGIRO allows traders and investors to trade a range of financial instruments, including

Investment funds

Bonds

Apart from its wide range of financial instruments (for trade), this account does not offer the option of trading with debit money and securities.

Regarding its

Connection cost (Exchange Connection Fee): €2.50 per scholarship annually.

Dividend Processing: €1.00 + 3.00% of dividend (maximum is 10.00%).

Coupon Processing: €1.00 + 0.10% of coupon (maximum is 10.00%).

Conversion fee: only applicable (If the base and withdrawal currencies are not the same.)

Note:

Securities in a custodian account can't be lent out (to third parties), and once the account has been activated, the trader can no longer switch between the standard account and custodian account.

DEGIRO account types comparison:

| Basic account | Active account | Trader account | Daytime trader account | Custodian account | |

|---|---|---|---|---|---|

| Minimum Deposit | €0.01 | €0.01 | €0.01 | €0.01 | €0.01 |

| Platforms | Provide two proprietary platforms: Web-based platform and App (IOS & Android) | Provide two proprietary platforms: Web-based platform and App (IOS & Android) | Provide two proprietary platforms: Web-based platform and App (IOS & Android) | Provide two proprietary platforms: Web-based platform and App (IOS & Android) | Provide two proprietary platforms: Web-based platform and App (IOS & Android) |

| Markets | Stocks ETF’s Bonds Investment Funds (more than 50 exchanges) | Bonds Stocks Futures ETF’s Options Investment Funds Leveraged products (Over 50 Exchanges) | Bonds Stocks Futures ETF’s Options Investment Funds Leveraged products (Over 50 Exchanges) | Bonds Stocks Futures ETF’s Options Investment Funds Leveraged products (Over 50 Exchanges) | Shares Bonds Investment Funds Trackers (ETFs) |

| Trade size | From 1 contract | From 1 contract | From 1 contract | From 1 contract | Not Available |

| Commissions | Starts from 1€ on U.S. stocks | Starts from 1€ on U.S. stocks Overnight fees are associated with leveraged trading |

Starts from 1€ on U.S. stocks CFD positions held overnight are subject to an overnight fee |

Starts from 1€ on U.S. stocks CFD positions held overnight are subject to an overnight fee |

Not Available |

| Max leverage | Not Available | Up to 33% margin on the position's value | Margin up to 80% of the position value | Margin up to 80% of the position value. However, when the markets are open, margins will be lower | Not Available |

| Special features | No fee applicable on the selection of the core ETFs | Selection of the core ETFs | No fee applicable on the selection of the core ETFs | Selection of the core ETFs | Not Available |

How to open a DEGIRO account?

There isn't much to opening a DEGIRO account. The only thing you have to do is follow these steps:

When opening via the website:

Navigate to the official website of DEGIRO.

How to open a DEGIRO account

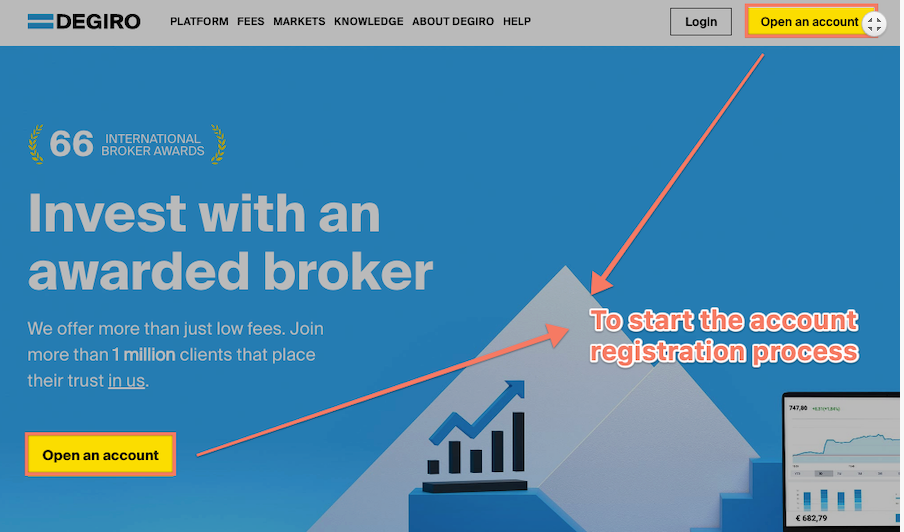

Once you have reached it, click on Open an account.

How to open a DEGIRO account

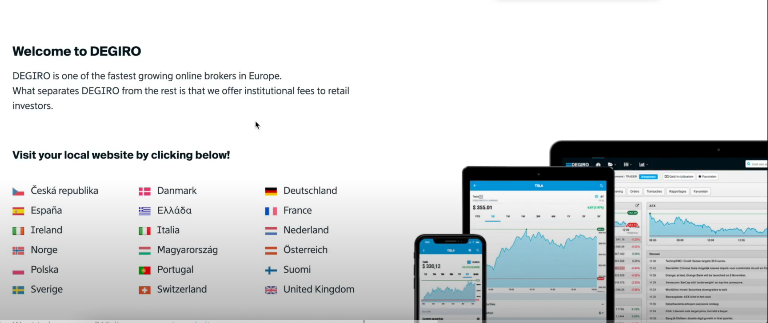

Following the click, you will be redirected to a page where you must select your country (among the 18 countries mentioned).

How to open a DEGIRO account

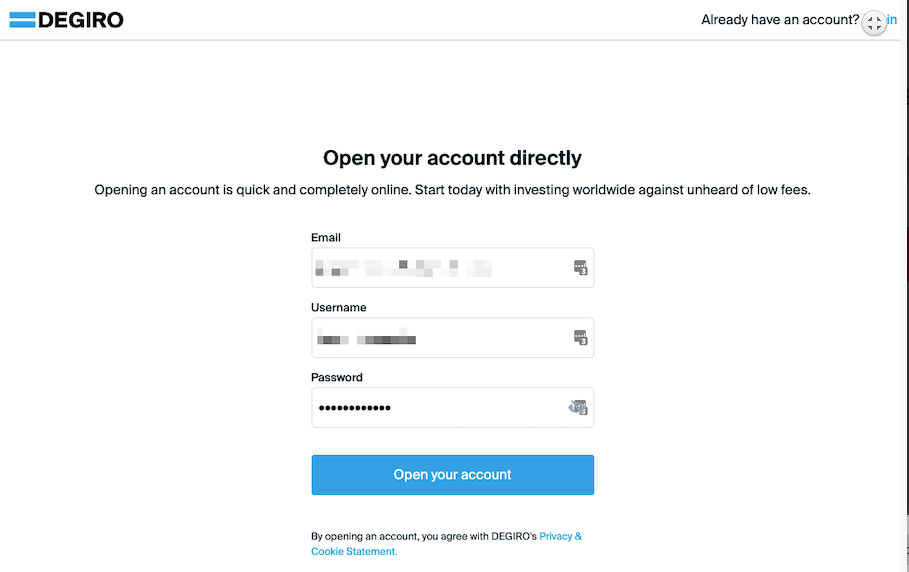

After selecting, input your e-mail address, username, and password (in the registration form).

How to open a DEGIRO account

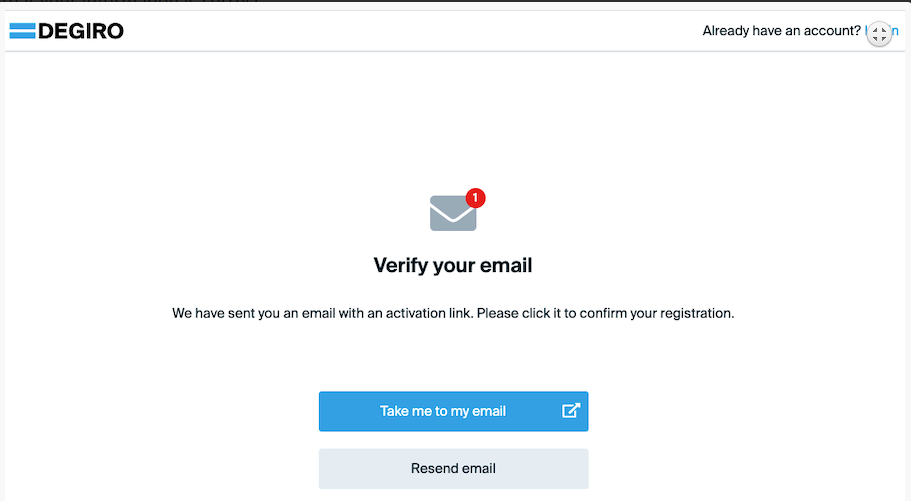

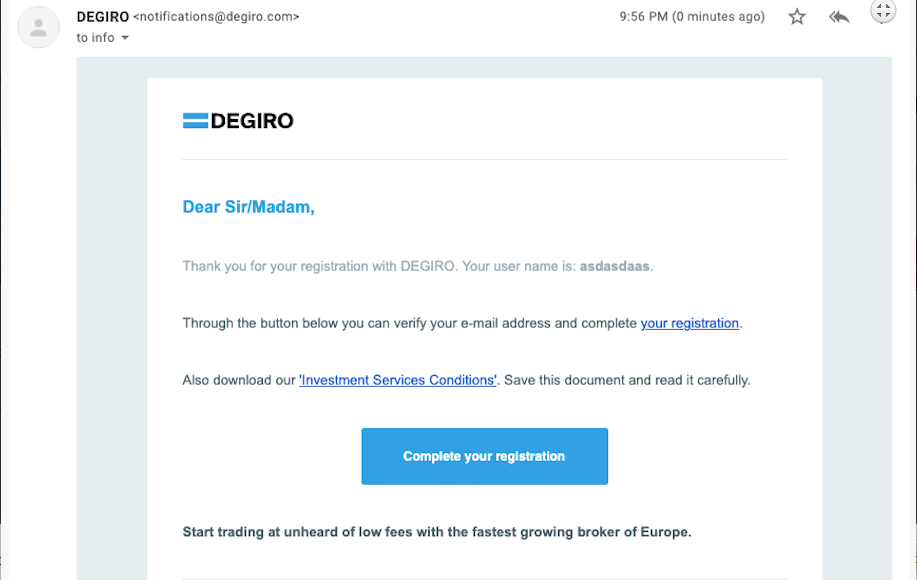

Please verify your e-mail account after entering the credentials.

How to open a DEGIRO account

How to open a DEGIRO account

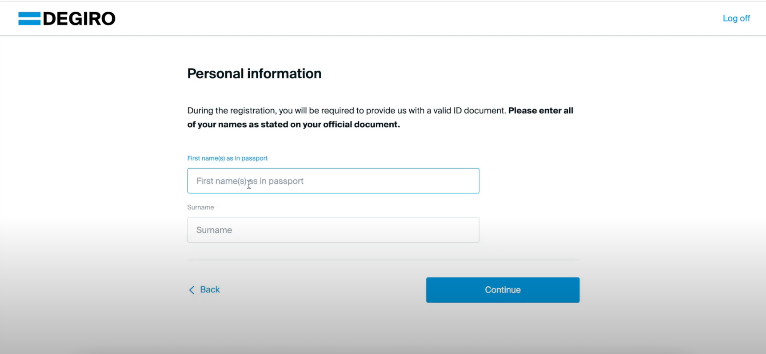

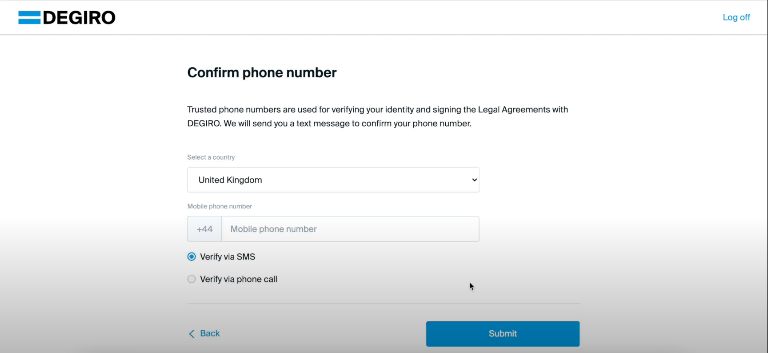

Upon verifying, fill in the required details like address, name, place of birth, phone number, etc. (as per your passport).

How to open a DEGIRO account

How to open a DEGIRO account

Then link your active bank account with your DEGIRO trading account.

Be sure to double-check the information you have entered.

After checking your details, you will be prompted to attach a picture of your EU ID card or passport.

As soon as you've filled out all the information and uploaded your documents, DEGIRO will evaluate your application and let you know the next steps.

And voila! You are now in possession of your DEGIRO account.

FAQ

Is DEGIRO a safe online brokerage platform?

DEGIRO has been registered by the UK Financial Conduct Authority and is superintend by German BaFin. So traders shouldn't worry about it being a scam.

What other products are available to trade with DEGIRO?

Currencies

Derivatives

NOTE:

Certain account types may also allow traders to trade derivatives (and other complex products) than bonds, mutual funds, ETFs, and stocks.

Can you track your wallet using the DEGIRO app?

Yes DEGIRO application has been designed primarily to keep track of your wallet and assist you with placing orders on your smartphone.

Is it free to sign up for a DEGIRO account?

Yes, there is almost no cost associated with creating a DEGIRO account.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.