According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Trader Workstation

- IBKR Mobile

- IBKR API

- Portal of clients

- Depending on the asset

- Options, trading, CFD, ETF, EPF

Our Evaluation of Interactive Brokers

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Interactive Brokers is a reliable broker with the TU Overall Score of 7.45 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Interactive Brokers clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

Interactive Brokers is a reliable brokerage company that is popular with traders from all over the world. Interactive Brokers offers its clients desktop, web and mobile trading platforms. Client Portal, the web-based trading platform features a convenient and understandable interface. In addition, the company has an IBKR API available for developing custom software. Interactive Brokers programs allows clients to trade products from 160 exchanges including stocks, option, currencies, bonds, funds and more from a single unified platform. The company accepts clients from over 200 countries and territories including the US. Interactive Brokers offers trading platforms and tools to meet the needs of active traders and institutional investors, as well as beginning investors.

Brief Look at Interactive Brokers

Interactive Brokers is among the best-known global online brokers. Based in the US, it has been operating since 1977. Interactive Brokers allows clients to trade products from 160 exchanges including stocks, option, currencies, bonds, funds and more from a single unified platform. The company is regulated by the US Securities and Exchange Commission (SEC), the US Financial Industry Regulatory Authority (FINRA), the UK Financial Regulatory Authority (FCA, 208159), and other international financial regulation commissions. Interactive Brokers has earned recognition as a top broker, garnering multiple awards and accolades from respected industry sources such as Barron's, Investopedia, Stockbrokers.com,and many others. Also, the broker is popular in other countries. Here you can read reviews of Interactive Brokers in Canada, Singapore, Australia, Hong Kong, Ireland.

- extensive and free educational resources through the IBKR Campus;

- access to160markets in 36 countries and territories;

- trading in stocks, options, futures, currencies, bonds, funds and more from a single unified platform.

- Support service does not work on Saturday;

TU Expert Advice

Financial expert and analyst at Traders Union

During its cooperation with Traders Union the Interactive Brokers investment company proved itself as a reliable partner, which faithfully fulfills its obligations to us. The broker provides clients with a wide range of services, allowing them to engage in both active trading and investments. At the same time, the broker charges a fee for an inactive account, and that's not convenient for passive investors.

Despite the lack of a minimum deposit, Interactive Brokers is focused on working with professional market participants. The US and Canadian investors are the main target audiences of the company. Interactive Brokers customer support will help you resolve claims made to the company.

You can find all the information about trading conditions and the specifics of various trading instruments on the broker's website. Before opening an account with this broker, we strongly recommend you to read about all trading conditions in detail, as well as reviews of other clients about cooperation with Interactive Brokers.

- You are an experienced investor. This broker's platforms and tools are tailored to suit the needs of seasoned traders who are accustomed to utilizing advanced features such as complex order types, in-depth research capabilities, and detailed data analysis.

- You seek low commissions and margin rates. Known for their competitive pricing structure, this broker is particularly advantageous for active traders who conduct high-volume transactions. If you're looking to minimize costs associated with trading, this broker's low commissions and favorable margin rates could significantly benefit your investment strategy.

- You invest globally. This broker offers access to a diverse array of global markets and assets, spanning across stocks, options, futures, forex, bonds, and funds. If you have an interest in diversifying your investment portfolio across different regions and asset classes, this broker provides the necessary platform and instruments to facilitate global investment opportunities.

- You require personalized investment advice or wealth management services. This broker primarily focuses on providing trading platforms and tools, rather than offering personalized investment advice or wealth management services.

Interactive Brokers Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Desktop: IBKR Desktop, Trader Workstation; Mobile: IBKR Mobile, IBKR GlobalTrader Web-based: Client Portal |

|---|---|

| 📊 Accounts: | Real, Demo |

| 💰 Account currency: | IBKR Offers 100+ Currency Pairs On 26 Currencies USD, AED, AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, KRW, MXN, MYR, NOK, NZD, PLN, SAR, SEK, SGD, TRY, TWD and ZAR. |

| 💵 Deposit / Withdrawal: | Bank Transfer (SEPA), US ACH Transfer, Direct Debit/Electronic Clearinghouse (ACH), Cheque, Canadian ETF Transfer, BACS / GIRO / ACH |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Depending on the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.1 lot |

| 💱 EUR/USD spread: | From 0 pips |

| 🔧 Instruments: | Stocks, options, futures, currency, metals, bonds, ETF, mutual funds, CFD, EPF, Robo-portfolios, hedge funds, forecast contracts (Product availability is dependent on IBKR affiliate and client country of residence) |

| 💹 Margin Call / Stop Out: | Depending on the asset |

| 🏛 Liquidity provider: | n/a |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Instant Execution |

| ⭐ Trading features: | Options, trading, CFD, ETF, EPF |

| 🎁 Contests and bonuses: | No |

Interactive Brokers is militantly developing, offering services to investors regardless of their trading experience. For this purpose, the broker doesn’t ask for a fixed minimum deposit but has margin requirements for accounts of various structures to make trading financially safe. The size of the leverage and Margin call and Stop out levels depends directly on the asset that the client is trading.

Interactive Brokers Key Parameters Evaluation

Video Review of Interactive Brokers

Share your experience

- Best

- Last

- Oldest

PK Rawalpindi

PK Rawalpindi The ability to trade everything from stocks

none

PK Peshawar

PK Peshawar he GlobalTrader app lets me trade in over 90 different markets

not suitable for a beginner

Trading Account Opening

Open a trading account to become a client of the company and start trading with Interactive Brokers. Read more about the registration and functionality in your personal account below.

To get a rebate, register on the Traders Union website, follow the referral link to the broker's page, and click on the "Open an account" button.

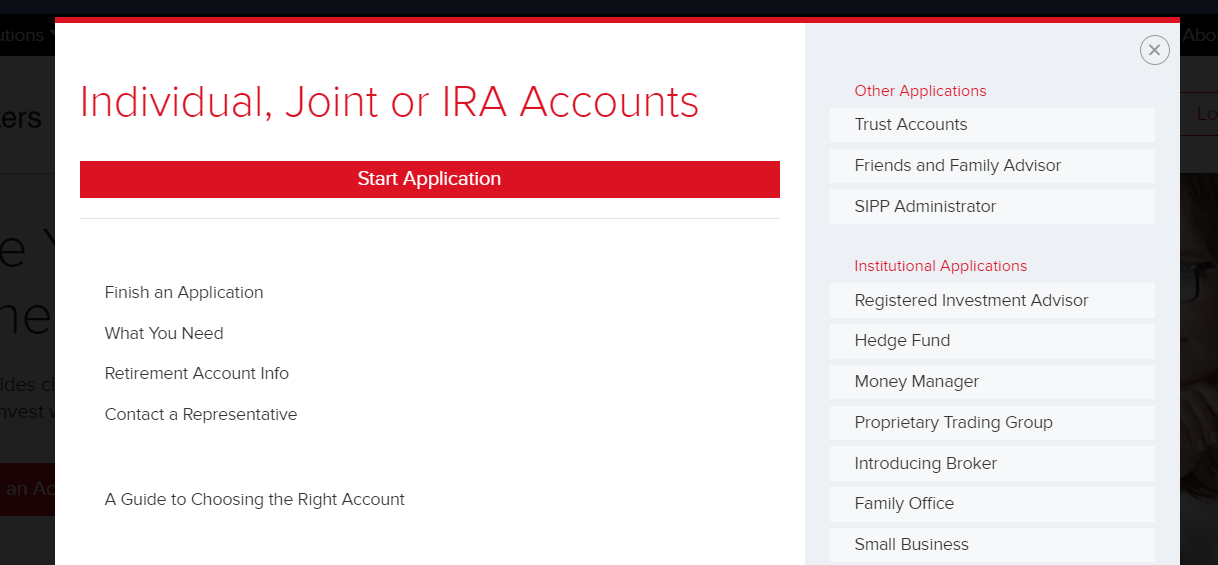

Choose the account that fits you.

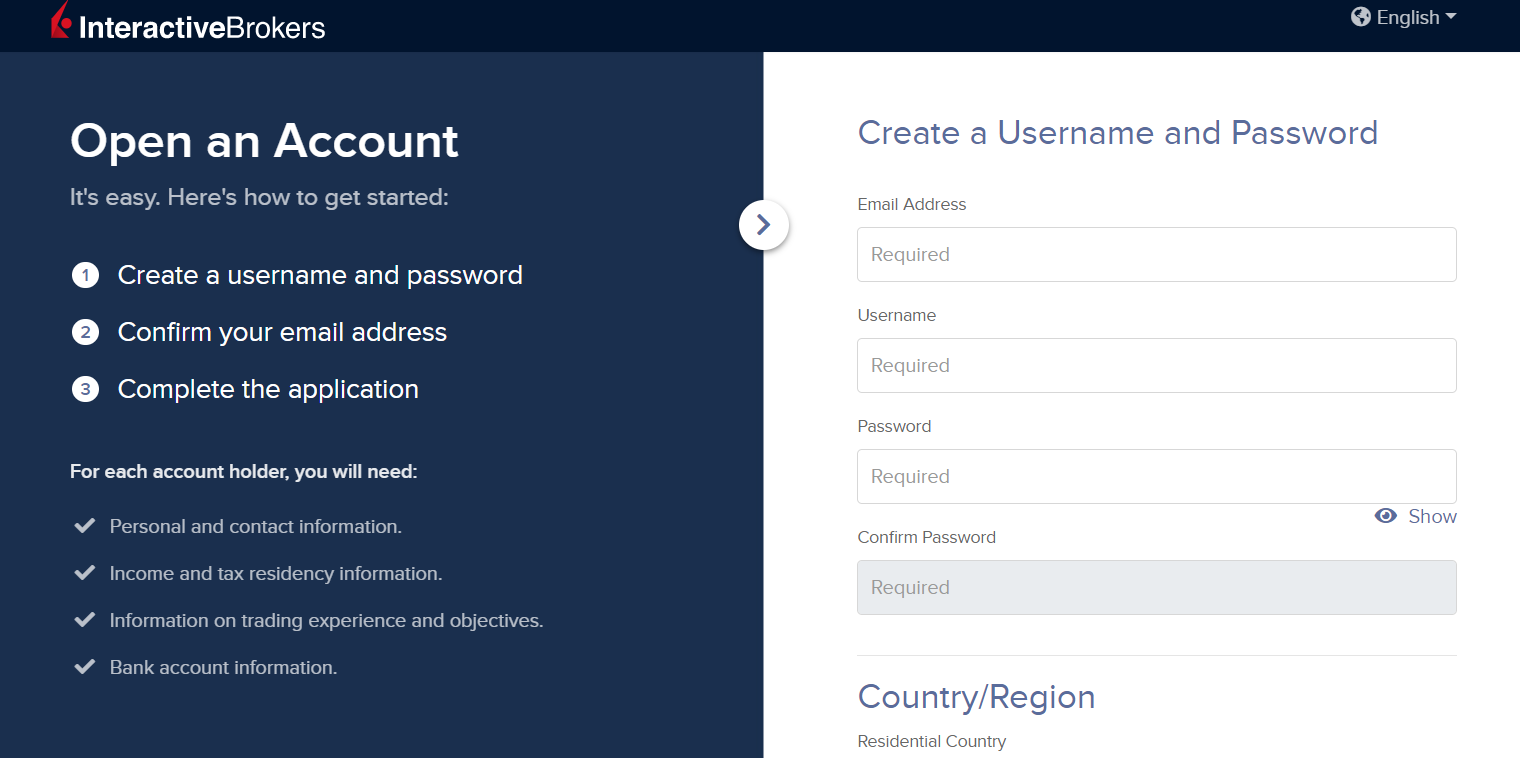

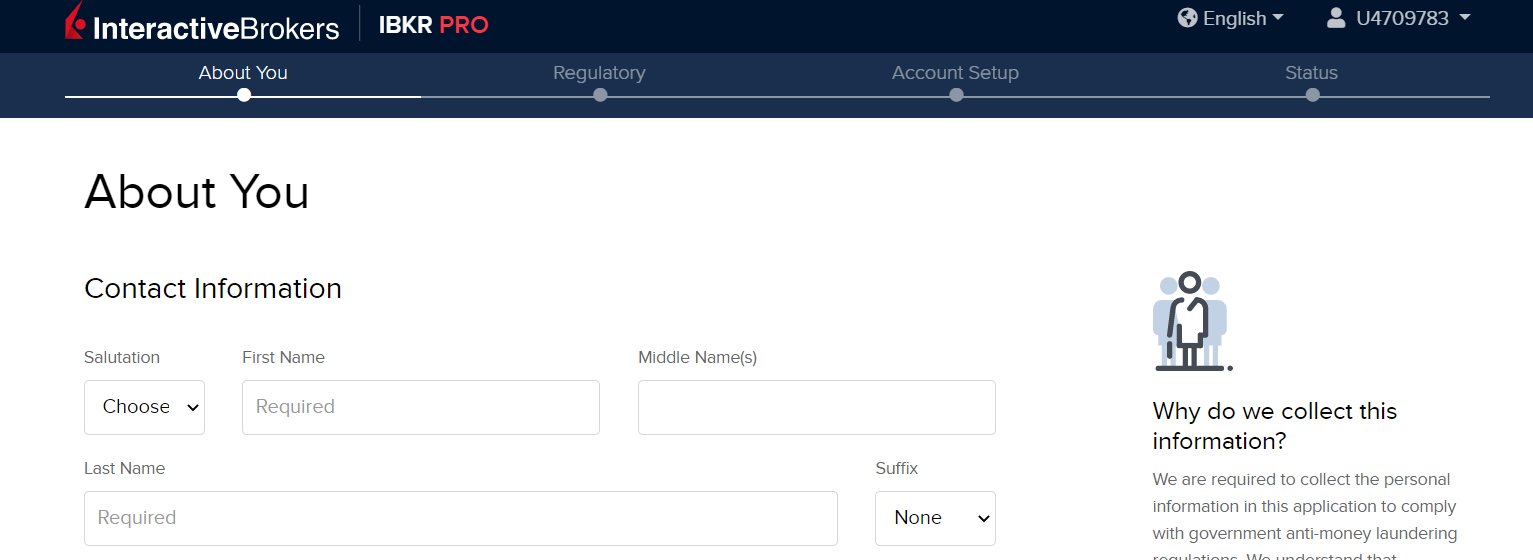

Complete the application to open an account. Enter your email address, full name, country of residence, and create a password to enter.

The next step is registration confirmation. Find a letter from the broker in your mailbox and click the "Confirm Application" button.

To complete your registration, enter your login and password in the appropriate input.

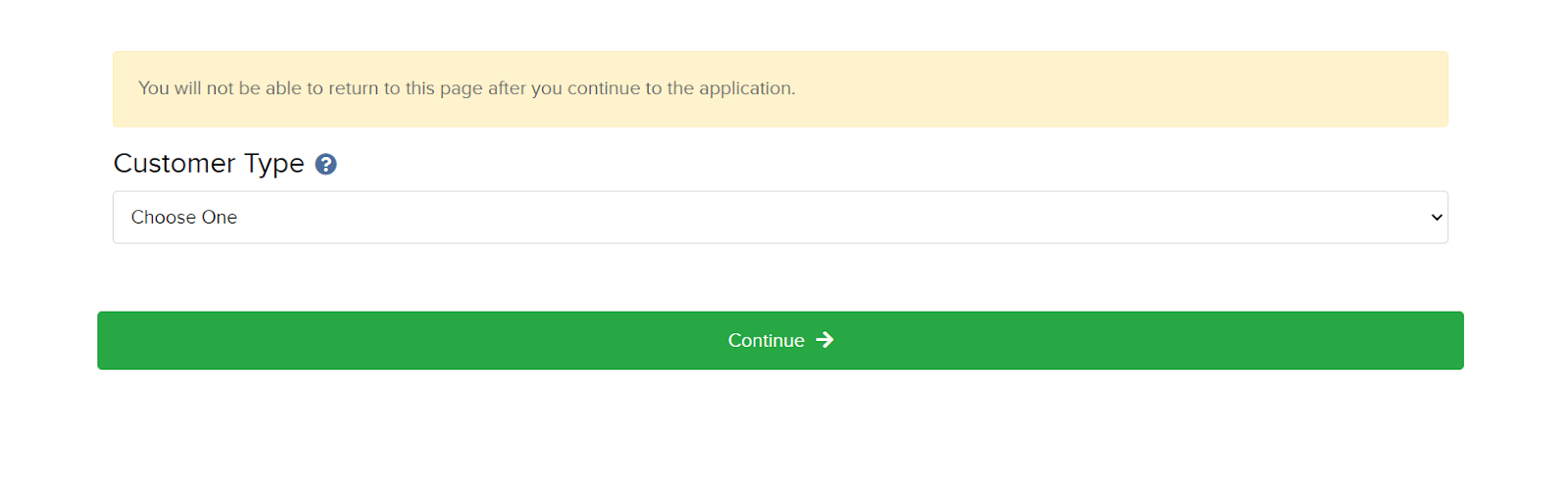

Now select the structure of the account you wish to open.

Fill out the profile fields, including contact information, personal information, identification, professional experience, source of wealth, account information, and confidential matters.

All fields are mandatory. After you specify all the data requested by the broker, your application shall be sent for consideration. This procedure takes several days, so you won't be able to start trading immediately. If your application is approved, you’ll get access to your personal account, where the following functions are available:

Additionally, you now have access to:

-

training materials;

-

quick connection to customer support;

-

statistics for the members of the referral program.

Regulation and safety

Information

Interactive Brokers is regulated by a variety of international commissions, such as US SEC FINRA, SIPC, UK FCA (208159), Australian AFSL (453554), Indian NSE, BSE (3285), SEBI (INZ000217730), Hong Kong SEHK, HKFE (01590), and Japan, and Canadian financial supervisory authorities.

Clients’ funds are protected by using segregated accounts.

Advantages

- A large number of regulatory authorities

- Clients' capital is protected

- A deposit insurance program

- The documentation is on the broker's website and in the public domain

Disadvantages

- A large number of regulatory documents to study

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Real | From $2 | Depending on the currency and withdrawal method |

Each of the trading instruments has individual margin requirements; you can find them directly on the website. Interactive Brokers trading commissions were analyzed and compared with the popular broker's characteristics. Find the results below:

Account types

Types of accounts:

In addition, Interactive Brokers offers a Paper Trading account Paper trading lets clients use the full range of trading facilities in a simulated environment using real market conditions. Clients can use this environment to learn trading features such as order types without risk, learn market dynamics in new exchanges and products, and simulate and test trading strategies. When clients use a paper trading account, they have limited access to Client Portal functions. Paper trading accounts are created within 24 hours under normal business circumstances.

All new clients automatically receive a paper trading account with 1,000,000 USD of paper trading Equity with Loan Value, and this equity will fluctuate as if the trades had executed in the real market.

Deposit and withdrawal

-

Apply to withdraw funds. Proprietary payment systems set limitations on the maximum withdrawal amount. One withdrawal per calendar month is free, but there is a fee for subsequent withdrawals, depending on the account currency and the payment system.

-

For deposits and withdrawals, you can use bank transfer (SEPA), direct debit or wire transfer through the ACH Clearinghouse, cheque, Canadian ETF transfer, US ACH transfer, and BACS/GIRO/ACH.

-

The speed of withdrawing money and crediting funds depends on the payment system.

-

Replenishments and withdrawals are available in 19 currencies: USD, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, SGD, SEK, CHF, CNH.

-

You are required to pass verification during registration for financial transactions.

Investment Options

Interactive Brokers is an automated electronic global broker. Investments are possible by investing in stocks, bonds, and ETFs, earning dividends from them, or subsequent sales at a higher price. Interactive Brokers provides individual and institutional investors with access to investment products across 160 exchanges from a single unified platform, including stocks, options, currencies, bonds, funds and more. Investors can fund and trade accounts in up to 28 currencies and use powerful trading platforms and tools. In addition, there are many services and features that cater to investors of all abilities worldwide. Examples include:

Overnight Trading Hours: This service currently lists over 10,000 US stocks and ETFs plus US Equity Index Options. Clients can now also trade US Treasuries, global corporate bonds, UK gilts, and European government bonds for 22 hours per day.

MultiSort Screener: Clients can easily find stocks that best match their strategies across a universe of over 70,000 stocks worldwide.MultiSort enables users to sort data using multiple factors simultaneously. This is essential for traders and investors who need to evaluate diverse information, such as fundamental data, past performance, and technical indicators. MultiSort makes it easy to input multiple preferences and quickly returns the most relevant results.

Option Lattice: Option Lattice is a graphical options chain display highlighting potential outliers in key metrics, such as Implied Volatility, Open Interest, Volume, or Last Price. Users can easily switch between categories for a comprehensive view and look back at the historical performance of the underlying for a more informed analysis.

Fractional Shares Trading: With fractional shares investors can divide investments among more stocks to achieve a more diversified portfolio, and put small cash balances to work quickly to maximize potential returns.

Interest on Instantly Available Cash: Clients can earn up to 3.83% on uninvested cash balances above USD 10,000.

Fundamentals Explorer: Free fundamentals data for over 30,000 companies worldwide.

Options Wizard: Helps investors learn about and start trading options.

PortfolioAnalyst: This free tool for clients and non-clients allows investors to consolidate, track, and analyzetheir portfolios. Recently added features include Retirement Planner to help investors better understand their retirement outlook and a Budgeting Tool which tracks and categorizes spending to help a client budget more effectively.

AI-powered News Summaries: Eligible clients can access concise summaries of news articles, streamlining insights from leading providers and making it easier for investors to stay informed; currently only available for eligible clients of the Interactive Brokers affiliates in Canada, the UK, Ireland, Hong Kong, Singapore, Australia, and Japan

Recurring Investments:Setup and execute a predetermined investment strategy by automatically investing funds on a recurring schedule.

Interactive Brokers affiliate program

Commercial referral program. The partner's challenge is to attract new customers using a unique link, and the partner shall get a fixed amount of $200 for each client attracted.

Referral program with extras. The partner's challenge is the same as in the commercial referral program. The only difference is that now the referrer (partner) gets a percentage of the trading commission that the client invited pays to the broker. Payments are made for 3 years.

There is no need to be a client of Interactive Brokers or be an active trader to participate in the affiliate programs. It is enough to meet the broker's requirements for partners.

Customer support

Information

The company offers online chat services to current clients 24 hours a day, Monday through Friday, and from 1 to 7 PM Eastern Time on Sundays in the US.

Contacts

Education

Information

IBKR believes that well-informed traders have the best chance for success. That’s why it remains dedicated to ramping up traders' knowledge of markets and IBKR tools to aid them on their investment journey.

The redesigned IBKR Campus continues to include courses, webinars, podcasts, and market commentaries to help investors learn about trading, financial markets, and Interactive Brokers' trading tools. There is improved site design and navigation to easily find all trading education features, better performance and overall site speed, live tickers and stock charting, and an updated Traders’ Glossary search. As part of Traders’ Insight, clients can watch or read market commentary and analysis from nearly 100 industry pros.

There is an IBKR Quant Blog for quantitative professionals with an interest in programming, deep learning, API, AI, blockchain and other transformative technologies. There is a podcast series featuring discussions on topics that impact global markets and trading, including Spanish-language content; additionally, there is a “Cents of Security” channel aimed at enabling financial literacy amongst the younger generation. For Traders’ Academy, there are now 110 total English and 15 international courses (representing 9 international languages). That includes 43 new or updated courses and 15 courses have been added from CME.

We highly recommend you use the IBKR trial version to test your knowledge in practice without financial risk.

Detailed Review of Interactive Brokers

Interactive Brokers is well-known globally. It provides services all over the world and offers traders and investors the best conditions to save and increase their capital. The company's priority is to create technology that will increase the order execution speed and the range of instruments to provide clients with access to advanced assets. Investors can trade stocks, options, futures, currencies. Bonds, funds and more across 160 exchanges from a single unified platform. The broker offers account funding trading in up to 28 currencies and options for active trading.

A few figures that could be interesting for traders choosing a broker:

-

over 42 years in the market;

-

access to 160 markets within 36 countries and territories;

-

3,617,000 Daily Average Revenue Trades;

-

trading is available around the clock;

-

access to 100+ types of orders;

-

3.54 million client account.

Interactive Brokers is a company for profitable investments and active trading

Interactive Brokers is a tried-and-true company focused on the active development of trading technology technologyfor even more profitable trading and investing.

For trading, the broker offers to use the Client Portal web platform, the IBKR Mobile and IBKR GlobalTrader mobile applications, IBKR Desktop and Trader Workstation for desktop, and the IBKR API to create your own trading software.

Interactive Brokers’ useful services are:

-

IBKR Bond Marketplace;

-

Mutual Fund Marketplace;

-

Portfolio Analyst;

Advantages:

wide range of trading instruments;

access to over 160 markets worldwide;

Wide range of accounts for various structures (private accounts, general, etc.);

No minimum deposit;

Free IBKR Campus for investors of different levels of experience;

regulation by a large number of international bodies worldwide.

Disclaimer:

Many, or all, of the products featured on this page are from our advertising partners, who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. The information provided on this page is for educational purposes only. Traders Union does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities, or other investments.

Latest Interactive Brokers News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i