Via Wealthsimple's secure website.

Wealthsimple Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Web platform

- Mobile platforms

- Not offered

- The amount of the management fee depends on the amount of investment and the country of residence of the client

Our Evaluation of Wealthsimple

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Wealthsimple is a reliable broker with the TU Overall Score of 7.39 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Wealthsimple clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

Wealthsimple is a regulated broker whose activities are controlled by financial institutions: FCA, FSCS, and CIPF. The company's clients can invest in portfolios formed from two types of funds - ETFs and mutual funds. The portfolio is developed individually for each client for the Premium account type. The minimum amount required to invest in Wealthsimple portfolios is 1 British pound or Canadian dollar. Wealthsimple is a broker for passive investing whose services are available only to residents of Canada and Great Britain.

Brief Look at Wealthsimple

Wealthsimple is a robo-advisor (algorithmic trading robot) that was founded in 2014 in Canada and also provides services in the UK. It is regulated by the UK and Canadian Securities Commissions, including the FCA (747883) and IIROC, and participates in the Financial Services Compensation Scheme (FSCS) as well as the Canadian Investor Protection Fund (CIPF). Wealthsimple serves over 1 million investors and manages £3 billion of investments.

- No minimum deposit requirements for the basic account.

- Top-notch security and regulation by reputable securities commissions and participation in compensation schemes.

- Ability to earn income passively, i.e., without having to actively trade yourself.

- No additional charges for account maintenance, deposit, withdrawal, and use of a mobile application.

- A simple principle for charging commissions for portfolio management is a fixed percentage of the deposited amount.

- Possibility to open accounts not only in pounds sterling but also in Canadian dollars.

- Detailed statistics on commissions and rebalancing of the formed portfolios, which are available in the personal cabinet on the website and in the mobile application.

- Registration is only available to UK and Canadian residents.

- The site does not have an online chat for prompt communication with the support team.

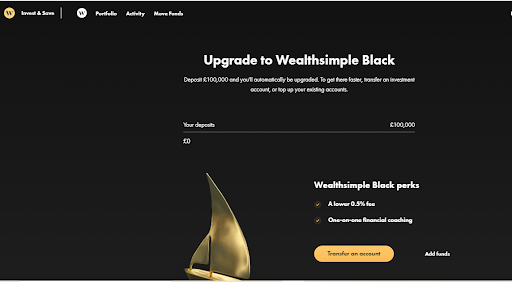

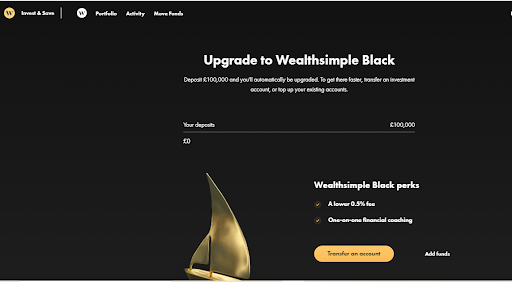

- The formation of an individual portfolio by an investment specialist is available when depositing £100,000 or more.

TU Expert Advice

Author, Financial Expert at Traders Union

Wealthsimple provides investment services focused on managed asset portfolios, utilizing a web platform and mobile app for client interaction. The company caters to passive investors, offering diverse investment options in ETFs and mutual funds. Wealthsimple supports accounts in GBP and CAD, with no minimum deposit for the Basic account. Notably, there are no fees for account maintenance, deposits, or withdrawals, enhancing the accessibility for users, especially those residing in Canada and the UK.

Drawbacks include the lack of live chat for client support, limited regional availability, and higher minimum deposits for premium services like personalized portfolio management. Despite these disadvantages, Wealthsimple may suit investors seeking a simplified, passive investment experience within its serviced regions. Active traders or those outside the UK and Canada may find other platforms more fitting.

Wealthsimple Summary

Via Wealthsimple's secure website. Your capital is at risk.

| 💻 Trading platform: | Web platform, mobile platform |

|---|---|

| 📊 Accounts: | Basic, Black, Generation, saving, and pension |

| 💰 Account currency: | GBP, CAD |

| 💵 Deposit / Withdrawal: | Debit card, bank transfer, Direct debit, account transfer |

| 🚀 Minimum deposit: | From 1 GBP/CAD |

| ⚖️ Leverage: | Not offered |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 EUR/USD spread: | No trading fee; annual commission for portfolio management starts from 0.4% of the investment amount |

| 🔧 Instruments: | Managed asset portfolios |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | The amount of the management fee depends on the amount of investment and the country of residence of the client |

| 🎁 Contests and bonuses: | Yes |

Wealthsimple offers asset portfolio management services to investors. All transactions and payment operations can be tracked in the personal account on the website and in the mobile app. Clients can invest only their capital. Borrowed funds (margin trading) are not provided by the broker. Three account types are available: basic accounts that allow you to start with any amount; premium accounts starting from £100,000 (black account) or £500,000 (generation account).

Wealthsimple Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Follow these instructions to create a personal account on Wealthsimple's website:

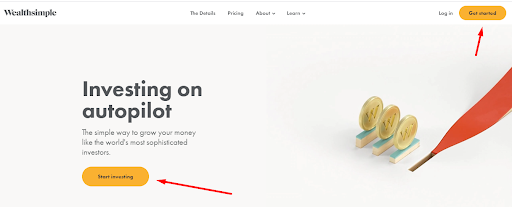

Visit the broker's official website and click one of the buttons on its home page to begin registration.

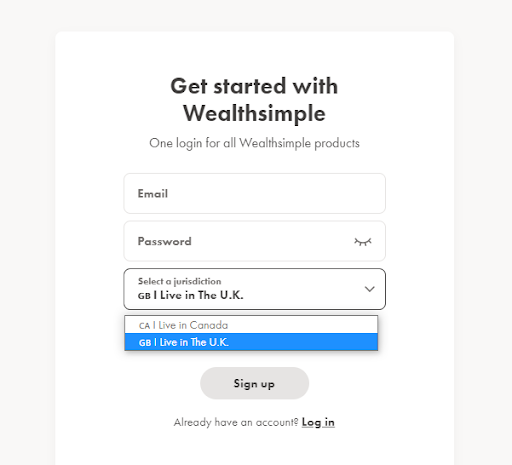

Then, in the form that opens, give your email address, make up a strong password and choose the company's division (British or Canadian) that serves clients from your country.

After that, enter your first name, last name, date of birth, phone number, as well as your citizenship, country of birth, and current residential address.

The last step of the registration is to enter your employment type and official place of employment. You must also enter your Unique Tax Reference Number (UTR) or National Insurance Number (NINO).

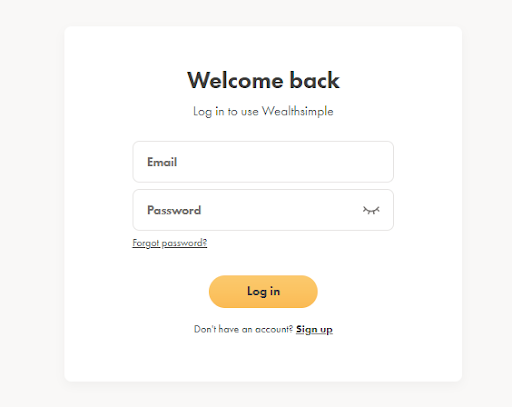

Use the email and password you specified earlier to log in to your personal account.

The following actions are available in your Wealthsimple personal account:

Also, a trader can conduct these actions in his personal account:

-

Verify the account.

-

Change personal details of the profile.

-

Associate a bank account.

-

Request a withdrawal.

-

Transfer funds between own accounts.

-

Create a report for a specified period on active portfolios.

-

Copy referral links and view affiliate program statistics.

-

Go to the Help Center section to quickly find an answer to your question.

Regulation and safety

The Wealthsimple brand is owned by Wealthsimple UK Ltd and is registered in England and Wales under number 747883. The regulator of the activities is the Financial Conduct Authority (FCA). Clients in the UK are covered by the Financial Services Compensation Scheme (FSCS), so their funds are protected up to £85,000 and investments up to £50,000.

Canada-based Wealthsimple Inc. is registered with the Securities Commissions of Ontario (OSC), British Columbia (BCSC), Alberta (ASC), Manitoba (MSC), and with the Autorité des Marchés Financiers as the portfolio manager. It is also a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF).

Advantages

- The reputable regulators of England and Canada control the financial activities

- Two-factor authentication (2FA) and data encryption are applied

- FSCS and CIPF deposit and asset protection

Disadvantages

- You have to provide not only personal data but also tax information to open an account

- Only UK and Canadian residents may open an account

- Withdrawals are only possible via wire transfers

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Basic | From 0.5% of portfolio value per year = £5 for an investment of £1,000 | No |

| Black | At 0.4% of portfolio value per annum = £400 in investments of £100,000 | No |

| Generation | At 0.4% of portfolio value per annum = £2,000 when investing £500,000 | No |

There are also two types of third-party fees. These are an annual ETF fund management fee of 0.16% to 0.33% and a market fee of up to 0.02% of the portfolio value, which is retained by the broker or market maker that executes the order to buy or sell the asset.

The table shows the comparison of the average commission of three stockbrokers: Wealthsimple, Charles Schwab, and Ally Bank. Its size was determined by Traders Union specialists during the analysis of trading conditions on different types of accounts.

| Broker | Average commission | Level |

|---|---|---|

|

$0.2 | |

|

$4 |

Account types

Wealthsimple offers basic and premium accounts to traders interested in making portfolio investments. They differ in the principle of forming a portfolio, the size of the minimum deposit, and management fees.

Account types:

Wealthsimple also offers popular savings accounts (GIA, ISA, JISA) and a retirement SIPP with investment options for UK customers. Canadians can open RRSP, TFSA, RESP, RRIF, Personal, Lira, Joint, and Business accounts.

Deposit and withdrawal

-

A client can only withdraw money from trading accounts by bank transfer.

-

It can take 7-10 working days from the request to withdrawal until the funds are credited to the bank account. This is because after placing trading orders with the broker, the actual money transfer takes up to 3 additional working days.

-

Deposited funds cannot be withdrawn within 5 days after they are credited to the account balance.

Investment Options

Wealthsimple offers passive investment through investments in managed portfolios. They are formed based on the data specified by the investor, such as objectives, time horizon, and the customer’s attitude toward risk.

Investing on autopilot: A picture-perfect way to get passive income on the stock market

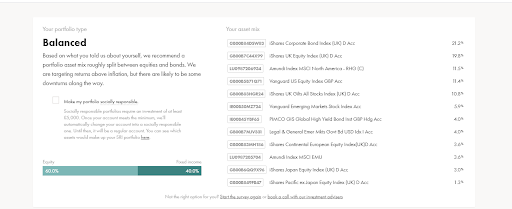

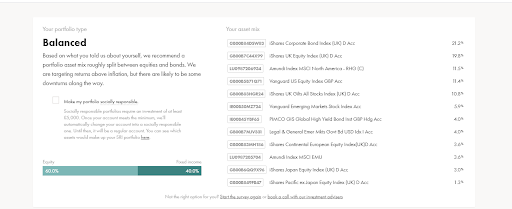

Wealthsimple offers its clients well-balanced portfolios with different risk levels. Each of them is diversified and contains from 10 to 15 funds in a certain segment. If the market situation changes, portfolios are rebalanced automatically. The investor does not participate in this process. Wealthsimple offers the following portfolio types:

-

Socially (SRI) and non-socially responsible investing portfolios. The fees charged by ETF managers of SRI portfolios range from 0.22% to 0.32%. The minimum investment in SRI funds is £5,000. Management fees for non-socially responsible investing ETFs are 0.18-0.2%, and the investor may invest any amount.

-

Conservative, Balanced, Growth. These are classifications of portfolios based on degrees of risk. The investor himself determines the permissible level. Each investor can have several portfolios with different risk profiles.

To invest in Wealthsimple managed portfolios, you need to answer several questions in the registration form. Based on this data, the algorithm will propose the optimal portfolio for you. The investor may agree to invest in it, apply for another portfolio or contact the company's specialist to create a personalized portfolio.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Wealthsimple’s affiliate program:

-

Referral Program. For each friend who opens and deposits £5,000 or more through a referral link, the existing client receives free asset management of £5,000. The referral receives the same remuneration.

Thus, the broker does not charge any fees for its services to the participants of the referral program for 12 months.

Customer support

The opening hours for the support desk are 8:00 am to 8:00 pm (Monday to Thursday) and 8:00 am to 5:30 pm (Friday) EST.

Advantages

- Support languages: English and French

Disadvantages

- No online chat

- Can't be contacted 24/7

- Responses by email arrive within 24-48 hours after submitting a question

To contact a support representative, an investor can:

-

Call the phone number listed on the website;

-

Fill out an email request form (available in the Help Center section);

-

Send a request to email;

-

write to Facebook Messenger, Twitter, or Instagram.

There is also a virtual chatbot on the website for Canadians.

Contacts

| Foundation date | 2014 |

|---|---|

| Registration address | 9th Floor, 160 Victoria Street, London, SW1E 5LB |

| Regulation | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. |

| Official site | https://www.wealthsimple.com/ |

| Contacts |

Education

The training section on the Wealthsimple website is called Learn. It has three blocks: Investing Master Class, Magazine, Personal Finance 101. They provide information for newcomers to the stock market, as well as describe the advantages of investing with the help of a robo-advisor.

Managed portfolios provide automatic rebalancing, which saves investors from the need for detailed market research and constant in-depth analyses.

Detailed Review of Wealthsimple

Wealthsimple is headquartered in Toronto, but the broker also has offices in New York and London. At the moment, the company only cooperates with investors from Canada and the UK. The UK office only offers managed asset portfolio investment services. The Toronto-based division also allows its clients to trade securities and cryptocurrencies independently.

Wealthsimple by the numbers:

-

Offering investment services for more than 7 years.

-

Serves more than 1 million clients.

-

Manages over £3 billion of client capital.

-

Manages more than 380 million dollars of investments received from the largest financial institutions globally.

Wealthsimple is a broker for passive investments in managed asset portfolios

Wealthsimple offers clients portfolios consisting of exchange-traded funds (ETFs) and mutual funds. The company's specialists believe that these financial instruments are the best way to reduce management costs and simplify the portfolio. Base portfolios are formed by a special algorithm. It analyzes investors' answers that they give when opening a new trading account. Potential clients indicate their level of acceptable risk, financial goals, age, profession, and income. Personalized portfolios for premium account holders are compiled by the company's in-house investment specialists.

Wealthsimple makes it possible to form a portfolio and view statistics on it in the web terminal (available in the personal account on the website) and the mobile application. The functionality of both versions does not include technical indicators, as passive investors do not need them.

Useful services of Wealthsimple:

-

Free-of-charge investment consultation from a Wealthsimple specialist. During a telephone conversation, the consultant finds out your attitude to risk, helps you set investment goals, talks about ways to reduce financial expenses and taxes.

-

Help Center. A section with detailed descriptions of trading conditions, an explanation of the basic concepts of the stock market, and tips on financial planning.

-

News & Webinars. A section with a feed of current news and recordings of webinars already conducted by Wealthsimple specialists.

Advantages:

The portfolio of assets is formed individually — based on the goals specified by the investor, acceptable terms of capital placement, and attitude to risk.

It is possible to open an account and pass verification online, without a personal appearance in the company's office.

Basic services for creating and managing portfolios are available to investors who have deposited between £1 and £99,999.

On premium accounts, the management fee is reduced by 0.1-0.2% compared to the fees on basic accounts.

In addition to investment accounts, clients of the broker can also open savings and retirement accounts.

The mobile app and the personal cabinet support two-step authentication.

The broker offers investments in Socially Responsible Investing (SRI) funds as well as portfolios with different risk levels, such as low, balanced, and aggressive.

Customers can set up Direct debit — a service for automatic monthly deposit of the amount specified by the investor.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i