A3Trading Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- Xcite

- FSA

- 2021

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- Xcite

- FSA

- 2021

Our Evaluation of A3Trading

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

A3Trading is a broker with higher-than-average risk and the TU Overall Score of 3.44 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by A3Trading clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

A3Trading works exclusively with tax residents of India, including those who live outside the country. It offers a wide range of assets, however, trading fees may not be optimal for all trading strategies and styles.

Brief Look at A3Trading

A3Trading is a Forex broker for traders from India that offers currencies, CFDs, options, and ETFs in the OTC (over-the-counter) market. It is regulated by the Seychelles Financial Services Authority (FSA) with license number SD012. The company's clients can trade more than 2,000 financial instruments with leverage of up to 1:200. A3Trading has developed a proprietary platform with advanced analytic capabilities, trading signals, and features for managing accounts and money transactions.

- Convenient mobile application;

- Wide choice of trading assets, such as Forex, popular types of CFDs, ETFs, and options;

- Losses for unsuccessful trades are covered for the first 5-15 trades subject to the deposit;

- Free training courses and mentoring for novice and experienced traders;

- This broker is licensed by an international financial regulator;

- A wide choice of payment methods ranging from bank transfers to local payment systems;

- Broadcast of professional analytics and fundamental data, and free access to Autochartist and reviews from Investing.com.

- Only tax residents of India can become this broker’s clients;

- No cent or demo accounts;

- High spreads on accounts with small deposits, especially in volatile markets.

TU Expert Advice

Financial expert and analyst at Traders Union

A3Trading offers a wide range of payment systems and trading assets, as well as a flexible pricing model that adapts to the market and traders’ needs. To protect clients from high risks of increasing volatility, floating spreads are converted into fixed ones. The company also securely protects confidential information such as bank card numbers, passwords, etc., by using the SSL protocol.

When the trading account balance reaches zero, A3Trading automatically closes all the trader's positions. This is done to protect accounts against negative balances. According to this broker, clients should not be responsible for funds provided for margin trading that exceed their own capital.

If traders have not made deposits or there has been no trading activity on their accounts for at least 45 days, A3Trading may cancel any accrued trading bonuses. At the same time, a user account is not considered active if only fees for withdrawal of funds or inactivity were withheld, and there were no other operations. The company also charges high fees for inactivity on the account, but there are no deposit or withdrawal fees.

A3Trading Summary

| 💻 Trading platform: | Xcite (web and mobile) |

|---|---|

| 📊 Accounts: | Real |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Replenishment / Withdrawal: | Bank transfers, VISA, Mastercard, Maestro, Skrill, Neteller, EcoPayz, Paysafecard, Paytm, MobiKwik, GlobePay, Oxigen Wallet, and JioMoney |

| 🚀 Minimum deposit: | $200 |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.0004 pips |

| 🔧 Instruments: | Currency pairs, indices, commodities, precious metals, cryptocurrencies, stocks, options, and ETFs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | International providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Floating spreads and reduced fees are available for clients with large deposits |

| 🎁 Contests and bonuses: | Trading benefits and first-protected positions |

Deposits can be made in any currency, but all of them are converted to the base account currency, which can be USD, EUR, or GBP. Leverage on all account types is the same with no restrictions for retail traders. The maximum trading leverage for currencies and commodities is 1:200; for CFDs on indices, it is 1:100; and for CFDs on stocks, it’s1:10. Individual leverage up to 1:20 applies to positions protected from loss. The minimum deposit is $200, but you can start investing in stocks with $100.

A3Trading Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

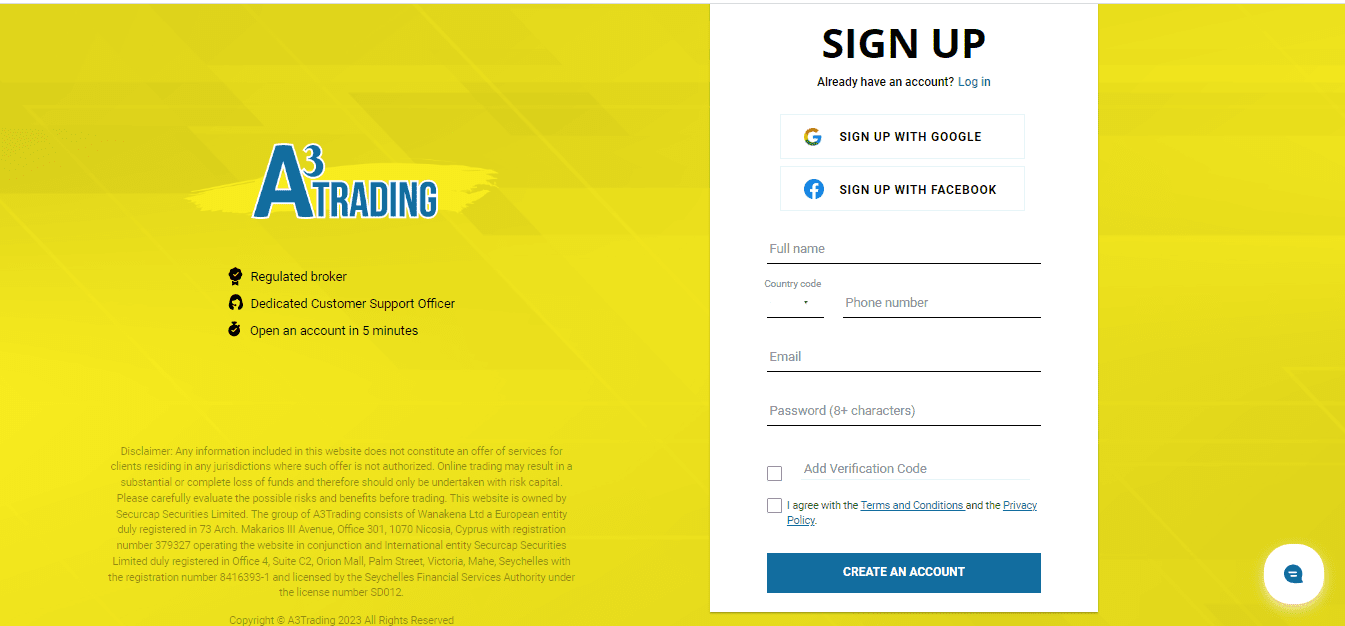

Only residents of India can register a user account on the A3Trading website. Traders Union has provided the instructions below on how to open a trading account and the many functions of the user account.

Click the “Open Account” button on the main page of the website. For convenience, you can switch to Arabic or Spanish.

Enter your first and last names, phone number, and email address. Also, create a password and agree to the terms of service. For faster registration, use your Google or Facebook profile.

After that, the company will ask for your address, date of birth, and Aadhaar number, which is India’s 12-digit single-person biometric identity and tax authentication, similar to the U.S. social security number, which is only 9 digits. Also, specify your occupation, income, and assets. To pass verification, use your passport or driver's license.

Regulation and safety

Securcap Securities Ltd, which owns the A3Trading trademark, is licensed by FSA. This regulator monitors the financial sector, including transactions in the Forex market.

Clearing services are provided by Wanakena Ltd, which was registered in Cyprus in 2018 and is part of the A3Trading group.

Advantages

- If the complaint is rejected by the compliance control service, the complainant may file an appeal with the regulator

- The license ensures this broker's client-oriented approach, because it is revoked by the regulator in case of violation of the services provision contract by this broker

- FSA allows retail traders to trade with leverage more than 1:30

Disadvantages

- A3Trading may disclose its clients’ personal information to regulatory or law enforcement bodies

- FSA does not compensate for trader losses resulted from this broker’s suspension

- Even the minimum deposit requires verification

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Real | $4 | Charged by a bank or payment system |

Swaps of 0.02% of the position amount are charged for currencies, indices, stocks, and commodities, and 0.1% for cryptocurrencies. The comparative table below shows average fees of A3Trading and popular Forex brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$4 | |

|

$1 | |

|

$8.5 |

Account types

Traders can only open one account type with A3Trading. Then their status will be changed subject to the deposit. The higher the status and the more money on the account balance, the lower the spreads and the wider the range of additional benefits and services. Each client is assigned a personal manager who can advise on available products and the best protocols to apply.

Account type:

A3Trading does not offer a demo account, but new clients can take advantage of the first protected positions option and execute the first 5-15 trades in a live account with a loss coverage. A3Trading is an online trading broker with advanced technical solutions, quality educational courses, and analytics. It charges only spreads and also offers a unique pricing model for its own services.

Deposit and Withdrawal

Clients can withdraw all or part of the available funds only after providing all the documents necessary to confirm their identity and closing all open positions;

Withdrawal can only be made by the method used to make the deposit. Available withdrawal methods are bank transfers, bank cards, and electronic payment systems;

Minimum withdrawal amount via bank transfers is $50. Limits from payment systems may also be possible;

A3Trading processes withdrawal requests within 24 hours. After the request is approved by the back office, the withdrawal is made within 120 business hours. Timing for crediting money depends on the issuing, intermediary, and/or recipient banks’ policies, the location of clients, and their status;

A3Trading does not charge a withdrawal fee, but it may be charged by payment service providers in accordance with their internal regulations.

Investment Options

A3Trading provides a platform for self-trading. Neither asset management services nor MAM or PAMM accounts are offered. The company does not offer MetaTrader, therefore investment services built into these platforms, such as copy trading, advisors, and custom indicators, are not available to its clients.

A3Trading’s platform does not support the copy trading option, however, it has a free signal service. It broadcasts a forecast for assets with entry/exit points and the time frame when buy or sell recommendations are considered relevant. A trader can copy a signal and thus execute a trade automatically, without conducting an independent analysis.

Another way to make passive income is to invest in CFDs on dividend stocks and to connect referrals under the partnership program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from A3Trading

This broker partners with Internovus, which is an international marketing company offering a variety of partnership programs for its clients’ needs. Rewards for A3Trading’s clients depend on the country of residence, the source of traffic, and the thematic focus of the domain through which referrals will be attracted.

To register as a partner, complete the appropriate form. The conditions are discussed by phone, Telegram, or Skype.

Customer support

Technical support is available 24/5. The client service in Arabic is open from 10:00 to 19:00 GMT+3; and in Spanish, it works on weekdays from 8:00 to 22:00; and on Saturdays, from 10:00 to 14:00 GMT+4.

Advantages

- Prompt responses in a live chat on the website and in WhatsApp

- Call back is available

Disadvantages

- Online support operators give uninformative answers

- Email service delays

You can contact the company’s representative by any of the following communication channels:

live chat on the website;

phone;

email;

WhatsApp.

Callback can be ordered through a chat operator, as there is no ready-made form on this broker's website.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | Securcap Securities Ltd, Room B11, First Floor, Providence Complex, Providence, Mahé, Seychelles |

| Regulation | FSA |

| Official site | https://www.a3t.live/ |

| Contacts |

+441519471242

|

Education

The A3Trading website has training for novice traders and reviews of advanced tools for experienced traders. Articles, video tutorials, and face-to-face online sessions with an instructor are available. All educational information is available in the Trading Courses section of the official website.

Money management rules, technical analysis, and a detailed analysis of the trading platform’s features are available in the section for advanced traders. Only registered clients can get access to all A3Trading training courses.

Comparison of A3Trading with other Brokers

| A3Trading | RoboForex | Exness | TeleTrade | FxPro | XM Group | |

| Trading platform |

Xcite | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MT5, MobileTrading, XM App |

| Min deposit | $200 | $10 | $10 | $10 | $100 | $5 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1 point | From 0.8 points | From 0 points | From 0.6 points |

| Level of margin call / stop out |

No | 60% / 40% | No / 60% | 70% / 20% | 25% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of A3Trading

A3Trading’s conditions are customized to meet the needs of each trader and provide the best earning opportunities. The company applies the no slippage policy, so all spot orders are executed at the price that traders choose in the trading platform under ordinary foreign exchange market conditions. During the increase in volatility, clients still receive stable ask (buy) and offer (sell) prices, but with fixed spreads.

A3Trading by the numbers:

2,000+ financial instruments are available to trade;

15 payment methods are supported;

The proprietary trading platform is used by 10,000+ traders;

The available number of loss-protected trades for new clients is 5, 10, or 15 depending on the account balance.

A3Trading provides a proprietary platform for OTC trading

A3Trading’s clients trade CFDs from Monday to Friday. Trading hours vary depending on the location of the exchange. So, according to GMT time, the U.S. market is open from 14:30 to 21:00; the EU and the UK is from 8:00 to 16:30; and Asia is from 0:00 to 2:00 and from 15:30 to 18:00. Trading currencies and commodities is possible from 22:00 Sunday to 22:00 Friday. Leverage depends on the financial asset and the market situation. At the same time, during high volatility, its value can be reduced without notifying traders. The range of trading instruments is the same for all clients, while the fee policy may be different.

In March 2023, A3Trading introduced Xcite, its new proprietary trading platform, which is available in web and mobile versions. Prior to this, its clients also used the proprietary A3Trading platform, released in November 2015. This broker does not offer trading on MetaTrader or cTrader.

Useful services offered by A3Trading:

Technical analysis tools. The trading platform supports charts with a wide range of indicators and drawing tools that can be used to spot a trend;

Autochartist. This program constantly analyzes the market based on support and resistance levels, and informs traders about the best trading opportunities;

Daily market review. It provides for real-time broadcasting of analytical forecasts and reviews, as well as charts and diagrams from the Investing.com website;

Economic calendar. It displays important financial reports for traders, as well as data and events that affect the price of assets, including those in OTC markets.

Advantages:

Negative balance protection is on all accounts, so that client losses cannot exceed their deposits;

A3Trading’s platform works on any device with access to the internet;

The company uses modern encryption methods to protect the personal and payment data of its clients;

The mobile platform broadcasts trading signals for popular assets that can be used for automated trading;

Technical support responds to requests in live chat and WhatsApp almost instantly, and also accepts call back requests.

A3Trading provides high-quality analytics, free training at various levels, and round-the-clock professional support.

User Satisfaction i