deposit:

- $500

Trading platform:

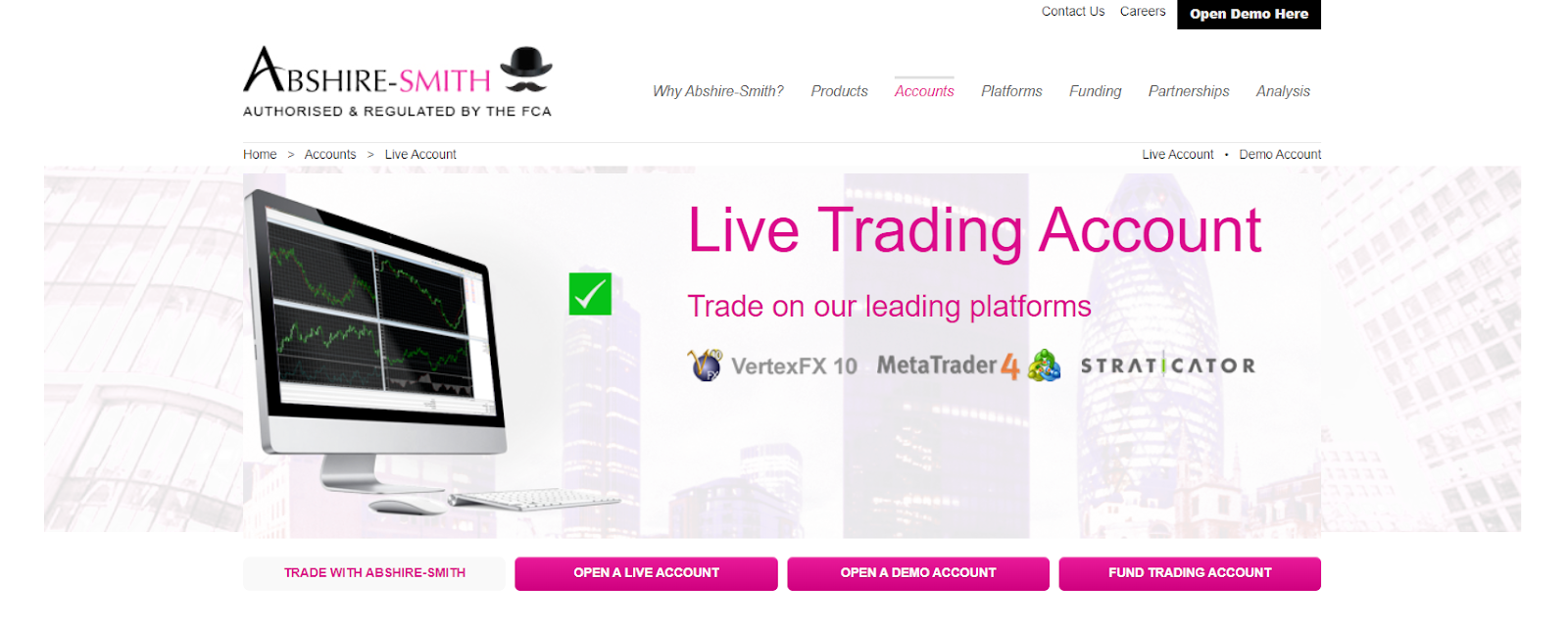

- MetaTrader4

- VertexFX 10

- Straticator

Abshire-Smith Review 2024

Attention!

This brokerage company is on the Blacklist. Working with companies on the Blacklist carries high risks of losing your money. We continuously monitor the Internet in order to identify new scams aimed at defrauding traders, and categorically do not recommend working with companies on the Blacklist.

We advise traders to choose reliable and trustworthy licensed companies from among top brokers of our rating:

Summary of Abshire-Smith Trading Company

Abshire-Smith is a trading company registered in the UK and operating under the regulation of the Financial Conduct Authority (FCA, reference number 590890). It offers three account types, such as demo, Standard, and Institutional. On a Standard account, the minimum deposit is $500, trade size starts from 0.01 lot, leverage is up to 1:400, and average spreads are 1.3 pips. Traders can work through the MetaTrader 4 (MT4), VertexFX 10, and Straticator trading platforms. There are no restrictions on styles and strategies, and it is possible to trade news, hedge, scalp, or use bots and advisors. Deposits and withdrawals of funds are carried out by bank cards or electronic transfer systems, such as Skrill. Three groups of financial instruments are available, namely currency pairs, stocks, and CFDs. Also, traders can work with DMA (Direct Market Access) and ECN (Electronic Communication Network). The broker does not offer partnership solutions for individuals, and there are no investment programs.

👍 Advantages of trading with Abshire-Smith:

- Low entry threshold, fast registration, and one-account type for individuals with favorable trading conditions;

- Hundreds of assets are available to traders and there are a lot of CFDs (contracts for difference) on energies, precious metals, and commodities;

- The broker has an average market spread of about 1.3 pips, however, trading fees are lower than those of many of its competitors;

- Three trading platforms are available and traders have the opportunity to use any plugin or extension tools;

- There are no restrictions on trading strategies, thus experienced traders can use the API (Application Programming Interface) and FIX (Financial Information eXchange) connection;

- The broker offers online loans in amounts from $500 to $15,000 on loyal conditions;

- The company's technical support is multilingual, represented by several communication channels, and is available 24/7.

👎 Disadvantages of Abshire-Smith:

- The company offers quite a lot of assets for trading, but many are CFDs;

- Traders do not have opportunities for passive income, and there are no investment options;

- The broker provides services globally, except residents of the U.S. and Iran cannot become its clients.

Geographic Distribution of Abshire-Smith Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment Programs, Available Markets and Products of the Broker

Some brokers offer their clients various investment solutions, for example, copy trading or joint PAMM accounts. As a rule, such programs do not replace active trading, although the copy trading service can be used for this. These solutions provide additional options for passive or relatively passive income. Sometimes referral programs are considered as passive income options, but traders should understand that these are fairly active income solutions. After all, in order to get a significant profit from invited users, you need to be as active as possible on the internet or have a popular blog.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Why Abshire-Smith doesn't offer passive income options:

The broker focuses on active trading. The budget of Abshire-Smith-Global Ltd is entirely directed to the introduction of the latest technologies, such as dedicated servers, which provide the platform with the highest performance. As for referral programs, their mechanism is always the same: a trader invites another trader through an affiliate link and receives a bonus for this (most often it’s a percentage of a referral’s deposit or trading fee). The goal is to stimulate the inflow of new users to the platform. But if the inflow is natural and large enough, a broker does not need to introduce a referral program. This is exactly the situation experts observe with Abshire-Smith-Global Ltd.

The broker implements a partnership program for business. It provides ready-made infrastructure and favorable trading conditions. Individual traders cannot access this program.

Trading Conditions for Abshire-Smith Users

If a broker offers several live accounts, each will differ in some aspects, including the minimum deposit. Abshire-Smith has only one account type, excluding demo and Institutional, so for individual traders, the minimum deposit is $500 under any conditions. All main deposit channels, such as bank cards and popular online systems are available. Leverage is determined by the asset traders select. The highest leverage for currency pairs is 1:200 under regular conditions, but in some cases, it can be 1:400. Leverage increases profit potential, but it also increases risk. The technical support of Abshire-Smith is excellent. It is represented by a live chat, email, and a call center that are available 24/7.

$500

Minimum

deposit

1:400

Leverage

24/7

Support

| 💻 Trading platform: | MetaTrader 4, VertexFX 10, and Straticator |

|---|---|

| 📊 Accounts: | Demo, Standard, and Institutional |

| 💰 Account currency: | USD |

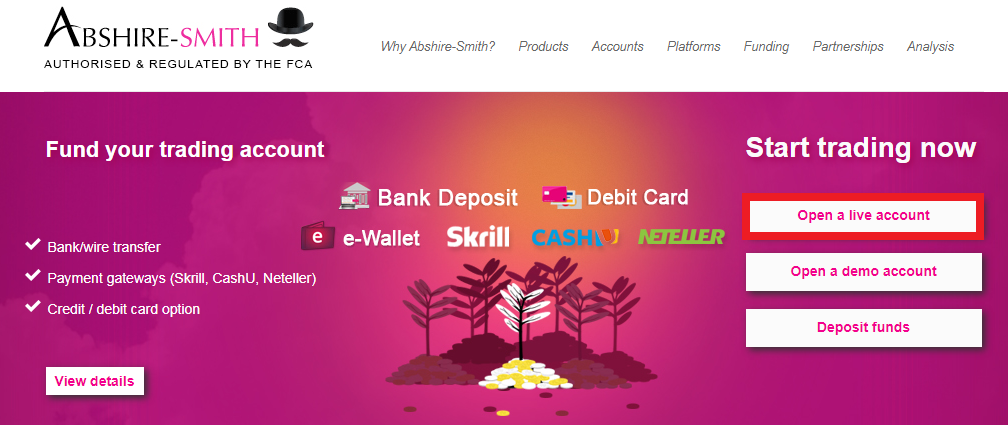

| 💵 Replenishment / Withdrawal: | Bank cards, Neteller, Skrill, and CashU |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:400, depending on the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | 1.3 pips |

| 🔧 Instruments: | Currency pairs, stocks, and CFDs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

One account type for individual traders; wide range of assets (but mainly CFDs); High leverage; Many popular deposit and withdrawal channels are available; No trading restrictions; Online loans are available; Newsfeeds with analytics; No passive income options |

| 🎁 Contests and bonuses: | Yes |

Abshire-Smith Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | $2 | Yes |

Traders prefer to compare brokers with each other. This practice allows them to get a clear result and understand which company is most profitable to trade with. But in the case of trading fees, the comparison is difficult, because there are too many factors that influence the fee amount. TU experts compared Abshire-Smith’s fees to those of its competitors.

| Broker | Average commission | Level |

| Abshire-Smith | $2 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of Abshire-Smith

Abshire-Smith is registered in the UK, regulated by FCA, and has been in business for over 12 years. All this speaks in favor of the reliability of the platform. The broker implements a number of protection mechanisms to keep its clients safe. For example, traders' funds are kept separate from the company’s funds. Moreover, the broker has an independent compensation fund in case of emergencies. Liquidity providers are tier-one institutions, in particular large banks, which is why Abshire-Smith can offer Prime Brokerage solutions to institutional clients. The broker's client-oriented approach is also confirmed by the fact that it offers swap-free Islamic accounts.

Abshire-Smith by the numbers:

-

3 types of instruments;

-

3 trading platforms;

-

6 channels for deposits and withdrawals;

-

Leverage is up to 1:400;

-

Online loans up to $15,000.

Abshire-Smith is a broker for currency pairs, stocks, and CFDs

Some brokers prefer to focus on a specific group of financial instruments, usually, it is currency pairs. Other platforms add assets from different categories, and this is always an advantage that expands the opportunities for traders. They do not have to limit themselves and can use different styles and strategies. Another advantage of a large choice of assets is risk diversification. The more diverse a trader's portfolio is, the less dependent he is on unpredictable market movements. Abshire-Smith offers plenty of choice in this regard. Its clients can work with currencies, stocks, and CFDs. The broker's pool contains CFDs on precious metals, energies, and commodities. This is more than enough for comfortable trading.

Useful services offered by Abshire-Smith:

-

Online loan. If traders do not have sufficient capital or they urgently need funds to increase trading volumes, they can contact the broker and get a loan from $500 to $15,000 on loyal conditions;

-

Analytical news. The Abshire-Smith newsfeed doesn't just include a list of important events and a brief description of them. The broker's experts give a competent assessment of the situation and try to predict market movements;

-

FIX Protocol. This is a real-time data transmission method, which is an international exchange standard. Abshire-Smith supports this protocol and allows its traders to use it.

Advantages:

The broker offers hundreds of financial instruments from three asset groups, which allows traders to diversify risks and implement various strategies;

The platform is controlled by one of the best international regulators and it uses advanced methods to protect its clients’ funds and information;

Individual traders can open a live account with really favorable conditions and successfully work in the international market;

The broker has relatively high spreads, but the fees are lower than those of many of its competitors, which, in combination with rebates from Traders Union, allows its clients to trade profitably;

Abshire-Smith technical support is available 24/7. Call center, live chat, email, and website tickets are available.

Guide on how traders can start earning profits

If a broker offers several account types, choosing the right one is of high importance for a trader. However, Abshire-Smith has only a demo account and one live account. Also, there is an Institutional (corporate) account, but it is intended for legal entities. Retail traders are advised to first open a demo account and evaluate the broker’s conditions. If users are satisfied with everything, they make a deposit of at least $500 and start trading on a live account. The conditions are quite comfortable. There are a lot of assets, leverage is up to 1:400, spreads are 1.3 pips on average, and low trading and withdrawal fees. In addition, traders choose one of the three trading platforms. It is impossible to declare which platform is better, they are all functional, and various extensions can be connected to them. So, it would be more useful to personally try each and make a decision.

Account types:

Note that to open a demo account, and not only a Standard account, verification will be required.

Investment Education Online

Traders must strive to improve their trading skills, otherwise, they will not be able to keep up with the market and be successful. They need to improve their standard techniques, explore advanced features, and try new instruments. And many brokers, interested in increasing their clients' loyalty, provide them with educational programs and other solutions for professional growth. Abshire-Smith doesn't have specialized education, but it does have a news blog with analytics that constantly posts helpful content.

Abshire-Smith does not aim to educate traders. Hence, the website does not have a trading glossary, basic guides, and other materials for novice traders. The broker assumes that its clients know how to work with assets and improve on their own. Therefore, only the analytics published in the relevant section is presented; it will be more useful to professionals.

Security (Protection for Investors)

The task of any broker is to display trades of their clients in the interbank market. Their main guarantee for traders is the availability of a license from a regulator. A regulator is a state-authorized organization that undertakes to monitor the legality and transparency of activities of financial companies that have its license. Abshire-Smith is regulated by FCA. It also states that traders' funds are kept separate from the company's funds. Moreover, there is a compensation fund for emergencies. These are the maximum security guarantees that traders can obtain.

👍 Advantages

- Possibility to contact the broker’s technical support

- Traders can apply to the Financial Conduct Authority

👎 Disadvantages

- Traders cannot contact the local financial authority if they are not residents of the UK

Withdrawal Options and Fees

-

If clients trade on a demo account, they do not receive profits and their balance is not replenished;

-

Traders earn only on live accounts, which balance and other information are displayed in the user account;

-

Clients can at any time submit a withdrawal request through technical support;

-

Usually, the application is processed quickly, the average processing time is 1-3 days;

-

Traders can review the limits and fees in their user accounts and during the submission of the application;

-

Withdrawal is available by bank transfer, to bank cards, as well as through Neteller, Skrill, and CashU systems.

Customer Support Service

Technical (client) support is an important element of the broker's infrastructure, as it largely reflects the quality of service and client-oriented approach. Support is needed when traders face situations that they cannot solve. Abshire-Smith offers multiple communication channels, such as a call center, live chat, email, and website tickets. All channels are multilingual and can be contacted 24/7.

👍 Advantages

- Even unregistered users can contact technical support

- Call center is multi-channel, and specialists respond promptly

- Support is available 24/7 for all regions

👎 Disadvantages

- The response rate of the call center may decrease during rush hours

If you have questions that you cannot solve yourself, contact client support using the following communication channels:

-

call center;

-

email;

-

live chat on the website and in the user account;

-

ticket on.

Note that communication channels for individual traders are listed above. There is separate support for corporate clients. The broker is represented only on Twitter.

Contacts

| Foundation date | 2011 |

| Registration address |

26 York Street, London, W1U 6PZ 20 Ropemaker Street, London, EC2Y 9AR |

| Official site | https://www.abshire-smith.com/ |

| Contacts |

Email:

info@abshire-smith.com,

Phone: +44 (0) 203 700 0085 |

Review of the Personal Cabinet of Abshire-Smith

To start trading with the broker, register and verify on its official website, then open a live account, and make a deposit. Below is a step-by-step guide.

Go to the broker's official website. Click the "Open a live account" button. You can also open a demo account; the sequence of actions will not differ. The broker allows you to have several accounts at once. New accounts (including demo) can be opened later in the user account.

Wait for the registration form to load. Enter your first and last names, email, phone number, and registration details. Follow the instructions on the screen.

To verify your user account, provide evidence of your personal information. A photo/scan of your passport or driver's license is enough. Wait for the broker to complete the check. After that, you will get full access to your user account and will be able to open a live account.

Features of Abshire-Smith’s user account:

Traders can track the status of their active accounts with minute details;

In the user account, open and closed positions are presented with indications of their current status;

Traders can see all their transactions, including deposits and executed withdrawal requests;

Links to trading platforms are available here;

Online loans are available up to $15,000 through the 1F Cash Advance service.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

Why has Abshire-Smith been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against Abshire-Smith by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of Abshire-Smith is down, not updated or operates with clear errors and some features are not available;

• Abshire-Smith has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if Abshire-Smith got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why Abshire-Smith got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from Abshire-Smith?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if Abshire-Smith is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.