eToro Dividends Explained

eToro pays dividends in various scenarios. You'll get debited or credited if you trade in stocks, EFTs, or a company that distributes dividends.

eToro is an investment platform for the complicated and risk-prone markets of ETFs, CFDs, and stocks. However, there is another straightforward way to earn on the platform; with dividend investments. If you want to make a steady income with eToro, read this article.

We discuss eToro dividends on stocks, ETFs, and CFDs, how you get dividends and if you pay taxes for them.

Does eToro Pay Dividends?

Yes. eToro pays dividends in various scenarios. You'll get debited or credited if you trade in stocks, EFTs, or a company that distributes dividends.

Here are instances in which you can get paid with dividends on eToro

The dividend is added to your available balance when you hold a BUY position.

The dividend is deducted from your account if you hold a SELL position.

Dividends on Stocks, ETFs and CFDs

eToro allows you to earn dividends on various financial instruments, including stocks, ETFs, and CFDs.

Stocks

You can get dividends on a stock if you own shares in the company through a brokerage account. You'll receive the cash immediately after the company releases the payments. They could do it for various reasons, like sharing profits with the people who put money into it. Only investors with shares before the day of the announcement will receive dividends.

CFDs

CFDs work in a similar way to stocks. If you own a CFD, you will receive a dividend if you own it before the ex-dividend date. On the payment date, your trading account is accredited with an amount equivalent to the dividend for each share to which you have exposure.

ETFs

ETF dividends happen when the broker holds the share of a particular company. They look at how clients are positioned on an instrument and go to buy the equivalent in real shares. When they receive the company dividend payments, they distribute them to clients according to their investment.

How Will I Get My Dividend

You'll receive your dividends depending on your position in stocks and ETFs. For CFDs, eToro will pay your dividend on the ex-dividend date, which will reflect in your account. Additionally, you must hold a position about two days before the ex-dividend date before the market closure.

When will I get my dividend?

There is no established standard on when companies are required to pay dividends. However, there are common patterns that have emerged. The most common is quarterly dividends that are paid four times a year. Other companies choose semi-annual dividends (given twice a year), and others prefer annual dividends paid once a year.

The bottom line is that companies can issue dividends whenever they decide to thank shareholders.

eToro Dividends Calendar

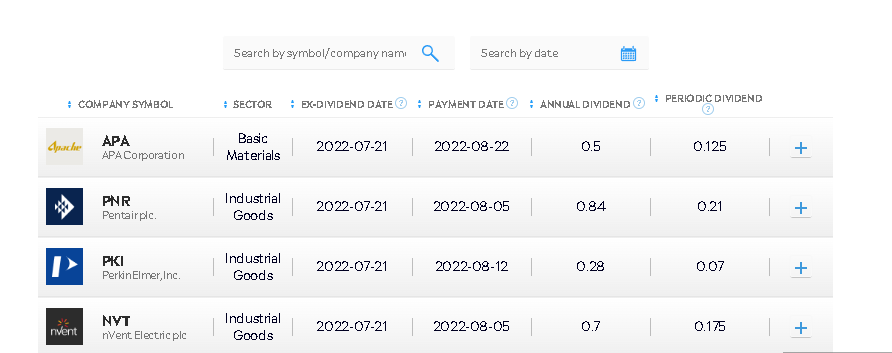

eToro provides a page with a calendar detailing companies that pay dividends to shareholders and shows relevant data on upcoming events. It provides dates on when the dividends are paid, ex-dividend date, the stock dividend per share price, company name, and sector.

eToro Dividends Calendar

The platform lists the dividend stocks by market capitalization. You'll also access a search option where you can search for a company name, symbol, or date.

Do I Pay Tax on Dividends?

Your dividends are subject to tax depending on the country or jurisdiction. eToro holds a percentage of tax depending on the regulations of the country in which the company is incorporated.

For example, dividends issued by a US corporation are subject to a withholding tax rate of 30%. However, the tax rate increases to 37% when effectively connected income( ECI) is paid.

For the non-US-issued dividends, eToro will use guidelines issued by authorities in those countries. If the company is a tax resident of several nations, eToro will use the applicable tax treaties to determine where the tax is levied.

It is also important to note that you may still be subject to taxes when you receive your dividends.Again, it all depends on your country of residence.

How Can you Earn Regularly on Dividends?

There is no proven formula to use to earn regularly from eToro dividends. However, there are various techniques that investors follow for best practice.

Search for successful companies that issue dividends

Invest in different countries in various sectors

Avoid selling shares in short periods

copy-trade an experienced investor who receives high dividend payments

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

"Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more"

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQ

In what countries can I use eToro?

eToro doesn't provide its services in some nations around the globe. You can find the list of these countries here.

They also don't offer services to US residents living outside the country.

Is eToro a safe investment platform?

Yes. eToro is regulated by various regulators that protect investor money and data. Some of the regulations they follow are from FCA. CySEC and ASIC.

Can you live off dividends?

When done right, dividends can be a good way to remain financially stable in retirement. Of course, you'll have to start investing early or bet on secure and high-yielding instruments that will cover you later in life.

Where can I see my dividend Payment?

You can access your dividend payments in your account statement. It shows your credited or debited amounts in a certain period.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.