EXCO Trader Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MetaTrader4

- FSA

- 2018

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MetaTrader4

- FSA

- 2018

Our Evaluation of EXCO Trader

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

EXCO Trader is a high-risk broker with the TU Overall Score of 2.62 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by EXCO Trader clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. EXCO Trader ranks 347 among 463 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

EXCO is interested in working with experienced market participants as well as novice traders with a certain amount of disposable funds. Clients can conveniently conduct financial transactions and combine active and passive strategies, but they must be aware of the risks associated with trading through an unregulated broker.

Brief Look at EXCO Trader

EXCO is a young brokerage company, registered in 2018 in Saint Vincent and the Grenadines. It provides access to the currency market and CFD trading through the most popular Forex platform, MetaTrader 4. EXCO offers a proprietary social trading platform and investment services for passive income. It also allows copy trading from the MQL website and the use of basic and advanced expert advisors. The company has won international awards, including for the best educational courses and brokerage services for traders from Africa.

- Choice of trading account types like STP and ECN.

- Broker offers favorable requirements for the first deposit amount which are $50 for STP and $100 for ECN.

- Market order execution, which is well-suited for virtually all trading strategies.

- Low commission per lot, only $2 per one side of a trade.

- Wide selection of payment systems for financial transactions.

- Award-winning educational courses and the opportunity for one-on-one training with an instructor.

- Lack of regulation and registration in an offshore region.

- High spreads on all account types, and inability to trade on cent accounts.

- Advanced education, VPS (Virtual Private Server), signal trading, and other options are only available to traders with large deposits and trading volumes.

TU Expert Advice

Financial expert and analyst at Traders Union

EXCO offers high leverage, a wide range of trading instruments, and a diverse selection of payment systems for depositing and withdrawing funds. Also, it restricts the investment and analytical capabilities of traders with small deposits. For instance, the company allows all its clients to use basic expert advisors (EAs), but premium expert advisors are only available to those with accounts holding at least $500. Similar limitations apply to the use of trading signals, personal mentoring, electronic education, bonuses, and commission discounts.

In addition, EXCO reserves the right to limit the number of simultaneously opened positions on the trading account. The user agreement states that the company may refuse to process any order. Such execution policy may negatively impact the client's productivity, reduce their income, or even lead to losses.

EXCO is designed for regular trading. After a lack of transactions for 2 months, a daily fee of $2 is deducted. When the funds on the account balance are depleted, it gets archived. A positive aspect is that the client can request reactivation. In this case, the company returns the funds deducted for the last month of inactivity.

EXCO Trader Summary

| 💻 Trading platform: | MetaTrader 4 (desktop, mobile) |

|---|---|

| 📊 Accounts: | Demo, STP, ECN |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfer, Visa, Mastercard, PaymentAsia, DusuPay, local payment systems, cryptocurrencies |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: |

On the STP account from 1 pips; On the ECN account from 0.5 pips |

| 🔧 Instruments: | Forex, indices, commodities, cryptocurrencies, bonds, gold, silver |

| 💹 Margin Call / Stop Out: | Stop out level is 30% |

| 🏛 Liquidity provider: | Top-tier banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Negative balance protection, automatic trading, and dynamic leverage is available |

| 🎁 Contests and bonuses: | Deposit bonus, Refer A Friend |

EXCO provides clients with the MetaTrader 4 trading platform, supporting interactive charts, 9 timeframes, 30 technical indicators, and 23 analytical tools. Trading is possible on both desktop and mobile applications. The platform allows transactions with 38 currency pairs, 21 indices, 15 commodities (including oil, gold, silver, and copper), and bonds. Cryptocurrencies such as BTC, ETH, LTC, and DSH are traded paired with the USD. The default maximum trading leverage is 1:500, but on accounts with deposits up to $500, the broker may double this leverage.

EXCO Trader Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Brief guide on how to create a user account on the EXCO broker's website and its key functions and features:

At the top of any page, locate and click on the "Open Account" button. This will initiate the registration process.

Choose the form for opening a real account and fill it out. The required information is minimal: name, surname, email address, phone number, and country of residence. You also need to select the account type – STP or ECN. After clicking "Sign Up," you will receive an email with the login password for your user account. In addition to the password, for authorization, you need to enter the email or account number (also indicated in the welcome email from EXCO).

EXCO’s user account features allow you to:

Your EXCO user account also allows you to:

-

Submit applications to open additional trading or investment accounts.

-

Confirm identity and country of residence according to the KYC (Know Your Client) procedure.

-

Submit withdrawal requests for trading and investment activities.

-

Purchase trading bots and advanced indicators from the store.

-

Review statistics on all open and closed orders, and financial transactions.

-

Download trading software for your computer or laptop.

Regulation and safety

EXCO is a brokerage firm and is registered in Saint Vincent and the Grenadines under the official name RSG Finance Ltd. The broker was listed in the International Business Company (IBC) registry with the number 25143 in 2018. Registered by the FSA.

Saint Vincent and the Grenadines is recognized as an offshore jurisdiction. Additionally, the regulatory authority of this country does not oversee the activities of Forex brokers and cryptocurrency exchanges. Consequently, this implies that funds belonging to EXCO clients are not safeguarded against the broker's misuse.

Advantages

- Traders can use electronic systems and cryptocurrency wallets to deposit and withdraw funds

- Very high leverage of up to 1:1000

- There is a simple account registration procedure and negative balance protection

Disadvantages

- Clients’ deposits are at risk

- Companies registered in offshore zones are not reliable

- EXCO is not supervised by any of the financial supervisory regulators

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| STP | From $10 | Yes, under certain conditions |

| ECN | From $5 | Yes, under certain conditions |

Swaps on all trading instruments at EXCO are negative. This means that the client will incur losses on position rollover fees regardless. Traders Union experts calculated the average commission values of popular Forex brokers, RoboForex and Pocket Option, and then compared them with the spreads of EXCO.

| Broker | Average commission | Level |

|---|---|---|

|

$7.5 | |

|

$1 | |

|

$8.5 |

Account types

If a trader decides to start trading through EXCO, they need to open a suitable account type. There are two options available – ECN and STP. ECN is more suitable for experienced traders with a significant trading volume, while STP is for beginners and market participants who are not yet professionals in online trading.

Account types:

The broker also offers demo accounts. These can be used for both learning to trade and testing the trading conditions of EXCO.

The presence of two execution models (STP and ECN) is an advantage for EXCO traders since they can choose the most efficient technology for their trading style.

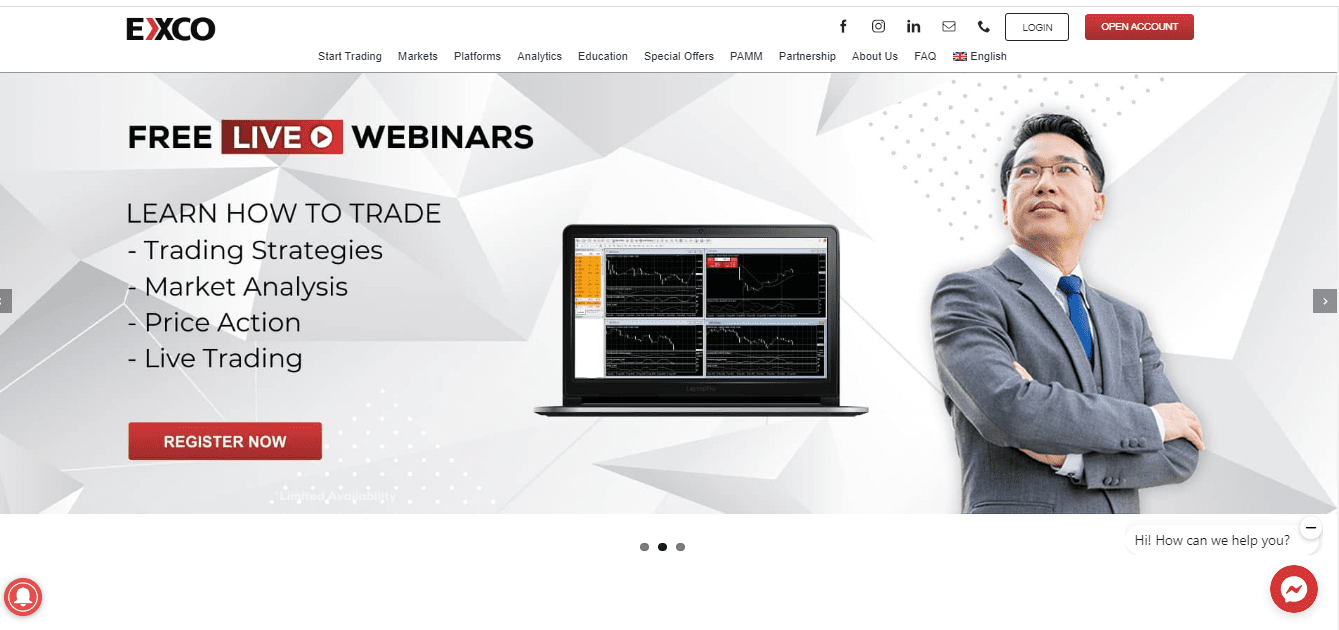

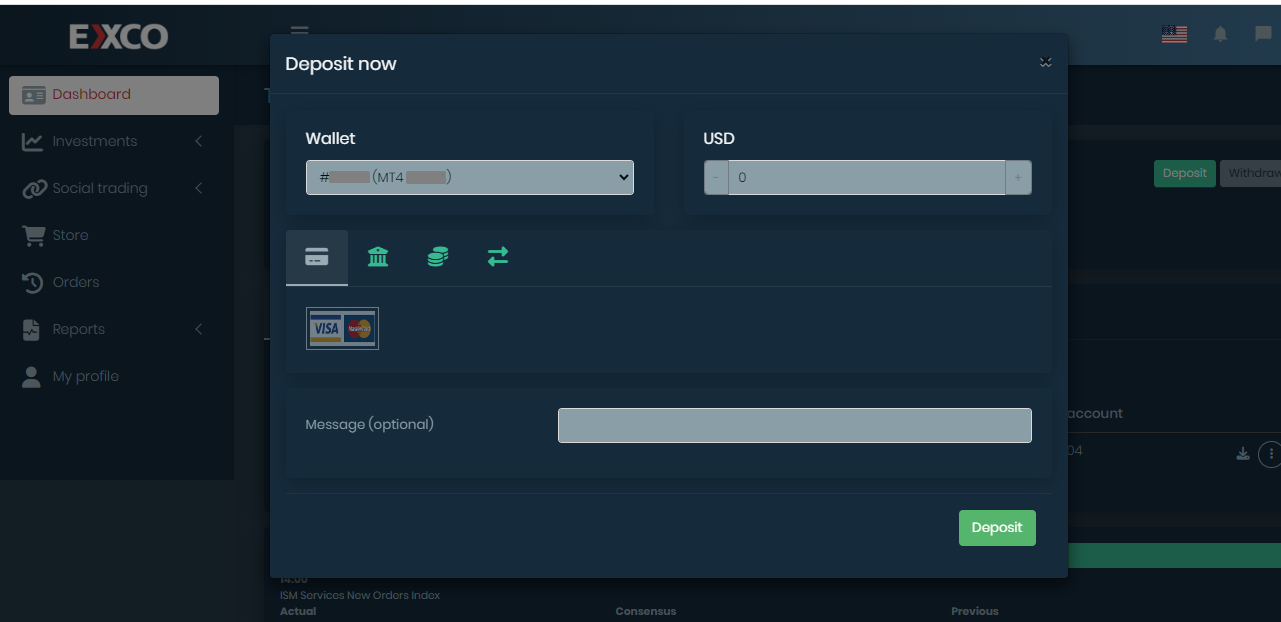

Deposit and Withdrawal

The company processes withdrawals to the same card, bank account, or electronic wallet that the client used to make the deposit.

Withdrawals are made from Monday to Friday, between 8:00 and 19:00 GMT+1. Requests submitted before 17:00 are processed on the same business day. Withdrawal processing may take 2-3 days if the request is made on a business day after 17:00 or a weekend or holiday.

EXCO reserves the right to suspend withdrawals at any time and may request additional documents to verify the source of funds previously credited to the client.

When a withdrawal request is made from an inactive account, the broker will deduct a transaction fee. This fee may be equivalent to bank charges or 6% of the total withdrawal amount. Additionally, a fee is charged for each bank transfer to cover the associated expenses.

Investment Options

For generating passive income, EXCO offers the standard features of MetaTrader, including a signal copying platform and the use of expert advisors (EAs). Additionally, the broker has proprietary services that allow earning without manual trading. The proprietary social trading platform, EXCO, enables clients to subscribe to signals from other company’s clients and automatically copy them. To extract investment income, ready-made strategies, and PAMM accounts can also be used. Passive profits can be achieved by promoting EXCO's services after registering as a partner.

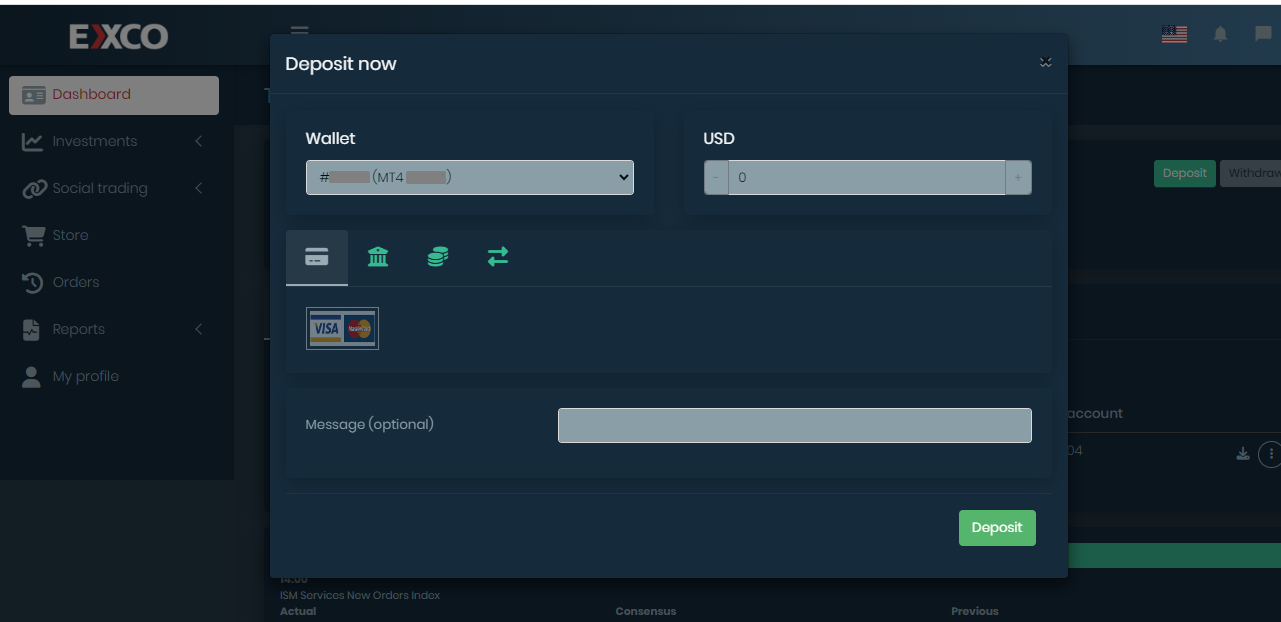

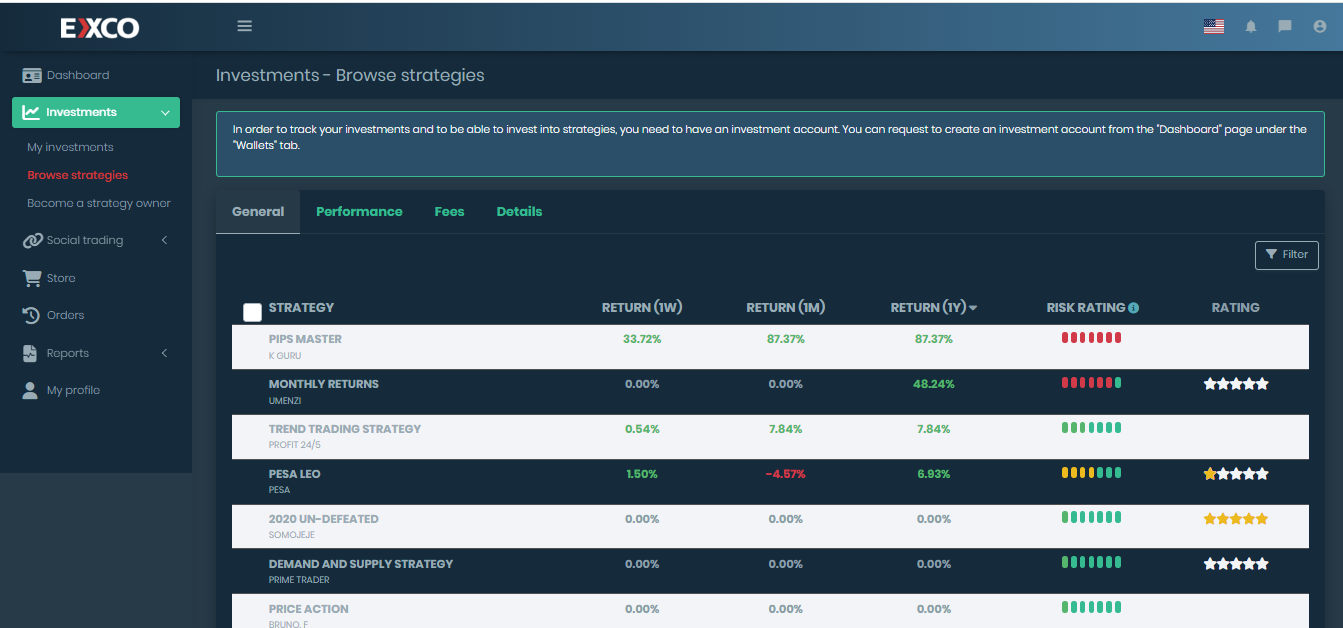

Investing in trading strategies

All investment-worthy strategies are listed in the EXCO dashboard under the section named "Investments." There are over 60 strategies with varying risk levels, sortable by multiple criteria for easy comparison. To invest in a selected manager, an investment account needs to be opened. Key features of the "Trading Strategies" service from EXCO include:

The minimum investment amount is $10. However, the more an investor contributes, the lower the performance fee they pay to the manager.

Master's performance fee ranges from 20% to 50% of the investor's profit. For example, investing $20 in the "Trend" strategy incurs a 50% fee, but if you invest $500, the fee decreases to 35%.

Each strategy is assigned a risk level from 1 to 7, calculated based on the master's trading performance over the last 12 months.

EXCO acts solely as a technology provider and does not participate in managing accounts or investor funds. The company allows the transmission of a strategy only to traders who have traded successfully for a specific period and passed a corresponding performance check.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

EXCO's partnership program:

The size of the partner commission depends on the account type the referee opens and the traded assets. The reward for each closed standard account lot of indices, cryptocurrencies, silver, and natural gas is $5, and for other commodities, it's $10. If the referee trades on an ECN account, the partner receives a percentage of the commission paid by them: 10% for cryptocurrencies and 55% for other assets.

EXCO offers a multi-level partnership and allows traders to choose a collaboration method that suits them. Available options include programs for professional traders, bloggers, website owners, webmasters, and others.

Customer support

You can reach out to an EXCO representative any day of the week as the company operates 24/7.

Advantages

- The service is available 24/7

- There are prompt responses in the website chat and on Facebook

Disadvantages

- The support doesn’t always have a specific answer to the given question

- Facebook account linkage is required for website chat communication

To contact the company, use the following communication methods:

Online chat on the website

Facebook Messenger

Email through the feedback form

Phone calls using the numbers provided in the About Us section

Sending an email to support@excotrader.com

Phone numbers for the U.K., Nigeria, South Africa, and the Philippines are listed on the website.

Contacts

| Foundation date | 2018 |

|---|---|

| Registration address | RSG Finance Ltd, Suite 305, Griffith Corporate Centre, Kingstown, Saint Vincent and the Grenadines |

| Regulation | FSA |

| Official site | https://excotrader.com/ |

| Contacts |

+234 912 698 8988

|

Education

The "Education" section on the EXCO website provides instructional materials in various formats. Some tools become available only after depositing a specific amount into the account, but they are provided for free. For example, access to an educational course requires a deposit of at least $300, while a 5-day intensive mentoring program demands a $500 deposit.

To apply theoretical knowledge in practice, practical training without the risk of losing funds is necessary. This is where the EXCO demo account comes into play, serving as another tool for learning the intricacies of trading.

Comparison of EXCO Trader with other Brokers

| EXCO Trader | RoboForex | Exness | TeleTrade | FxPro | Eightcap | |

| Trading platform |

MetaTrader4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MT5 |

| Min deposit | $50 | $10 | $10 | $10 | $100 | $100 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | 1.00% | No | No | No | No |

| Spread | From 1 point | From 0 points | From 1 point | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No / 30% | 60% / 40% | 60% / No | 70% / 20% | 25% / 20% | 80% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of EXCO Trader

EXCO was founded to provide top-quality brokerage services worldwide. Its operations are centered around satisfying the needs of every trader and adapting to the latest market trends. EXCO offers a wide range of financial instruments, quality education, fast order execution, and the highly popular MetaTrader 4 platform. All of these aspects help clients trade in financial markets comfortably and with high efficiency.

EXCO by the numbers:

Over 5 years of intermediation in over-the-counter markets.

10+ methods for depositing and withdrawing funds.

Over 75,000 open trading accounts.

More than 36,000 followers on the company's Facebook profile.

EXCO is a broker that adapts the level of leverage to the trader's capital

The maximum leverage for currency pairs is 1:500; for indices, commodities, and bonds, it’s 1:100; and for cryptocurrencies, it’s 1:5. These values are set as the default settings of the trading account, but the broker reserves the right to change the maximum leverage, either lowering or increasing it. The adjustment depends on the balance of the trading account. For example, the leverage for currencies at 1:500 increases to 1:1000 if the client's equity is below $500. However, if there's more than $3000 in the account, the leverage may be reduced to 1:200. The maximum leverage for account owners with capital exceeding $10,000 is 1:100.

Each client is assigned a level based on the existing deposit which also determines the list of available benefits. A trader with capital up to $500 receives the Basic status with minimal features, such as using expert advisors (EAs) and participating in webinars. For Pro (deposit $500-$1500), access to trading signals, discounts, and personal manager support is granted. VIP clients with deposits over $1500 gain access to one-on-one mentoring, direct access to expert analysis, and exclusive events.

EXCO’s analytical services:

Store. A dedicated section in the client's dashboard where proprietary indicators and trading robots can be purchased. The cost of tools ranges from $100 to $300.

VPS. EXCO provides free access to VPS server services to clients who close at least 3 lots in the current month. If the trading volume is less, a $20 fee is deducted from the trader.

Free analytics. The company regularly publishes reviews and forecasts for currency pairs EUR/USD and GBP/USD, as well as indices S&P 500, Nasdaq 100, and Dow Jones.

Economic calendar. Reflects important information that can influence investment strategies and the selection of potentially profitable financial instruments.

Advantages:

Hedging, automated and mobile trading, and one-click trading are available.

All accounts have negative balance protection, preventing clients from losing more funds than initially invested.

The broker offers trading in various asset classes, not limited to the currency market.

Lucrative terms for partner programs allow participants to earn stable income even without engaging in trading.

The company provides bonuses and periodically offers discounts on trading activity commissions.

EXCO clients worldwide can participate in educational seminars and webinars, use advanced robots for algorithmic trading, and engage in margin trading on various markets.

User Satisfaction i