Activotrade Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Activo Trade

- Activo Plus

- Activo Pro

- CNMV

- FCA

- DFSA

- CySEC

- 2013

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Activo Trade

- Activo Plus

- Activo Pro

- CNMV

- FCA

- DFSA

- CySEC

- 2013

Our Evaluation of Activotrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Activotrade is a broker with higher-than-average risk and the TU Overall Score of 3.8 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Activotrade clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Activotrade is a regulated Spanish broker that offers a wide range of trading instruments and functional platforms to trade on stock exchanges in the U.S., Asia, and Europe.

Brief Look at Activotrade

Activotrade has its head office in Barcelona, Spain. It offers trading over 30,000 financial instruments on one account. Available assets include over 22,000 stocks of the U.S. and Spain, over 600 ETFs, bonds of 26 countries, futures, options, and more than 9,000 CFDs and Forex assets. The broker’s activity has been regulated by CNMV (Comisión Nacional del Mercado de Valores) since 2010. Its client funds are protected by the FOGAIN (Fondo General de Garantía de Inversiones) scheme. The company provides its services to traders worldwide, except for the U.S. and countries from the OFAC (Office of Foreign Assets Control) sanctions list.

- State regulation and protection of investment capital;

- Wide choice of financial instruments and markets;

- Low fees for trading stocks listed on Spanish stock exchanges;

- No requirements for the minimum deposit;

- Diverse trading platforms for different investment needs and experience of traders;

- Free demo accounts on all platforms;

- High-quality analytical base that includes market research, technical analysis, forecasts, and trading signals from stock market experts.

- The broker neither manages client assets nor offers other investment solutions for passive income;

- Fees for trading U.S. stocks are $8-$10 subject to the stock price and the account type;

- Limited choice of deposit and withdrawal methods.

TU Expert Advice

Financial expert and analyst at Traders Union

Activotrade is a stock and Forex broker with over 13 years of experience. It is registered in Spain, but its services are provided to traders worldwide, except for the U.S. and countries from the OFAC sanctions list. Activotrade offers trading over 30,000 assets without requirements for the initial deposit.

CNMV regulation and membership in FOGAIN provide for the security of client funds and fair working conditions. If the broker violates any of the clauses of the service agreement, Activotrade clients can file complaints to the regulator or the court. Moreover, the company has its compliance department that considers traders’ claims within 30 days and tries to resolve disputes.

Activotrade offers profitable conditions to trade securities listed on local stock exchanges, including Bolsa de Madrid, the largest stock exchange in Spain. Moreover, the broker allows traders to enter the internal market and to trade on 50 of the world’s major stock exchanges. If desired, its clients can also trade CFDs on different assets, including Forex and cryptocurrencies.

Activotrade Summary

| 💻 Trading platform: | Activo Trade, Activo Plus, and Activo Pro |

|---|---|

| 📊 Accounts: | Demo, Basic, Standard, Trader, and Active |

| 💰 Account currency: | EUR and USD |

| 💵 Replenishment / Withdrawal: | Wire transfers, transfers of money or investment portfolios to or from another broker, and bank cards |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Up to 1:30 for Forex |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: |

U.S. stocks — from $0.015 per stock; Spanish stocks — from 0.08% of the nominal value; Futures — from $3 per contract; Stock options — from $4.5 per contract. |

| 🔧 Instruments: | Stocks, ETFs, CFDs, Forex, options, futures, and bonds |

| 💹 Margin Call / Stop Out: | 100%/20%-100%/50% subject to a contractor |

| 🏛 Liquidity provider: | Saxo Bank, Interactive Brokers, and other major tier-1 providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Reduced fees for active traders with deposits from €5,000 |

| 🎁 Contests and bonuses: | No |

There are no requirements for minimum investments, however, when traders deposit over €5,000, trading conditions become much more profitable. The broker offers its in-house software and third-party platforms to trade over 30,000 assets of stock and OTC (Over-the-Counter) markets. Account currencies are EUR and USD, which provide for reducing conversion fees when trading instruments of the U.S. market. The fee for the purchase or sale of securities not denominated in the account currency is 1.75% of the position value. The choice of available assets depends on the chosen trading platform.

Activotrade Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

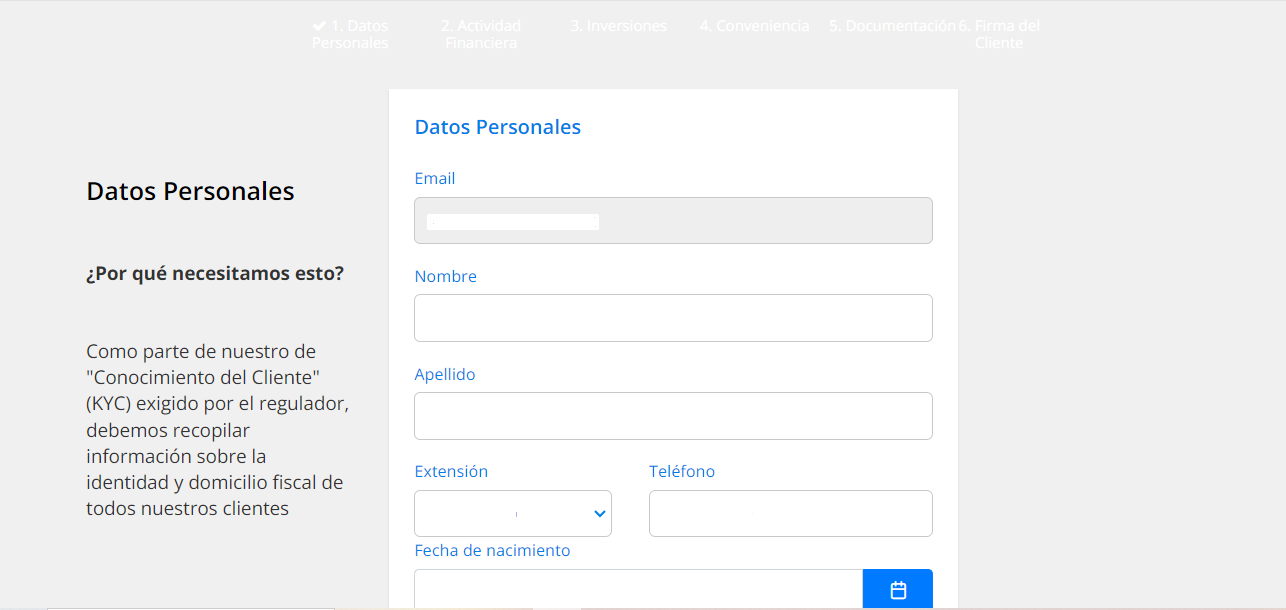

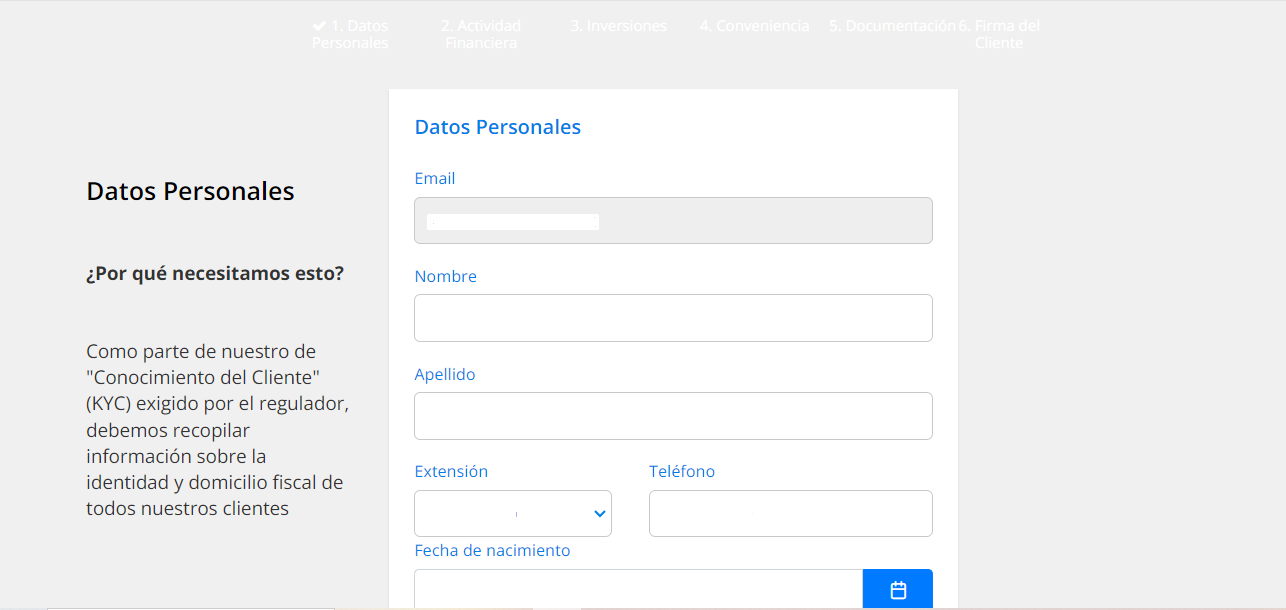

Trading Account Opening

To open an account with this broker, create a user account on its website.

At the top of the screen, click the “Abrir una cuenta” (“To open an account”) button available on every page.

Fill in the registration form providing your first and last names, phone number, and email. Next, follow the on-screen instructions.

To open a trading account, follow the link sent to your email. The company requires the trader’s personal data, information on financial activities, and investment capital. To pass identity verification, uploading documents of good quality is required.

To access your user account, choose a trading platform and enter the username and password sent by email.

Regulation and safety

Activotrade is regulated by CNMV. It’s registered under number 239. The broker is a member of FOGAIN, which is an important part of insurance against losses in case of the broker’s bankruptcy or liquidation. If the court or CNMV officially confirms Activotrade’s financial insolvency, each of its clients can receive compensation of up to €100,000.

Interactive Brokers and Saxo Bank which are regulated by FCA (Financial Conduct Authority) and DFSA (Danish Financial Supervisory Authority), are the broker's contractors for trading Forex and CFDs. Other partners where Activotrade is an introducing broker, are licensed by CySEC (Cyprus Securities and Exchange Commission) and FCA.

Advantages

- Compensation fund for Spanish retail clients

- Investor funds are segregated from the broker’s capital

- Reliable executive brokers licensed by reputable European regulators

Disadvantages

- Account opening and verification takes up to 2-3 business days

- Information on free capital and its origin is required

- Documents are uploaded during registration of the user account

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Basic | $6 | $0 or $50 |

| Standard | $6 | $0 or $50 |

| Trader | $4.5 | $0 or $50 |

| Active | $3 | $0 or $50 |

If there is no trading within 180 days of the last purchase/sale of an asset, the inactivity fee of $100 is charged. The comparative table below shows the trading fees of Activotrade and other brokers. TU experts calculated fees on all account types and compared their average.

| Broker | Average commission | Level |

|---|---|---|

|

$4.9 | |

|

$1 | |

|

$8.5 |

Account types

To start investing through Activotrade, create a user account on its website and choose the trading platform. Access to a live account becomes available upon uploading your documents and their verification by the company. Four tariff plans that are subject to the trader’s activity and the deposit, are available.

Account types:

If traders don’t know what platform to choose, they can test each of them on a demo account without making a deposit.

Activotrade offers more profitable conditions to clients with large trading volumes and high trading activity. However, novice traders may be interested in its services due to the possibility to start trading with any amount.

Deposit and Withdrawal

To withdraw profits, submit a withdrawal request on the trading platform, by phone, or by email;

Fees are not withheld if requests are submitted on the trading platform. Submitting requests by other methods costs $50;

Investors also can request the transfer of Spanish stocks and bonds to another financial institution. This service costs €50 per stock but not more than €160 per transfer.

Investment Options

Activotrade offers platforms with a wide range of stock assets that can also be used for long-term investments. Yet, traders must decide themselves whether to buy/sell certain instruments, since the broker doesn’t offer asset management services.

Traders can use investment solutions offered by the broker’s partners Saxo Bank and Interactive Brokers. For example, to receive passive income, traders can use the SaxoSelect investment portfolios managed by experienced employees of Saxo Bank. Interactive Brokers offers over 34,000 mutual funds and an online tool to build asset portfolios that match investors’ goals and financial opportunities.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from Activotrade:

Activotrade attracts new investors through its official website and social media. Active clients are not involved in increasing the active user base.

Customer support

Working hours of technical support are not provided on the broker’s website, but the head office in Barcelona works from 9:00 to 18:00 (GMT+1) Monday through Friday.

Advantages

- Free telephone calls for Madrid and Barcelona

- Possibility to request call back through the feedback form

Disadvantages

- No live chat on the website

- The broker’s office doesn’t work on weekends and state holidays

The broker may assist you via the following channels:

Email;

Telephone;

Live chat on the trading platform;

Personal visit to one of its offices.

Non-registered traders cannot use a live chat, but other communication channels are available to them.

Contacts

| Foundation date | 2013 |

|---|---|

| Registration address | C/ Av. Diagonal 309, 6ª planta, Barcelona 08013, Spain |

| Regulation | CNMV, FCA, DFSA, CySEC |

| Official site | https://activotrade.com/ |

| Contacts |

Education

Activotrade experts developed several educational courses for novice traders but any interested person can use them. Also, there are weekly webinars available to the broker’s clients. The company’s website contains the basics of trading on stock and OTC markets.

Novice traders can request the course with basics of trading underlying and derivative instruments. It is focused on reviews of successful strategies, risk management, and chart rules.

Comparison of Activotrade with other Brokers

| Activotrade | RoboForex | Pocket Option | Exness | InstaForex | 4XC | |

| Trading platform |

Activo Pro, Activo Trade, ActivTrades | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MultiTerminal, MobileTrading, MT5, WebTrader | MT5, MT4, WebTrader |

| Min deposit | $1 | $10 | $5 | $10 | $1 | $50 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 20% | 60% / 40% | 30% / 50% | No / 60% | 30% / 10% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed review of Activotrade

Activotrade provides direct access to 125 markets globally (Europe, Asia, and the U.S.) using the DMA (Direct Market Access) technology. Trading platforms are designed for both trading on stock exchanges and working with CFDs. They have built-in tools for deep technical market analysis and positions can be placed directly from the chart. Platforms are available in web and mobile versions.

Activotrade by the numbers:

13+ years of operation on stock and OTC markets;

Over 11,000 active clients;

More than 400,000 executed trading operations;

Trading volume is over €96 billion;

40,000 traders completed educational courses and webinars held by the company.

Activotrade is a broker with a large choice of trading instruments and a diversity of trading platforms

Activotrade offers over 190 currency pairs for spot trading, over 130 forward contracts, and 40 Forex options with expiration dates from 1 day to 12 months. Also, its platforms provide for trading 9,000 CFDs on different assets, including 9 cryptocurrencies. Moreover, Activotrade provides access to more than 300 futures contracts and over 3,000 options on currencies, stock indices, metals, energies, and agricultural products, listed on 20 international exchanges.

The range of available markets and trading instruments is subject to the chosen trading platform. The simplest platform with basic options and features is Activo Trade. Activo Pro is intended for professional trading. On Activo Plus, traders work on the conditions of Saxo Bank. Each platform is available in a demo mode, which is called Paper Account on Activo Pro. Platforms have live chats for real-time communication with support.

Useful services offered by Activotrade:

Stock screener on trading platforms. It helps to evaluate the market situation at a certain time and to choose the most prospective securities.

Daily market comments. Activotrade experts are online at 9:00 and 15:30 during the opening of U.S. and European stock exchanges.

Blog. This is a collection of useful financial articles, reviews, and the latest news. The broker’s team of analysts publishes research, technical signals, and forecasts about the nearest market movements.

Advantages:

Fast order execution at better prices due to tier-1 liquidity;

Access to trading instruments with fixed profit;

Free educational courses and webinars held by experienced investors;

Trading fees are reduced as trading volume and investment capital grow;

Positions can be placed and corrected by phone.

Activotrade doesn’t charge fees for the maintenance of active trading accounts and custody of client securities. Also, it ensures a high-security level for investor funds.

User Satisfaction