Exness Social Trading Review: A Complete Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Exness social trading allows investors to copy expert traders' strategies, making Forex trading accessible without deep market knowledge. With transparent analytics, risk management tools, and flexible investment options, it provides an efficient way for beginners and experienced traders to optimize their trading approach.

The financial markets are constantly changing, and social trading is making it easier for newcomers to get started. With Exness social trading, beginners can connect with experienced traders and learn from their strategies in a way that suits them. The right trading conditions can make a big difference, helping investors trade more confidently without needing years of experience.

If you're curious about how the Exness social trading app works, this article breaks it down for you. You’ll see why more and more traders are getting into copy trading on Exness and what makes it appealing.

By the time you finish reading, you’ll have a clear understanding of:

How Exness copy trading actually works

The key benefits of copy trading

How to pick the right strategy provider for your goals

Practical tips to manage risks while following other traders

Understanding social or copy trading: How it works in the financial markets

Social trading allows investors to copy trading expert traders’ strategies in the financial markets. It takes away the stress of learning complex technical analysis. Instead, traders can follow experienced strategy providers to guide their trades while keeping an eye on trading conditions.

This approach makes trading accessible to those with limited market experience. It’s a great way to get started with Exness social trading without needing advanced skills, while also helping traders manage risks smartly.

How copy trading differs from traditional trading

Traditional trading usually demands:

Deep market knowledge.

Technical and fundamental analysis skills.

Independent decision-making.

Social trading, on the other hand, makes things simpler:

You can copy trading strategies from experts.

Follow strategy providers with a solid track record.

Generate income while keeping risks under control.

With Exness’s social trading app, investors can track and copy trades effortlessly, without needing to analyze the financial markets manually.

Key players in copy trading

Strategy providers. These are experienced traders who share their trading strategies for others to copy. How well they perform — along with trading conditions — directly affects investors' success.

Investors. They use this approach to grow their portfolios by following proven strategies. They pick strategy providers by looking at their past results, risk management approach, and current trends in the financial markets within Exness social.

Key benefits of Exness social trading for investors

Exness social trading provides traders with an easy way to step into the financial markets. Rather than needing deep expertise, investors can follow proven social trading strategies from experienced traders. This makes trading beginner-friendly and offers opportunities for passive income.

Unlike traditional trading, the Exness strategy following platform focuses on transparency, ease of use, and risk control. Users can analyze traders’ past performance based on key metrics, apply risk management techniques, and adjust copied strategies. The platform helps traders aim for the best returns while staying mindful of risk.

Below are the top benefits of using Exness copy trading service as an investor.

1. Accessibility for beginners

Many new traders struggle with the financial markets. Trading is challenging, but Exness social trading solves this by offering a trading app where users can follow professionals on the platform. You don’t need deep strategies and market knowledge to start. Simply copy trading strategies from expert strategy providers.

With Exness Social, beginners can trade with confidence. The platform simplifies decision-making by showing trader rankings, past performance, and risk management indicators.

2. Passive income opportunities

Investors can earn without actively managing trades. With copy trading, you can follow the best traders and use their trading strategy to generate consistent returns by choosing the right strategy provider.

Unlike traditional methods, Exness trading replication allows investors to profit while experts handle social and technical aspects of trading strategy. This makes it a smart option for those who want exposure to the financial markets with minimal effort.

3. Transparency and risk management features

Exness social trading provides complete transparency. Investors get a clear view of how experienced traders with strong track records have performed over time. They can also assess risk levels and drawdowns of copied strategies on the platform, along with in-depth insights into the financial markets and how different conditions affect trades.

With the insights of Exness social trading, you can easily find strategies that fit your goals based on real trader performance.

4. Advanced analytics and trading tools

The platform includes built-in analytics to track copied strategies. Investors can see trade execution times, the performance of traders, and market trends.

Additionally, the Exness social trading platform integrates powerful risk management tools. This ensures investors can set stop-loss levels, adjust trade sizes, and manage exposure effectively.

How to get started with Exness social trading app

Exness trade replication makes it easy for investors to start copied strategies through copy trading. The platform is designed for seamless navigation, allowing users to find traders with proven track records and start trading quickly. Whether you're a beginner or an experienced trader, the copy trading app simplifies the process while ensuring optimal trading conditions.

Getting started with Exness social trading - Step by step guide

Below is a step-by-step guide on how to create an account and begin trading with Exness social trading.

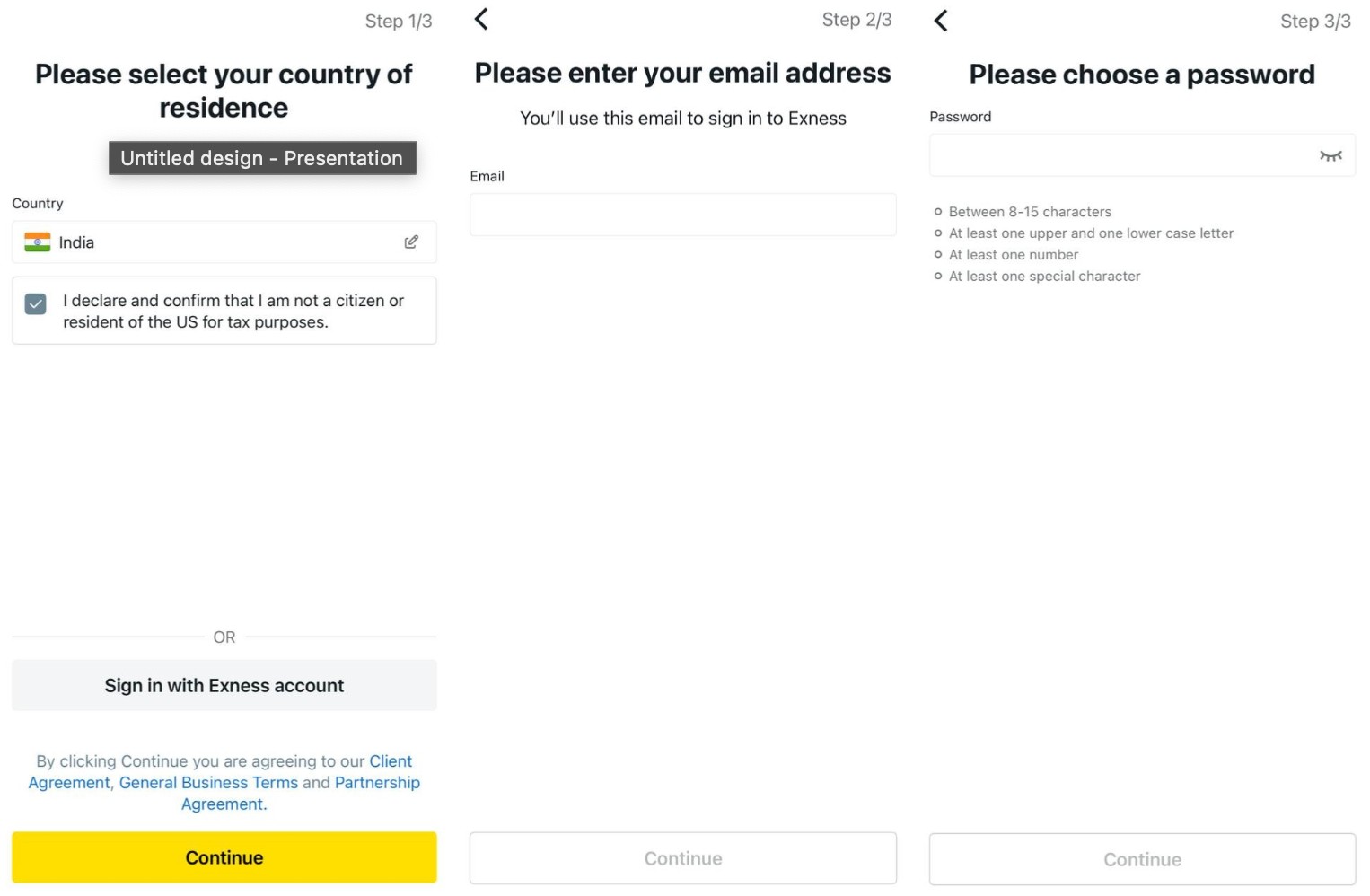

Step 1: Sign up for an Exness social trading account

Visit the Exness social trading website or download the copy trading app.

Click on "Sign Up" and enter your details.

Verify your email and phone number.

Complete the identity verification process.

Once registered, you can explore available strategy providers and view their trading strategies.

Step 2: Choose the right trading account

We have already discussed the available account options in detail in the previous section. Now let’s categorize them:

If you are a beginner trader, the Social Standard account offers low entry barriers and simplified conditions.

If you have some trading experience and prefer tighter spreads, Social Pro could be a better fit.

If you are a professional trader who wants more control over execution and order settings, the Pro account is the best option.

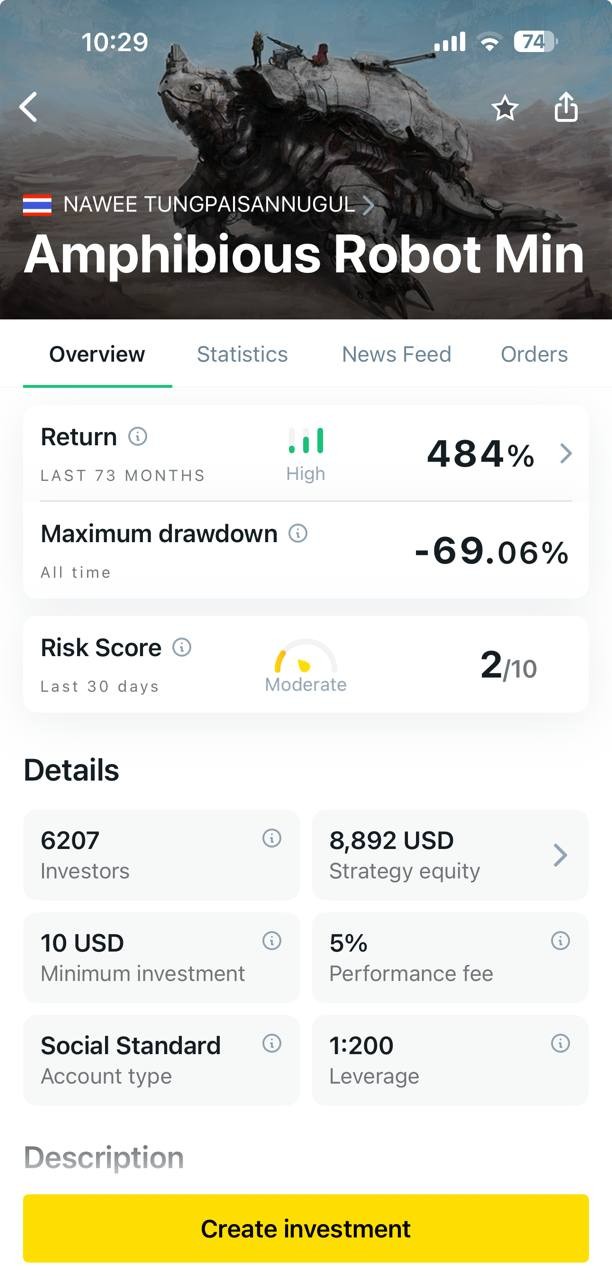

Step 3: Select a strategy provider to copy

Before investing, analyze strategy providers based on:

Performance history.

Risk management strategy.

Number of followers.

Consistency in trading results.

The Exness copy trading app provides detailed trader statistics to help you choose the best trading strategies.

Step 4: Set your investment amount

After selecting a strategy provider, decide how much to invest. Your risk management is crucial here, to help you trade confidently. Start with an amount you are comfortable with. The platform allows you to adjust or stop copied strategies at any time, giving you full control over how you trade with Exness.

Step 5: Monitor and adjust your trading strategy

Regularly review copied strategies to ensure they align with your trading goals. The social trading app offers tools to track performance and optimize results.

Exness social trading platform overview and key features

The Exness social trading app connects you with experienced traders, letting you follow and copy their successful strategies. This setup helps both new and seasoned investors benefit from shared market insights.

Key features

User-friendly interface

The app's user-friendly design makes it simple for everyone, from newcomers to seasoned traders, to find their way around.Real-time performance metrics

You can see the latest stats on different trading strategies, including returns, risk levels, and how many others are following each one, helping you make informed choices.Diverse strategy selection

Explore and pick from various trading strategies in different markets like Forex, commodities, and cryptocurrencies. Each comes with detailed analytics to help you choose what fits your financial goals and comfort with risk.Secure fund management

You always have complete control over your money with the app. Depositing and withdrawing funds is straightforward, and only you can access your account.Customizable investment parameters

Adjust how much you invest and set your own rules for copying trades, tailoring your experience to match your preferences and financial aims.Transparent performance fees

Traders set their own fees, and you'll see these clearly before deciding to copy a strategy, so there are no surprises.In-app communication

The app lets you chat directly with traders, building a community feel where you can share insights and feedback.Regular updates and notifications

You'll get quick updates on market changes, how your chosen strategies are doing, and more, keeping you in the loop for timely decisions.Comprehensive support and resources

Find learning resources, how-to guides, and get help from a friendly support team, all within the app, to boost your trading knowledge.

Account types and requirements

Exness offers multiple account types for strategy providers in social trading. These accounts come with unique trading conditions, allowing traders to align their strategies with the platform’s features. Let’s break down each account type to help you decide which one suits your trading needs.

Social trading accounts on Exness

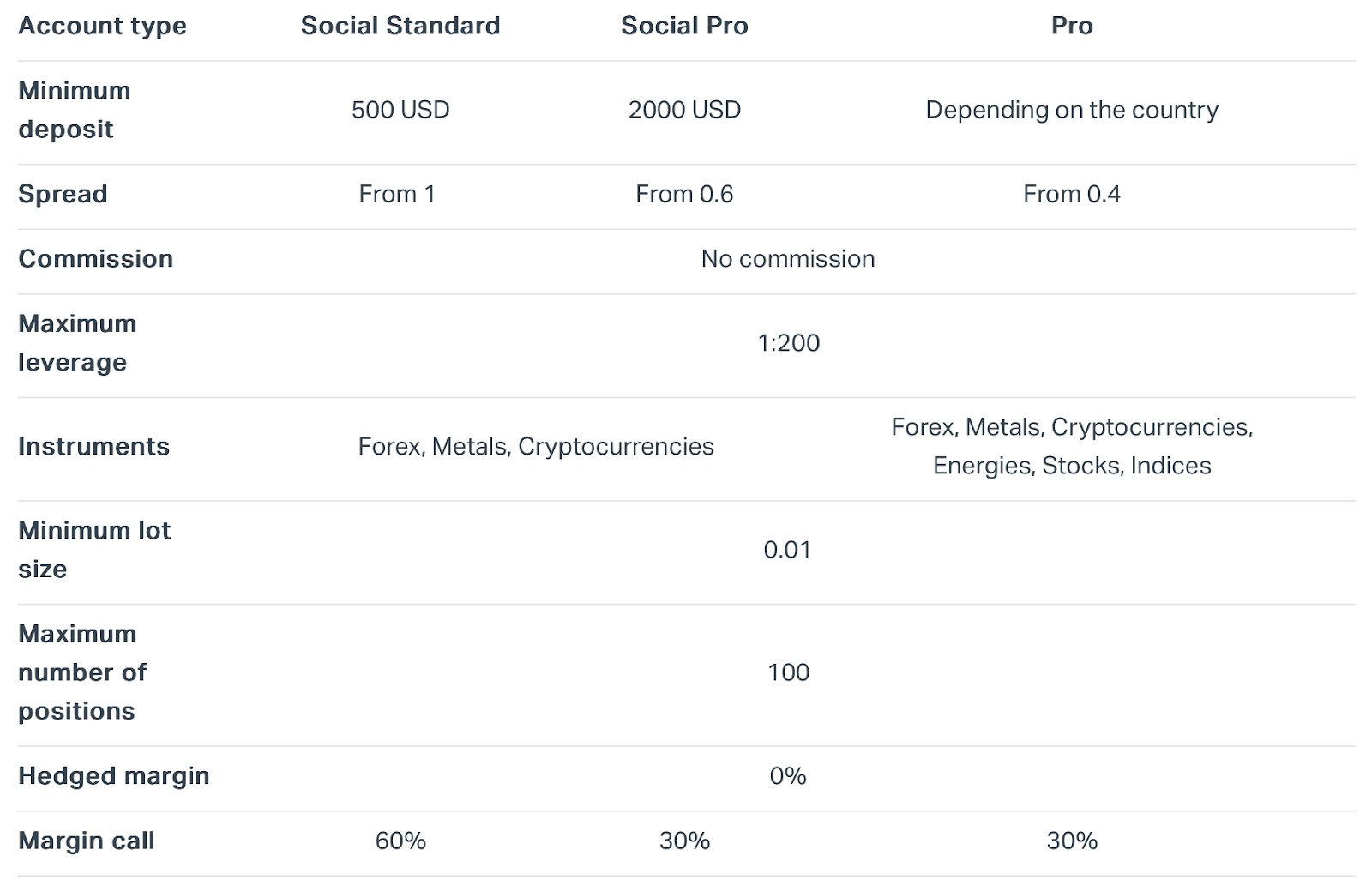

Exness provides three Social Trading account types for strategy providers (SPs):

Social Standard

Social Pro

Pro

These accounts differ in terms of deposit requirements, trading conditions, and execution methods. Below is a detailed comparison:

| Feature | Social Standard | Social Pro | Pro |

|---|---|---|---|

| Minimum deposit | $500 | $2,000 | Varies by country |

| Spread | From 1.0 | From 0.6 | From 0.4 |

| Commission | No commission | No commission | No commission |

| Maximum leverage | 4:20 | 4:20 | 4:20 |

| Tradable assets | Forex, Metals, Cryptocurrencies | Forex, Metals, Cryptocurrencies, Energies, Stocks, Indices | Forex, Metals, Cryptocurrencies, Energies, Stocks, Indices |

| Minimum lot size | 0.01 | 0.01 | 0.01 |

| Maximum positions | 100 | 100 | 100 |

| Margin call | 60% | 30% | 30% |

| Stop out | 0% | 0% | 0% |

| Execution Type | Market (Forex, Metals), Instant (Crypto) | Market (Forex, Metals, Indices, Energies, Stocks), Instant (Crypto) | Market or Instant (configurable) |

Source: Exness

Note: Pro account users can modify the execution type from their Personal Area, except for cryptocurrencies, which always use market execution.

Social trading account requirements

Before activating your strategy account, consider the following requirements:

| Requirement | Social Standard | Social Pro | Pro |

|---|---|---|---|

| Strategy activation | $500 deposit | $2,000 deposit | Activated upon first deposit |

| Minimum equity for copying | $100 | $400 | $100 |

| Maximum equity for copying | Below $200,000 | Below $200,000 | Below $200,000 |

Source: Exness

Note: For Social Pro accounts, strategies only become active once the account equity reaches $2,000, which can be achieved through deposits and trading. For eg., if your Social Pro account has $1,990 in equity, you must deposit at least $10 or earn the difference through trading for activation.

Choosing the best trading strategy to copy on Exness

Picking the right trading strategy to follow on Exness can greatly influence your investment outcomes. Here's how to make a smart choice.

Key factors to consider

Risk level. Consider how much risk you're comfortable with and select strategies that match that comfort level. Some strategies might promise high returns but come with higher risk, while others are more cautious.

Returns. Look at how strategies have performed over time. Strategies that have delivered steady returns are often more reliable.

Trading style. Find out if the strategy is aggressive or conservative, and whether it's aimed at short-term or long-term gains. Make sure it aligns with what you're aiming for.

How to analyze strategy providers

Performance history. Check the provider's past to see if they've been consistently profitable.

Risk management. Observe how the provider handles risk. Those who use tools like stop-loss orders and keep losses in check show good risk management.

Trading style fit. Ensure the provider's trading approach matches your preferences, whether it's day trading, swing trading, or investing for the long haul.

Tips for diversification

Spread your investments. Avoid putting all your money into one strategy. Diversifying across several strategies can help cushion potential losses.

Mix asset types. Choose strategies that involve different assets like Forex, commodities, and cryptocurrencies to spread out your risk.

Keep an eye and adjust. Regularly monitor how your chosen strategies are performing and make changes as needed to keep your investments balanced.

Essential tips for successful copy trading with Exness broker

Exness strategy following makes investing easier, but success depends on risk management and strategy. Many beginners start without a plan and end up with losses. To maximize profits and protect your trading account, follow these essential tips.

1. Set realistic expectations

Social trading is not a get-rich-quick scheme. While Exness trade replication allows you to copy trading strategies, results vary.

Avoid chasing high-risk trading strategies.

Focus on consistency rather than overnight profits.

Expect market fluctuations and plan for them.

The key is to build your trading portfolio gradually and avoid emotional decisions.

2. Manage risk effectively

Good risk management is crucial. Without it, even the best-copied strategies can lead to losses.

Never invest all your funds in one strategy provider.

Use stop-loss settings to limit potential losses.

Diversify by copying multiple trading strategies.

The Exness copy trading platform allows you to set risk limits. Use this feature to control losses.

3. Monitor and adjust copied strategies

Blindly following copied strategies can be risky. Trading conditions change, and even top strategy providers experience downturns.

Regularly review the performance of your chosen traders.

Remove underperforming copied strategies when needed.

Adjust your investments based on market trends to manage your risk effectively.

With Exness social trading, you have full control over your trading decisions.

4. Choose strategy providers carefully

Not all strategy providers are reliable. Before investing, analyze their trading style, risk levels, and long-term performance of their strategies.

Look for consistent profits rather than short-term success.

Check past drawdowns to understand traders with strong risk management strategies.

Avoid traders with highly volatile trading conditions that could put your investment at unnecessary risk.

Using the social trading app, you can compare multiple strategy providers before deciding.

5. Stay updated on market trends

The financial markets are constantly changing. Keeping up with market news can help you choose the right trading strategies.

Follow financial news to understand market shifts.

Learn how global events impact trading strategies.

Use Exness auto-copy trading insights to refine your approach.

By staying informed, you can make smarter investment decisions.

Why Exness social trading is the best choice for beginners

Many new traders struggle to understand the financial markets. Exness strategy following simplifies this process. Instead of spending months learning trading strategies, beginners can copy trading from experienced strategy providers.

Low learning curve. Unlike traditional trading, where beginners must master technical analysis, risk management, and market trends, Exness Social Trading allows users to start with minimal knowledge. By following experienced traders, beginners can learn by observing real strategies in action without extensive research.

Hands-free trading experience. Social trading eliminates the need for constant market monitoring. Once a trader is selected, their trades are automatically copied, providing a passive approach to investing. This is especially beneficial for beginners who may not have the time or confidence to trade actively.

Guidance from professional traders. Exness connects users with experienced traders whose performance, strategies, and risk levels are transparent. Beginners can choose traders that align with their risk tolerance and goals, ensuring they learn from real market professionals. Additionally, traders often provide insights, helping followers understand market moves and improve their knowledge over time.

Blindly copying top traders in Exness social trading can drain your account

Most beginners in Exness social trading fall into the trap of copying the highest-ranked strategy providers, assuming that top rankings equal steady profits. But here’s something most traders don’t realize: a high win rate doesn’t always mean smart trading. Some traders keep losses open for long periods, making their stats look good on the surface, while in reality, they’re sitting on dangerous risks. Instead of getting lured by big numbers, check how they handle losses. Do they take small, controlled hits, or do they avoid closing bad trades altogether? Also, keep an eye out for traders who suddenly increase trade sizes after losses — this kind of high-risk recovery method might work in the short term but can lead to a total wipeout in volatile markets.

Another game-changer most beginners miss is syncing their trades with the right market sessions. The same trader who performs exceptionally well during London’s fast-paced trading hours might struggle in the quieter Asian sessions. Instead of following them round the clock, track when they make their best trades and adjust your copied trades to align with those timeframes. This small tweak can help you avoid unnecessary exposure when the market is slow and make sure you’re benefiting from their best moves at the right time.

Conclusion

Exness social trading simplifies investing in the financial markets by allowing users to choose and copy trading strategies from expert strategy providers. It offers a social trading app with advanced tools for managing your risk, making it ideal for both beginners and experienced traders. Users can select trading strategies, adjust your risk levels, and track copied strategies in real-time.

This hands-free approach suits traders from all backgrounds. Whether you're looking for passive income or professional guidance, social trading provides transparency, flexibility, and control. By choosing the right strategy providers, investors can optimize their trading experience while keeping your risk under control.

FAQs

How does Exness social trading work?

Users choose a strategy provider, allocate funds, and automatically copy trading strategies in real time.

How to become an Exness social trading investor?

To become an Exness Social Trading investor, you need to sign up on the Exness Social Trading app, complete identity verification, deposit funds into your account, and select a strategy provider to copy.

How to open an investment with Exness social trading?

To open an investment, log into the Exness Social Trading app, choose a trader from the available strategy providers, enter the amount you wish to invest, and confirm the investment to start copying trades automatically.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).