The best strategies for new traders who want to work with Exness:

Chart Pattern Strategy.

Trend-following Strategy.

Counter-trend Strategy.

Breakout Strategy.

The best strategies for new traders who want to work with Exness:

Chart Pattern Strategy.

Trend-following Strategy.

Counter-trend Strategy.

Breakout Strategy.

Trading Strategy is a subject of great interest in the Forex market because it is like a manual that tells a trader what to do in the market. It guides a trader on when to open a trade position, hold, or exit. Essentially, trading strategy is a critical subject in the Forex industry because it can make or mar any trader. In this guide, we’ll discuss everything you need to know about the best Exness strategy 2023 for beginners.

The Exness strategy is one of the best beginner trading styles that would assist you in growing your trading capital. It would bring you up to seed with the dynamic and multifaceted nature of the Forex market to assist you in making sound trading decisions.

Every Forex trader relies on a trading strategy to make trade entries or exit in the financial trading industry. However, it may be a daunting task to find a profitable trading strategy, especially for a beginner. Therefore, we’ve selected the best four trading strategies that would help you to make quick progress in the Forex market.

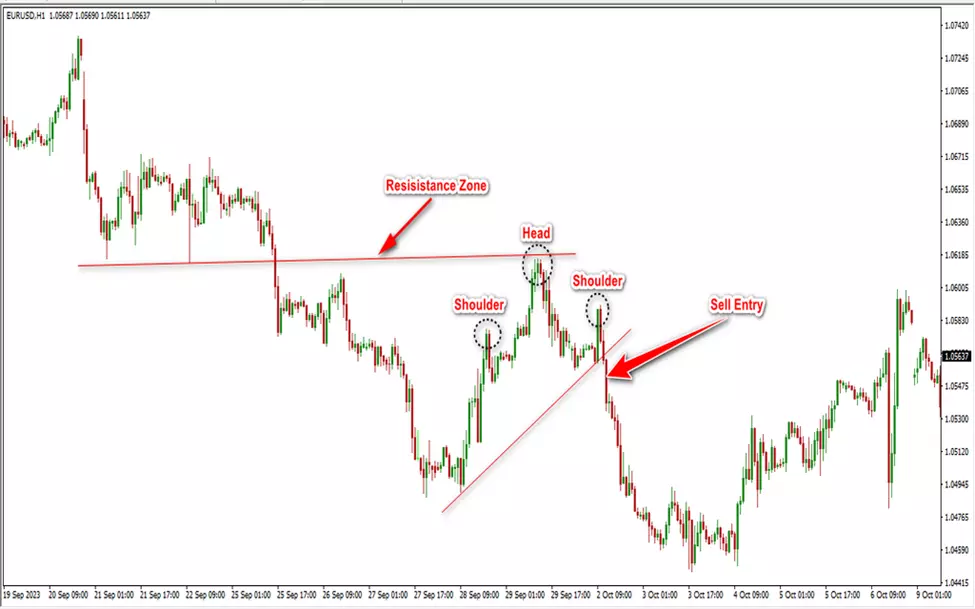

Chart Pattern Strategy

The chart pattern strategy is purely price action. Essentially, it is a technique that uses trend reversal or continuation chart patterns (e.g., double tops and bottom, head and shoulder, bullish/bearish flag patterns, etc.) to identify trading opportunities in the Forex market.

However, chart patterns are to be backed up with technical analysis to make probable trade decisions. For instance, a head and shoulder pattern around a resistance zone has a high probability of playing out.

Image: Chart pattern trading

Trend-following Strategy

Trend following strategy is one of the best Exness strategies to find trading opportunities in the Forex market. It is a trading approach whereby traders look for entry opportunities to buy or sell in the direction of an established trend. Trade entries are made after a minor retracement (pullback) for a possible trend continuation.

Image: Trend-following strategy

Counter-trend Strategy

The counter-trend trading strategy is the direct opposite of the trend-following strategy. Just like the name sounds, it involves identifying trading opportunities against the direction of the market trend. This technique is based on the idea that the price would most likely retrace at some point (correctional movement/pullback) before continuing in the direction of the original trend.

The counter-trend strategy is commonly used along with the trend line to find short entry positions. You can use it to find scalping, day trading, and swing trading setups, which depends on the time frame used for analysis.

Image: Counter-trend strategy

Breakout Strategy

The breakout strategy is the last Exness strategy on our list. It is on the concept that a broken support zone may become a resistance zone in the future and vice versa. The breakout strategy is commonly employed when the price breaks out of the trend line, price channel, rising/falling wedge, bullish/bearish triangles, etc.

Image: Breakout strategy

All the strategies that were discussed above are reliable for a beginner trader. You need to find the one that works for you and stick to it. For instance, you can practice the chart pattern strategy on a demo account to see if it gives you an edge in the market. Besides, chart patterns are easy to identify and trade, which makes it a suitable beginner strategy for Exness.

The Forex market is complex and dynamic, which makes it somewhat of a hassle for traders, especially a beginner to make consistent profits. So, we’ve put together a few tips to give you an edge and improve your trading performance in the Forex market. Here are some tips below:

Education/Knowledge of the Forex market: You need to continuously seek information to improve your trading performance in the Forex market.

Back-test your strategy: Use past price actions to see the success rate of a trading strategy before implementing it on your account.

Be patient: Many Forex traders make needless losses in the market due to lack of patience. Be patient with the market; allow it to present the best trading opportunity before you make a trade entry.

Risk management: Don’t expose your capital to the market through over-leverage. Manage your trade position prudently to grow your equity.

Use stop-loss: The use of stop-loss in the Forex market is essential to protect your account from huge losses due to bad trades.

Forex trading involves the exchange of currencies in the financial market, which is highly volatile and unpredictable. So, yes, Forex trading is a risky venture. It carries inherent risks because it is affected by complicated factors like market sentiment and economic indicators.

Also, some Forex traders lose their capital through over-leveraging. The idea of high leverage may be enticing as it potentially enables traders to make bigger profits from small capital. However, it is a recipe that magnifies potential losses because it exposes a Forex trader’s account to the market.

Finally, Forex traders can incur significant losses in the financial market due to a surge in volatility caused by economic news releases and global events. High volatility makes the market fluctuate, which can lead to loss of capital.

However, Forex trading, though risky, can be financially rewarding when risk management principles are strictly adhered to. Traders can potentially grow their capital over time with patience and risk management.

One of the risk management rules is position sizing, whereby a trader pre-determines an appropriate position size for a trade, usually between 1-3% of the trading capital. Furthermore, the use of stop loss is another risk management principle that helps to define the potential amount of money to be lost should the market move against a trader.

Finally, maintaining an ideal risk-to-reward ratio helps to manage and balance the margin between profits and losses.

The breakout strategy is one of the most profitable strategies; especially when a trade position is opened after the price breaks and retests a zone.

Standard accounts are the best account type on Exness that suits the needs of different traders. It consists of the standard account and the standard cent account.

You can make profits on Exness broker with a proven trading strategy backed up with risk management.

Yes, Exness is a good broker. It is regulated by different financial bodies, which requires that it sticks to strict financial regulatory guidelines to operate.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.