How to Open an IC Markets Account?

If you are interested in trading in the forex markets, you may want to learn how to open an IC Markets account. This fully online, user-friendly process is designed to make it easy to sign up for a live account and get started trading the market. It should be at least 90 days old and clearly show your residence. You can upload a copy of the document later on if necessary.

First, visit ICmarkets' homepage and click on "open a demo account." Next, select your operating system and device and click "Download MT4". After deciding on the platform and MT4, double-click the icmarkets4setup file and it will begin downloading and installing. After it has been completed, select "Finish" and you're ready to trade. To learn how to open an IC Markets live account in 15 minutes using the TU step-by-step guide, keep reading this text up to the last.

IC Markets Account Requirements and Documents

Before you can open an IC Markets account, you must provide certain documents. A photo ID with your full name and date of birth must be uploaded. A certified ID will add an additional 30 points. These documents must be up to 90 days old and clearly show your name and address. The document must also be translated into English, as IC Markets does not accept illegible documents.

You can open an IC Markets live account if you meet their minimum deposit requirement. The company offers three account types: Standard, Raw Spread, and cTrader. All three accounts offer excellent trading conditions. Standard accounts can be opened for 200 USD, which makes them suitable for beginner traders. Standard and Raw Spread accounts are available for MetaTrader and cTrader platforms. However, if you want tighter spreads, you should opt for the cTrader Raw Spread Account.

Photo & ID Card

Photo must be clear and visible

It must be issued by a government agency

Name, signature, expiry date, and date of birth must be clear

Proof of Address

Must be no older than 3 months

Must show the same name and address as your account application

IC Markets Account Types

There are several different types of IC Markets accounts, so a little bit of information about these types of accounts will help you choose the right one for your trading needs. The platform was created by traders, for traders, and their services deliver unbeatable spreads on the raw spread accounts, as well as top-notch customer service. Read about how to buy/sell on IC Markets in the Traders Union article.

Standard IC Markets Account

The Standard Account is the most affordable of the three. The spreads on EUR/USD are just 0,7-0,9 pips, which is competitive with the standard accounts from other brokers.

IC Markets Raw Spread Account

Whether you're looking for low spreads, low minimum deposits, or the best prices, the IC Markets Raw Spread Account is a great choice for you. This account type offers a wide product selection and lightning-fast execution with nearly zero latency. Moreover, you can use Metatrader or MT4 to trade on an IC Markets Raw Spread account without any limitations. EURUSD spread starts is only 0.1 pips in everage with fee $3.5 per lot.

IC Markets cTrader Account

If you're looking to join the global exchange without having to open a new account, the IC Markets cTrader account might be the best choice for you. Despite its simplicity, this account offers many advantages, including tight spreads and high liquidity. cTrader also has an intuitive user interface and allows you to hedge your trades easily. You may also open an IC Markets demo account before starting trading on it.

IC Markets Islamic Accounts

The costs of Islamic accounts may be higher than those of standard accounts, but this is offset by the fact that the account is swap free. The rest of the trading conditions are very similar.

Is Forex Trading Halal?IC Markets Account Opening Guide

In this ICMarkets Account Opening Guide, we'll look at the important steps involved in opening an account and identifying what to expect. To open a standard account, you'll need to have at least one form of a photo ID and a document verifying Proof of Residence. Your documents must contain your full name and date of birth. You may open an IC Markets demo account at first and after that, you can also create an IC Markets live account for live trading.

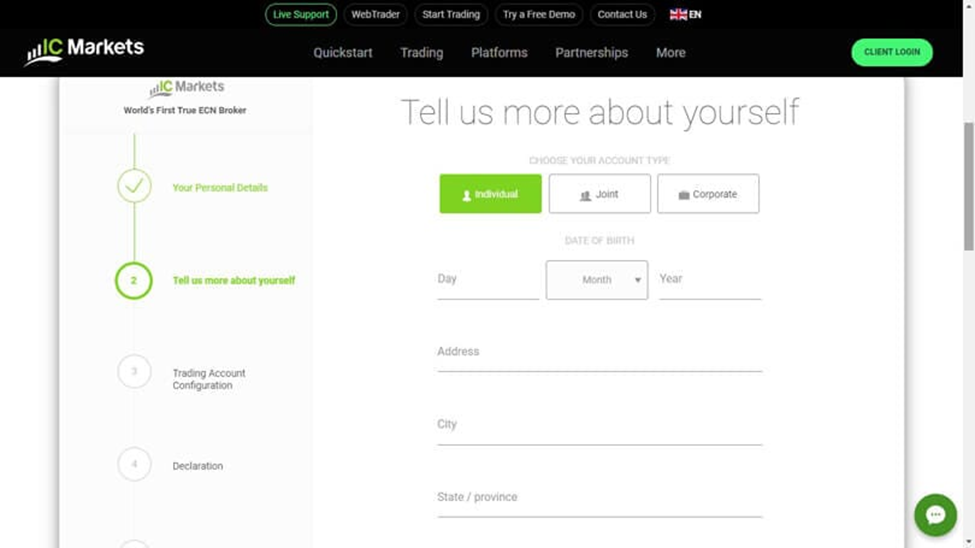

1. Select a user account

Make sure you have chosen the appropriate type of brokerage account for you before providing any of your personal information.

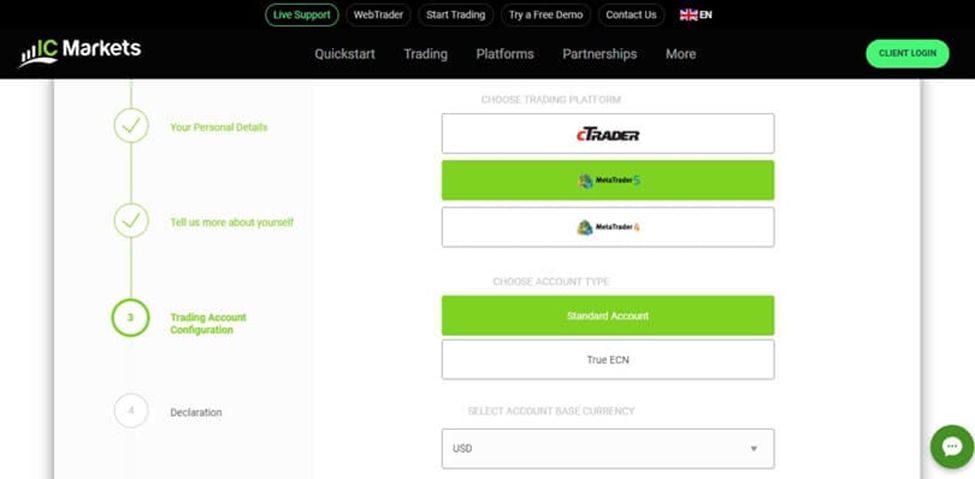

How to open an IC Markets Account

2. Include personal data

The next step is to complete the questionnaire for basic information. You will be required to give information such as your name, birthdate, residence, nationality, place of employment, and other details. The broker you selected will determine how difficult this stage will be. Along with answering security questions to confirm that you have the proper authorization to trade, you will also be asked about your trading history.

How to open an IC Markets Account

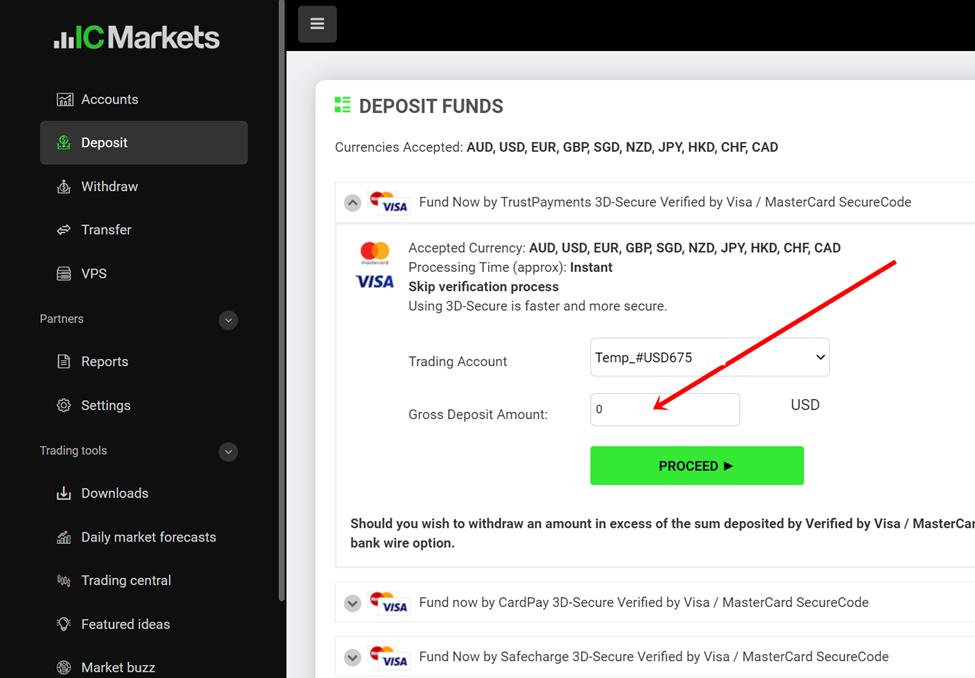

3. Add money to your account

You can start trading as soon as your account has been verified and opened. Transfer the required amount to your broker account, or any amount if none is required, and then start trading! Now you are a shareholder!

How to open an IC Markets Account

How to Close an IC Markets Account?

If you are worried about how to close an IC Markets account then there are many ways to close an account with IC Markets. IC Markets will archive your account after a specified period of time. There are also several ways to close a dormant account, including closing all open positions. You can close your account completely or in part.

You have to open your account on IC Markets

Then close your positions

Have to withdraw all your funds

Your account will be achieved then

You must contact customer service if you want to permanently remove it or retrieve it

FAQ

Are IC Markets Regulated?

The companies of the group hold the following licenses: Raw Trading Ltd. is licensed by the SFSA, Seychelles, International Capital Markets Pty Ltd by the ASIC, Australia, and IC Markets (EU) Ltd by the CySEC, Cyprus.

Do IC Markets Accept International Traders?

If you are an international trader, you may be wondering, "Does IC Markets accept international traders?" The answer is yes, but you should be aware of some of the restrictions you should know before making your first deposit. IC Markets offers a variety of deposit and withdrawal options, including credit cards, bank wire transfers, and broker-to-broker transfers.

What is the Minimum Deposit Requirement at IC Markets?

If you're thinking about opening an account at IC Markets, you should know that the minimum deposit amount is $200. With this amount, you can trade in the forex and CFD markets on three platforms. Depending on your trading strategy, you can choose from one of three accounts, including a standard account and a raw spread account. The Standard Account has a standard spread and has no commission fee.

What Are IC Markets Trading Hours?

If you're new to cryptocurrency trading, it's helpful to know the trading hours of IC Markets, as well as how you can trade at these times. You can trade 24 hours in IC Markets Trading account. In addition to trading hours, IC Markets offers a wide range of resources to trade. Moreover, IC Markets trading hours are governed by the time zone of the broker you're located in. You can even trade in different currencies, which means that you can exchange the different kinds of cryptocurrencies.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!