How To Trade Forex On IC Markets

How to Buy/Sell on IC Markets

Firstly, you need to register and verify your account on IC Markets. Create a live trading account, fund it, pick a trading platform, select investment instruments, decide on lots and leverage, incorporate a risk management plan, and then initiate a trade.

With a focus on professional service, quick executions, and low spreads, IC Markets Global offers online CFD trading for stocks and currencies. It is recommended that traders only open real accounts to trade on IC Markets when they have acquired enough knowledge about the assets they want to start trading. However, since trading on the IC Markets demo account is identical to trading on a real account, it is essential to practice buying and selling pairs using this free account.

This article is going to focus on how to buy/sell on IC Markets. TU experts will show potential traders how to trade Forex on IC Markets. Let's look at the first thing you need to start trading on IC Markets.

Can I deposit $100 on IC Markets? The minimum deposit amount traders are to deposit on their trading accounts is $200; you can verify from customer care if you can deposit less than $200.

Can I buy stocks from IC Markets? Clients of IC Markets can trade only contracts for differences (CFDs) rather than actual stocks. With exceptional execution and competitive pricing, traders can trade more than +2100 large-cap stock CFDs on the NYSE, ASX, and NASDAQ stock exchanges, but only through the IC Markets Global MetaTrader 5 platform.

Can I trust IC Markets? Yes, IC Markets is a reliable trading platform for trading assets like Forex, futures, bonds, stocks, crypto, and commodities. They are regulated by the FSA (Financial Services Authority) and provide top account management tools for users.

How do I start trading on IC Markets? To start trading on IC Markets, you need to open a trading account. You can open a standard, Raw spread, or demo account. After opening the account, deposit up to $200 in your account and select your ideal trading platform to start trading.

How to start trading on the IC Markets platform?

It is assumed that traders seeking to learn how to buy/sell on IC Markets must have opened an account on the platform. Nevertheless, the first thing to do if you do not already have an IC Market account is to open a real or demo account. A demo account can be created for free, even though the platform offers two types of real accounts: standard and Raw spread accounts. First, go to IC Market's official website and click on “Get Started” to create a new demo or real account to open a trading account. Then, you'll be directed to the secure client area, where you can quickly create a real account or a demo.

Step 1: Visit the official website of IC Markets and click on Get Started or the client login button.

If you are a new user, you can click on the get started button, as the client login is for old users who already have a login credential, but there are options for opening new accounts for first-timers there as well.

IC Markets website

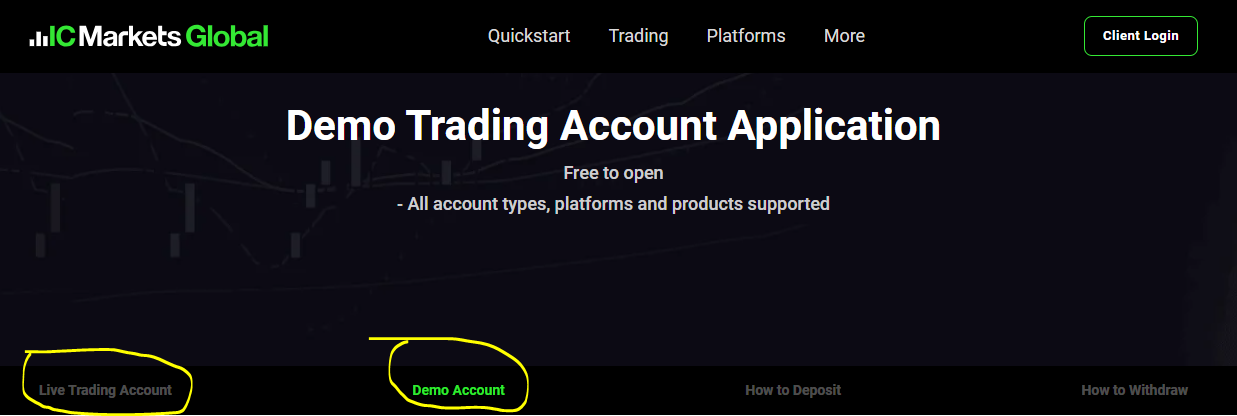

Step 2: Select the type of account you want to open and enter your details

Here, you need to enter your name as it appears on your government-issued ID cards and bank statements.

IC Markets website

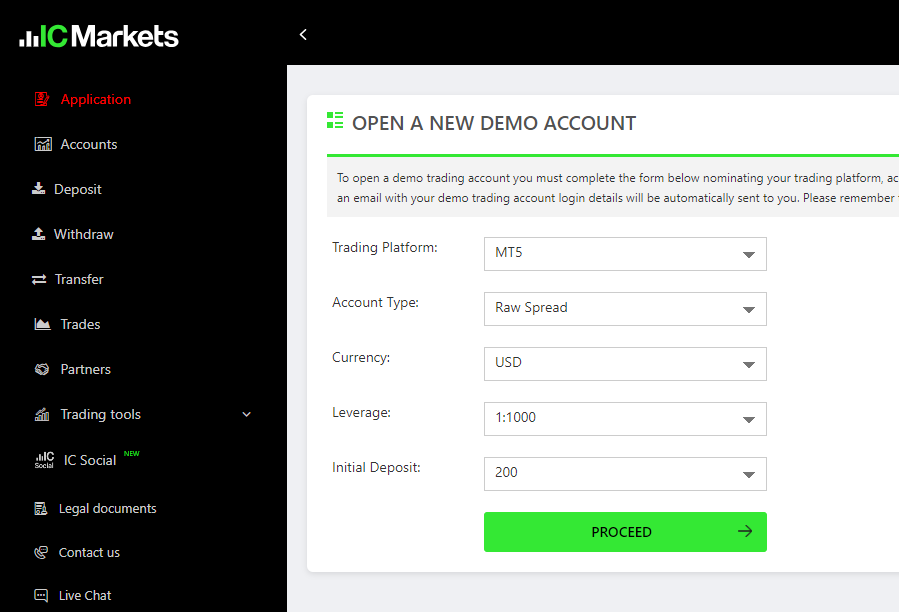

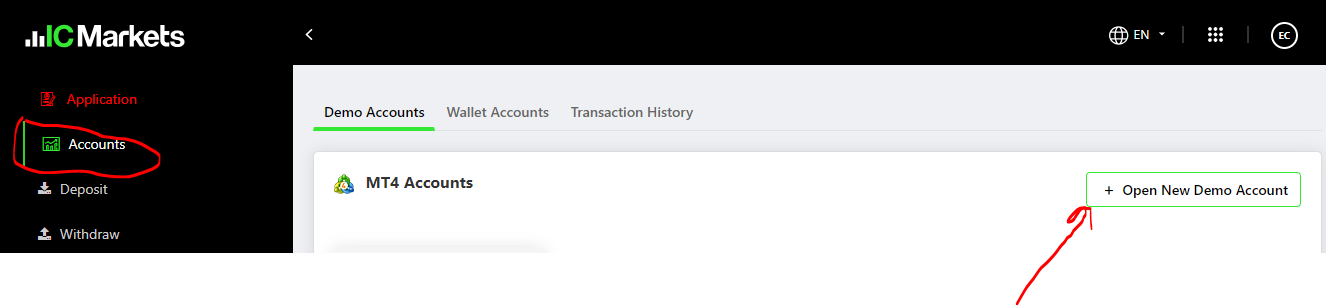

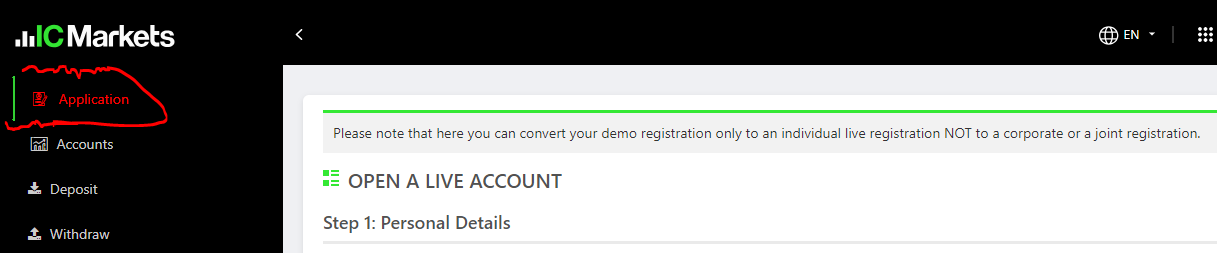

Step 3: Continue with the trading account creation in your IC Market secure area

In the secure client area, you can continue with the demo account creation or click on the application button to create a real account.

IC Markets website

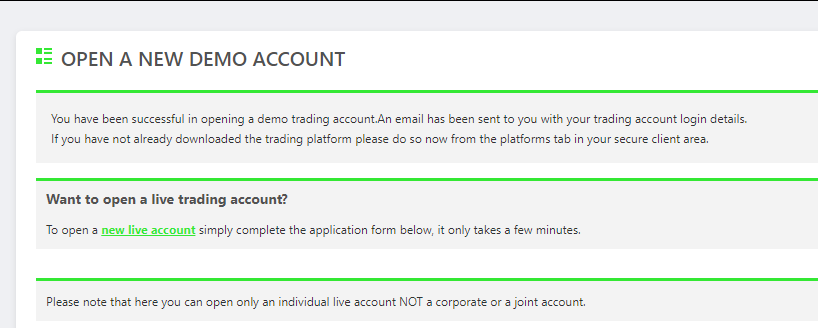

Step 4: Your login information will be sent to you through email.

IC Markets website

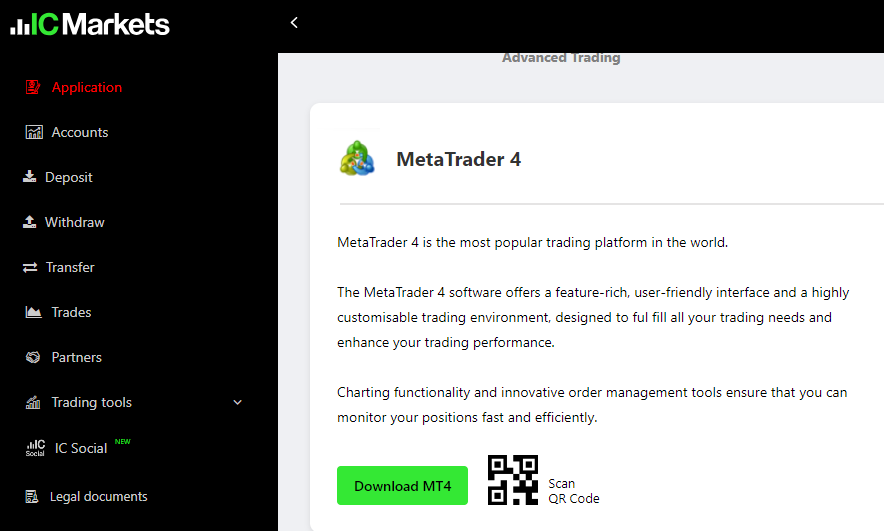

Step 5: Download the trading platform

IC Markets website

Note:

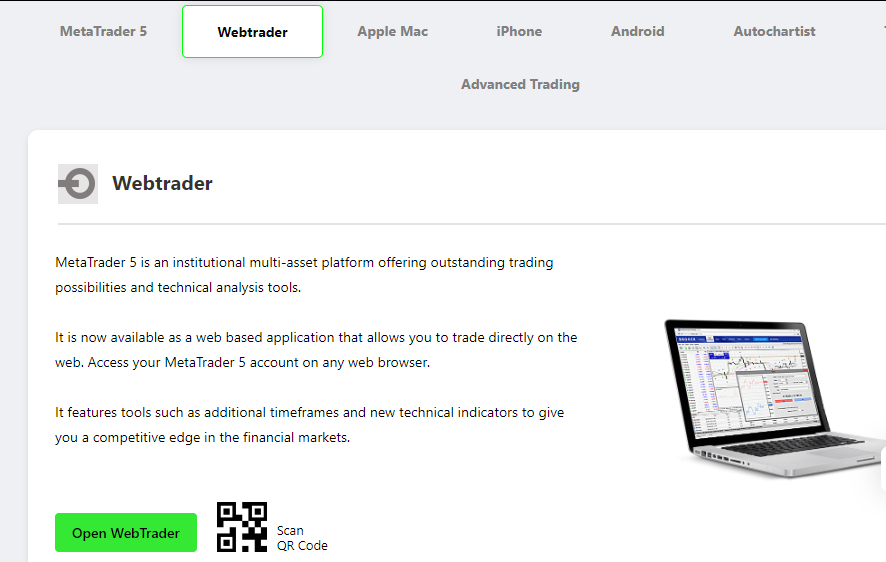

You can trade with WebTrader if you do not want to leave the secure client space when trading on the IC Market.

IC Markets website

Simply select the Webtrader option, select the platform you want, and enter the login details sent to your email.

IC Markets website

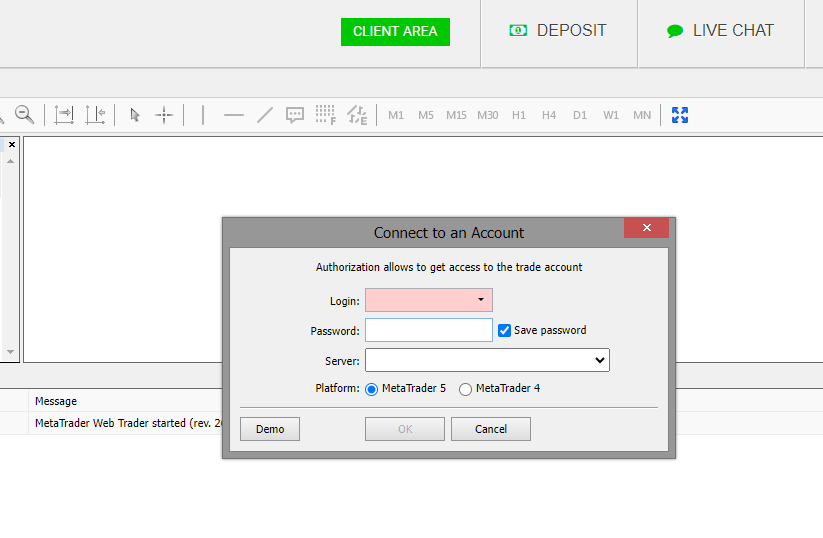

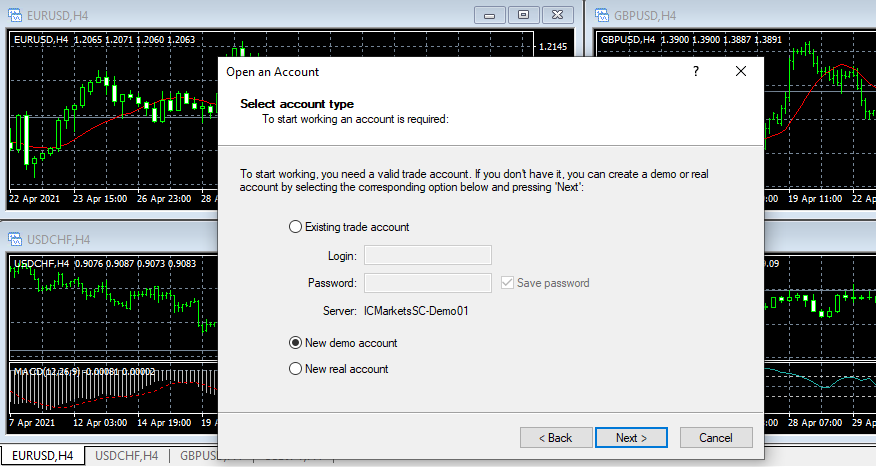

Step 6: Enter the login credentials sent to your email in the downloaded trading platform and start trading

IC Markets website

Let's give an example of how to trade on IC Markets

Here's an illustration of how to trade Forex on IC Markets.

Open your IC Markets app and navigate to the secure client area.

IC Markets website

Select the trading platform you want and enter your login details (WebTrader is used for this illustration)

IC Markets website

Select the currency pair you want to trade from the list of available options

IC Markets trading platform

Use different time frames to identify potential larger trends and finer-grained price action.

IC Markets trading platform

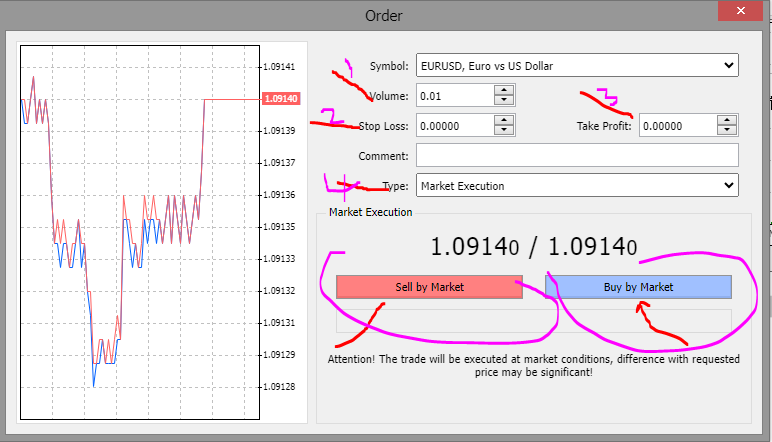

Set your order lots and establish your levels of take-profit and stop-loss to control your risk.

IC Markets trading platform

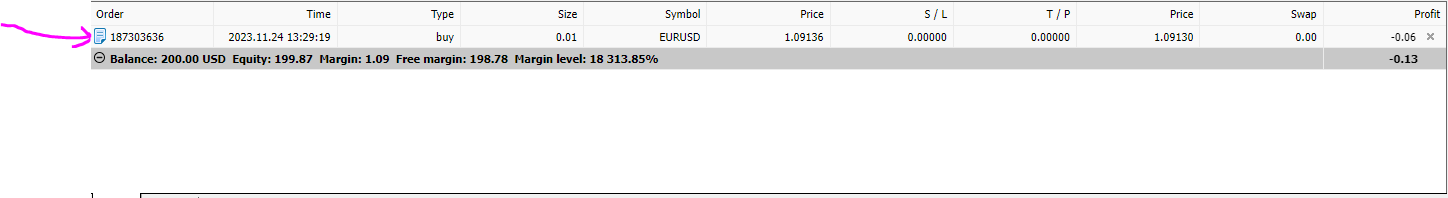

Hit the "Sell" or "Buy" button to complete your transaction. Click the open trade option to see the order you placed

IC Markets trading platform

Available trading instruments on IC Markets

The types of tradable assets on the IC Markets platform include:

60+ currency pairs (CFDs)

2,100+ stocks (CFDs)

Futures (CFDs)

Indices (CFDs)

Commodities (CFDs)

Metals (CFDs)

Bonds (CFDs)

Cryptocurrencies (CFDs)

FOREX (CFDs)

Bonds CFDs

Digital currencies

IC Markets trading platform and features

IC Markets integrates popular trading platforms. These include:

MetaTrader 4

Due to its convenience and functionality, professional traders choose MetaTrader 4 or MT4. It provides an extremely customizable trading environment with an abundance of features, all aimed at meeting every trader's trading requirements and improving trading performance.

MetaTrader 5

MetaTrader 5 incorporates improved tools for in-depth price analysis, a better terminal interface, and increased productivity and performance to make trading in stocks, futures, and Forex easier. With new features like more timeframes and advanced charting tools, you get an advantage over competitors in the financial markets.

cTrader

CTrader is another platform with an incredibly elegant user interface that connects to the most cutting-edge backend technology. For even the most experienced traders, cTrader will be more than enough.

WebTrader

Because Web Trader guarantees the high reliability of the web platform and its compatibility with the entire MetaTrader ecosystem, it is nearly identical to desktop MetaTrader. The application incorporates a multilingual interface, one-click trading, stop-loss/take operations, fully customizable charts, indicators, and analytics, and is safe to use.

How much does it cost to trade on IC Markets?

While the minimum deposit is $200, IC Markets charges different trading fees to traders based on the accounts they wish to use and other considerations. The following three elements mostly impact trading costs on the IC Markets platform:

Spreads

Swaps

Commissions

Spreads

Larger spreads usually equate to higher trading expenses because spreads in trading are the difference between the ask and bid prices. On the cTrader, MetaTrader 4, and 5 platforms, spreads begin at 0.0 pips, with an average of 0.1 pips on the EURUSD pair 2. On Raw Spread accounts, variable spreads begin at 0 pip, but on Standard accounts, they are 0.6 pip.

Swaps

When referring to the interest that traders pay or receive on a position they hold overnight in Forex trading, the term "swap" is used. Every currency pair has a unique swap fee, which is calculated using 1.0 lots, or 100,000 base units, as the standard measurement. On the IC Markets Standard account, for instance, the fee for a short position in GBPUSD is -0,1. The cost of Wednesday night swaps is three times higher than that of standard FX, metals, bonds, and commodity CFDs.

Commissions

In return for facilitating trade, IC Markets will demand a commission, but this varies depending on the account type. For example, the commission that applies to Forex and Metals varies by trading account type.

Commission per USD 100k on Raw Spread (cTrader) is $3

Commission per lot per side on Raw Spread (MetaTrader) is $3.5

Commission per lot per side on standard account (MetaTrader) is $0

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.