Interactive Brokers Ireland Review

After humble beginnings over 43 years ago, Interactive Brokers has grown to become not only one of the most popular brokers around the world, but also one of the largest. In fact, it has over $10 billion in equity capital and is rated as investment grade by Standard and Poor’s.

Interactive Brokers is headquartered in Connecticut in the USA and has offices in the USA, Switzerland, Canada, Hong Kong, UK, Australia, Hungary, Russia, Japan, India, China, Luxembourg, Singapore, Ireland, and Estonia. It currently has over 2400 employees in these offices around the world.

The broker offers its services to customers in 33 countries and serves 135 markets and offers trading and investments in 23 currencies. For its customers, it offers the opportunity to trade and invest in global stocks, options, futures, currencies, ETFs, and bonds. Moreover, it offers trading and investment in all these instruments from a single trading account.

Interactive Brokers provides these services to its customers through a variety of entities globally. In Ireland specifically, it provides these services through Interactive Brokers Ireland Limited. Here, it’s regulated by the Central Bank of Ireland under reference number C423427 and is registered with the Companies Registration Office under registration number 657406. It’s also a member of the Irish Compensation Scheme (ICS).

But what does Interactive Brokers Ireland offer to its customers? In this post, we’ll look at this question in more detail and consider what products it offers, the fees it charges, and more.

Interactive Brokers Ireland - General Information

Photo: Interactive Brokers platform

As mentioned earlier, Interactive Brokers provides its trading and investment services in Ireland through its entity Interactive Brokers Ireland Limited. This entity was established in 2020 as part of the global expansion of the Interactive Brokers Group. The name of the group was changed to Interactive Brokers Group LLC in 2001.

-

💰 Account currency:

AUD, CAD, CNH/CNY, CHF, CZK, DKK, EUR, GBP, HKD, HUF, INR, JPY, MXN, NOK, NZD, RUB, SEK, SGD or USD.

-

🚀 Minimum deposit:

No.

-

⚖️ Leverage:

Depending on the asset.

-

💱 Spread:

From 0 pips.

-

🔧 Instruments:

Stocks, options, futures, currency, metals, bonds, ETF, mutual funds, CFD, EPF, Robo-portfolios, hedge funds.

-

💹 Margin Call / Stop Out:

Depending on the asset.

Through this Irish subsidiary, Interactive Brokers Ireland provides investors with the same services and offering it does through its other subsidiaries around the world. As such, it provides investors and traders with global access to a wide range of investment and trading instruments, low fees, and its intuitive and sophisticated trading platforms. Let's now look at what Interactive Brokers Ireland has to offer.

Pros and Cons

Now that we’ve seen a broad overview of Interactive Brokers Ireland and the services it offers, let’s look at some pros and cons of the broker.

👍 Pros

• Huge variety of trading instruments

• Low fees with a choice of pricing plans

• A large library of educational material and resources

•Offers a free trial to test out the platform

• Feature-rich and easy to use mobile and desktop trading platforms

👎 Cons

• Doesn’t offer card deposits

•Charges inactivity fees

Interactive Brokers Ireland Review

One of the main advantages of using Interactive Brokers as your broker of choice when you want to trade and invest, is the massive number of trading assets and instruments you’ll have access to. In addition, another benefit is that the platform offers competitive pricing and commissions.

Ultimately, this means that, no matter what your investment goals, needs, requirements, or risk appetite, you’ll likely find a trading asset or instrument that meets your unique needs and preferences.

Apart from this, Interactive Brokers also gives you access to its intuitive mobile and desktop trading platforms. Traders Workstation, its desktop trading platform, has a wealth of features that include a variety of trading, chart, order management, and portfolio tools in a single, easy-to-use, and intuitive platform.

Broker’s Fees

Interactive Brokers Ireland offers its customers both fixed-rate and tiered commission pricing plans. With the fixed-rate pricing option, you’ll pay a fixed-rate commission per share or as a percentage of the trade value every time you execute a transaction. This fixed-rate commission then includes all other exchange and regulatory fees.

Conversely, with the tiered commission pricing plan, the commission you’ll pay on trades will decrease the more you trade. So, in simple terms, the higher your trading volume, the lower the commissions you’ll pay. Here, it’s also important to remember that, unlike the fixed-rate pricing option, the commission does not include exchange, regulatory, and other clearing fees.

Let’s now look at these commissions in more detail for different trading assets.

US Stocks and ETFs

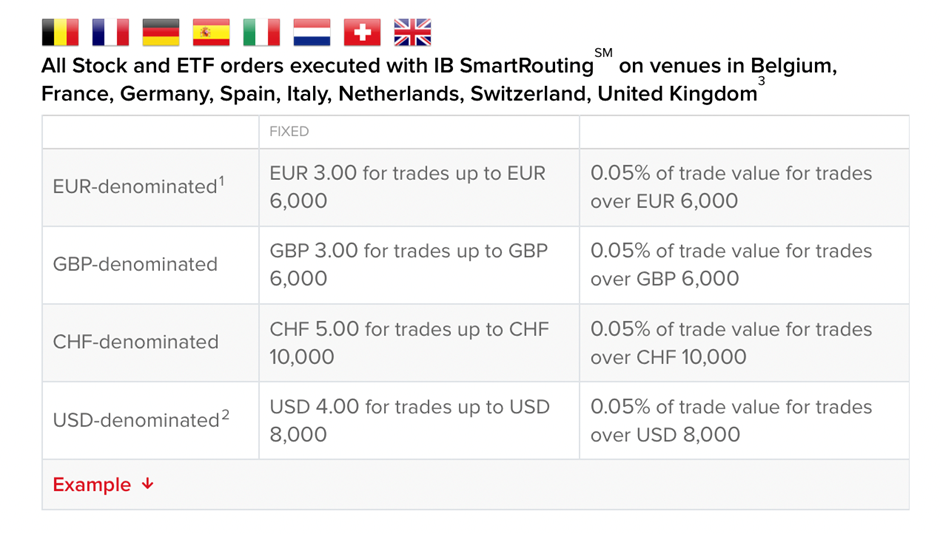

On the fixed-rate pricing plan, Interactive Brokers Ireland charges a commission of USD 4.00 for trades up to USD 8,000 and 0.05% of the trade value for trades over USD 8,000 for all USD denominated stocks.

Photo: all stock and ETF orders executed with with IB SmartRouting

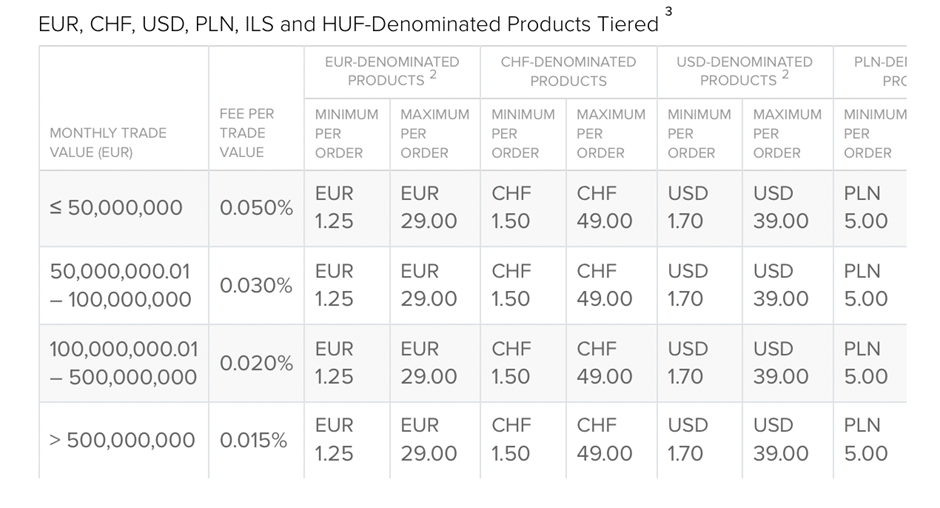

On the tiered pricing plan, the commissions when trading USD-denominated stocks vary from 0.050% of the trade value when you trade less than EUR 50,000,000 per month to 0.015% of the trade value when you trade more than EUR 500,000,000 per month.

In all these instances, there’s a minimum commission of EUR 1.70 and a maximum commission of EUR 39.00. Here, as mentioned earlier, you’ll also need to pay exchange, clearing, and transaction fees.

Irish Stocks

On the tiered pricing plan, the commissions when trading EUR-denominated stocks vary from 0.050% of the trade value when you trade less than EUR 50,000,000 per month to 0.015% of the trade value when you trade more than EUR 500,000,000 per month.

In these instances, there’s a minimum commission of EUR 1.25 and a maximum commission of EUR 29.00. Here, as mentioned earlier, you’ll also need to pay exchange, clearing, and transaction fees.

Photo: EUR, CHF, USD, PLN, ILS and HUF - denominated Products tiered

On the fixed-rate pricing plan, you’ll pay a commission of EUR 3.00 for trades up to EUR 6,000 and 0.05% of the trade value for trades over EUR 6,000.

Options

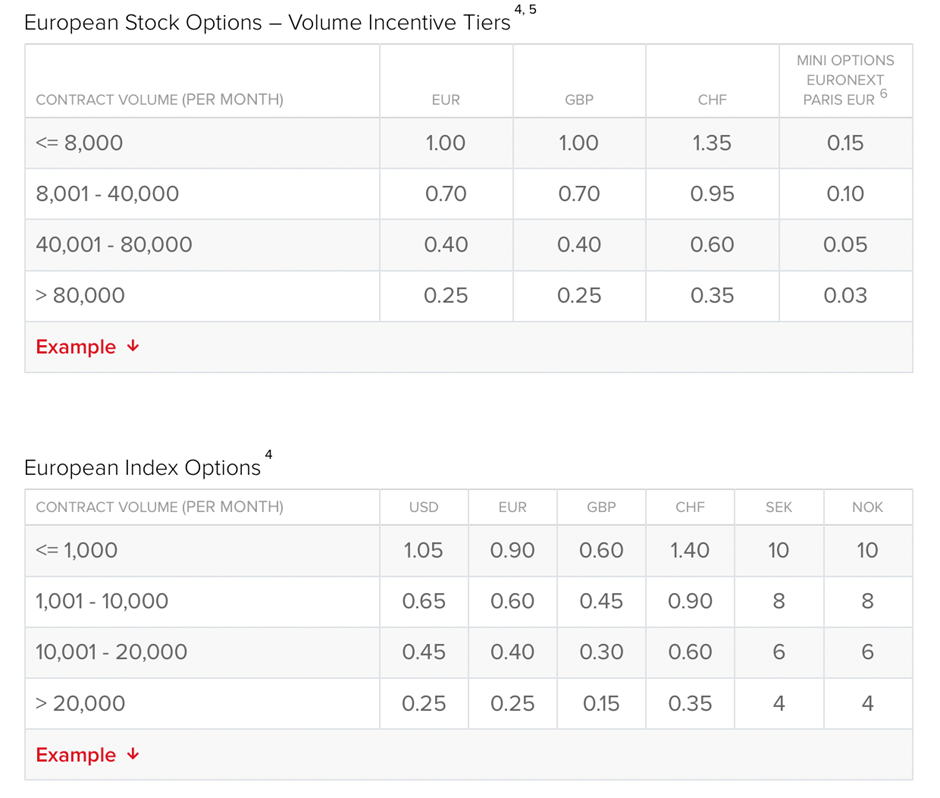

When trading options, the commissions you’ll pay will vary between EUR 0.20 per contract to EUR 3.00 per contract on the fixed-rate pricing plan. These commissions vary depending on the specific option and the country where it’s traded.

On the tiered pricing plan, the commissions also differ. For instance, for European stock options, the commissions vary between EUR 1.00 and 0.25 EUR, depending on the trading volume. Likewise, for European index options, the commissions vary between EUR 0.90 and EUR 0.25, depending on the trading volume.

Photo:Europian stock options and Europian index Options

Forex

When you trade forex on Interactive Brokers, you’ll pay a commission that varies based on your trading volume. Here, the commission will equal 0.20 basis points times the trade value with a minimum of USD 2.00 per order if you trade less than USD 1,000,000,000.

If you trade more than USD 5,000,000,000, the commission will decrease to an amount equal to 0.08 basis points times the trade value with a minimum of USD 1.00.

Photo: IBKR comissions

Trading Assets

Now that we’ve looked at what Interactive Brokers Ireland’s trading commissions are, let’s take a closer look at what you’ll be able to trade on the platform.

These trading and investment assets include:

Stocks and ETFs. Interactive Brokers gives you access to stocks on over 80 global markets. So, you’ll be able to trade stocks and ETFs on the New York Stock Exchange (NYSE), NASDAQ, the London Stock Exchange (LSE), the Frankfurt Stock Exchange (FWB), the Australian Stock Exchange (ASX), the Tokyo Stock Exchange (TSEJ), and many others.

Forex. Interactive Brokers Ireland gives you access to over 100 currency pairs with 23 base currencies including USD, CAD, CHF, AUD, GBP, EUR, JPY, and others.

Options. With Interactive Brokers Ireland, you’ll have access to options on all the major exchanges globally.

Futures. Interactive Brokers Ireland gives you access to futures on all the major exchanges globally.

Apart from these trading assets, Interactive Brokers Ireland also gives you access to other trading assets like mutual funds, metals, indices, and more.

Is Interactive Brokers Ireland Regulated? Is This Company Safe?

As mentioned earlier, Interactive Brokers Ireland is registered with the Irish Companies Registration Office, and it’s regulated by the Central Bank of Ireland with reference number C423427.

As also mentioned, Interactive Brokers is a member of the Irish Investor Compensation Scheme (ICS). This scheme protects the customers of an investment firm in the event that it goes out of business and when it’s unable to return funds or instruments to these customers. Here, the ICS provides protection up to a maximum of €20,000.

Apart from its regulation and the protection provided by the ICS, Interactive Brokers Ireland also implements the necessary security measures to keep customers’ funds safe including holding all customer funds in segregated accounts.

Interactive Brokers - Best for Massive Variety and Low Fees

If you want access to trade with or invest in a massive variety of trading assets or instruments, Interactive Brokers Ireland is definitely worth a look. Moreover, its low commissions make it an attractive option for any investor or trader.

Summary

Considering everything mentioned above, Interactive Brokers Ireland is an excellent option for Irish traders and investors. It offers everything any trader or investor could wish for including a huge variety of trading assets, low fees, and excellent security and protection.

For more broker reviews like these or for more information on trading assets and strategies, why not join Traders Union today.

FAQs

In addition to the information we’ve provided above, we’ve also compiled a list of frequently asked questions that traders and investors often have when it comes to Interactive Brokers Ireland.

How do I fund my Interactive Brokers Trading Account?

Interactive Brokers Ireland offers a variety of payment methods including direct deposits.

How do I withdraw funds from my Interactive Brokers account?

To withdraw funds, you’ll need to complete a withdrawal request in your Client Portal.

Will my money be safe?

Yes, your money will be safe. Interactive Brokers Ireland is a reputable and trusted broker that is properly regulated. It also has the necessary fund protection measures in place.

How much do I need to deposit?

Interactive Brokers Ireland has no minimum deposit requirement.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.