deposit:

- $1

Trading platform:

- MT4

- Mobile application

- MFSA

- 0%

Nextmarkets Review 2024

deposit:

- $1

Trading platform:

- MT4

- Mobile application

- MFSA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Nextmarkets Trading Company

Nextmarkets is a broker with higher-than-average risk and the TU Overall Score of 3.78 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Nextmarkets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Nextmarkets ranks 237 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The Nextmarkets broker cooperates exclusively with traders from EU countries and offers classic trading conditions, under which all commissions are included in the spreads.

The Nextmarkets brokerage company was founded in 2014 in Germany. Since then, it has significantly expanded the asset range for trading and has become a universal intermediary that offers access to both stock exchanges and the Forex market. The Nextmarkets broker is registered in Malta and regulated by the MFSA financial commission (IS/ 77603). It is a member of the Investor Compensation Scheme and stores its clients' money in major European banks. At the moment, Nextmarkets serves only traders from EU countries.

| 💰 Account currency: | EUR, GBP |

|---|---|

| 🚀 Minimum deposit: | No minimum deposit requirements |

| ⚖️ Leverage: | Up to 1:30 (retail traders), up to 1:100 (professional clients) |

| 💱 Spread: | From 0.6 pips |

| 🔧 Instruments: | Currency pairs, CFDs on indices, stocks, metals, energies, cryptocurrencies, ETFs, real stocks |

| 💹 Margin Call / Stop Out: | No data |

👍 Advantages of trading with Nextmarkets:

- Carrying out activities under the license of the European regulator MFSA.

- Long-term operation of the parent company.

- The ability to start Forex trading after depositing any amount, starting from 1 US dollar or pound sterling.

- MetaTrader 4 among the list of available terminals.

- No non-trading commissions from the broker.

- Participation of Nextmarkets in a compensation plan that protects client deposits in the event of a broker's bankruptcy.

- Tight spreads for major currency pairs (from 0.6 pips for EUR/USD), no additional commission for trading.

- More than 300 free trading ideas from company analysts and investment specialists are provided monthly.

👎 Disadvantages of Nextmarkets:

- Lack of cent (micro) accounts with the possibility of trading in a micro lot.

- Only residents of the countries of the European Economic Area can become clients of the broker.

- Low leverage on accounts for retail traders.

Evaluation of the most influential parameters of Nextmarkets

Geographic Distribution of Nextmarkets Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Nextmarkets

Nextmarkets is a broker that works exclusively with traders from the countries of the European Economic Area. Its website has been translated into 7 languages to make it easy for most users to find the information they need. However, this does not help much, because the site provides general information about different brokers, and there is practically no specifics tailored to Nextmarkets. Getting to know the conditions is also complicated by there is no online chat on the official resource of the company. Therefore, a potential client cannot quickly clarify the data of interest to him.

All Nextmarkets clients trade with the same spreads. The company does not offer professional traders lower commissions as do many Forex brokers. The only trading advantage experienced market professionals get is higher leverage.

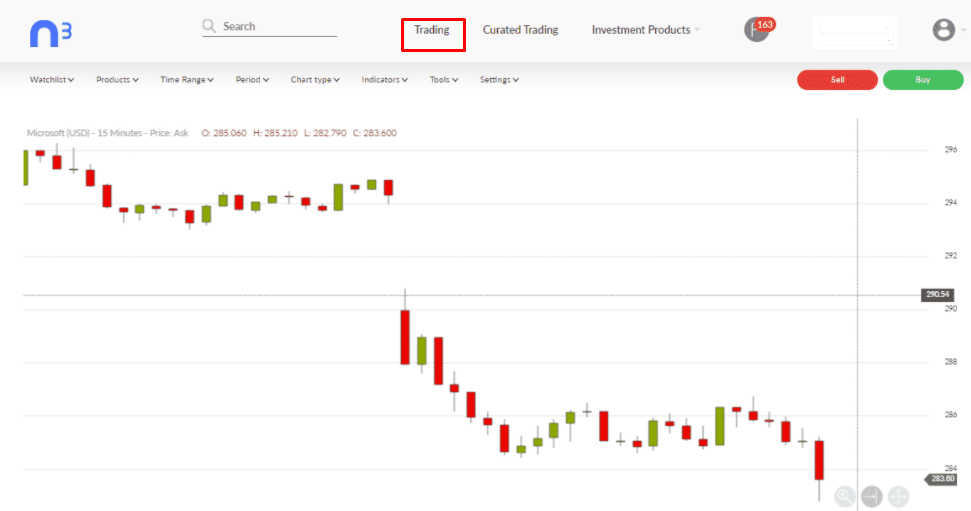

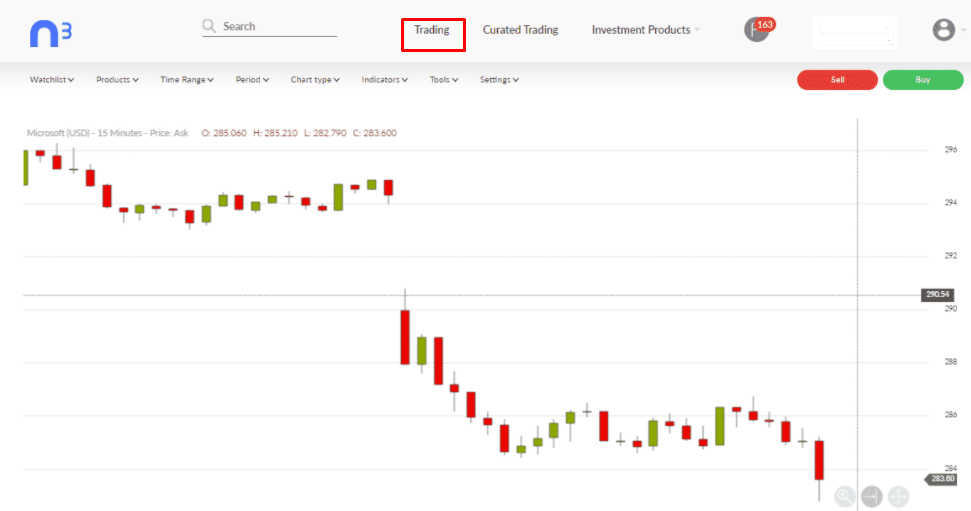

Nextmarkets specializes in trading stock market assets and offers a limited selection of Forex instruments. As a consequence, only 19 currency pairs are available and all analytical studies and reviews are customized to stocks and ETFs. If a client prefers trading from a smartphone, then he can do this only through the proprietary mobile application. MT4 is only available in desktop and web versions, but not in all countries.

Latest Nextmarkets News

Dynamics of Nextmarkets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

There is no information on the Nextmarkets website about investment solutions available to Forex investors. The company does not specify whether it is possible to conduct algorithmic trading or copy trades of other traders. We emailed this question to its tech support, but never got a response. As for the stock market, the broker offers several investment programs, described later below.

How clients can earn passive income without self-trading

Again, all investment solutions in Nextmarkets are designed for traders who work with stock market assets, not Forex. Accordingly, the broker offers the following ways to receive passive income:

-

Portfolio Management - managing a client's portfolio of assets to achieve his investment goal. The manager himself makes the necessary adjustments (without the input or consent of the investor). However, he does not guarantee that his actions will necessarily bring profit.

-

Robo-Advisor - advisory services for asset management using a robotic advisor (algorithm). In this case, the investment decision is made not by a sentient personality, but by a program based on applied algorithms. This option also does not give a 100% guarantee of income.

-

Dividends - the distribution of a part of the company's profits among its shareholders, that is, the owners of shares (real, not CFDs). If dividends are paid in a foreign currency (i.e., not in euros), then the Nextmarkets depository will automatically convert it into euros.

Documents posted on the broker's website do not specify the minimum investment required to use Portfolio Management and Robo-Advisor. However, as a rule, asset management services are available only to large investors. At the same time, to receive dividends, small investments are required and it is enough to buy one share of a company that pays the dividends to its shareholders.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Nextmarkets’ affiliate program:

-

Introducing Broker is a program for companies and firms providing brokerage services. The amount of IB's remuneration depends on the instruments chosen by its clients. For every $1 million traded, an IB receives up to $200 for indices and commodities, up to $350 for FX Minors, and up to $600 for FX Majors.

-

The affiliate program is for website owners, bloggers, and private traders who are interested in income from attracting new clients. The maximum CPA commission is $800 per connected referral. The conditions for calculating remuneration on the company's website are not spelled out.

The affiliate can choose the desired terms for crediting income, such as weekly, monthly, or quarterly. Trading turnover and the number of referrals are displayed in real-time in a dedicated affiliate's account.

Trading Conditions for Nextmarkets Users

The Nextmarkets broker allows you to trade various classes of CFDs, including currency pairs and cryptocurrencies. Retail clients can use leverage, however, according to the requirements of ESMA (European Securities and Markets Authority), it cannot exceed 1:30. At the same time, the maximum level is available only for currency trades. Leverage for CFDs on indices is only up to 1:20, for CFDs on stocks, it’s up to 1:5. For payment transactions, only bank transfers and cards can be used.

$1

Minimum

deposit

1:100

Leverage

9/5

Support

| 💻 Trading platform: | MT4 (desktop, WebTrader), proprietary platform (web version and mobile apps for Android and iOS) |

|---|---|

| 📊 Accounts: | Demo, CFD, and Pro accounts |

| 💰 Account currency: | EUR, GBP |

| 💵 Replenishment / Withdrawal: | Bank transfer (IBAN, SEPA), Visa, MasterCard, Trustly |

| 🚀 Minimum deposit: | No minimum deposit requirements |

| ⚖️ Leverage: | Up to 1:30 (retail traders), up to 1:100 (professional clients) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.6 pips |

| 🔧 Instruments: | Currency pairs, CFDs on indices, stocks, metals, energies, cryptocurrencies, ETFs, real stocks |

| 💹 Margin Call / Stop Out: | No data |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Slippage is possible when executing Market and Stop orders |

| 🎁 Contests and bonuses: | Yes, by the Traders Union |

Comparison of Nextmarkets with other Brokers

| Nextmarkets | RoboForex | Pocket Option | Exness | XM Group | FxGlory | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, MobileTrading, XM App | MT4, MobileTrading, MT5 |

| Min deposit | $1 | $10 | $5 | $10 | $5 | $1 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:30 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 8.00% |

| Spread | From 0.6 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 2 points |

| Level of margin call / stop out |

50% / 50% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 20% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | Yes | No | No | Yes | No |

Broker comparison table of trading instruments

| Nextmarkets | RoboForex | Pocket Option | Exness | XM Group | FxGlory | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | No |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | No |

| Stock | Yes | Yes | Yes | Yes | Yes | No |

| ETF | Yes | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Nextmarkets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| CFD Account | From $6 | No |

| Pro Account | From $6 | No |

When transferring a position to the next trading day, the broker charges a swap commission.

The table below shows the average trading fees of three Forex brokers: Nextmarkets, RoboForex and Forex4you. The assigned commission level shows how profitable it is to trade with each of the considered companies.

| Broker | Average commission | Level |

| Nextmarkets | $6 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Nextmarkets

Nextmarkets acts as a CFD broker and market maker. It provides services within the European Economic Area and allows traders from 28 countries, including the UK, Germany, Poland, Italy, and Austria, to open an account. The company is headquartered in Cologne, with offices in Malta and Lisbon. The broker cooperates with leading banks such as Barclays, Baader Bank, and Deutsche Börse financial holdings.

Nextmarkets by the numbers:

-

The parent company was founded over 7 years ago.

-

The proprietary trading application has been downloaded by more than 100,000 traders.

-

In 2021, the broker received an investment of $30 million (Series B).

-

Clients have access to free advice and analysis on 7 asset classes from 21 stock market experts.

-

Analysts broadcast more than 300 trading ideas every month.

Nextmarkets is a broker for trading in the currency and stock markets

Nextmarkets is focused on providing services for trades with stock market assets. Thus, its clients have access to investments in more than 1,000 ETFs and 8,000 stocks from 52 countries. Forex traders can trade several classes of CFDs through this broker, however, their list is limited. Six stock indices are available such as gold, silver, copper, and 5 cryptocurrencies. Energy resources are represented by gas, Brent and WTI oil. The list of trading assets also includes 19 currency pairs. The amount of available leverage depends not only on the asset class but also on the status of the client — retail or professional.

To make trades, Nextmarkets offers to use proprietary mobile applications and WebTrader. Also, in some jurisdictions, trading from the MetaTrader 4 terminal is available. Thus, it can be used by traders from the UK, Austria, Germany, Spain, and France.

Useful services of the Nextmarkets broker:

-

Curated Investing. Analysis and trading ideas from experienced investment professionals. The option is available in the author's web platform and mobile applications.

-

Forex calendar. Reflects key economic events that may affect the foreign exchange market.

-

Productivity report. It measures the levels of production in the economy calculated using historical GDP and labor force data.

Advantages:

Customer deposits are not stored within Nextmarkets but in the accounts of leading European banks.

The proprietary platform allows you to combine trading in real shares and CFDs on stocks.

The broker offers two types of partnerships: remuneration is available not only to companies specializing in intermediary services but also to ordinary traders.

The average trading account opening time is 6 minutes.

Limit and stop orders can be placed for a period of 1 to 360 days.

All Forex clients can work with 3 types of orders such as market, limit and pending.

How to Start Making Profits — Guide for Traders

To start trading through Nextmarkets, you need to open a real account. For retail traders, the broker offers a single account type for trading currency pairs and CFDs. Clients who are qualified as professionals will be able to trade from a pro account. Accounts for retail and professional traders differ in the amount of leverage.

Account types:

For virtual trading, a trader can use a demo account with a virtual balance of €10,000

Nextmarkets strives to create an optimal trading environment for traders of all experience levels and available funds.

Bonuses Paid by the Broker

The European Securities and Markets Authority (ESMA), which ensures the stability of the EU financial system, from August 1, 2018, prohibits brokers from accruing bonuses to their clients. Nextmarkets strictly complies with the rules of the supervisory authority, therefore it does not offer bonus programs.

Investment Education Online

The broker's website provides the basics of Forex trading and a glossary. A separate section is devoted to intraday trading. After opening an account, all Nextmarkets customers get access to exclusive video materials lasting more than 15 hours. They help explain the features of financial instruments, the functionality of trading software, working with different types of orders, and the basics of analysis.

The broker offers a demo account, which is an effective tool for learning and gaining practical experience.

Security (Protection for Investors)

Nextmarkets is a trading brand of Nextmarkets Trading Limited. It is registered in Malta and regulated by the MFSA, the local Financial Services Authority (license IS/77603). The Nextmarkets GmbH parent company is headquartered in Cologne, Germany.

Nextmarkets is a member of the Investor Compensation Scheme, which insures the deposits of private investors. Under its terms, each trader can receive compensation of up to €100,000 if the broker serving him suspends his activities or declares bankruptcy.

👍 Advantages

- Parent company established over 7 years ago

- Client funds are held in trust accounts

- Deposits are protected by the Investor Compensation Scheme

👎 Disadvantages

- It is not possible to deposit and withdraw funds using e-wallets or cryptocurrencies

- The company opens a trading account only after potential client passes full identity verification

- Lack of license from reputable EU regulators such as FCA or BaFin

Withdrawal Options and Fees

-

The company withdraws funds only to cards or a bank account linked during registration. In some countries, instant payments are available via internet banking using Trustly. To withdraw funds, the client must use the same method by which the deposit was made.

-

When applying for a withdrawal of money, open limit and pending orders are not taken into account.

-

All income received with the help of a broker is calculated in euros. If the client chooses another currency for withdrawal, it will be converted into euro.

-

Nextmarkets does not charge withdrawal fees, but there may be deductions from banks making transfers.

-

The minimum withdrawal amount is €150.

-

The terms for crediting money on the broker's website are not indicated.

Customer Support Service

You can contact the customer support service by phone, from Monday to Friday from 09:00 to 18:00 (GMT + 1). Telephone support languages are English and German.

👍 Advantages

- Email contact form is available in 7 languages

👎 Disadvantages

- Phone support is available 9/5

- There is no online chat on the company's website

- For communication, one phone number is indicated, which is the number of the main office in Germany

This broker provides the following communication channels for its clients:

-

phone call;

-

requests by email;

-

feedback form.

The company has a Facebook profile, but there is no button to send messages.

Contacts

| Foundation date | 2014 |

| Registration address | Portomaso Business Tower, Portomaso, St Julian’s, STJ 4011, Malta |

| Regulation |

MFSA |

| Official site | https://www.nextmarkets.com/ |

| Contacts |

Phone:

+49 221 98259 007

|

Review of the Personal Cabinet of Nextmarkets

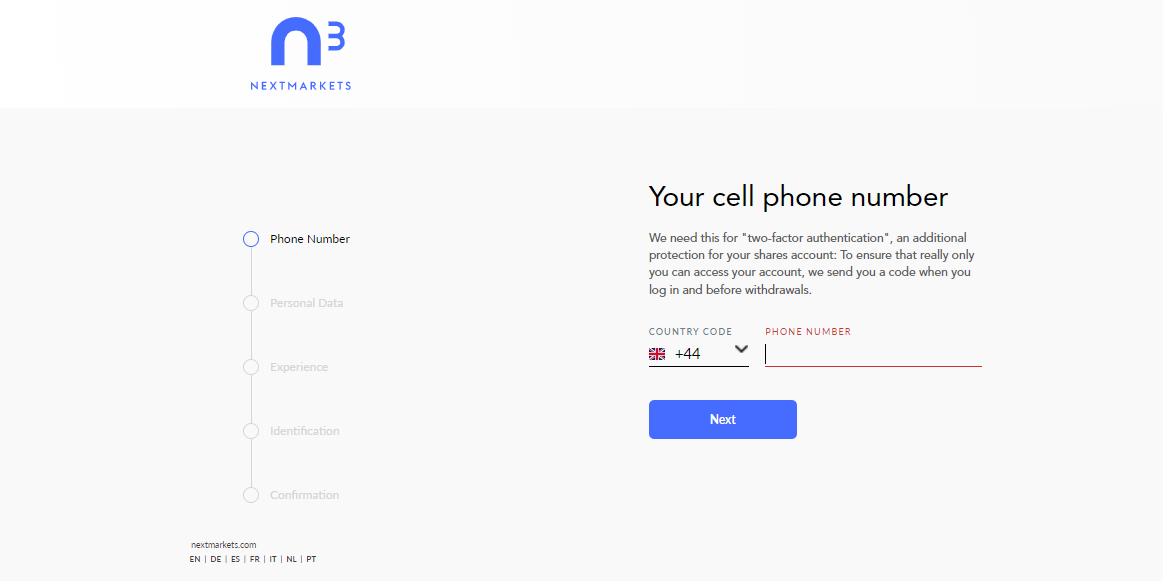

A user account is needed to manage your trading account and make payments (deposit and withdrawal of funds). To create it, you need to register on the Nextmarkets website. Below is a short guide with screenshots.

After going to the Nextmarkets broker website, on its main page, click Open account now.

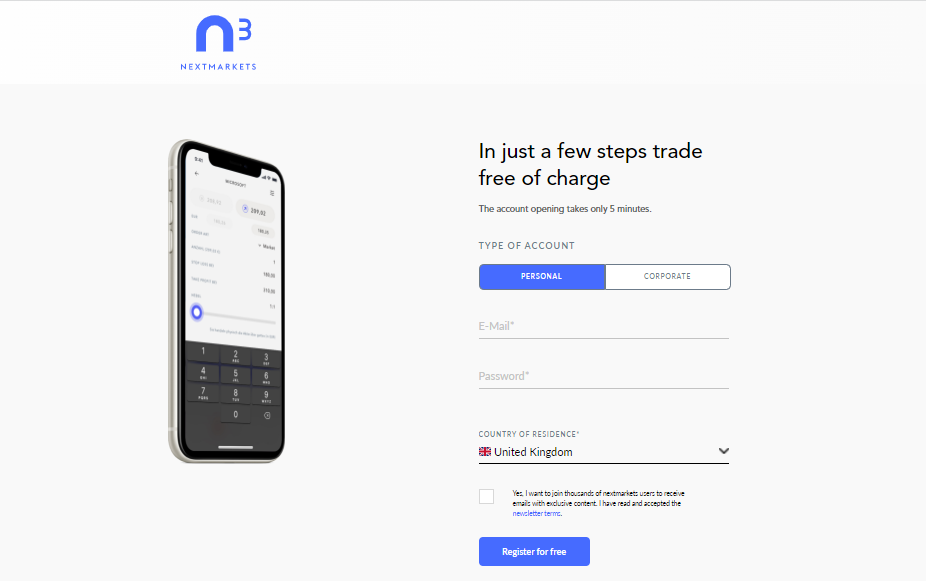

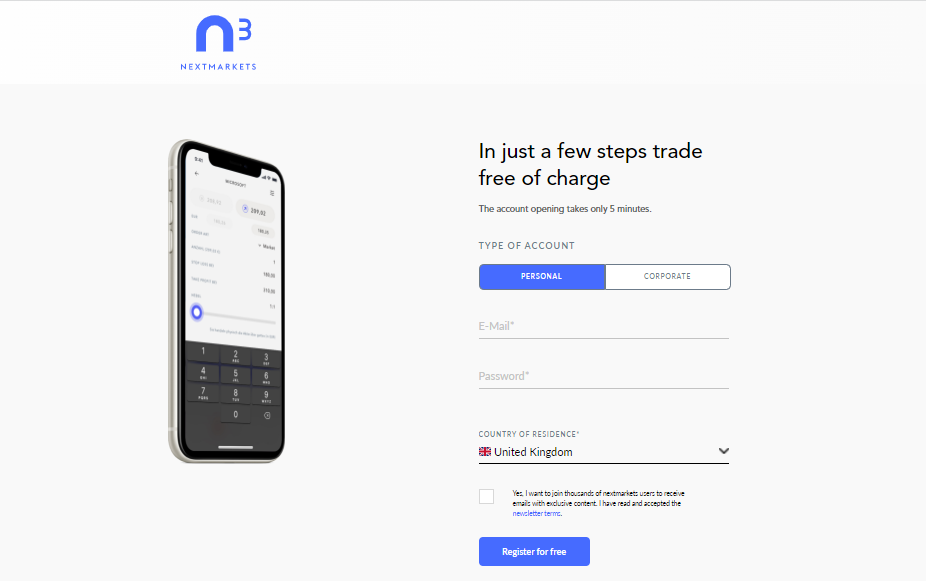

After that, select the type of account, enter your email address and country of residence. Also, create or generate a strong password.

Next, enter your current phone number, personal details (as in your passport) and answer questions about your trading experience. After that, provide scanned copies of documents for verification.

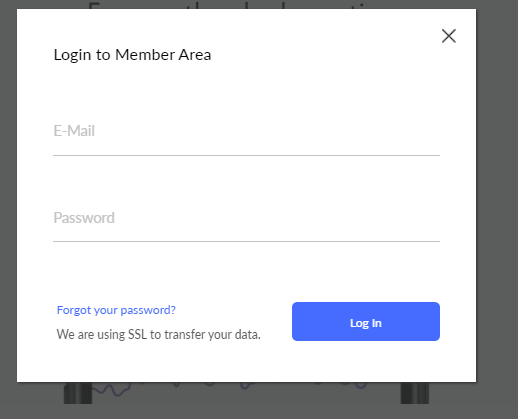

After registration, you can enter your new user account. To do this, you need to enter the email and password that were specified in the application form.

The functionality of the Nextmarkets user account:

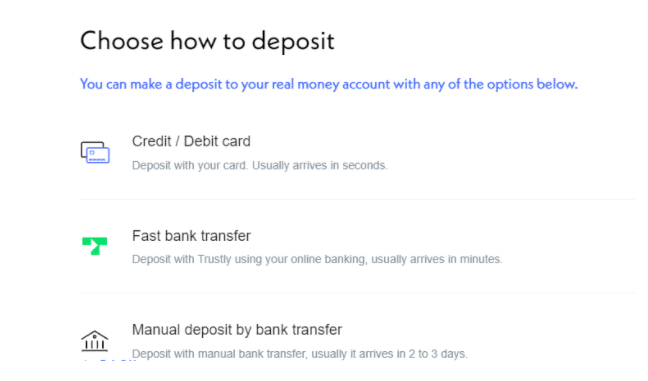

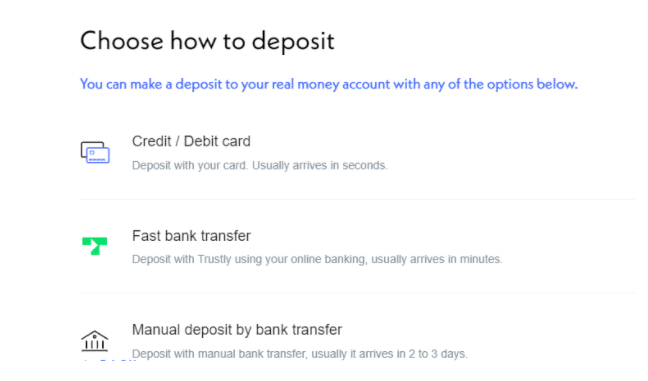

1. Trading account replenishment:

2. Trading through the proprietary web platform:

1. Trading account replenishment:

2. Trading through the proprietary web platform:

Also, in the user account, the trader can perform the following actions:

-

Switch between demo and live trading accounts.

-

Subscribe to or unsubscribe from email.

-

Set up price alerts when working with stock market assets.

-

Create and manage watchlists.

-

Connect and modify the necessary tools for technical analysis such as indicators, drawing tools, chart types, etc.

Articles that may help you

FAQs

Do reviews by traders influence the Nextmarkets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Nextmarkets you need to go to the broker's profile.

How to leave a review about Nextmarkets on the Traders Union website?

To leave a review about Nextmarkets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Nextmarkets on a non-Traders Union client?

Anyone can leave feedback about Nextmarkets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.