OX Securities Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $0

- MT4

- MT5

- ASIC

- SVG FSA

- 2013

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $0

- MT4

- MT5

- ASIC

- SVG FSA

- 2013

Our Evaluation of OX Securities

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

OX Securities is a broker with higher-than-average risk and the TU Overall Score of 3.61 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by OX Securities clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

OX Securities is a versatile broker for active traders, passive investors, and those who want to earn on partnership.

Brief Look at OX Securities

OX Securities is a broker that has provided access to trading financial assets since 2013. The company’s clients can trade Forex, CFDs, cryptocurrencies, energies, and precious metals. The broker is regulated by the Australian Securities and Investments Commission (ASIC, license number 438402) and the St. Vincent and the Grenadines Financial Services Authority (SVG FSA, registration number 25509 BC 2019).

- 80+ trading instruments.

- Educational trading on demo accounts without the risk of losing real money.

- Spreads from 0 pips on professional accounts.

- The broker is regulated by authorized bodies of Australia and St. Vincent and the Grenadines.

- No fees on depositing or withdrawing funds.

- No cent accounts for trading at reduced risk.

- No negative balance protection.

- The broker does not offer bonuses to new or existing clients.

TU Expert Advice

Financial expert and analyst at Traders Union

OX Securities has been operating in financial markets for nearly 10 years and has become a convenient broker for active traders, professional market players, and those who profit from passive investing. The company offers three account types with spreads from 1.0 pips on standard and swap free accounts and from 0 pips on pro accounts. Leverage is up to 1:500 and there are no minimum deposit requirements. Thanks to straight-through processing (STP) and direct cooperation with liquidity providers, the company’s clients get favorable quotes and fast order execution.

You can trade with OX Securities on the classic МТ4 and МТ5 platforms using computers and mobile devices. The broker maintains a history of all trades in the user account and features an educational section and market analytics. Legal information and trading commission rates can be reviewed in full on the broker’s website.

OX Securities offers MAM and PAMM accounts for passive earnings on investments. You can apply any trading strategy and automated advisors. There are four types of partnership programs where you can earn by attracting referrals and using the company’s infrastructure and technical features. The support service responds quickly and gives useful advice on all relevant questions.

OX Securities Summary

| 💻 Trading platform: | МТ4 and МТ5 for Windows, Mac, Linux, iOS, and Android |

|---|---|

| 📊 Accounts: | Demo, Standard, Pro, and Swap Free |

| 💰 Account currency: | USD, AUD, CAD, EUR, GBP, JPY, and SGD |

| 💵 Replenishment / Withdrawal: | Bank transfers, AdvCash, AWEPay IDR, BitWallet, crypto wallets, FasaPay, Interac, Neteller, Skrill, SticPay, UnionPay |

| 🚀 Minimum deposit: | $0 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: |

Pro – from 0 pips Standard and Swap Free – from 1 pips |

| 🔧 Instruments: | Currency pairs, global index on CFDs, metals, cryptocurrencies, and energies |

| 💹 Margin Call / Stop Out: | 90%/20% |

| 🏛 Liquidity provider: | Large banks and financial institutions |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution, pending orders |

| ⭐ Trading features: | Free VPS for clients that deposit $5,000 or more and trade over 10 lots monthly |

| 🎁 Contests and bonuses: | No |

OX Securities provides access to trading over 80 financial products on MetaTrader 4 and 5. The company offers three account types, including swap-free accounts that are suitable for Muslim traders. Spreads start at 0 pips and trading leverage is up to 1:500. There are demo accounts for learning and testing conditions and strategies.

OX Securities Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

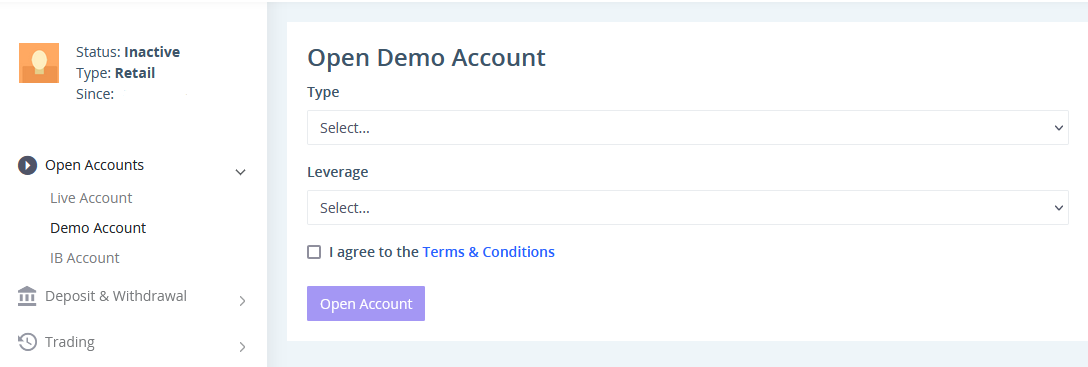

Trading Account Opening

To start trading with OX Securities, register and open a live account. The simple procedure looks like this:

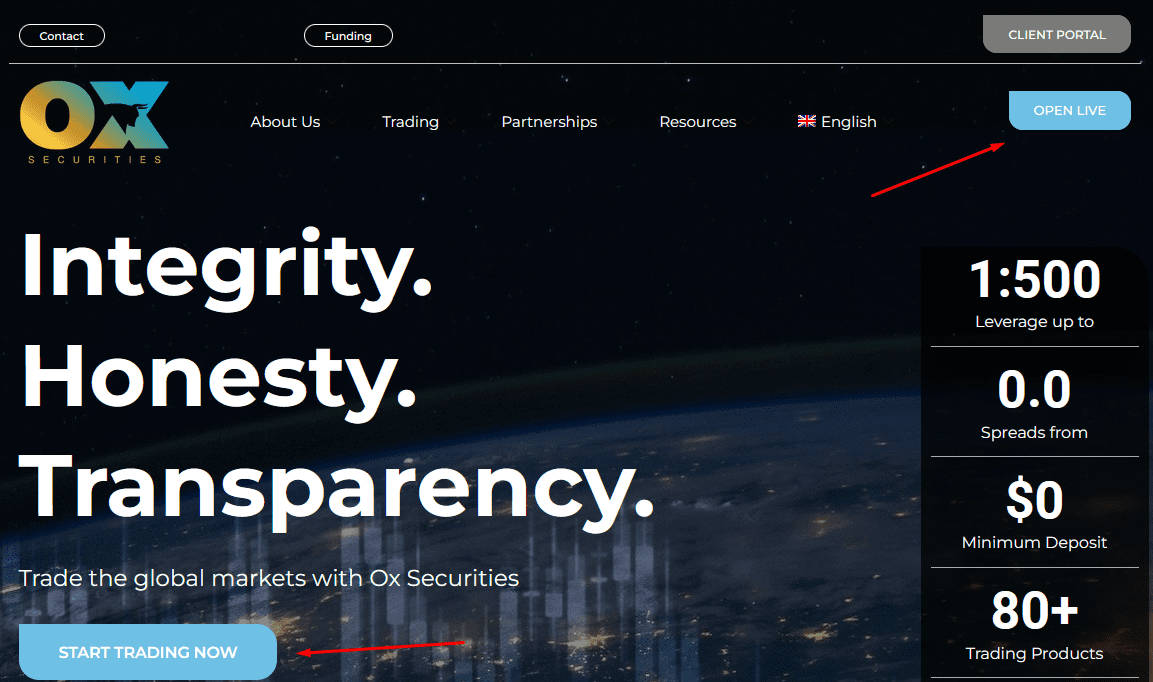

On the OX Securities website, click START TRADING NOW or OPEN LIVE.

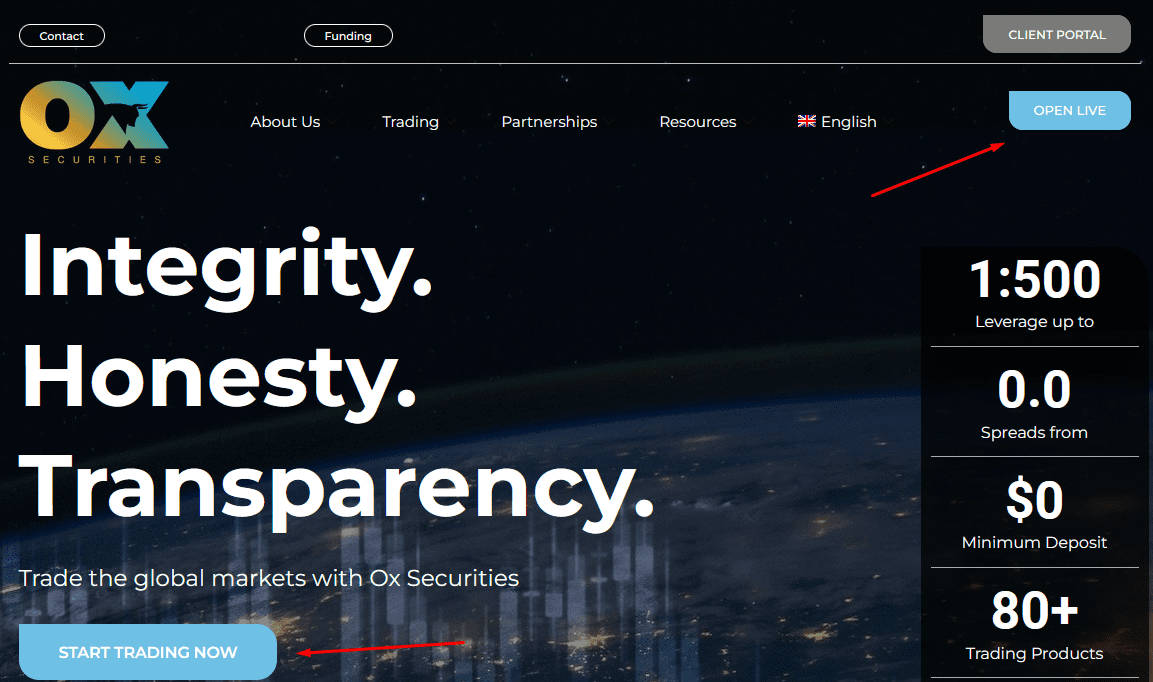

Select an account type: demo, individual, or corporate. Fill out a form with your personal information: first and last names, email, country, city, zip code, street address, date of birth, and phone number. Then select one of the five languages and enter and confirm your password

Features of OX Securities’ user account:

In the user account, clients can do the following:

-

Download the documents needed to verify the user’s data.

-

Download the МТ4 and МТ5 installation files.

-

View the history of all trading transactions; or specify a period.

-

See detailed information about referrals.

-

Create tickets to contact the support service.

Regulation and safety

OX Securities operates in Australia and St. Vincent and the Grenadines in compliance with the laws of these countries.

OX Securities Pty Ltd holds a license with number 438402 from the Australian regulator ASIC. OX Securities Ltd (SV) is registered in Kingstown, St. Vincent and the Grenadines, under number 25509 BC 2019, SVG FSA. Before registering with the broker, you should carefully review the legal documents because, for example, OX Securities Ltd (SV) does not render services to residents of the USA and Australia.

Pros

- Client funds are held in segregated accounts separately from the broker’s capital

- The company is regulated by ASIC of Australia and the SVG FSA of St. Vincent and the Grenadines

- If the company violates its obligations, a client can file a complaint with the regulators

Cons

- You can open an account only after getting verified

- Account protection through two-factor authentication is not available

- No negative balance protection

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | From $10 | No |

| Pro | From $0 | No |

| Swap Free | From $10 | No |

The broker applies swap fees for keeping positions open overnight, except on swap-free accounts.

Traders Union specialists have compared the average trading fees of OX Securities, RoboForex, and Pocket Option. The results are presented in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$6.7 | |

|

$1 | |

|

$8.5 |

Account types

OX Securities offers three types of trading accounts that can be used on MetaTrader 4 and 5. On all accounts, leverage is up to 1:500; the available currencies are USD, EUR, GBP, AUD, CAD, JPY, and SGD; and any trading strategy is allowed.

Account types:

Demo accounts can be used on МТ4 and МТ5.

OX Securities offers good prices, fast order execution thanks to the STP system, and flexible trading conditions for traders of different levels.

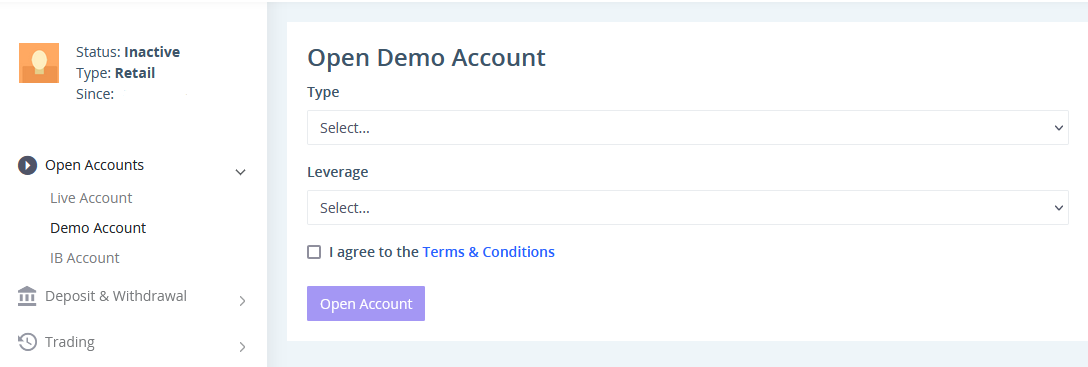

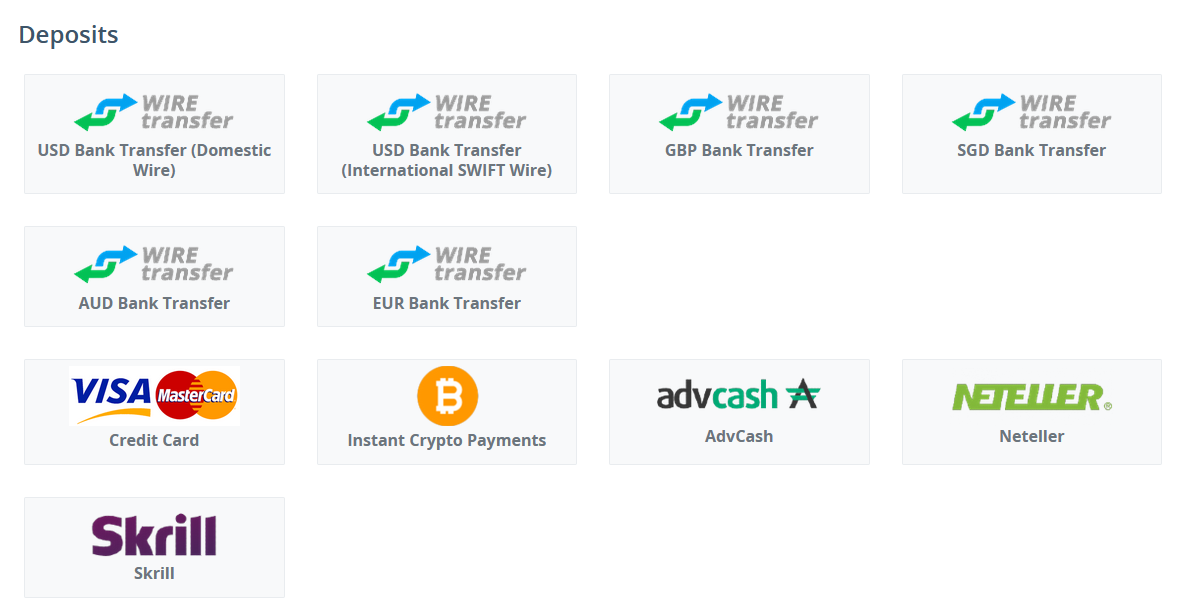

Deposit and Withdrawal

The company does not charge commissions on withdrawing funds.

Withdrawals can be made via bank transfers, FasaPay, Interac, UnionPay, Neteller, Skrill, and crypto wallets.

Except for bank transfers, withdrawal requests are processed instantly. Requests for bank transfers are fulfilled in 1-3 business days.

There is a 0.5% conversion fee on withdrawing over 20,000 USD in cryptocurrency.

Investment Options

The broker offers versatile cooperation and therefore is suitable for both active market participants and those who profit from investing in МАМ and PAMM accounts. OX Securities also allows earning through social trading platforms by copying professionals’ trading signals. The company has several partnership programs for regional partners and introducing brokers. Participants earn by attracting new clients and receiving a percentage of their trading volume as a reward.

PAMM and MAM accounts: Flexible management of investor funds

OX Securities offers PAMM and МАМ accounts to manage client funds on favorable conditions, such as tight spreads and better quotes, thanks to STP technology. STP is direct trading with liquidity providers, which, in addition to favorable conditions, ensures fast placement and execution of orders. The company’s website has video guides on using PAMM accounts for investors and managers.

Features of PAMM and MAM accounts:

Trades can be allocated using various methods, such as proportional, fixed, and based on investment amount.

Any trading strategy is allowed.

Commissions are accrued in real-time.

Funds can be deposited or withdrawn at any time.

Managers can adjust trading accounts, trade all asset types, and view detailed statistics and analytics in their user accounts. Investors and managers can withdraw earnings at any moment without limits or delays.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

OX Securities partnership programs

Introducing Broker. The company pays partners commissions on the trading activity of referrals. Conditions are discussed individually after a client files an introducing broker application in his user account.

Money Manager. Partners can manage their clients’ funds using OX Securities MAM, PAMM, or copy trading technology.

White Label partnership. Partners use OX Securities infrastructure under their own brands. The broker provides its infrastructure and client base, as well as ensures tight spreads and deep liquidity.

Regional partnerships are for the broker’s regional representatives who use the OX Securities infrastructure with all necessary tools and technologies.

A simple and transparent reward calculation system and necessary marketing tools are provided to partners of all types. Profits are accrued automatically after trades are closed, and withdrawal is available in any way offered on the broker’s website.

Customer support

On business days, the support service is available around the clock.

Pros

- Issues can be resolved in real time through an online chat

- Support service operators respond to both registered clients and unregistered users

Cons

- The support service works 24/5 and is unavailable at weekends

- There is no feedback form

The support service can be contacted in the following ways:

phone;

tickets in the user account;

email;

online chat.

Also, the broker has Instagram and Facebook profiles, where users can ask questions directly or under publications.

Contacts

| Foundation date | 2013 |

|---|---|

| Registration address |

OX Securities Pty Ltd, Zenith Tower B, Suite 902, 821 Pacific Highway, Chatswood, Australia. OX Securities Ltd (SV), Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St Vincent and the Grenadines |

| Regulation | ASIC, SVG FSA |

| Official site | https://oxsecurities.com/ |

| Contacts |

+1 (213) 459 3544

|

Education

The OX Securities website has an educational section with articles on financial markets, analytical reviews, and video guides.

The company does not provide cent accounts, but clients can use demo accounts for learning and risk-free practice.

Comparison of OX Securities with other Brokers

| OX Securities | RoboForex | Pocket Option | Exness | Eightcap | FreshForex | |

| Trading platform |

MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading |

| Min deposit | No | $10 | $5 | $10 | $100 | No |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1 point | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

90% / 20% | 60% / 40% | 30% / 50% | No / 60% | 80% / 50% | 40% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of OX Securities

OX Securities presents itself as a transparent and client-oriented company that is constantly developing its technologies to improve the quality of its services. The broker provides access to Forex and various other assets, such as cryptocurrencies, indices, metals, and energies. Clients can trade on three types of live accounts: standard, professional, and swap-free. Demo accounts can be used to learn and practice.

OX Securities by the numbers:

80+ trading products;

Over 10 years of work in the brokerage services segment;

3 types of trading accounts.

OX Securities is a broker for active traders, investors, and partners

OX Securities provides a broad selection of instruments for various categories of clients. Active traders can choose different accounts and use the advantages of STP technology, such as tight spreads and favorable quotes. Those who prefer passive earning can copy the signals of professional traders and invest in PAMM and MAM accounts. Partners are offered four types of programs where they can attract referees and receive rewards for their trading activity. OX Securities’ liquidity providers are large banks and financial institutions and therefore the broker’s clients get favorable trading conditions and guarantees of fast order execution.

Traders are permitted to use automated advisors and other trading strategies. Partners are provided with all tools to attract new clients and promote their own brands.

OX Securities’ useful services:

-

Help Center is a large section with answers to questions regarding trading conditions, financial transactions, user accounts, and more.

-

Economic calendar is a schedule of global events that can impact the market.

-

Trading history. In his user account, a trader can see statistics on all trades and analyze his performance.

-

VPS ensures uninterrupted trading in case of problems with electricity or the internet.

Advantages:

Secure holding of funds in segregated accounts with Tier 1 banks;

PAMM and MAM accounts for passive investing;

Earning through social trading platforms;

Four partnership programs to earn from attracting new clients;

Transparent trading conditions, including information about all fee types;

No minimum deposit requirements.

User Satisfaction