According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1000

- MT4

- JForex

- FORTEX 6

- MFSA

Our Evaluation of Tier1FX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Tier1FX is a moderate-risk broker with the TU Overall Score of 5.01 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Tier1FX clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Tier1FX provides generally comfortable working conditions. The platform offers a variety of assets, and significant leverage, and operates transparently. Additional advantages include multiple trading platforms, passive income options, and quality technical support. However, drawbacks include a 60-day limit on the demo account, a high entry threshold, and a withdrawal fee despite average market trading costs. Only bank transfers are accepted for deposit and withdrawal, and there is no educational support, only basic FAQs about the platform.

Brief Look at Tier1FX

Tier1FX offers access to the markets of currency pairs, metals, and commodities. The broker's pool also includes CFDs on indices and cryptocurrencies. The minimum deposit is $1,000, with a maximum leverage of 1:200. The account's base currency can be EUR, USD, or GBP. The minimum spread is 0.2 pips, and the trading commission depends on the traded asset, for example, $2.75 per lot for currency pairs. Only bank transfers are accepted for deposit and withdrawal, with a fixed withdrawal fee of $20. Available platforms include MT4, JForex, and Fortex 6. Traders can use any trading strategy with no restrictions, and there are joint accounts (e.g., MAM), segregated funds, and a referral program. However, there are no educational programs available.

- A single live account with universal conditions is suitable for both beginners and experienced traders.

- Spreads are lower than the market average, with trading commissions competitive with leading competitors.

- Transparent cooperation with all commissions known in advance, and no additional hidden charges.

- There are no restrictions on traders, allowing scalping, algorithmic trading, and the use of advisors.

- The broker offers moderate leverage, enabling increased profit potential without excessive risk.

- Broker provides the choice of three trading platforms, each with desktop and mobile versions.

- Multiple options for passive income for investment-focused clients.

- The minimum deposit requirement is $1,000.

- Complete absence of any educational programs.

- Not available for residents of Iran, North Korea, Japan, and some other countries.

TU Expert Advice

Author, Financial Expert at Traders Union

Tier1FX provides a range of trading instruments, including Forex, metals, commodities, and CFDs on indices and cryptocurrencies, supported by MT4, JFOREX, and Fortex 6 platforms. The broker offers a single account type with a minimum deposit of $1,000 and leverage up to 1:200. Noteworthy features include transparent fees, low spreads from 0.2 pips, and a trading commission of $2.75 per lot. Its clients benefit from multiple passive income options, free demo accounts, and no restrictions on trading strategies.

Despite its advantages, Tier1FX presents several drawbacks. The platform's high entry threshold may not appeal to novice traders, and withdrawal comes with a fixed fee of $20. Limited to bank transfer methods for deposits and withdrawals, and the absence of comprehensive educational support could also be seen as disadvantages. While the company's offerings may suit experienced traders with sufficient capital, newcomers may find the lack of educational resources a challenge. However, the broker's demo account can serve as an exploratory tool for anyone considering Tier1FX.

Tier1FX Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Tier1FX and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4, JFOREX, FORTEX 6 |

|---|---|

| 📊 Accounts: | Demo, Main |

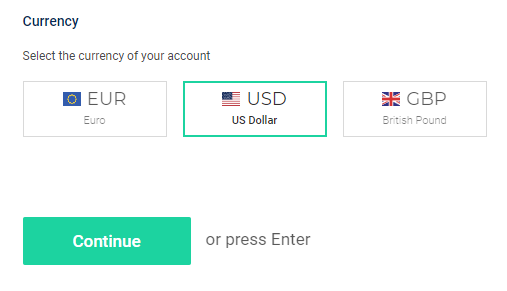

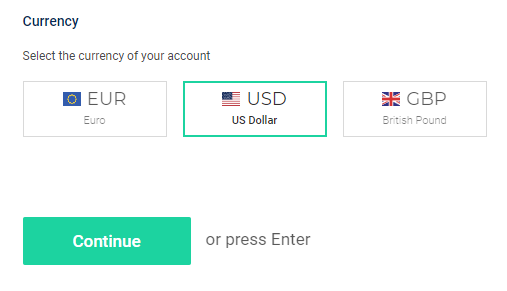

| 💰 Account currency: | EUR, USD, GBP |

| 💵 Deposit / Withdrawal: | Bank transfer |

| 🚀 Minimum deposit: | $1000 |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs, metals, commodities, CFDs on indices, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Free demo account, one live account with versatile trading conditions, high initial deposit, many asset types, moderate leverage, several basic account currencies, several trading platforms, no education programs, and analytics. Technical support is available 24/5. |

| 🎁 Contests and bonuses: | Yes (rebates from TU) |

If a broker offers multiple live accounts, the minimum deposit for them often differs because trading conditions vary. However, Tier1FX has only one live account, so the deposit is consistently set at $1,000 in any case. As for leverage, it is determined not only by the traded asset but also by the trader's rank. Under general conditions, the highest leverage for currency pairs is 1:30. Professional rank allows increasing leverage to 1:100, and under certain circumstances, it can be as high as 1:200. The broker's technical support operates 24/5 and is available through a multi-channel call center, email, site tickets, and live chat.

Tier1FX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To initiate work with Tier1FX broker, register on its website, undergo verification, and open an account. This is a relatively simple process that doesn't take much time. However, experts at Traders Union have prepared a step-by-step guide to eliminate any questions. They have also explored the features of the user account.

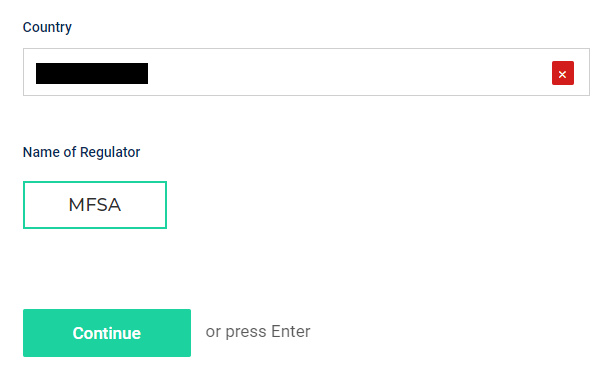

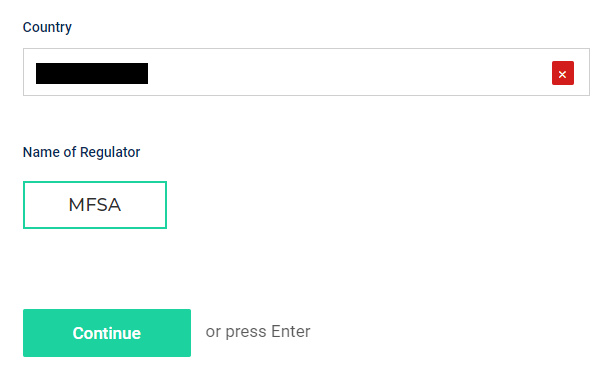

Go to the official broker's website. In the upper right corner, select the interface language. Click on "Open Live", then "Get Started".

Select your country and regulator, then click “Continue.”

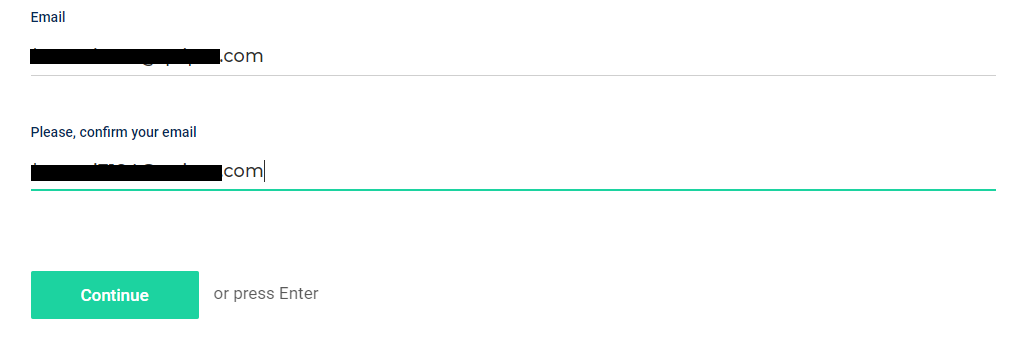

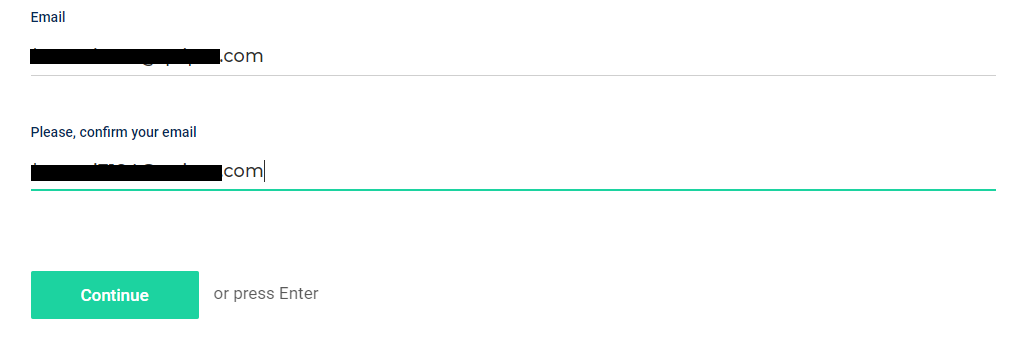

Specify the account type, and enter your full name, phone number, and email. Repeat the email. Generate a password and agree to the terms of collaboration by checking the corresponding box. After filling in each data block, click "Continue".

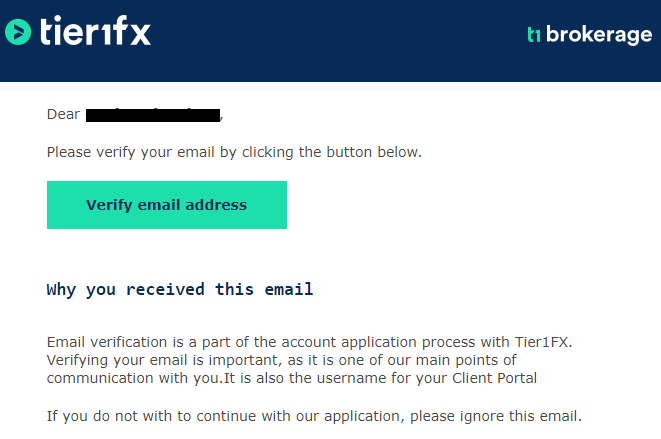

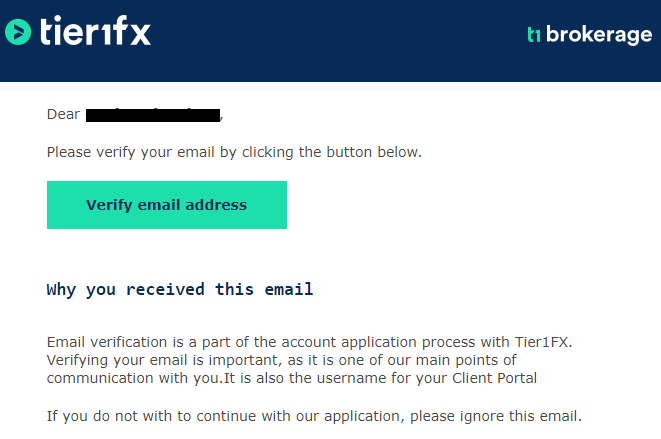

An email will be sent with a confirmation link. Follow the link to continue the registration.

Choose the base currency of the account, trading platform, and other parameters. Click "Continue" each time.

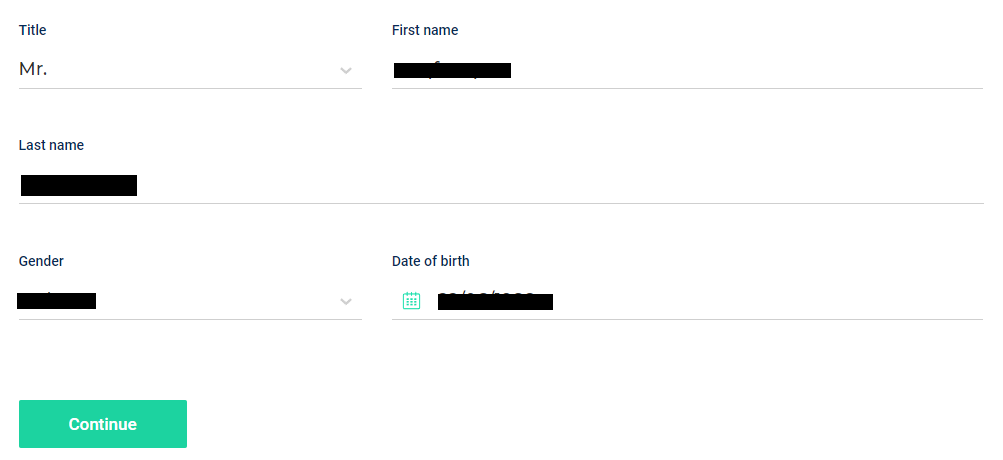

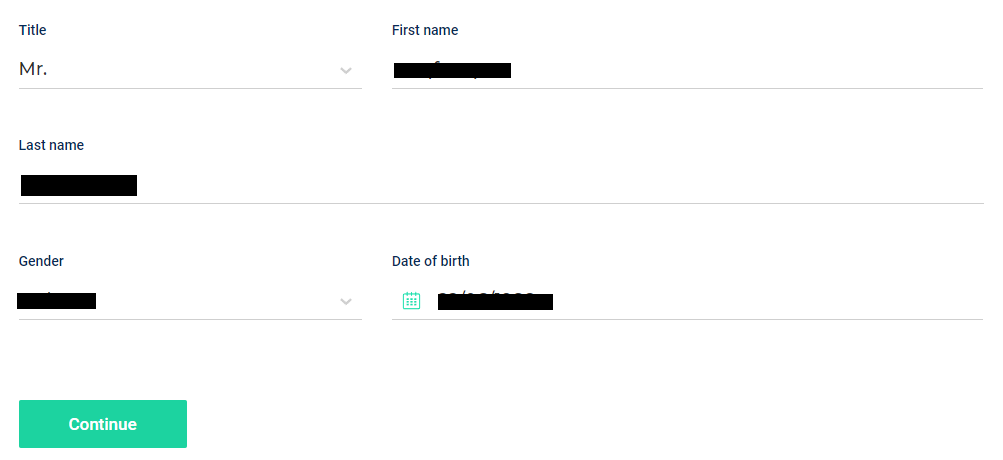

Provide detailed information about yourself such as gender, date of birth, registration address, residency, as well as tax and finance details.

Enter details about your bank and the account (this can be done later).

Share information about your trading experience by answering a few questions. Click "Continue".

Familiarize yourself with the broker's warnings and recommendations. Check the boxes in each field and click "Continue".

In the final registration stage, a verification code will be sent to your phone. Enter it in the corresponding field. You will then gain access to the user account, where you can fund your account.

You can download any of the supported trading platforms, e.g., MetaTrader 4, from the respective feature's website. Install it on your device, enter the registration details, and start trading.

Your Tier1FX user account also provides access to:

-

The dashboard that allows the trader to monitor the status of active accounts, and receive details and reports.

-

The ability for traders to open and close live accounts (only one demo account is available).

-

Options for depositing funds into the account balance, and conducting internal transactions are available.

-

The ability for traders to submit a request to withdraw profits at any time.

-

A section where personal data can be adjusted, and security settings can be configured.

-

The technical support for a trader via all channels, including live chat (only on weekdays).

Regulation and safety

Tier1FX has a safety score of 5.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Not tier-1 regulated

Tier1FX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

MFSA MFSA |

Malta Financial Services Authority | Malta | Up to €20,000 | Tier-2 |

Tier1FX Security Factors

| Foundation date | - |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Tier1FX have been analyzed and rated as Low with a fees score of 9/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Tier1FX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Tier1FX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Tier1FX Standard spreads

| Tier1FX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,6 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,4 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,9 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Tier1FX RAW/ECN spreads

| Tier1FX | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Tier1FX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Tier1FX Non-Trading Fees

| Tier1FX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 10 | 0 | 0 |

Account types

Choosing from several trading account types can be a challenging task. Therefore, many platforms simplify the process by offering clients one account type with universal trading conditions. Tier1FX adheres to this approach. However, the choice of the trading platform is a separate matter. Traders can work with MT4, JFOREX, or FORTEX 6, each with its characteristics. Experts recommend trying all three options before deciding, as they are all free. As for alternative methods of earning, there are plenty of them, allowing everyone to find a suitable option. For instance, a trader can become a manager of a joint account (MAM).

Account types:

If a trader has never worked with the broker before, it makes sense to start with a demo account. This allows for exploring the platform and experimenting with trading strategies without financial risks. If everything suits the user, they can then transition to a live account and engage in full-fledged trading.

Deposit and withdrawal

Tier1FX received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Tier1FX offers limited payment options and accessibility, which may impact its competitiveness.

- No deposit fee

- Minimum deposit below industry average

- Low minimum withdrawal requirement

- Bank wire transfers available

- Wise not supported

- BTC not available as a base account currency

- USDT payments not accepted

What are Tier1FX deposit and withdrawal options?

Tier1FX offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making Tier1FX less competitive for those seeking diverse payment options.

Tier1FX Deposit and Withdrawal Methods vs Competitors

| Tier1FX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Tier1FX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Tier1FX supports the following base account currencies:

What are Tier1FX's minimum deposit and withdrawal amounts?

The minimum deposit on Tier1FX is $100, while the minimum withdrawal amount is $100. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Tier1FX’s support team.

Markets and tradable assets

Tier1FX offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 55 Forex pairs.

- Crypto trading

- 55 supported currency pairs

- Indices trading

- Bonds not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by Tier1FX with its competitors, making it easier for you to find the perfect fit.

| Tier1FX | Plus500 | Pepperstone | |

| Currency pairs | 55 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Tier1FX offers for beginner traders and investors who prefer not to engage in active trading.

| Tier1FX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Why can't I fund my account with an electronic transfer? What types of orders can I open when using the MT4 platform? Why was my trade forcefully closed? Some questions from traders arise from their lack of competence or inattention. However, users often encounter atypical situations and issues with trading, deposits, or withdrawals. In any case, when a Tier1FX client has a question, they can reach out to client support. The client support operates 24 hours, but it is unavailable on Saturdays and Sundays. Managers can be contacted by phone, email, submitting a ticket on the website, or live chat.

Advantages

- Eight communication channels are available

- Managers are available day and night on weekdays

- User reviews of client support are mostly positive

Disadvantages

- On weekends, the broker's clients cannot receive qualified assistance

It doesn't matter whether you are a company client or not because even unregistered users can contact client support.

Here are the current contact methods:

-

Phone;

-

Email;

-

Ticket on the page;

-

Live chat on the website.

It is recommended to subscribe to the broker's newsletter or periodically check the "News" section on the website. This is necessary to stay informed about the latest platform changes.

Contacts

| Registration address | Nu Bis Centre Mosta Road, Lija LJA9012 Malta |

|---|---|

| Regulation | MFSA |

| Official site | https://www.tier1fx.com/ |

| Contacts |

+356 23 27 3000, +356 23 27 3999

|

Education

Often traders who have no experience in trading come to brokers. That is why some platforms offer training materials such as e-books, video lectures, podcasts, and full-fledged courses. But Tier1FX has none of these. The broker assumes that if a user opens an account here, he knows what to do next. The company's website has only basic FAQs and comments on the peculiarities of working with the platform, no educational materials are presented.

The absence of training cannot be considered a drawback of Tier1FX that makes it inferior to competitors. After all, most brokers either lack educational resources altogether or have very limited offerings. Traders should understand that if they want to work with the platform, they need to acquire at least basic theoretical preparation elsewhere.

Comparison of Tier1FX with other Brokers

| Tier1FX | Bybit | Eightcap | XM Group | FBS | 4XC | |

| Trading platform |

FORTEX 6, MT4, JForex | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MobileTrading, MT5, FBS app | MT5, MT4, WebTrader |

| Min deposit | $1000 | No | $100 | $5 | $5 | $50 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:3000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.2 points | From 0 points | From 0 points | From 0.8 points | From 1 point | From 0 points |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | 40% / 20% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Tier1FX

Tier1FX has been in the market for over 10 years, establishing itself as a well-known brokerage firm that implements best practices and uses advanced technological infrastructure. Its microservices architecture eliminates the possibility of a global system failure, while virtual servers and top-tier liquidity providers ensure high-speed order execution. Token authentication and SSL protocols guarantee security, safeguarding user funds and data from fraudulent activities. The broker's favorable trading conditions attract a stable influx of new clients, eliminating the need for special promotions. It's worth noting the relatively high entry barrier, which filters out those who are not confident in their abilities. Thus, Tier1FX creates a community of professional traders focused on results.

Tier1FX by the numbers:

-

The minimum deposit is $1000.

-

There are 100+ instruments from 5 different groups available.

-

The maximum leverage is 1:200.

-

The minimum spread is 0.2 pips.

-

The withdrawal fee is $20.

Tier1FX is a broker for active trading and investing

The platform offers an extensive pool of diverse assets, from currencies to CFDs on indices. This allows traders to implement various trading strategies, and the broker imposes no restrictions. Simultaneously, many financial instruments provide the opportunity to create a diversified investment portfolio, allowing traders to remain profitable even when one asset declines due to unforeseen trend changes. In addition to active trading on financial markets, Tier1FX offers joint accounts and segregated funds that can provide clients with stable passive income. The partner program can also be lucrative for both individuals and legal entities. An additional advantage is that partnership conditions are individually negotiated.

Tier1FX’s analytical services:

-

MAM accounts. Joint accounts of the MAM type allow for passive income on investor positions (with managers earning additional commissions).

-

Partnership options. The broker offers several collaboration models for both individuals and legal entities, including unique comprehensive automatic mechanisms for asset management and trade tracking.

Advantages:

The broker provides transparent collaboration with all fees known in advance.

One live account with optimal trading conditions (low fees, moderate leverage).

Extensive pool of diverse assets with no restrictions on trading strategies.

Several options for passive income and individual partnership conditions.

24/5 technical support providing competent consultations.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i