According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $94

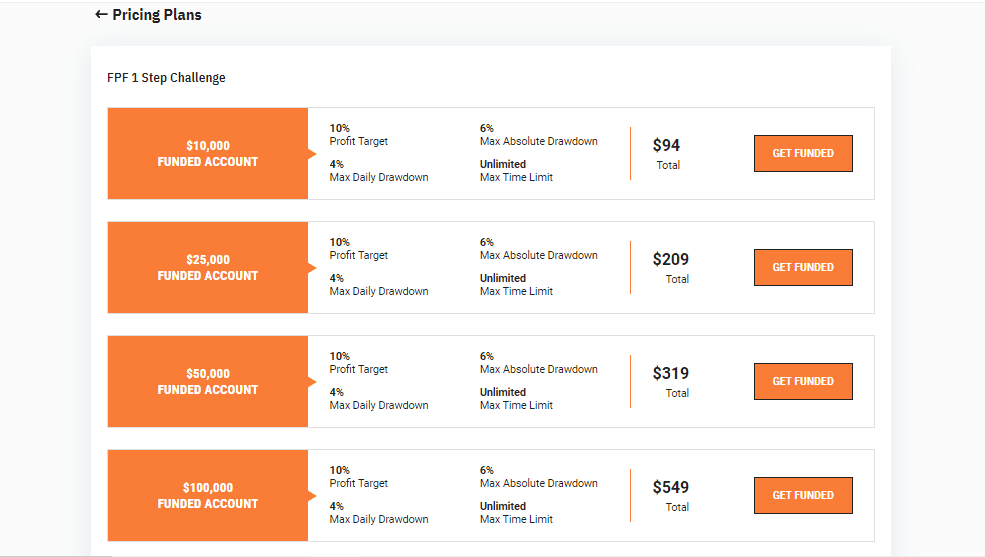

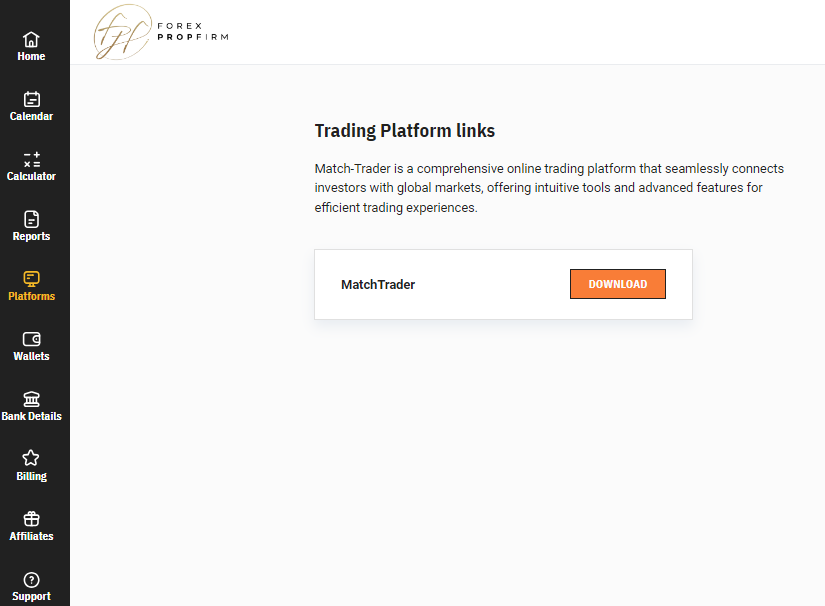

- Match Trader

- Martingale, layering, grid trading, and arbitrage strategies are forbidden

- Up to 1:30

Our Evaluation of Forex Prop Firm

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Forex Prop Firm is one of the best proprietary trading firms in the financial market with the TU Overall Score of 9.35 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Forex Prop Firm clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company.

In addition to standard two-stage evaluation models, FPF offers other unique products. To get funded, traders are required to comply with certain trading rules and not to use forbidden strategies.

Brief Look at Forex Prop Firm

Forex Prop Firm (FPF) was founded in 2016 and officially launched on January 1, 2022. It offers a variety of funding models, ranging from $10,000 to $400,000, as well as a scaling plan up to $10 million. FPF also provides instant funding accounts that require no evaluation.

In addition to funding, FPF offers a partnership program that allows individuals to earn commissions without even having a user account. The firm also hosts trading competitions and regularly awards monetary prizes.

- Trading is conducted through Eightcap regulated by FCA (the Financial Conduct Authority), CySEC (the Cyprus Securities and Exchange Commission), and ASIC (the Australian Securities and Investments Commission);

- Wide range of evaluation programs;

- Discount coupons for initial payments;

- Traders’ profit share is 80%-100%;

- Trading over 1,000 instruments with leverage up to 1:30 is available;

- Instant funding for traders able to trade with a maximum daily and total drawdowns of 5%;

- Partnership program with clear reward calculation.

- The choice of trading platforms is limited to Match-Trader;

- There are limitations on trading strategies;

- The demo account is available only upon initial payment.

TU Expert Advice

Author, Financial Expert at Traders Union

Forex Prop Firm offers a range of services, including funded trading accounts for Forex and CFDs on stocks, commodities, and cryptocurrencies. Traders can choose from multiple evaluation models to access funding ranging from $10,000 to $400,000, with the opportunity to scale up to $10 million. The firm provides a profit share of 80% to 100%, leveraging up to 1:30, and over 1,000 trading instruments through the Match-Trader platform. Unique advantages include a partnership with Eightcap, various evaluation models, discount coupons for initial payments, and an instant funding option.

However, Forex Prop Firm comes with certain drawbacks such as limited trading platforms and restrictions on certain strategies like martingale and high-frequency trading. The firm does not offer a free demo account without payment, and there are caps on maximum loss, affecting risk management. These characteristics may deter traders who prefer high-frequency trading or extensive platform options. Overall, while Forex Prop Firm’s structure may appeal to experienced traders seeking significant funding levels, beginners or those seeking extensive platform flexibility may consider alternatives.

Forex Prop Firm Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | Match-Trader |

|---|---|

| 📊 Accounts: | Free Challenge accounts and Funded accounts |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: |

Deposit: bank cards and Wire Transfer; Withdrawal: Wire Transfer, RISE, cryptocurrencies, and WISE |

| 🚀 Minimum deposit: | $94 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | Floating, from 0 pips |

| 🔧 Instruments: | Forex, commodities, stocks, indices, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | 80%/50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Martingale, layering, grid trading, and arbitrage strategies are forbidden |

| 🎁 Contests and bonuses: | Yes |

Traders may have multiple accounts with total funding of up to $400,000 credited every two months. Scalping, except tick and high-frequency, is allowed. Also, traders can implement a hedging strategy, but they cannot hedge positions within accounts held by one client. Leverage is 1:10 for cryptocurrencies, 1:5 for stocks, and 1:30 for other assets. There are no restrictions on the lot size.

Forex Prop Firm Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

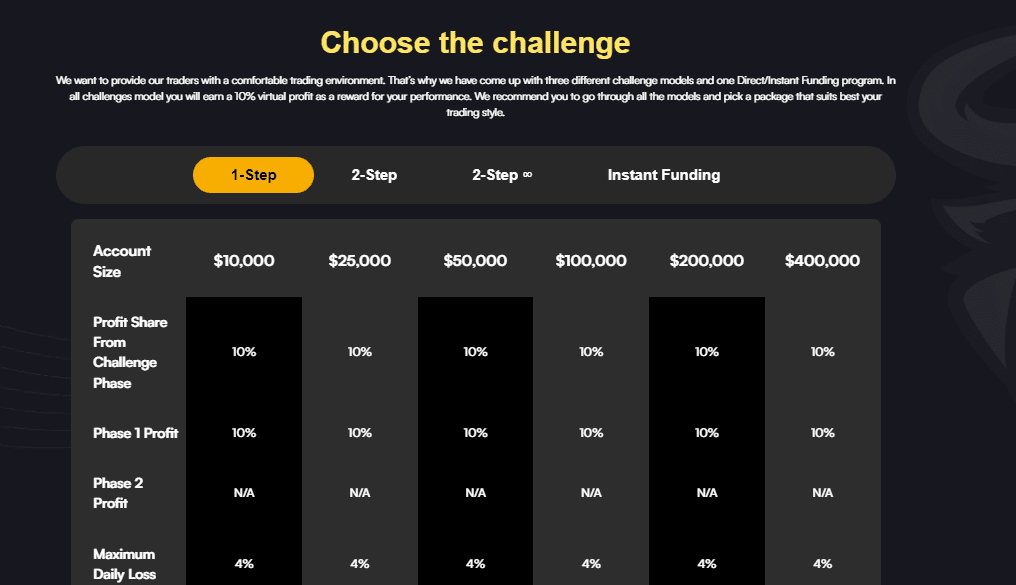

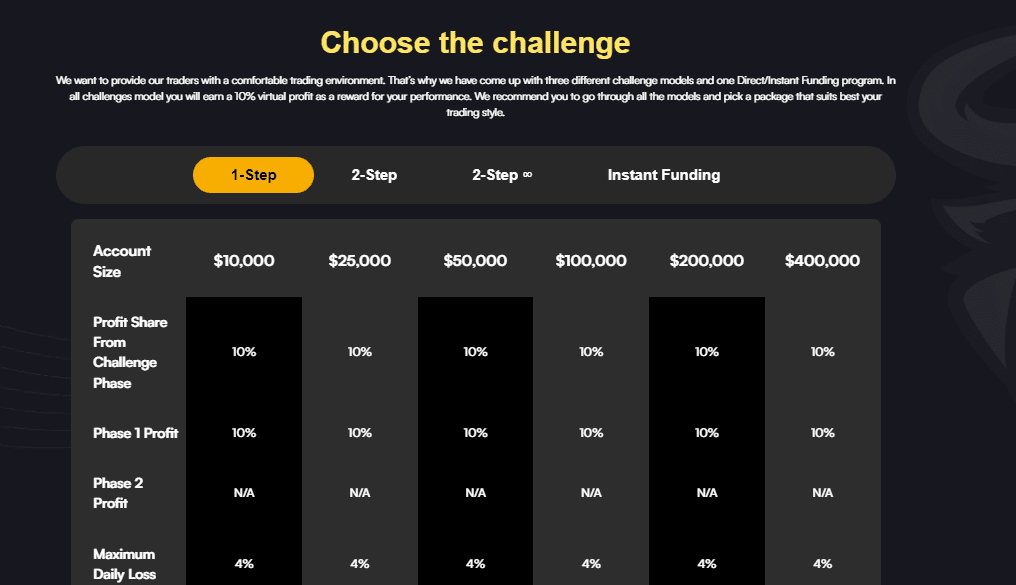

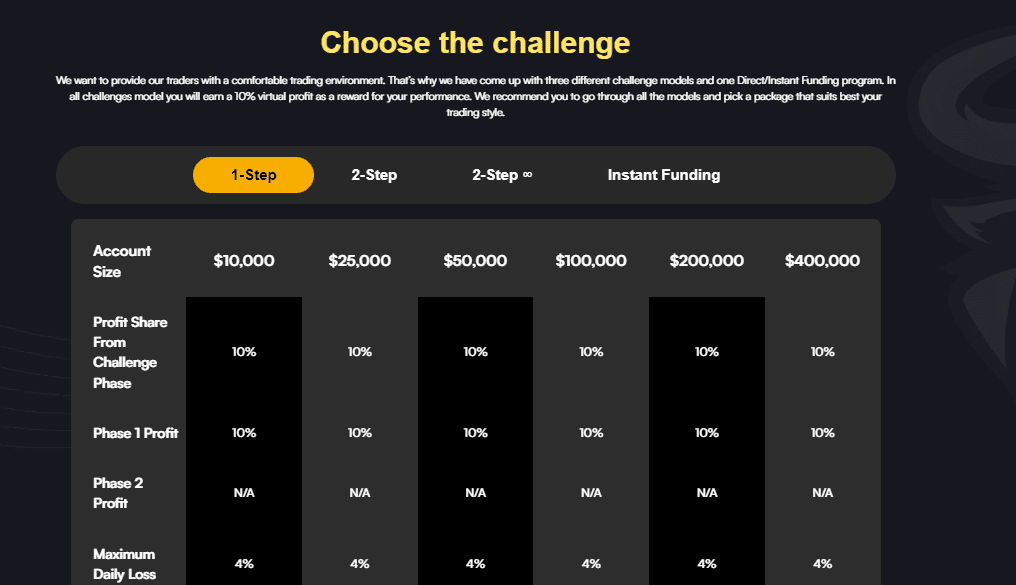

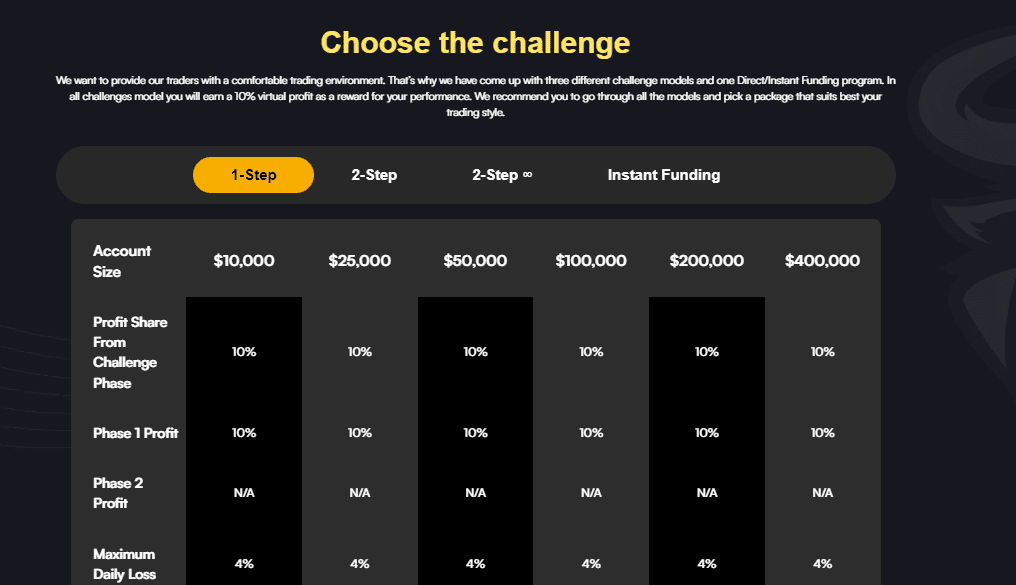

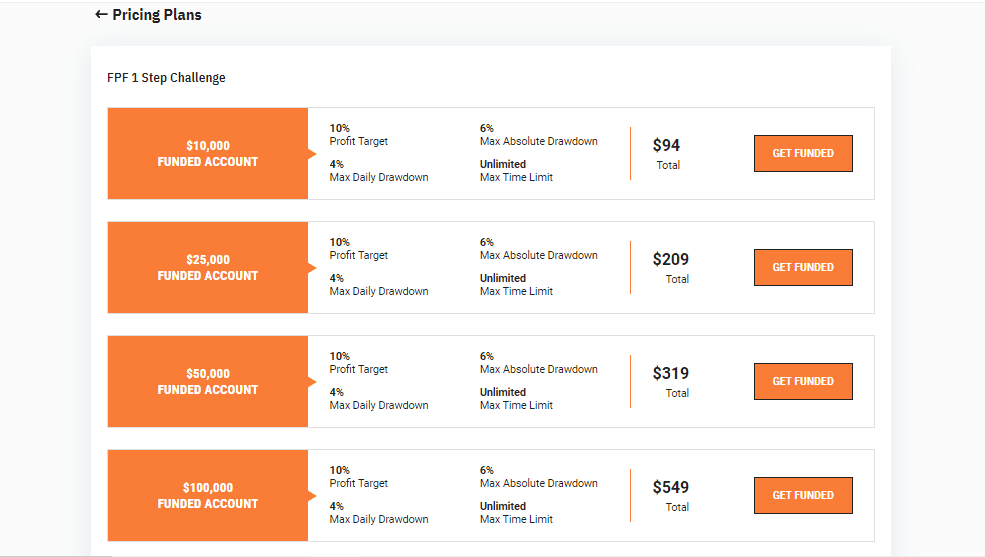

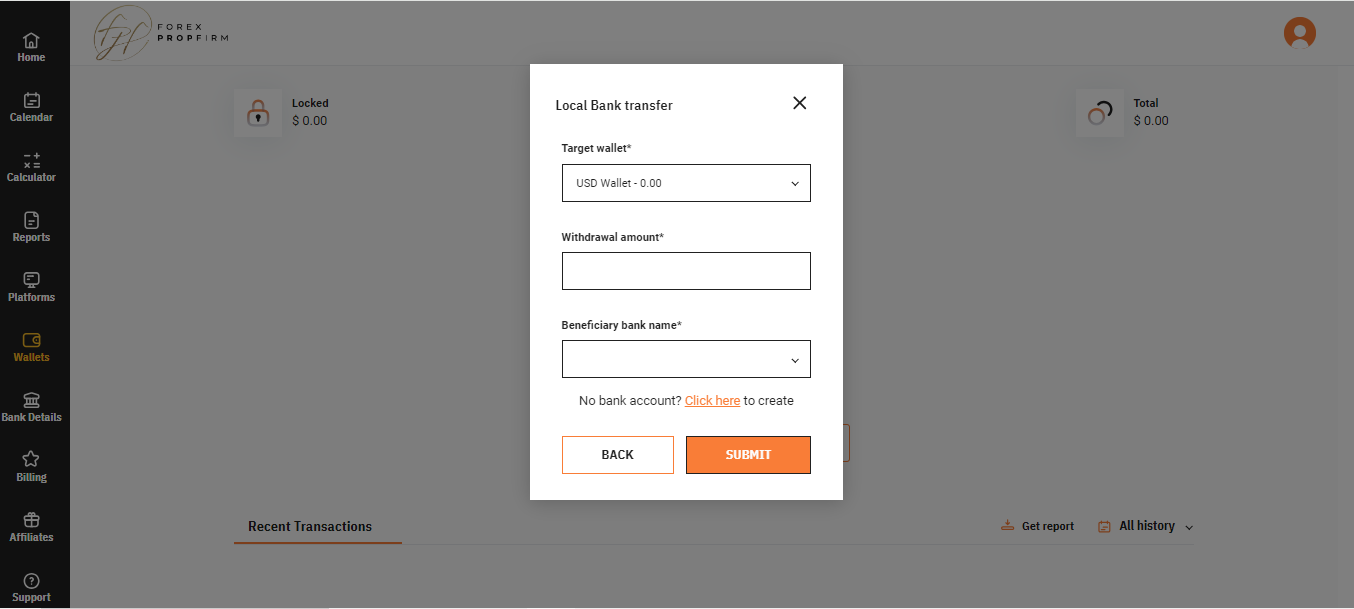

Challenge rules and pricing

Forex Prop Firm provides access to funding up to $10 000 000, with challenges requiring at a minimum of 30 trading days. The entry-level plan starts at $65, min but the fee is non-refundable.

- High funding potential — up to $10 000 000

- Instant funding available

- No free evaluation option

- Above-average entry cost — from $65

Forex Prop Firm Challenge fees and plans

We compared Forex Prop Firm’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| Premium |

|

|

|

|

|

| Advanced |

|

|

|

|

|

| Pro |

|

|

|

|

|

| 1-Step |

|

|

|

|

|

| 2-Step |

|

|

|

|

|

| 2-Step Pro |

|

|

|

|

|

| 3-Step |

|

|

|

|

|

What’s the minimum trading period for Forex Prop Firm’s challenge?

A minimum of 30 trading days is required, regardless of how quickly you reach the profit target.

Does Forex Prop Firm offer a free evaluation?

No, Forex Prop Firm does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Forex Prop Firm?

Yes, Forex Prop Firm offers instant funding. Details may vary by plan, so we recommend checking the latest terms on the company’s official website.

Trading rules

Forex Prop Firm outlines the main rules for funded accounts, including a max. loss of 5% and a daily loss limit of 0%. The firm also restricts certain trading strategies, which are detailed below.

- News trading allowed

- Trading bots (EAs) allowed

- Flexible leverage up to 1:30

- Strict max loss

- Copy trading not allowed

Forex Prop Firm trading conditions

We compared Forex Prop Firm’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Forex Prop Firm | Hola Prime | SabioTrade | |

| Max. loss, % | 5 | 5 | 6 |

| Max. leverage | 1:30 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

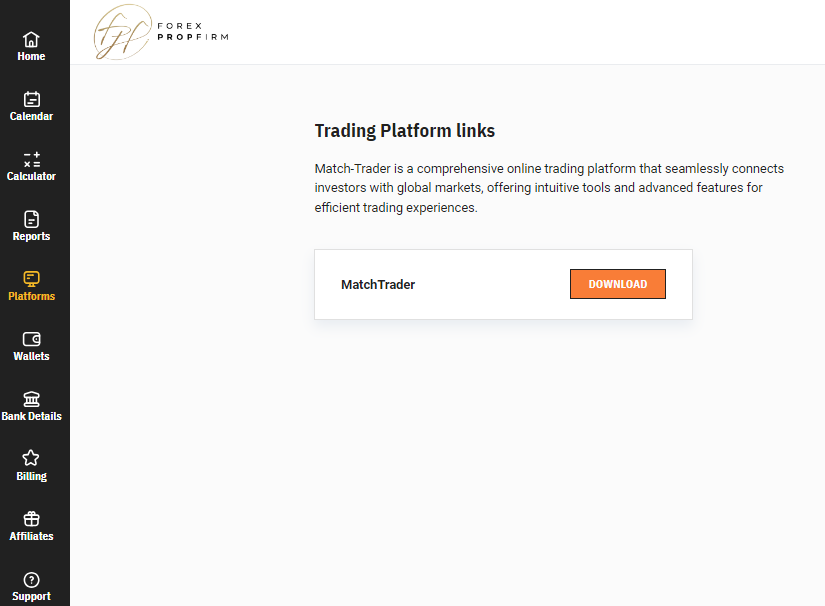

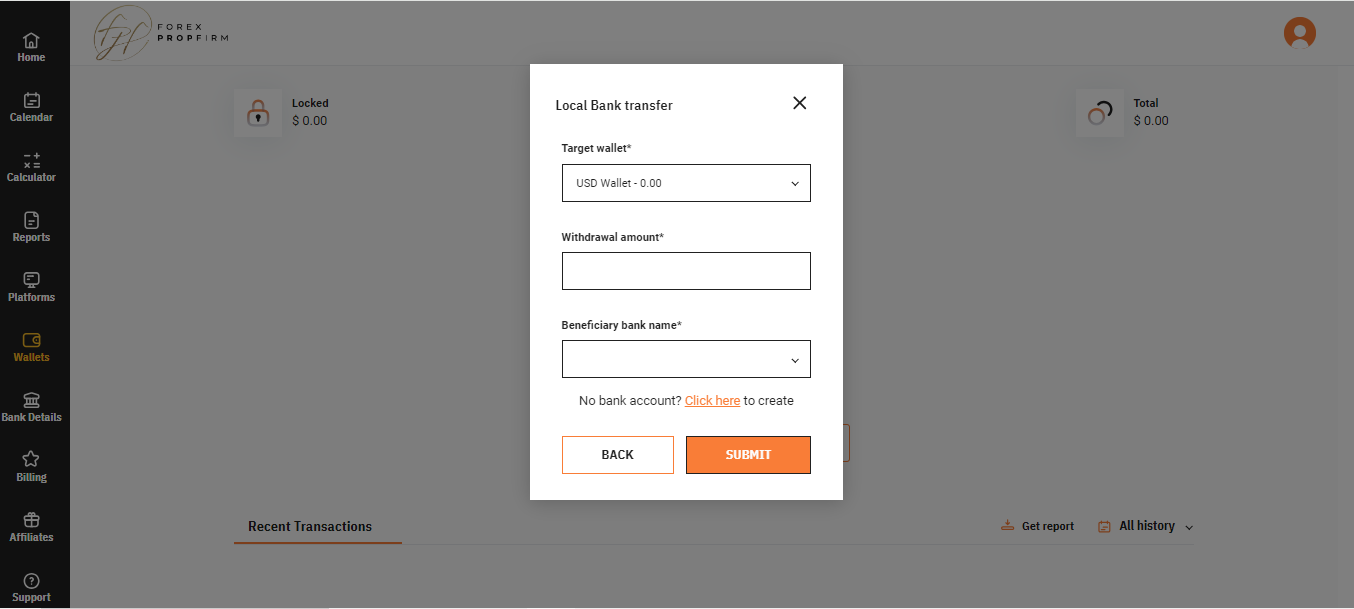

Deposit and withdrawal

Forex Prop Firm earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at Forex Prop Firm meet most standard requirements and are in line with what many prop firms provide.

- Weekly payouts

- Bank сard deposits and withdrawals

- Supports bank wire transfers

- No on-demand withdrawals

- Wise not supported

- Payoneer not supported

Deposit and withdrawal options

To help you evaluate how Forex Prop Firm performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Forex Prop Firm Payment options vs Competitors

| Forex Prop Firm | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | Yes | No | No |

| Crypto | No | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Forex Prop Firm with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Forex Prop Firm | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | Yes | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

Forex Prop Firm offers the following base account currencies:

Trading Account Opening

To sign into the user account on the FPF website, enter your email and password. Unregistered users have to create a user account, using the instructions below:

Choose the account type from the Models section on the firm’s website.

Next, enter your first and last names, phone number, and email. Make a password and specify how you learned about FPF.

Make a one-time payment to subscribe to a chosen program.

Features of FPF’s user account that allow traders to:

Additional features of Forex Prop Firm’s user account allow traders to:

-

Access real-time economic calendar;

-

Use margin and position size calculators;

-

View reports on executed trades;

-

Manage their bank account;

-

View statistics on the referral program.

Regulation and safety

Forex Prop Firm is managed by 9452-8635 Quebec Inc., incorporated in Canada under the number 1177044626 and registered by Enterprise Register (Services Quebec). The Legal Entity Identifier (LEI) is 98450089B805D45B0B13.

Canadian regulators are FINTRAC (the Financial Transactions and Reports Analysis Center of Canada) and IIROC (the Investment Industry Regulatory Organization of Canada) which supervise securities and capital markets and provide protection for retail investors. Since FPF is not a stock or Forex broker, it is not obliged to obtain licenses from FINTRAC or IIROC. However, Eightcap, the broker used by FPF clients, is licensed by the FCA, ASIC, CySEC, and SCB (the Securities Commission of the Bahamas).

Advantages

- Partnership with a regulated broker

- Fair trading conditions and regulatory supervision

- FPF holds funds with major banks in Canada, the UAE, and the U.S.

Disadvantages

- Traders cannot choose an introducing broker or a trading platform

- Leverage is limited to 1:30

- No guarantees for the absence of technical issues with trading platforms

Markets and tradable assets

Forex Prop Firm has a score of 3.5/10, which corresponds to a Low assessment of its market and asset offering.

- Forex trading supported

- Indices available

- Stock trading allowed

- CFDs not offered

- Futures not available

Tradable markets

We compared the range of tradable instruments offered by Forex Prop Firm with two leading competitors to highlight the differences in market access.

| Forex Prop Firm | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | No | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | Yes | No | No |

| Crypto | No | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

FPF does not offer passive income options, as it focuses on providing funds to active Forex traders.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from Forex Prop Firm:

FPF offers a partnership program with rewards for evaluations bought by referrals. Rewards vary depending on the number of referred traders. The reward structure is as follows:

-

1 level with up to 100 referrals — 15% of their payments;

-

2 level with 100-500 referrals — 17.5%;

-

3 level with 500-2,000 referrals — 20%;

-

4 level with over 2,000 referrals — 25%.

To become a partner, it is enough to register for the program without having a user account. The minimum withdrawal amount is $100, payable once a month.

Customer support

FPF’s technical support is available 24/7. Live chat communication is conducted in English.

Advantages

- 24/7 availability

Disadvantages

- Slow operation

- Few communication channels

-

Live chat on the website;

-

Email.

The Contact Us section of the FPF website includes a feedback form that allows traders to provide their phone numbers.

Contacts

| Registration address | 9452-8635 Quebec Inc, 288 Christin, J5z 4n1, Qc, Canada |

|---|---|

| Official site | https://home.forexpropfirm.com/ |

Education

Forex Prop Firm focuses on working with professional traders with a developed trading strategy. Nevertheless, it offers certain educational articles for novice traders on its website.

FPF does not provide educational courses or seminars. Furthermore, traders only gain access to a demo account after making the initial payment.

Comparison of Forex Prop Firm to other prop firms

| Forex Prop Firm | FundedNext | Hola Prime | SabioTrade | Hyrotrader | Gerchik&Co | |

| Trading platform |

Match Trader | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | Bybit’s web platform and mobile apps | MetaTrader5, Match Trader, cTrader |

| Min deposit | $94 | $32 | $48 | $119 | $89 | $29 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

80% / 50% | No | No | 100% / 50% | No | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed Forex Prop Firm review

Forex Prop Firm offers a wide range of funding programs and over 1,000 Forex and CFD assets. Traders can use any trading styles and strategies on demo and live accounts, while stop loss is not required as with other prop firms. FPF has a unique offer: it pays 10% of profits from trading on a demo account during the first withdrawal.

Forex Prop Firm by the numbers:

-

20,500+ satisfied clients;

-

4,100+ funded traders;

-

Payouts exceed $7 million;

-

Maximum funding is $10 million.

Forex Prop Firm is a prop trader offering numerous programs designed to identify certified traders

FPF offers four funding models. The first model implies a 1-step evaluation on a demo account with no time limits. The profit target is 10% of the initial balance with a maximum daily drawdown of 4% and a total drawdown of up to 6%. The second model is a 2-step evaluation available in two options: with time limits of 35 days for phase 1 and 60 days for phase 2, and without time limits but with more strict requirements on a profit target. The profit split after both options is 90%/10%.

Also, FPF offers an instant funding program where traders work on a live account starting from the first day. Three options are available: Pro with a profit share of 20%, Advance with a 50% profit, and Premium with a profit share of 80%.

Useful services offered by Forex Prop Firm:

-

Blogs. It features useful information on Forex for novice traders and describes FPF’s terms of service and details of offered programs.

-

Trading Competition. The top 50 participants receive a free challenge account and bonuses, while the first prize is $1,000.

-

Scaling Plan. Funded traders showing stable deposit growth can get up to $10 million from the firm. To get these funds, they are required to invest 10% of their profits in trading.

-

Live Chat. Its operators are available 24/7 to help with any issues and answer questions from active traders and potential clients.

Advantages:

The firm’s clients can trade during news releases and execute trades with CFDs on cryptocurrencies 24/7;

One-time payment applies to 2-step evaluations;

Residents of any country can become FPF’s partners;

It is allowed to leave open positions when the market is closed;

24/7 technical support is available via email and live chat.

Traders can withdraw funds twice a month without closing open trades.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i