According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MetaTrader5

- TradeLocker

- DXTrade

- News trading, swing trading, and limited EAs are allowed.

- Up to 1:100

Our Evaluation of Funding Traders

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Funding Traders is a prop trading firm with higher-than-average risk and the TU Overall Score of 4.09 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Funding Traders clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work.

Funding Traders offers successful traders funding up to $2,000,000, flexible trading conditions, and progressive profit split. Most trading strategies are allowed, including holding positions overnight and over the weekend. However, arbitrage, martingale, and high-frequency trading (HFT) are prohibited.

Brief Look at Funding Traders

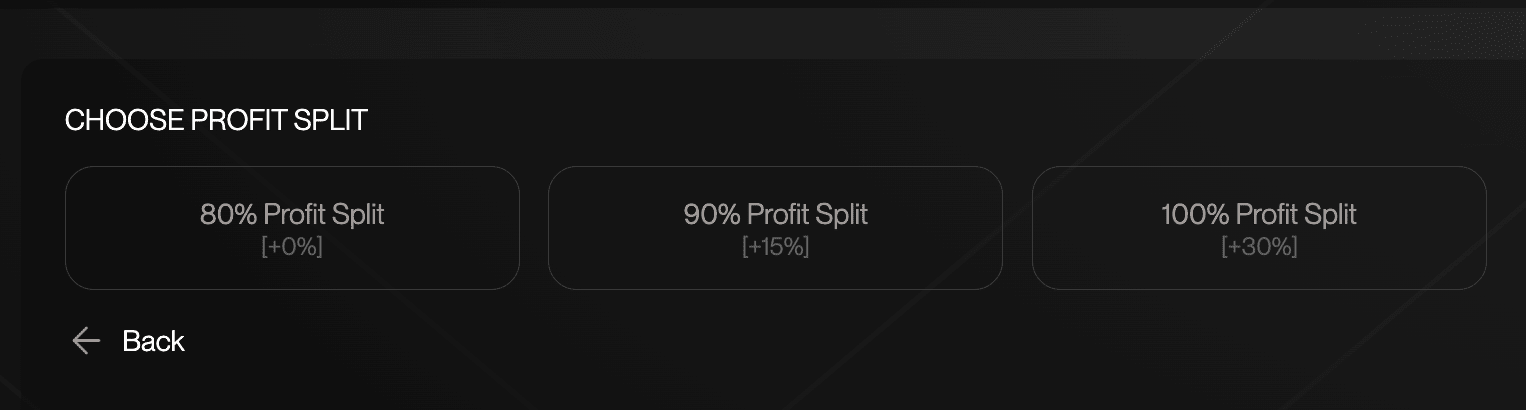

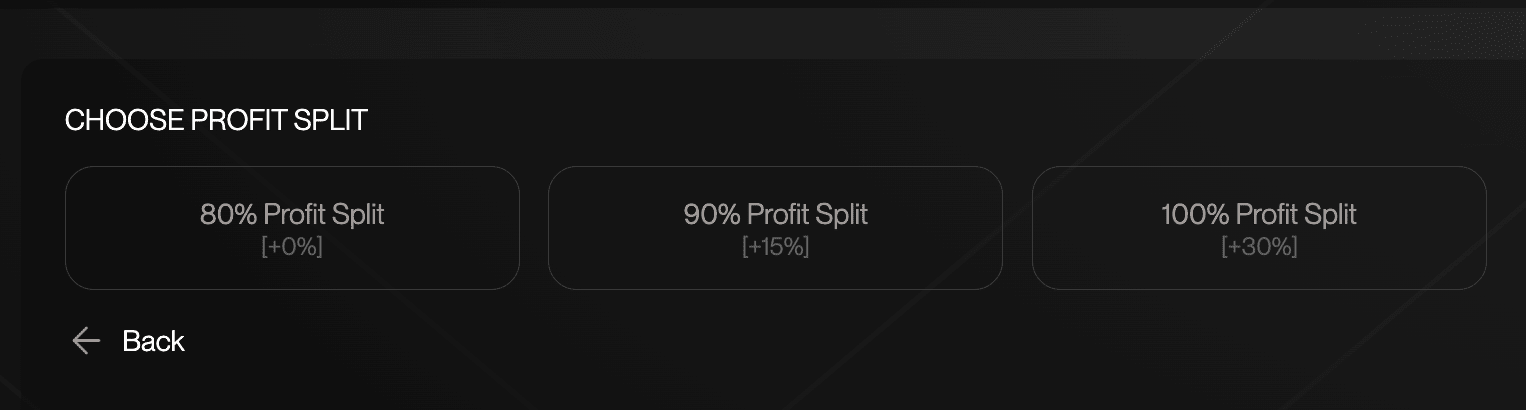

Funding Traders, a proprietary trading firm founded in 2023, offers funded accounts ranging from $5,000 to $500,000, scalable up to $2 million. Traders can manage multiple accounts and copy trades between them; however, their total managed funds cannot exceed $500,000 during the funded phase. The standard profit split is 80%, with options to increase it to 90%-100%. Funding Traders is registered in the UAE and Hong Kong and claims a global presence in key financial centers, including Miami and the UK.

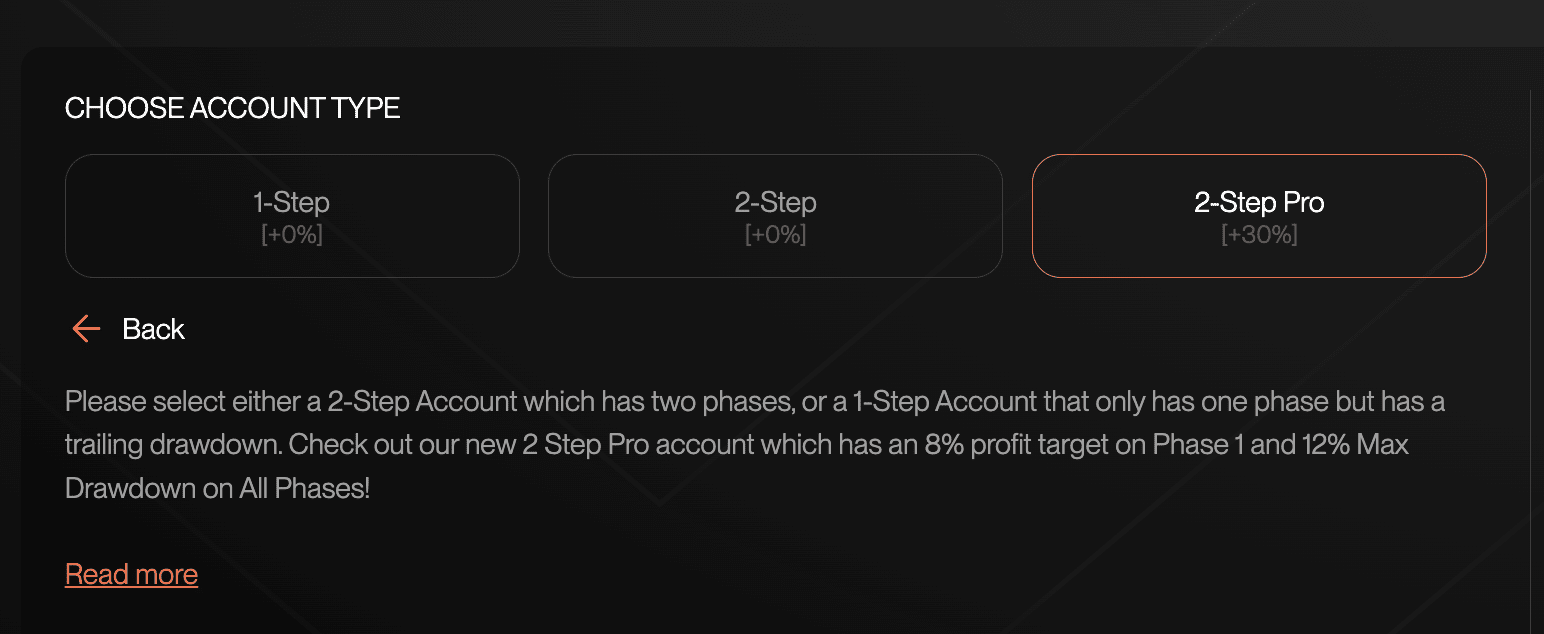

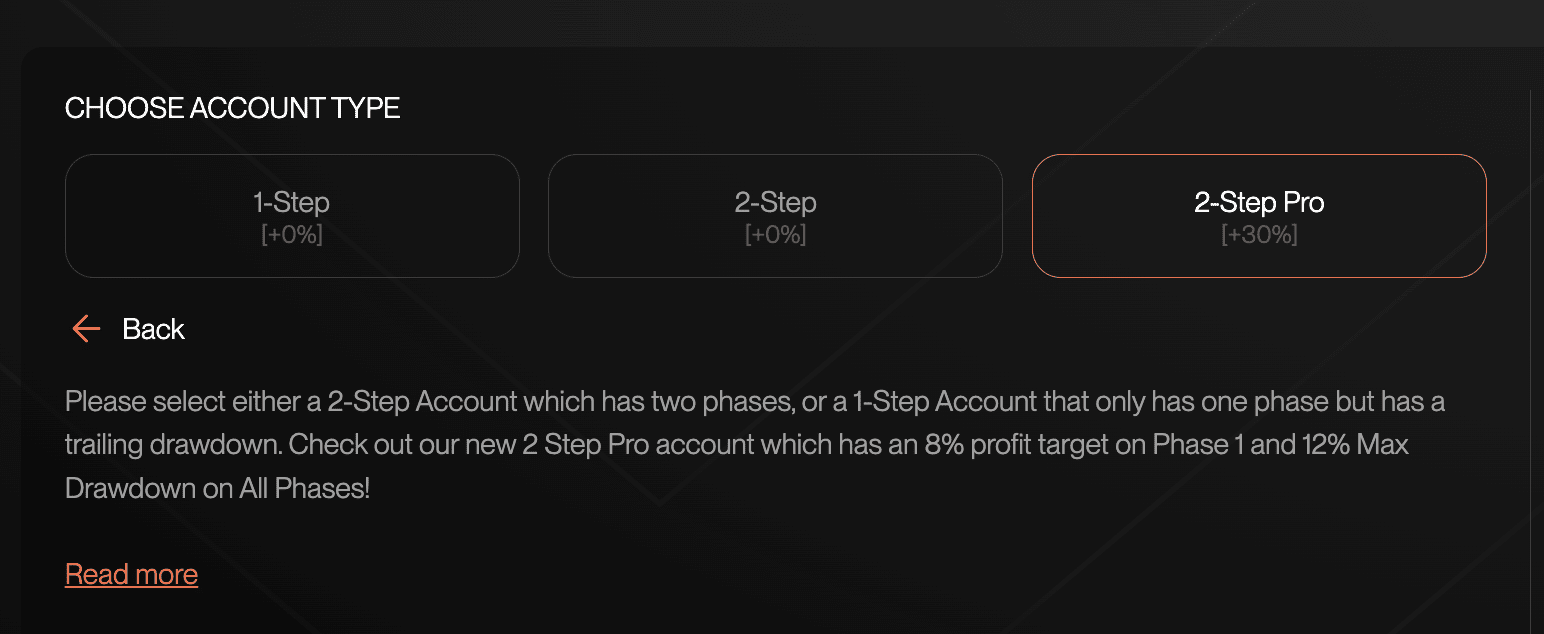

- 1-step and 2-step programs are available;

- Profit split is 80%, 90% or 100%;

- Multiple trading platforms are provided;

- Scaling plan for Apex and Elite accounts is offered.

- No instant funding program;

- Large deposit accounts are subject to minimum trading day and transaction requirements.

TU Expert Advice

Author, Financial Expert at Traders Union

Funding Traders is a proprietary trading firm offering various account types, from $5,000 to $500,000, scaling up to $2 million for successful traders. It provides a flexible profit split, starting at 80% and potentially rising to 100%, with trading available on MetaTrader 5 and DXTrade platforms. Traders enjoy the ability to hold positions overnight and over weekends, while leveraging up to 1:100 for Forex and indices. The firm supports most trading strategies, including swing trading and the use of EAs, though certain high-risk strategies like arbitrage and martingale are restricted.

However, Funding Traders presents several drawbacks. There is no provision for instant funding, and larger accounts must adhere to minimum trading days and transaction requirements, which may not suit all traders. Additionally, the absence of a financial license could be a concern for those prioritizing regulatory oversight. The firm is potentially more suitable for experienced traders who are comfortable with the requirements and restrictions, rather than beginners or those preferring low-risk, passive investment strategies.

Funding Traders Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 5, TradeLocker, and DXtrade |

|---|---|

| 📊 Accounts: | Standard: Rapid 1-Step Program, Classic Funding 2-Step Program, and 2-Step Pro programVIP: Apex and Elite |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: |

Deposits: Visa, Mastercard, American Express, and Discover; Withdrawals: bank transfers via Rise and cryptocurrencies |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | Floating from 0 pips |

| 🔧 Instruments: | Forex, indices, metals, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market and limit |

| ⭐ Trading features: | News trading, swing trading, and limited EAs are allowed. |

| 🎁 Contests and bonuses: | Yes |

Funding Traders does not require stop-loss orders. Leverage up to 1:100 is available for currencies, 1:50 for indices and gold, and 1:5 for cryptocurrencies. Trading from multiple IP addresses and VPNs is allowed. Martingale and arbitrage strategies are prohibited due to their inherent risk. Holding positions overnight and over weekends is allowed, and there are no lot size restrictions.

Funding Traders Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

Funding Traders provides access to funding up to $2 500 000, with challenges requiring at a minimum of No time limits trading days. The entry-level plan starts at $49, min but the fee is non-refundable.

- Low entry cost — from $49

- High funding potential — up to $2 500 000

- Instant funding available

- No free evaluation option

- No demo account provided

Funding Traders Challenge fees and plans

We compared Funding Traders’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| 1 Step Knight |

|

|

|

|

|

| 1 Step Knight Pro |

|

|

|

|

|

| 2 Step Royal |

|

|

|

|

|

| 2 Step Royal Pro |

|

|

|

|

|

| 3 Step Dragon |

|

|

|

|

|

What’s the minimum trading period for Funding Traders’s challenge?

No minimum trading days. You can complete the challenge as soon as you reach the profit target.

Does Funding Traders offer a free evaluation?

No, Funding Traders does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Funding Traders?

Yes, Funding Traders offers instant funding. Details may vary by plan, so we recommend checking the latest terms on the company’s official website.

Trading rules

Funding Traders outlines the main rules for funded accounts, including a max. loss of 6% and a daily loss limit of 3%. The firm also restricts certain trading strategies, which are detailed below.

- Scalping allowed

- Trading bots (EAs) allowed

- Copy trading allowed

- Weekend close required

- News trading not allowed

Funding Traders trading conditions

We compared Funding Traders’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Funding Traders | Hola Prime | SabioTrade | |

| Max. loss, % | 6 | 5 | 6 |

| Max. leverage | 1:200 | 1:100 | 1:30 |

| Weekend close rule | Yes | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | No | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | Yes | No | No |

Deposit and withdrawal

Funding Traders earned a Low score based on how smoothly and conveniently traders can deposit and withdraw funds.

Funding Traders's limited selection of payment methods and supported currencies may reduce its convenience and global accessibility.

- Weekly payouts

- Bank сard deposits and withdrawals

- USDT payments not supported

- Limited base currency options

Deposit and withdrawal options

To help you evaluate how Funding Traders performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Funding Traders Payment options vs Competitors

| Funding Traders | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | No | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Funding Traders with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Funding Traders | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | Yes | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

Funding Traders offers the following base account currencies:

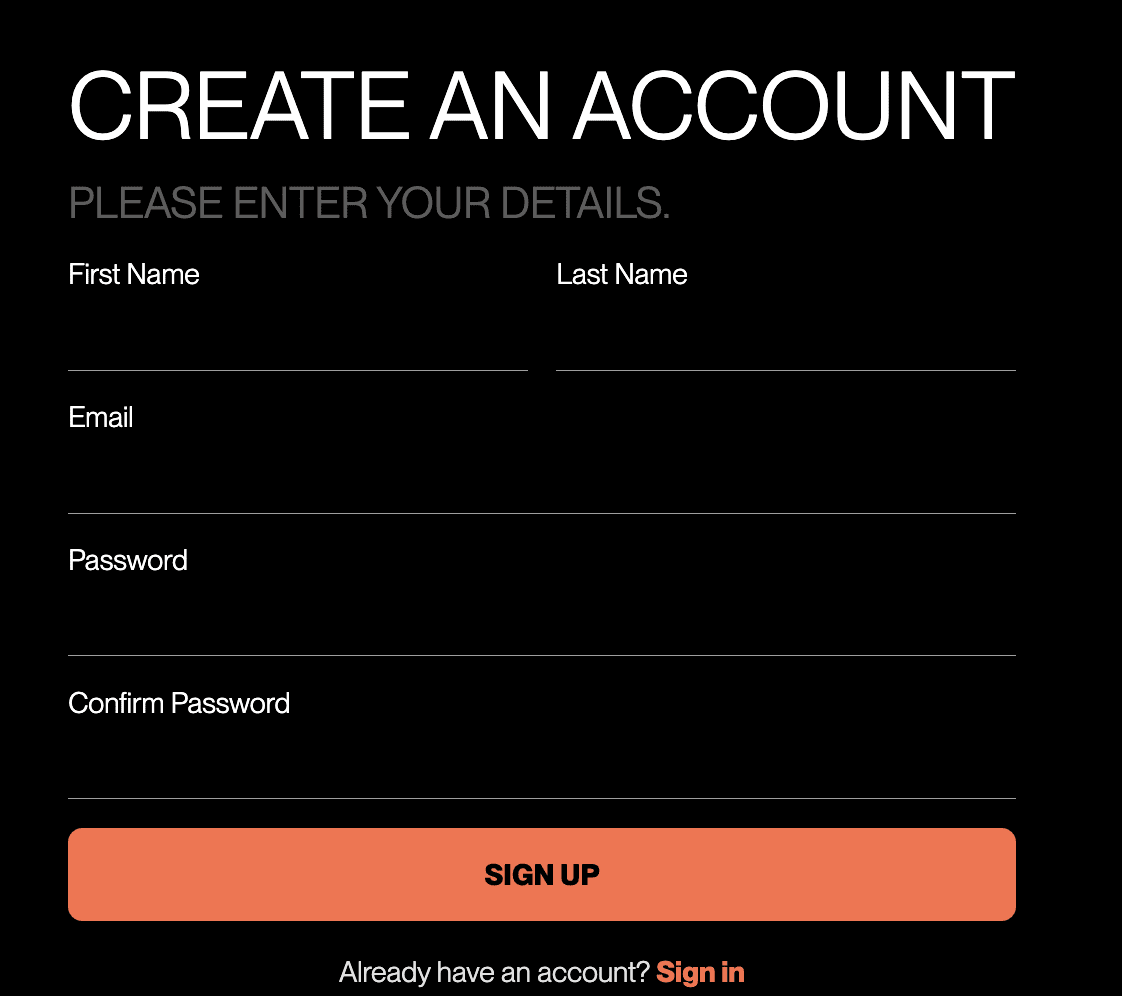

Trading Account Opening

To start trading with a virtual deposit at Funding Traders, register on its website and follow the steps described below:

Go to the Funding Traders website and click Get Funded or Buy Challenge.

Fill out the registration form with your personal details.

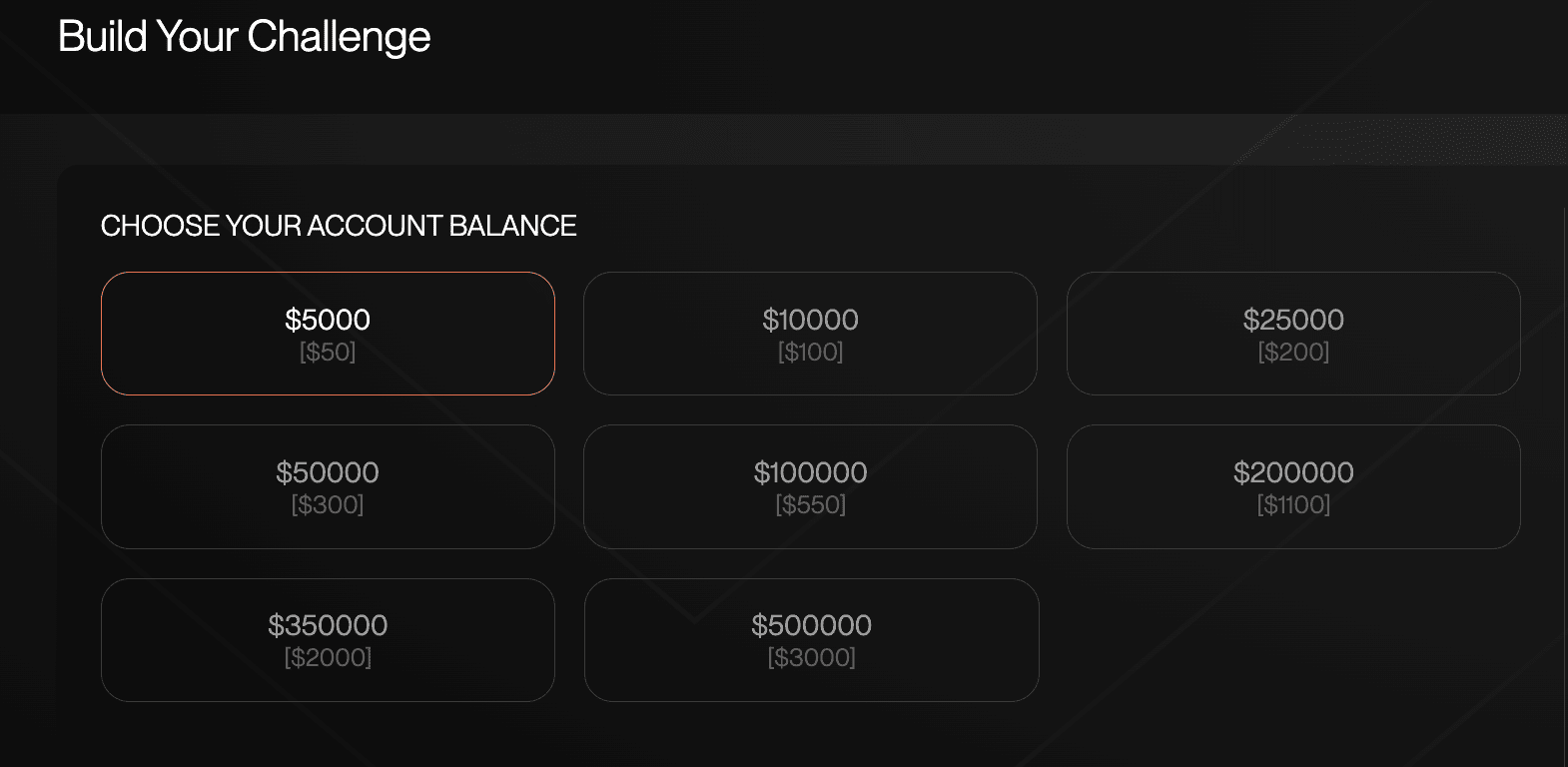

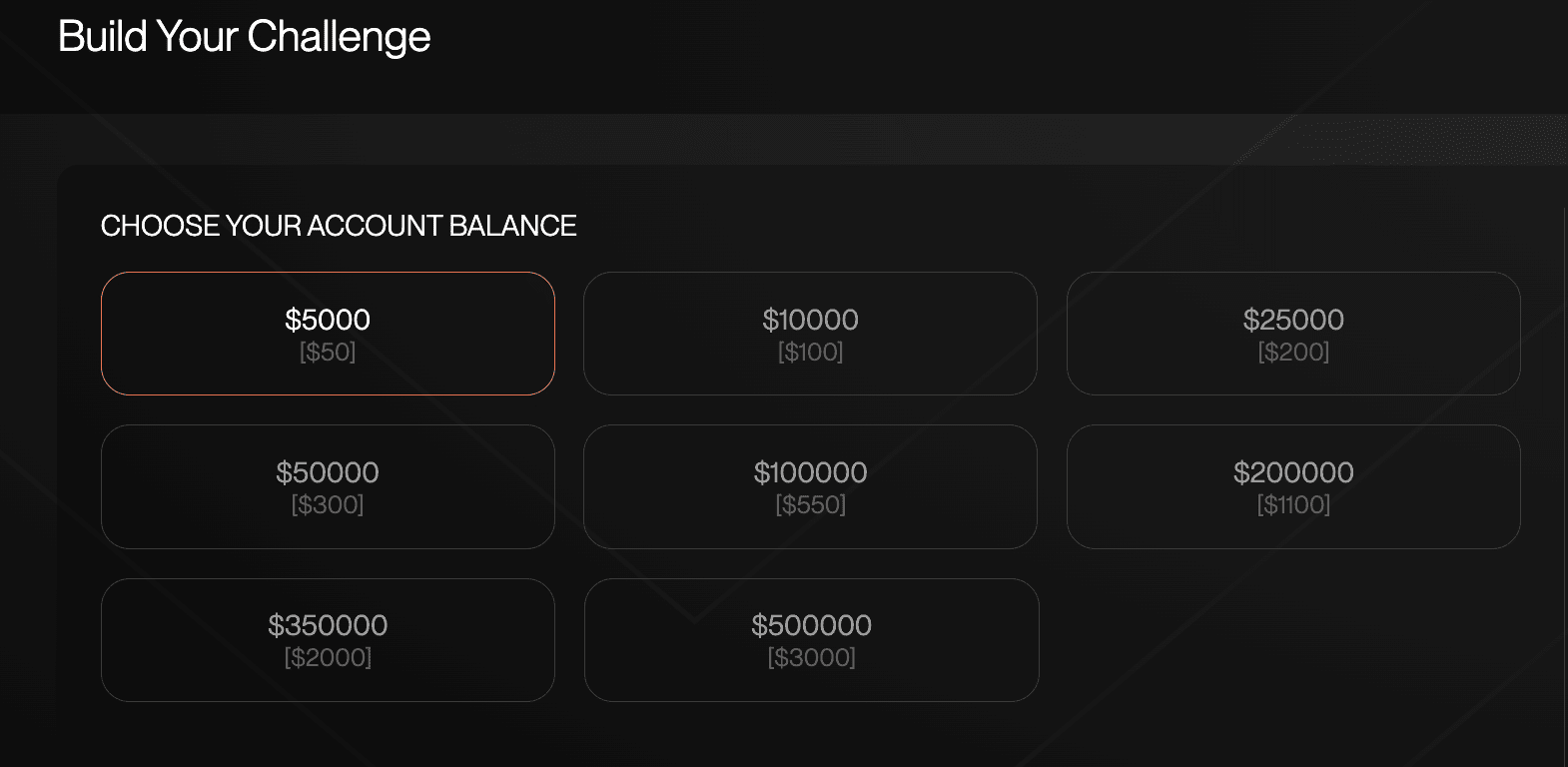

Once you log into your user account, choose the desired account balance. The subscription fee is shown next to each account size.

Choose the challenge type and the trading platform.

Choose the profit split.

Features of the user account allow traders to:

-

Pay for a challenge;

-

Install a trading platform;

-

View statistics on their profits;

-

View payment history and request withdrawals;

-

Visit the affiliate section.

Regulation and safety

Funding Traders is operated by MCF Group FZCO, registration number DSCO-FZCO-24876, located in Dubai Silicon Oasis (DSO). DSO is a free economic zone designed to promote advanced technologies and innovation in Dubai.

This registration confirms that MCF Group FZCO is officially registered in this jurisdiction; however, it does not constitute a financial license to provide brokerage or investment services.

Advantages

- Dual registration in the UAE and Hong Kong

- Client payment details are protected

Disadvantages

- Disputes with clients are resolved without third-party involvement

Markets and tradable assets

Funding Traders has a score of 2.5/10, which corresponds to a Low assessment of its market and asset offering.

- Forex trading supported

- Indices available

- Options not supported

- Crypto trading unavailable

Tradable markets

We compared the range of tradable instruments offered by Funding Traders with two leading competitors to highlight the differences in market access.

| Funding Traders | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | No | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | No | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

Funding Traders allows copy trading only between traders’ own accounts, enabling efficient management of multiple strategies. However, copying trades from other traders and sharing trading signals are strictly prohibited and considered a violation of conditions.

The firm supports the use of EAs and bots for automation and enhanced trading efficiency, particularly those designed for risk and position management. Ready-made EAs purchased online are permitted only for risk management purposes. Grid trading EAs are prohibited.

Partnership program from Funding Traders:

Funding Traders’ affiliate program offers the opportunity to earn additional income for referring other traders. It features a tiered structure and additional bonuses for performance.

Levels of the program:

-

Start — 10% commission on the referrals’ subscription fee;

-

Advance — 15% commission, available upon certain trading volume;

-

Pro — 20% commission, available for partners with a large number of referrals.

In addition to standard commissions, partners can earn bonuses for consistent performance and high referral volume. Attracting 25, 50, or 100 clients per month qualifies them for the Rapid program with funding of $25,000, $50,000, and $100,000, respectively.

Customer support

Funding Traders provides online client support via multiple channels.

Advantages

- Live chat is active 24/7

- Online support on any issues

Disadvantages

- No phone assistance

Available communication channels:

-

Live chat;

-

Email;

-

Feedback form;

-

Discord.

The firm has profiles on Instagram, X, Telegram, and YouTube.

Contacts

| Registration address | IFZA Business Park, DDP - 001, A1 - 3641379065, Dubai |

|---|---|

| Official site | www.fundingtraders.com |

| Contacts |

Education

Funding Traders offers educational resources to help traders improve their skills, learn effective strategies, and prepare for successful trading. These materials include analytical reviews, educational programs, and personalized professional advice.

Funding Traders offers high-quality educational resources tailored for both novice and experienced traders looking to develop professionally.

Comparison of Funding Traders to other prop firms

| Funding Traders | FundedNext | Hola Prime | SabioTrade | FTMO | OneUp Trader | |

| Trading platform |

DXTrade, MetaTrader5, TradeLocker | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader4, MetaTrader5, cTrader, DXTrade | Ninja Trader, RTrader, iTrader, Photon, QScalp |

| Min deposit | $50 | $32 | $48 | $119 | $155 | $125 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:1 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | 50% / 50% | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | Instant Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed Funding Traders review

Funding Traders offers flexible trading conditions, allowing traders to use various styles and strategies without strict limitations. Clients can hold positions overnight and over weekends, use EAs, and trade on news. The firm also offers a competitive profit split — the standard split is 80%, but successful traders can increase their share to 90% or even 100%. The higher profit split is also available to any client for an additional fee.

Funding Traders by the numbers:

-

The firm was established in 2023;

-

$4.7 million in total payouts for 2023;

-

Over 5,200 clients;

-

Single payout exceeds $20,000;

-

Average withdrawal time is 4 hours.

Funding Traders is a prop trading firm with a well-designed risk management system and trading activity requirements

To mitigate risk, substantial drawdowns, and potential account closure, Funding Traders clients must comply with standard proprietary trading rules. Specifically, traders must maintain consistent position sizing, limiting risk per trade to 2% of their initial account balance. High-risk strategies are prohibited to ensure sustainable profitability.

Minimum trading day requirements are as follows: 1 day for accounts from $5,000 to $100,000; 7 days for $200,000 accounts; 25 days for $350,000 accounts; and 40 days for $500,000 accounts. Large accounts also have minimum trade requirements: 15 trades for $350,000 accounts and 20 trades for $500,000 accounts. Each trade must be at least 0.2% of the account's initial balance.

Useful services offered by Funding Traders:

-

Analytics and educational resources, including webinars, strategy analysis, and psychological training;

-

Affiliate program with rewards up to 20% and bonuses for referred clients;

-

Elite and Apex accounts with funding of $1 million and $2 million, respectively, for professional traders with proven track record;

-

20% discount on challenge repurchases after a failed evaluation.

Advantages:

Floating spreads starting from 0 pips;

Flexible trading conditions;

Cryptocurrency withdrawals;

No trading fees during evaluation;

Competitive leverage for trading major currency pairs.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i