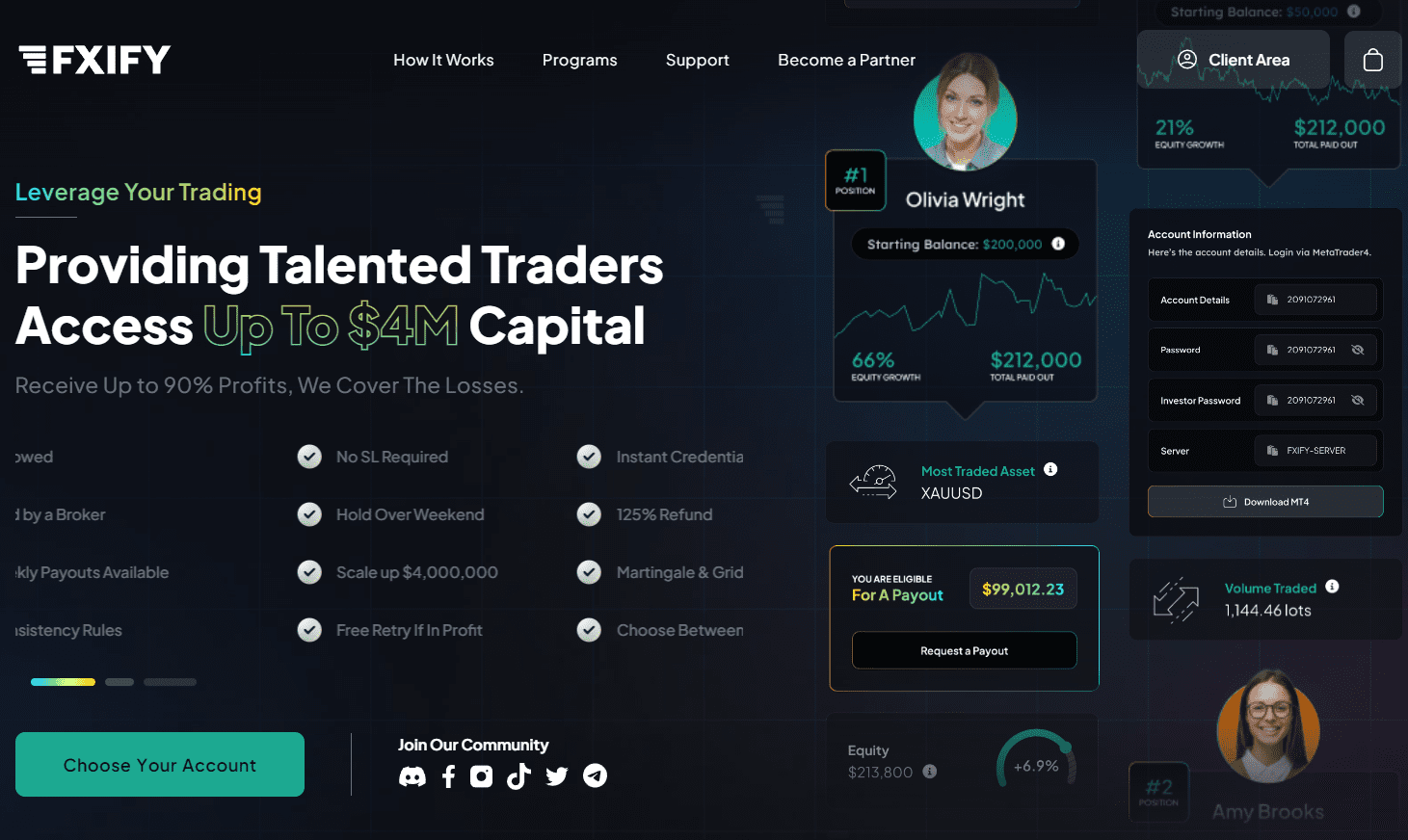

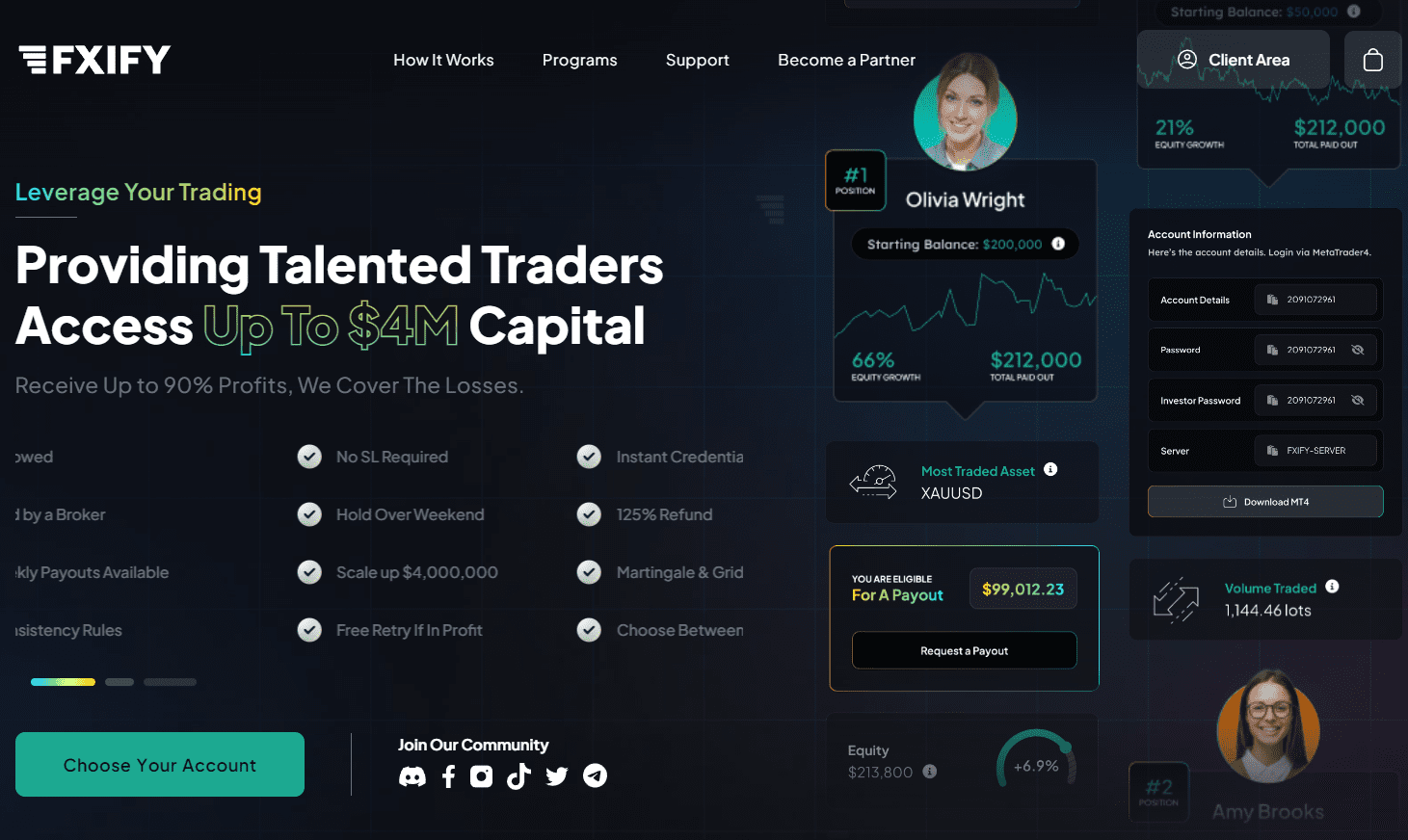

FXIFY Opiniones 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $39

- MetaTrader4

- MetaTrader5

- DXTrade

- Accounts with one or two challenge phases, 6 balance steps (plus scaling), the fee is refundable, no monthly subscription fee, no trading restrictions, moderate leverage, and lots of assets

- Up to 1:50

Our Evaluation of FXIFY

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FXIFY is one of the best proprietary trading firms in the financial market with the TU Overall Score of 9.47 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FXIFY clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company.

FXIFY offers comfortable working conditions. The challenges are fairly straightforward (10% target profit or 10%/5% over two phases). There are enough assets to diversify risk and apply a wide range of strategies, without restrictions imposed by the company. Moderate leverage ensures higher profit potential. The trader's fee is competitive and can be increased over time with successful trades. The referral program offers additional earnings. Please note that FXIFY has regional restrictions.

Brief Look at FXIFY

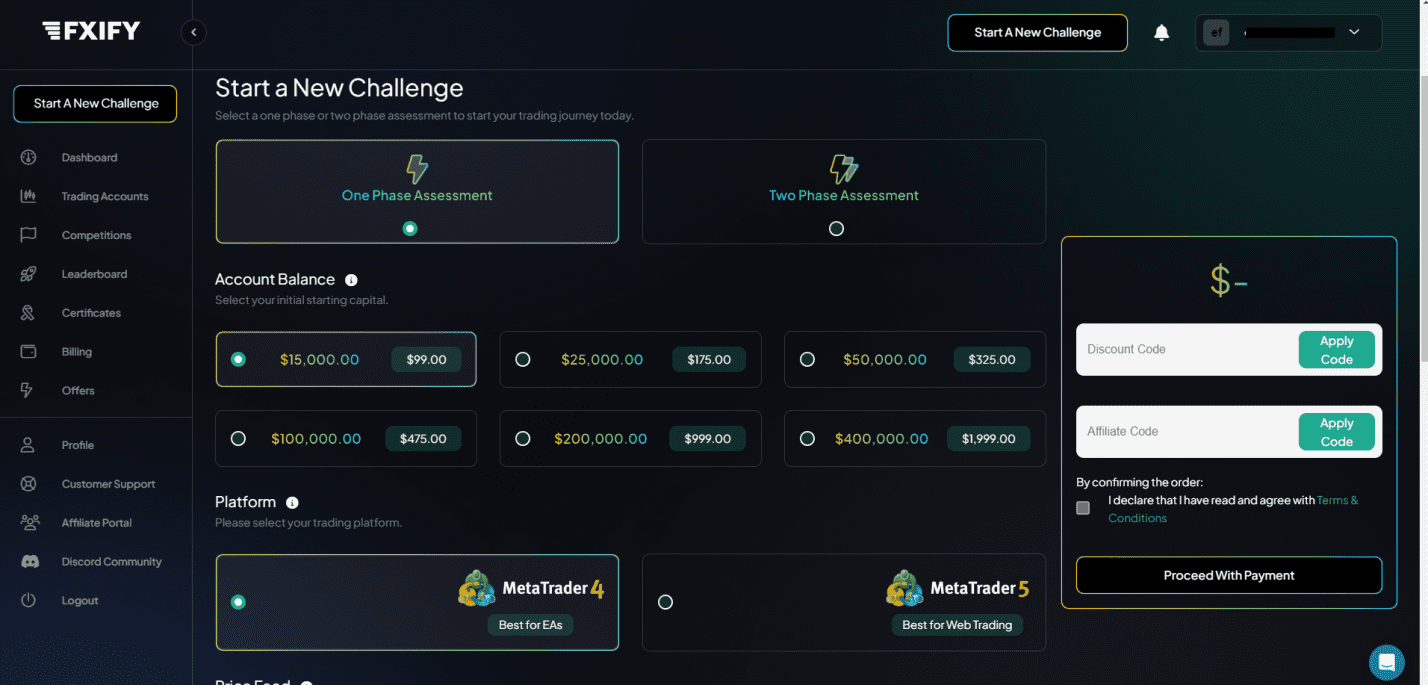

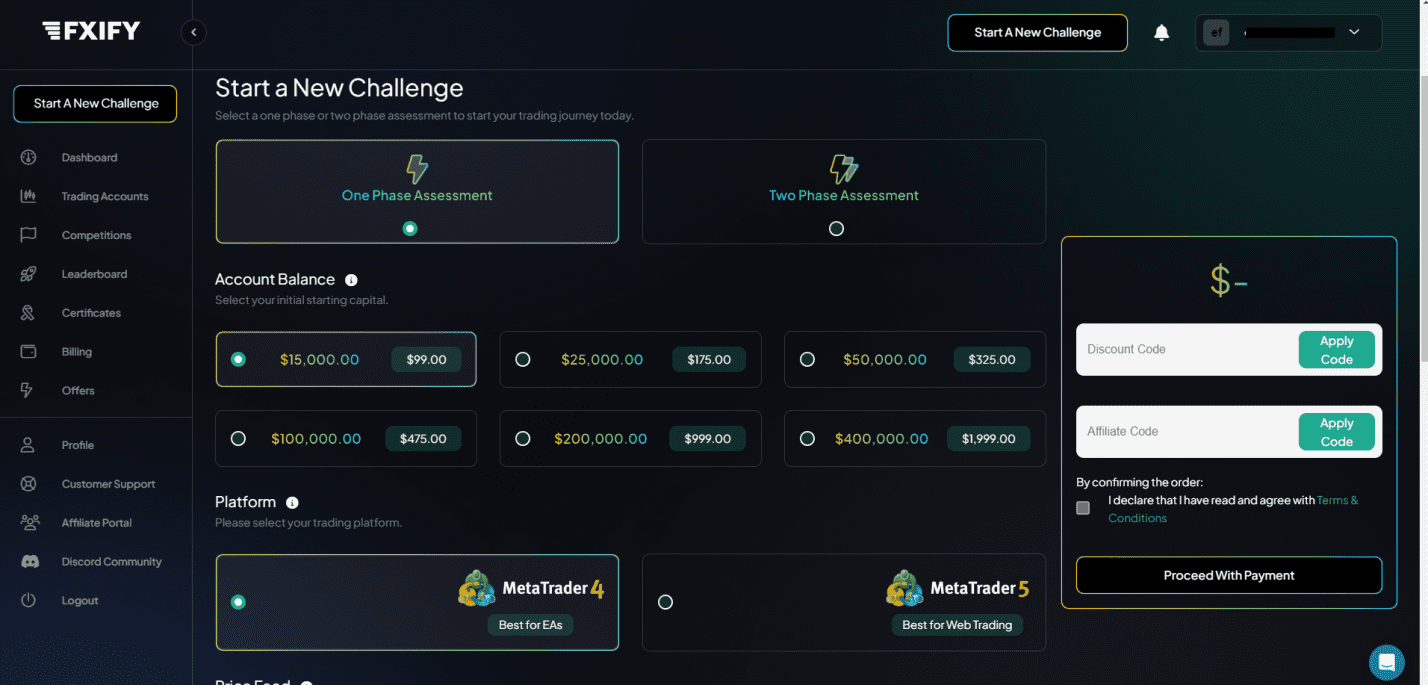

The prop-trading company FXIFY offers two types of accounts, with one and two challenge phases. The difference is that accounts with one phase have a maximum drawdown limit of 6%, while accounts with two phases must not exceed a drawdown of 10%. For each type of account, there are six funding options ranging from $15,000 to $400,000, with the possibility of scaling up to $4 million. The initial contribution varies depending on the amount of funding received, ranging from $99 to $1,999. Once the challenge is completed, the contribution is returned at 125% (meaning that the trader receives an additional 25% of the deposit in his trading account). Initially, the client's share of the prop-trading company's profits is 75%, which can be increased to 90% during trading. Available assets include currency pairs, stocks, indices, gold and cryptocurrencies. Maximum leverage is 1:50, and most major deposit and withdrawal methods are available. No training is provided, and a standard referral program is offered.

Important. The MetaTrader platform is not available to US clients. Traders from this country can use the DX platform.

- Challenge in one or two phases with 25% bonus contribution back, and 6 financing options.

- Traders can trade up to $400,000 ($4 million during scaling), with profit percentages ranging from 75% to 90%.

- Deposit/withdrawal methods include wire transfers, credit cards, PayPal and cryptocurrency wallets.

- There are no trading restrictions, allowing scalping, hedging, and news trading.

- The daily drawdown allowed is up to 5%; generally up to 6% or 10%.

- The company's prop-trading partner program allows earning up to 20% of the initial referral contribution, in addition to other bonuses.

- Traders use top-notch MT4 and MT5 trading platforms with individual customization.

- The first profit withdrawal can be made at any time upon request, after no more than once every two weeks with a prior request.

- 5 types of assets are presented, but the set of financial instruments is smaller compared to many competitors.

- Residents of Ukraine, Syria, Iran, North Korea and other countries included in the OFAC (Office of Foreign Assets Control) list cannot be clients of the company.

TU Expert Advice

Financial expert and analyst at Traders Union

FXIFY presents an attractive model for South Africa traders interested in flexible trading paths, including instant capital access and performance-based scaling. With MetaTrader and DXtrade platforms, traders can use a wide array of tools across diverse asset classes. The refundable challenge fees and tiered funding system further enhance its appeal for performance-driven individuals.

That said, the platform does have drawbacks: profit withdrawals are limited to bi-weekly, and the educational content is minimal. South Africa traders who value autonomy and flexible execution will find FXIFY a strong contender, but those who depend on automated strategies or require local regulation should proceed with caution.

FXIFY Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | Market |

|---|---|

| 📊 Accounts: | Accounts with one or two challenge phases, 6 balance steps (plus scaling), the fee is refundable, no monthly subscription fee, no trading restrictions, moderate leverage, and lots of assets |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, electronic payment systems, and cryptocurrency wallets |

| 🚀 Minimum deposit: | $39 |

| ⚖️ Leverage: | Up to 1:50 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | Normal or raw from 0 pips |

| 🔧 Instruments: | Currency pairs, stocks, indices, gold, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Accounts with one or two challenge phases, 6 balance steps (plus scaling), the fee is refundable, no monthly subscription fee, no trading restrictions, moderate leverage, and lots of assets |

| 🎁 Contests and bonuses: | Yes |

Most prop-trading companies offer several account types with different balance increments. Depending on the account and balance, the initial contribution varies, as does the subscription fee. FXIFY does not charge its clients for maintenance. Traders only need to pay the contribution, which is returned at 125% upon completing the challenge. The contribution amount ranges from $99 (for a $15,000 balance) to $1,999 (for a $400,000 balance). All accounts have available leverage, depending on the traded asset. The highest leverage is for currency pairs (1:50). Technical support from FXIFY prop-trading company is available through WhatsApp, email, website tickets, and live chat. Managers are reachable 24/5, meaning they operate around the clock but only on weekdays.

FXIFY Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

FXIFY provides access to funding up to $4 000 000, with challenges requiring at a minimum of 5 trading days. The entry-level plan starts at $75, min but the fee is non-refundable.

- High funding potential — up to $4 000 000

- Multiple scaling options

- Flexible trading rules and conditions

- No demo account provided

- Minimum trading period required

FXIFY Challenge fees and plans

We compared FXIFY’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| One Phase |

|

|

|

|

|

| Two Phase |

|

|

|

|

|

| Three Phase |

|

|

|

|

|

What’s the minimum trading period for FXIFY’s challenge?

A minimum of 5 trading days is required, regardless of how quickly you reach the profit target.

Does FXIFY offer a free evaluation?

No, FXIFY does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at FXIFY?

No, FXIFY does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

FXIFY outlines the main rules for funded accounts, including a max. loss of 5% and a daily loss limit of 5%. The firm also restricts certain trading strategies, which are detailed below.

- No weekend close rule

- News trading allowed

- Scalping allowed

- Strict max loss

- Copy trading not allowed

FXIFY trading conditions

We compared FXIFY’s leverage and trading conditions with competitors to help you better understand how it measures up.

| FXIFY | Hola Prime | SabioTrade | |

| Max. loss, % | 5 | 5 | 6 |

| Max. leverage | 1:30 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

FXIFY earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at FXIFY meet most standard requirements and are in line with what many prop firms provide.

- PayPal supported

- Bitcoin (BTC) supported

- Bank сard deposits and withdrawals

- USDT (Tether) supported

- Payoneer not supported

- No on-demand withdrawals

- Limited deposit and withdrawal options

Deposit and withdrawal options

To help you evaluate how FXIFY performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

FXIFY Payment options vs Competitors

| FXIFY | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | Yes | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared FXIFY with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| FXIFY | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | Yes | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

FXIFY offers the following base account currencies:

Trading Account Opening

To start working with a prop-trading company, you need to register on its official website, confirm your identity, choose the account type and the required balance, and then pay the startup fee. After that, you can download the trading platform, and start the Challenge. Below is a step-by-step guide. Experts at TU also describe the features of the user account.

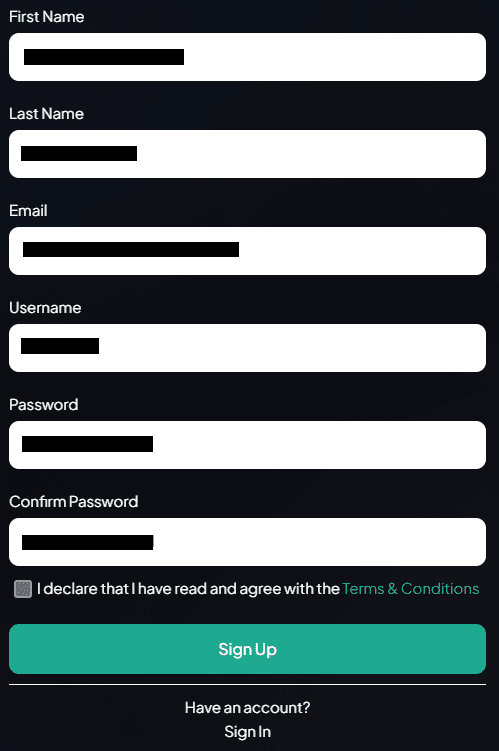

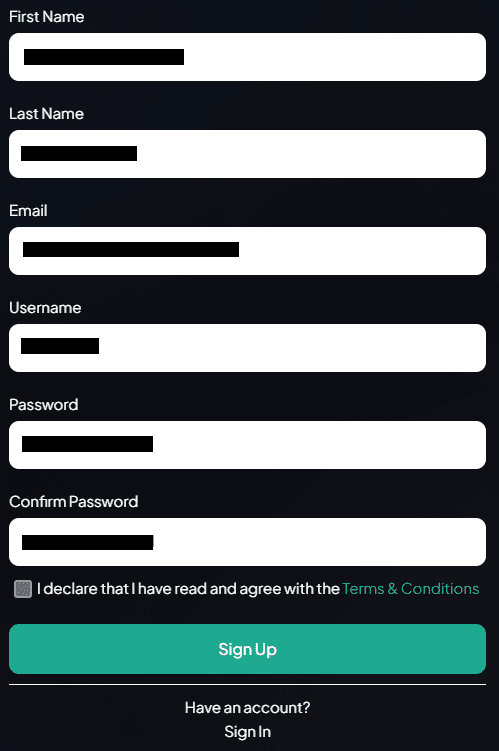

Visit the company's website and click "Client Area" in the top right corner. Alternatively, you can click "Open Account."

If you have login details, enter your username and password. Otherwise, click "Sign Up."

Provide your name, email, and nickname. Create and confirm your password. Read and agree to the collaboration terms by checking the box. Click "Sign Up."

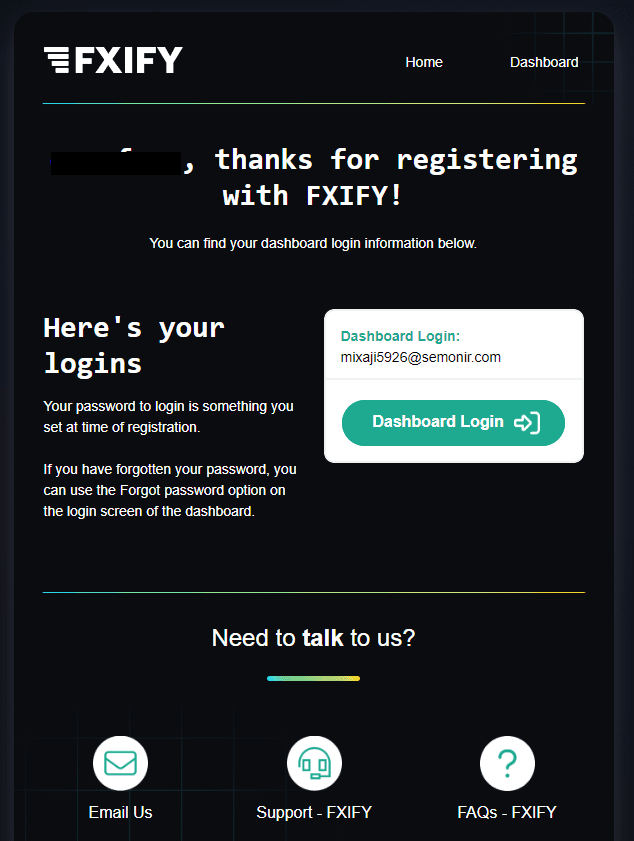

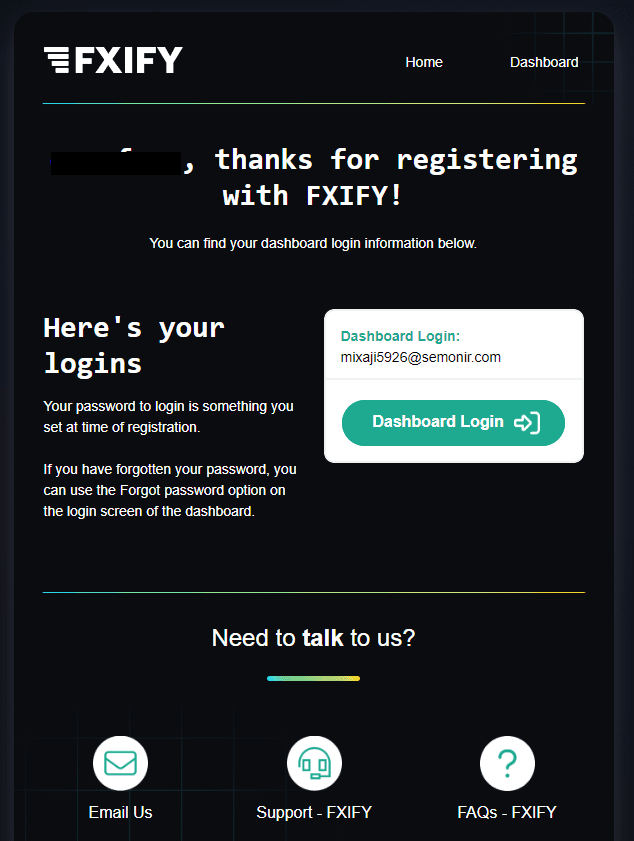

Check your email for a confirmation message. Activate your account by following the provided link.

In the top left corner of the user account, click "Start a New Challenge".

Choose the account type and desired balance. Specify the trading platform you will use and select the spread type and other account parameters.

Enter your registered address. Input any discount and referral codes, if applicable. Agree to the terms by checking the box on the right. Click "Proceed to Payment."

Choose the payment channel, enter the required details, and click "Pay Invoice." Wait for the payment confirmation. Now, download the MT4 or MT5 trading platform, enter your registration details, and begin the challenge. Upon successful completion, you will receive a real account with the specified balance for trading.

Your FXIFY user account also provides access to:

-

View the status of active challenges and real accounts, to obtain detailed information and reports.

-

Initiate new challenges. Opening an account without a challenge is impossible, and all challenge results are archived.

-

Withdraw funds from the account using any available channel. Other channels are discussed individually.

-

Open the referral program, track referral statuses, and receive bonus payments for referrals.

-

Receive special offers (discount codes for partner stores affiliated with the prop-trading company).

-

Adjust personal settings and security parameters and contact technical support.

Regulation and safety

For a broker, it is crucial to have official registration and regulation, whereas prop-trading companies only need to be registered. FXIFY is registered in the United Kingdom, with its headquarters located in London and license number 14451720. The company does not process the trader's transactions or route them to the interbank as it acts only as an investor. FXIFY operates transparently and does not have legal issues.

Advantages

- The company has been operating for several years

- Works with a licensed broker

- Officially registered in the United Kingdom

Disadvantages

- In the event of a dispute, the company's client does not have regional protection beyond the United Kingdom.

Markets and tradable assets

FXIFY has a score of 8/10, reflecting a strong variety of markets and assets available for trading.

- Indices available

- Forex trading supported

- CFDs offered

- Options not supported

- Futures not available

Tradable markets

We compared the range of tradable instruments offered by FXIFY with two leading competitors to highlight the differences in market access.

| FXIFY | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

In essence, this prop-trading company invests in its clients. Traders gain access to significant capital and trades, giving the company a share of the profits. Aside from earning through active trading, the only other income option is the affiliate program, which could serve as a competitive advantage. However, traders should understand that this is by no means passive income.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FXIFY referral program conditions:

To participate, the client must register as a client of the prop-trading company and then fill out a special form. Managers will review and approve the application, after which the trader will gain access to marketing materials. They can freely distribute these materials online. Anyone who joins the company through the trader's invitation becomes their referral. Each referral brings the trader 10% of the initial contribution. After the trader invites 100 people, their payout increases to 15%. After 500 people, it becomes 20%. Additionally, there are three milestones – 50, 250, and 500 active referrals. At each milestone, the prop company's partner receives an account with balances of $25,000, $100,000, and $200,000, respectively.

Customer support

What is the deposit amount for an account with a balance of $100,000? Can funds be deposited from USDT cryptocurrency wallets? Which broker does the prop-trading company collaborate with? If a trader has a question, it is crucial to provide a prompt response. That's why FXIFY offers technical support that is available 24/5. Managers can be contacted via WhatsApp, email, the ticket system, or live chat.

Advantages

- Support operates 24/5

- There are four communication channels available

- Prompt and knowledgeable responses

Disadvantages

- Support is unavailable on weekends.

You can reach out to FXIFY's client service even if you are not a current client of the company. Managers are here to make collaboration with them as comfortable as possible at every stage.

Here are the current contact methods:

-

Email;

-

Tickets;

-

WhatsApp;

-

Live chat on the website and in the user account

Additionally, the prop-trading company is present on various social platforms: Facebook, X (formerly Twitter), Discord, and Instagram (links to accounts are available in the website footer). You can also contact support managers there.

Contacts

| Registration address | 30 Copenhagen Place, London, United Kingdom, E14 7FF |

|---|---|

| Official site | https://www.fxify.com/ |

| Contacts |

Education

In prop-trading companies, there might be basic training provided through thematic articles or video lectures, but overall, this is not a common situation. Most representatives in this field assume that if a trader is ready to receive funding, they understand at least the basics of trading in the markets and are genuinely capable of earning from them. Therefore, FXIFY does not offer training, only FAQs and comments on collaboration terms.

Traders can rely only on their knowledge and experience. Essentially, after grasping the basics and gaining minimal experience, a period of active practice follows. Proprietary trading is not designed for those who have never traded before, such individuals simply won't pass the challenge.

Comparison of FXIFY to other prop firms

| FXIFY | FundedNext | Hola Prime | SabioTrade | The5ers | Forex Prop Firm | |

| Trading platform |

MetaTrader4, MetaTrader5 | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader5 | Match Trader |

| Min deposit | $99 | $32 | $48 | $119 | $39 | $94 |

| Leverage |

From 1:1 to 1:50 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:10 to 1:100 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | 80% / 50% |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | N/a | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of FXIFY

FXIFY, as a prop-trading company, is characterized by a transparent commission policy. In reality, the trader's only cost is the initial contribution, which is returned with a bonus if the challenge is successfully completed. Subsequently, the client leaves 10-25% of the earned profit with the company (the more successful the trading, the greater the trader's share). No fees are charged for withdrawals. However, fees may be incurred by the other party involved in the transaction, such as a bank, cryptocurrency wallet, or electronic transfer system. FXIFY has no relation to these fees.

FXIFY by the numbers:

-

Up to $400,000 initially on the balance (plus scaling).

-

The minimum deposit is $39.

-

Raw spread is from 0 pips.

-

There are 5 groups of financial instruments.

-

Up to 90% of the profit remains with the trader.

FXIFY is a universal prop company with broad capabilities

One of FXIFY's key advantages is its low entry barrier. A trader needs only $99 to access the challenge (for a $15,000 balance). Another plus is that the minimum deposit is refunded with a bonus, and the profit share can be increased from 75% to 90%. The prop-trading company sets no limits as the trader has the freedom to use any trading methods and strategies. They have access to dozens of assets from 5 groups, providing strategic flexibility and the ability to form a diversified investment portfolio. Finally, the referral program, not only generates profits but also offers free trading accounts with varying balances, which adds to FXIFY's versatility. This makes FXIFY truly universal, catering to traders with any preference and level of ambition.

FXIFY’s analytical services:

-

One Phase or Two Phase. Traders decide which type of challenge to undertake. They can choose 1 phase for faster funding and are ready for slightly more challenging conditions. The 2-phase option takes more time, but the requirements are less stringent.

-

Several deposit/withdrawal options. FXIFY supports bank accounts and cards, electronic transfer systems like PayPal, and recently added cryptocurrency wallets. Alternative options are discussed individually.

-

Selecting a trading platform. FXIFY does not work with rTrader, cTrader, NinjaTrader, and other solutions. Traders can only trade through MT, but they can choose between the fourth and fifth versions. Both are functional, intuitive, and highly customizable.

Advantages:

The company is officially registered and operates transparently with no hidden payments or fees.

Traders work under flexible customizable conditions, limited only by daily and overall drawdown.

The initial deposit is low (compared to its competitors) and refunded with a bonus if the challenge is completed successfully.

Users can easily obtain an account with a balance of up to $400,000. Scaling is available up to $4 million.

The client's profit share with the prop-trading company increases during trading, reaching 90%.

FXIFY's client support operates 24/5 on weekdays, with various communication channels.

Latest FXIFY News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i