Lux Trading Firm Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 199 GBP

- MetaTrader5

- Match Trader

- Proprietary dashboard, KPMG qualification, traders keep 75% of profits, copy trading and third-party advisors are not allowed

- Individually assigned

Our Evaluation of Lux Trading Firm

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Lux Trading Firm is a moderate-risk prop trading firm with the TU Overall Score of 5.7 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Lux Trading Firm clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews.

The conditions offered by Lux Trading Firm are generally favorable. If a trader successfully finishes the evaluation on a demo account, his enrollment fee is fully refunded, and when he trades on a real account, the firm leaves him 75% of his profits. Clients can use any trading strategy, but cannot copy trades or apply third-party advisors. The maximum account size for standard qualification is rather large: $1,000,000. A reliable liquidity provider and a KMPG qualification certificate are big benefits.

Brief Look at Lux Trading Firm

British prop trader Lux Trading Firm cooperates with Barclays, the largest financial conglomerate in the country. The official partners of Lux Trading Firm are Credit Suisse and Goldman Sachs banks. Lux Trading Firm offers 2 types of accounts. The minimum enrollment fee is GBP 199 (after evaluation, enrollment fees are fully refunded). Clients can get between $50,000 and $1,000,000 under management and increase their balances up to $10 million using TradingView or MetaTrader 5. However, Lux Trading Firm has some restrictions. For example, it is not possible to copy trades or use advisors developed by third parties (only advisors created by traders themselves are allowed).

- has developed a dashboard with a control panel of the trader's activity, which can be tested free of charge for 7 days;

- users who have passed the evaluation and have been trading with the company for a long time obtain an official KPMG certificate confirming their qualification;

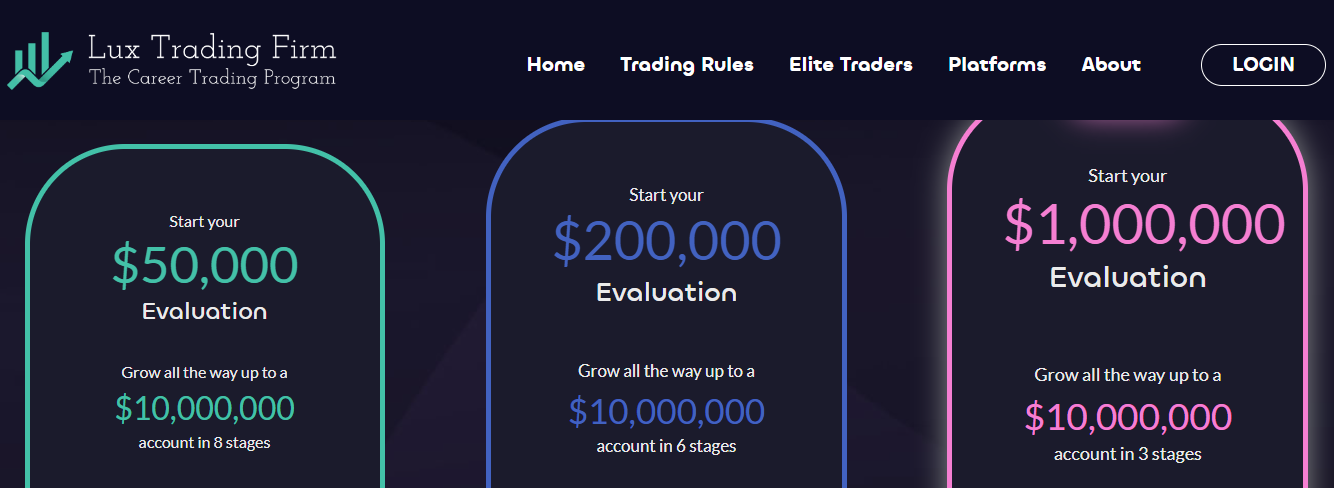

- under standard conditions, traders get $50,000, $200,000 or $1,000,000 under management. Professionals can count on $10 million;

- clients who pass the assessment get a 100% refund of their registration fees. As fully funded traders, they keep 75% of the profits earned;

- the company offers many popular withdrawal options, such as bank cards, wire transfers and e-wallets, and charges no additional fees;

- the liquidity provider of Lux Trading Firm is Global Prime, one of the world's leading brokers that allows trading forex, stocks, indices, cryptocurrencies, etc;

- the evaluation is done on demo accounts, which means that traders do not get any real profit, although they get their registration fees back;

- traders can only use advisors that are their intellectual property. The use of other advisors results in a ban.

TU Expert Advice

Financial expert and analyst at Traders Union

The company Lux Trading Firm has been operating since 2020. The company's official partners are its undoubted strength. I am mainly referring to the broker Global Prime which provides the company's clients with prop trading accounts and access to trading almost all types of assets such as currencies, cryptocurrencies, stocks, indices, commodities, metals, etc. Of course, traders who are registered with Lux Trading Firm use more favorable conditions. The prop company does not charge commissions, it only takes 25% of the profit from trading with your funds. Please note that you do not earn anything from the evaluation, as it is performed on a demo account. But your registration fee will be refunded if you pass.

Currently, a trader can earn $50,000, $200,000, or $1,000,000 after passing a 2-step assessment and then increase his balance in 3, 6, or 8 steps, depending on the account size he selects. The maximum balance is $10 million. Few prop trading companies offer similar amounts. The profit target and maximum drawdown increase along with the growth of your balance. The profit share of 75% remains the same in all real stages.

Traders can use MetaTrader 5, TradingView. The company also offers its own control panel, which cannot be used for trading, but is very handy for monitoring your account and getting analytics. Like many other prop companies, Lux Trading Firm offers its clients a comprehensive mentoring and support program. It is logical because the company can develop and make profit only if its clients develop and make profit. In addition, Lux Trading Firm has an agreement with KPMG, thanks to which all professional traders who cooperate with the prop company get an official qualification. For professionals, this is a great advantage that opens up numerous opportunities in the trading industry.

Lux Trading Firm Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 5, LuxTrader, Match Trader |

|---|---|

| 📊 Accounts: | Standard, Elite |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank cards and accounts, online payments, electronic wallets, digital banks, and all-purpose transfer systems |

| 🚀 Minimum deposit: | 199 GBP |

| ⚖️ Leverage: | Individually assigned |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 EUR/USD spread: | No data |

| 🔧 Instruments: | Currencies, cryptocurrencies, stocks, bonds, indices, and commodities |

| 💹 Margin Call / Stop Out: | No data |

| 🏛 Liquidity provider: | FX-EDGE Trading Venue |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | No data |

| ⭐ Trading features: | Proprietary dashboard, KPMG qualification, traders keep 75% of profits, copy trading and third-party advisors are not allowed |

| 🎁 Contests and bonuses: | No |

An important advantage of this proprietary trading firm is that it uses almost all financial channels. Traders can withdraw profits to bank cards, bank accounts, electronic wallets, or via online transfers. Lux Trading Firm supports Wise and a number of other international digital banks. All information about withdrawal fees is displayed in the user account before you make a withdrawal (take third-party fees into account). Lux Trading Firm allows trading with leverage that is determined individually for each trader in accordance with his professionalism and strategy. Note that the company’s tech support is available around the clock seven days a week.

Lux Trading Firm Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

Lux Trading Firm provides access to funding up to $10 000 000, with challenges requiring at minimum of 29 trading days. The entry-level plan starts at $199, and the fee is refundable if the challenge is successfully completed.

- High funding potential — up to $10 000 000

- Multiple scaling options

- Flexible trading rules and conditions

- No free evaluation option

- Minimum trading period required

Lux Trading Firm Challenge fees and plans

We compared Lux Trading Firm’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | 2 - Profit target, $ | Daily loss,% | Max. loss, % |

| Trading Plan 1 |

|

|

|

|

|

|

| Trading Plan 2 |

|

|

|

|

|

|

| Trading Plan 3 |

|

|

|

|

|

|

What’s the minimum trading period for Lux Trading Firm’s challenge?

A minimum of 29 trading days is required, regardless of how quickly you reach the profit target.

Does Lux Trading Firm offer a free evaluation?

No, Lux Trading Firm does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Lux Trading Firm?

No, Lux Trading Firm does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

Lux Trading Firm outlines the main rules for funded accounts, including a max. loss of 6% and a daily loss limit of 0%. The firm also restricts certain trading strategies, which are detailed below.

- Flexible leverage up to 1:30

- Scalping allowed

- News trading allowed

- Copy trading not allowed

- Trading bots (EAs) not allowed

Lux Trading Firm trading conditions

We compared Lux Trading Firm’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Lux Trading Firm | Hola Prime | SabioTrade | |

| Max. loss, % | 6 | 5 | 6 |

| Max. leverage | 1:30 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | Yes | No | No |

| Trading bots (EAs) | No | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

Lux Trading Firm earned a Low score based on how smoothly and conveniently traders can deposit and withdraw funds.

Lux Trading Firm's limited selection of payment methods and supported currencies may reduce its convenience and global accessibility.

- USDT (Tether) supported

- Wise transfers supported

- Supports bank wire transfers

- Bitcoin (BTC) supported

- No on-demand withdrawals

- Limited base currency options

- Payoneer not supported

Deposit and withdrawal options

To help you evaluate how Lux Trading Firm performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Lux Trading Firm Payment options vs Competitors

| Lux Trading Firm | Hola Prime | SabioTrade | |

| Bank Card | No | Yes | Yes |

| Bank Wire | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | Yes | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Lux Trading Firm with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Lux Trading Firm | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | Yes | Yes | No |

What base account currencies are available?

Lux Trading Firm offers the following base account currencies:

Trading Account Opening

To use the prop firm’s services, you need to register on its official website and get a user account. In your user account, you can manage your trading account, monitor trades, withdraw funds, etc. Below, TU provides a step-by-step registration guide and describes the main features of Lux Trading Firm’s user account in detail.

Go to the Lux Trading Firm website. On its homepage, click “Start your career” or “Free trial” to initiate registration.

Next, review the account types offered by the firm, select one of them, and click “Start now” or “Free trial”.

Now, you can select a trading platform. Note that Islamic accounts are available for TradingView, but not for MT5. Click the “Select” button under the platform that is suitable for you.

Enter the required billing details. Include real data only, otherwise, you will not pass the verification.

Scroll down the page. Make sure you see the account you chose and the enrollment fee. Provide the details of your credit card or another payment method.

Read the Terms of Use, Terms and Conditions, and Rules of Engagement (available via the links at the bottom of the page) and tick the box to accept them. Click “Place order” and follow the on-screen instructions.

Now, you have a Lux Trading Firm account that enables you to use all features of your account. The only difference is that you trade the prop firm’s funds, not yours, and you can do it on a familiar trading platform. The primary features of Lux Trading Firm’s user account are:

-

trading performance monitoring;

-

evaluation progress control;

-

trading account analytics;

-

profit withdrawal;

-

account settings;

-

tech support.

Regulation and safety

Lux Trading Firm does not hold its clients’ funds. They are held by the broker that provides access to the market. However, Lux Trading Firm is officially registered in the UK and operates under the aegis of local regulators.

Advantages

- Traders can consult Lux Trading Firm’s legal department

- Traders can submit requests to the broker’s and its regulator’s lawyers

Disadvantages

- If a trader is not from the UK, he does not have regional protection

Markets and tradable assets

Lux Trading Firm has a score of 8/10, reflecting a strong variety of markets and assets available for trading.

- CFDs offered

- Forex trading supported

- Stock trading allowed

- Futures not available

- Options not supported

Tradable markets

We compared the range of tradable instruments offered by Lux Trading Firm with two leading competitors to highlight the differences in market access.

| Lux Trading Firm | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

Lux Trading Firm does not run investment projects. Clients can trade currencies, cryptocurrencies, securities, indices, commodities, and energies using the funds provided by the company. Therefore, traders do not risk losing their own funds. They only pay an enrollment fee that is refunded if the evaluation is completed successfully. Lux Trading Firm does not offer alternative earning options.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Customer support

Lux Trading Firm’s tech support is available 24/7 through several communication channels.

Advantages

- Unregistered users can also consult tech support

- Several communication channels are available

Disadvantages

- Tech support is provided in English only

- Responses via email are not sufficiently prompt

Traders can contact the prop firm’s tech support using the following channels:

-

call center;

-

email;

-

live chat on the official website.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | 128 City Road, London EC1V 2NX, UK |

| Official site | luxtradingfirm.com |

| Contacts |

+44 20 7193 9534

|

Education

All proprietary trading firms want traders to improve their qualifications. More experienced players make higher profits and therefore firms earn more. That is why Lux Trading Firm offers educational content, holds regular webinars and other online events, and assigns mentors to new traders.

The company gives almost no attention to psychological stability and money management rules, suggesting that traders already know these rules and understand the risks.

Comparison of Lux Trading Firm to other prop firms

| Lux Trading Firm | FundedNext | Hola Prime | SabioTrade | GoatFundedTrader | E8 Markets | |

| Trading platform |

MetaTrader5, TradingView | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader5, Match Trader, TradeLocker | MT5, Match Trader |

| Min deposit | $299 | $32 | $48 | $119 | $30 | $33 |

| Leverage | No |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:50 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | No |

| Order Execution | No | N/a | Market Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Lux Trading Firm

Seeing that Lux Trading Firm has been in business for over 3 years, experts can evaluate it comprehensively. Official registration, regulation, and reliability are the firm’s conceptual advantages, along with the simplicity of opening an account. During the evaluation, a trader has to earn a 6-15% profit and should not lose more than 6% of the balance. These are completely attainable objectives, even for traders that have little experience. After the evaluation, a client moves from a demo to a real account, has 100% of his enrollment fee back, and gets a balance of $50,000-$1,000,000 depending on the account type he chose. A trader receives everything he needs to earn a lot steadily: individually calculated leverage, access to thousands of instruments in the primary markets, customizable multifeatured dashboard, etc.

Lux Trading Firm by the numbers:

-

199 GBP minimum enrollment fee;

-

100% of the enrollment fee is refunded if you pass the two-step/two-part evaluation;

-

$50,000 minimum balance for fully funded traders;

-

$10 million balance potential;

-

7 days of free usage of Lux Trading Firm’s dashboard.

Lux Trading Firm | A prop firm for trading currencies, cryptocurrencies, securities, and other financial instruments

Proprietary trading firms themselves don’t provide access to financial instruments. This is done via brokers, with which traders must open an account. Lux Trading Firm cooperates with FX-EDGE Trading Venue which allows trading currencies, cryptocurrencies, stocks, bonds, indices, commodities, etc. Spreads depend on the assets. For example, the average spread for EUR/USD is 0.02 pips. This data is publicly available on FX-EDGE Trading Venue official website.

Useful features of Lux Trading Firm:

-

Clients can trade on MetaTrader 5, one of the most popular platforms. The other available platform is the all-inclusive TradingView.

-

Lux Trading Firm offers its own dashboard with a trader activity control panel. The dashboard is customizable, provides comprehensive data on current and closed trades, and has built-in analytical tools.

-

If a professional trades successfully, he can obtain a KPMG certificate that confirms his qualification.

Advantages:

The company operates officially and transparently. No disputes or violations have been registered.

The entry threshold is quite low: enrollment fees are reasonable and if trading on a demo account is successful, they are refunded. Evaluation objectives are achievable.

The profit share for trading on real accounts is 75% and cannot become lower under any circumstances.

All traders get mentors and access to exclusive educational content that helps improve their qualification.

The company cooperates with one of the top brokers that offers numerous trading instruments.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i