Maven Trading Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $15

- cTrader

- Match Trader

- Weekend trading is supported

- Expert advisors are allowed.

- Up to 1:75

Our Evaluation of Maven Trading

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Maven Trading is a prop trading firm with higher-than-average risk and the TU Overall Score of 4.17 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Maven Trading clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work.

Maven Trading is suitable for traders seeking access to substantial trading capital without a significant initial investment. The firm offers flexible conditions, including no time limits on challenge completion, access to large trading accounts, and a favorable profit split.

Brief Look at Maven Trading

Maven Trading is a Vancouver-based proprietary trading firm established in 2022. It offers funded accounts ranging from $2,000 to $100,000 upon successful completion of a simulated trading evaluation. Traders can participate in one-, two-, or three-step challenges. Successful traders have the opportunity to scale their accounts up to $1 million. Maven Trading provides access to cTrader and Match-Trader platforms and partners with regulated brokers and liquidity providers such as Purple Trading and Match-Prime. Its clients can trade Forex and CFDs on cryptocurrencies, commodities, and indices.

- Diverse trading challenges;

- Funded accounts with varying capital levels;

- 24/7 client support;

- Profit share is 80/20.

- MetaTrader platforms are not available;

- No demo mode.

TU Expert Advice

Financial expert and analyst at Traders Union

Maven Trading provides access to over 75 trading instruments, including 40 currency pairs, cryptocurrencies, metals, energies, and agricultural commodities. A wide range of global indices is also available, including those from the U.S., Australia, China, the EU, Japan, and the UK.

The firm offers a unique Buyback feature, allowing traders to regain access to their funded accounts without having to re-complete challenges. The cost of buying back an account depends on its balance. For example, a $5,000 account would require a $400 fee.

Maven Trading prohibits certain trading styles, including Martingale and All-in strategies. Overall, trading without proper risk management is prohibited. Excessive scalping, defined as holding 50% or more of positions for less than a minute, is also not allowed.

Maven Trading Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | Match-Trader and cTrader |

|---|---|

| 📊 Accounts: | $2,000, $5,000, $10,000, $20,000, $50,000, and $100,000 |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: |

Deposits: bank cards and cryptocurrencies; Withdrawals: direct bank transfer, Rise, and cryptocurrencies |

| 🚀 Minimum deposit: | $15 |

| ⚖️ Leverage: | Up to 1:75 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | From 0 pips |

| 🔧 Instruments: | Forex and CFDs on indices, commodities, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Match-Prime, etc. |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market and limit |

| ⭐ Trading features: |

Weekend trading is supported; Expert advisors are allowed. |

| 🎁 Contests and bonuses: | Yes |

Maven Trading offers leverage up to 1:75 for Forex, 1:20 for commodities and indices, and 1:2 for cryptocurrencies. Weekend trading and swap-free accounts are available. Traders are required to use stop-loss and take-profit orders and are prohibited from opening or closing positions within two minutes before or after major news releases.

Maven Trading Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

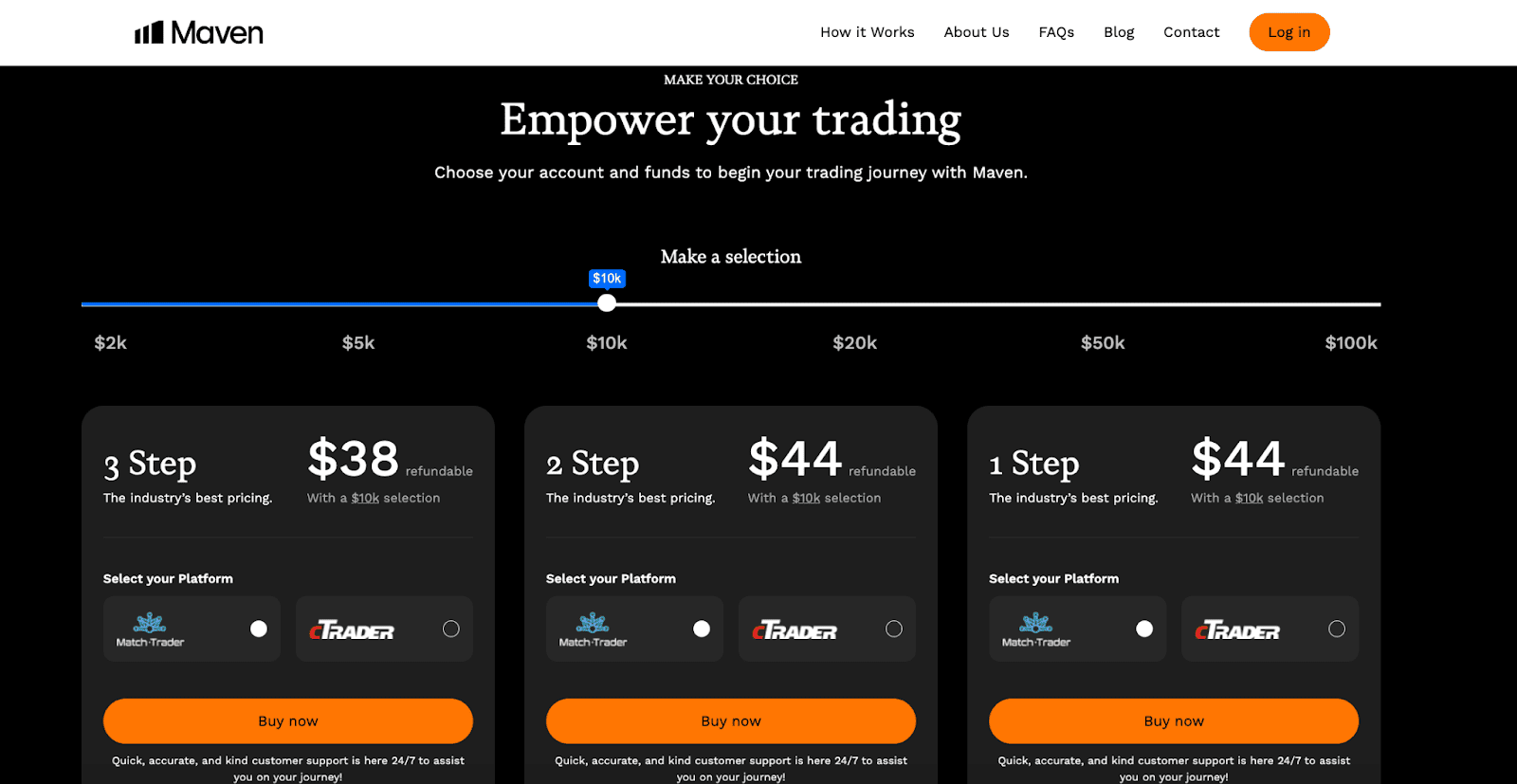

Challenge rules and pricing

Maven Trading provides access to funding up to $1 000 000, with challenges requiring at minimum of No time limits trading days. The entry-level plan starts at $15, and the fee is refundable if the challenge is successfully completed.

- High funding potential — up to $1 000 000

- Low entry cost — from $15

- No demo account provided

- No free evaluation option

Maven Trading Challenge fees and plans

We compared Maven Trading’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| 1 Step |

|

|

|

|

|

| 2 Step |

|

|

|

|

|

| 3 Step |

|

|

|

|

|

What’s the minimum trading period for Maven Trading’s challenge?

No minimum trading days. You can complete the challenge as soon as you reach the profit target.

Does Maven Trading offer a free evaluation?

No, Maven Trading does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Maven Trading?

No, Maven Trading does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

Maven Trading outlines the main rules for funded accounts, including a max. loss of 3% and a daily loss limit of 2%. The firm also restricts certain trading strategies, which are detailed below.

- No weekend close rule

- Flexible leverage up to 1:75

- News trading allowed

- Scalping not allowed

- Strict max loss

Maven Trading trading conditions

We compared Maven Trading’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Maven Trading | Hola Prime | SabioTrade | |

| Max. loss, % | 3 | 5 | 6 |

| Max. leverage | 1:75 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | No | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

Maven Trading earned a Low score based on how smoothly and conveniently traders can deposit and withdraw funds.

Maven Trading's limited selection of payment methods and supported currencies may reduce its convenience and global accessibility.

- Bitcoin (BTC) supported

- Bank сard deposits and withdrawals

- USDT (Tether) supported

- Bank transfers not available

- No on-demand withdrawals

Deposit and withdrawal options

To help you evaluate how Maven Trading performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Maven Trading Payment options vs Competitors

| Maven Trading | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Maven Trading with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Maven Trading | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | Yes | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

Maven Trading offers the following base account currencies:

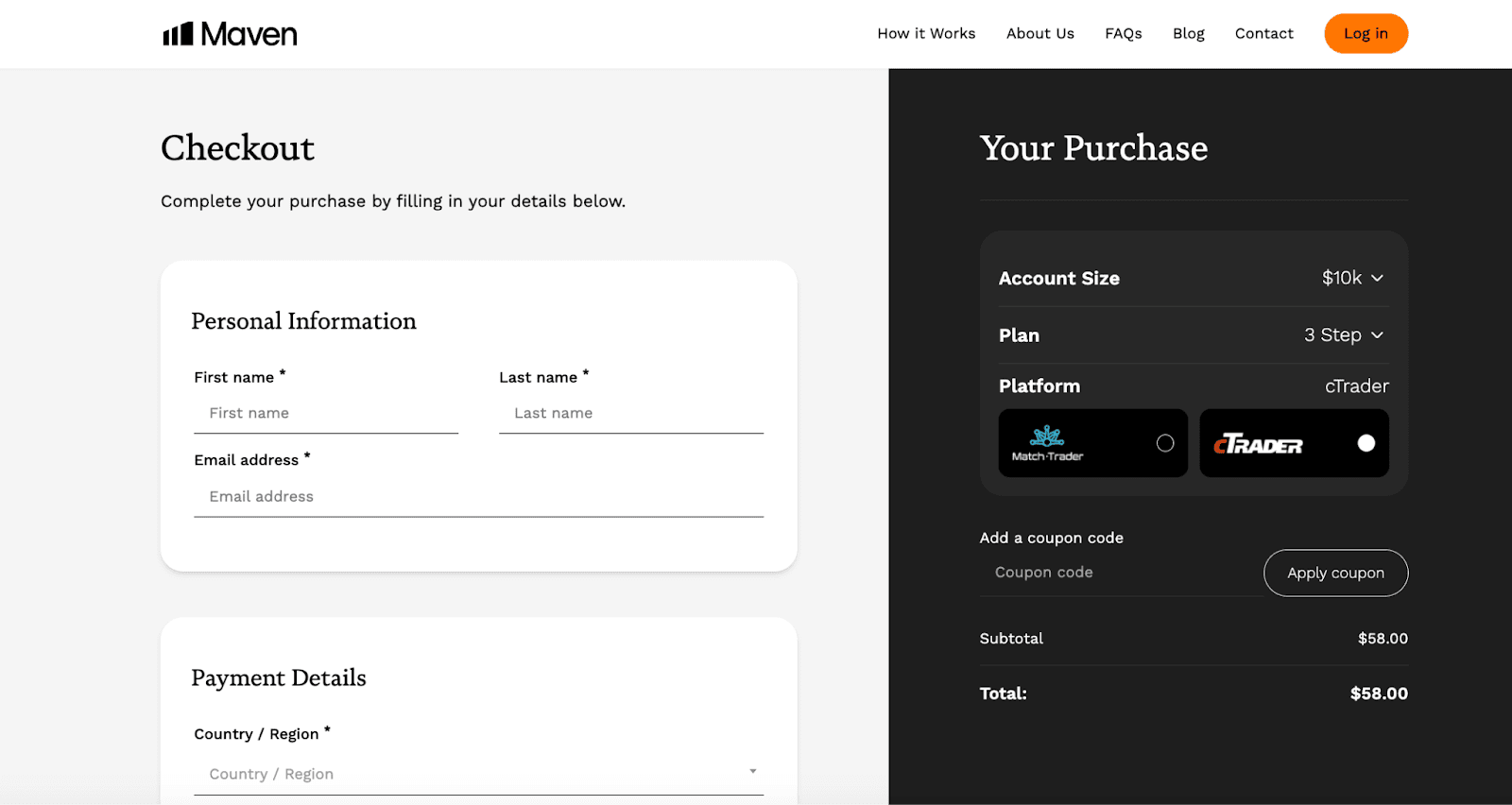

Trading Account Opening

To start trading on Maven Trading’s virtual account, register on its website and pay the challenge fee, following the instructions below.

Go to the page describing the available account types and click Buy now.

Choose the required funding amount and the trading platform, and fill out the registration form.

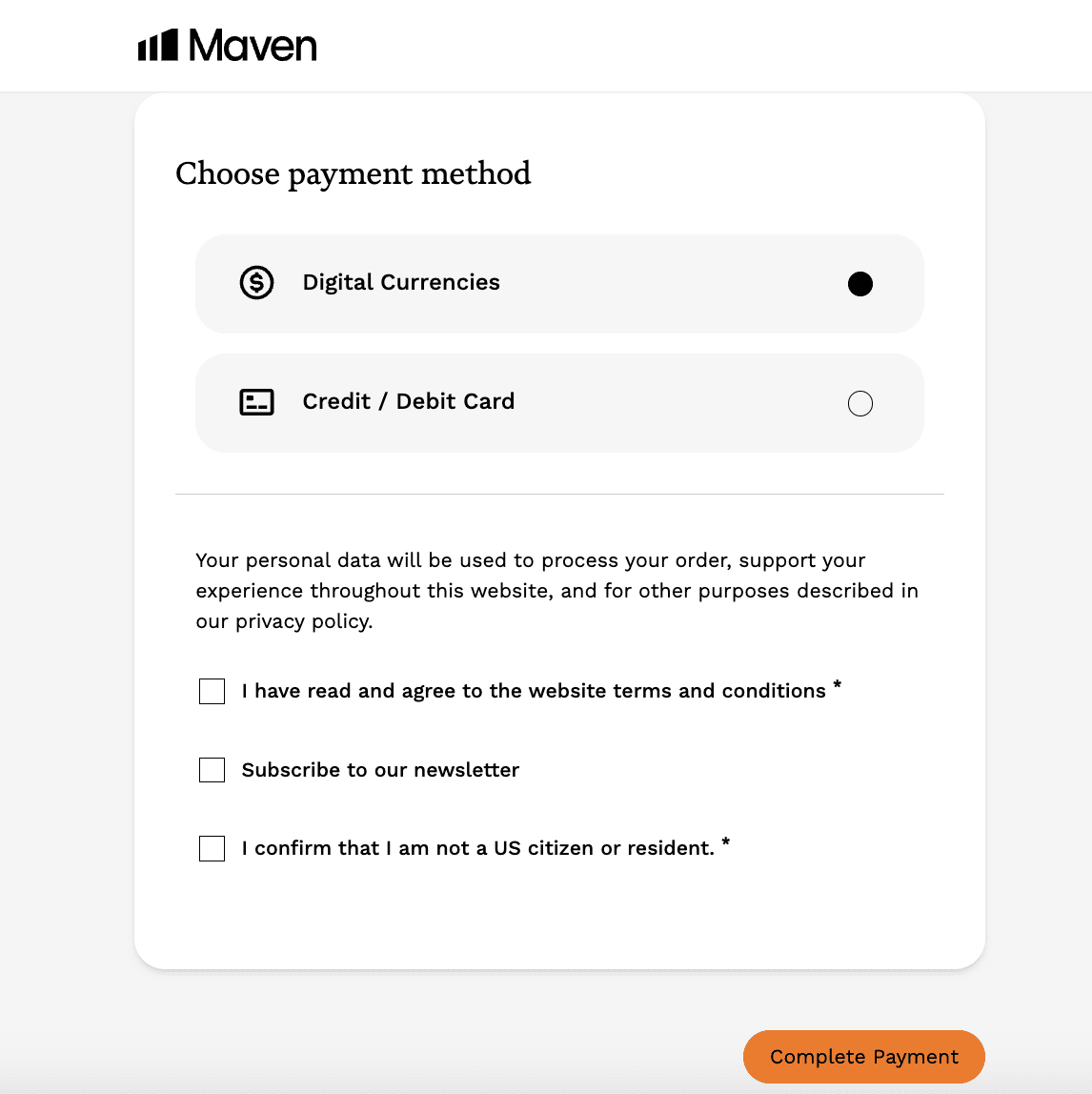

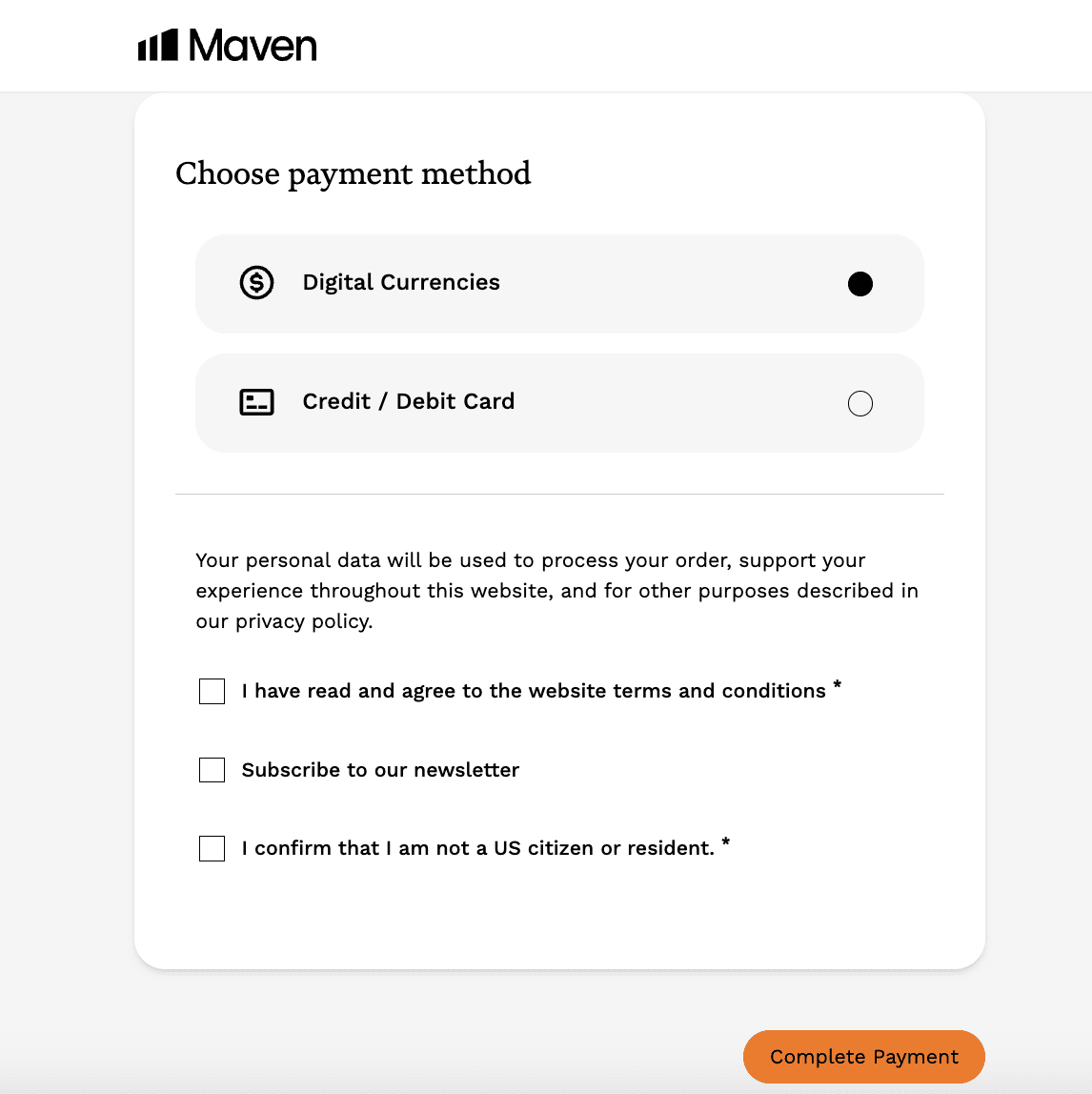

Choose the payment method.

Upon successful payment, an email with further instructions, including your account number and password for accessing the user account, is sent at the address provided during registration.

Regulation and safety

Maven Trading partners with CySEC-regulated entities, including Purple Trading and MTG Liquidity Limited (Match-Prime).

As a prop trading firm, Maven Trading is not a broker and therefore is not subject to the same regulatory requirements.

Advantages

- Partnership with EU-regulated companies

- Two-factor authentication is available for user account protection

Disadvantages

- Client orders are executed by third-party brokers

Markets and tradable assets

Maven Trading has a score of 6/10, indicating an Average offering of markets and tradable assets.

- Forex trading supported

- CFDs offered

- Crypto trading available

- Options not supported

- Stock trading not allowed

Tradable markets

We compared the range of tradable instruments offered by Maven Trading with two leading competitors to highlight the differences in market access.

| Maven Trading | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | No | Yes | Yes |

Investment Options

Maven Trading permits automated trading, subject to certain restrictions.

-

Expert advisors (EAs) are allowed, provided they comply with the established rules. However, the misuse of EAs, such as utilizing the demo environment for hedging or high-frequency trading (HFT), is considered fraudulent.

-

Trading using automated strategies, such as HFT and hedging, that may lead to abnormal market conditions or disrupt platform operations, is prohibited. If such activities are detected, traders are required to provide evidence of the specific EA used, if applicable.

Overall, automated trading is permitted, provided it complies with platform rules. Any actions that manipulate the market, such as hedging and high-frequency trading, are considered violations.

Partnership program from Maven Trading:

Maven Trading offers an affiliate program that rewards its clients for referring new traders. The reward is calculated as a percentage of the fee paid by referred traders for their chosen plan.

Conditions:

-

Affiliates get 5% on each sale;

-

Minimum withdrawal amount is $200 or the equivalent of 10 sales.

Affiliates are required to actively promote Maven Trading through social media, personal channels, and email. Participation is open to influencers and website owners.

Customer support

Maven Trading offers 24/7 client service available via multiple channels.

Advantages

- Prompt assistance in a live chat

- Active Discord community

Disadvantages

- No phone support

- No feedback form

Available communication channels:

-

Live chat;

-

Email;

-

Discord channel.

The firm also has its social media profiles.

Contacts

| Registration address | 2410 Cornwall Ave, Vancouver, Canada, V6K 1B8 |

|---|---|

| Official site | www.maventrading.com |

| Contacts |

Education

Educational content is available in the Blog section of the Maven Trading website, although the current choice of articles is limited.

While Maven Trading offers the FAQ section, it primarily focuses on trading conditions, lacking educational resources for novice traders.

Comparison of Maven Trading to other prop firms

| Maven Trading | FundedNext | Hola Prime | SabioTrade | Funded Trading Plus | E8 Markets | |

| Trading platform |

cTrader, Match Trader | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader4, MetaTrader5, DXTrade, TradingView, Match Trader, cTrader | MT5, Match Trader |

| Min deposit | $15 | $32 | $48 | $119 | $119 | $33 |

| Leverage |

From 1:1 to 1:75 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:30 |

From 1:1 to 1:50 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed Maven Trading review

Maven Trading provides qualified traders with up to $100,000 of initial funding, offering multiple accounts with varying balances. A scaling program enables top-performing traders to manage up to $1 million. The absence of swap fees, the ability to hold positions over weekends, and the unique Buyback feature enhance trading flexibility and position management.

Maven Trading by the numbers:

-

The firm was established in 2022;

-

65,000+ registered traders and 15,000+ funded clients;

-

Payouts exceed $1 million;

-

Largest individual payout is over $45,000;

-

70,000+ participants are registered in the Discord community.

Maven Trading is a prop trading firm offering account types tailored to various trading styles and strategies

The firm’s accounts offer three drawdown types: static, capital-based reset to the highest capital at 00:00 UTC, and balance-based reset to the daily balance at rollover. A trailing drawdown, which adjusts upward as the trader's capital grows, is also available.

There is no maximum duration for challenges, allowing traders to take as long as needed to reach their profit targets. To scale up, traders must achieve a 10% profit over a 4-month period (2.5% per month) and make at least one withdrawal per month. Upon meeting these criteria, the trading account is increased by 25%.

Useful services offered by Maven Trading:

-

One-, two-, and three-step challenges are available;

-

Swap-free trading is offered for all account types;

-

Withdrawals are available every 10 days;

-

Affiliate program is provided.

Advantages:

Flexible challenge duration, allowing traders to work at their own pace;

Clear trading conditions, including stop-loss and take-profit orders;

Strict daily and overall drawdown limits for risk management and trading discipline;

Support for Match-Trader and cTrader platforms, offering traders flexibility in choosing trading tools;

Regular withdrawals available every 10 business days.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i