According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $125

- iTrader

- NinjaTrader

- RTrader

- QScalp

- Photon

- No initial fees

- trade 7 days for free

- traders keep 90-100% of profits

- prompt tech support

- analytics aggregated in the user account

- Individually calculated

Our Evaluation of OneUp Trader

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

OneUp Trader is one of the best proprietary trading firms in the financial market with the TU Overall Score of 8.98 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by OneUp Trader clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company.

The OneUp Trader proprietary trading firm is rightly one of the leaders in its segment. This is an easy-to-use service with an intuitive user account interface, where account analytics are displayed in detail. Partners can trade futures on all asset types, except cryptocurrencies. Trading is available on NinjaTrader, rTrader, iTrader, Photon, QScalp, and other popular platforms. Another benefit is the referral program that allows traders to get 20% of every referral’s trading fees. Plus, Traders Union offers its rebate program as a bonus.

Brief Look at OneUp Trader

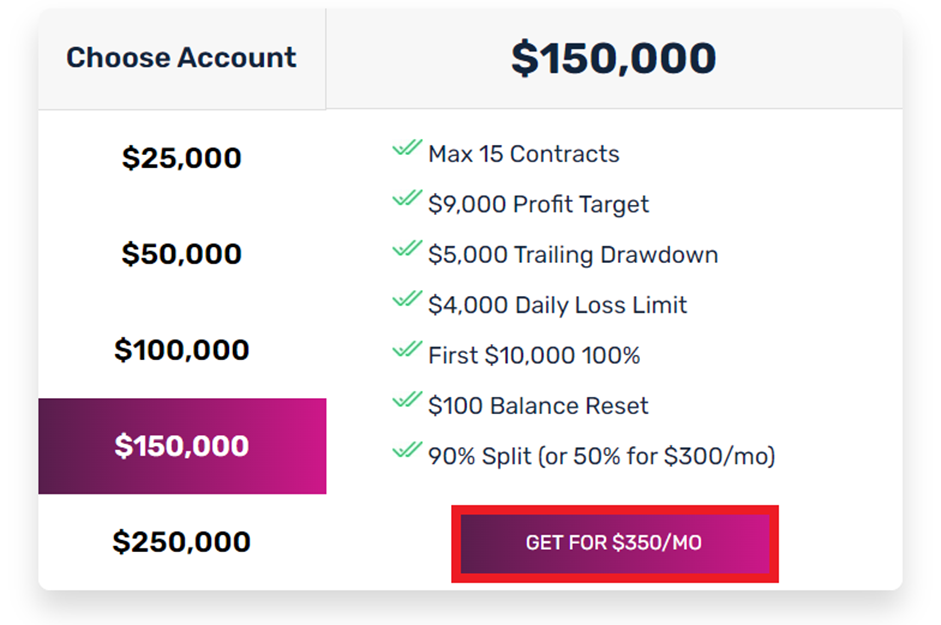

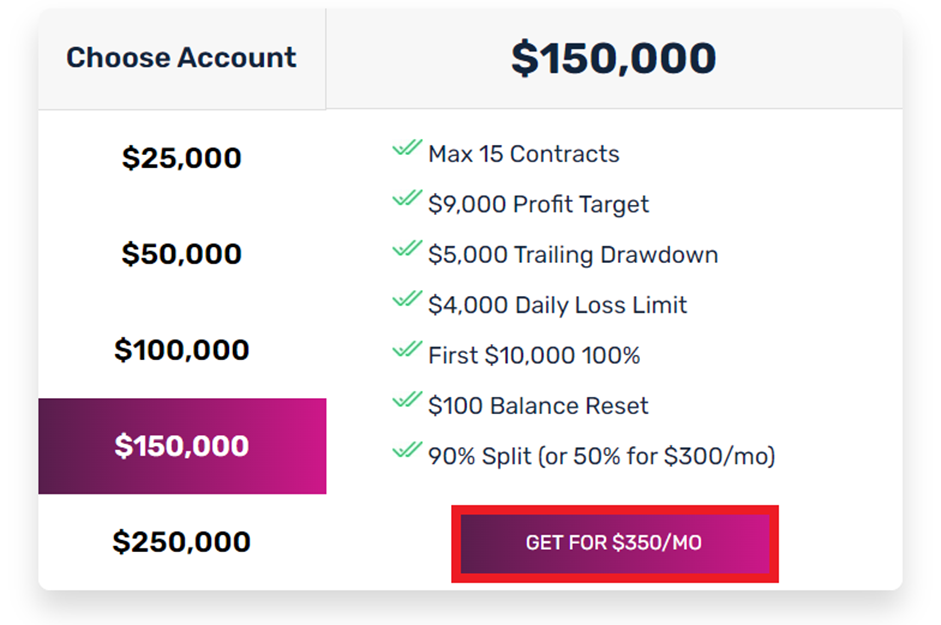

This proprietary trading firm with headquarters in Delaware is well-known in its segment of the global market due to its favorable trading conditions and lenient financial policy. Traders can get funding from $25,000 to $250,000. They do not need to pay initial fees, but there are monthly fees from $125 depending on the plan. The challenge has one step and no additional conditions, just the profit target. No withdrawal fees or additional charges. A trader takes 100% of his profit until he earns $10,000. After that, the profit share is 90%. Withdrawal is available from day 1 with just one limit: the minimum amount is $1,000. There is no overall drawdown limit, only daily and trailing drawdowns. Trading is available on 15 platforms. Other features that are worth mentioning include quality educational content, dynamic analytics displayed on the user account dashboard, a two-level strike price system, and a generous referral program.

- five plans that differ in funding amount, profit target, and maximum drawdown;

- no initial fees. During the first 7 days, all features are available for free;

- partners keep 90-100% of the profits earned;

- all primary deposit and withdrawal channels are available. Withdrawals from $1,000 can be made at any moment;

- no overall drawdown, only daily and trailing drawdowns. Account parameters can be reset for $100;

- the challenge has 1 step and no time limit. A trader only has to earn a specified amount;

- users can trade futures on all asset types such as currencies, indices, stocks, commodities, metals, etc.

- after the trial period ends, a trader has to pay monthly fees from $125 to $650, depending on the plan selected;

- partners can trade futures only (although they can be used for all asset types, including agricultural products and energies). Cryptocurrencies are not available;

- you can use any trading style or strategy, but only within intraday trading: the firm does not permit holding positions overnight.

TU Expert Advice

Author, Financial Expert at Traders Union

OneUp Trader offers a range of trading opportunities through its proprietary trading firm structure, featuring futures contracts on various asset classes like currencies, stocks, commodities, and more. Trading is conducted on popular NinjaTrader, iTrader, and other platforms, with five account types providing different profit targets and drawdown allowances. A notable advantage is the absence of initial fees, allowing a 7-day free trading period, and traders can retain 90-100% of their profits.

However, OneUp Trader does have some drawbacks, such as monthly fees starting from $125 and restrictions on holding positions overnight, making only intraday trading possible. Additionally, cryptocurrencies are not available for trading. These characteristics suggest that OneUp Trader may be ideal for experienced traders comfortable with its fee structure and intraday trading limits but less suited for those desiring a wider range of trading instruments, including cryptocurrencies.

- You're ready to commit (financially), as OneUp Trader doesn't require an upfront deposit for their evaluation process, but funded accounts come with a minimum capital commitment, ranging from $25,000 to $250,000. Be prepared to allocate this capital if you succeed in the evaluation.

- You can trade as per their hours, as OneUp Trader primarily focuses on futures markets, with specific trading hours based on the underlying assets. Ensure your availability aligns with their active trading windows.

- You don’t want your trading capital to be high, as funded accounts come with a minimum capital commitment. If you can't comfortably allocate $25,000 or more to a prop trading account, it's best to wait until you build your capital base.

- You're a trading newbie, as OneUp Trader seeks experienced traders with a proven track record. If you're just starting out, consider building your experience and capital in a smaller personal account before pursuing prop firm opportunities.

OneUp Trader Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | NinjaTrader, rTrader, iTrader, Photon, QScalp, and others |

|---|---|

| 📊 Accounts: | Five account types that differ in balance, profit target, and maximum drawdown |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank card, bank transfer, and electronic wallet |

| 🚀 Minimum deposit: | 125 USD |

| ⚖️ Leverage: | Individually calculated |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 EUR/USD spread: | No data |

| 🔧 Instruments: | Futures on currencies, stocks, indices, agricultural products, metals, energies, and Micro E-Mini futures |

| 💹 Margin Call / Stop Out: | No data |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No data |

| ⭐ Trading features: | No initial fees; trade 7 days for free; traders keep 90-100% of profits; prompt tech support; analytics aggregated in the user account |

| 🎁 Contests and bonuses: | Yes |

Some prop trading firms do not charge monthly fees, only initial ones. They leave their partners not more than 60-70% of profits to compensate for expenses. When trading with OneUp Trader, you get 100% of the first $10,000 earned. Then, you take 90%, but you have to pay monthly fees that depend on your balance. Note that all asset types can be traded with leverage that is calculated individually. The firm’s tech support operates through a call center, email, and live chat. All these channels are available 24/7.

OneUp Trader Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

OneUp Trader provides access to funding up to $250 000, with challenges requiring at a minimum of 15 trading days. The entry-level plan starts at $125, min but the fee is non-refundable.

- Free demo account available

- Multiple scaling options

- Flexible trading rules and conditions

- No instant funding options

- Limited funding — up to $250 000

OneUp Trader Challenge fees and plans

We compared OneUp Trader’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| Trading Plan 1 |

|

|

|

|

|

| Trading Plan 2 |

|

|

|

|

|

| Trading Plan 3 |

|

|

|

|

|

| Trading Plan 4 |

|

|

|

|

|

| Trading Plan 5 |

|

|

|

|

|

What’s the minimum trading period for OneUp Trader’s challenge?

A minimum of 15 trading days is required, regardless of how quickly you reach the profit target.

Does OneUp Trader offer a free evaluation?

No, OneUp Trader does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at OneUp Trader?

No, OneUp Trader does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

OneUp Trader outlines the main rules for funded accounts, including a max. loss of 2,2% and a daily loss limit of 0%. The firm also restricts certain trading strategies, which are detailed below.

- News trading allowed

- Scalping allowed

- Trading bots (EAs) allowed

- Copy trading not allowed

- Strict leverage rules

OneUp Trader trading conditions

We compared OneUp Trader’s leverage and trading conditions with competitors to help you better understand how it measures up.

| OneUp Trader | Hola Prime | SabioTrade | |

| Max. loss, % | 2,2 | 5 | 6 |

| Max. leverage | 1:1 | 1:100 | 1:30 |

| Weekend close rule | Yes | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

OneUp Trader earned a High score based on how smoothly and conveniently traders can deposit and withdraw funds.

OneUp Trader stands out by offering a wide variety of payment options, ensuring a smooth and efficient fund management experience for traders.

- On-demand withdrawals

- Wide range of deposit and withdrawal options

- Bitcoin (BTC) supported

- Supports bank wire transfers

- Limited base currency options

- PayPal not supported

- Payoneer not supported

Deposit and withdrawal options

To help you evaluate how OneUp Trader performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

OneUp Trader Payment options vs Competitors

| OneUp Trader | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared OneUp Trader with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| OneUp Trader | Hola Prime | SabioTrade | |

| On demand | Yes | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

OneUp Trader offers the following base account currencies:

Trading Account Opening

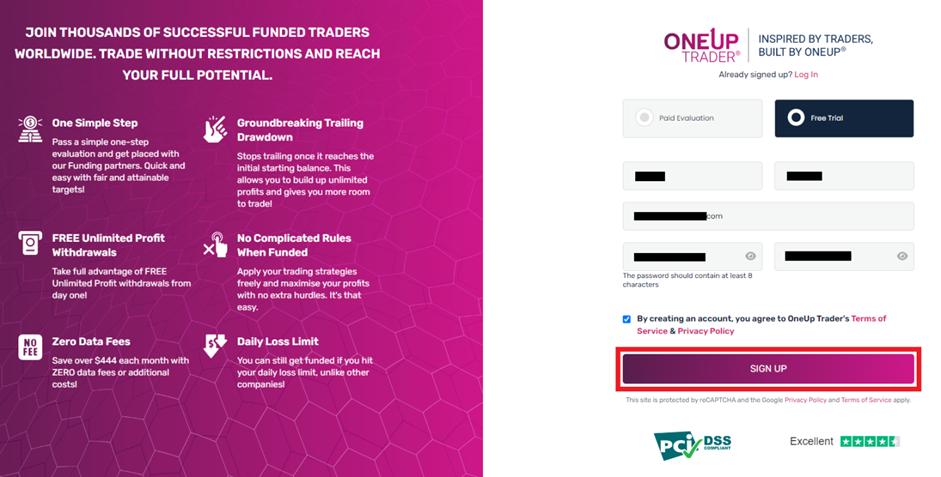

Go to the firm’s official website and click the “Start Now” button in the top right corner.

You can also click “Get Funded”, “Start Free Trial Period” or any other similar button on the website’s pages.

You get to the section that lists the plans and their conditions. Carefully review the information and select a plan that is suitable for you. Click “Get for $…/MO” (every plan has its own monthly fee).

Choose a paid or free version (after 7 days, the free version automatically changes to paid, and a funds deposit is required). Enter your first and last names and email. Create and confirm a password. Review the terms of service, accept them (tick the box), and click “Sign Up”.

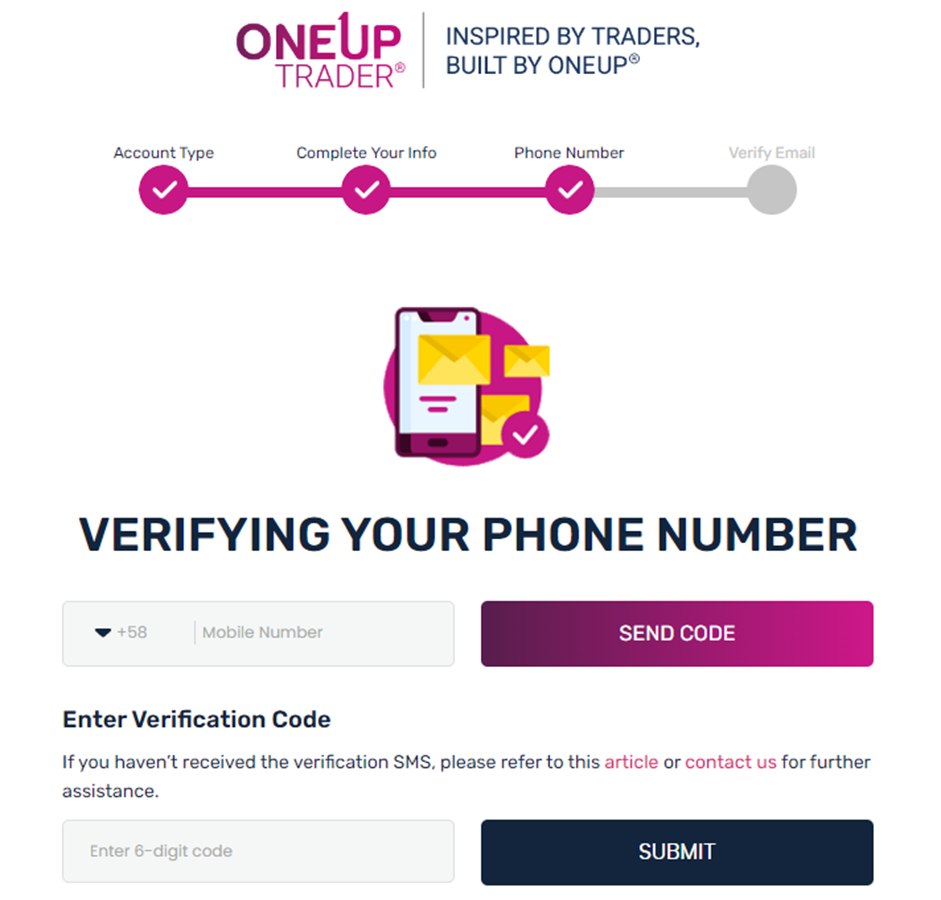

Include your username, date of birth, and place of residence with a zip code. Click “Next”. You need to enter your phone number and email (again) and then confirm them using a verification code. Follow the on-screen instructions.

You now have access to your user account. Next, you need to complete verification (confirm your personal information) and include a channel for depositing monthly fees and withdrawing funds. Usually, it’s a bank card, but there are other options. Remember that you can contact tech support at any time to get online consultations.

Primary features of OneUp Trader’s user account:

-

Dynamic dashboard with current data on trading accounts.

-

Tabs with complete information about profits and losses, challenge progress, and incoming/outgoing transactions.

-

Detailed analytics and expert recommendations on a trader’s financial activity.

-

News and key events from the world of politics and economy, as well as opinions and advice from professional traders.

-

Economic calendars, market movers and shakers, and many other tools with charts.

-

Access to live chat, community, and educational and analytical content.

Regulation and safety

Proprietary trading firms do not provide financial services themselves. In fact, they are intermediaries between traders and liquidity providers. They only place their capital under their partners’ management. Therefore, these companies must register as financial institutions but don’t need to be licensed by regulators. OneUp Trader is registered in the USA, operates legally, and can cooperate with residents of most countries. Real security always depends on liquidity providers, and in the case of OneUp Trader, these are proven, licensed, and regulated organizations.

Advantages

- Traders can ask the prop firm’s lawyers for help

- Traders can contact liquidity providers directly

Disadvantages

- International regulators’ support isn’t available to traders

Markets and tradable assets

OneUp Trader has a score of 4.5/10, indicating an Average offering of markets and tradable assets.

- Crypto trading available

- Futures available

- Options not supported

- CFDs not offered

Tradable markets

We compared the range of tradable instruments offered by OneUp Trader with two leading competitors to highlight the differences in market access.

| OneUp Trader | Hola Prime | SabioTrade | |

| Futures | Yes | No | No |

| CFDs | No | Yes | Yes |

| Forex | No | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | No | Yes | Yes |

Investment Options

Proprietary trading firms rarely offer investment programs in their traditional forms, such as buying dividend stocks or cryptocurrency staking. OneUp Trader’s referral program is the only way the firm’s partners can earn additional income. But this type of earning is only relatively passive, as traders need to socialize online rather actively, otherwise, they won’t have enough referrals and their profits will be small. On the other hand, if a partner has a popular blog and is constantly cooperating with colleagues, a referral link may bring him a good income.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

OneUp Trader affiliate program

Every registered trader receives a referral link. He can post it on blogs and social media, and send it via messengers and email. Users that follow this link and register with OneUp Trader become the trader’s referrals. After that, 20% of their trading fees automatically go to the trader’s account. These funds can be withdrawn for free along with primary profits. The referral status is perpetual, meaning that OneUp Trader’s partners bring profits to the trader that invited them for as long as they trade the prop firm’s funds.

The OneUp Trader referral program is typical. However, 20% of fees is a rather high value that enables socially active traders to earn considerable bonuses.

Customer support

OneUp Trader’s tech support operates 24/7 and is available even when the market is closed (at night and on holidays).

Advantages

- You don’t need to be a partner of the firm to consult tech support

- The call center and live chat are the fastest means of contact. Responses are almost instant

Disadvantages

- The managers don’t always respond promptly by email

To contact OneUp Trader’s tech support, use the following channels:

-

phone;

-

email;

-

live chat on the website

The company has profiles on the most popular platforms, such as YouTube, Twitter, Instagram, etc. The links are included in the website’s footer.

Contacts

| Foundation date | 2017 |

|---|---|

| Registration address | 1007 N. Orange St. 4th Floor, Wilmington, Delaware 19801 |

| Official site | www.oneuptrader.com |

| Contacts |

+1 302-231-0217

|

Education

Profits of proprietary trading firms depend on their partners’ profits. The more traders earn, the more the prop firms earn. For this reason, prop firms try to improve their traders’ qualifications by providing them with educational guides, conducting webinars, etc. OneUp Trader is not an exception, and it also helps its partners trade better.

Issues of trading psychology and money management are discussed in separate articles in the blog. Information isn’t grouped into topics, but you can find what you need using tags. OneUp Trader’s materials can be useful for traders with any experience.

Comparison of OneUp Trader to other prop firms

| OneUp Trader | FundedNext | Hola Prime | SabioTrade | Earn2Trade | The Trading Pit | |

| Trading platform |

Ninja Trader, RTrader, iTrader, Photon, QScalp | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | NinjaTrader, R Trader Pro, Finamark, Overcharts | MetaTrader4, MetaTrader5, BOOKMAP, R Trader, QUANTOWER |

| Min deposit | $125 | $32 | $48 | $119 | $150 | $99 |

| Leverage |

From 1:1 to 1:1 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:1 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | 10% / 10% | No |

| Order Execution | No | N/a | Market Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of OneUp Trader

No cases of violation of the company’s obligations to its clients have been reported. OneUp Trader is officially registered and complies with U.S. financial law. Partners mention simplicity and transparency as the firm’s basic advantages. For example, there are five plans that differ by balance, profit target, and acceptable drawdown. Monthly fees also differ, and traders do not incur any other expenses (withdrawal fees don’t apply). Available instruments include futures contracts on all asset types, except cryptocurrencies.

OneUp Trader by the numbers:

-

$0 for the first 7 days;

-

$125 minimum monthly fee;

-

$250,000 maximum balance;

-

20% profit from the fees paid by referrals;

-

100% profit is taken by a trader from the start;

-

90% profit share goes to a trader after he earns $10,000.

OneUp Trader | Prop firm for trading futures

The company is unique in many ways, and one of its features is the list of financial instruments. Partners of OneUp Trader cannot trade currencies, metals, and energies directly, but the firm offers various futures contracts on most assets. For example, interest rate futures: Eurodollar, 2-30 year bonds, and ultra bond futures. Such a variety of instruments enables traders to apply almost any strategy, although they are limited to intraday trading. Moreover, it’s the simplest and the most effective way to diversify trading risks. Note that trading is not available on holidays or at weekends. OneUp Trader operates 07:00-15:15 Pacific Time. By the end of the trading day, all trades must be closed, otherwise, the firm closes them itself. In the latter case, a trader does not get a strike price but may sustain a loss. This is the only real restriction that must be taken into account.

Useful features of OneUp Trader:

-

Most proprietary trading firms have 2-stage challenges. OneUp Trader’s challenge has only one stage, which makes it considerably easier and quicker.

-

With some prop firms, traders start on demo accounts. The partners of OneUp Trader trade on real accounts right away and get 100% of the profit.

-

During the 7-day trial period, traders have unlimited access to all features, including calendars, analytics, and a dashboard with dynamic statistics.

Advantages:

A trader’s experience and skills don’t matter. He can select one of the five plans and start earning on favorable terms, having up to $250,000 in his account.

OneUp Trader does not set an overall drawdown limit. There are only trailing and daily drawdown limits that allow you to control the trading process accurately. No other restrictions apply.

If a trader violates the company’s rules, he gets a strike price and time to rectify the situation. Even after a second strike price, he can resolve the issue without having his account blocked.

In any event, a trader can reset his account parameters, i.e., return them to their initial values. Irrespective of the plan, a reset costs $100.

Partners keep almost all of their profits (90-100%), and there are no additional charges or expenses. OneUp Trader does not apply withdrawal fees.

The affiliate program brings a 20% bonus on every fee paid by referrals. The number of referrals is unlimited, which can potentially yield high profits.

The prop firm offers great educational content, an extensive blog with useful articles, an active community, and prompt tech support that is available at any time.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i