According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $59

- Match Trader

- Hedging and news trading are prohibited

- up to 1:50

Our Evaluation of QuickFunded

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

QuickFunded is a prop trading firm with higher-than-average risk and the TU Overall Score of 3.07 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by QuickFunded clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work.

QuickFunded offers traders a straightforward path to start trading with allocated capital. Its evaluation programs are designed to be both flexible and growth-oriented, making them a valuable tool for both novice and experienced traders. QuickFunded’s approach empowers traders to focus on skill development and achieving success in the financial markets.

Brief Look at QuickFunded

QuickFunded is a proprietary trading firm founded in London in February 2024. After successfully passing an evaluation test, traders receive capital of up to $500,000 and a scaling plan that offers funding of up to $2 million. QuickFunded clients can trade various instruments, including Forex currency pairs, energies, commodities, indices, and cryptocurrencies. Traders can choose a one- or two-step evaluation process to secure funding. QuickFunded's services are accessible worldwide, including the United States and the European Economic Area (EEA).

- A wide range of assets is available for trading.

- The Match Trader platform with an intuitive interface.

- Scaling opportunities for successful traders.

- The ability to copy trades between accounts after successful evaluation.

- There are restrictions on using third-party trading advisors.

- Ban on group trading and copy trading during the evaluation phase.

TU Expert Advice

Financial expert and analyst at Traders Union

QuickFunded offers a convenient solution for those who want to trade in the market using allocated capital without risking their funds. The company provides opportunities to test trading skills in real-world conditions through a demo account and a unique one- or two-step evaluation system. This allows beginners to safely develop their skills, while experienced traders can access real capital without risking their funds.

The Match Trader platform supports a wide range of financial instruments (Forex and CFDs), offering extensive trading opportunities. For beginners, it's a chance to explore various assets, while for professionals, it's an opportunity to hone their skills in specific areas. However, the ban on using third-party automated advisors may be a limitation for some users.

QuickFunded offers a scalable structure that enables successful traders to increase their capital and earn a higher share of profits. This makes QuickFunded an excellent partner for traders seeking long-term success in the financial markets.

QuickFunded Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | Match Trader |

|---|---|

| 📊 Accounts: | QuickFunded Evaluation (Demo), QuickFunded Trader (Live) |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, Stripe, and cryptocurrencies |

| 🚀 Minimum deposit: | $59 (and 2-Step Challenge) |

| ⚖️ Leverage: | up to 1:50 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | From 0.0 pips on EUR/USD |

| 🔧 Instruments: | Forex, metals, energies, commodities, indices, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Hedging and news trading are prohibited |

| 🎁 Contests and bonuses: | Yes |

Prohibited strategies include hedging and placing large orders that use the entire account balance in a single trade. News trading is restricted: new trades cannot be opened within 2 minutes before or after the release of significant news. Leverage is limited to 1:50 for Forex, 1:10 for energies, 1:20 for indices and commodities, and 1:2 for cryptocurrencies. Using a VPN while trading is prohibited. There are no restrictions on lot size.

QuickFunded Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Deposit and withdrawal

-

The first withdrawal from a funded account is allowed 14 days after the first trade is placed.

-

Supported withdrawal methods include bank transfers, Stripe, and cryptocurrency transactions. Available cryptocurrencies include BTC, ETH, LTC, BSC, XRP, and others.

-

The minimum withdrawal amount is $50.

-

Withdrawals are processed within 2-5 business days.

-

Clients can request withdrawals every 14 days.

-

All open positions must be closed before submitting a withdrawal request.

-

Withdrawals are canceled if the account balance is lower than the initial amount of capital provided by the company.

Trading Account Opening

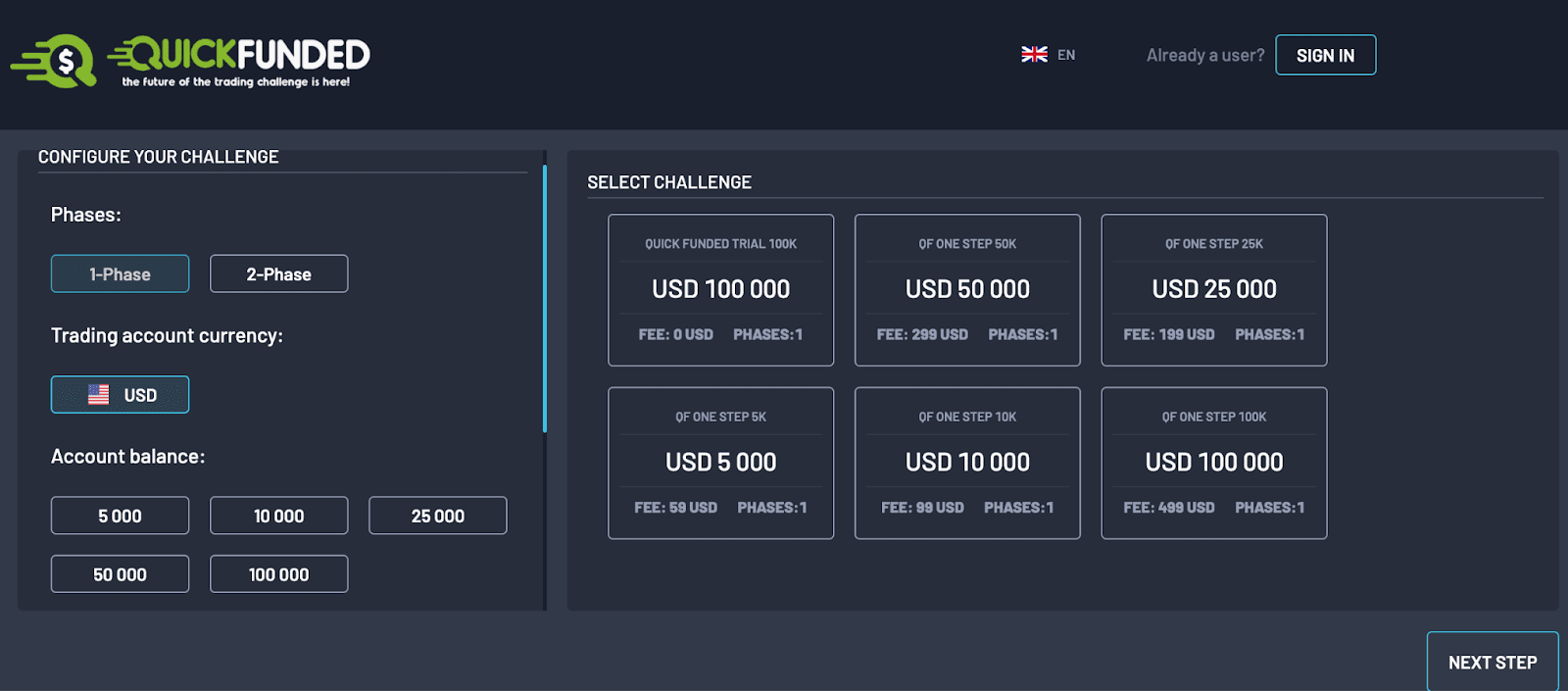

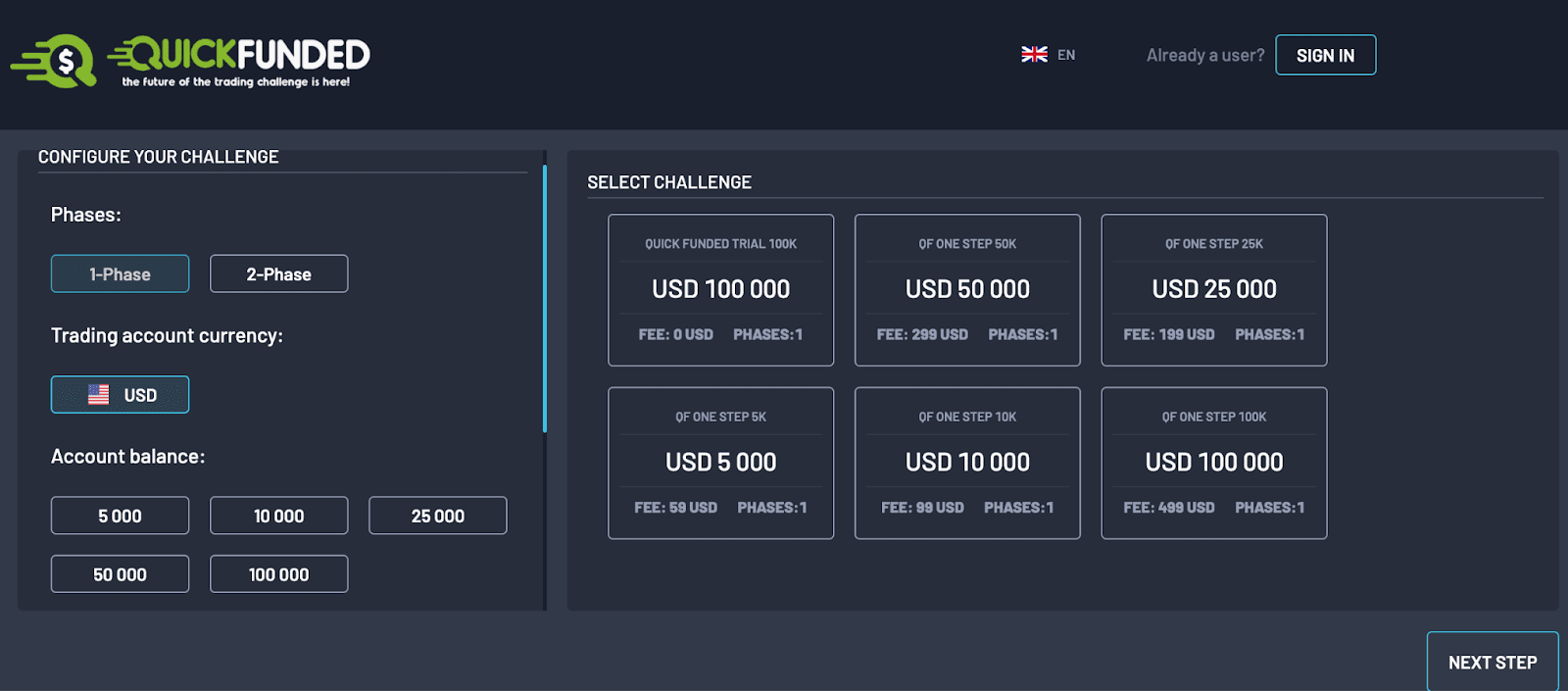

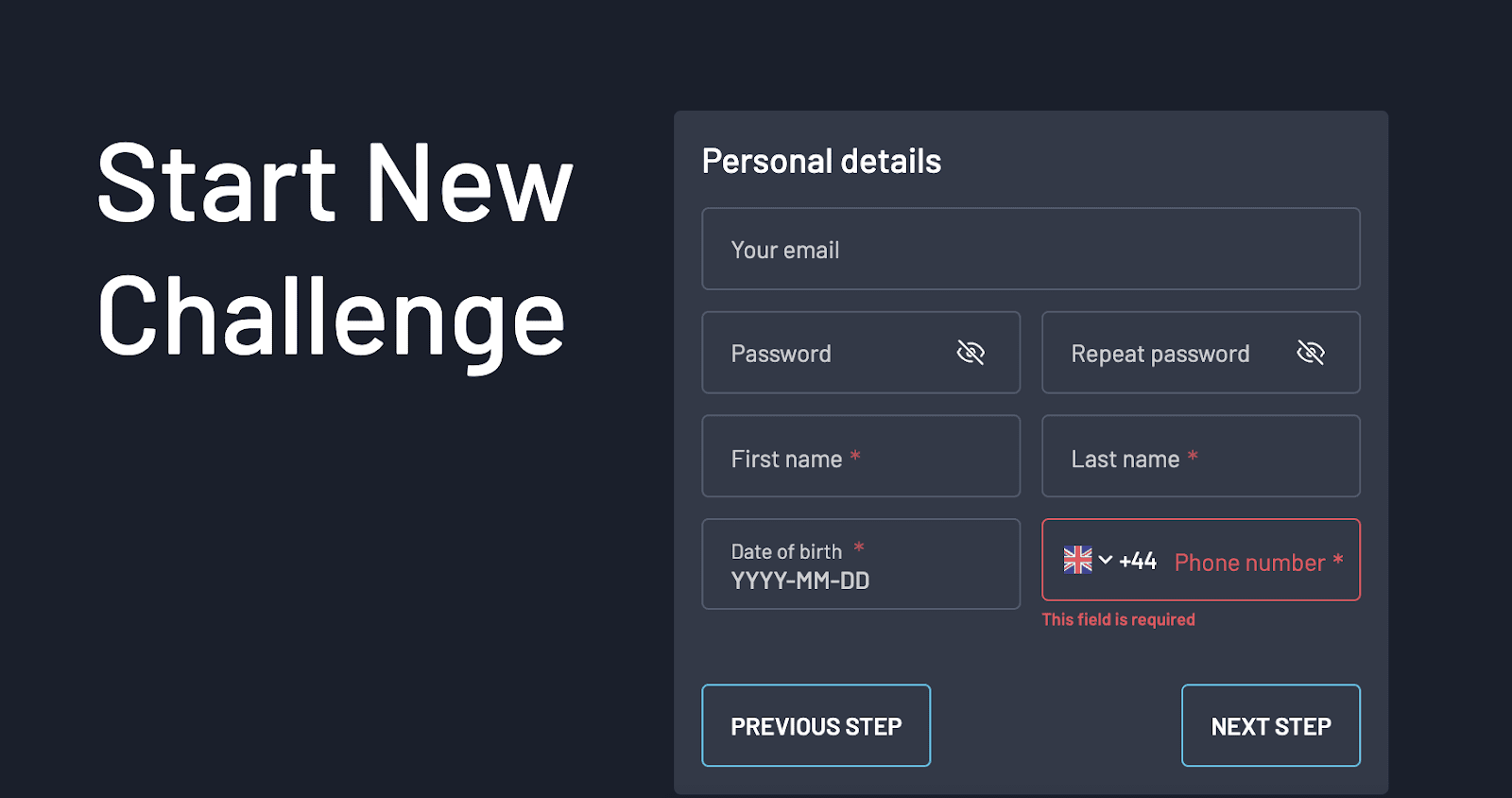

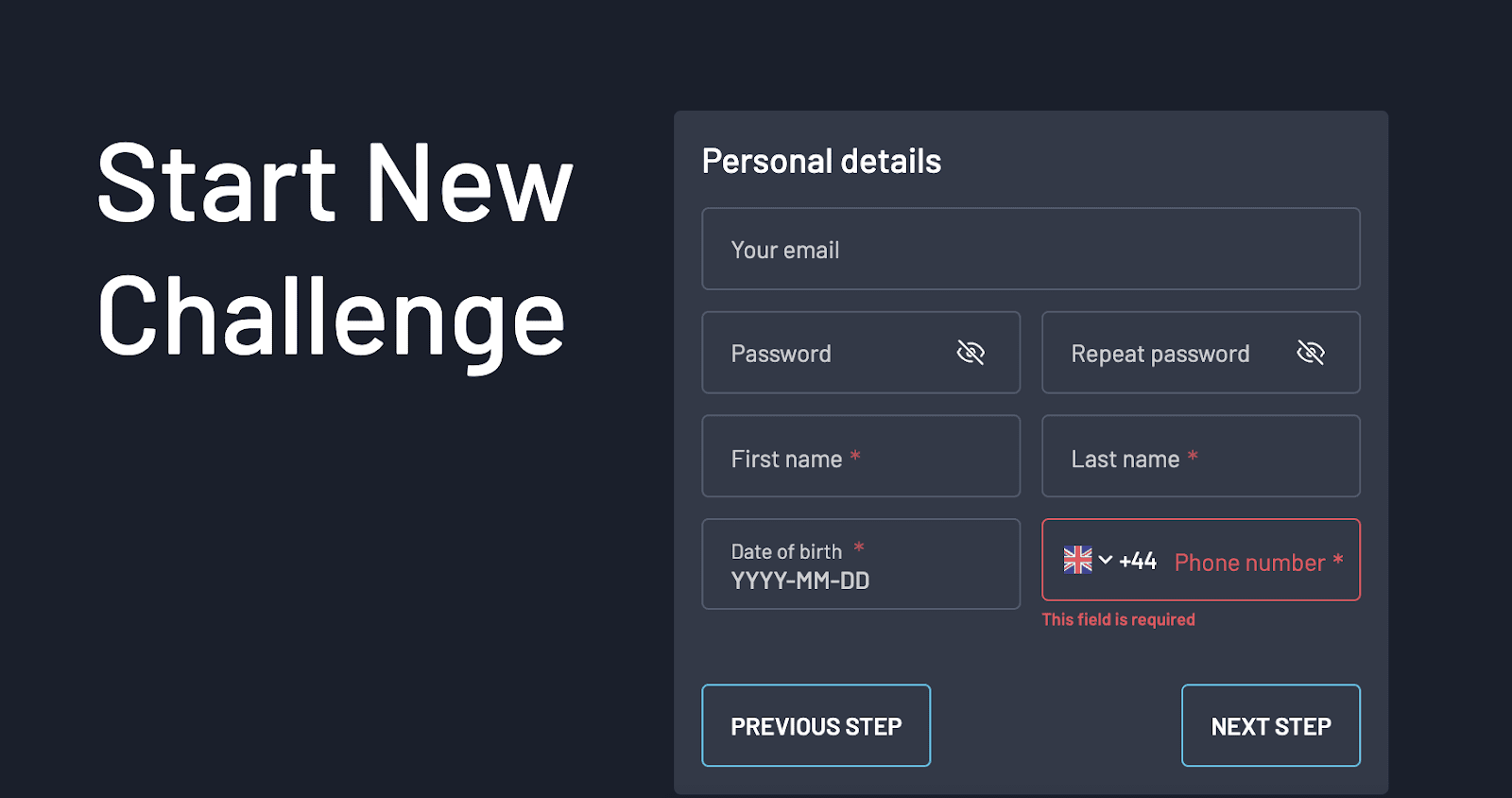

To begin the evaluation process with QuickFunded, visit the official website and follow the steps below:

Click ‘Buy Challenge’.

Select the challenge type and the desired funding amount.

Fill out the registration form with your personal information.

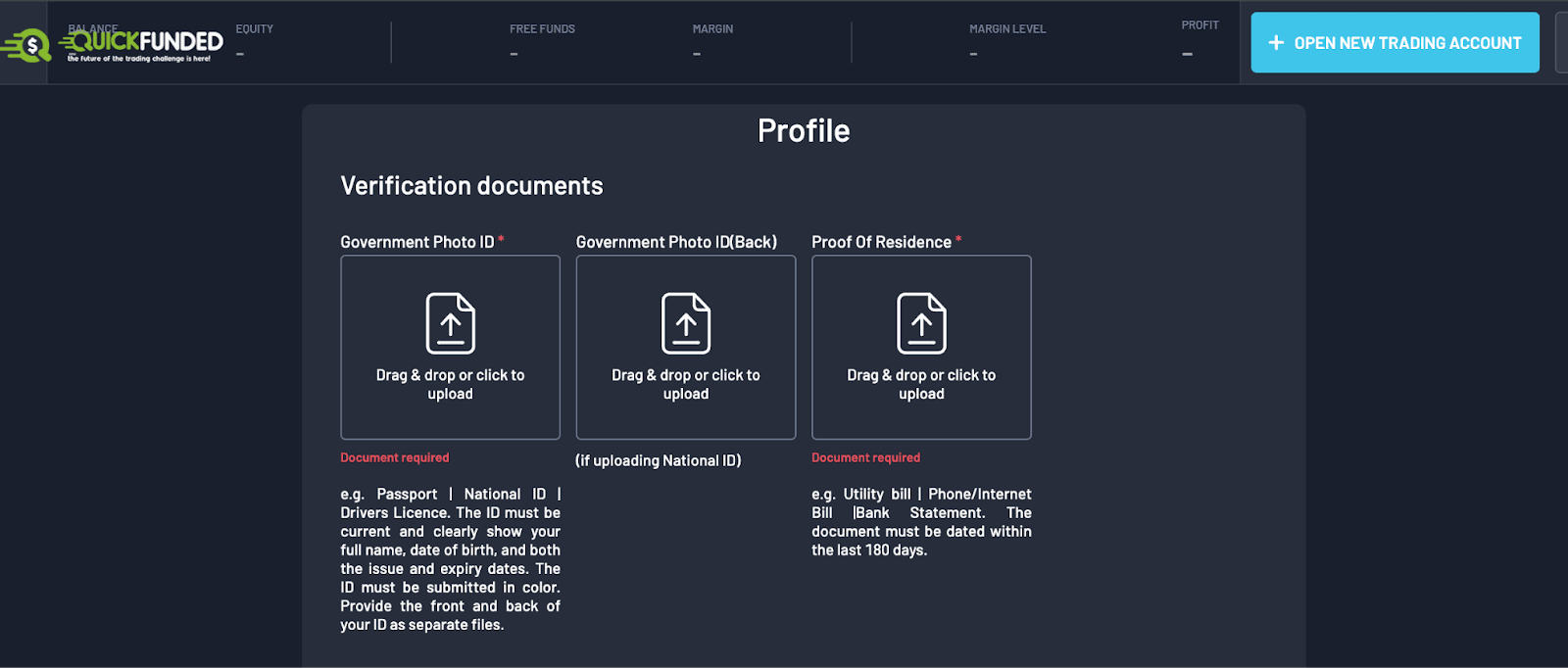

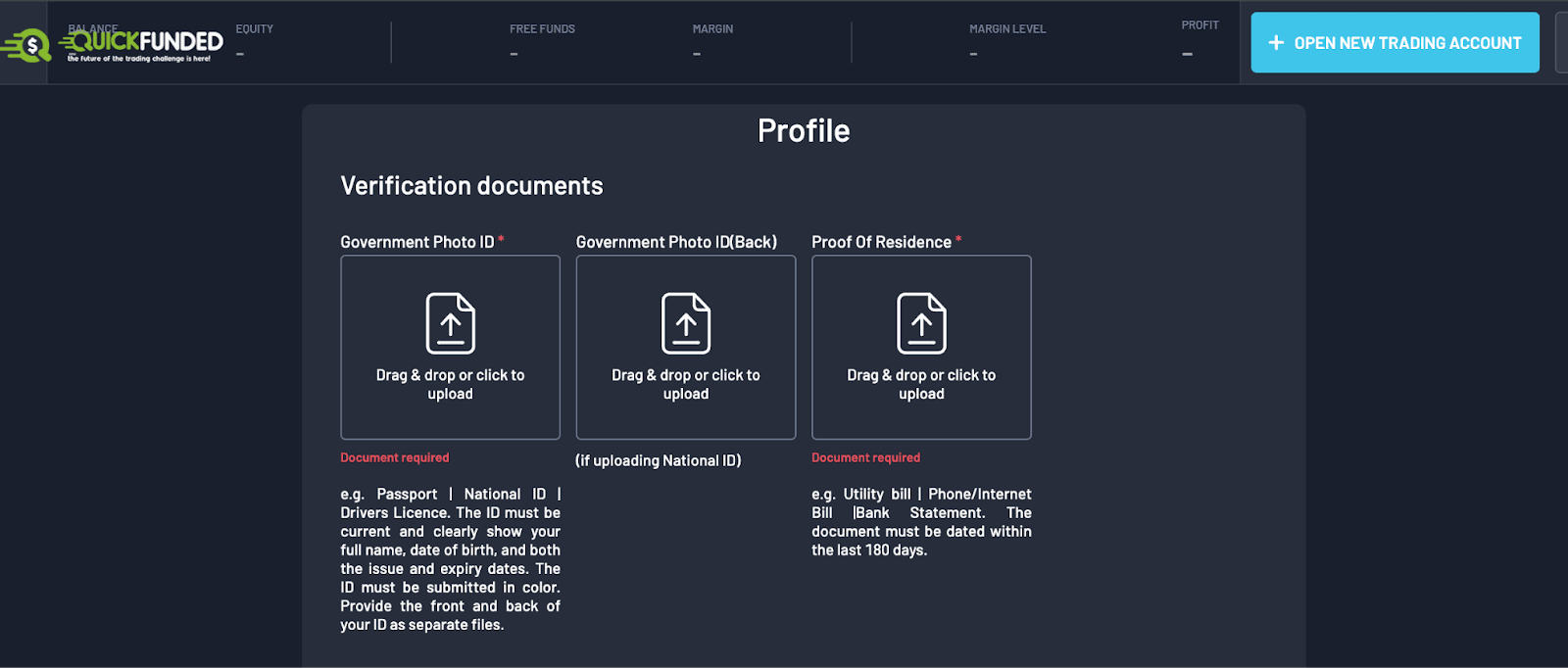

Complete the verification process. After verification, you can proceed to pay for the challenge.

Additional features of QuickFunded user account allow traders to:

-

Open a live account.

-

Install the desktop platform.

-

Configure account settings.

-

Generate trading statistics.

-

Submit withdrawal requests.

Regulation and safety

QuickFunded Ltd is a proprietary trading firm, not a broker. It is registered in the United Kingdom and operates without a license, as proprietary trading activities are not regulated. Additionally, traders do not deposit their funds to trade, meaning they do not risk their capital in trades. QuickFunded Ltd’s registration number in the Companies House is 15503879.

Advantages

- QuickFunded is registered in the UK.

- The company accepts residents from the U.S. and EU.

- Adheres to a strict data privacy policy.

Disadvantages

- Profit withdrawals may be canceled if trading conditions are violated.

- QuickFunded does not execute trades on behalf of traders.

- Clients cannot file complaints with the FCA (Financial Conduct Authority).

Markets and tradable assets

QuickFunded has a score of 0/10, which corresponds to a Low assessment of its market and asset offering.

- No Forex trading

- Futures not available

Tradable markets

We compared the range of tradable instruments offered by QuickFunded with two leading competitors to highlight the differences in market access.

| QuickFunded | Hola Prime | SabioTrade | |

| Futures | No | No | |

| CFDs | Yes | Yes | |

| Forex | Yes | Yes | |

| Options | No | No | |

| Stocks | No | No | |

| Crypto | Yes | Yes | |

| Indices | Yes | Yes |

Investment Options

On the QuickFunded platform, traders must develop and implement their strategies independently. Group trading and copy trading during the challenge are strictly prohibited. The use of third-party advisors (EAs) is also not allowed and may lead to account termination. However, traders may use their custom-built advisor if they provide the source code and a detailed explanation of the strategy. After completing the evaluation, copy trading between live accounts and one of the demo accounts is permitted if the trader decides to start a new challenge with a different funding amount.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

QuickFunded’s Partnership Program

QuickFunded offers a partnership program with a rewards system for bringing in new clients. Partners can access different program levels, allowing them to earn commissions based on the number of referrals.

The main terms of the partnership programs:

-

Level 1 (fewer than 50 referrals): 10% commission.

-

Level 2 (50 to 99 referrals): 12.5% commission and a code or link with a 5% discount for new users.

-

Level 3 (100+ referrals): 15% commission and a code or link with a 7.5% discount for new users.

This program enables partners to earn income while encouraging new users through discount codes, making the terms attractive for both parties.

Customer support

The QuickFunded website features a 24/7 chat for communication with a bot. This chat can also be used to connect with a company representative during business hours.

Advantages

- Quick and detailed responses via chat.

- Option for phone support.

Disadvantages

- Live operators are unavailable on weekends

- Phone support is only available within the UK.

You can reach out to QuickFunded through:

-

Online chat on the official website.

-

Email.

-

Contact form on their website.

Additionally, QuickFunded has channels and profiles on Discord, Telegram, Facebook, and X (formerly Twitter).

Contacts

| Registration address | 128 City Road, London, EC1V 2NX, United Kingdom |

|---|---|

| Contacts |

Education

The QuickFunded website does not offer educational materials.

QuickFunded does not offer a free trial account. To access a demo account, traders must pay a registration fee ranging from $59 to $499, depending on the chosen plan.

Comparison of QuickFunded to other prop firms

| QuickFunded | FundedNext | Hola Prime | SabioTrade | Instant Funding | FXIFY | |

| Trading platform |

Match Trader | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | cTrader, DX Trade, MetaTrader5, Match Trader | MetaTrader4, MetaTrader5 |

| Min deposit | $59 | $32 | $48 | $119 | $79 | $99 |

| Leverage |

From 1:1 to 1:50 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:50 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed QuickFunded review

QuickFunded offers clear and straightforward conditions for traders interested in proprietary trading services. The first step involves trading on a demo account. For the one-step challenge, successful trading on the demo account leads to funding and access to a live trading account. The two-step evaluation requires passing both phases to access managed capital. The maximum funding amount for both challenge types is $500,000, allowing traders to hold multiple active accounts and trade them simultaneously to maximize profits.

QuickFunded by the numbers:

-

Accounts with deposits ranging from $5,000 to $100,000.

-

Payouts every 14 days.

-

20% refund of the challenge fee if the evaluation stage is not passed.

-

Scaling plan with funding up to $2 million.

-

Payouts to traders range from 80-95% of profits.

QuickFunded is a new UK-based proprietary trading services company.

There are specific rules to be aware of before registering with QuickFunded. Traders cannot merge accounts; each account requires a unique trading strategy. Using the same trading methods on different accounts will cause account suspension. Only its verified owner can use each trading account. Third-party trading is strictly prohibited.

The company will deactivate an account after 90 days of inactivity. To keep the account active, at least one trade must be made within this period. Trading on weekends is allowed, which is particularly relevant for cryptocurrencies. There is no maximum duration for the evaluation period, but a minimum of 3 trading days is required.

QuickFunded’s analytical services:

-

Choice of evaluation models.

-

The Match Trader platform supports a variety of financial instruments.

-

Ability to use leverage.

-

Trading simulator with realistic market conditions.

-

Scaling plan to increase capital and profit shares for successful traders.

Advantages:

Ability to withdraw profits in cryptocurrencies.

Trading on a demo account that mirrors real market conditions.

Servicing traders from around the world.

Transparent trading conditions.

Leverage from 1:2 to 1:50 depending on the asset.

User-friendly experience with high-quality support.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i