Note:

This article is not financial advice and is for educational purposes only. Buying cryptocurrencies is a high-risk type of investment.

It is hard to correctly pick one cryptocurrency that will undoubtedly skyrocket in price and make amazing profits. But XRP (Ripple) is a promising candidate because it already has a large following and some key advantages over other cryptocurrencies. It might not be the most expensive cryptocurrency at the moment, but many crypto experts suggest that XRP (Ripple) has the capability to revolutionize transaction processes worldwide.

One of the most important differences between Ripple and other cryptocurrencies and platforms is that it is aimed at the financial services industry. XRP is also consistently ranked among the top ten digital currencies in terms of market capitalization. This article will teach you everything you need to know about Ripple (XRP), so you can decide whether it's worth buying or not.

Start trading cryptocurrencies right now with Binance!Whether you want to buy XRP or another cryptocurrency, you must ensure that you use the correct buying strategy. Not only will it assist you in avoiding all undesirable situations, but it will also help you to determine whether XRP is a good option or not.

The Traders Union experts have created a short, step by step strategy for buying XRP. This strategy is not only suitable for XRP but almost any other cryptocurrency in the world. Here it is:

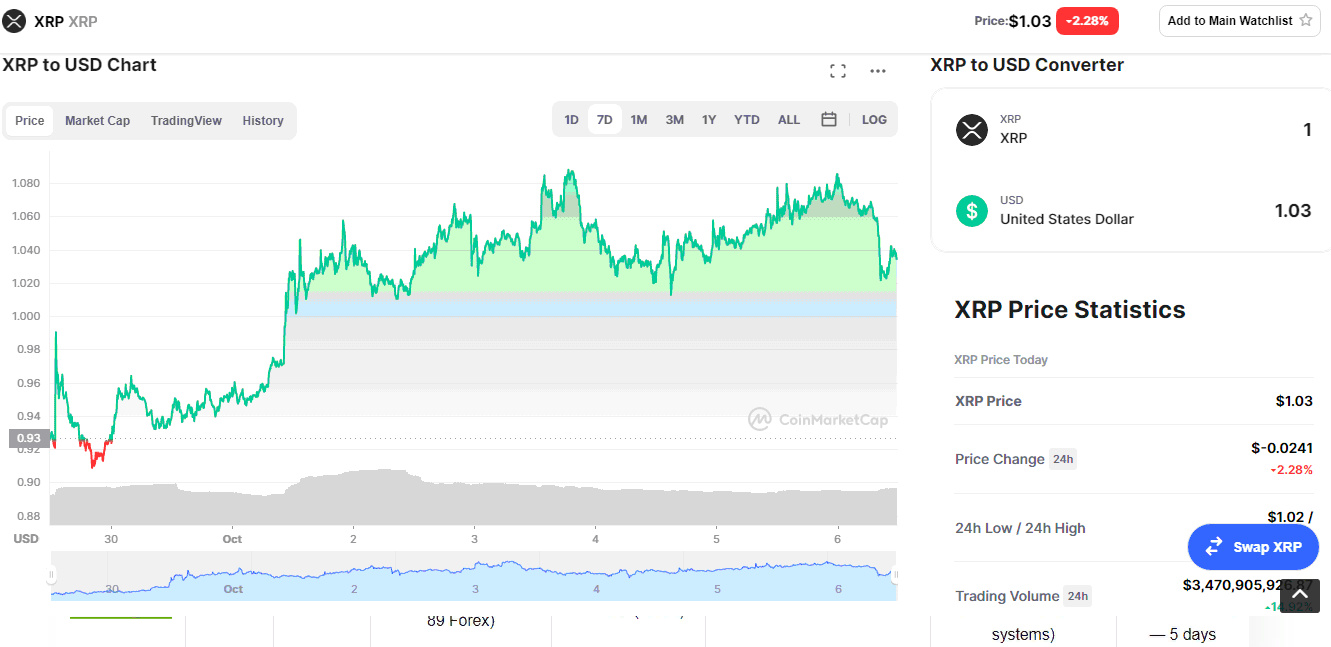

Before purchasing any cryptocurrency, you should conduct market research. You should start by researching the current market performance of the cryptocurrency you're interested in (XRP in this case). In order to study XRP the right way, it is recommended to go to a reputable and trusted crypto price tracking online service such as CoinMarketCap.

There, you can learn everything you need to know about the cryptocurrency you want to buy. This includes current progress, historical data, future price predictions, and more.

XRP Price Statistics

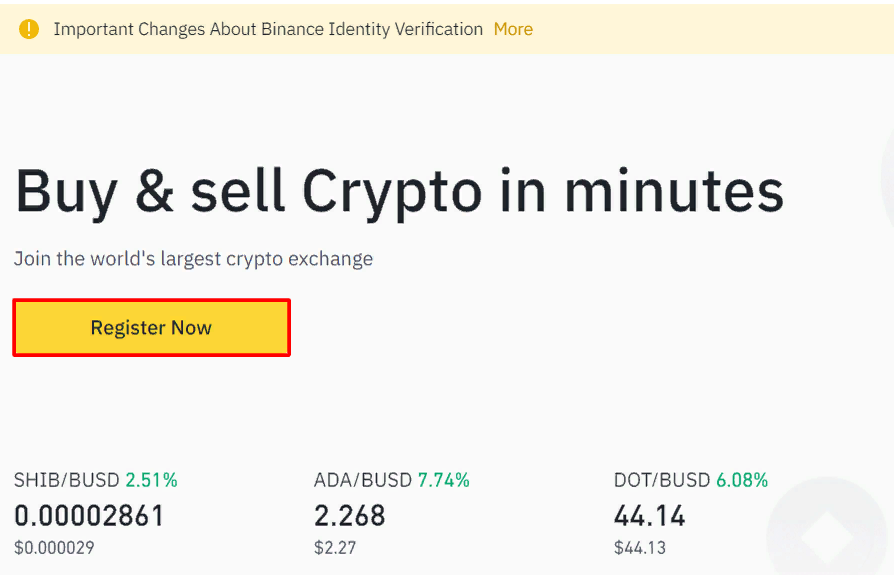

There are many online crypto brokers where you can buy XRP. However, we consider Binance to be the best online cryptocurrency exchange for purchasing XRP. The first step toward using Binance is to create a free trading account. It only takes a few minutes because all you have to do is open the official Binance website and click on the big yellow “Register Now” button.

How to Register on Binance

To complete your registration, you must enter your email address or phone number, as well as a strong password.

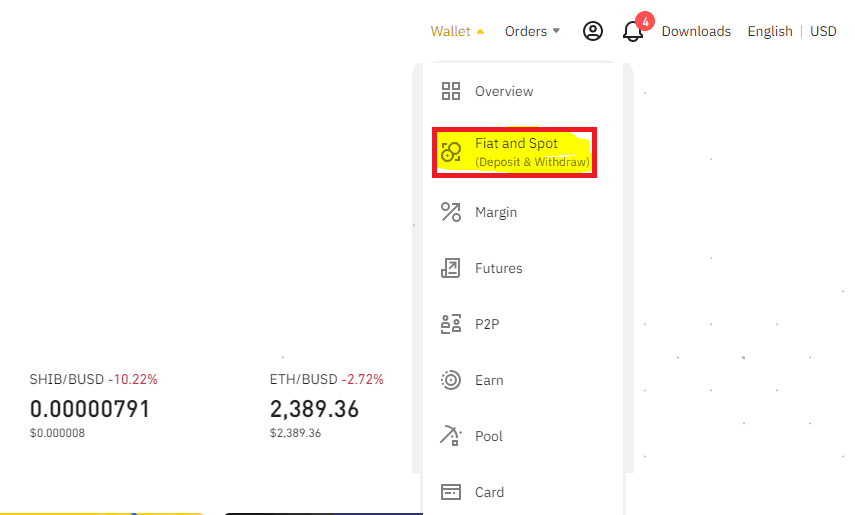

To buy any crypto, you must have enough funds in your account balance to pay for it. To fund your Binance account, you have two options: fiat currency or cryptocurrency.

First, you have to click on the “Wallet” button and then select the “Fiat and Spot” option.

How to Make Deposit on Binance

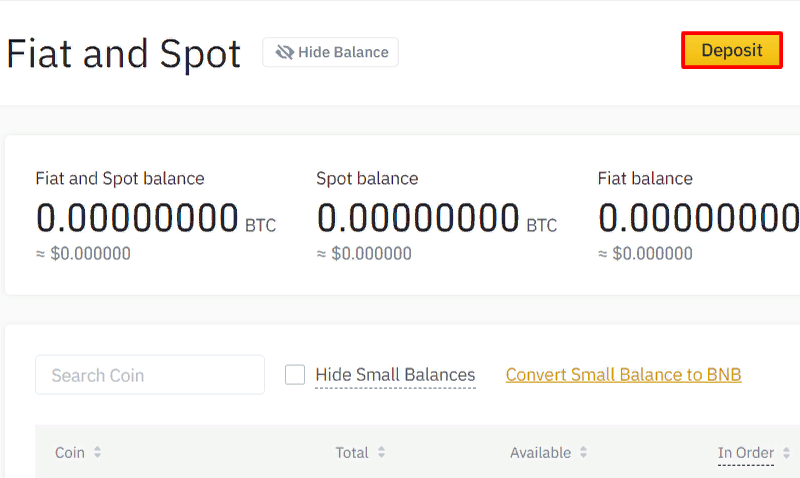

You will now be redirected to another page where you must simply click the "Deposit" button, as shown below.

Deposit button

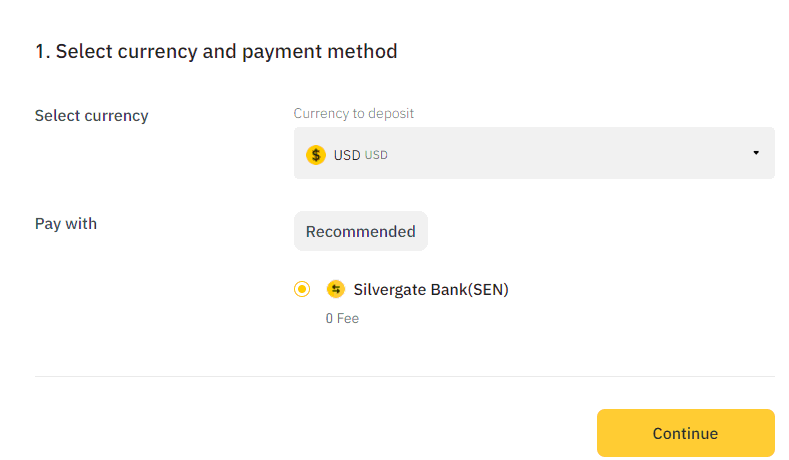

On the following page, you'll be asked to choose between fiat and cryptocurrency. If you choose fiat currency, you have to select your currency and bank, and then click “Continue”. After that, you'll only need to enter your bank account information and the amount you want to deposit into your account.

If you select the "Deposit Crypto" option, you will be redirected to another page where you must attach your crypto wallet.

Account Funding on Binance

The Binance app is available for both iOS and Android devices and is very easy to use. The following steps will guide you through the process of purchasing XRP with the Binance app.

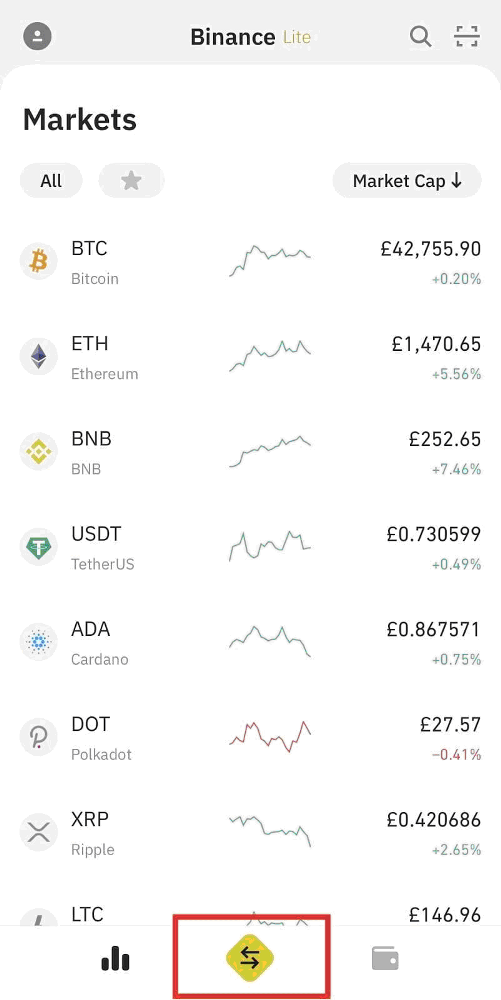

After you have logged into your account on the Binance app, you'll need to click on the yellow button with double arrows in the bottom bar, as shown in the image below.

How to Buy XRP on Binance

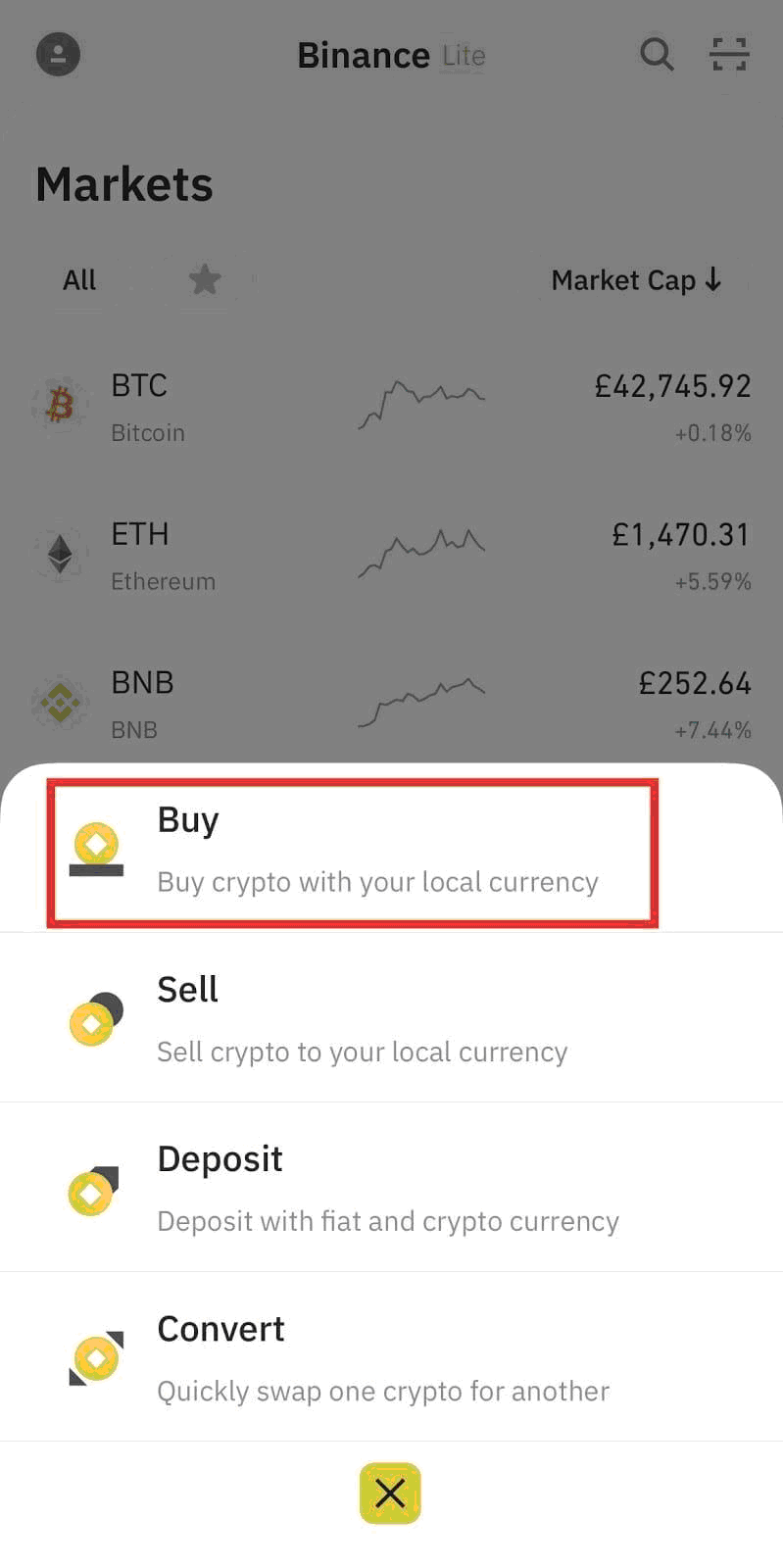

The system will display a small menu with several options, and you must select the “Buy” option.

How to Buy XRP on Binance

Then, you will be taken to another page where you can select XRP from the available list of cryptocurrencies and enter the amount you want to buy. Then, you will be asked to select a payment method, and you must select "Binance Cash." After that, you will own a certain amount of XRP tokens based on the amount you entered.

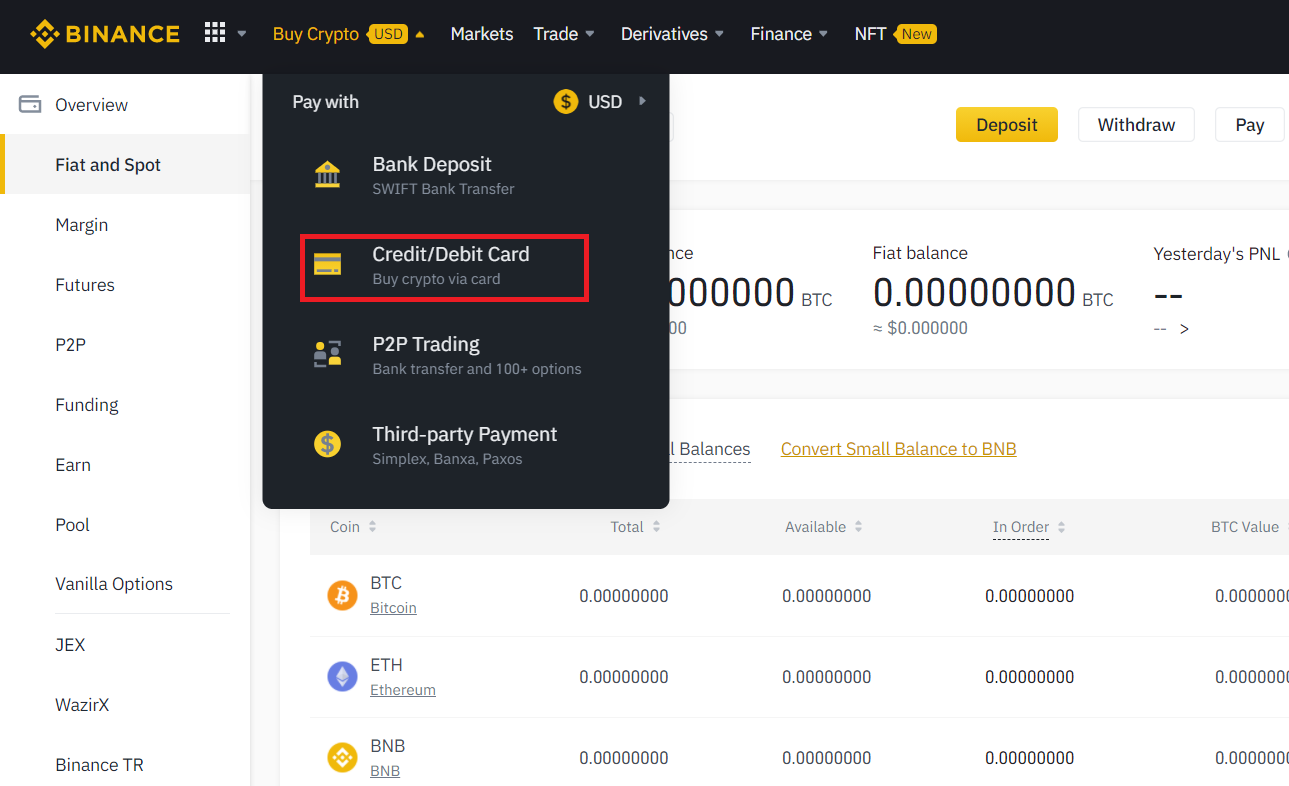

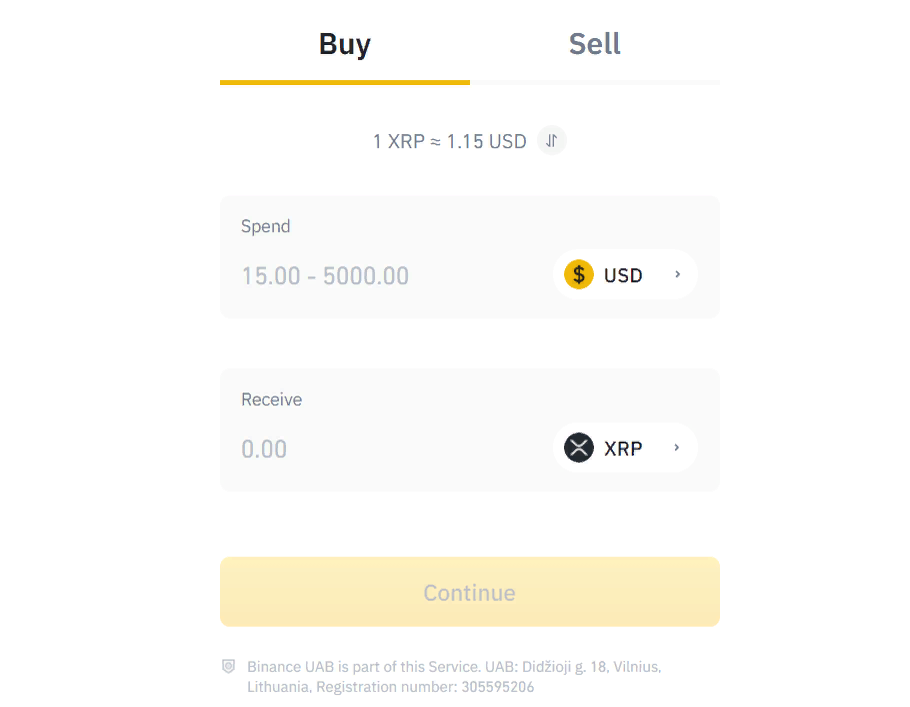

Binance also allows you to buy XRP tokens without first funding your account. To do so, you have to open Binance in your browser and select the “Buy Crypto” option, which is situated near the Binance icon. Then you'll see a small dropdown menu, where you have to select the first option with the “Credit/Debit Card” label.

How Buy XRP Directly

On the following page, enter the amount in fiat currency and select XRP from the selection of different cryptocurrencies. Now, click the "Continue" button, and the system will require you to fill in your bank account information. After that, all you have to do is click the “Continue” button to finish the operation.

How Buy XRP Directly

The best crypto exchanges in the market today are considered Binance and Coinbase. It is important to choose the best crypto broker for you because a small part of your trading success is determined by your broker. So, here are the biggest differences between Binance and Coinbase:

The Binance fees are only 0.1-0.2% per trade, while Coinbase charges 0.5% per trade. Of course, there are some other fees for things such as credit card and debit purchases, withdrawals, but Binance is generally cheaper.

Here, you have to know that the global version of Binance supports over 500 cryptocurrencies, while the US version only supports 52 cryptocurrencies. On the other hand, Coinbase only supports 51 cryptocurrencies in total. It is worth mentioning that neither Binance US nor Coinbase supports XRP, but the global Binance does.

Binance US is legal to operate in the US, but it is not regulated by any regulator. One advantage of Coinbase is that it is regulated by the New York State Department of Financial Services in the US.

With Binance, it is easier and quicker to transform your crypto tokens into cash.

Ripple is both a blockchain platform and a cryptocurrency. The blockchain platform was founded by Jed McCaleb and Chris Larsen in 2004 and was called OpenCoin in the beginning, but changed its name to Ripple Labs. Ripple was created to be a platform for sending payments all around the world quickly and very cheaply.

Ripple Labs Inc. created the XRP cryptocurrency in 2012 with the goal of providing the cheapest and fastest transactions for international funds transfers within the Ripple platform. The Ripple payment system allows you to conduct transactions in either XRP or fiat currency. Furthermore, it is regarded as one of the world's most scalable and fastest decentralized platforms for sending and receiving payments.

Ripple progressed slowly in the first two years, but 2015 and 2016 were pivotal years for the platform's growth. Ripple introduced two of its most valuable features in 2017, which were payment channels and escrow. It greatly aided the platform's growth and performance by providing businesses with unbelievably cheaper and faster international payments experience. Ripple also formed a partnership with ten new banks in the same year. Following that, over 100 banks from the United States and Japan began using Ripple.

The most notable advantages of the Ripple blockchain platform are:

Ripple can easily process and confirm an international transaction that would otherwise take two to three business days in just 3-5 seconds. It is an incredibly fast speed that has the potential to change the global landscape of international payments.

Ripple's transaction fee is negligible, and you would only have to pay 0.00001 XRP per transaction, which is less than a penny.

Ripple has evolved over time, and it can now process other commodities, cryptocurrencies, and fiat currencies in addition to XRP transactions.

Ripple (XRP) is used by many international institutes, particularly banks all over the world. It also distinguishes itself from the rest of the cryptocurrencies because its market adoption is greater than that of all of its competitors.

The XRP cryptocurrency was created to be used as a financial instrument that facilitates the transactions taking place across the Ripple platform.

Unlike other cryptocurrencies that were created to be used by the general audience for paying for services and goods, XRP was created for transfers between banks, other institutions, or individuals. In the last few years, numerous traders and investors started being interested in XRP as a financial instrument, and it became available for the public.

Another difference between XRP and other cryptocurrencies is that XRP cannot be mined. Ripple Labs pre-mined 100 billion XRP tokens and it is impossible to mine any more. However, around 60% of those 100 billion tokens are held in an escrow account. Ripple cannot release more than one billion tokens within a month.

The XRP international transfers take just a few seconds to be processed and have a negligible fee. On the other hand, the international transfers done with other cryptocurrencies take longer to be processed and have considerable fees in certain cases.

In the table below, you can find a few key aspects of the XRP token. Although Ripple pre-mined a huge number of XRP tokens, not all of them have been released in the market. That is because, in the crypto market, the supply and demand of a cryptocurrency influence its price very much. So, Ripple is controlling the amount of XRP tokens in the market, the supply, to maintain their value.

| Ticket | XRP |

|---|---|

Max supply |

100,000,000,000 |

Total supply |

99,990,358,414 |

1-year price low |

$0.21019 |

1-year price high |

$1.75781 |

Current Price |

0.67$ |

Market cap |

$43 511 323 411 |

Markets |

Binance, Huobi Global, KuCoin |

The crypto market is constantly changing, and you could never know what cryptocurrencies will go up in value or which ones will go down in value. This question is relevant for any other cryptocurrency because you have no guarantee that a certain cryptocurrency will continue to increase its value after you buy it.

One thing you have to know about XRP is that it is a very volatile cryptocurrency. Its price usually fluctuates very much during 7 days, and it has a very big intraday volatility, and this represents a big risk of losing money. However, its price increases considerably sometimes, and that represents a big opportunity for some traders who know how to take advantage of those situations.

Many crypto experts suggest that XRP has a very bright future and that it will become a very important cryptocurrency in the future, thanks to the Ripple transfer platform. All of that being said, XRP might be a good choice for long term investment because the Ripple project is constantly evolving, and it gained a lot of popularity recently.

Remember that crypto trading is a high-risk type of investment, and you should not risk more than you can afford to lose.

There is a great number of traders all around the world who constantly invest in XRP because they consider that it will suddenly go up in value and they will gain lots of profits then. XRP has a very good performance and is considered one of the best cryptocurrencies to invest in. However, it is very volatile, and that could be noticed in the chart below that shows its price fluctuations between October 2020 and January 2023. During this period, the lowest price was $0.2 for a token, while the highest price was $1.93 for a token.

XRP Performance

| XRP | |

|---|---|

1m return |

0.70% |

1y return |

126.50% |

Picking the correct asset to invest in can be a difficult task, and cryptocurrency is no exception. We've done the hard work for you and compiled a list of the top ten cryptocurrencies to invest in. Our experts chose these options after conducting extensive market research and technical analysis, with the most significant factors being popularity, technology, current and historical performance, and future indications.

| Cryptocurrency | Industry | Current price | 1y return | 1m Return | Total score | |

|---|---|---|---|---|---|---|

Binance Coin (BNB) |

Cryptocurrency exchange |

484.90$ |

177.59% |

16.57% |

9.5 |

Invest |

Cardano (ADA) |

Blockchain platform |

2.13$ |

181.68% |

-10.80% |

9.2 |

Invest |

Ripple (XRP) |

Payments |

1.08$ |

126.50% |

0.70% |

9 |

Invest |

Dogecoin (Doge) |

Payments |

0.25$ |

195.85% |

2.50% |

8 |

Invest |

Polkadot (DOT) |

Blockchain platform |

41.17$ |

165.43% |

16.57% |

8 |

Invest |

LItecoin (LTC) |

Payments |

185.60$ |

119.22% |

2.29% |

7.6 |

Invest |

Stellar (XLM) |

Payments |

0.38$ |

129.51% |

16.45% |

7.5 |

Invest |

Uniswap (UNI) |

Decentralized exchange |

25.64$ |

159.96% |

4.38% |

7.4 |

Invest |

Tron (TRX) |

Blockchain platform/Media |

0.10$ |

116.40% |

-7.61% |

7 |

Invest |

IOTA (MIOTA) |

Internet of Things |

1.24$ |

129.67% |

-28.95% |

6.9 |

Invest |

Note:

This article is not financial advice and is for educational purposes only. Buying cryptocurrencies is a high-risk type of investment.

Many people consider that Ripple and XRP are the same things. But the truth is that Ripple is an international payment system that created XRP for facilitating the transfers within the system. XRP is a cryptocurrency that has gained a lot of popularity recently and represents a big investment opportunity for investors and traders all around the world.

We hope that this guide will help you make the most informed decisions about investing in XRP, and it has answered most of the questions you had about buying XRP. Furthermore, before investing a big amount of money at once, we recommend that you first buy a few coins in order to understand how the entire system works and if you could gain profits from buying XRP.

No. Although these two terms are frequently used interchangeably, they do not have the same meaning. Ripple is a funds transfer platform, and XRP is a cryptocurrency that was created for being used on that platform.

A few big brokers unlisted XRP because Ripple is confronting an SEC complaint. That complaint states that Ripple co-founder Christian Larsen and current CEO Bradley Garlinghouse raised funds through unregistered securities by selling XRP in the United States and other countries in 2013. However, Binance still offers XRP to international users.

Because transactions made with XRP only take 3-5 to settle, the big companies, such as banks, do not hold it for an extended period, and they are not affected by its volatility.

No, XRP and Ripple are distinct entities, and purchasing XRP does not imply ownership of Ripple. More than that, Ripple is not a publicly traded company, and you cannot purchase its shares.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).