According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $189

- cTrader

- DXTrade

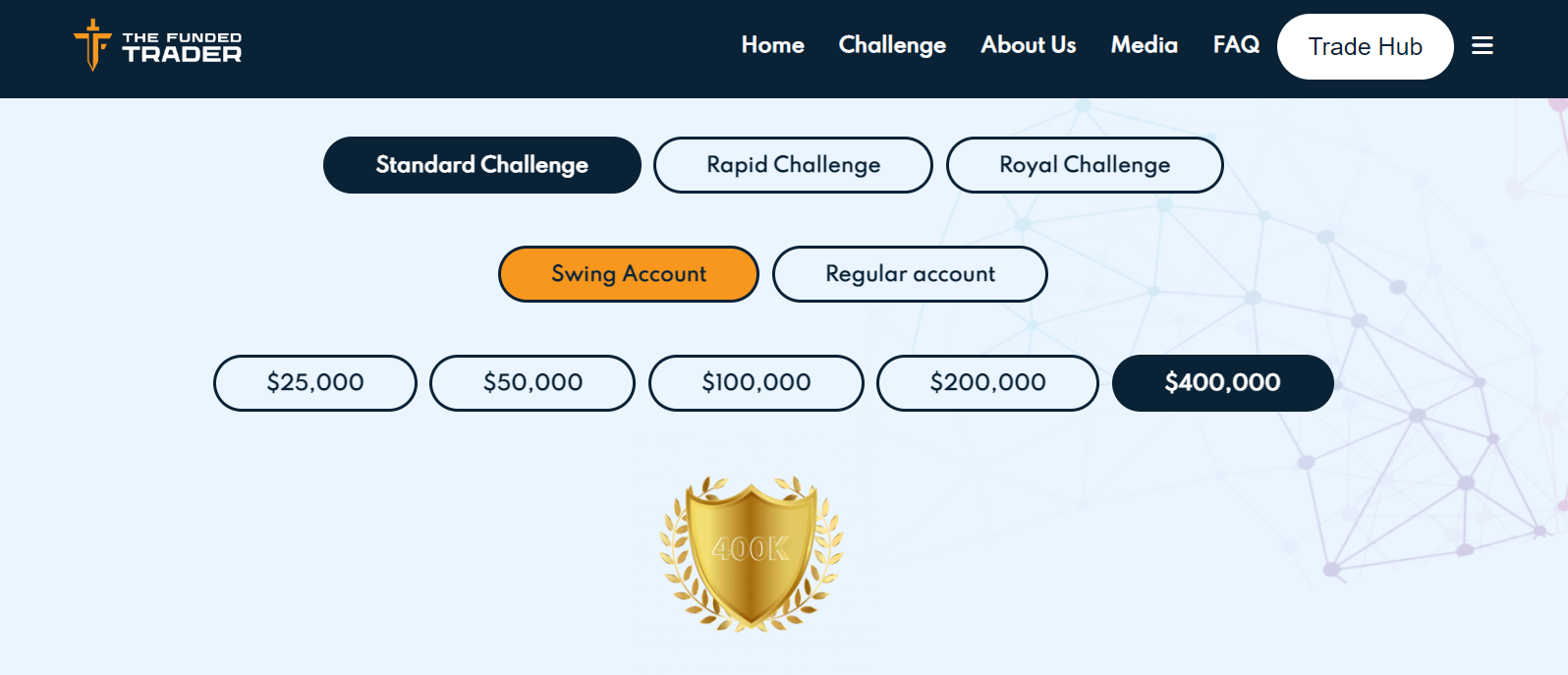

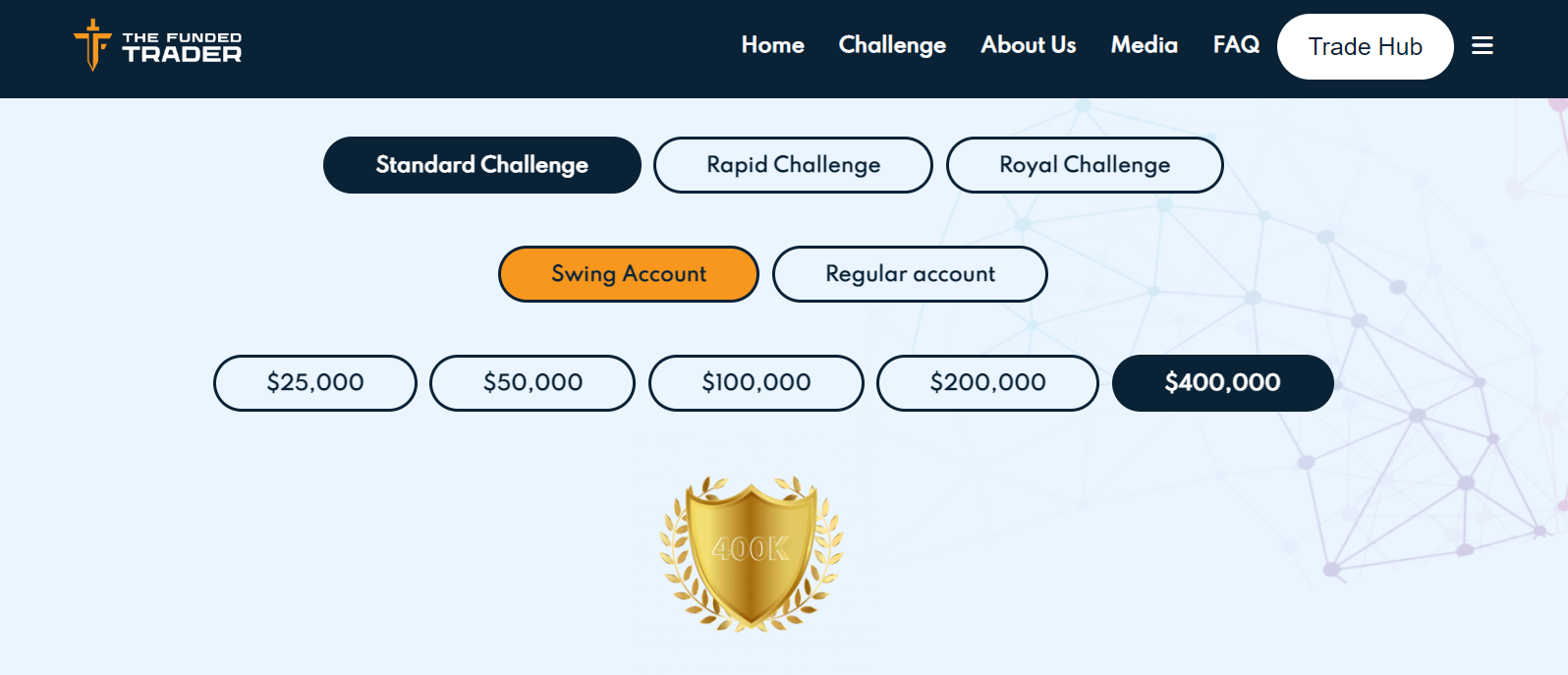

- Four accounts types and several subtypes

- Balance scale is from $25,000 to $400,000

- Initial fee is refundable

- Failed challenges can be retried

- Traders keep 80%-90% of profit split

- Up to 1:200

Our Evaluation of The Funded Trader

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

The Funded Trader is a prop trading firm with higher-than-average risk and the TU Overall Score of 4.49 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by The Funded Trader clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work.

The Funded Trader proprietary firm works with a well-known broker. Eightcap has successfully operated in the global market for many years, and there are no regional restrictions. The firm’s website is fast, convenient, and easy to learn. The features of standard accounts are on average better than those of its competitors, and the initial fee is relatively low. The Funded Trader imposes minimum restrictions on its partners in an effort to avoid excessive risks. Now it has over 6,000 partners and 500+ professionals worldwide who teach in trading academies, and who are trained by The Funded Trader.

Brief Look at The Funded Trader

The Funded Trader is a prop trading company that works in partnership with Eightcap broker. It offers users the possibility to trade currencies, indices, gold and commodities, although cryptocurrencies are only available during challenges. The minimum leverage allowed is 1:2, while the maximum is 1:200. The prop trading company supports all trading styles, including scalping, and also allows copy trading with certain restrictions. The Funded Trader offers four types of accounts with balances ranging from $25,000 to $400,000. The initial fee required for each account is refundable and varies depending on the account type and balance. For example, the initial fee for a standard account with a balance of $100,000 is $549. Traders start with an 80% profit split, but this can increase to 90%, with the remaining percentage going to the prop trading firm. The firm follows a standard KYC/AML (Know Your Customer/Anti-Money Laundering) protocol to ensure compliance. The Funded Trader regularly offers promotions that provide traders with discounts and special conditions. It also has a typical affiliate program that provides additional income opportunities.

- It offers four account types with different subtypes, allowing a wide range of balance options.

- Traders have the possibility to repeat a challenge in case they fail the first time.

- Trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5) and TradingView.

- Eightcap provides a wide range of trading instruments, such as currencies, indices, commodities and gold. However, cryptocurrencies are only available during challenges.

- There are no restrictions on the strategies applied, and traders can use expert advisors.

- Partners of the prop trading company initially get 80% of the net profit, but this percentage can be increased up to 90%.

- The prop trading company's platform offers an intuitive, aesthetically pleasing and ergonomic dashboard to facilitate traders' operations.

- Although Eightcap provides a wide range of instruments, only some of them are available through this prop trading company.

- Cryptocurrency trading is only possible during challenges and is not otherwise available.

- The company's website is translated into four languages (English, French, Spanish and Portuguese), but technical support is only available in English.

TU Expert Advice

Author, Financial Expert at Traders Union

The Funded Trader is a proprietary trading platform partnered with Eightcap, offering various account types including Standard, Rapid, Royal, and Knight Challenges. These accounts accommodate balance ranges from $25,000 to $400,000, with leverage up to 1:200 across cTrader and DXTrade platforms. Users benefit from a profit-sharing model, initially retaining 80% of profits, which can increase up to 90%. The platform supports trading currencies, indices, commodities, and gold, allowing scalping and the use of expert advisors.

Despite its advantages, The Funded Trader has limitations like cryptocurrency trading restricted to challenges, limited trading instruments, and English-only support. The firm's regulatory oversight is minimal, mainly relying on its broker partner Eightcap. The platform may not suit traders prioritizing full instrument access or immediate withdrawals. However, with low entry costs and refundable initial fees, it is suitable for traders seeking diverse account types and flexible profit-sharing options.

The Funded Trader Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | DXTrade, cTrader |

|---|---|

| 📊 Accounts: | Standard Challenge, Rapid Challenge, Royal Challenge, and Knight Challenge |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, e-wallet, crypto wallet, and online bank account |

| 🚀 Minimum deposit: | $189 |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not available |

| 💱 EUR/USD spread: | Not available |

| 🔧 Instruments: | Forex, indices, commodities, and gold |

| 💹 Margin Call / Stop Out: | Not available |

| 🏛 Liquidity provider: | Not available |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Not available |

| ⭐ Trading features: | Four accounts types and several subtypes;Balance scale is from $25,000 to $400,000;Initial fee is refundable;Failed challenges can be retried;Traders keep 80%-90% of profit split |

| 🎁 Contests and bonuses: | Yes |

During the registration process, the prop firm’s partners choose the type of account and pay the initial fee. After that, they get the opportunity to complete the challenge. The fee can be paid with a bank card. This is the main, but not the only way to deposit funds. Later, funds are withdrawn to bank cards, bank accounts, e-wallets, and crypto-wallets. The amount of leverage for The Funded Trader’s partners depends on the assets they trade. For example, on a Standard account, leverage for currencies is 1:100; for indices, it is 1:20; and for commodities and gold, it is 1:40. Technical support is available by phone, email, and live chat on the website, it works without breaks and days off.

The Funded Trader Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

UA Kyiv

UA Kyiv Challenge rules and pricing

The Funded Trader provides access to funding up to $1 500 000, with challenges requiring at minimum of 5 trading days. The entry-level plan starts at $49, and the fee is refundable if the challenge is successfully completed.

- Low entry cost — from $49

- High funding potential — up to $1 500 000

- No instant funding options

- No demo account provided

The Funded Trader Challenge fees and plans

We compared The Funded Trader’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | 2 - Profit target, $ | Daily loss,% | Max. loss, % |

| Standard |

|

|

|

|

|

|

| Rapid |

|

|

|

|

|

|

| Roval |

|

|

|

|

|

|

| Knight |

|

|

|

|

|

|

| Dragon |

|

|

|

|

|

|

What’s the minimum trading period for The Funded Trader’s challenge?

A minimum of 5 trading days is required, regardless of how quickly you reach the profit target.

Does The Funded Trader offer a free evaluation?

No, The Funded Trader does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at The Funded Trader?

No, The Funded Trader does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

The Funded Trader outlines the main rules for funded accounts, including a max. loss of 6% and a daily loss limit of 3%. The firm also restricts certain trading strategies, which are detailed below.

- Flexible leverage up to 1:200

- Scalping allowed

- Trading bots (EAs) allowed

- Weekend close required

- News trading not allowed

The Funded Trader trading conditions

We compared The Funded Trader’s leverage and trading conditions with competitors to help you better understand how it measures up.

| The Funded Trader | Hola Prime | SabioTrade | |

| Max. loss, % | 6 | 5 | 6 |

| Max. leverage | 1:200 | 1:100 | 1:30 |

| Weekend close rule | Yes | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | No | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

The Funded Trader earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at The Funded Trader meet most standard requirements and are in line with what many prop firms provide.

- On-demand withdrawals

- Bank сard deposits and withdrawals

- USDT (Tether) supported

- Bitcoin (BTC) supported

- Limited base currency options

- Wise not supported

- PayPal not supported

Deposit and withdrawal options

To help you evaluate how The Funded Trader performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

The Funded Trader Payment options vs Competitors

| The Funded Trader | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared The Funded Trader with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| The Funded Trader | Hola Prime | SabioTrade | |

| On demand | Yes | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

The Funded Trader offers the following base account currencies:

Trading Account Opening

To use the services of The Funded Trader, it is necessary to register on its official website. After registration, go through verification (confirm your personal data). This will grant you access to the functions of the user account and dashboard. The step-by-step registration process and the list of the main blocks available in the user account are as follows:

Go to the official website of the prop firm. Click the "Start Challenge" button in the main block.

In the block with account types, select the one that suits you best and click the "Buy" button.

Enter your first and last names, your company’s name is optional. Select your country/region, then enter your registration address, including city, street, house, and a zip code. Enter your phone number, email address, and fill in additional fields.

Specify your required balance. Then select the trading platform. Specify the broker (Purple Trading is now available except for Eightcap) and the account type. Tick the "Create an Account" box, then create a username and password. You can specify any information you think may be required by the specialists of the prop firm who verify your data in the "Additional Notes" box.

On the right side of the screen, select the initial fee payment channel. If you would like to use a channel not on the list, contact support. In TU’s example, enter bank card details. Agree to the terms of the website by ticking the appropriate boxes. Finally, click “Complete Order”.

After payment of the invoice and verification of the entered data by the company's specialists, you will be granted full access to the user account. To enter your user account, use the login and password that you created earlier.

Services of The Funded Trader’s user account:

Traders have access to detailed information on their accounts in the dashboard of the user account;

Also, traders can track their progress in active challenges;

Separate blocks are devoted to all incoming and outgoing transfers with transaction details;

Traders can submit applications for the withdrawal of profits;

Information on referrals and referral payments are displayed in the user account;

A trader can access useful study materials in the support block or contact the technical support via live chat.

Regulation and safety

Prop firms are not regulated by authorized bodies, since they are not brokers and they do not bring users’ trades to the market. At the same time, The Funded Trader is officially registered in the USA and can also work in other countries. In this case, it is important for a partnering broker to be regulated, and Eightcap has no problem with this.

Advantages

- Traders can address the legal department of the prop firm or broker

- Traders can file complaints to the broker’s regulator

Disadvantages

- The prop firm is not responsible for traders’ funds. It’s the broker’s responsibility

Markets and tradable assets

The Funded Trader has a score of 7/10, reflecting a strong variety of markets and assets available for trading.

- CFDs offered

- Crypto trading available

- Indices available

- Futures not available

- Options not supported

Tradable markets

We compared the range of tradable instruments offered by The Funded Trader with two leading competitors to highlight the differences in market access.

| The Funded Trader | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

The Funded Trader does not implement any investment solutions. Such solutions traditionally include banking opportunities to passively increase your capital. Vivid examples of an investment program are cryptocurrencies staking and simple investments in stocks. At The Funded Trader, there’s only the referral program, which provides relatively passive income. It is “relatively passive”, because the firm’s partner needs to be socially active in order to earn a significant amount.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program of The Funded Trader:

Partners of the prop firm receive a referral link, which can be placed on any websites of their choice. Each trader who follows this link, registers with the firm, and pays the initial fee, becomes a referral of the link’s owner. The first 50 referrals bring 7.5% of their initial fee. The next 50 referrals bring 10%. As soon as the link owner invites more than 100 people, the partnership payments increase to 15%.

Also, The Funded Trader partners receive a coupon that gives referrals a 5% discount on the initial fee and a 110% refund after completing the challenge. Profits are paid every 30 days, the minimum withdrawal is $100.

Customer support

Usually, the technical support of The Funded Trader is available 24/7, but traders are advised to follow the newsletter and posts on social platforms, where the company can announce days off.

Advantages

- Three channels of technical support are available

- Not only registered users can address the prop firm’s experts

Disadvantages

- Responses via email or live chat are not always prompt

Traders have the opportunity to contact The Funded Trader’s technical support in the following ways:

-

call center;

-

email;

-

live chat in the lower right corner of the website.

Note that the footer contains links to the prop firm’s social media profiles, including Telegram, Facebook, and others.

Contacts

| Foundation date | 2018 |

|---|---|

| Registration address | 14001 W HWY 29, Suite 102, Liberty Hill, TX 78642 |

| Official site | https://thefundedtraderprogram.com/ |

| Contacts |

(888) 920-3079

|

Education

All prop trading firms strive to improve the professional level of their partners. After all, the better traders trade, the more the prop firm earns, and the higher is its profit. The Funded Trader also provides its partners with opportunities to improve their skills.

Compared to some other prop trading firms, The Funded Trader provides relatively little information on the theory and practice of trading. However, the firm has an active developed community, which can be found on various social platforms, such as Discord. The Funded Trader partners are friendly to their colleagues and always ready to help with advice.

Comparison of The Funded Trader to other prop firms

| The Funded Trader | FundedNext | Hola Prime | SabioTrade | The Trading Pit | Forex Prop Firm | |

| Trading platform |

MetaTrader5, MetaTrader4, TradingView | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader4, MetaTrader5, BOOKMAP, R Trader, QUANTOWER | Match Trader |

| Min deposit | $189 | $32 | $48 | $119 | $99 | $94 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:30 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | 80% / 50% |

| Order Execution | N/a | N/a | Market Execution | Market Execution | No | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of The Funded Trader

The Funded Trader was founded in 2019 by Angelo Ciaramello and Nick D'Arcangelo. Prior to that, they created well-known trading courses such as Forex League and VVS Academy. They are professional traders and teachers with more than 10 years of experience. They have trained over 500 professional market participants, many of whom teach at major trading academies. Over the 3 years of the website’s existence, it has acquired a powerful partner base of 6,000 traders at all levels. They include traders who have been trading for only a couple of years, those who have never dealt with prop firms before, and prolific trading sharks.

The Funded Trader by the numbers:

-

The minimum initial fee is $189;

-

The initial fee is 100% refundable subject to successful completion of the challenges;

-

The maximum balance is $400,000;

-

Profit split is 80-90%;

-

The firm charges 0% in fees.

The Funded Trader is a prop firm for trading currencies, indices, commodities, and gold

TU has already mentioned that prop trading firms usually do not offer the full range of instruments, unlike their partnering brokers. This is due to the specifics of the firm and conditions of the partnership agreement. For example, Eightcap allows you to trade several types of precious metals, but The Funded Trader offers only gold. Nevertheless, there are enough instruments, including dozens of currency pairs, the most popular indices, and commodities. All these assets can be traded on the popular DXTrade and cTrader platforms. Note that trading cryptocurrencies is available only during the challenge, and in the future this asset may not be used. Upon request, withdrawals can be made in cryptocurrency to the crypto wallet specified by a trader.

Useful services of The Funded Trader:

-

Initially, traders receive 80% of the net profit (excluding fees and other costs). However, upon their successful trading, the prop firm increases this split up to 90%;

-

When moving to the next trading level, traders can stay at the current level of available trading balance with a 90% split. But they also have the opportunity to return to 80% splits, scaling their balance at the same time;

-

Qualification challenge comprises two phases. If traders fail to achieve the required target at any phase, they can retry the challenge for free.

Advantages:

There are several account types, subtypes, and rates that differ in the balance on a trader's account. This diversity allows choosing the most optimal conditions for a particular partner;

The Funded Trader has a loyal pricing policy. The minimum initial fee is only $189. Moreover, the initial fee is fully refunded as soon as traders successfully complete the two-stage challenge;

Few prop trading firms give their partners 90% of the net profit. Usually the profit split is 60-70%. The Funded Trader gives traders 80% at the start, the split can be increased up to 90% later;

Prop firms often allow trading on only one platform. The Funded Trader gives its partners the opportunity to choose from the popular platforms DXTrade and cTrader.

The Funded Trader provides a lot of interesting bonuses, it also constantly holds promotions for new partners. There is a profitable referral program with a high percentage payout as well.

It is important that the company does not limit its partners to specific strategies and trading styles. You can scalp, hedge, copy trades, and use expert advisors.

Latest The Funded Trader News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i