Comprehensive Mid-2024 Analysis and Bitcoin Price Predictions

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Bitcoin Forecasts for End of 2024:

Bearish Scenario:

- JPMorgan Chase: Predicts Bitcoin will drop to $45,000, citing uncertainty about its growth path but recognizing its resilience.

Bullish Scenario:

- Mike Novogratz (Galaxy Digital): Anticipates Bitcoin reaching $500,000, driven by the maturation of the crypto market and increased institutional adoption.

- Tim Draper (Venture Capitalist): Predicts Bitcoin will rise to $250,000.

- Tom Lee (Fundstrat): Projects Bitcoin to hit $180,000, fueled by growing adoption.

- Robert Kiyosaki ("Rich Dad, Poor Dad"): Predicts Bitcoin will hit $100,000, viewing it as a hedge against economic uncertainty and inflation.

Bitcoin's roller-coaster ride in 2024 has kept everyone on their toes. Starting the year with a dip and then hitting an all-time high above $70,000 in March, Bitcoin has shown its typical volatility and resilience. This mid-2024 analysis dives into the factors behind these dramatic shifts, including the surge in institutional investments and the excitement around Bitcoin ETFs.

As we look towards the latter half of the year, understanding the forces at play — regulatory changes, market sentiment, and technical indicators — is crucial. This report breaks down what happened in the first six months and what we might expect moving forward, providing a clear and concise outlook for Bitcoin's potential path ahead.

Bitcoin hits new all-time high above $60,000 in March

BlackRock's iShares Bitcoin Trust, boosted demand driving up prices

Bitcoin consolidated in Q2, facing profit-taking and ended June below $62,000

Bearish channel and death cross on the daily chart suggest potential downtrends

Overview of Bitcoin, January to Mid-2024

2024 has undeniably been a notable year for the cryptocurrency market, with Bitcoin making the headlines. The year began on a bearish note, with significant outflows from exchange-traded products (ETPs) pushing the price down to $44,172. However, Bitcoin displayed its characteristic resilience, staging a remarkable comeback in February.

Fueled by an influx of new ETF listings and the anticipation of the upcoming Bitcoin halving, the price surged by a staggering $20,074.80, surpassing the $60,000 mark and culminating in a new all-time high in March.

Despite a stellar first quarter, the excitement cooled somewhat in Q2. Bitcoin experienced a period of consolidation around $63,000, followed by a decline in April. However, it managed to rally above $70,000 again in early June before succumbing to profit-taking pressures. May's price trajectory, which made a high of $72,000 followed by a settlement below $68,200, reflects a modest monthly gain of 5.9%. By the end of June, the price had dipped further, settling below $62,000.

While Bitcoin's overall valuation increased by a noteworthy 39.4% ($17,408.40) during the first half of 2024, the second quarter highlighted the cryptocurrency's inherent volatility.

Moving forward, several key factors, including regulatory developments and broader market sentiment will likely influence Bitcoin's price trajectory in the latter half of the year.

Factors Behind Bitcoin's Record-breaking Performance in the First Quarter of 2024

Institutional Investment via ETFs: The launch and rapid growth of Bitcoin Exchange-Traded Funds (ETFs) have significantly boosted demand. Notably, BlackRock's iShares Bitcoin Trust reached $10 billion in assets under management within just seven weeks, highlighting a substantial inflow of institutional investment. These ETFs now manage a large portion of Bitcoin's available supply, reducing market liquidity and driving prices up.

Anticipation of the Bitcoin Halving: The “sentiment” regarding Bitcoin halving event, was a major bullish catalyst. This event, which occurs every four years, halves the reward for mining new Bitcoin, thus reducing the supply of new Bitcoin entering the market. Although historically, Bitcoin prices have surged following halving events but the event did not make a significant difference this year.

Increased Institutional Buying: Institutional interest surged in the first quarter of 2024, as evidenced by the significant Coinbase Premium, which indicates higher Bitcoin prices on Coinbase compared to other exchanges. This premium was complimented by aggressive buying by institutions and high-net-worth individuals, which pushed up Bitcoin's price pp.

Corporate Accumulation: Companies like MicroStrategy continued to accumulate Bitcoin, with MicroStrategy issuing $600 million in convertible note early during the year to fund further Bitcoin purchases. This corporate buying added additional demand and signaled strong confidence in Bitcoin's long-term value.

Geopolitical and Macro Factors: The macroeconomic environment, including persistent inflation and the search for hard assets, created favorable conditions for Bitcoin. Investors increasingly considered Bitcoin as a hedge against inflation and currency devaluation. This contributed to its rising value.

Fundamental Factors To Affect Bitcoin Going Forward in 2024, 2025

The Federal Reserve’s Progress on Inflation: The Fed's struggle with persistent inflation may lead to continued high-interest rates. This could dampen Bitcoin’s appeal as a hedge against inflation if the Fed maintains its restrictive policies longer than anticipated, delaying potential interest rate cuts.

Potential Interest Rate Cuts: Although rate cuts were expected, the Fed's recent stance suggests they might occur later in 2024 or not at all. Any eventual cuts could provide a bullish impulse to Bitcoin, as lower rates generally boost risk assets.

Ongoing Scrutiny of Crypto Exchanges and Executives: Regulatory scrutiny remains a critical factor. Increased oversight and potential legal challenges could hinder market confidence and liquidity, impacting Bitcoin’s price stability and growth potential.

Institutional Interest in Spot Bitcoin ETPs: The approval of spot Bitcoin ETFs, particularly in markets like Hong Kong, can significantly impact Bitcoin’s institutional adoption. However, the effectiveness of these ETFs will depend on market liquidity and trading infrastructure. Successful uptake in major financial markets could enhance Bitcoin’s credibility and drive demand .

The recent US House approval of the FIT21 bill, aiming to provide clearer regulations for digital assets, and the surprise green light for spot Ether ETPs offer glimpses of a potentially more crypto-friendly regulatory environment. This could pave the way for further innovation in space.

While the path ahead may not be a straight line, the fundamentals suggest the Bitcoin bull run could resume in the latter half of 2024. Careful monitoring of these key factors will be crucial for investors navigating the ever-evolving crypto landscape.

Bitcoin Mid-Year Analysis: Can Bitcoin Recover Its Upward Momentum?

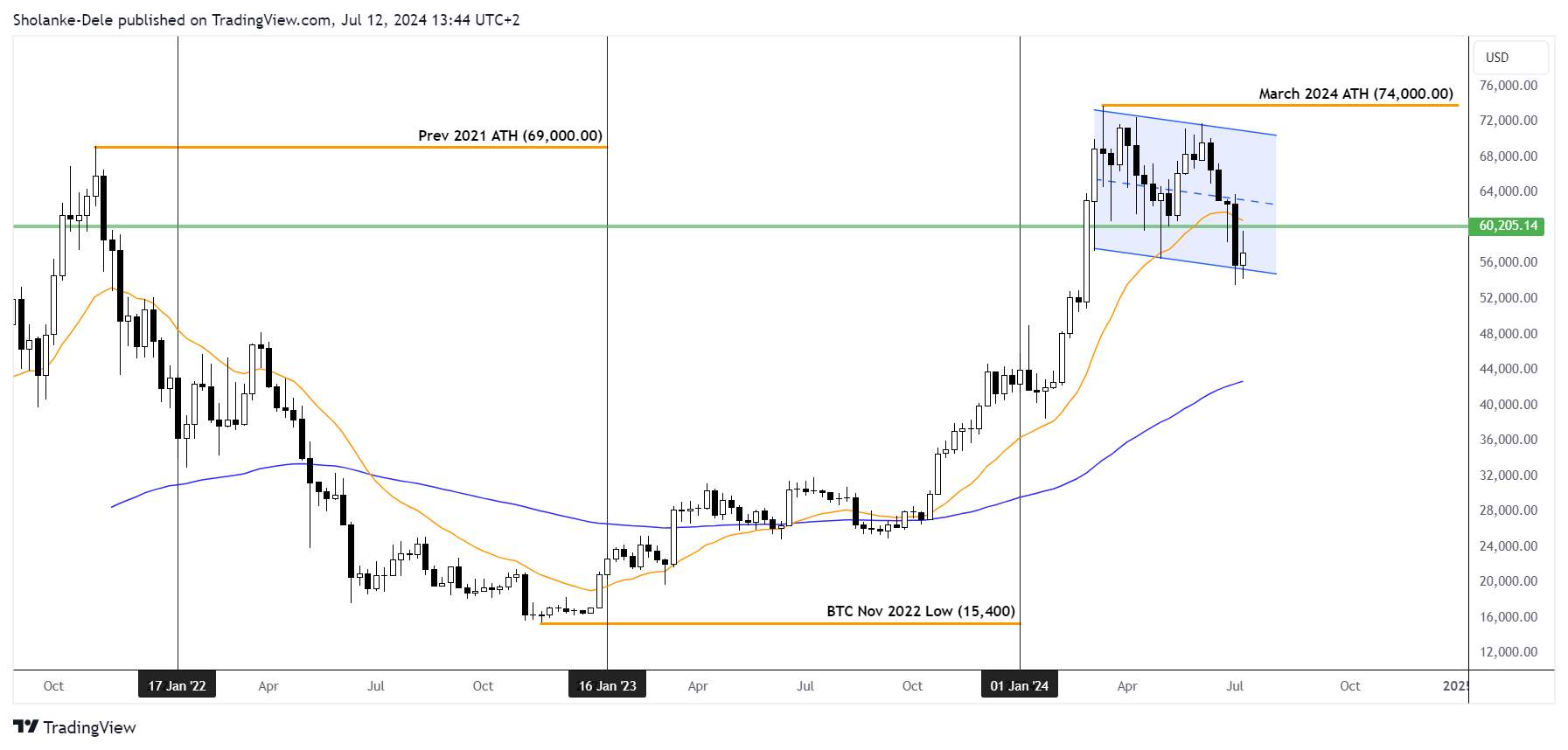

Bitcoin's price action paints a concerning picture on the daily chart. Following its May all-time high, the digital currency has become trapped within a slightly downward-sloping bearish channel . This formation is characterized by swing lows established in May and early July, highlighting a potential downtrend.

While Bitcoin staged a notable recovery from its May swing low of $57,000, its recent early-July swing low finds itself precariously resting at the channel's lower boundary. Unlike the swift rebound witnessed in May, a similar upswing seems less likely in the current environment due to multiple headwinds now confronting Bitcoin bulls such as:

Critical Resistance at $60,000: This psychological level looms large as a significant hurdle that bulls must overcome to regain control.

Death Cross Confirmation: The 20-day and 100-day Exponential Moving Averages (EMAs) have recently completed a bearish crossover, often referred to as a "death cross." This technical indicator historically suggests a potential continuation of the downtrend.

Bitcoin Technical Outlook

The confluence of the bearish channel, the critical resistance level, and the death cross could amplify bearish sentiment in Bitcoin's price movement. This scenario might lead to a price dip below the supportive trendline of the bearish channel, potentially targeting the $50,000 level. However, a complete reversal is not yet set in stone. Should bulls regain control, fueled by a surge in demand for Bitcoin, and manage to break above the psychological barrier of $60,000, there's a possibility for renewed upside momentum. A breakout above this level could offer some hope to Bitcoin buyers and potentially trigger further price appreciation.

Economist Bitcoin Predictions and Forecast for 2024

2024 has seen a flurry of predictions for Bitcoin's price, with experts offering a wide range of estimates. Here's a quick rundown:

Bitcoin Bullish Predictions:

Mike Novogratz (Galaxy Digital) predicts $500,000 in expectation of crypto market maturation.

Tim Draper (Venture Capitalist) predicts $250,000 due to the transformative potential and disruption of traditional banking.

Bitcoin Moderate Predictions:

Tom Lee as Fundstrat predicts $180,000 based on adoption, limited supply, and institutional interest.

Pantera Capital predicts $148,000 due to the Bitcoin halving and reduced supply.

Standard Chartered Bank predicts $120,000. Influenced by hash rate reaching all-time highs and potential ETF approval.

Robert Kiyosaki ("Rich Dad, Poor Dad") predicts $100,000. He sees Bitcoin as a hedge against economic uncertainty

Adam Back (Bitcoin Pioneer) predicts $100,000 based on scarcity and future financial landscape.

Bitcoin Cautious Prediction:

Arthur Hayes (BitMEX) predicts $70,000 due to market volatility.

JPMorgan Chase predicts $45,000. It remains unsure of growth path but recognises bitcoin resilience

Will Institutional Bitcoin Adoption Rise Again?

Recent data showing a pullback in institutional interest for spot Bitcoin Exchange-Traded Products (ETPs) after a strong March might raise eyebrows. However, a closer look suggests this could be a pause for strategic positioning, not a retreat from the cryptocurrency.

As Chris Kuiper of Fidelity Digital Assets aptly points out, the current slowdown likely reflects the due diligence and regulatory scrutiny that institutional investors undertake before committing significant capital to new asset classes. Spot Bitcoin ETPs are a relatively new financial instrument, and navigating compliance hurdles takes time. Additionally, limited platform availability for these products currently restricts access for some institutions.

Kuiper views these challenges as temporary hurdles, not insurmountable roadblocks. He expects broader availability and active marketing of these ETPs once initial regulatory and operational hurdles are cleared. However, this is likely to be a gradual process, a "slow burn" rather than a sudden surge.

The key takeaway for investors is that institutional interest in Bitcoin is likely a long-term play, not a fleeting trend. The initial phase might be characterized by caution and measured steps, but this could ultimately pave the way for a more sustainable and impactful wave of adoption in the future. As these products mature and regulatory clarity improves, we can expect broader institutional participation, fueling the growth of the Bitcoin ecosystem.

Conclusion

While sentiment has cooled, long-term fundamentals are strong. The imminent approval of Ethereum ETFs could attract significant institutional investment, and potential interest rate cuts may provide further support. Crypto will also be a key topic in the upcoming US elections, potentially leading to favorable policy shifts and offering a compelling buying opportunity for long-term investors.

Remember, volatility is part of the cryptocurrency market. The potential for high returns comes with significant risks. As always, thorough research and a cautious approach are essential.

Related Articles

Team that worked on the article

Sholanke is a financial market analyst, trader, and writer. He has over 10 years of experience in forex, stocks, commodities, indices, cryptocurrencies, and other financial assets. As an author for Traders Union, he enjoys sharing institutional insights, analytics and expert forecasts on various financial instruments.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.