The 1% Daily Profit Myth in Forex

The 1% a day myth in Forex asserts that it’s possible to consistently make 1% profit a day in Forex, resulting in huge gains over a trader’s long-term career. In this article I’ll break down the myth, explain whether it’s possible to make 1% a day, explore realistic expectations and explain how to leverage compound for continuous growth.

There are many common myths when it comes to Forex; that you can predict the market, that the market is rigged, or that you can get rich quick, to name some examples. Yet one of the most pernicious Forex myths is that you can consistently make 1% in profit every single day. While this idea sounds appealing and even reasonable at first glance, and 1% sounds small enough to make this myth believable, it is not a goal that’s based on reality.

In this article I’ll be explaining why making 1% a day isn’t possible, how much profit you can realistically expect to make in Forex, how you can compound leverage for consistent growth, and how to balance risk and reward in daily trading goals.

-

What is the average annual return achieved by most successful traders?

Successful traders average in the 10-30% range annually depending on their strategy and market conditions. Anything consistently above 40% long-term would be exceptional.

-

What is the biggest challenge to achieving 1% daily returns consistently?

Managing risk. Even strategies with a positive expected value will see drawdowns that make consistent 1% profits extremely difficult.

-

Should I lower my goal if I can't hit 1% daily regularly yet?

Absolutely. Unrealistic goals breed frustration and bad habits like overtrading. Making money consistently should always come before arbitrary daily profit targets.

-

Does using leverage make achieving 1% daily easier?

While leverage amplifies profits, it also magnifies losses at an exponential rate. It doesn't make the goal fundamentally easier and in fact increases the risk of ruin if not managed extremely carefully.

Is it possible to make 1% a day in Forex?

Realistically, it is not possible to make 1% profit a day in Forex. Many traders mistakenly assume that setting a 1% daily profit goal is modest and attainable. While it is definitely possible to sometimes make 1% daily profit using the right strategies, it is extremely unlikely (verging on physically impossible) to do this every single day.

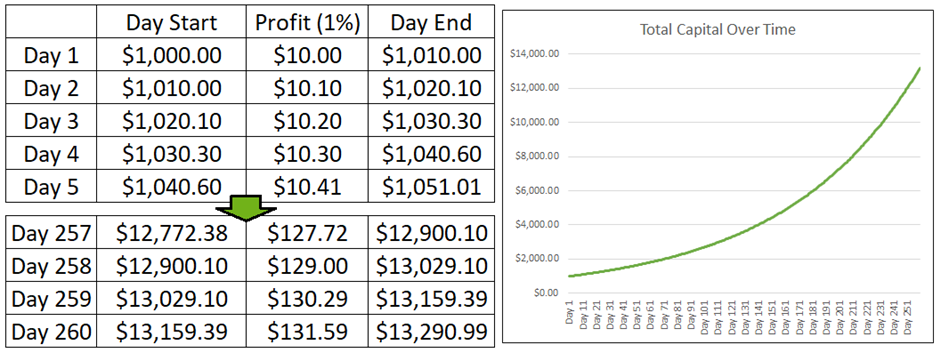

To give you an idea of how unrealistic 1% a day is, let’s imagine what it would look like. Let’s say you start off with $1,000 capital on day 1 of trading. You manage to make a healthy 1% in profit, or $10.00, on that day, leaving you with $1,010.00. The next day your capital increases by another 1% of that capital (adding $10.10), leaving you with a total capital of $1,020.10 on day 2.

Total capital over time illustration

If this trend continued and you consistently saw a 1% increase in capital for a whole year, or 260 trading days, you’d have $13,290.99 in your account, with $131.59 profit being added on day 260 alone. That’s an increase of 1229.099% in one year. You can probably see why this is highly unrealistic.

Even if a trader set out to make 1% of their initial $1000.00 investment every day and not compound their returns, that would still require a consistent $10.00 increase daily. By day 260 they would have $3,590.00 in capital, an increase of 259% compared to day 1. This is also quite unrealistic.

Market Conditions Impact

The volatility and prevailing market conditions also heavily influence the level of difficulty in achieving consistent daily returns. Profits are far more obtainable during periods of strong trending price action versus periods of consolidation or ranging markets.

In strongly trending markets, the overall directional bias makes it easier to profit from trades that move in the direction of the trend. Trades can be entered with the probability tilted in the trader's favor. In these environments, daily returns of 1% or more are certainly possible with the right trading strategy and execution.

However, no market trends in one direction indefinitely. Periods of ranging or sideways movement are inevitable. These types of market conditions greatly increase the challenge of the 1% daily goal. Without a clear near-term direction, traders have to rely more on short-term technical patterns and price noise rather than the overarching trend.

Historical data shows that during periods of low volatility in particular, any consistent profits above 0.1% per day were already highly impressive performances. The risks of whipsaws and unpredictability rise sharply for traders. Achieving outsized daily returns becomes more a matter of luck than skill or system in these environments.

As a result, traders attempting the 1% target would be well-served to factor market conditions into their expectations. Strong trends provide the best opportunities, while consolidations should warrant more modest return targets to maintain risk control. Flexibility and patience are key amid shifting market regimes.

Best Forex brokers

Realistic profit expectations in Forex

Realistic profit expectations in Forex can vary widely depending on several factors, including your trading strategy, risk tolerance, account size, and level of experience. Market volatility and global events that affect the market can also have unforeseen impacts on your investments. While it's difficult to provide specific numbers or percentages that will apply universally, here are some general guidelines to consider:

Conservative expectations (Low risk):

A conservative trader might aim for a monthly profit roughly in the range of 1% to 3% of their trading capital. Annually, a total return of 12% to 36% is considered conservative. This would be based on low-risk trading, trading during less volatile market times and a careful, long-term strategy.

Moderate expectations (Moderate risk):

Traders with a moderate risk tolerance may target monthly profits between 3% to 5% of their capital. On an annual basis, a target return of 36% to 60% is in the moderate range.

Aggressive expectations (Higher risk):

Aggressive traders willing to take on more risk might aim for monthly profits exceeding 5% of their capital. An annual return target of over 60% would be considered aggressive. Traders involved in high-risk trading may potentially experience significantly larger returns on their investments within a shorter timeframe. However, this approach also exposes them to the possibility of substantially greater losses.

A trader who is willing to spend more time learning about Forex is more likely to increase their profit margin as a result. The amount of hours you can spend on trading each day will also have a significant impact on your profit potential. Overall, the most important factor in making consistent profits is a well-planned trading and risk-management strategy.

Leveraging compounding for consistent growth

Leveraging compounding for consistent growth in Forex is a powerful strategy that can help your trading account grow over time. Compounding involves reinvesting your profits to generate earnings on both your initial capital and the profits you've already earned.

To ensure steady growth and compounding profits, traders should follow some crucial steps:

Prudent risk management: Implement strict risk management practices, including setting stop-loss orders and risking only a small percentage of your trading capital on each trade. This protects your account from significant losses.

Consistent profitability: Focus on consistent profitability. Strive to develop a trading strategy that has a positive expectancy, meaning that long-term, it generates more profitable trades than losing ones.

Reinvest profits: Instead of withdrawing profits, reinvest them into your trading account. This increases your trading capital and allows you to trade large positions over time.

Gradually increase position size: As your account grows due to compounding, you can gradually increase your position size while maintaining prudent risk management practices. Avoid over-leveraging and ensure that you still risk only a small percentage of your account on each trade (limit yourself to 1% to 2% of total capital for each trade).

Be patient and disciplined: Compounding takes time and requires patience and discipline. Avoid the temptation to deviate from your trading plan or withdraw profits too early.

Balancing risk and reward in daily trading goals

The most effective way to balance risk and reward when working towards your daily trading goals is to implement a stringent trading strategy and to regulate your emotions. It’s often too easy to let our emotions get the better of us - we’re only human after all. Feelings of greed, anxiety or fear can lead to more risky trades. The desire to reach unattainable daily profits can influence our decision-making skills.

Map out your strategy before starting trading and regularly consult your strategy blueprint to help you stick to it. Set stop-loss and take-profit orders and stick to them to avoid your emotions dictating when to close a trade. Patience and discipline are key if you want to be consistently profitable and see long-term compounding gains.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.