Forex Trading Profit Per Day: How Much You Can Earn

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The amount you can earn in forex depends on many factors - such as: amount of capital, experience, strategy used, market volatility, country of the trader, type of employment and others. According to recruitment resources:

- A successful private trader can earn 30%-60% of his own trading capital (but there is also a high risk of losing funds)

- A prop trader earns 50% to 90% of income from the amount under management

- A rader for hire’s average salary is $155K per year in the US

Every year the attractiveness of the Forex market as a source of income becomes more and more obvious, and the ranks of traders are steadily growing. New traders are attracted by the free schedule, the possibility of remote unlimited earnings, the independence of income and the vast scope for self-development and financial education.

It is no secret that Forex trading is complex and carries quite serious risks. Therefore, entering the market guided only by rumors, illusions and inflated expectations can be a disappointing venture.

Traders Union experts told what are the real chances of beginners to earn money, how much Forex traders earn on average, what is needed to optimize earnings on the international financial market and how to avoid common risks and mistakes.

How much do Forex traders earn?

The amount of income of Forex traders is an uncertain clear range, which can rise to sums amounting to millions of dollars per year and fall below zero. It's all about a large number of factors that directly affect the final figure.

The first factor is the type of employment. Traders have 3 main options:

Trading on a personal account. In this case, a trader opens an account with a Forex broker in their own name, funds it with their own money, and trades currencies (as well as CFDs and other instruments) to capitalize on price fluctuations.

Trading through a proprietary trading firm. In this option, the trader formalizes a partnership with a firm that provides him with capital (usually between $5,000 and $100,000, but in case of successful results, the capital can be increased to a million or more) to trade according to the available strategy.

Trading after employment. In this case, the trader becomes an employee for hire, receiving a salary and bonuses.

What is the income of a Forex trader at each of the options? Let's consider them sequentially.

How much does a private trader earn in Forex?

Working as an independent private trader provides maximum freedom in decision making:

which currencies to trade and when,

what volume,

what drawdowns are acceptable,

and so on.

Maximum freedom has the opposite side - an unlimited range of possible incomes: from millions of dollars a year to negative values. The greatest influence will have: 1) the trader's performance and 2) the starting capital.

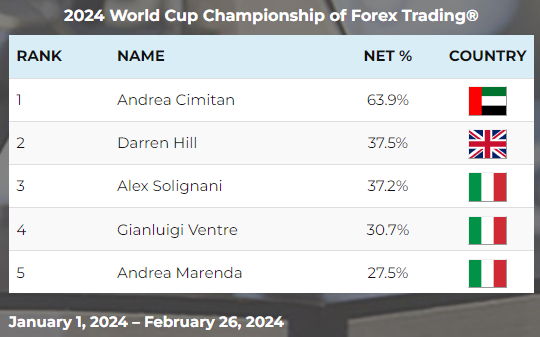

What is considered a good return? Let's take the known results of the best traders from the World Trading Championship:

Based on these statistics for 2024, the ability to increase the account by 20% in 1 month can be considered a world professional level.

Now let's build a table of possible values of private trader's income depending on the trading capital.

| Trading capital | Effectiveness | Trader's income, per month |

|---|---|---|

| $25,000 | 20% world-class | $5,000 |

| $5,000 | 20% world-class | $1,000 |

| $100 | 20% world-class | $20 |

| $25,000 | 10% advanced | $2,500 |

| $5,000 | 10% advanced | $500 |

| $100 | 10% advanced | $10 |

| $25,000 | 5% good | $1,250 |

| $5,000 | 5% good | $250 |

| $100 | 5% good | $5 |

Based on the table we can draw an objective conclusion that, without sufficient trading capital, even the best traders in the world cannot achieve an income above the average salary.

To solve this problem, the services of proprietary trading firms, which give traders access to sufficient amounts of capital on the condition that they receive a portion of the profits in return, are becoming increasingly popular.

How much do prop traders earn?

For more details on how business with prop trading firms works, check out the article: How Do Prop Traders Make Money?

Usually, proprietary trading firms charge 15% of the profits earned by the trader for their services (provided that the trader is able to stay within the risk tolerance).

Profit margins of proprietary trading firms are not strict, but some set a benchmark of 10% per month. We will use this value in the calculations below:

| Affordable prop capital | Trader efficiency, per month | Trader's income, per month |

|---|---|---|

| $100,000 | 10% | $8,500 |

| $25,000 | 10% | $2,125 |

| $10,000 | 10% | $850 |

Thus, it is acceptable to assume that if a Forex trader reaches the desired profit target every month, then, trading on an account = $100K, he will earn = $102K in 1 year.

The flip side of the coin of cooperating with prop trading firms can be that:

Traders must fit into strict norms of acceptable risks. Otherwise - their account will be closed and their income will be zero.

in order to receive capital for management, traders usually have to prove their qualifications by completing a challenge.

If you are interested in making money on Forex this way - pay attention to the instructions in the article: How to Become a Prop Trader?

What is the salary of Forex traders?

As in any profession, the earnings of Forex traders are highly dependent on many factors:

Capital size. The higher the volume with which a trader enters a trade, the higher the potential earnings

Experience. A great deal of experience means a trader's ability to successfully adapt to the changing nature of the markets

The strategy employed. For example, scalping strategies have the potential to generate the highest profits for the trader, but they also carry the greatest risk

Market volatility. If markets are in a state of narrow consolidation, the potential to profit from price differences will be significantly limited.

The country of the trader. Traders in the United States will earn more than traders in other countries, but the requirements are comparatively higher. For example, having a FINRA license is standard.

Type of Employment. A trader may trade in their own account, either at a proprietary firm, or receive a fixed salary (plus a bonus), or have another type of employment that affects their salary.

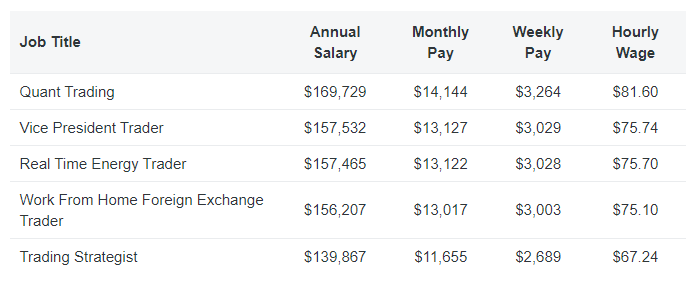

Below are the results of a study that covers data on traders' salaries in the United States in 2024. Even if you are located in another country, these figures can serve as a reference point for you as Forex is an international market.

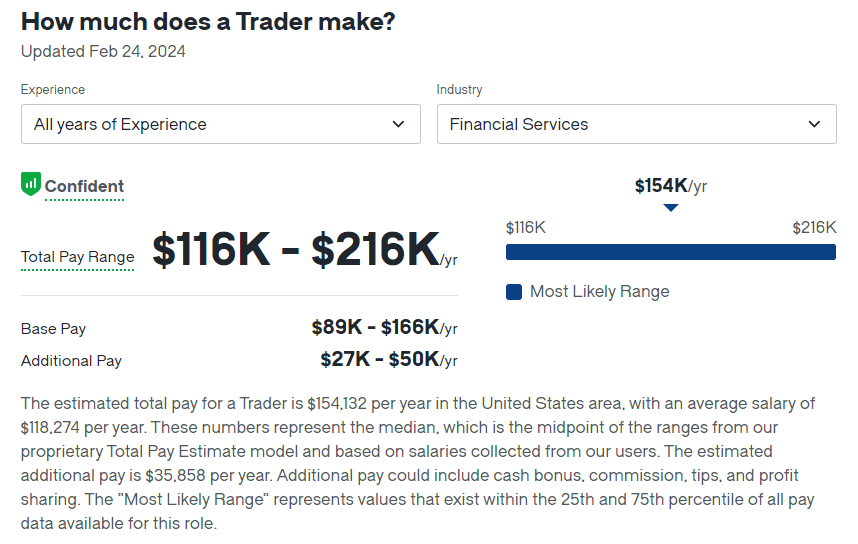

Glassdoor, an employment portal, shows that according to the data it has, a forex trader earns an average of $154,000 per year, or $12.8,000 per month.

How much does a trader make?

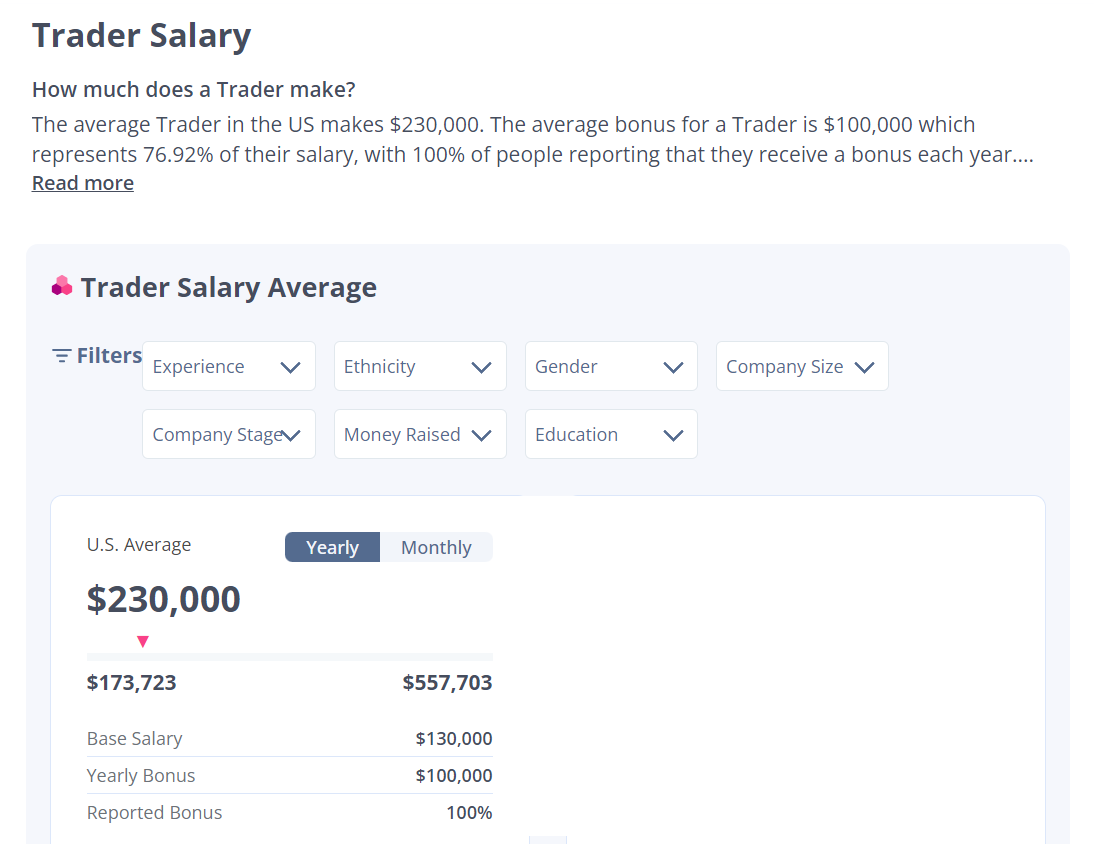

How much does a trader make?In turn, the portal Comparably provides more impressive figures, according to which the trader's earnings are 230 thousand dollars a year including bonuses, or more than 19 thousand dollars a month.

How much does a trader make?

How much does a trader make?According to Comparably, bonuses constitute an important income item because:

the size of bonuses is about 3/4 of the salary;

100% of traders confirm receiving bonuses every year.

What is remarkable is that the best representatives of their profession have income levels several times higher than average (which is true not only for Forex trading).

Among the best jobs found by Indeed.com, traders can expect to earn up to 163 thousand dollars a year.

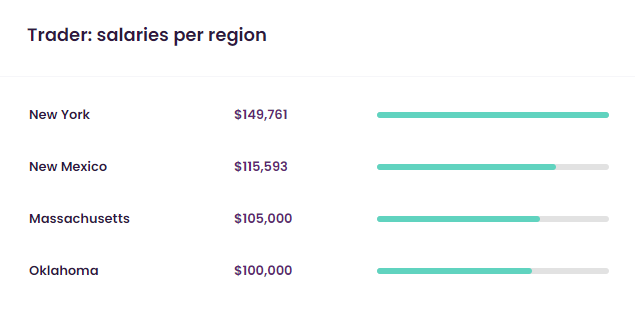

And data from talent.com indicates that moving from the region to one of the financial capitals of the world, which is New York, can increase income by 50%, as it is in New York that traders' salaries are the highest.

On the other hand, if you are away from New York City (and the US in general), this can reduce your income. According to CryptoJobList data, which includes salary values collected from around the world, a trader's salary is nearly $90,000 per year.

Trader Salary

Trader SalaryConcluding the review of current data on traders' salaries for 2024, we note the data from ZipRecruiter, which shows that specialists familiar with quantitative strategies have a high earning potential - as this work requires not only knowledge of financial markets, but also statistics, mathematical modeling and other related fields.

Calculating a simple average, we get that the salary of a trader (with emphasis on data from the USA) is about 13 thousand USD per month.

Is it a lot or a little? Yes, a lot. Considering that according to the US Department of Labor, the average salary in 2023 was $4650 per month.

That is, a Forex trader's salary is 2.8 times higher than the average salary, which may be true not only for the US, but also for other countries, and thus reflect the high demands that are placed on those who make trading decisions in the highly competitive global financial markets.

How much on average does a trader earn per day?

As follows from the data collected above, a Forex trader (working in the United States) earns about $590 per day. However, this level of income is due to the fixed rate that the trader receives for his labor as a hired professional.

Can a professional trader working on his personal account provide such level of income? The answer is yes, but with a sufficient amount of trading capital.

Let's assume that the strategy used by a private trader allows him to count on +1% to the account for one working day. Then, to reach the level of $590 per day, the trader needs to have an account of $59,000. Pretty high requirements, especially for beginners looking to increase their level.

But if you have a proven strategy that gives +1% per day, getting $50,000 or more under management is not an extraordinary problem, due to cooperation with a prop trading company. The idea is that qualified low capitalization Forex traders can make transactions using the company's money. In doing so, the proprietary trading firm takes a small portion of the Forex trader's profits and also sets the risk terms.

How this scheme works, which allows you to reach the income level of a professional trader, is described in the article: What is Prop Trading? Top Pros and Cons

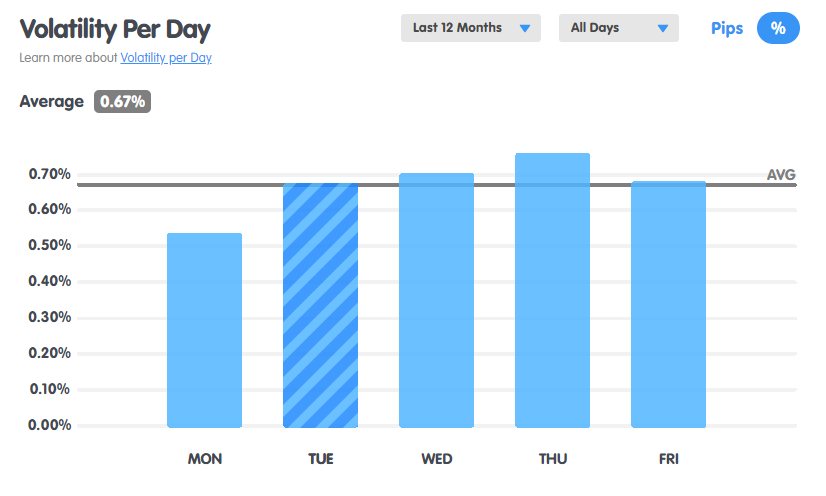

Concluding the topic of Forex trader earnings in 1 day we should note that it can vary greatly depending on the day of the week.

EUR/USD Daily Volatility

EUR/USD Daily VolatilityThe stats above show that EUR/USD volatility declines strongly on Monday, making it difficult to take an average rate of return on that day.

How much on average can a trader earn per month?

According to a study of specialist recruitment sites focused on the US audience, Forex traders are offered an average salary of 13 thousand USD per month, which is approximately 180% higher than the national average salary.

How much on average do Forex traders earn per year?

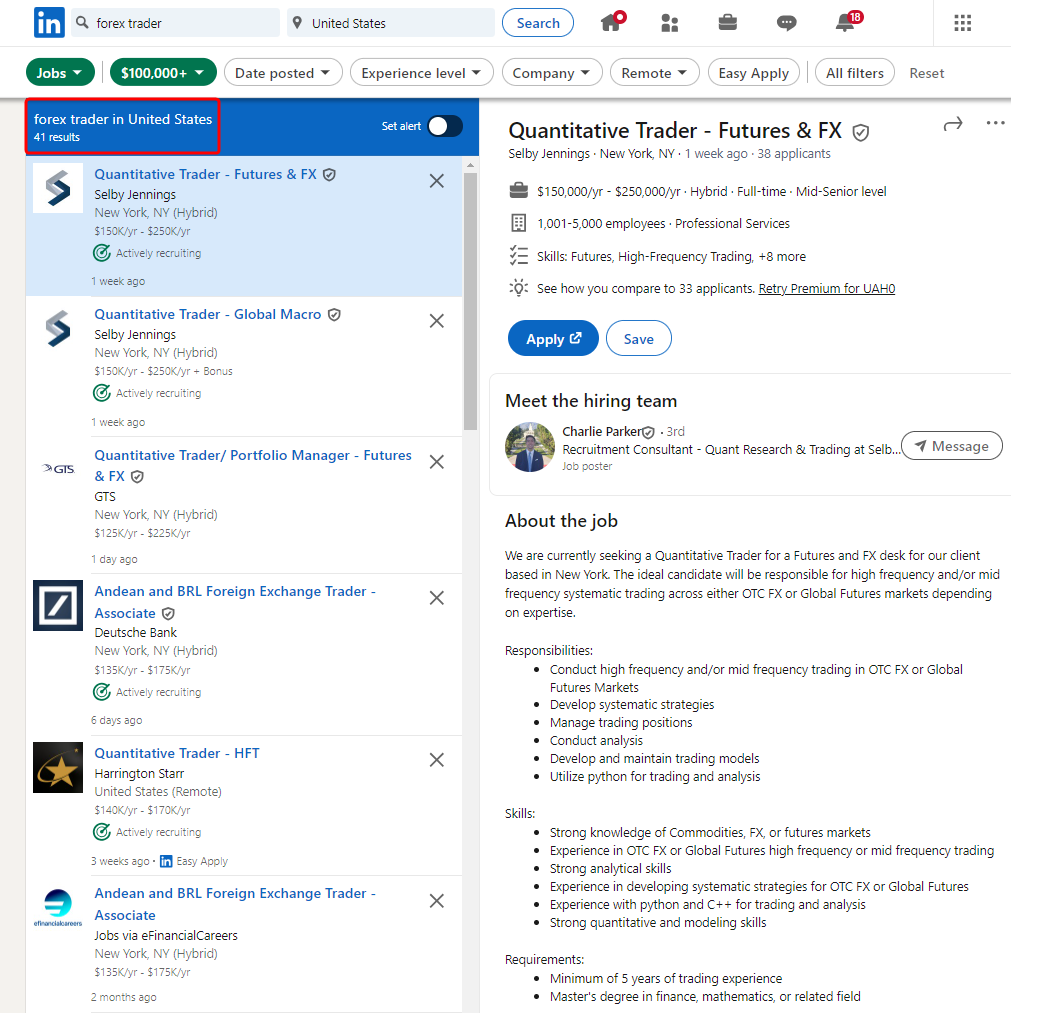

A job search using a social network of business contacts confirms the elevated salaries of Forex traders in the US.

Trader's salary in the USA

Trader's salary in the USASo, traders can expect to earn money - according to the search results, traders are offered more than $100,000 per month, with more than 40 jobs for the US found in total. But there are high requirements for applicants:

a college degree in finance, math or related sciences;

analytical skills;

trading experience of more than 5 years;

programming skills.

It should be noted that the best representatives of the profession can expect to earn $500K per year and more, including bonuses. Given these data, novice Forex traders have every reason to consider their aspirations promising.

Which Forex broker should I choose?

For successful trading, it’s optimal to choose a broker with strong regulation, low fees, a user-friendly trading platform, and excellent customer support. These factors ensure that your trading experience is secure, cost-effective, and accessible, providing you with the tools you need to thrive in the Forex market.

| Plus500 | Pepperstone | OANDA | |

|---|---|---|---|

|

Min. deposit, $ |

100 | No | No |

|

ECN Spread EUR/USD |

No | 0,1 | 0,15 |

|

Customer support score |

5.48 | 6.98 | 5.41 |

|

Trading platform |

Mobile, Web, Desktop | MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | WebTrader, MetaTrader4, Mobile platforms, MetaTrader5 |

|

Regulation |

FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

How to correctly calculate the potential income from Forex trading

To calculate the potential income from Forex trading, Traders Union experts suggest using the following formula.

Potential Profit (PD) = (Position Size (PP) × Price Difference (PDiff)) × Number of currency units (NU)

Or in mathematical notation:

PD = (PP × PDiff) × NU

Where:

PD - Potential income from a trade deal. This is the amount of money that a trader can earn or lose from a particular trade deal. The potential profit depends on the position size, price difference and the number of currency units.

PP - Position size expressed as a fraction of trading capital or as a percentage of it. This is the amount of money a trader is willing to risk in a trade. The position size determines how much money will be invested in the trade.

PDiff - Difference in price measured in pips (pip) or other units of price change. This is the change in the price of the currency pair (or other asset) on which the trade is executed. The price difference indicates the change in the value of the asset from the moment a position is opened to its closing.

NU - Number of currency units expressed in lots or other standardized trading units. This is the number of currency units that a trader trades within a trade. The number of currency units determines the size of the trade and affects the potential profit from the trade.

How Do Traders Make Money?

Professional traders can earn significant amounts of money, and there are many examples of successful traders who have achieved outstanding results in the market.

For example, George Soros is famous for his successful trades in the currency market, including Black Tuesday in 1992, when he crashed the British pound sterling and made over $1 billion dollars. His Forex trades have earned him a reputation as one of the most successful traders in the world.

Soros and his Quantum Fund significantly increased their short positions against the British pound from $1.5 billion to $10 billion. It was a highly profitable strategy with minimal risk and limitless potential. The move could be compared to gambling, where the outcome was just as random: if the pound devalued successfully, traders made huge profits, while if the exchange rate was stable, they lost only a small amount on interest payments on the loan.

Stanley Druckenmiller worked alongside George Soros at Quantum Fund and is considered one of the most talented traders in the industry. He was also active in the currency market and achieved significant success.

Paul Tudor Jones is famous for his successful trades in the financial markets, including successfully betting on the 1987 stock market crash when he made huge profits.

These traders are just some of the many professionals who are earning significant sums in the market. Their successes demonstrate the potential of making money in Forex for those with experience, knowledge and trading skills.

Factors affecting Forex trader's income

Among the main factors affecting the Forex trader's income in the market, TU experts emphasize the following:

Deposit Amount:

The size of the initial deposit plays a key role in determining a trader's profitability. A larger deposit provides greater opportunities for opening positions with larger volume and risk management.Leverage (leverage):

Leverage allows a trader to increase their buying power by leveraging the broker's borrowed funds. High levels of leverage can increase potential profits, but also increase the risk of loss.Currency instruments used:

Different currency pairs have different volatility, spreads and liquidity, which affects a trader's potential returns. Some pairs may have more predictable price behavior, while others may be more risky.Trading Strategy:

The selection and effective application of a trading strategy is of paramount importance to a trader's profitability. This includes choosing the appropriate time frame, indicators, analysis methods and risk management.Psychology and discipline:

A trader's emotional state, confidence, patience and discipline affect decision making and execution of trading plans. Lack of control over emotions can lead to wrong decisions and losses.Economic events and news:

Economic indicators, news and events affect exchange rates and market dynamics. The ability to analyze and predict market reactions to such events is an important skill for a successful trader.Level of Education and Experience:

Education and experience in financial markets play an important role in successful Forex trading. The more knowledge and experience a trader has, the more effectively he can analyze the market and make decisions.Technical Infrastructure:

A fast and stable internet connection, a quality trading platform and access to up-to-date market information are important factors for successful trading. Continuous access to the market and execution of transactions without delays can affect trading results.

How to Start Forex Trading

Learn the basics of the Forex market:

Before you start trading, learn the basics of the Forex market, including its structure, basic concepts (currency pairs, pips, lots, etc.), and the basic principles of Forex trading.Choose a reliable broker:

Research different brokerage companies and choose a reliable and licensed Forex broker.

Answer the question “What is the best Forex broker for low risk trading?”. The main criteria when choosing a broker include reliability, reputation, trading conditions (spreads, leverage, commissions), available tools and technical support.Open a trading account:

After selecting a broker, proceed to opening a trading account. This process usually takes place online and involves filling out an application form, providing proof of identity and selecting an account type. The broker may offer different types of accounts, including demo accounts for training and live accounts.Prepare the necessary documents:

Most brokers will require certain documents to prove your identity and residence. This usually includes scans of your passport or ID card, as well as utility bills or bank statements.Make a deposit:

After successful account opening, you will be required to make a deposit to your trading account. The broker will provide you with different ways to deposit your account, such as bank transfer, credit/debit cards, electronic payment systems, etc. Choose the most convenient and safe method for you.Select a trading platform:

Most brokers provide their clients with access to trading platforms to execute trades. Choose the platform that is most convenient and suits your needs. Popular trading platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).Practice on a demo account:

Before you start trading on a real account, it is recommended to practice on a demo account. A demo account will help you familiarize yourself with the trading platform, test your strategies without the risk of losing real funds and gain experience.Develop your trading strategy:

Create your own trading plan and strategy that includes rules for entering and exiting trades, risk management, setting stop loss and take profit levels and other important aspects of your trading.Start trading on a real account:

When you are ready to start trading on a live account, start with small amounts and stick to your trading plan. It is important to monitor the market, analyze your trades and gradually increase your trading volume as your experience and confidence increases.Learn and grow:

Forex is a dynamic market, so it is important to constantly learn and develop as a trader. Read literature, study analytics, participate in trading communities and communicate with experienced traders to share experience and advice. Don't forget to analyze your trades and learn from your experience.Control your emotions:

When trading Forex, it is important to be able to control your emotions, such as fear and greed, which can negatively affect your decision making and trading results. Fear can cause you to close a position too early or avoid high-risk trades, while greed can push you to be too aggressive and take unreasonable risks. Develop an emotion management plan, use relaxation and confidence techniques, and stick to your trading plan to minimize the influence of emotions on your decisions.

How much money do you need to start Forex trading?

As a rule, traders do not have to start Forex trading with a large amount of money. Some brokers, such as Exness and RoboForex, offer minimum entry thresholds from 1 to 10 dollars. In addition, there are so-called "cent accounts" where you can trade with minimum amounts measured in cents, which makes trading accessible to a wide range of traders with any level of capital.

There are also opportunities to copy trades (copy trading) and invest in PAMM accounts, which allow novice traders to learn and earn by following experienced managers or copying their trading strategies. Thus, it only takes a small amount of money to start trading Forex and there are various tools and opportunities to get started in the world of financial markets.

Here is a list showing the approximate deposits to start Forex trading depending on the broker and account type:

Minimum deposit: from 1 to 10 dollars.

Account type: standard account.

Cents Accounts:

Minimum deposit: from 1 to 10 dollars.

Account type: cent account.

On a cent account, 1 cent equals 1/100 of a dollar, which makes trading accessible for beginners with small capital.

Copy trading:

Minimum deposit: varies from broker to broker, usually between $100 and $500.

Account type: standard account.

A trader can copy the trades of experienced traders by investing in their trading strategies.

PAMM accounts:

Minimum deposit: varies depending on the manager and broker, usually between 100 and 1000 dollars.

Account type: investment account.

A trader can invest in a managing trader who does the trading for him and receive a share of the profits according to the share of the investment.

How to make money in Forex?

Classic Forex trading - that is, buying and selling currency pairs in order to profit from changes in their exchange rates - is the main, but not the only way to make money in Forex, emphasize the TU experts.

Market trading:

This is the main way of making money in Forex, which involves buying and selling currency pairs in order to profit from changes in their exchange rates. Traders can use various strategies and analysis techniques to predict price direction and make trading decisions.Investing in PAMM accounts:

PAMM (Percent Allocation Management Module) is an investment system in which investors invest their funds in a managed account of a managing trader. The manager trades in the market and profits (or losses) are distributed among investors according to their share of the investment.Copy trading:

This method allows beginners to copy the trades of experienced traders, automatically repeating their actions on their own account. This is ideal for those who do not have enough experience to trade independently, but want to make money on the market.Automated trading (Algorithmic trading):

Such trading involves the use of software (Expert Advisors, Expert Advisors and indicators) for automated Forex trading. Such programs can analyze the market, make trading decisions and execute transactions without human participation.Investing in cryptocurrencies:

Some brokers provide an opportunity to trade cryptocurrencies on Forex. Investing in cryptocurrencies can be a lucrative way to make money, especially if you choose the currency and the timing of entry/exit trades well.Arbitration:

Arbitrage strategies are based on identifying differences in the prices of the same asset in different markets or brokers. A trader buys an asset at a low price in one market and sells it at a higher price in another market, earning on the difference.Participation in contests and promotions of brokers:

Some brokers hold regular contests and promotions for their clients, where you can win cash prizes, bonuses or other valuable prizes. Participation in such events can be an additional source of income.Training and Counseling:

Experienced traders can make money by providing training and advice to other traders. This may include conducting webinars, writing books and articles, providing paid advice, etc.

Is Forex income taxable?

Yes, income earned from Forex trading may be subject to taxation depending on the laws of the trader's country of residence. Taxation of Forex income may vary from country to country and depends on several factors such as the status of the trader (individual or company), the length of time the assets have been held, the amount of profit earned and other factors.

For example, in some countries Forex income is taxed as capital income, while in other countries income tax or turnover tax may apply. There may also be special tax incentives or exemptions for Forex traders.

Therefore, it is important to refer to the tax laws of your country or consult a professional tax advisor to get information about the taxation of Forex trading income and fulfill all the necessary tax obligations.

U.S.A:

In the US, income from Forex trading is generally taxed as capital gains. Traders may be liable to pay capital gains tax at a rate depending on the length of time they hold the assets (usually 0%, 15% or 20%).

Traders are also required to file tax returns and report all Forex trading income on tax forms such as Form 1099 and Form 8949.

Countries of Europe:

The taxation of Forex trading income in Europe can vary from country to country. Generally, capital gains are taxed at a rate that may also vary depending on the amount of income and the length of time the assets have been held.

Traders must comply with local tax laws and report their income.

Asian countries:

In Asian countries, the taxation of income from Forex trading may also vary. Generally, income is subject to income tax or personal income tax.

Traders should familiarize themselves with local tax laws and fulfill all necessary tax obligations, including tax payment and reporting.

Main requirements for Forex trading

To start trading on Forex, you need to open a trading account with a selected broker. It is important to choose a broker with a good reputation and reliable regulation, taking into account the trading conditions and minimum deposit. The minimum deposit can vary significantly depending on the broker and the type of trading account. The recommended minimum deposit for beginner traders is usually between a few dozen and a few hundred dollars. It is important to choose a deposit amount that a trader is willing to lose without damaging his financial position, starting with smaller amounts and increasing it as he gains experience and confidence in his trading skills.

More information about minimum deposit

Forex broker's minimum deposit is the smallest amount of money that a trader must deposit into his trading account to start trading. Each broker sets its own minimum deposit depending on its terms of service. Examples of minimum deposit at popular brokers:

Exness: from $1

RoboForex: from $10

XM: from $5

A trader should make a deposit amount that will not lead to financial difficulties in case of losing trades. TU experts emphasize that one should start Forex trading without a credit load, and only with those funds, the loss of which in case of failure will not cause financial problems.

It is not recommended for beginners to use high leverage (more than 1:100) and trade with large sums of money until they have mastered the basic principles and strategies of trading. The starting capital for beginners can be considered the amount they are willing to lose without serious harm to their financial situation.

Ability to start trading without a minimum deposit:

Some brokers offer no deposit bonuses or demo accounts where traders can start trading without having to deposit their own funds. However, this approach may have limitations and is not always recommended for serious trading.

Training, understanding the basic principles and risks of trading, and disciplined money management are among the prerequisites for novice traders. Beginners should start with small amounts, gradually building their experience and confidence

Working as a salaried trader Vs. Individual trading

An individual trader works for himself, trading using his own capital. A hired trader is a person who trades on financial markets using funds or capital of other persons or organizations, receiving remuneration for this in the form of commissions, percent of profit or other contractual remuneration.

The category of hired traders also includes full-time employees working in the relevant departments (proprietary trading) and trading on the stock exchange on behalf and at the expense of the company's capital.

Working as a hired trader and individual trading have their advantages and disadvantages that should be considered when choosing an approach to Forex trading:

Working as a salaried trader

- Pros

- Cons

- Stable income: Hired traders usually receive a stable salary or commission for their work, which can provide financial stability.

- Access to capital: Some mercenary traders have access to large investment funds or capital, which allows them to trade with large volumes and make large profits.

- Professional support: Hired traders usually have access to professional analytics, training and technical support to help them make more informed trading decisions.

- Limitations in freedom: Hired traders are usually restricted by corporate rules and procedures, which can reduce their freedom of action and creativity.

- Employer Dependency: Salaried traders may be dependent on their employer for financial terms, working hours and other aspects of the job.

Individual trade

- Pros

- Cons

- Freedom and flexibility: Individual traders have complete freedom to make trading decisions and manage their time, allowing them to tailor their strategies and approaches to their needs and preferences.

- Potentially high profits: Successful sole traders can earn significantly more than salaried traders due to the possibility of receiving all profits from their successful trades.

- Financial Risks: Individual traders do not have a guaranteed income and may face financial losses, especially in the initial period of their career.

- Need for self-study: Individual traders have to learn the market on their own, develop their skills and strategies, which requires time, effort and resources.

Thus the choice between becoming a professional trader for hire or trading independently depends on individual preferences, goals and degree of readiness for financial risk and responsibility.

Mistakes and misconceptions of traders that prevent them from making money

Forex trading is a complex and dynamic process in which no one is immune from mistakes. Let's consider the main and most common mistakes that prevent traders from trading successfully and making money.

Lack of education and training: Many traders start trading without proper training and understanding of the market, leading to loss of money due to inexperience and ignorance.

Using too much leverage: Some traders use high leverage from the start, which can lead to large losses for small price changes.

Lack of a trading plan: Many traders do not develop a clear trading plan and do not follow a strategy, which makes their trading impulsive and unpredictable. And these are qualities that the market usually does not forgive.

Emotional reactions: Traders, especially beginners, are often prone to emotions such as fear, greed and panic, which can lead to rash decisions and losing trades.

Improper risk management: Many traders ignore the rules of risk management and risk too much on a single trade, which can lead to large losses.

Lack of discipline: Traders often fail to stick to their trading plan and strategy due to lack of discipline, which ultimately leads to losses.

Only conscious and purposeful training, development of a clear trading plan and strategy, as well as psychological preparation for Forex trading will help to avoid these common mistakes and misconceptions. Only in this way traders will be able to achieve stable and successful results in the market.

Expert Opinion

While many ask "how much can you earn trading?", I believe a trader's primary focus should be on improving their trading skills, maintaining discipline, and sticking to a plan. Only consistent good trading decisions will lead to profits.

Technically there is no limit to a successful trader's earning potential, with top hedge fund traders making millions, it's crucial for beginners to not get fixated on chasing large sums right away. Instead, the primary focus should be on:

- Developing skills and knowledge.

- Mastering discipline and risk management.

- Gradually building capital.

Remember, success in trading takes time and effort. Set realistic goals, focus on progress, not immediate profits, and with the right approach, you can achieve your desired income level.

FAQs

How Much You Can Earn From Trading?

The potential profit depends on many factors, including the trader's level of experience, the trading strategy chosen, the amount of capital and the ability to manage risk. There is no guaranteed answer to this question, as Forex trading involves a high level of uncertainty and risk.

How to turn $100 into $1,000 in Forex?

Turning $100 into $1,000 is possible, but requires strict risk management, an effective trading strategy and patience. This can be achieved by developing a trading plan tailored to the available capital, utilizing stop-loss and profit levels, and managing emotions.

Can I trade Forex on $100?

Yes, you can trade Forex with an initial capital of $100 or even less, but it is important to realize that it can be difficult due to the limited amount of capital. Trading with such a small capital requires extreme caution, effective risk management and a strategic approach.

Can I make a living trading Forex?

Yes, some traders make a living trading Forex. However, it requires serious study, practice, discipline and a strategic approach.

How do I know bad brokers?

To identify a bad broker, check if they are licensed by a reputable financial regulator and review feedback from other traders. Be cautious if you come across negative reviews, unclear fee structures, or a lack of information about the company. Between 65% and 82% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Related Articles

Team that worked on the article

Anastasiia has 17 years of experience in finance and content marketing. She believes that the support of information and expert opinion is very important for the success of investors and new traders. She is ready to share her knowledge of forex, stock and cryptocurrency trading, as well as help choose the right investment products and strategies to achieve active or passive income.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

A private trader is an individual who doesn’t represent any institution and trades using their own capital.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.