Best currency pairs to trade for beginners in 2024

Top 6 Forex pairs to trade for beginners:

-

1

EUR/USD - the most traded currency pair across the globe

-

2

USD/JPY - driven by the influence of the yen in Asia and the dollar's prominence worldwide

-

3

GBP/USD - represents a significant portion of daily Forex transactions

-

4

AUD/USD - highly impacted by changes in commodity prices

-

5

USD/CAD - strong correlation with oil prices

-

6

USD/CHF - attracts investors owing to Switzerland’s reputation of financial stability

Are you a beginner in the world of Forex trading? Wondering which currency pairs are the best to trade in 2023? Look no further! In this guide, the experts at TU have compiled a list of the best Forex pairs to trade, specifically tailored for beginners. By understanding the key factors that make a currency pair favorable for trading, you can kickstart your Forex journey on the right track. Whether you're seeking stability, liquidity, or volatility, the experts will help you navigate through the vast array of options and find the ideal currency pairs to enhance your trading performance.

What are currency pairs?

Understanding currency pairs is essential for anyone venturing into the Forex market. These pairs, also known as trading pairs, are utilized for exchanging one national currency for another. Each currency pair consists of two assets, with the order of their placement holding significant meaning in trading. The first currency listed, known as the base currency, establishes the foundation of the pair, while the second currency, called the quote currency, determines the exchange rate against the base currency.

As an example of how to read currency pairs, let's consider the EUR/USD pair. In this case, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. The exchange rate signifies how many U.S. dollars are required to purchase one euro. If the current exchange rate for EUR/USD is 1.20, it means that you would need 1.20 U.S. dollars to buy one euro. Conversely, if you were to sell one euro, you would receive 1.20 U.S. dollars. It's crucial to keep in mind that currency pairs are always traded in pairs, as the value of one currency is always relative to another.

Currency pairs classification

Currency pairs classification

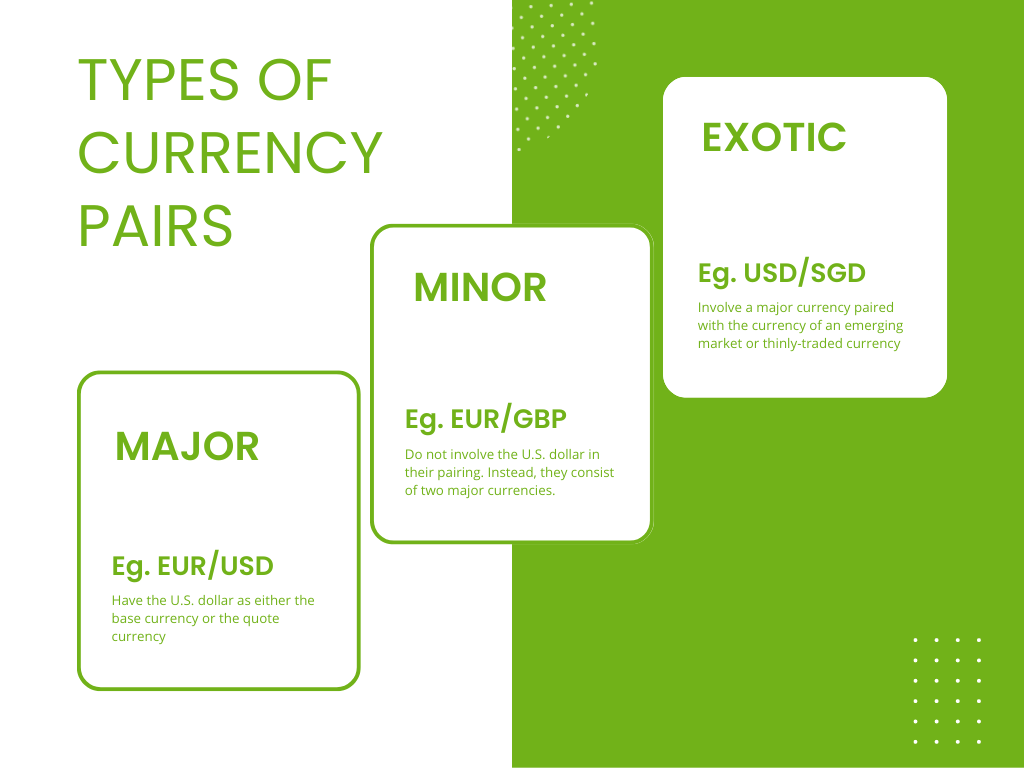

Currency pairs in the Forex market can be classified into three main categories: major currency pairs, crosses, and exotic pairs. Each category has distinct characteristics and considerations for traders:

Major currency pairs:

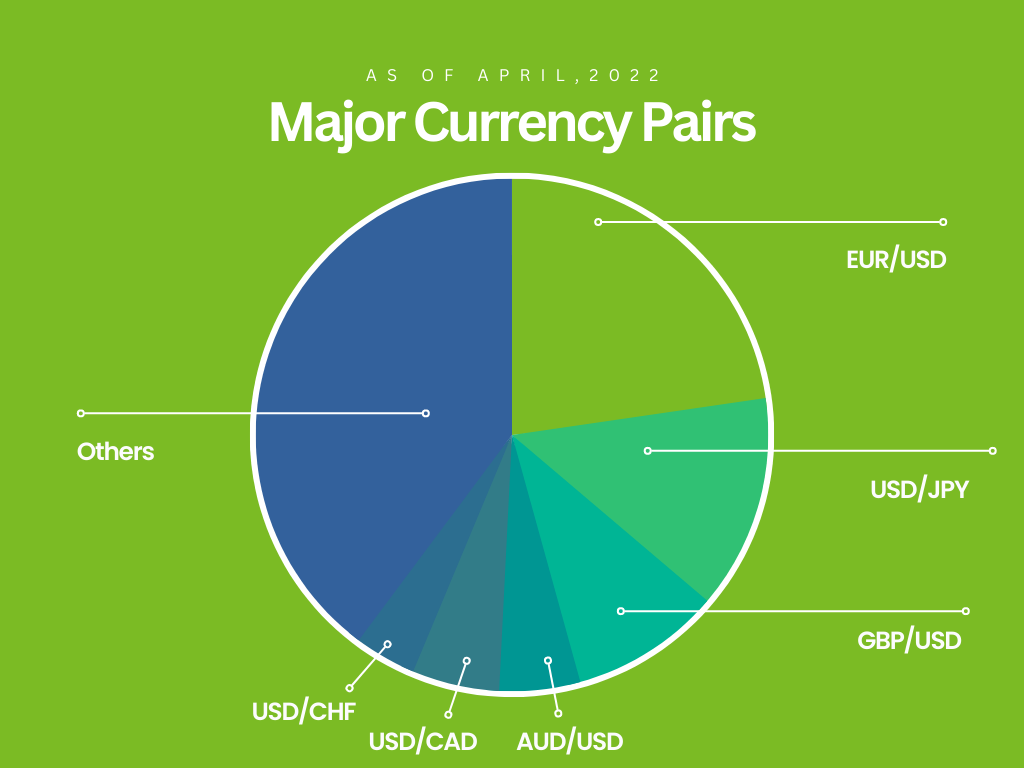

Major currency pairs are the most actively traded pairs in the Forex market. They always include the U.S. dollar as either the base currency or the quote currency. This category comprises widely recognized pairs such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD. Major currency pairs are favored by traders due to their high liquidity, tight spreads, and availability of market information. These pairs often reflect the overall strength or weakness of the U.S. dollar and are influenced by significant global economic events and central bank policies

Crosses:

Cross currency pairs, also known as minor currency pairs, do not involve the U.S. dollar in their pairing. Instead, they consist of two major currencies. Examples of cross currency pairs include EUR/GBP, GBP/JPY, and EUR/CHF. Crosses provide traders with opportunities to speculate on the relationship between two major currencies without the influence of the U.S. dollar. While they may have wider spreads and lower liquidity compared to major pairs, crosses still offer sufficient trading opportunities. Traders focusing on specific regions or having insights into the economies of the paired currencies often find value in cross currency pairs

Exotic pairs:

Exotic currency pairs involve major currency pairs with the currency of an emerging market or thinly-traded currency. These pairs, such as USD/SGD, USD/HKD, and EUR/TRY, represent the currencies of countries with smaller economies or restricted capital markets. Exotic pairs typically exhibit lower liquidity, wider spreads, and higher volatility compared to major and cross currency pairs. These are often categorized as the most volatile Forex pairs. Traders who are experienced and risk-tolerant may find opportunities in exotic pairs, as they can offer higher profit potential. However, trading exotics requires thorough research, understanding of the underlying economies, and careful risk management due to their higher unpredictability

It's important to note that the classification of currency pairs as major, crosses, or exotic may vary slightly among different brokers and traders.

What makes a Forex currency pair good to trade?

Key factors how to choose a good Forex pair

When evaluating the suitability of a Forex currency pair for trading, there are several factors to consider. Here are key points to keep in mind:

Volatility:

The level of price fluctuations in a currency pair affects trading opportunities and risk. Higher volatility can offer more potential for profit but also increases the risk. Traders should assess their risk tolerance and choose currency pairs accordingly

Liquidity:

The ease of buying or selling a currency pair without significant price impact is crucial. Major currency pairs, like EUR/USD and USD/JPY, tend to have high liquidity and tight spreads. Ample liquidity ensures efficient trade execution

Trading hours:

Each currency pair has specific trading hours, and understanding the overlaps between trading sessions is important. The European and US session overlap often presents high liquidity and volatility, providing more trading chances

Fundamental news and events:

Economic data releases, central bank announcements, and geopolitical events can greatly influence currency pairs. Traders should stay informed about upcoming events and news that may impact their chosen currency pair, adjusting their trading strategies accordingly

Risk tolerance and trading strategy:

Optimal currency pairs vary based on individual risk tolerance and trading strategies. Major currency pairs are favored by many traders due to their liquidity and tight spreads. Exotic currency pairs, while riskier, may offer higher potential returns. Understanding personal risk tolerance and aligning it with the chosen currency pair is essential

What are the best currency pairs to trade for beginners?

For beginner traders, certain currency pairs are often recommended as they provide favorable opportunities for learning and trading success. The top currency pairs for beginners include EUR/USD, GBP/USD, and USD/JPY. These pairs are popular among novices due to their liquidity, market stability, and availability of market information. By focusing on these currency pairs, beginners can develop their skills in utilizing both fundamental and technical analysis to identify trading setups and increase their chances of making successful trades. It is important for beginners to gain a solid understanding of these currency pairs and continuously improve their trading strategies through practice and education.

The easiest currency pairs to trade

When starting out as a trader, it is beneficial to focus on currency pairs that offer ease of trading due to their liquidity and lower volatility. These currency pairs provide clearer price action and are considered the easiest to trade. Among the identified easiest currency pairs are EUR/USD, GBP/USD, USD/CHF, USD/CAD, and GBP/JPY. The first four pairs involve major currencies, while GBP/JPY is a minor currency cross. By selecting these currency pairs, traders, regardless of their level of experience, can navigate the Forex market with greater confidence and potentially achieve more successful trading outcomes. It is important for beginners to gain familiarity with these currency pairs and gradually expand their trading skills and knowledge as they progress.

The most traded currency pairs (TOP 6)

Most traded currency pairs

EUR/USD

EUR/USD, also known as "The Fiber", is a currency pair that combines the euro and the US dollar. It is considered the most traded currency pair due to the involvement of two major economies. The pair offers low spreads, high liquidity, and the ability to execute large volume trades. This makes it attractive for Forex scalping strategies, allowing traders to profit from smaller, frequent earnings. The stability of the EUR/USD throughout the year contributes to its profitability.

Minimum spread: 0.7 points

USD/JPY

USD/JPY, known as "The Gopher", combines the US dollar and the Japanese yen. It is one of the best Forex pairs to trade right now, driven by the influence of the yen in Asia and the dollar's prominence worldwide. The currency pair exhibits high liquidity, allowing traders to transact in large volumes without significant price fluctuations. Additionally, it features tight spreads, reducing trading costs for participants.

Minimum spread: 0.7 points

GBP/USD

GBP/USD, referred to as "Cable", involves the pound sterling and the US dollar. It represents a significant portion of daily Forex transactions. The exchange rate is influenced by the relative strength of the British and American economies. If the British economy outperforms the US economy, the pound strengthens against the dollar, and vice versa. Traders monitor economic indicators to assess the potential direction of this currency pair.

Minimum spread: 0.9 points

AUD/USD

AUD/USD, known as the "Aussie", pairs the Australian dollar with the US dollar. It constitutes a notable percentage of daily Forex trades. The value of the Australian dollar is closely tied to commodity exports, particularly metals and minerals. Changes in commodity prices impact the currency pair, with a decrease in commodity values causing the Australian dollar to weaken against the US dollar. Interest rate differentials between the Reserve Bank of Australia and the US Federal Reserve also influence AUD/USD.

Average spread: 1.2 pips

USD/CAD

USD/CAD represents the US dollar against the Canadian dollar. It is considered a commodity pair and has a strong correlation with commodity prices, particularly oil. Economic ties between the US and Canada contribute to the pair's volatility. Traders closely monitor factors such as oil prices and economic indicators of both countries to make informed trading decisions.

USD/CHF

USD/CHF, also known as "Swissie", pairs the US dollar with the Swiss franc. It is the seventh most traded currency pair globally. The Swiss franc's value is influenced by the Swiss National Bank's actions and economic data published by the Swiss Federal Statistical Office. Switzerland's reputation for financial stability attracts investors during times of market volatility, making the CHF a popular safe-haven currency. As demand for the franc increases, the value of USD/CHF tends to decline.

Minimum spread: 2.5 points

Where can I trade the best Forex pairs?

RoboForex - Best for international trading

RoboForex is a reputable brokerage company that has been serving the financial markets since 2009. It operates in 169 countries and boasts a client base of over 3.5 million users. Known for its software development expertise, RoboForex has earned recognition as one of the best Forex brokers according to client reviews.

RoboForex offers a range of trading accounts, including ECN, Prime, R Trader, Pro-Cent, and Pro-Standard accounts. The minimum deposit requirement for all account types is $10 USD/EUR, which is remarkably low compared to other platforms. The Prime Account allows for a maximum leverage value of up to 1:300.

For investors seeking simple and short-term investment opportunities, RoboForex provides the CopyFX investment platform. It allows users to copy the trades of experienced traders, subject to meeting the minimum deposit requirements set by the chosen traders.

Tickmill - Best for active traders

Tickmill caters to active traders with its selection of trading platforms. Traders can choose between the widely used MetaTrader 4 (MT4) platform or Tickmill's WebTrader platform, both of which offer advanced charting tools, technical indicators, and automated trading capabilities.

Tickmill offers various account types to accommodate different trading needs, such as Classic, Pro, and VIP accounts. The required minimum capital to open an account ranges from $100 for Classic accounts to $50,000 for VIP accounts.

Traders can benefit from Tickmill's competitive spreads, especially on their commission-based VIP and Pro accounts, which are known for their tight spreads. This makes Tickmill an attractive choice for those seeking cost-effective trading.

What are common mistakes that beginners make when trading currency pairs?

When trading currency pairs, beginners commonly make several mistakes that can hinder their success in the market. These mistakes include:

Overtrading:

Beginners often fall into the trap of overtrading, driven by excitement and the desire to profit quickly. They may take too many trades without proper analysis or a well-thought-out strategy. Overtrading can lead to impulsive decisions, increased transaction costs, and higher risk exposure

Lack of a trading plan:

Many beginners neglect to create a trading plan, which is a crucial tool for success. A trading plan outlines specific entry and exit points, risk management strategies, and overall trading goals. Without a plan in place, beginners may make decisions based on emotions or random factors, leading to inconsistent and ineffective trading

Poor risk management:

Beginners often underestimate the importance of risk management. They may risk a significant portion of their capital on a single trade, exposing themselves to substantial losses if the trade goes against them. Additionally, beginners may fail to set appropriate stop-loss orders, which are essential for limiting potential losses. Proper risk management is vital to protect capital and maintain a sustainable trading approach

Insufficient analysis:

Inadequate analysis is a common mistake among beginners. They may not spend enough time studying and understanding currency pairs before entering trades. It is crucial to perform both technical analysis, analyzing price charts and patterns, and fundamental analysis, evaluating economic and geopolitical news that can impact currency movements. Insufficient analysis can lead to poor trade decisions based on incomplete information

Ignoring currency correlations:

Beginners may overlook the importance of currency correlations when trading. Certain currency pairs have significant direct or inverse correlations, meaning they tend to move in the same or opposite direction. Ignoring these correlations can result in unintended risk exposure. Trading correlated pairs without considering their relationship can lead to amplified losses or missed opportunities

Summary

In summary, becoming a full-time trader requires discipline, knowledge, and a strategic approach. When it comes to currency pairs, beginners are advised to focus on the most traded and easiest pairs, such as EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, and GBP/JPY. These pairs offer ample opportunities for successful trades with their high liquidity, low spreads, and stability. However, it is crucial to avoid common mistakes like overtrading, lacking a trading plan, poor risk management, and insufficient analysis. Additionally, understanding currency correlations is essential to avoid unintended risk exposure.

FAQs

What is the easiest Forex pair to trade for beginners?

The easiest Forex pair to trade for beginners is often considered to be EUR/USD. It offers high liquidity, low spreads, and stable price movements, making it more predictable and easier to analyze.

Which currency pair is most profitable?

The profitability of currency pairs can vary based on market conditions and trading strategies. However, some commonly traded currency pairs like EUR/USD, GBP/USD, and USD/JPY tend to offer good profit potential due to their high trading volume and liquidity.

What is the best Forex market to trade on as a beginner?

The best Forex market to trade on as a beginner is the major currency market, particularly the New York and London sessions. These sessions offer higher trading volume, increased liquidity, and more trading opportunities, providing a favorable environment for beginners to learn and execute trades.

Which currency pair is best to trade?

The best currency pair to trade depends on various factors, including individual trading strategies, risk tolerance, and market conditions. Popular currency pairs like EUR/USD, GBP/USD, and USD/JPY are widely traded and offer good liquidity and volatility, making them suitable choices for many traders.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

4

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

5

Cross Currency

Cross currency refers to a currency pair or transaction that does not involve the U.S. dollar (USD). In the foreign exchange market, most currency pairs are quoted against the U.S. dollar, such as EUR/USD or USD/JPY. These are known as major currency pairs.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).