Proprietary trader job explained

Most people in the finance world have heard of prop traders. Prop traders are assumed to be intelligent and skilful people who thoroughly understand the capital market and have hawkeye for profitable opportunities. Cash-rich people, firms or organizations hire them and give access to their underlying capital, which is further invested. Prop traders try to profit from stock price fluctuations, arbitrage opportunities, and other vivid investment decisions.

If you aspire to join a prop trading firm or become a prop trader, it's time to roll your sleeves and focus on developing the necessary skillset. Becoming a prop trader is a tough grind but doable. This 5-minute read will help you understand the nitty-gritty related to the life of a prop trader, the prop trader's salary, and the obvious—how to become a prop trader. It will also clarify funded trading and how it compares to traditional prop trading.

So, let’s begin.

Proprietary Trader Job Explained

Do you want to know what a proprietary trader job entails? Well, it’s more than just making money.

To be a successful prop trader, you need to understand the different financial market and how it works. You also need to know what kinds of trading strategies work best for you and which ones don't. You should also know how to manage risk and keep your emotions in check when things go wrong. This article will help you do that. We'll also discuss the benefits of becoming a prop trader, how to get started, and more. Read the Traders Union article for the best way to find a job in prop trading.

Who is a Prop Trader?

A prop trader, short for proprietary trader, works for a financial institution trading financial instruments like stocks, bonds, commodities, or currencies. Unlike regular traders, who trade on behalf of clients, a prop trader uses the firm's own money to generate profits.

What Does a Prop Trader Do?

A prop trader aims to make profitable trades using a variety of financial instruments. They operate with two main goals: maximizing profits and managing risks. They employ in-depth research, data analysis, and financial models to make informed decisions. Prop traders often have access to sophisticated trading platforms and technologies that give them a competitive edge. They may specialize in specific markets, such as equities, fixed income, or derivatives. The profits or losses they make directly impact the financial health of the firm they work for.

How to Become a Prop Trader?

How to Become a Prop Trader?

How to Become a Prop Trader?

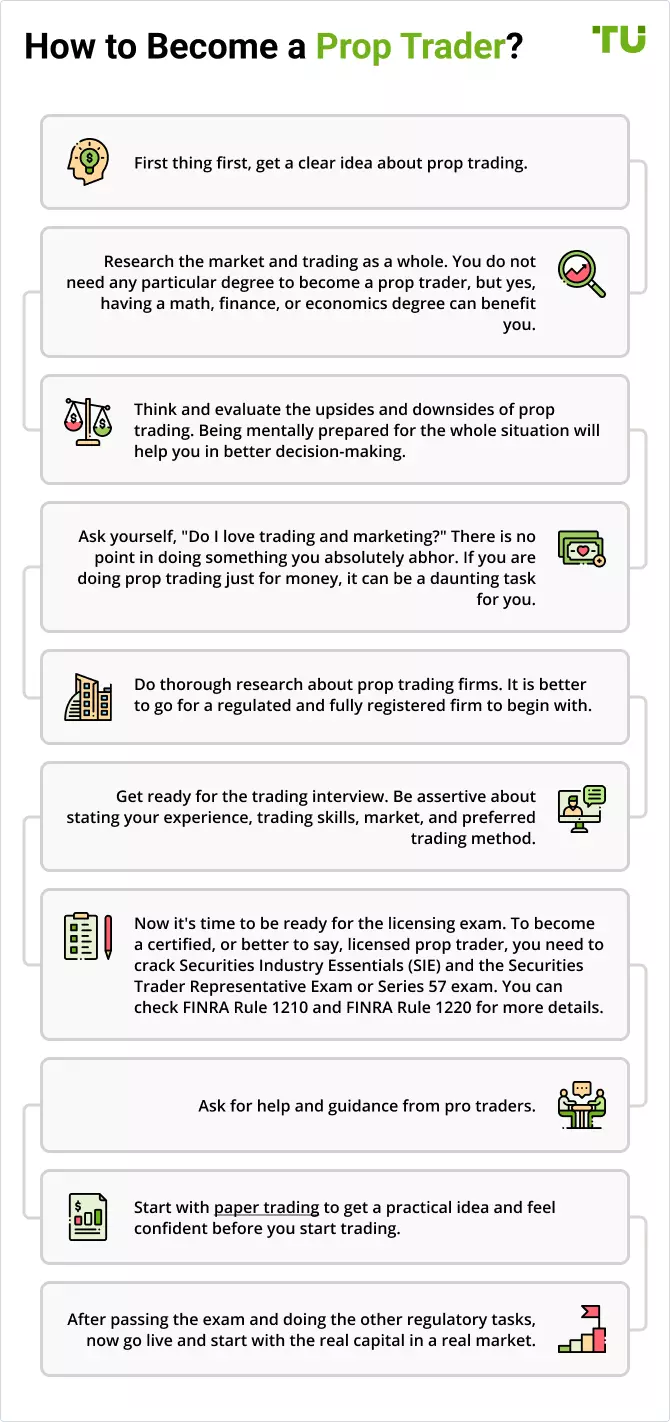

Here are the steps to becoming a prop trader:

-

First thing first, get a clear idea about prop trading.

-

Research the market and trading as a whole. You do not need any particular degree to become a prop trader, but yes, having a math, finance, or economics degree can benefit you.

-

Think and evaluate the upsides and downsides of prop trading. Being mentally prepared for the whole situation will help you in better decision-making.

-

Ask yourself, "Do I love trading and marketing?" There is no point in doing something you absolutely abhor. If you are doing prop trading just for money, it can be a daunting task for you.

-

Do thorough research about prop trading firms. It is better to go for a regulated and fully registered firm to begin with.

-

Get ready for the trading interview. Be assertive about stating your experience, trading skills, market, and preferred trading method.

-

Now it's time to be ready for the licensing exam. To become a certified, or better to say, licensed prop trader, you need to crack Securities Industry Essentials (SIE) and the Securities Trader Representative Exam or Series 57 exam. You can check FINRA Rule 1210 and FINRA Rule 1220 for more details.

-

Ask for help and guidance from pro traders.

-

Start with paper trading to get a practical idea and feel confident before you start trading.

-

After passing the exam and doing the other regulatory tasks, now go live and start with the real capital in a real market.

Pros and Cons of Being a Prop Trader

Advantages of being Prop Trader

The job of a prop trader is demanding. But at the same time, it’s among the most scoured job in the current economic scenario. Prop traders enjoy the following advantages:

They have flexibility in working either from home or from the office.

Prop traders enjoy being in a group of experienced traders and investors and can learn much from them. Working with other professional traders can be a great learning curve for beginners.

You will have more trading capital to access than before.

Firm trading fees are often lower than costs for those prop trading on their own.

Prop Traders Limitation

As with anything, there are also a few drawbacks to being a prop trader:

The learning curve is steep. It will take time to be pro.

As a beginner, expect tough competition.

Multiple firms have shifted to digital because it is cheaper than a brick-and-mortar company. It means you might be on your own. Yes, online communities and communications are there. But it's not the same as being surrounded by pro traders.

Expenses charged to traders by some companies include software access fees, seat rental fees, and marked-up commissions. A share of the profits may also be added.

Requirements of prop firms for traders

Getting a job as a prop trader isn't a walk in the park. These firms have a set of requirements to ensure they hire the most competent candidates capable of maximizing profits while minimizing risks. Here are some common requirements:

Educational background. A bachelor's degree in finance, economics, mathematics, or a related field is often a minimum requirement. Some firms might demand an MBA or another advanced degree, especially for specialized roles.

Certifications. Licenses such as the Series 7, Series 56, or Series 63 might be necessary depending on the jurisdiction and the types of securities traded.

Technical skills. Firms expect you to be proficient in financial analysis tools, trading platforms, and computer programming languages like Python, R, or C++.

Proven track record of successful trading. Previous experience in trading or a related financial field can give you an edge. Some firms may require a specific amount of professional trading experience or a demonstrated track record of profitable trading.

Risk Management. Demonstrable skills in managing risk are crucial. You must show an understanding of how to manage and quantify risk to protect the firm’s capital.

Analytical abilities. Strong quantitative and qualitative analytical skills are vital. You'll be dealing with complex financial instruments and strategies, so the ability to analyze them effectively is a must.

Capital contribution. Some firms require traders to invest their own capital as a sign of commitment and shared risk.

Communication skills. Although trading might seem like a solitary endeavor, good communication skills are essential. Traders must be able to explain their strategies clearly to stakeholders and collaborate with team members.

Psychological traits. Trading is stressful. Resilience, discipline, and the ability to make quick decisions under pressure are all psychological traits that firms look for.

Fulfilling these requirements won't guarantee you a spot, but they will make you a competitive candidate. Prop firms often have their own in-house training programs to further hone your skills once you're in the door.

How Much Do Prop Traders Make?

Prop trading requires skill and hard work, but it can pay off. Depending on the type of trading firm and how much money is involved, prop traders make money based on the percentage of the firm’s profits. Some prop trading firms have a prop trader salary plus a portion of the profits, while others only pay commissions on each trade made by the employee.

Generally, your percentage will depend on your trading skills. As such, proprietary trading is one of the highest-paying jobs in finance. So, how much do prop traders make? The average salary for a prop trader can range from $100k to $500k per year, depending on their skill level and how much money they make for their firm.

How Much Can You Make Trading ForexFunded Trading Account vs. Prop Trading Firm

Some beginner traders might have come across the terms “funded trading account” and “proprietary trading firm.” It can be tricky to understand the difference between these two types of accounts, so here are some differences that will help you know the difference:

Funded Trading Account

A funded trading account is one where a broker-dealer provides traders with capital to trade with. The trader then takes a portion of their profits on each trade.

Here are the pros of a funded trading account:

Direct access to substantial capital from day one: This is a considerable advantage for newer traders, who can start making trades immediately. This can help them avoid the frustration of waiting for their account to grow before they can begin trading. Having access to capital also helps new traders learn how margin works and how you need to manage your positions carefully when using margin.

No need to risk your own money: Funded trading accounts let you trade with other people’s money. This means that you don’t need to stake your capital, which enables you to learn how to trade without putting yourself at risk. It also helps keep losses to a minimum while learning how to trade instead of risking your own money and potentially losing even more than what is in your account.

Funded trading accounts have demerits, too. They include:

Working on an assigned trading platform: Traders participating in funded trading accounts must work with a designated platform. This limits your options and could mean you miss out on some of the best available platforms. You may also not be able to customize your trading experience as much as you would like because it is impossible to control certain aspects of a funded account.

Need to show consistent results: You will need to deliver consistent results to keep your funded trading account. If you do not make the profits you anticipate, or if the losses exceed a certain amount, the company may terminate your account, and all of the money that your broker deposited will be withdrawn from it. This could leave you with no funds left for further trading.

Splitting the profits: As part of your trading agreement, you may be required to split your profits with the broker that funded your account. This means that even if you make a high profit on a trade, you may only receive a portion of that profit because it is shared with the broker who provided the funds for trading purposes.

Prop Trading Firm

We've already discussed the pros and cons of working with proprietary trading firms for beginners. So, working with a funded trading account or a prop trading firm will depend on your circumstances.

If you are new to trading and want to learn more about the fundamentals of trading, then funded accounts are likely your best option. If you already have a good understanding of the market and how it works, then working with a prop firm may be better suited as they can provide you access to more advanced trading strategies and tools.

How to Choose a Prop Trading Firm or Funded Trading Account?

Choosing a trading firm or funded trading account can take time for a new trader. There are many factors to consider. These include:

The reputation of the company: This is a crucial consideration. Reputable firms will have more experienced traders on staff, which can help you learn more about the market and how it works.

Trading strategy limitations: You should also look into the types of trading strategies that are available. Some firms will only allow you to use a specific system, while others may offer more flexibility. This can be important if you focus on arbitrage or high-frequency trading strategies, for example.

The age of the proprietary firm: Another thing to consider is the age of the proprietary firm. Some firms have been around for decades, which means they’ve had time to build up their reputation and develop a solid trading strategy. You may also get more personalized attention from these types of companies.

Education & support: Some firms will offer you the opportunity to take classes on investing, while others may provide you with a mentor who can help guide you through your trading career.

Capital scaling options: A prop trading firm will typically offer you the opportunity to scale your trading capital up or down, depending on your needs. This can be especially important if you are starting this industry. It gives you the freedom to trade with as little or as much money as you would like.

Open Community: A prop firm will typically offer you the opportunity to connect with other traders and participate in an open community where ideas are shared and discussed.

Best prop trading accounts

FAQ

What are the qualifications for becoming a prop trader?

The qualifications for becoming a prop trader are relatively basic. You will need to demonstrate your trading expertise and ability to consistently generate profits from your trades. It would be best if you also had a firm grasp of the financial markets and their functions.

How long does it usually take for someone to become a successful prop trader?

Becoming a successful prop trader can take a few months to several years. This will depend mainly on your experience level and the strategies you plan to use.

What are the risks and rewards associated with being a prop trader?

The risks and rewards associated with being a prop trader are similar to those of any other job. The risk level will depend on your strategies, while the reward will vary depending on how much effort you put into your work and how well you understand the market.

Are there any other resources you recommend to someone who wants to become a prop trader?

Yes, many resources are available to help you learn how to become a prop trader. You can start by reading books and taking online courses, which will give you a solid foundation in the basics of trading.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.