What Is A Forex Rebate (Cashback)?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

A Forex rebate is a cashback program where traders receive a portion of the spread or commission paid on trades. Brokers offer rebates to attract clients, rewarding them with a percentage of their trading costs. This helps traders reduce overall trading expenses while boosting profitability.

Forex rebates benefit both traders and brokers by lowering costs and encouraging trading activity. This article explores how Traders Union helps traders reduce Forex trading costs through cashback programs. It covers how rebates work, their benefits, and ways to maximize returns. Readers will learn about trusted brokers, rebate eligibility, and passive income through the affiliate program.

What is a Forex rebate?

A Forex rebate, also known as cashback, is a program where traders get back a portion of the transaction costs, such as spreads or commissions, after executing trades. This helps reduce overall trading expenses, boosting profitability whether trades result in profits or losses.

How Forex rebates work

Account linking. Traders link their trading accounts to a rebate provider or choose a broker offering rebates.

Trade execution. Brokers earn from spreads or commissions applied when trades are made.

Rebate allocation. Part of the broker’s earnings is returned to traders as a rebate, either directly into their accounts or through a rebate service.

Types of Forex rebates

Fixed rebates. A set amount returned per lot traded, ideal for traders with consistent trading volumes.

Tiered rebates. Rebate percentages increase with higher trading volumes, encouraging more active trading.

Benefits of Forex rebates

Lower trading costs. Traders can reduce their expenses by receiving a portion of trading fees back.

Extra income. Rebates add to overall earnings, regardless of trade outcomes.

Volume-based rewards. Some brokers offer better rebate rates with higher trading volumes.

Important considerations

Choosing the right broker. Select reputable brokers and rebate services to ensure transparency.

Trading strategy compatibility. Use rebates wisely to support trading strategies, avoiding overtrading just for cashback benefits.

How to get a Forex rebate?

Follow these steps to get a rebate:

Register with the Traders Union rebate service here. Read more about registration below.

Read more about various brokers on Traders Union and learn about their trading conditions, opportunities, and rebate conditions. You can also read dozens of reviews on brokers.

Choose one or several brokers and register with it; open a trading account; go through verification; and replenish the deposit.

Enter your trading account number in the "Accounts" section in the Traders Union personal area.

Open transactions and get compensation based on the terms of the rebate service.

After the account is connected to your personal account at the Traders Union, feel free to confirm with Traders Union’s support staff that everything was done properly and correctly and whether your rebate will be credited to you.

How does your rebate benefit your broker?

Forex rebate programs, where traders receive a portion of transaction costs back, offer several benefits to brokers.

Attracting new clients. By offering rebates, brokers can differentiate themselves in a competitive market, appealing to cost-conscious traders seeking reduced trading expenses.

Increasing trading volumes. Rebates incentivize traders to execute more trades, as they effectively lower transaction costs. This heightened activity leads to increased revenue for brokers through cumulative spreads and commissions.

Enhancing client retention. Providing rebates fosters a sense of value and appreciation among traders, encouraging loyalty and long-term engagement with the broker's platform.

Building positive reputation. Brokers offering transparent and beneficial rebate programs can enhance their reputation in the trading community, attracting referrals and organic growth.

How does the Traders Union work and make money from rebates?

Traders Union works as an intermediary between traders and brokers, facilitating rebate programs that benefit both parties. Here’s how it operates and earns revenue.

Partnerships with brokers.Traders Union collaborates with brokers through affiliate agreements to attract traders to their platforms.

Trader registration. Traders sign up on the Traders Union platform and open trading accounts with partner brokers using referral links.

Trading activity. Traders execute trades, incurring standard transaction costs such as spreads or commissions.

Rebate distribution. Brokers pay a portion of their commission to Traders Union as an affiliate reward. Traders Union then returns part of this commission to traders as a rebate, reducing their trading costs.

How Traders Union makes money

Affiliate commissions. While a significant portion of the affiliate commission is paid back to traders as rebates, Traders Union keeps a small percentage as revenue. For example, if a trader pays a $40 spread, and the broker offers 50% ($20) to Traders Union, the Union might return 80% ($16) to the trader and keep $4 as income.

Affiliate program. Traders Union has a two-tier affiliate program where partners earn a percentage from clients they refer and additional earnings from second-level referrals.

Benefits to traders

Lower trading costs. Rebates help traders reduce transaction expenses and increase profitability.

Access to resources. Traders receive broker ratings, educational content, and support services to make better trading decisions.

Advantages of Traders Union rebate service

Maximum rebate returns.Traders Union offers some of the best rebate conditions in the market, allowing traders to receive up to 100% of their trading spreads back. This significantly lowers trading costs and increases profitability.

Exclusive trading perks. By partnering with Traders Union, clients gain access to special trading terms and additional benefits that are not available to regular broker clients. This means reduced trading expenses and better overall conditions.

Reliable broker ratings. Traders Union regularly updates its list of top-rated brokers based on their performance in the global currency and stock markets. This helps traders choose trustworthy brokers with proven track records.

Dedicated customer support. Clients benefit from 24/7 customer assistance. In case of disputes with brokers, Traders Union’s legal team steps in to represent the trader’s interests, ensuring a fair resolution.

Passive income opportunities.Traders Union’s two-level affiliate program allows clients to earn extra income by referring other traders. Affiliates receive commissions not only from direct referrals but also from the activity of traders referred by their contacts.

Choosing the right Forex broker is crucial for successful trading, especially when considering factors like spreads, commissions, and leverage. To simplify your decision-making process, we have carefully selected a list of top Forex brokers known for their competitive trading conditions.

| Demo | Min. deposit, $ | Max. leverage | ECN Spread EUR/USD | ECN Commission | Raw Commission | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | No | No | No | 0,5 | 0,9 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | 0,1 | 3 | No | 0,5 | 1,5 | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | 0,15 | 3,5 | No | 0,1 | 0,5 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | 0,2 | 5 | 2,5 | 0,7 | 1,2 | Study review | |

| Yes | No | 1:30 | 0,2 | 2 | No | 0,2 | 0,8 | Open an account Your capital is at risk. |

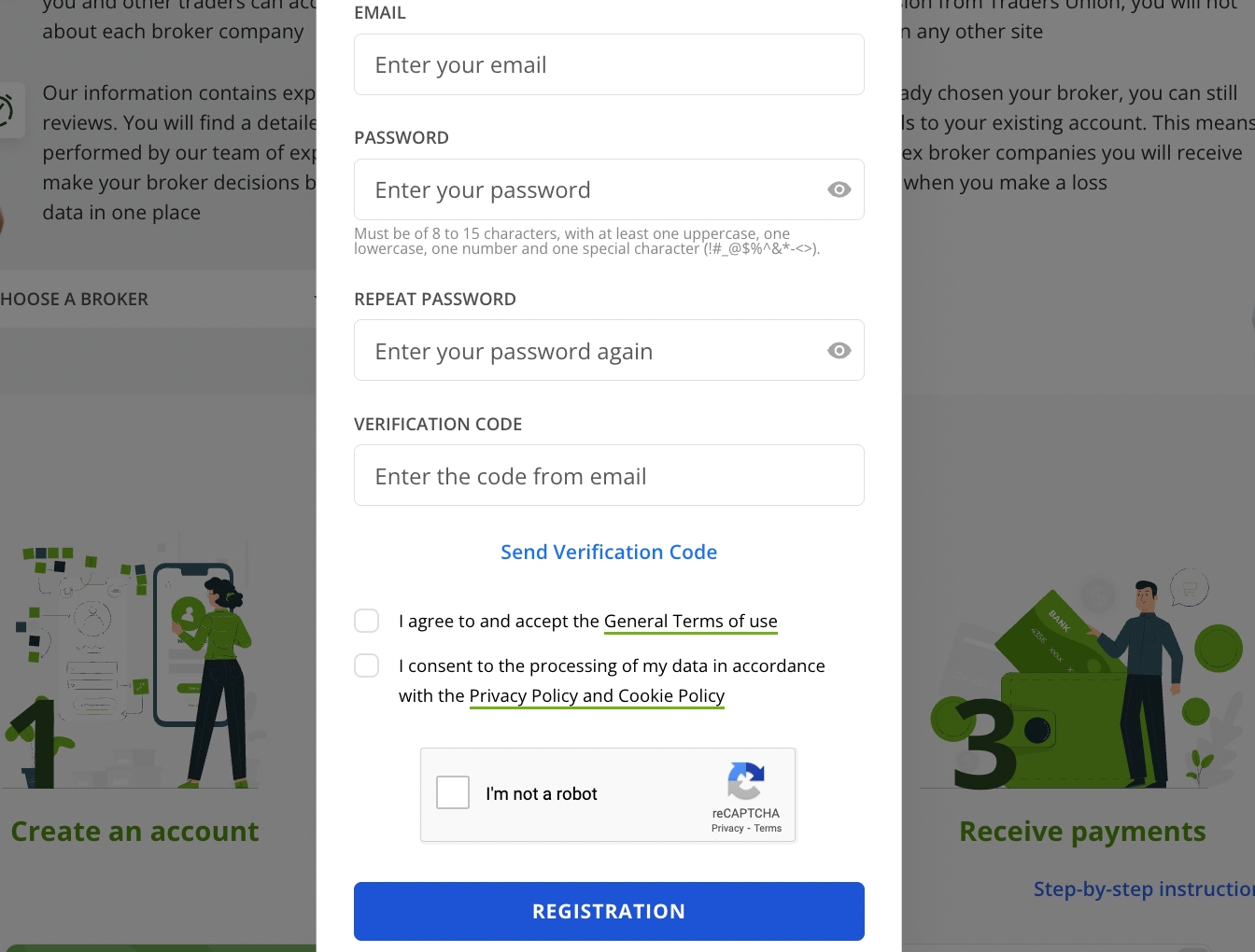

How to register a Forex broker account with Traders Union?

Here’s how to register a Forex Broker’s account:

Click the "Register" button on the Traders Union website and follow the instructions.

Select the broker you are interested in on the Traders Union website and follow the link to open its website. Register with the broker and go through the verification process.

Go to the “Accounts” section and enter the number of the trading account you opened with the broker.

Look for brokers regulated by well-known financial authorities

When you're starting out in Forex trading, it’s smart to trade major currency pairs like EUR/USD or GBP/USD. These pairs usually have lower transaction costs, tighter spreads, and are easier to trade due to their high liquidity. This makes them perfect for maximizing Forex rebates, as frequent trading on these pairs can result in more cashback. By focusing on these pairs, you can steadily build trading experience while enjoying cost savings through cashback programs offered by brokers.

Also, be sure to choose a reliable broker with a transparent and fair rebate system. Look for brokers regulated by well-known financial authorities and those clearly explaining how their rebate programs work. A trustworthy broker won’t have hidden fees or complicated terms that reduce your earnings. This helps you trade with confidence, knowing you’re getting the most value from your trades while minimizing expenses. Taking time to research brokers and understanding their rebate conditions can greatly improve your overall trading performance.

Conclusion

Forex rebates offer a practical way for traders to reduce costs and enhance profitability. By partnering with trusted brokers through Traders Union, traders can earn cashback on spreads and commissions, regardless of trading outcomes. The rebate system benefits both traders and brokers by encouraging trading activity while lowering expenses.

Traders Union simplifies the process by offering transparent rebate programs, top broker ratings, 24/7 support, and legal assistance in disputes. Additionally, traders can generate passive income through the affiliate program. Understanding how Forex rebates work, choosing the right broker, and managing trading strategies can significantly increase profitability. With its comprehensive resources, Traders Union provides the tools needed for a successful trading experience.

FAQs

How to calculate the compensation amount?

Each broker sets conditions based on account type and turnover. Use the International Forex Traders Union's summary table and rebate calculator to check and estimate rebates.

Is it possible to get compensation for several accounts at the same time?

Yes. The compensation depends on the conducted turnovers exclusively, regardless of the number of accounts and brokers.

How can I use the spread paid back to me?

Any way you wish. Unlike accrued bonuses, rebates belong to you and are real — not virtual — money. You can either trade with it again or withdraw it.

Where do I go to discuss problems with the rebate?

Review the spread rebate agreement, focusing on the rebate procedure. For assistance, contact Traders Union support to resolve the issue or escalate it to the broker.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.