The Bybit card is convenient, secure, and affordable. It offers rewards for spending, no annual or dormancy fees, and features cutting-edge fraud prevention technology.

Bybit Card Review | How Can I Get it?

The adoption of cryptocurrencies is steadily expanding and influencing various sectors, including the banking industry. Bybit, a renowned cryptocurrency exchange platform, has stepped into the banking sector by launching the Bybit card. This debit card offers a unique way for crypto holders to utilize their digital assets in everyday transactions. This article delves into the features and advantages of the Bybit card, provides guidance on acquiring one, and discusses how it stands out from other banking alternatives.

What are cryptocurrency cards?

Cryptocurrency cards are cards that serve as a bridge between digital currencies and traditional commerce. They are designed much like regular debit or credit cards but with the unique capability of allowing users to spend their cryptocurrencies, such as Bitcoin, Ethereum, and other supported digital assets, just as they would spend traditional currency.

These crypto cards function by instantly converting the user's cryptocurrencies into local fiat currency during a transaction. Therefore, you can use these cards to purchase at any merchant that accepts standard debit or credit cards, essentially bringing cryptocurrencies into the everyday mainstream marketplace. By doing so, cryptocurrency cards help break down the barriers between digital assets and conventional finance, enabling fluid transactions and facilitating a new level of convenience and integration for cryptocurrency users.

What you need to know about the Bybit card?

The Bybit card, launched by the cryptocurrency exchange platform Bybit, is a Mastercard debit card that offers crypto holders an easy and secure way to access and utilize their funds. Here's everything you need to know about it:

Type and accessibility. The Bybit card is a Mastercard debit card that connects directly to your Bybit funding wallet. It's available as a virtual and physical debit card, allowing you to access your funds whenever needed.

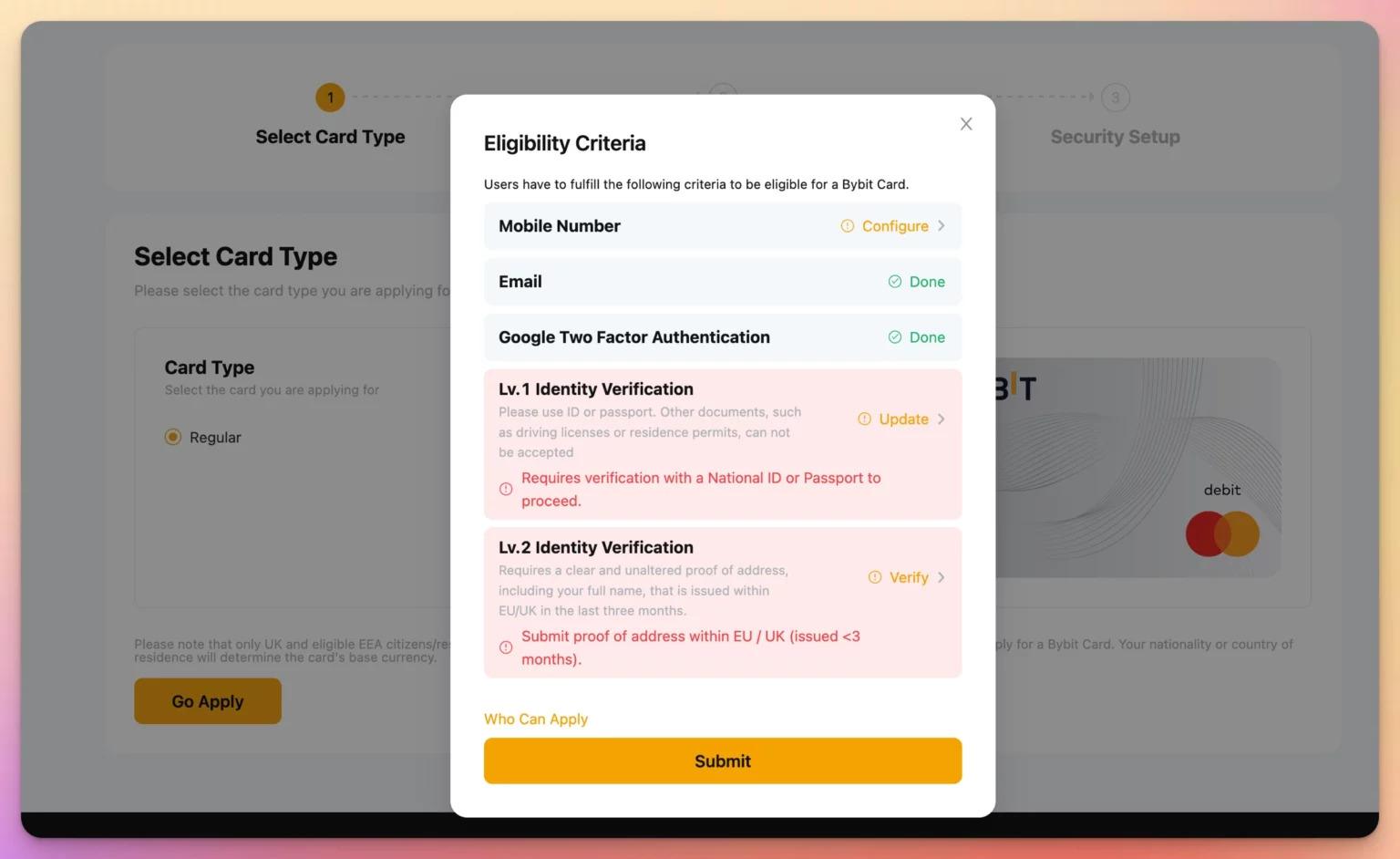

Verification level. To use the Bybit card, you must have completed level 2 verification on Bybit, including a phone number and email verification, along with enabling two-factor authentication.

Geographical availability. Currently, the card is available in select jurisdictions of the EU and UK, with some exceptions.

Dependability. The Bybit card can be used for purchases locally and internationally, wherever Mastercard is accepted.

Fees. The Bybit card is highly cost-efficient. It has no annual fees, and the only costs incurred by the user are the fees on transactions made using the card. These include a foreign exchange fee of 0.5% (on top of Mastercard's foreign exchange rate) and a crypto liquidation fee of 0.9% (on top of Spot fees).

Transaction restrictions. Unlike credit cards, the Bybit card is a debit card that uses the funds already available in your account. You cannot use it to borrow money or credit card transactions.

Card re-issuance and cancellation. If you lose your card or need to cancel it, you'll be relieved that there are no fees associated with card cancellation or re-issuance for the virtual Bybit card.

Validity and renewal. The Bybit Card is valid for 3 years, and the virtual Bybit Card is automatically renewed upon expiration. You can only hold one valid virtual Bybit Card at a time, but you can apply again once your card is terminated.

Currency support. The currencies supported by the Bybit Card include fiat and crypto. The supported fiat currencies are EUR and GBP, while the supported cryptocurrencies include BTC, ETH, XRP, USDT, and USDC.

How to get a Bybit card

Getting a Bybit card is a straightforward process. Here's a step-by-step on how to use Bybit and get its card:

Step1. Bybit Account. First, you must log in to your Bybit account. You can easily apply for it on the Bybit website if you don't have one.

Step 2. Level 2 Verification. Make sure your account has completed Level 2 verification. This includes adding your phone number and email and enabling two-factor authentication.

Image: How to get a Bybit card

Step 3. Application. Once logged in to your Bybit account, navigate to the card application page and click “Apply Now”.

Step 4. Instructions. Follow the on-screen instructions, and submit your application. The process is intuitive and user-friendly.

Step 5. Activation. Once approved, you can use your virtual debit card immediately. Unlike some other cards, there is no need to activate your Bybit Card for overseas transactions separately.

How the Bybit card works

The Bybit Card is designed to make cryptocurrency transactions as straightforward as possible. Here's a breakdown of how it works:

Card type and use. As a Mastercard debit card, it draws from your Bybit funding wallet funds. It's not a credit card and cannot be used for credit card transactions.

Accessibility and utility. The card is available as both a physical and a virtual card. You need to have level 2 verification on Bybit to use it.

Geographic limitations. The card is available in limited jurisdictions of the EU / UK, with some exceptions (Croatia, Iceland, Ireland, Liechtenstein, and Romania are excluded).

Global transactions. You can use the card locally or internationally anywhere Mastercard is supported.

Cost and fees. No annual fees are associated with the Bybit card. Costs are primarily transactional, including a foreign exchange fee of 0.5% (in addition to Mastercard’s foreign exchange rate) and a crypto liquidation fee of 0.9% (on top of Spot fees).

Card expiry and reissuance. The Bybit Card is valid for three years. The virtual card gets automatically renewed after expiration. However, you can only hold one valid virtual Bybit Card.

Supported currencies. The Bybit Card supports several fiat and cryptocurrencies. The fiat currencies are EUR and GBP, while the crypto options include BTC, ETH, XRP, USDT, and USDC.

Bybit card benefits

The Bybit Card is packed with a variety of benefits designed to make your crypto transactions convenient and cost-effective:

Affordable maintenance. The card has no annual fees or inactivity charges, making it affordable.

Security. The Bybit crypto debit card is EMV 3D Secure-enabled, an advanced fraud prevention technology that verifies user identity during online transactions.

Rewards. For every 1 EUR/GBP spent, you earn 1 point, up to 12,500 points per month. Points have no expiry date. VIP users enjoy double rewards points without a cap or an expiry date.

Bybit cashback: Loyalty reward program

The Bybit card has an attractive loyalty rewards program. For the non-VIP level, you earn 1 point for every 1 EUR/GBP spent, up to 12,500 points each month, with no expiry date. VIP users receive double rewards points without a cap and expiry date.

Conclusion: Should I get a Bybit card?

With its flexible spending options, cost-effectiveness, security, and reward program, the Bybit card offers significant advantages for cryptocurrency users. If you often transact in EUR/GBP or cryptocurrencies, the Bybit card could be a worthwhile addition to your financial toolkit.

FAQs

Does Bybit have a card?

Yes, Bybit offers a Mastercard debit card.

Does Bybit have a crypto card?

Indeed, the Bybit Card serves as a crypto debit card that features a Loyalty Reward program.

What countries are eligible for the Bybit card?

The Bybit card is available to users in countries within the EEA (excluding Croatia, Iceland, Ireland, Liechtenstein, and Romania) and the UK.

What are the benefits of the Bybit card?

The Bybit card is convenient, secure, and affordable. It offers rewards for spending, no annual or dormancy fees, and features cutting-edge fraud prevention technology.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.