Bakkt Company Review: Trading, Wallets, And Payments

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Bakkt, established in 2018, is a U.S.-based company focused on bridging the gap between digital assets and traditional financial systems. The company provides secure infrastructure for institutional-grade custody, trading, and seamless integration of cryptocurrencies into mainstream financial activities. Bakkt emphasizes regulatory compliance, aiming to facilitate sustainable, long-term crypto adoption among businesses and consumers.

Bakkt is a digital asset management platform focused on cryptocurrency trading, asset storage, and cryptocurrency payment integration solutions. Founded in 2018 as a subsidiary of Intercontinental Exchange (ICE), Bakkt aims to merge traditional financial instruments with the digital economy. The platform provides institutional and retail users with the ability to securely buy, sell, and store digital assets, as well as use them in everyday payments. The Bakkt App allows you to convert cryptocurrencies and rewards points into cash, making the use of digital assets more accessible. Cooperation with companies such as Mastercard and Starbucks expands the use of cryptocurrencies in the real economy. The article discusses the main services of Bakkt, the stages of the company's development, and its role in the modern cryptocurrency market.

Bakkt: general information

Bakkt, founded in 2018 and headquartered in Alpharetta, Georgia, aims to bridge the gap between traditional finance and digital assets. The company provides secure, innovative solutions for institutional and consumer-facing digital asset use cases. It integrates cryptocurrencies, loyalty points, and other digital assets into everyday financial systems through a highly secure and regulatory-compliant infrastructure. Bakkt’s ecosystem caters to institutional custody, trading solutions, payment platforms, and consumer loyalty programs, providing a seamless connection between traditional and digital economies.

| Category | Details |

|---|---|

| Founded | 2018 |

| Headquarters | Alpharetta, Georgia, USA |

| Key Backer | Launched by Intercontinental Exchange (ICE), parent company of the New York Stock Exchange |

| Initial Focus | Initially created as a regulated Bitcoin futures and custody platform |

| Expansion | Pivoted to include consumer-focused solutions, such as loyalty and payments management |

| Acquisitions | Acquired Apex Crypto in 2022 to expand digital asset offerings |

| Unique Offering | Combines cryptocurrencies with loyalty programs, allowing for interoperability |

| Regulatory Compliance | Operates with rigorous regulatory oversight to ensure security and trustworthiness |

Interesting facts

In October 2021, Bakkt partnered with Mastercard to provide cryptocurrency payment solutions.

In November 2024, reports emerged that Trump Media & Technology was considering acquiring Bakkt.

Launching Bitcoin Futures: In September 2019, Bakkt began trading physically-deliverable Bitcoin futures contracts, giving institutional investors a new way to engage with cryptocurrencies.

Acquiring Apex Crypto: In April 2023, Bakkt completed the acquisition of Chicago-based cryptocurrency trading platform Apex Crypto, strengthening its position in the digital asset market.

Partnering with Starbucks: In April 2021, Bakkt launched the Bakkt App, allowing users to convert loyalty points and bitcoin into U.S. dollars to top up Starbucks cards.

Public Offering: In October 2021, Bakkt went public, trading on the New York Stock Exchange under the ticker symbol BKKT.

Partnership with Microsoft and BCG: Since its inception, Bakkt has partnered with Microsoft and Boston Consulting Group to build a robust digital asset management platform.

Bakkt history

July 31, 2018:

Bakkt was founded as a subsidiary of Intercontinental Exchange (ICE) to create a regulated digital asset ecosystem.

January 2019:

Acquired assets from Rosenthal Collins Group, boosting consumer payment capabilities.

April 2019:

Acquired Digital Asset Custody Company (DACC), enhancing digital asset custody services.

September 2019:

Launched Bitcoin futures trading, providing regulated products for institutional investors.

February 2020:

ICE acquired Bridge2 Solutions, integrating it into Bakkt to strengthen loyalty program services.

October 2021:

Became a publicly traded company on the New York Stock Exchange (NYSE) under the ticker symbol "BKKT."

April 2023:

Completed the acquisition of Apex Crypto, expanding its trading platform and digital asset services.

April 2024:

Announced a 1-for-25 reverse stock split to comply with NYSE listing standards.

June 2024:

Partnered with Crossover Markets to launch "BakktX," a cryptocurrency ECN for institutional trading.

November 2024:

Reported merger talks with Trump Media and Technology Group (TMTG), hinting at expansion into broader cryptocurrency services.

Bakkt's solutions: BakktX and Bakkt Brokerage

BakktX

BakktX represents Bakkt's foray into creating a high-performance crypto trading platform specifically designed for institutional clients. It leverages cutting-edge technology from Crossover Markets to provide an electronic communication network (ECN) with ultra-low latency and customized liquidity solutions.

The platform aims to meet the increasing demand for compliant, efficient, and reliable trading venues in the U.S., addressing the needs of institutions seeking to trade cryptocurrencies securely and transparently

Bakkt Brokerage

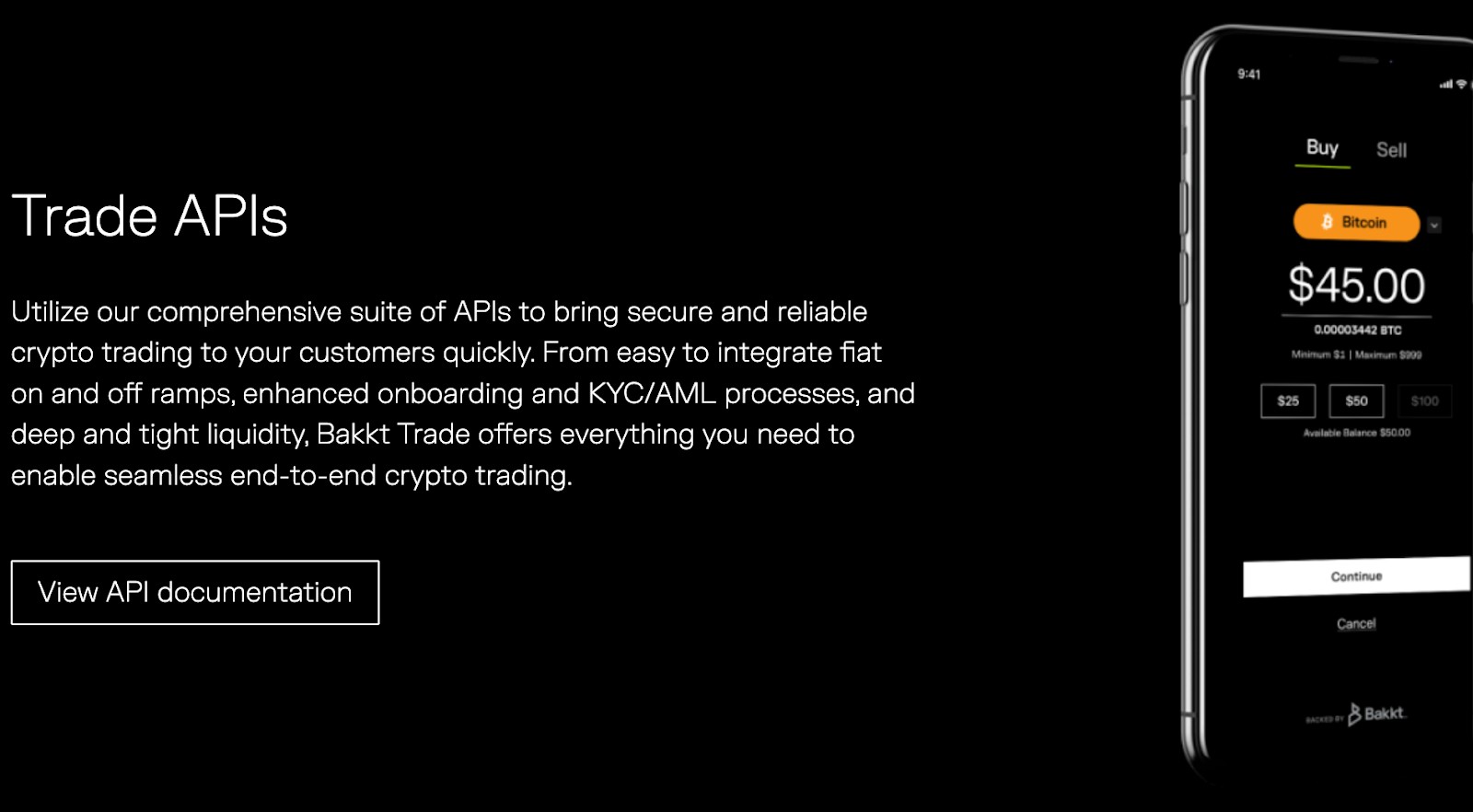

Bakkt Brokerage provides a comprehensive, regulated infrastructure for businesses looking to integrate crypto trading capabilities. This solution simplifies the process for companies by offering APIs that handle essential functions like Know Your Customer (KYC), Anti-Money Laundering (AML) compliance, tax reporting, and custody.

By utilizing Bakkt Brokerage, companies can tap into deep liquidity markets and provide 24/7 trading services to their customers, all while meeting regulatory standards in multiple jurisdictions

Key offerings of Bakkt

Crypto custody and trading

Bakkt provides institutional-grade custody solutions with advanced security features, including multi-signature wallets and physical storage in bank-grade vaults. It caters to businesses seeking regulatory-compliant platforms for trading and holding digital assets. The trading platform ensures transparent price discovery and deep liquidity, making it a preferred choice for institutional investors. Bakkt also supports futures contracts and derivatives trading, enabling sophisticated strategies for portfolio management.Consumer-focused solutions

Bakkt simplifies digital asset management for consumers by offering tools to store, track, and spend assets. Users can handle cryptocurrencies alongside loyalty points, miles, and gift cards, all within a unified ecosystem. The platform's intuitive interface bridges traditional and digital financial systems, promoting wider cryptocurrency adoption by everyday users.Payment integration

Bakkt partners with leading payment processors and merchants, allowing consumers to use cryptocurrency for everyday purchases. This capability transforms digital currencies into a medium for real-world transactions, fostering mainstream use. Its seamless backend integration ensures fast, secure, and user-friendly payment experiences, bridging the gap between merchants and crypto holders.Loyalty and rewards management

Bakkt reinvents how businesses and consumers interact with loyalty programs by converting rewards points and miles into usable digital assets. This interoperability allows users to consolidate and utilize points more flexibly, such as converting them into cash or cryptocurrency. Companies benefit from enhanced customer engagement and retention through Bakkt’s streamlined loyalty management solutions.

Bakkt — new possibilities in interaction with cryptocurrencies

Bakkt significantly simplifies access to cryptocurrencies for a wide range of users by connecting traditional financial instruments with digital assets. One of the most significant achievements is the integration of cryptocurrency payments through a partnership with Mastercard. Users get the opportunity to pay with cryptocurrencies at regular points of sale without the hassle of conversion. This solution is especially useful in the United States, where the financial infrastructure for digital assets is developing faster.

The Bakkt App stands out for its versatility: it allows you to combine loyalty points, gift cards, and cryptocurrencies in one wallet. It is important to remember that such platforms require regular security updates and transaction monitoring. I recommend users to set up two-factor authentication and check the relevance of linked cards and digital accounts to exclude vulnerabilities.

If you are considering Bakkt as a platform for asset storage or crypto trading, it is worth keeping an eye on its institutional initiatives, such as deliverable futures and custodial solutions. The emergence of such tools helps to minimize risks and strengthen investor confidence. In addition, the platform may be useful for those planning long-term storage of digital assets in a regulated market.

Conclusion

Bakkt continues to strengthen its position in the digital asset market by providing solutions for trading, storing and using cryptocurrencies. Through partnerships with leading companies such as Mastercard and Starbucks, the platform successfully integrates digital assets into the daily financial lives of users. The Bakkt App allows you to manage cryptocurrencies, rewards points and gift cards through a single application, making the ecosystem more accessible and convenient. The launch of Bitcoin futures and the development of custodial services attract institutional investors, creating a stable foundation for the company's growth. With the growing interest in cryptocurrencies, Bakkt is a shining example of a platform capable of connecting traditional finance with the digital economy. This trend opens up new opportunities for users and investors on a global level.

FAQs

What services does Bakkt provide for institutional clients?

Bakkt offers digital asset custody, cryptocurrency trading, and cryptocurrency payment integration solutions to institutional clients.

How does Bakkt ensure the security of its users’ digital assets?

Bakkt uses institutional security standards, including cold storage, multi-factor authentication, and regular audits to protect digital assets.

What partnerships has Bakkt formed to expand its services?

Bakkt has partnered with companies like Mastercard and Starbucks to integrate cryptocurrency payments and loyalty programs.

How has going public affected Bakkt’s business?

Becoming a public company has given Bakkt additional resources to expand its services and strengthen its position in the digital asset market.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.