Marathon Digital Review

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Marathon Digital Holdings is a leading Bitcoin mining company known for its innovative strategies, commitment to sustainability, and high mining capacity. Headquartered in Las Vegas, Nevada, the company operates one of the largest mining facilities in North America.

In this review, we will take a deep dive into Marathon Digital's business model, financial performance, strategic goals, and the challenges it faces. Additionally, we will examine how the company fits into the broader cryptocurrency market and its prospects for the future. If you’re looking to understand how one of the largest publicly traded mining companies navigates the volatility of the crypto market, this article is your go-to resource.

Marathon Digital overview

Marathon Digital Holdings, founded in 2010 by Merrick Okamoto, initially operated as a patent-holding company. However, in 2020, it shifted its focus to cryptocurrency mining, capitalizing on the rising popularity of Bitcoin. Headquartered in Las Vegas, Nevada, Marathon Digital has since become one of the largest publicly traded mining companies in North America. The company’s mission is to support and secure the Bitcoin network while maximizing shareholder value through efficient and scalable mining operations.

History of the company

Marathon Digital Holdings (MARA) is a leading Bitcoin mining company focused on optimizing cryptocurrency mining efficiency while maintaining sustainability. As one of the largest publicly traded Bitcoin miners, Marathon plays a significant role in the evolving blockchain ecosystem. This article provides a detailed review of Marathon Digital, covering its operations, performance, and investor opportunities.

2010: Established as Marathon Patent Group, initially focused on patent enforcement.

2017: Transitioned to cryptocurrency mining.

2020: Rebranded as Marathon Digital Holdings to reflect its new focus.

2025: Achieved a hash rate of 27.8 EH/s and became a leader in sustainable Bitcoin mining.

| Company | Hash Rate (EH/s) | Region | Sustainability Initiatives | Market Cap ($B) |

|---|---|---|---|---|

| Marathon Digital | 27.8 | North America | Renewable energy usage, AI systems | $4.48 billion |

| Riot Platforms | 23.1 | North America | Diversified energy partnerships | $2.79 billion |

| Bitfarms | 4.0 | Canada | Hydro-powered mining facilities | $1.62 billion |

Interesting facts

Expanding mining operations. Marathon Digital has strengthened its presence in Bitcoin mining by acquiring two mining sites with a combined 390-megawatt capacity. This move shifts the company’s approach from leasing to owning and operating its facilities, allowing for better control and improved efficiency.

Introducing the Anduro network. In early 2024, Marathon launched Anduro, a multi-chain layer-two solution built on Bitcoin. This initiative aims to make Bitcoin more versatile by enabling multiple sidechains, paving the way for new use cases and greater adoption within the crypto community.

Revenue growth and leadership in innovation. Marathon reported a 34.5% rise in revenue compared to the previous year, reaching $131.6 million in quarterly earnings. Industry analysts have praised the company’s innovative approach, particularly its strategic decisions that position it as a leader in the Bitcoin mining space.

Strategic financial moves. In late 2024, Marathon raised $850 million through a convertible senior notes offering due in 2030. The company plans to use the funds to buy back 2026 notes, acquire more Bitcoin, and support overall business growth — demonstrating a well-thought-out financial strategy.

Expanding into AI and high-performance computing. Marathon is broadening its focus beyond Bitcoin mining, venturing into artificial intelligence and high-performance computing. This shift leverages its infrastructure to explore emerging tech trends, which could shape its future as more than just a crypto company.

Key features of Marathon Digital

Extensive mining fleet: Marathon operates one of the largest fleets of Bitcoin mining machines in North America, with continuous investments in state-of-the-art ASIC miners to ensure high efficiency and scalability.

Focus on sustainability: The company is committed to reducing its environmental footprint by sourcing renewable energy for its mining operations, aligning with global sustainability goals.

Strategic Bitcoin reserve management: Marathon holds a significant portion of its mined Bitcoin as a long-term asset, positioning itself as one of the largest corporate Bitcoin holders.

Collaborative partnerships: By forming strategic alliances with hosting providers and hardware manufacturers, Marathon ensures cost-effective operations and access to advanced technologies.

Commitment to compliance: Marathon proactively addresses regulatory challenges, adhering to compliance standards and engaging with policymakers to navigate the evolving legal landscape.

Marathon Digital operational strategy

Marathon Digital employs a strategy focused on high efficiency and scalability. By securing access to large-scale mining facilities and adopting state-of-the-art hardware, the company aims to maintain a competitive edge in the rapidly evolving crypto-mining industry. Key aspects of its operational strategy include:

Infrastructure expansion. Marathon consistently invests in expanding its mining capacity by acquiring cutting-edge ASIC miners. The company also partners with hosting providers to ensure access to reliable and cost-effective energy sources.

Focus on renewable energy. With increasing scrutiny on the environmental impact of cryptocurrency mining, Marathon has taken steps to transition toward sustainable energy solutions. A significant portion of its mining operations now relies on renewable energy sources.

Strategic partnerships. Marathon collaborates with leading industry players to secure favorable agreements for hardware procurement, energy costs, and facility management. These partnerships enable the company to optimize its operations and reduce costs.

Should I buy Marathon Digital (MARA)

Deciding whether to invest in Marathon Digital Holdings (MARA) or any stock depends on several factors, including your investment goals, risk tolerance, and market conditions.

Here's a breakdown of considerations to help you make an informed decision:

- Pros

- Cons

Industry leadership. Marathon is one of the largest Bitcoin mining companies, with significant investments in mining infrastructure and Bitcoin reserves.

Bitcoin price correlation. If you are bullish on Bitcoin, MARA could be a leveraged way to gain exposure, as its performance is highly correlated with Bitcoin prices.

Sustainability efforts. The company has taken steps to address environmental concerns by transitioning to renewable energy sources for mining operations, which may improve its appeal to ESG-focused investors.

Expansion potential. Marathon has plans for operational growth, including increasing its mining fleet and efficiency, which could boost profitability in the long term.

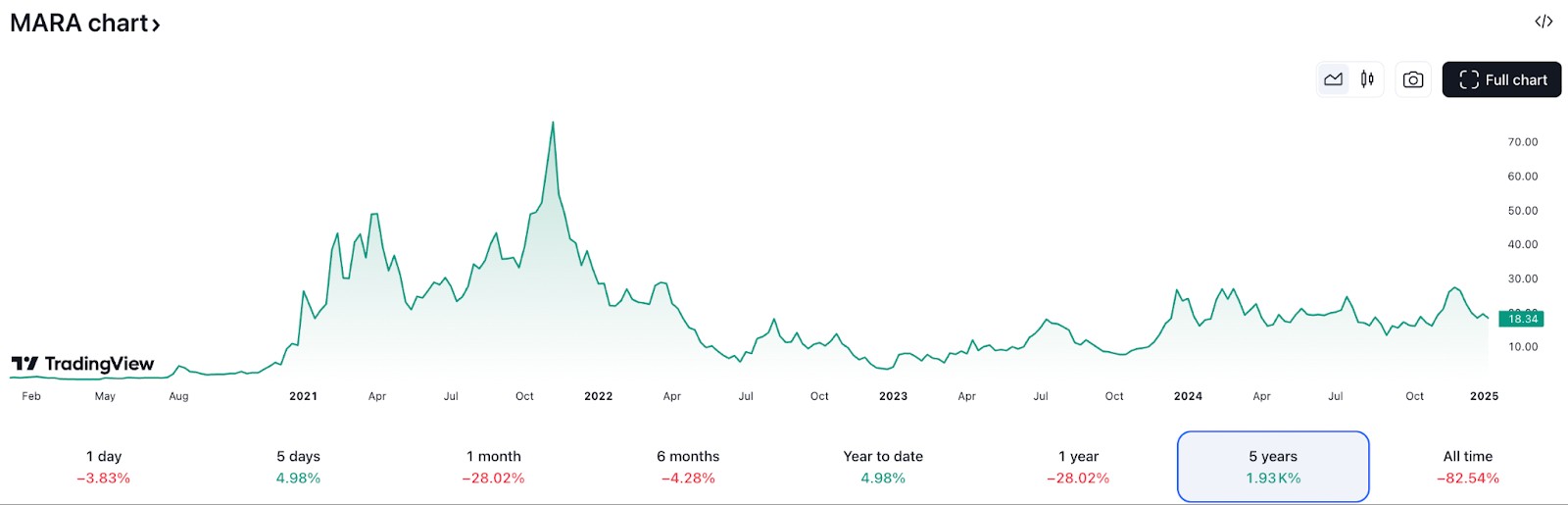

Volatility. MARA's stock price is highly volatile and sensitive to Bitcoin's price fluctuations. Large swings in Bitcoin prices can significantly impact MARA's valuation.

Regulatory risks. The cryptocurrency mining industry faces increasing regulatory scrutiny regarding environmental impact and financial compliance, which could affect Marathon's operations.

Competition. The crypto mining space is competitive, and advancements in mining technology or changes in Bitcoin's mining difficulty could affect Marathon's market position.

Operational costs. Rising energy costs or inefficiencies could erode profit margins, particularly if Bitcoin prices decline.

How Marathon Digital's focus on sustainable mining and large bitcoin reserves set them apart

Marathon Digital is a top contender in the Bitcoin mining space, and what makes them unique is their focus on building scalable operations. Beginners should look at Marathon’s strategy of investing in high-performance mining equipment and using eco-friendly energy to keep costs low in the long run. Their move to sustainable mining practices not only reduces operational costs but also helps them stand out in a competitive market, making them a more attractive player in the industry.

Another factor to consider is Marathon's growing Bitcoin reserves. With over 44,000 Bitcoins in their possession, they have a strong position in the market. This gives them an edge, not just from mining rewards but also from the long-term potential of Bitcoin appreciation. For beginners, understanding how holding a large amount of Bitcoin can help mitigate the impact of market volatility is key. It will be interesting to see how this strategy helps Marathon navigate the ups and downs of the crypto market and grow in the coming years.

Summary

Marathon Digital Holdings ranks among the most trusted names in the cryptocurrency mining sector. With its innovative Marathon Digital crypto infrastructure, robust blockchain technology, and sustainability focus, it continues to lead the industry. The company’s energy-efficient practices and transparent reporting make it a solid choice for investors. However, potential risks, such as Bitcoin price fluctuations, need consideration.

FAQs

How to buy Marathon Digital stock?

Interested investors can purchase MARA stock via NASDAQ-listed brokerage platforms.

Is Marathon Digital Holdings real or fake?

Marathon Digital Holdings is a legitimate and publicly traded Bitcoin mining company.

What makes Marathon unique?

Its high hash rate, ESG commitment, and transparent reporting.

What is Marathon Digital energy consumption focus?

The company prioritizes renewable energy to reduce its environmental impact.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.