TeraWulf Review: Should You Invest?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

TeraWulf, known for its expertise in mining, has quickly become a well-known name in the cryptocurrency industry. It is recognized for its focus on sustainability and innovation. As the demand for eco-friendly solutions grows, the company integrates renewable energy sources into its operations. This approach supports global sustainability goals and reduces environmental impact.

TeraWulf, which specializes in Bitcoin mining, achieves a balance between environmental responsibility and strong performance by using advanced technologies and improving energy efficiency. Its scalable infrastructure and strategic planning set a high standard for the industry. The company is leading the way in making blockchain solutions greener and more sustainable. Read on to learn how the company is making waves in the global crypto market.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

TeraWulf overview

TeraWulf, known for its expertise in blockchain technology, operates as a cryptocurrency mining company with a primary focus on Bitcoin. TeraWulf integrates advanced crypto solutions into its mining operations, combining blockchain infrastructure with sustainable energy to set new standards for environmental responsibility in mining.

Region of operation

Many traders ask, where exactly is TeraWulf located? Well, TeraWulf’s mining operations are strategically based in the United States. The company takes advantage of the country’s infrastructure and regulatory stability. Its mining facilities are positioned near abundant renewable energy sources to ensure cost efficiency and minimize environmental impact.

Market capitalization

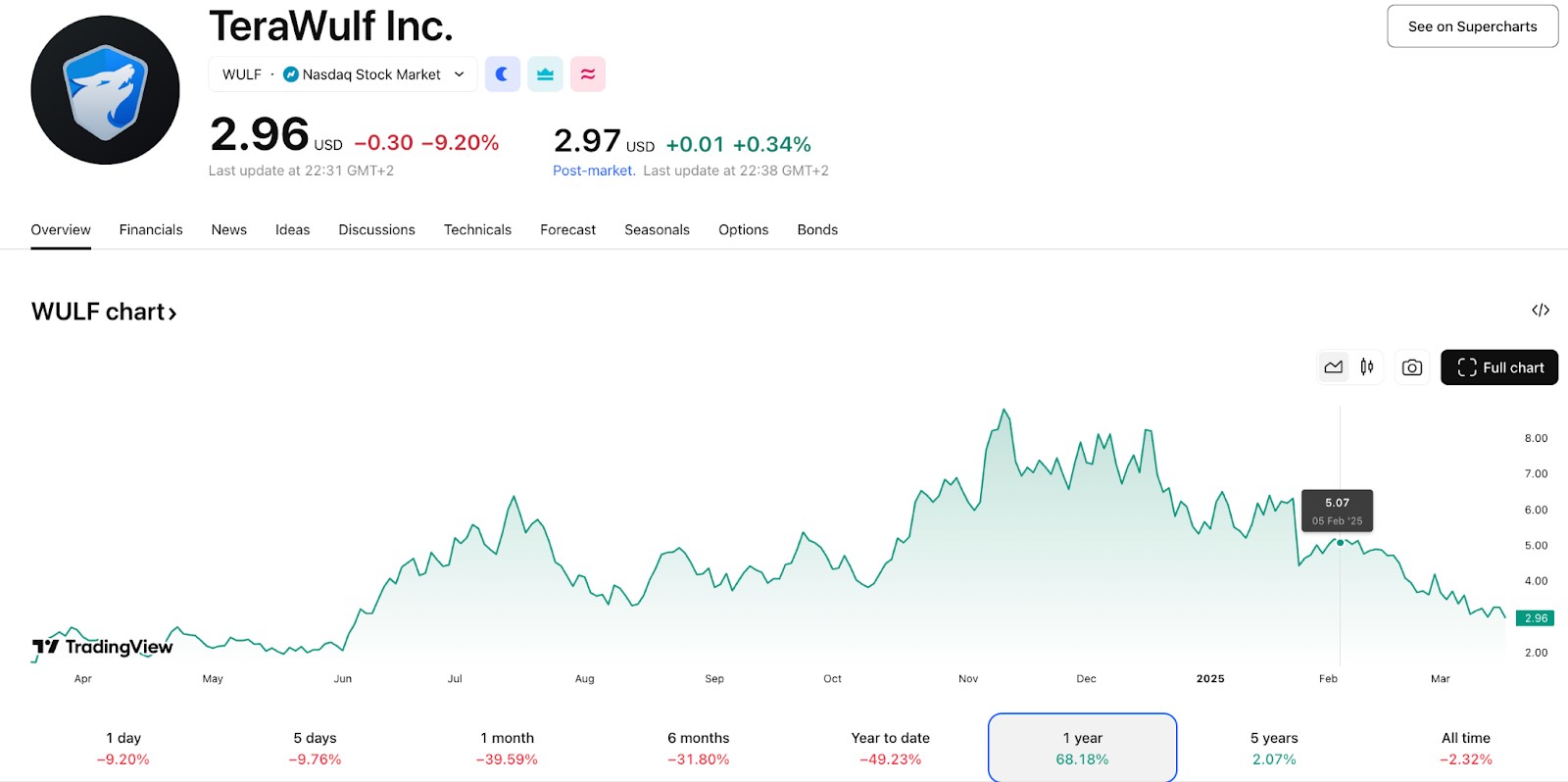

As of the most recent data, TeraWulf stock (WULF) has a market capitalization of approximately $1.20 billion. This valuation places it among the leading players in the eco-conscious cryptocurrency mining space. Investors also keep an eye on WULF earnings, as financial performance plays a key role in assessing the company’s growth and stability.

TeraWulf main products

TeraWulf Inc. is an energy infrastructure company specializing in developing and operating fully integrated, sustainable facilities supporting Bitcoin mining and AI/HPC (High-Performance Computing) applications. The company's primary operations include:

Bitcoin mining operations. TeraWulf focuses on environmentally sustainable Bitcoin mining, utilizing over 90% zero-carbon energy sources, such as nuclear, hydro, and solar power.

AI and High-Performance Computing (HPC) services. Beyond cryptocurrency mining, TeraWulf is expanding its infrastructure to support AI and HPC workloads, offering advanced data center services for computationally intensive applications.

These operations position TeraWulf as a leader in sustainable digital infrastructure, catering to the growing demands of both the cryptocurrency and high-performance computing industries.

Who is the founder of TeraWulf?

TeraWulf was co-founded by Paul Prager, a seasoned entrepreneur with extensive experience in energy infrastructure and finance. His leadership has been instrumental in driving TeraWulf’s focus on sustainable and efficient mining operations.

TeraWulf history

Main phases of development:

2021. TeraWulf crypto began expanding its mining operations with a mission to revolutionize Bitcoin mining through sustainability.

2022. Construction of its first state-of-the-art TeraWulf energy-efficient facility for mining started in New York and Pennsylvania.

2023. Achieved operational scalability by deploying next-generation ASIC mining rigs, increasing its hash rate capacity to over 5 EH/s.

2024. Introduced initiatives for carbon-neutral operations, further reinforcing its commitment to sustainability.

Interesting facts about TeraWulf

Sustainable mining operations. TeraWulf utilizes over 95% zero-carbon energy sources, including nuclear, hydro, and solar power, for its Bitcoin mining operations, aiming for 100% zero-carbon energy usage.

Strategic expansion into AI and HPC. Beyond cryptocurrency mining, TeraWulf is expanding its infrastructure to support Artificial Intelligence (AI) and High-Performance Computing (HPC) applications, positioning itself to capitalize on the growing demand in these sectors.

Publicly traded company. TeraWulf is listed on the NASDAQ stock exchange under the ticker symbol WULF, reflecting its established presence in the financial markets.

Operational facilities. The company operates state-of-the-art Bitcoin mining facilities, including the Lake Mariner facility in New York, which began mining operations in March 2022, utilizing over 91% zero-carbon energy.

Leadership in sustainable mining. TeraWulf is recognized as a leader in sustainable Bitcoin mining, leveraging its core expertise in energy management to maximize operational efficiency while minimizing environmental impact.

Check efficiency and energy contracts, not just Bitcoin price

If you’re eyeing TeraWulf, forget the usual hype about Bitcoin prices. What actually matters is how much Bitcoin they mine for every dollar spent on energy — that’s what keeps them in the game long-term. The secret? Check their mining efficiency numbers. Most beginners stare at Bitcoin prices, but the real gold is in how much power they use per mined Bitcoin. TeraWulf runs on low-cost, carbon-neutral energy, meaning they don’t get wrecked when electricity prices go crazy. A simple trick? Look at their joules per terahash (J/TH) — the lower, the better. If they’re squeezing out more Bitcoin with less power than competitors, they’ll survive the bear markets while others shut down.

Here’s another move almost no one talks about — dig into their electricity contracts. Most mining firms are at the mercy of rising energy prices, but TeraWulf locks in long-term deals for cheap power. If they’ve locked in a fixed low rate, it means they can keep mining at a profit even when others can’t. Before you invest, check their SEC filings — if they’ve secured low rates for years, that’s a green flag. If they’re paying whatever the market demands, that’s a time bomb waiting to explode. Most investors don’t even think about this, but it’s the real reason some mining companies thrive while others die off.

Conclusion

TeraWulf is transforming the landscape of mining by focusing on renewable energy and environmental responsibility. While challenges such as regulatory uncertainty and market volatility persist, the company’s approach to TeraWulf Bitcoin operations in mining emphasizes sustainability and innovation. This positions it as a frontrunner in the industry.

FAQs

What makes TeraWulf unique?

TeraWulf’s commitment to achieving carbon-neutral operations and its focus on renewable energy set it apart in the Bitcoin mining sector.

Where is TeraWulf located?

TeraWulf operates mining facilities in the United States, with major operations in New York and Pennsylvania.

Can I invest in TeraWulf?

Yes, TeraWulf is publicly traded on the NASDAQ under the ticker symbol WULF, making it accessible to investors globally.

Is TeraWulf environmentally friendly?

Yes, TeraWulf prioritizes sustainability and uses over 91% renewable energy for its mining operations, aiming to become fully carbon-neutral by 2025.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.