Crypto’s Biggest Gambling Grounds — The Memecoins

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Memes are the DNA of the Soul, the basic cultural units of ideological exchange. Memecoins are the embodiment of that idea, and they follow the same rules as the memes. The more powerful the idea behind the memecoin — the more likely it is to survive.

You will understand this article only after you finish reading it. Be aware — it will sound weird, but it will make total sense at the end and take you ahead of the 99% of the memecoin market. After reading this article you will effectively be able to tell true memecoins from the junk, and find the ones that will shoot through the moon to the sun and beyond.

Understanding the memecoins: memes — the DNA of the soul

What you must understand is that memes are the precursor of the memecoins. Let’s break down what memes are.

5 rules of memes:

Meme cannot be created or destroyed — it only changes its shape;

Memes cannot be forced — for that is to create a meme;

Memes are mortal and can die — but only temporarily;

Amount of forms an idea can take is infinite — and so are memes;

Attempt to erase the meme forces it to spread violently — Streisand Effect in action.

See, the memes are the DNA of the soul — ideas so clingy they manage to live a life of their own, an informational virus spreading from one person to the other. In crypto you can tokenize anything: a dog, an idea of a dog, a toilet paper roll, a pancake, YoMama jokes, a unit of trust towards a corporation, and even a meme. Tokenization is the process of backing the crypto with anything in a 1 to 1 ratio — 1 coin represents 1 unit of the idea behind it.

Rules behind memes that power the memecoins

Memes are the basic units of the culture, like a phoneme in a language — the idea of marriage is a meme, the idea of a bank is a meme, the idea that you as a person have to succeed or you're a failure to your family is a meme, and the idea of a cute doge in a hat is a meme. If the idea has an incentive to be spread from one person to the other — it is called a meme.

Congrats — by understanding that paragraph you effectively became a graduate on the basic memeology course, now let’s go to advanced memeology.

Memes were a thing long before crypto — one of the oldest memes is the idea of cat superiority in ancient Egypt, the first meme is the idea of the superiority of the fire as a primal source of

survival. Gods themselves are the most fundamental of memes, and primal fears (fear of snakes, spiders, darkness) are the memes shared by the people in order to increase chances of survival.

5 core takeaways about the memes

Memes are alive and they evolve. Take it or leave it, won’t change the truth;

What ca me first — thing or the idea of the thing? Memes are the answer to that question;

Memes shape the culture. Shared in a single community, memes shape that community and their way of thinking;

Meme is what happens when idea is refined so hard you want to share it;

Every meme as strong, as the core idea behind it.

So, why just don’t call memes an idea? Ideas are immortal, and their faces are infinite — memes can die and represent one face of an idea;

Definition of the Memecoins

What you must understand is that memecoins are the most volatile type of asset, because it is essentially a tokenization of the meme — either made to immortalize it or to enforce a new meme (can’t happen).

Every memecoin is powered by the underlying meme — one that holds the core idea behind the memecoin. If stocks represent a share in the company, the memecoins represent a share in the meme.

All memecoins inherit the basic 5 rules of the memes on how they spread, evolve over time, grow and capture their position in the market.

If you’re interested in investing in such coins, you may do so through the brokers presented below. These brokers have a track record of listing new memecoins early, along with providing access to key features needed for hassle-free crypto investing:

| Memecoins | Foundation year | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Alerts | Copy trading | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2011 | 10 | 278 | 0,4 | 0,25 | Yes | Yes | Yes | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 2016 | 1 | 250 | 0,5 | 0,25 | Yes | No | Yes | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 2018 | 1 | 72 | 0,2 | 0,1 | Yes | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 2012 | 10 | 249 | 0,5 | 0,5 | Yes | No | Yes | 6.89 | Open an account Your capital is at risk. |

|

| Yes | 2021 | 10 | 474 | 0,1 | 0,08 | No | Yes | Yes | 5.65 | Open an account Your capital is at risk.

|

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

4 stages of the memecoin market and where we are now

Stage 1: Inception of the Memecoins

This is the stage where classic internet memes meet crypto and become friends for a while.

Before crypto became mainstream we had Shiba Inu, Pepe the Frog, multiple niche memes that stayed away from mainstream media like Revolver Ocelot or Chungus Bugs Bunny. They are the original memes — ones which pre-date the attempts to tokenize them, or, to profit from the memes. It’s important because they have the backing of thousands of people already knowing about them, and are not enforced.

The first memecoin is the Dogecoin, born in 2010 and respawned as memecoin in 2013 — made from clashing the crypto and the love to Shiba Inu by the name of Kabosu, long may their name be remembered. His son is the Pepe, born as a meme in 2005 — one who found out it can become a meme and got violently resurrected in 2023 by the crypto. Since inception, Dogecoin gained 34000% increase in price — to the moon and beyond.

Pepe? Measly 85965338% increase in price since resurrection as a memecoin and still kicking.

The one you couldn’t miss on is the PNUT — a memecoin born out of spite for New York authorities killing an orphaned squirrel. Its fundamental value is the meme of an authority abusing the power, and so, it is a powerful meme which has gained 331180% increase in price since birth.

Reasons? These memes had powerful ideas to them, ones shared by many, and memecoins only cemented the strength of that idea.

Key idea: giving a memecoin to a meme powers it up, violently.

Stage 2: Infection of Memecoins

This is when memes of the classic internet are started to be exploited for profit.

At this stage people started to make memecoins and their derivatives — DogWiFiHat, ToiletPaperCoin, BONE, BONK, and myriad of other no-name memes that are essentially made to capitalize on the idea of the meme, not to help it spread further. Remember — when people make a memecoin before the meme, they try to make a forced meme.

Key idea: Crypto is only a new medium to spread the memes, not the founding ground.

Key differentiator is that true memes predate their memecoins, and fake memes exist only a memecoin is made about them. Exceptions are the powerful memes, rooted in the real world cases that spread violently — like PNUT.

Stage 3: Cancer of Memecoins

This is where people try to exploit memes for profit and enforce them onto the internet. This is the stage where numerous Telegram Memepads like Notcoin start to kick in and attempt to capitalize on the idea of mememaking. But they all mimic the original memecoin launchpad.

See, what happens when you make an automated tool to launch coins into the market? That is how Pump.Fun was born — it essentially allows anyone to launch a memecoin into the market. All you need is to draw attention, pass a bonding curve and the memecoin becomes deployed into the main market. Pump.Fun is when Imageboard culture meets crypto, when people who are versed in making memes are equipped with a tool to endlessly print memecoins, and so, they inflate the market with new memes.

Every memecoin launched after the birth of the Pump.Fun is enforced. Artificial, meta-memes that exist only inside the closed cultural system of the crypto sphere, not rooted in real life scenarios and only made to harness profit off the idea behind a meme. They are dead on arrival and made for profit.

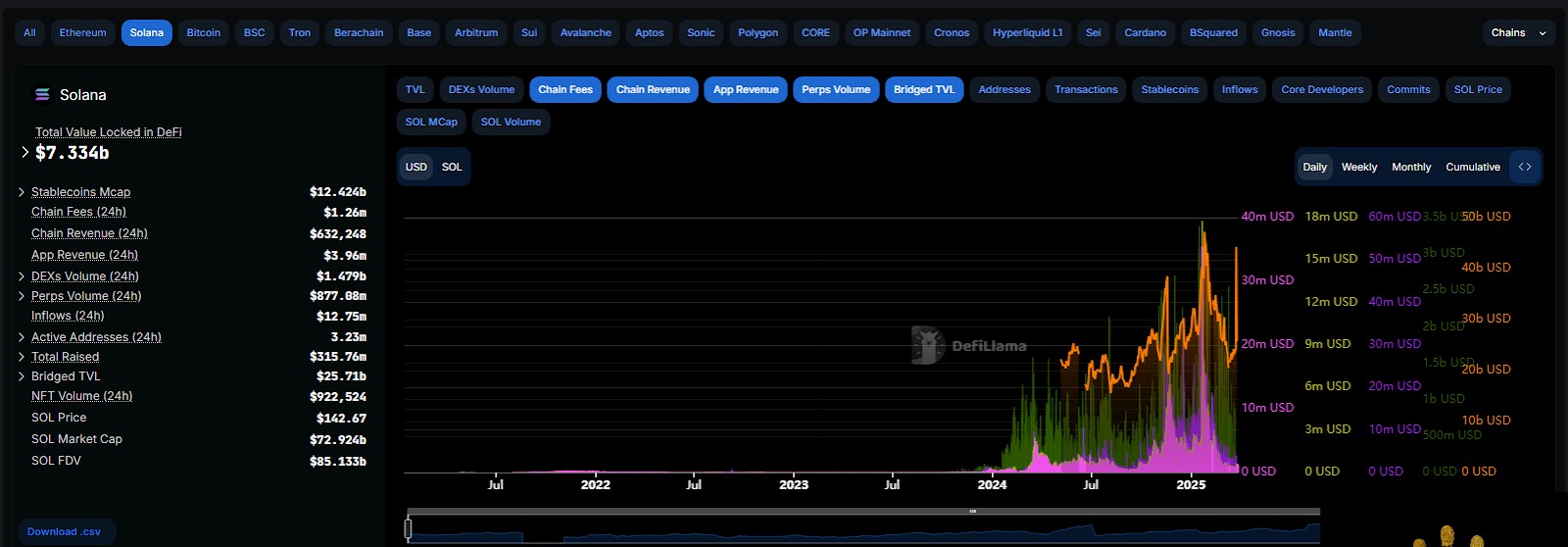

What happened after the Pump.Fun launch in 2024 to the Solana? The resurrection: TVL, Chain Revenue, App Revenue, Perps Volume and Bridged TVL — every metric you can think of skyrocketed tenfold. People started to trade memecoins so hard the chain itself became a meme with 3 to 5 Solana business days becoming the running joke.

You know why Solana metrics exploded tenfold? People turned memes into a gambling ground, essentially abusing the DYOR! Deploy! Diversify! principle.

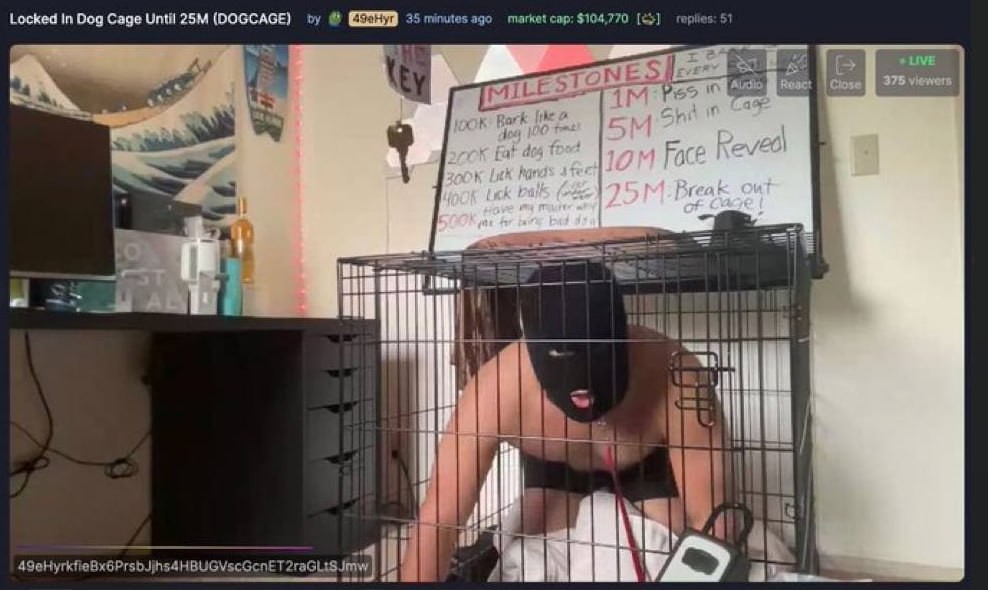

This is what gave birth to a Degen Market — a niche in crypto that is the cancer of it. Want to know how hard that Degen Market goes? People lock themselves in cages to stream it online until their memecoin reaches a bonding curve on the Pump.Fun only to rug the participants. Others threaten to shoot themselves if the coin ain’t reaching the bonding curve. People gave birth during the live translations to pump their memecoin’s price. This ended only when Pump.Fun developers banned live translations for the coin developers.

Here are some other notable cases of why Degen Market is the cancer of Crypto Culture:

Real case of a user threatening to unalive themselves if their Pump.Fun coin reaches 1M evaluation.

Pump.Fun developer trying to manipulate the market into literally letting them rugpull the participants.

Key idea: Degen Market is the Cancer of Crypto. Pump.Fun opened floodgates to literal hell that is the shadow of the society.

Now you see it — Pump.Fun tries to enforce memes, which goes against the rules, and it shows.

Stage 4: Memecoin tumor grows and spreads

At this stage we have celebrity memecoins, made in the name of popular celebrities that only represent what people actually think of them. See, celebrity memecoins are the predators of the meme ecosystem — they prey on people who think there’s some value to a celebrity memecoin.

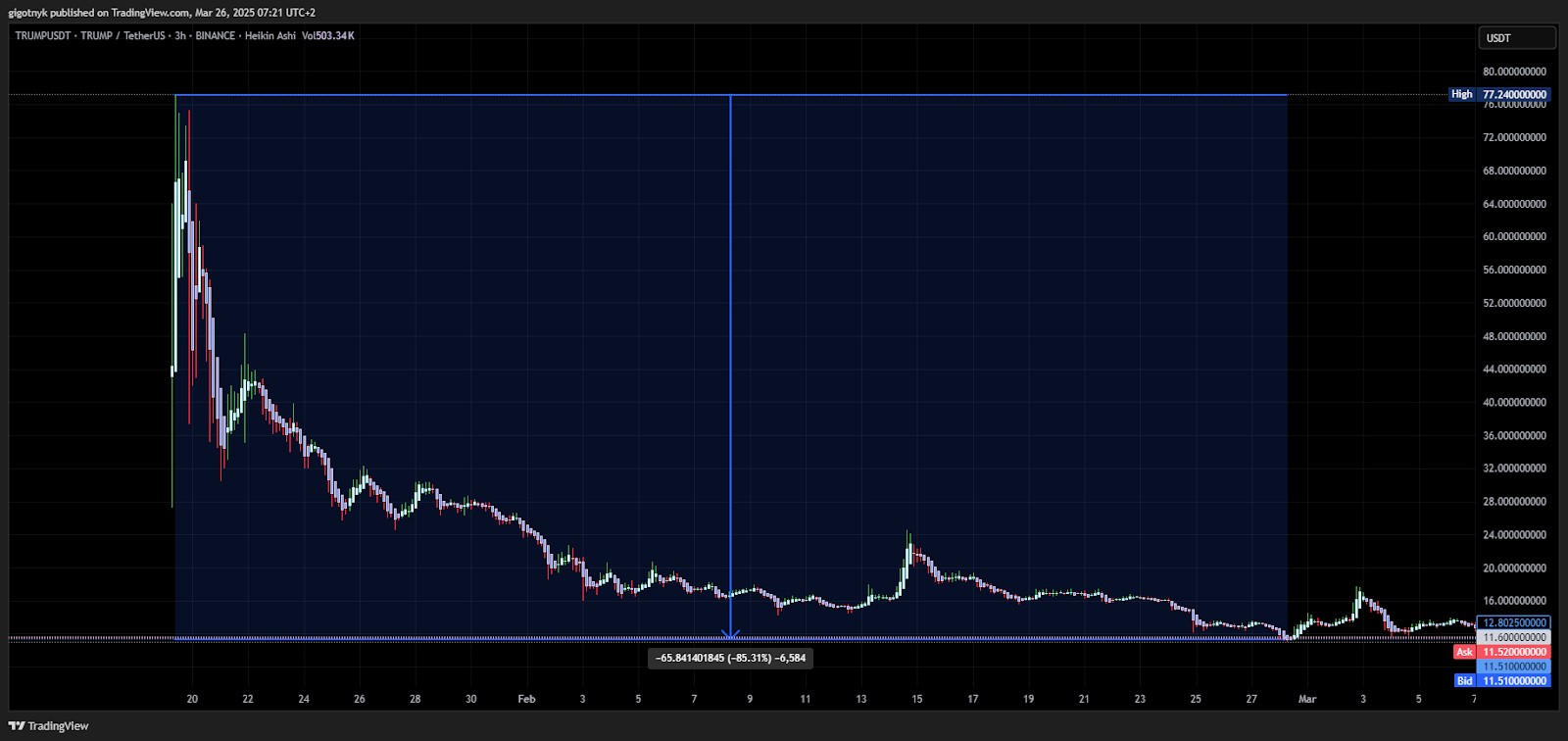

Take the TRUMP coin — it plummeted and lost 86% of its value right after the launch. People thought it would be a moonshot and mistook a forced meme for a real one, because the moment Trump enforced it onto his Twitter (X) audience — the TRUMP Coin died.

Same goes for MELANIA and countless other celebrity memecoins — they are dead on arrival, as they are made by the celebrities themselves to profit off of the idea of their own popularity.

Key takeaway: Celebrity memecoins are pure degeneracy — they are made to profit off of you, who thinks that celebrity memecoins have any value to them.

Find memecoins backed by real, lasting memes

If you’re just getting into memecoins, don’t fall for the trending lists or hyped-up influencer posts. The smartest way in? Look for the meme that people were already obsessed with before it became a coin. That’s your signal.

If the idea behind it has been around for years — funny, emotional, or just sticky — it’ll already have cultural power. A memecoin slapped onto a forced trend dies fast. But one tied to something people already live and breathe? That’s where real upside hides. Dig deeper, not louder.

Conclusion

Memes are what shapes the memecoins, and memecoins started as a way to support and spread the powerful memes across the web. Slowly, cracks started to show up when people began exploiting memecoins for profit.

Situation quickly escalated after the launch of Pump.Fun, which turned memecoins into the cancer of crypto. The pinnacle of the cancer came with celebrity memecoins — ones, which can only go down. This is how you became versed in memecoins, this is why you are now ahead of the market.

FAQs

Will the memecoin I hold shoot to the moon?

The moment you ask it — the moment you exit the coin. It is only you who can judge if the memecoin can shoot or die violently.

Can you launch your own memecoin?

Yes. It was possible since the inception of crypto in 2009, and crypto is the embodiment of the meme of not trusting the third parties, be it people or governments.

Popular websites suggest buying random memecoins — can I trust them?

Memes cannot be enforced, only shared. You can trust only your own gut when it comes to memecoins, and websites that publish the lists of memecoins that are «likely going to the moon» are only trying to draw your attention to the topic for SEO metrics.

How can I spot the next x100 memecoin?

Look at the core idea and think about it in terms of decades: will this idea stand in the next 10 years or it is only an attempt to profit off the meme? Dogecoin is 12 years old, but the idea of the Doge behind it is older — 15 years to date.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.