Best Currency Pairs To Trade At Night In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best currency pairs to trade at night in 2025:

USD/JPY: high liquidity and volatility during the Asian session make this pair popular for night trading.

AUD/USD: active during the Australian market hours, this pair often reflects regional economic events.

NZD/USD: similar to AUD/USD, it provides opportunities based on New Zealand's market activities.

EUR/JPY: a mix of European and Asian market activity ensures moderate volatility at night.

GBP/JPY: often sees movement during overlapping European and Asian session hours.

Are you looking for the best Forex pairs to trade at night? In this article, a team of experts will provide you with valuable insights on how to enhance your trading performance during nighttime trading sessions. Designed specifically to assist traders, the experts at TU will unveil the top Forex currency pairs that offer lucrative opportunities during the night hours.

What are the best currency pairs to trade at night?

The best currency pairs to trade for night trading depend on your strategy and risk tolerance. During overnight sessions, Asian and Oceanian pairs like AUD/NZD, AUD/JPY, and NZD/JPY often show increased volatility, offering opportunities for active traders. Align your choice with market analysis and your trading goals for the best results.

Here’s an expanded explanation of the currency pairs best suited for night trading:

USD/JPY

Known for its high liquidity and volatility during the Asian trading session, USD/JPY is a go-to pair for nighttime traders. Japan’s economic activity and announcements often influence this pair, making it responsive to macroeconomic data such as interest rates and trade balances. Additionally, the pair benefits from the U.S. dollar's status as a global reserve currency, ensuring consistent market activity.AUD/USD

This pair becomes active during the Australian market hours, reflecting economic trends in the region. Factors like commodity prices (particularly gold and iron ore) and Reserve Bank of Australia (RBA) policy decisions heavily impact its movement. Traders often use AUD/USD to capture price actions tied to Australia’s economic data releases and global risk sentiment.NZD/USD

Similar to AUD/USD, this pair thrives on economic events specific to New Zealand, such as agricultural export performance and Reserve Bank of New Zealand (RBNZ) policy updates. It is popular among night traders due to its predictable reaction to market news and its correlation with the AUD/USD pair, offering diversification with regional insights.EUR/JPY

As a cross pair involving two major economies, EUR/JPY provides unique opportunities during the overlap of European and Asian sessions. Moderate volatility at night makes it suitable for traders seeking stable trends influenced by events in Europe, such as ECB policies, alongside Japanese market activities.GBP/JPY

This pair is known for its significant price movements during the Asian-European overlap, making it attractive for experienced traders. The GBP/JPY pair is influenced by both the UK economy and Japan’s financial policies, offering a balance of volatility and liquidity. It is particularly appealing for traders looking to profit from breakout strategies during active market hours.

Key tips for Forex night trading

Forex night trading occurs outside regular exchange hours, allowing traders to react to global events and economic changes. These hours vary by exchange and provide opportunities to trade during session overlaps, such as the Asian and European markets, which increase activity and liquidity. Understanding night trading schedules, available currency pairs, and market conditions helps traders plan strategies, adapt to price fluctuations, and seize opportunities effectively.

Key tips for Forex night trading:

Focus on low-volatility strategies. At night, markets move slower, so it’s a good time to trade between clear high and low points on the chart. This way, you can make safer moves and reduce your chances of losing money.

Capitalize on regional currency pairs. Asian currencies like the Japanese yen or Australian dollar often see some activity at night. Learn their patterns to spot easy opportunities when the rest of the market is quiet.

Use pending orders strategically. Instead of watching your screen endlessly, set buy or sell orders at key points on the chart. If the price hits those levels, your trade will trigger automatically, saving you time.

Avoid news-driven pairs. Pairs like EUR/USD can act up due to random news, even late at night. Stick to quieter pairs to keep things predictable.

Implement automated systems with caution. Trading bots are handy, but many don’t work well when the market is sleepy. Test your tools to make sure they’re not giving you useless signals.

Track institutional movements in futures markets. Check reports like COT to see what big players are doing. Their decisions often hint at what’s coming, even during quieter hours.

Is overnight trading a good idea?

Overnight trading can enable the following:

Flexibility. Overnight trading offers the flexibility to trade at your convenience, not limited to regular market hours. This is advantageous for individuals with busy schedules who struggle to find time for trading during the day

Market analysis. Analyzing market performance during the day allows for informed trading decisions during overnight sessions. Utilizing market trends and analysis can lead to more strategic decision-making

Order modification. It allows for the modification or cancellation of orders during non-trading hours, providing the freedom to adjust positions based on changing market conditions or personal preferences

Global event impact. Overnight trading also enables traders to capitalize on global events that occur outside of regular trading hours, such as economic releases or political decisions. This allows for timely actions, such as selling stocks affected by negative events or investing in companies likely to benefit from positive developments

Lower competition. Generally, night hour trading has less competition due to fewer active traders in the market. This can create opportunities to exploit market inefficiencies and potentially generate profits

Diversification. Including overnight trading as part of a diversified trading strategy helps manage risks and spread investments across different timeframes and market conditions

Reduced emotional stress. Trading during regular market hours can be emotionally taxing with rapid price fluctuations and the need for quick decisions. Overnight trading provides a more relaxed environment, allowing for a thorough market analysis and informed decision-making

Access to multiple markets. Overnight trading allows access to markets that operate 24 hours a day, such as Forex and futures markets. This expands trading opportunities and the ability to benefit from different market trends and conditions

Where can I trade the best Forex pairs

Choosing the right platform is crucial for trading top Forex pairs effectively. Below is a comparison of the best brokers offering competitive features, tight spreads, and a wide range of currency pairs to suit both beginners and advanced traders.

| Demo | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Scalping | Max. Regulation Level | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | 0,5 | 0,9 | Yes | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | 0,5 | 1,5 | Yes | Tier-1 | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | 0,1 | 0,5 | Yes | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | 0,7 | 1,2 | Yes | Tier-1 | Study review | |

| Yes | No | 1:30 | 0,2 | 0,8 | Yes | Tier-1 | Open an account Your capital is at risk. |

It’s important to recognize how quieter hours impact specific currencies

During night trading, it’s important to recognize how quieter hours impact specific currencies and use that to your advantage. A top pick is AUD/NZD, a pair that often moves in sync and doesn’t experience major price shocks. This makes it beginner-friendly and less stressful to trade. Keep an eye on Australia’s commodity news or New Zealand’s dairy updates — small changes here can create big opportunities. Instead of relying on generic indicators, try using real-time tools that show how many buyers and sellers are active. This way, you’ll have a better sense of when to jump in or hold back.

Another great option is USD/JPY, particularly when the Tokyo and Sydney markets overlap. The yen tends to move based on global risk trends, so following news about bonds or safe-haven investments can give you an edge. Big players often try to trigger common stop-loss levels, so instead of placing your stops in obvious spots, base them on how much the market is fluctuating. Watch out for clues from Japan’s central bank too — they sometimes drop hints about their next moves if you read between the lines.

Summary

For nighttime trading, Asian and Oceanian cross pairs like AUD/NZD, AUD/JPY, and NZD/JPY offer increased volatility and active markets. Popular Forex pairs like EUR/USD, USD/JPY, and GBP/USD provide high liquidity and diverse opportunities. Beginners should consider factors like volatility, liquidity, and trading sessions when choosing pairs to trade.

FAQs

What Forex pair to trade at night?

For those looking to trade Forex at night, suitable currency pairs include Asian and Oceanian cross rates that do not include USD, such as AUD/NZD, AUD/JPY, or NZD/JPY.

Should you trade Forex at night?

Trading Forex at night can be beneficial for those who prefer increased volatility and are able to actively monitor the market during nighttime trading sessions.

Is trading at night better?

Whether trading at night is better depends on individual trading styles and preferences. Nighttime trading can offer increased volatility, which can present both opportunities and risks.

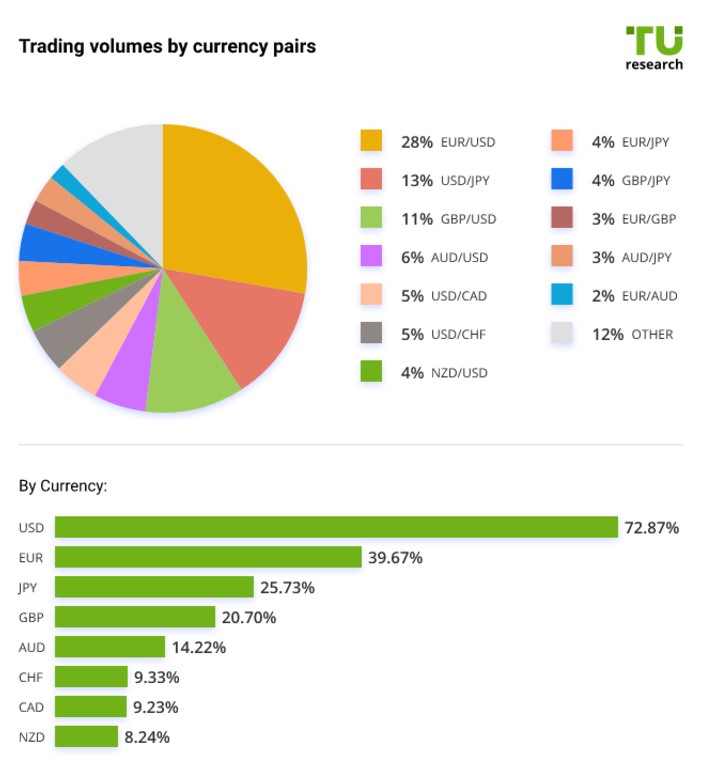

Which currency pair is best to trade?

The best currency pair to trade depends on various factors, including personal trading goals, risk tolerance, and market conditions. Some popular currency pairs for Forex trading include EUR/USD, USD/JPY, GBP/USD, USD/CAD, AUD/USD, and USD/CHF.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.