Best Carbon Capture And Decarbonization Investments

If you're too busy to read the entire article and want a quick answer, the best commission-free stock broker is Plus500. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- Extensive research and educational tools

- Diverse investment options

The best carbon capture technology stocks are:

-

Equinor (NYSE: EQNR) – One of the pioneers of carbon capture and storage development

-

FuelCell Energy Inc (NASDAQ: FCEL) – Using CO2 for generating hydrogen for fuel cell electricity production

-

Aker Carbon Capture (OSL: ACC) – Supported by its strategic position in the UK, Scandinavia, and Benelux

-

Delta CleanTech (CSE: DELT) – Manufactures modular equipment for CO2 capture

-

Occidental Petroleum Corp (NYSE: OXY) – On track of developing the world's largest facility capturing 1 million tons of CO2 annually

-

Fluor Corporation (NYSE: FLR) – Constructing a facility designed to extract CO2 directly from the air

-

Exxon Mobil Corp (NYSE: XOM) – Actively investing in low-carbon technologies

-

NRG Energy Inc (NYSE: NRG) – Specializes in selling electricity generated from oil, coal, and gas

-

Calix Limited (ASX: CXL) – Introduced a revolutionary reactor capable of directly separating CO2 from magnesium minerals

In the pursuit of a sustainable future, investing in cutting-edge technologies becomes not only an opportunity for financial growth but a crucial step towards environmental conservation. On similar lines, carbon capture technology has given rise to a lot of stocks poised to shape the future of sustainable investing. This article explores the landscape of the best carbon capture technology stocks in 2023, focusing on companies at the forefront of innovation, each with its unique approach to curbing carbon emissions.

What are carbon capture stocks?

In the global effort to combat climate change, the spotlight often centers on renewable energy, but an increasingly recognized and vital component of the solution is carbon capture. Carbon capture stocks represent companies pioneering green technology solutions aimed at mitigating or eliminating carbon dioxide from the atmosphere. Investing in these stocks offers an opportunity to participate in the surging demand for carbon reduction and omission technologies.

These companies proactively disclose their carbon emissions, supporting policies that incentivize emission reductions through regulation or other means. One approach involves the construction and operation of facilities dedicated to capturing CO2 emissions from smokestacks. These captured emissions are then utilized in enhanced oil recovery (EOR) processes to extract oil, showcasing an innovative dual-purpose solution. On another front, there are companies specializing in carbon capture, utilization, and storage (CCUS). These entities develop cutting-edge technologies to extract CO2 directly from its sources, with some focusing on transforming CO2 into feedstock for the production of plastics and other materials. Simultaneously, other companies concentrate on compressing and storing CO2 underground to prevent its release into the atmosphere, contributing to a more sustainable future.

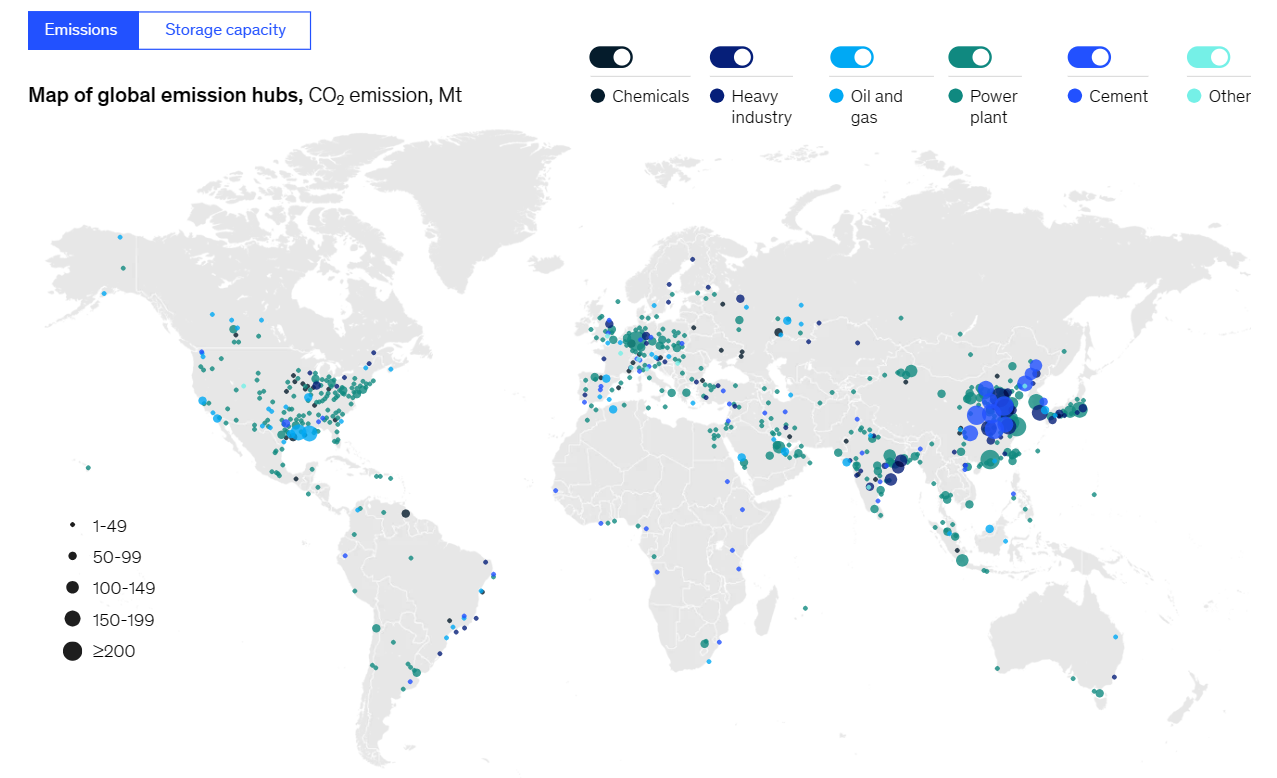

For your reference, here is how the global CO2 emission hubs are spread out across the world.

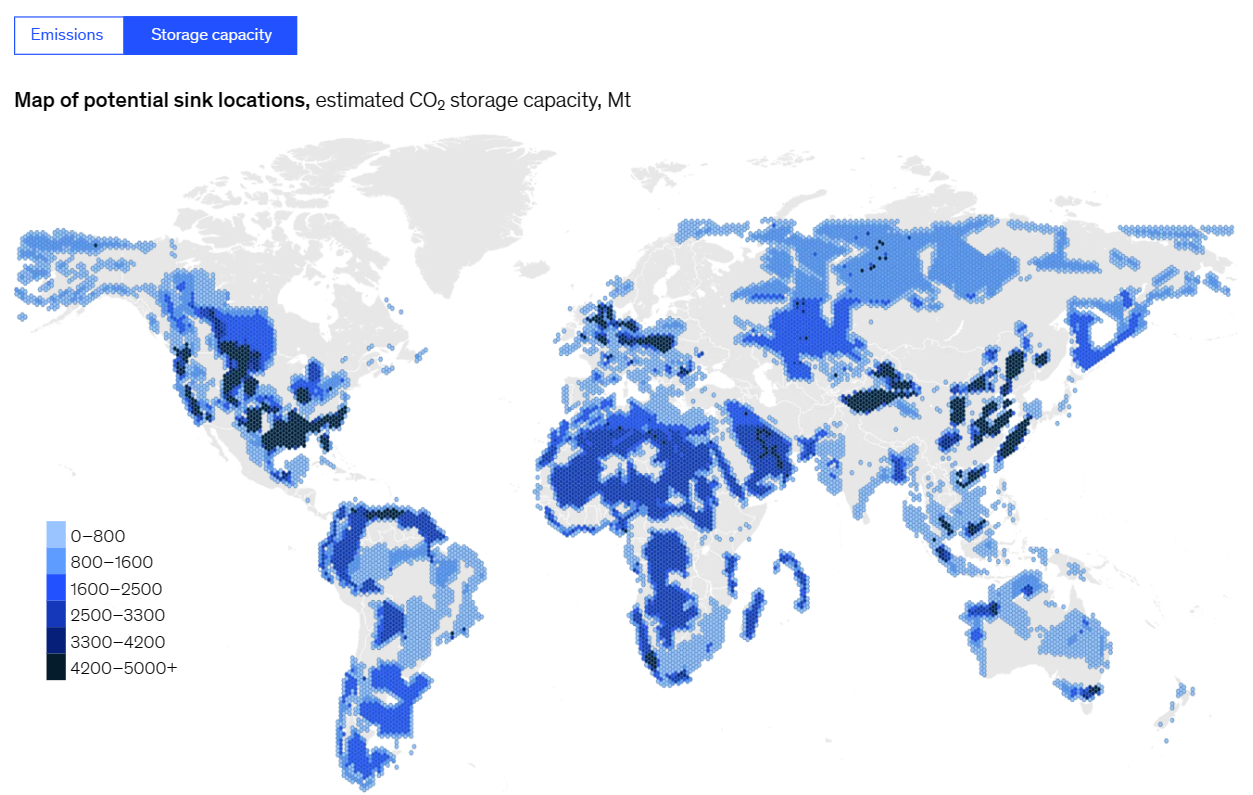

Supporting the same, here is where the largest potential stands for establishment of sink locations, i.e., spaces where the natural habitats are likely to capture carbon emissions from the atmosphere.

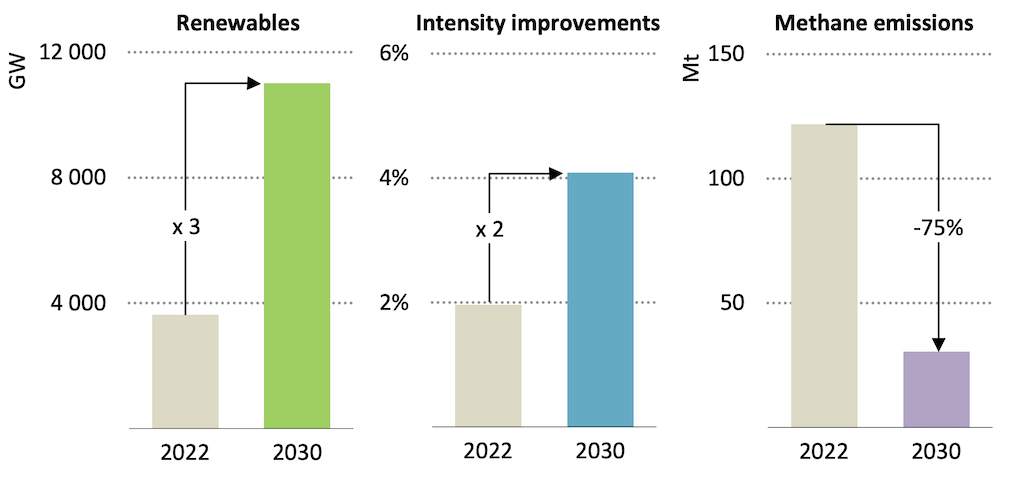

Lastly, this following diagram outlines the International Energy Agency's targets for limiting global warming to 1.5°C. It calls for tripling renewable energy capacity to 11,000GW, doubling annual energy efficiency improvements to 4%, and cutting methane emissions from fossil fuel extraction by 75% by 2030. These measures, deemed cost-effective, provide crucial emissions reductions, directly boosting the demand for carbon capture stocks.

Best carbon capture technology stocks in 2024

Investing in carbon stocks holds promising prospects as the global Carbon Capture and Storage (CCS) market is set to reach USD 5.61 billion by 2030, with a CAGR of 7.1%. Europe, driven by favorable government policies, is a key player in CCS technology. Despite concerns about high costs, the increasing demand for CCS, especially in power generation, and initiatives like the Net Zero Industry Act, make carbon stocks a viable future investment.

| Name | Stock Ticker | Dividend % | P/E Ratio | EPS Growth Next 5 Years | Market Cap (Nov-23) |

|---|---|---|---|---|---|

| Equinor | EQNR | 10.80% | 5.92 | 5.80% | $97.21B |

| FuelCell Energy Inc. | FCEL | N/A | N/A | 15.00% | $500.20M |

| Aker Carbon Capture | ACC | N/A | N/A | 6.10% | $6.296B |

| Delta CleanTech Inc. | DELT | N/A | N/A | N/A | 1.276M CAD |

| Occidental Petroleum Corp | OXY | 1.14% | 13.12 | N/A | $52.71B |

| Exxon Mobil Corp | XOM | 3.56% | 10.33 | 45.30% | $416.48B |

| Fluor Corporation | FLR | 0.32% | 62.26 | 56.60% | $6.53B |

| NRG Energy, Inc. | NRG | 3.28% | N/A | 4.00% | $10.49B |

| Calix Limited | CXL | N/A | N/A | 3% | 611.19M AUD |

Equinor (NYSE: EQNR)

Equinor, a major player in the oil and gas industry, is at the forefront of carbon capture technologies. Operating the world's oldest carbon capture and storage (CCS) facility, Equinor has been a pioneer in CCS development for over two decades. Involved in 40 CCS projects, including Norway's Northern Lights project, the company exhibits a robust commitment to reducing CO2 emissions. Its engagement spans diverse projects, such as fitting CCS technology on natural gas-based energy plants, hydrogen production with associated CO2 capture, and support for innovative carbon removal startups like Repair. With a focus on clean hydrogen and carbon capture and storage, Equinor's stock, trading slightly below all-time highs, appears well-positioned to benefit from its extensive experience and commitment to low-carbon technologies.

Fuel Cell Energy (NASDAQ: FCEL)

Fuel Cell Energy, operating in the domain of fuel cell electricity production, introduces an innovative twist to carbon capture. The company utilizes ultrahigh temperatures to combine methane with CO2, generating hydrogen for fuel cell electricity production. While the process involves CO2 production, the captured CO2 is in a form conducive to sequestration. Fuel Cell Energy aims to achieve net-zero CO2 production when using methane as an energy source. Despite reporting an operating loss of $22.4 million in Q1 2023, the company shows promise with $315 million in cash and cash equivalents. Additionally, revenue from "Advanced Technologies," encompassing carbon capture, demonstrated 10% growth from Q1 2022. Fuel Cell Energy's technology, if successful in overcoming challenges and turning a profit, holds potential in the pursuit of a net-zero future.

Aker Carbon Capture (OSL: ACC)

Aker Carbon Capture was established in August 2020 as part of Aker Horizons, and the company benefits from Aker ASA's two decades of technology development and operational expertise in carbon capture. Aker Carbon Capture, despite reporting a net loss of $5 million in Q3 2022, holds promise amid a rapidly evolving market. The industry's positive fundamentals include a rising carbon price and decreasing costs of capturing emissions. The Global CCS Institute's data reveals a 44% increase in planned carbon capture and storage capacity, reaching 244 million metric tons annually. Aker Carbon Capture's strategic position in the UK, Scandinavia, and Benelux aligns with its objectives, notably supported by the UK government's $1 billion commitment to carbon capture and storage hubs. Despite uncertainties, the company's half-year financial statement indicates a potential intersection where carbon capture costs align with effective carbon prices in the coming years.

Delta CleanTech (CSE: DELT)

Delta CleanTech, a Canadian company focusing on carbon capture since the early 2000s, stands out as one of the oldest players in the field. After a $7.5 million funding round in March 2021, the company went public on the Canadian Securities Exchange (CSE) under the ticker DELT. Delta CleanTech's business revolves around manufacturing modular equipment for CO2 capture, including the LCDesign that extracts CO2 emissions from various sources. Positioned in a country with ambitious climate change policies, the company benefits from Canada's increased carbon prices, reaching $170 per ton by 2030. Delta CleanTech's expansion and global recognition in CO2 capture projects, alongside its expertise in solvent and ethanol purification, hydrogen production, and carbon credit certification, contribute to its promising outlook.

Occidental Petroleum Corp (NYSE: OXY)

Occidental Petroleum Corporation is the fifth-largest oil and gas company in the US, distinguishing itself as a forward-looking entity in the carbon capture arena. While historically using carbon capture for enhanced oil recovery, Occidental has shifted its focus toward green economy transition. With 24.46 million metric tons of CO2 equivalent emissions in 2021, the company demonstrates a commitment to offsetting emissions by permanently storing 20 million tons of CO2 annually. The formation of Oxy Low Carbon Ventures (OLCV) in 2018 underscores Occidental's dedication to developing carbon capture, utilization, and storage technologies. Notable among OLCV's initiatives is the 1PointFive direct air capture project, poised to be the world's largest facility capturing 1 million tons of CO2 annually. Despite being an oil company, Occidental's transition stock has surged 104% since January 2022, signaling its attractiveness to investors keen on the company's profitable future development plans in carbon capture.

Exxon Mobil Corp (NYSE: XOM)

ExxonMobil (XOM) stands as a prominent integrated oil and gas company deeply involved in oil exploration, production, and refining. While not following the same renewable energy trajectory as its counterparts, ExxonMobil has been making strategic investments in low-carbon technologies. Notably, the company entered the carbon capture arena through the acquisition of oil recovery specialist Denbury for $4.9 billion. This move bolsters Exxon's carbon capture and storage assets, including 1,300 miles of CO2 pipelines and 10 onshore sequestration sites along the Gulf Coast. The region, rich in refineries and hydrocarbon-related infrastructure, provides ample opportunities for decarbonization investment, particularly in carbon capture and storage. Finally, ExxonMobil's commitment to low-carbon solutions is reflected in its Low Carbon Solutions business, launched in 2021, focusing on carbon capture, storage, hydrogen, and lower-emission fuels.

Fluor (NYSE: FLR)

Fluor stands as a prominent engineering and construction company making strategic strides in the carbon capture arena. Recently engaged by CarbonCapture (privately held), Fluor is involved in constructing Project Bison, a facility designed to extract CO2 directly from the air. This ambitious project aims to sequester CO2 in deep saltwater aquifers beneath Wyoming. Unlike some counterparts, Project Bison doesn't directly generate revenue from CO2 usage. Instead, it plans to sell carbon credits, a venture that could gain momentum if more governments adopt carbon offset regulations. Fluor, with a robust financial profile boasting $13.7 billion in revenue and $427 million in earnings for FY 2022, diversifies its portfolio with carbon capture under its Energy Solutions segment. While the success of Fluor's carbon capture initiatives hinges on regulatory developments, the company remains resilient with other revenue streams. The potential for increased demand in carbon offsets could position Fluor favorably, making it a subject of interest if more state governments mandate carbon offset compliance.

NRG Energy (NYSE:NRG)

NRG Energy has a compelling case study illustrating the challenges and rewards associated with carbon capture. Operating as a classic carbon-intensive power company, NRG Energy specializes in selling electricity generated from oil, coal, and gas. The Petra Nova plant, a testament to their carbon capture efforts, was initially constructed as a market-driven solution, utilizing CO2 for enhanced oil recovery. While Petra Nova initially supported NRG's profitability, external factors such as falling oil prices and rising project costs led to its sale to Japanese firm Eneos in 2022. Despite this, NRG Energy remains committed to pursuing carbon capture solutions, leveraging its substantial 2022 revenue of $31.5 billion and earnings of $2 billion. The company's dedication to carbon capture aligns with the evolving energy landscape, and future regulations may propel continued efforts in this direction.

Calix Limited (ASX: CXL)

Calix Limited, an Australian technology company founded in 2005, emerges as a key player addressing global challenges with a diverse array of sustainable products. Venturing into carbon capture in 2014, Calix introduced a revolutionary reactor capable of directly separating CO2 from magnesium minerals. This technology, applied to the cement and lime manufacturing processes, allows the extraction of CO2 released during mineral grinding without additional energy penalties. Calix formed the LEILAC projects in collaboration with European and Australian partners in 2015, demonstrating breakthrough carbon capture technology. The pilot plant at Heidelberg Materials' cement facility in Lixhe, Belgium, successfully showcased CO2 separation without additional chemicals. With 93% ownership of LEILAC, Calix is supported by €12 million ($12.8 million) in funding from the European Union's Horizon 2020 program.

How to choose sustainable carbon capture stocks?

Choosing sustainable carbon capture stocks requires careful consideration of various factors to ensure both environmental impact and potential financial returns.

Understand the technology

To choose sustainable carbon capture stocks, it's crucial to understand the technology each company employs. Evaluate whether the company focuses on direct air capture, carbon capture and storage (CCS), or other innovative approaches. Look for companies with proven, efficient, and scalable technologies. Take a deep dive into the company's carbon capture methods. Understand if they use advanced, energy-efficient processes and whether their technology has been successfully deployed and tested at scale.

Assess regulatory environment

Examine the regulatory landscape in regions where the company operates. Favor companies situated in areas with supportive carbon pricing mechanisms, emissions reduction targets, or incentives for carbon capture initiatives. Regulatory support significantly influences the success of carbon capture ventures. Investigate how well-positioned the company is within the regulatory framework and if it aligns with future sustainability goals.

Evaluate project portfolio

Review the company's project portfolio, considering both current and future initiatives. A diversified and well-managed project portfolio indicates a company's commitment to sustainability and resilience against market fluctuations. Look into specific projects the company is involved in. Assess their scale, partners, and potential for real-world impact. Projects with multiple revenue streams or those contributing to broader sustainability goals add value.

Financial health

Sustainable investing doesn't exclude financial considerations. Evaluate the company's financial health, including revenue growth, profitability, and debt levels. A financially stable company is better positioned for long-term success. Understand the financial reports, analyze revenue sources related to carbon capture, and assess the company's ability to weather economic challenges. A sustainable investment should balance both environmental impact and financial returns.

Consider long-term viability

Look for companies with a long-term vision and commitment to sustainability. Assess their strategic plans, research and development efforts, and partnerships. A company with a clear roadmap for long-term viability is more likely to navigate industry changes successfully. Investigate the company's commitment to ongoing research and development. Explore if they are actively seeking improvements in their carbon capture technology and adapting to emerging trends.

Industry collaboration and partnerships

Assess the company's collaborations and partnerships within the industry. Partnerships with research institutions, other businesses, or government bodies indicate a commitment to collective efforts in advancing carbon capture solutions. Research the nature of partnerships. A company engaged in collaborative efforts with various stakeholders signals a commitment to knowledge sharing and collective problem-solving in the pursuit of sustainable solutions.

Environmental, Social, and Governance (ESG) ratings

Consider the company's ESG ratings. These ratings provide insights into the company's environmental impact, social responsibility, and governance practices. Higher ESG ratings often correlate with companies dedicated to sustainable practices. Delve into the specific ESG criteria the company excels in and areas where it might have room for improvement. A comprehensive ESG analysis can offer a holistic view of the company's sustainability performance.

Community and stakeholder engagement

Companies that engage transparently with local communities and stakeholders are likely to navigate challenges more effectively. Assess how the company communicates its environmental impact, involves local communities, and addresses stakeholder concerns. Explore the company's communication channels, community engagement initiatives, and responsiveness to stakeholder queries. A company fostering positive relationships with communities and stakeholders demonstrates a commitment to ethical practices.

Best Stock brokers

How to build a well-diversified portfolio of sustainable stocks?

To construct a well-diversified portfolio of sustainable stocks, adopt the following strategies.

Incorporate ESG factors

Integrate environmental, social, and governance (ESG) factors into your investment decisions, giving them equal importance as traditional financial metrics. This strategic and tactical allocation ensures a comprehensive evaluation of a company's sustainability practices.

Define clear investment objectives

Establish specific investment goals aligned with sustainability criteria that matter most to you. Whether it's addressing climate change, promoting social equality, or emphasizing robust corporate governance, your asset allocation should reflect these objectives.

Opt for diverse sustainable sectors

Select stocks from a range of sustainable sectors, including renewable energy, innovative technologies, and socially responsible enterprises. This approach to security selection fosters diversification, managing risk effectively while optimizing the balance between risk and return.

Regular monitoring and rebalancing

Consistently monitor your portfolio's performance and stay abreast of industry trends. Implement rebalancing as necessary to ensure your portfolio remains in harmony with your sustainability goals, adapting to evolving market conditions.

Government support

Explore companies that enjoy governmental backing and subsidies for their sustainable initiatives, especially in areas like carbon capture technology infrastructure. Government support can bolster the growth prospects of these companies, contributing to the sustainability of your portfolio.

Focus on long-term value

Strive to generate enduring value for investors while making positive contributions to society and the environment through sustainable investments. Emphasize a long-term perspective, aligning your portfolio with sustainable practices that yield lasting impact.

Pros and cons of carbon capture stocks

Investing in carbon capture stocks has both advantages and challenges. Here’s what experts have to say on the same.

- Pros

- Cons

-

Addressing global warming

By investing in carbon capture stocks, individuals can actively contribute to the global effort to combat climate change. These stocks play a role in mitigating the impact of greenhouse gas emissions, making it a positive environmental choice. -

Profit potential

If carbon capture technologies successfully scale and expand, there's significant profit potential for investors. As these technologies mature and become more widespread, shareholders may reap financial benefits from the growth of the carbon capture industry. -

Environmental impact and profitability

Carbon capture investments align with the dual goals of reducing CO2 emissions and offering financial returns. The environmental impact is twofold – contributing to sustainability while also providing the potential for profitable outcomes for investment portfolios. -

Government support

Companies engaged in carbon capture often enjoy government support and subsidies for their sustainable initiatives. This backing enhances the financial outlook for these companies, offering a layer of stability and growth potential.

-

New and costly technology

The infancy of carbon capture technology introduces a level of uncertainty, especially regarding short-term profits for retail investors. The novelty and high costs associated with development may limit immediate returns. -

Reliance on subsidies

Carbon capture firms often depend heavily on subsidies, and their viability can be influenced by the prevailing political climate. In environments where strong governmental support is lacking, the sustainability of these companies may face challenges. -

Uncertain returns

The profitability of carbon capture stocks remains uncertain for retail investors. High development costs and the nascent stage of the technology introduce risks that may affect returns, making it imperative for investors to carefully evaluate the potential for financial gains.

FAQs

What is the most promising carbon capture technology?

The most promising carbon capture technologies include direct air capture, utilization, and storage (CCUS) methods. These technologies aim to capture and either store or repurpose carbon dioxide emissions, showing significant potential in the fight against climate change.

What carbon capture companies can you invest in?

Several carbon capture companies offer investment opportunities. Prominent options include Aker Carbon Capture, Delta CleanTech, Fluor Corporation, NRG Energy, Calix Limited, and Occidental Petroleum Corporation.

Who is the leader in carbon capture technology?

Currently, there isn't a single clear leader in carbon capture technology. The industry is evolving rapidly, with various companies contributing innovative solutions. Aker Carbon Capture, Equinor ASA, and General Electric are among those making significant strides.

Who are the major players in CCUS?

Major players in Carbon Capture, Utilization, and Storage (CCUS) include General Electric, Equinor ASA, JGC Holdings Corporation, and Mitsubishi Heavy Industries, Ltd. These companies are at the forefront of developing and implementing CCUS technologies, contributing to the global efforts to reduce carbon emissions.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.