Best 7 Semiconductor Stocks With Strong Growth Prospects

Top commission-free stock broker - eToro

Top 7 Semiconductor Stocks to invest in are:

-

Monolithic Power Systems, Inc. (MPWR) – strong growth in diverse markets

-

Axcelis Technologies Inc. (ACLS) – robust financial performance, expanding market share

-

Taiwan Semiconductor Manufacturing Company (TSM) – leading foundry, strategic global expansion

-

Advanced Micro Devices (AMD) – gaming and data center stronghold

-

NVIDIA Corporation (NVDA) – AI focus, stellar Q3 performance

-

Intel Corporation (INTC) – anticipated PC market growth

-

NXP Semiconductors NV (NXPI) – innovations driving automotive market growth

In this article, experts will delve into the potential growth of semiconductor stocks in 2024. The discussion will include the current state of the semiconductor industry, expectations for recovery, and sustained demand fueled by technologies like AI, IoT, and 5G. Alongside these insights, experts have identified and recommended seven specific semiconductor stocks for investment in 2024. The analysis will cover key financial indicators, strategic considerations, and the overall landscape, offering readers a comprehensive overview and guidance on navigating the semiconductor market in the coming year.

-

What are the key growth drivers for semiconductor stocks?

The growth drivers for semiconductor stocks include technological advancements like AI, IoT, and 5G, which fuel demand across diverse industries. The industry's adaptability and crucial role in shaping the future of technology contribute to sustained expansion.

What are semiconductor stocks

Semiconductor stocks represent shares in companies specializing in the design, manufacture, and distribution of vital semiconductor devices. These components, including integrated circuits and microchips, are integral to electronic devices across diverse industries like technology, telecommunications, automotive, and healthcare. The surge in demand for semiconductor stocks aligns with the rapid growth of technological advancements such as the Internet of Things (IoT), 5G, Artificial Intelligence (AI), and autonomous vehicles. Semiconductors, unique for their surface conductivity, underpin the production of electronic gadgets ranging from computers to medical instruments. The performance of semiconductor stocks is influenced by industry trends, technological progress, supply and demand dynamics, and broader market conditions. Investors keen on technological innovation often turn to semiconductor stocks as a strategic investment, given their pivotal role in shaping the contemporary electronic landscape.

Growth of semiconductor sector

Semiconductors Revenue Forecast.

emt.gartnerweb.com

-

The global memory market is anticipated to experience a substantial 38.8% decline in 2023, primarily due to weak demand and oversupply issues leading to decreased pricing for NAND flash, resulting in a revenue drop to $35.4 billion. However, analysts predict a recovery in 2024, with a robust 66.3% growth, reaching $53 billion for NAND flash. In the DRAM sector, oversupply and low demand are pushing vendors to lower market prices to reduce inventory. A rebound in pricing is expected in late 2023, with a significant impact in 2024, where DRAM revenue is forecasted to surge by 88%, reaching a total of $87.4 billion.

-

Gartner analysts project that by 2027, more than 20% of new servers will integrate AI techniques into data center applications, reflecting the growing influence of AI on server technologies.

-

The semiconductor industry is set for significant growth, with the market expected to reach USD 1.09 trillion by 2028 according to Mordor Intelligence, fueled by a CAGR of 10.86%. The global surge in consumer electronics and the transformative impact of AI, IoT, and ML technologies are key drivers.

-

As of 2023, the market stands at USD 0.65 trillion. AI integration, represented by companies, is boosting demand for memory chips, particularly in industrial applications. Miniaturization of devices using materials like silicon, germanium, and gallium arsenide contributes to the industry's evolution.

-

Despite challenges in smart factory development, including energy supply and infrastructure, the sector is actively addressing these issues. Global disruptions, such as the COVID-19 pandemic, impacted automotive manufacturing but highlighted the semiconductor industry's resilience. The growing need for remote work has propelled networking, communication, and data processing applications, mitigating supply chain disruptions. Silicon's prominence and ongoing technological innovations position the industry for sustained expansion, reflecting its adaptability and crucial role in shaping the future of technology.

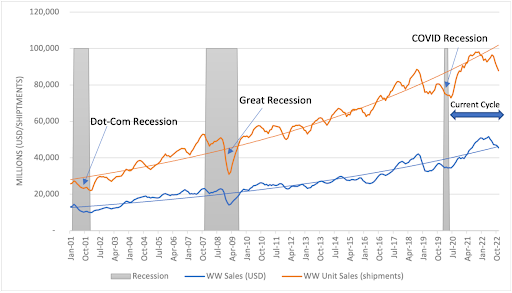

Sales and Unit Shipments 3 month moving average.

semiconductors.org

Semiconductor Industry Market size.

mordorintelligence.com

Best stock brokers

Top 7 semiconductor stocks to invest in 2024

| Company | Stock Ticker | Market Cap` | EPS after 5 years | Dividend Yield | Forward P/E Ratio |

|---|---|---|---|---|---|

Monolithic Power Systems, Inc. |

MPWR |

$26.81B |

25% |

0.69% |

43.38 |

|

Axcelis Technologies Inc. |

ACLS |

$4.12B |

20% |

N/A |

15.31 |

|

Taiwan Semiconductor Manufacturing Company |

TSM |

$511.12B |

2.70% |

1.84% |

16.7 |

|

Advanced Micro Devices |

AMD |

$196.11B |

9.80% |

N/A |

32.22 |

|

NVIDIA Corporation |

NVDA |

$1155.10B |

N/A |

0.04% |

22.69 |

|

Intel Corporation |

INTC |

$184.41B |

5.51% |

1.58% |

22.91 |

|

NXP Semiconductors NV |

NXPI |

$53.02B |

7.84% |

1.87% |

14.12 |

Monolithic Power Systems, Inc. (MPWR)

Consider investing in Monolithic Power Systems Inc. (MPWR) in 2024 for compelling reasons. MPWR has consistently surpassed its competitors in the analog and mixed-signal market, evident in its stock price of $543.44 and a robust market capitalization of $26.185 billion. The company's Q3 revenue growth of 7.6%, particularly in key segments like Enterprise Data, Automotive, Storage, and Compute, highlights its adaptability to diverse market demands.

A noteworthy aspect is MPWR's significant growth prospects in the automotive sector, backed by a substantial Serviceable Addressable Market of $7 billion and $1 billion in design wins. This positions MPWR favorably for future expansion.

The company's commitment to reducing energy and material consumption aligns with sustainable investment trends, appealing to socially conscious investors. Despite a 4.1% YoY revenue decrease in Q3 2023, the 7.6% sequential growth suggests positive momentum.

Moreover, the unanimous "Strong Buy" rating from 11 stock analysts signals high confidence in MPWR's future performance, indicating its potential to outperform the market.

| Metric | Projected Range for 2024 (Initial Months) |

|---|---|

Revenue |

$442.0 million to $462.0 million |

|

GAAP Gross Margin |

55.2% to 55.8% |

|

Non-GAAP Gross Margin |

55.4% to 56.0% |

|

GAAP Operating Expenses |

$127.1 million to $131.1 million |

|

Non-GAAP Operating Expenses |

$95.9 million to $97.9 million |

|

Total Stock-Based Compensation Expenses |

$32.2 million to $34.2 million |

|

Interest and Other Income |

$4.1 million to $4.5 million |

|

Fully Diluted Shares Outstanding |

48.7 million to 49.1 million |

Axcelis Technologies Inc. (ACLS)

Investing in Axcelis Technologies Inc. (ACLS) for 2024 presents a compelling opportunity for several reasons. The company, a provider of manufacturing equipment to semiconductor firms, demonstrated robust financial performance in Q3 2023. With reported revenues of $292.3 million, marking a substantial 27.5% increase from the previous year, and a noteworthy net income of $65.9 million, significantly higher than Q3 2022, Axcelis has displayed consistent growth.

The company's Q4 2023 revenue forecast of approximately $295 million and an expected operating profit of about $73 million indicate a positive trajectory. Notably, the anticipation of exceeding $1.1 billion in revenue for the entire year, positions Axcelis for significant financial achievement.

Analyst reports from Bank of America contribute to the positive outlook for Axcelis. The expectation of the company expanding its market share to 35% by CY25E, up from 28% in CY22, highlights its potential for superior growth.

Axcelis is identified as a key beneficiary in emerging trailing-edge auto/industrial applications, with an expected growth of 10-15% CAGR in implant TAM. The company's strategic position in this sector aligns with sustained demand for trailing-edge processes. Here is the table showcasing projections for this stock as per the analysis of Simply Wall St

| Date | Revenue | Earnings | Avg. No. Analysts |

|---|---|---|---|

31-12-2023 |

$1.116B |

$241M |

7 |

31-12-2024 |

$1.206B |

$266M |

7 |

31-12-2025 |

$1.305B |

$296M |

3 |

Taiwan Semiconductor Manufacturing Company (TSM)

Investing in Taiwan Semiconductor Manufacturing Company (TSMC) for 2024 presents a compelling opportunity driven by several key factors. As one of the world's largest semiconductor foundry, with a current market cap of $502.641 billion, the company is a frontrunner in manufacturing and designing semiconductors for diverse industries.

The escalating demand for TSMC's chips, driven by the growth of cloud computing, mobile devices, and gaming, positions the company favourably. Moreover, despite the international chip shortage, TSMC is well-positioned to capitalize on the heightened demand for semiconductors, reinforcing its growth trajectory into 2024.

A significant indicator of TSMC's commitment to expansion is its unprecedented $40 billion investment in a new semiconductor fabrication plant in Arizona, slated to be operational by 2024. This move highlights the company's strategic global positioning and underscores confidence in its future prospects.

Geographically, TSMC's revenue distribution showcases a strong presence in North America, where 69% of total net revenue is generated. Projections from Simply Wall St further strengthen the investment case, forecasting a 12% annual growth in earnings, a 14.7% increase in revenue, and a 12.2% growth in earnings per share. Here is the table showcasing projections for this stock as per analysis of Simply Wall St

| Date | Revenue | Earnings | Free Cash Flow | Cash from Op | Avg. No. Analysts |

|---|---|---|---|---|---|

|

12/31/2025 |

$3.106T |

$1187.010B |

$794.892B |

$1.9108T |

24 |

|

12/31/2024 |

$2.611T |

$977.11B |

$595.132B |

$1.605T |

31 |

|

12/31/2023 |

$2.1525T |

$825.176B |

$311.650B |

$1.2756T |

29 |

Advanced Micro Devices (AMD)

Investing in Advanced Micro Devices (AMD) for 2024 presents a compelling opportunity grounded in the company's robust performance and strategic advancements. With a market cap of $197.11 billion. AMD has witnessed an impressive 88% increase in its stock price year to date, reflecting an extraordinary year.

AMD's stronghold in the gaming and data center markets positions it favorably for continued success in the upcoming year. The growing demand for high-quality gaming and data processing aligns seamlessly with the company's core strengths, boding well for its future performance.

In June, AMD unveiled its highly anticipated MI300 line of chips, touted as its most powerful GPU ever. Set to ship in 2024, this release comes at a crucial stage as the market seeks increased competition. Wall Street analysts project a 21% revenue growth and a remarkable 51% increase in earnings per share for AMD in 2024, highlighting positive market expectations.

The growing artificial intelligence (AI) market, forecasted to experience a 37% CAGR, further enhances AMD's prospects. With approximately $2.8 trillion invested in leading AI companies in 2023, AMD is poised to feature prominently in this landscape in 2024, labeled a “Strong Buy” by leading analysts.

AMD's strategic partnership with Microsoft's Azure, utilizing the MI300X, signals innovative possibilities in new services and generative AI capabilities. The company's focus on AI technology is evident through strategic acquisitions like Nod.ai and Mipsology, expected to amplify its AI software capabilities and empower developers to unleash the full potential of GPUs like the MI300X.

| Key Aspects for 2024 | Details |

|---|---|

Market Performance |

In the first half of 2023, AMD stock demonstrated strong performance, indicating a positive trend in the company's market value. |

|

Product Innovations |

AMD introduced cutting-edge processors, such as the MI300 chips, emphasizing their commitment to AI applications and Alienware laptops. Additionally, they launched the Ryzen Threadripper 7000 and PRO 7000 WX-Series, showcasing a dedication to pushing technological boundaries. |

|

Competitive Landscape |

AMD faces competition from Qualcomm's Snapdragon X Elite, as Qualcomm enters the AI-capable PC chip market. This suggests a dynamic and competitive environment in the semiconductor industry. |

|

Strategic Positioning |

AMD strategically positions itself at the forefront of AI-compatible PCs, leveraging acquisitions and investments to maintain a leadership role in technology. This strategic approach indicates a proactive stance in the ever-evolving tech landscape. |

NVIDIA Corporation (NVDA)

NVIDIA Corporation (NVDA), a technology powerhouse specializing in graphics processing units (GPUs) for gaming, automotive, and diverse industries, stands out with a staggering market cap of $1.18 trillion. Remarkably, the stock has surged by 245.65% year to date, fueled by the thriving gaming and artificial intelligence (AI) markets. Anticipating a continuation of this success, experts highlight NVIDIA's commitment to innovation and product enhancement across various sectors.

NVIDIA's stellar Q3 2023 financials reveal a revenue of $18.12 billion, reflecting a remarkable 206% YoY increase and a substantial 34% QoQ growth. The company's strategic focus on AI technology and high-end online gaming, along with its involvement in cloud computing, supercomputing, and autonomous vehicles, positions it as a long-term growth contender.

With the AI boom driving a tripling of revenue in Q3, NVIDIA is expected to maintain an 85% share in Gen AI accelerators even in 2024. Jensen Huang, the founder and CEO, attributes the company's robust growth to the industry's transition toward accelerated computing and generative AI. Experts have discussed in the below table segments of the company and the factors that will contribute to growth in 2024.

| Segment | Factors for Growth in 2024 |

|---|---|

|

Data Center |

Continued data center demand signals growth - Innovations enhance competitiveness - Partnerships and cloud advancements position for sustained revenue growth |

|

Gaming |

Strong gaming revenue reflects market presence - DLSS 3.5 and TensorRT-LLM™ showcase ongoing innovation - Expanding game library boosts platform engagement |

|

Professional Viz. |

Omniverse adoption indicates industry relevance - New workstations cater to AI model demand - Expanding applications in manufacturing enhance NVIDIA's role |

|

Automotive |

Growing EV collaboration with Foxconn aligns with global trend - Steady automotive revenue suggests ongoing relevance - Utilization of DRIVE platform emphasizes NVIDIA's role in shaping automotive tech future |

Intel Corporation (INTC)

Investing in Intel Corporation (INTC) for 2024 holds promise for several reasons. As a multinational technology company specializing in microprocessors and hardware components, Intel is positioned for potential growth. The company's recent revenue performance improvement, coupled with the introduction of new processors for the data center market, indicates positive momentum.

One key factor supporting investment in Intel is the anticipated growth in the PC market in 2024. With shipments expected to rise by 3.7% to 261.4 million units, Intel stands to benefit from increased demand for its products, particularly in the PC segment.

The company's fourth-quarter guidance further reinforces its positive trajectory. Projecting $15.1 billion in revenue, an 8% improvement over the year-ago quarter, and non-GAAP earnings of $0.44 per share, Intel demonstrates a notable recovery from previous periods. This growth outlook is significant, considering the challenges faced in the prior year when revenue was down by 32%.

Moreover, the focus on new processors designed for the data center market positions Intel strategically in an evolving tech landscape. As data center demand continues to rise, these processors could contribute to further gains in 2024.

NXP Semiconductors NV ( NXPI)

Investing in NXP Semiconductors (NXPI) for 2024 is a strategic choice, driven by the company's recent advancements and promising growth avenues. The introduction of the Trimension NCJ29D6, a fully integrated automotive Ultra-Wideband (UWB) family, showcases NXP's commitment to innovation in the automotive sector. This UWB solution offers real-time localization, enabling secure car access, child presence detection, intrusion alerts, and gesture recognition, positioning NXP for significant traction in the growing automotive market.

The UWB market itself presents substantial growth prospects, with estimates projecting it to reach $3.45 billion by 2028, boasting a compelling CAGR of 17.4% from 2023 to 2028. Another report suggests the global UWB market could reach $6.33 billion by 2030, indicating a robust CAGR of 19.9% during 2023-2030.

NXP's emphasis on the automotive market extends beyond UWB, with strategic moves like the acquisition of LaterationXYZ's technology and the launch of S32M2 for motor control solutions. These initiatives demonstrate NXP's commitment to addressing evolving trends, particularly in electric vehicles.

The company's strong performance in the automotive end-market, constituting 55% of total revenues in Q3 2023, highlights its market relevance. Despite challenges like mounting expenses and supply-chain constraints, NXP's proactive measures and focus on high-growth areas position it for sustained success. The anticipated revenue growth in the automotive segment and a diversified product portfolio make NXP Semiconductors a compelling investment option for 2024, aligning with the upward trajectory in key markets and technological innovations in the semiconductor industry.

Is it good time to invest in semiconductor stocks

The semiconductor industry has garnered significant attention in recent times, particularly amid the challenges posed by the global pandemic. The surge in demand for semiconductors has been remarkable, although it has been accompanied by supply constraints, resulting in a global shortage. Despite these challenges, semiconductor companies continue to remain popular due to their crucial role in electronic devices.

Analysts suggest that investing in the semiconductor industry presents promising long-term opportunities. The sector's evolution and the transformative impact of technology on our daily lives indicate a sustained demand for semiconductors. Semiconductor stocks offer diverse investment options, ranging from intraday scalping to monthly market timing, with highly liquid securities supporting various profit strategies.

Looking ahead, the future of the semiconductor industry appears bright, fueled by the growing demand for emerging technologies such as artificial intelligence, the Internet of Things, and 5G networks. A report highlights that semiconductor stocks, particularly those linked to the AI revolution and electric vehicles, are positioned as winners in the current market landscape.

The global semiconductor industry is expected to undergo a recovery in 2024, with projections indicating year-over-year increases across all segments. Electronics sales are anticipated to surpass their 2022 peak, signifying a positive trajectory for the industry.

With applications spanning over 150 industries, the necessity for semiconductors ensures a perpetual demand. Consequently, investing in semiconductor stocks could be considered against this backdrop of ongoing technological evolution and increasing global demand.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).